Global Home Decor Market Report By Type (Home Textile, Floor Covering, Furniture, Other Types), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Other Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 32585

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

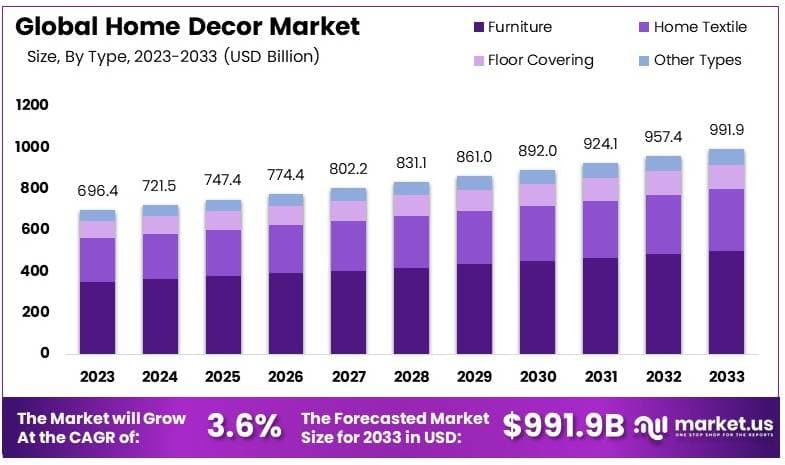

The Global Home Decor Market size is expected to be worth around USD 991.9 Billion by 2033, from USD 696.4 Billion in 2023, growing at a CAGR of 3.6% during the forecast period from 2024 to 2033.

Home decor refers to the products and accessories used to enhance the aesthetic appeal and functionality of living spaces. This includes furniture, textiles, lighting, wall art, and decorative items.

The home decor market encompasses the design, production, and sales of products used to furnish and decorate homes. It includes a wide range of products like furniture, curtains, lighting, and other decorative accessories. The market covers retail stores, online platforms, and specialty boutiques.

The home decor market is experiencing steady growth as homeowners continue to invest in enhancing their living spaces. According to a survey by Opendoor, 66% of homeowners are opting for cost-effective decor options like fresh paint, and 49% are moving furniture to create new layouts. Additionally, 41% of homeowners prefer open layouts for kitchen, living, and dining areas, showing a trend towards maximizing space and functionality.

The increase in personal income and disposable income also drives demand. In August, personal income rose by $50.5 billion (0.2%) and disposable personal income increased by $34.2 billion. As people have more money to spend, they are likely to invest in home decor.

Interest in interior design has also surged due to home improvement services and TV shows, social media, and blogs. According to the U.S. Bureau of Labor Statistics, employment of interior designers is projected to grow by 4% from 2022 to 2032, which will likely boost the market further.

Several factors are driving growth in the home decor market. Rising disposable income and increased interest in interior design are key drivers. New homeowners are also a significant segment.

A 2022 study by the National Association of Home Builders found that buyers of new homes spend an average of $12,000 on renovations, $5,000 on furnishings, and $4,000 on appliances within the first year. This indicates a substantial market for decor products among new homebuyers.

The demand for sustainable and personalized decor is another opportunity. Consumers are now seeking eco-friendly products, leading to growth in sustainable decor options. Additionally, customization is becoming a major trend, with many preferring unique and tailored designs to reflect their personality.

While the home decor market is expanding, it is approaching saturation in urban areas where demand has peaked. However, there are still opportunities in suburban and rural areas. The market is competitive, with both established brands and new entrants vying for customer attention. Companies differentiate themselves through product innovation, affordability, and sustainability to capture market share.

Key Takeaways

- The Home Decor Market was valued at USD 696.4 billion in 2023 and is expected to reach USD 991.9 billion by 2033, with a CAGR of 3.6%.

- In 2023, Furniture dominated the type segment with 50.4%, as consumers prioritized comfort and functionality in home spaces.

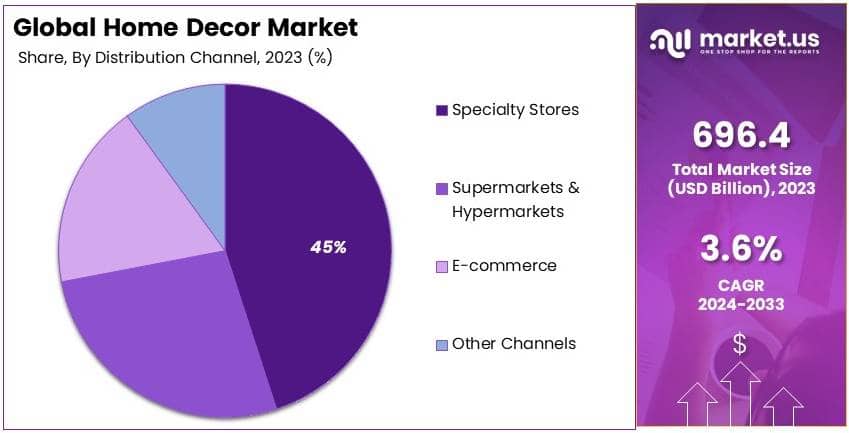

- In 2023, Specialty Stores led the distribution channel with 45%, reflecting consumer preference for curated and high-quality products.

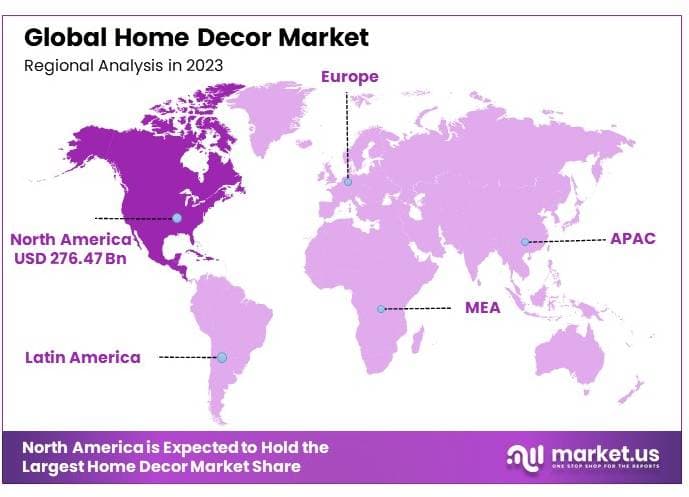

- In 2023, North America accounted for 39.7% of the market, benefiting from strong consumer spending and home improvement trends.

Type Analysis

Furniture dominates with 50.4% due to its essential role in home aesthetics and functionality.

In the home decor market, the Furniture segment stands out as the dominant sub-segment, accounting for 50.4% of the market. This significant share is primarily due to furniture’s dual role in enhancing the aesthetic appeal and functionality of living spaces.

Furniture’s versatility and the wide range of styles and designs available allow it to cater to diverse consumer tastes and needs. This adaptability helps maintain its market dominance. Additionally, the rise in homeownership and the increasing trend of home personalization fuel the continuous growth of the furniture market.

Other types within the home decor market include Home Textile, Floor Covering, and Other Types. While Furniture dominates, these segments contribute to market diversity. Home Textiles enhance comfort and aesthetic quality with items like rugs, curtains, and cushions. Floor Covering is essential for completing the look and functionality of a space, with options ranging from hardwood to carpets.

Innovation in materials and sustainability is becoming increasingly important. Eco-friendly furniture and ethically sourced materials are gaining traction, appealing to environmentally conscious consumers. The future growth of the furniture market will likely hinge on integrating technology and sustainability, which can attract a broader customer base and foster deeper market penetration.

Distribution Channel Analysis

Specialty Stores dominate with 45% due to personalized customer service and product expertise.

Within the distribution channel of the home decor market, Specialty Stores take the lead, holding a 45% market share. This dominance is largely because these stores provide a specialized shopping experience that general retailers cannot match.

The personalized shopping experience available in Specialty Stores greatly influences consumer preferences, especially for customers who value quality over price and are looking for unique or custom products.

The expertise of sales staff and the high level of customer care ensure that consumers receive guidance in making purchases that suit their personal and home styling needs, which is less feasible in larger, more general retail settings.

Other channels in the home decor market include Supermarkets and Hypermarkets, E-commerce, and Other Channels. While E-commerce platforms is growing rapidly, providing convenience and often competitive pricing, it cannot always replicate the personalized experience of Specialty Stores.

Supermarkets and Hypermarkets offer convenience for general purchases but lack the specialized focus that home decor enthusiasts often seek.

Key Market Segments

By Type

- Home Textile

- Floor Covering

- Furniture

- Other Types

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- E-commerce

- Other Channels

Drivers

Growing Interest in Personalization and Customization Drives Market Growth

The rising demand for personalized and customized home decor products significantly drives market growth. Consumers now seek unique and tailored designs that reflect their personalities, leading to an increase in the availability of customizable options from manufacturers.

Furthermore, the growing influence of interior design professionals is shaping market dynamics as more individuals rely on their expertise to create curated living spaces. Home renovation and remodeling activities have also surged, especially in urban areas where older homes require modern updates.

Additionally, the demand for premium and luxury home decor products has increased as consumers prioritize quality and exclusivity. This combination of factors accelerates market growth, making personalization and customization central to industry expansion.

Restraints

Limited Availability of Skilled Labor Restraints Market Growth

The home decor market faces several restraints, including the limited availability of skilled labor, which impacts production and customization services. Many regions experience labor shortages, especially in the skilled craftsmanship required for high-quality decor items.

Fluctuating economic conditions further affect the market, as economic downturns reduce consumer spending, leading to decreased demand for non-essential products like home decor. Rising raw material prices add another layer of difficulty, making it challenging for companies to maintain competitive pricing.

Moreover, stringent government regulations, especially regarding safety and environmental compliance, increase operational costs and complicate production processes. These restraining factors collectively limit the market’s potential growth, requiring companies to find innovative solutions to overcome these challenges.

Opportunity

Expansion into Emerging Markets Provides Opportunities

The home decor market finds growth opportunities in the expansion into emerging markets. These regions offer untapped potential, with rising disposable incomes and increasing urbanization driving demand for diverse home decor products.

Furthermore, the adoption of advanced manufacturing technologies such as 3D printing enables companies to streamline production processes and offer innovative product designs. Developing eco-friendly product lines also presents an opportunity, as environmentally conscious consumers seek sustainable home decor solutions.

Growth in direct-to-consumer (DTC) sales channels, particularly through online platforms, allows brands to reach a global audience, expanding market reach and enhancing profitability. Such opportunities encourage companies to invest in product innovation and market diversification, fostering growth in the industry.

Challenges

High Competition from Local and International Brands Challenges Market Growth

The home decor market faces significant challenges due to intense competition from both local and international brands. This competitive landscape pressures companies to continuously innovate and differentiate their offerings, which can be resource-intensive.

Additionally, variability in consumer preferences across regions complicates product development and marketing strategies, requiring companies to tailor their approaches to specific markets. The dependency on seasonal trends also creates unpredictability, as companies must anticipate and adapt to shifting consumer tastes throughout the year.

Furthermore, macroeconomic shifts, such as inflation or economic slowdowns, impact consumer spending behavior, making it challenging for brands to maintain consistent sales. These factors combine to create a dynamic yet challenging environment for companies in the home decor market.

Growth Factors

Increasing Popularity of Home Office Setups Is Growth Factor

The growing demand for home office setups is a significant growth factor in the home decor market. As remote work becomes more prevalent, consumers invest in creating functional and aesthetically pleasing workspaces within their homes.

Additionally, there is a rising preference for outdoor and garden decor, as people seek to enhance their outdoor spaces for relaxation and entertainment. The demand for sustainable and organic materials further supports market growth, with consumers increasingly choosing eco-friendly options.

Celebrity and influencer endorsements also play a vital role in shaping consumer behavior, as they drive trends and promote specific products or styles. These factors collectively contribute to the expansion and diversification of the home decor market, highlighting areas of potential growth.

Emerging Trends

Smart Home Integration and Automation Is Latest Trending Factor

The integration of smart home technology is a prominent trend in the home decor market. Consumers increasingly prefer automated and technology-driven solutions that enhance their living experience.

This trend includes smart lighting, automated window treatments, and home security systems integrated into decor designs, offering convenience and modern aesthetics. Vintage and retro-inspired decor styles have also gained traction, appealing to consumers looking for nostalgic and timeless designs.

Multifunctional and modular furniture is another growing trend, catering to the needs of compact urban living spaces by offering flexibility and space efficiency. The popularity of Scandinavian minimalist aesthetics continues to influence decor trends, focusing on simplicity, functionality, and natural materials.

Regional Analysis

North America Dominates with 39.7% Market Share

North America leads the Home Decor Market with a 39.7% share, amounting to USD 276.47 billion. This dominance is fueled by high consumer spending on home improvement and renovation. Growing interest in interior design trends and the influence of social media also contribute to the strong performance in this region.

The region’s market benefits from a well-developed retail infrastructure, including specialty stores and major e-commerce platforms. North American consumers prioritize high-quality and customizable products, boosting demand for premium decor items. Additionally, favorable economic conditions and housing market growth support increased spending on home decor products.

North America’s influence in the global home decor market is expected to grow, as consumers continue investing in modern, eco-friendly, and smart home solutions. The rise in online sales channels and innovative design trends will further strengthen the region’s position in the market.

Regional Mentions:

- Europe: Europe shows stable growth in the home decor market, driven by a focus on sustainable and eco-friendly designs, particularly in Northern European countries.

- Asia Pacific: Asia Pacific is expanding rapidly, supported by urbanization and rising disposable incomes. Markets like China and India lead with increasing home improvement activities.

- Middle East & Africa: The Middle East and Africa are growing, with a focus on luxury decor and real estate developments, especially in the UAE and Saudi Arabia.

- Latin America: Latin America is gradually developing its home decor market, with demand rising in Brazil and Mexico due to an increase in home ownership and renovation activities.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Home Decor Market is competitive and diverse, with a mix of global and regional players. It includes various segments like furniture, lighting, textiles, kitchenware, and smart home products. The market is growing due to increasing demand for stylish and functional home environments, urbanization, and rising disposable incomes.

These companies offer a wide range of home decor products. Inter IKEA Systems B.V. and Home24 lead in affordable, modern furniture and home accessories, targeting a broad customer base.

High-end brands like Herman Miller, Inc., and Kimball International Inc. focus on premium furniture and office decor solutions. Meanwhile, Suofeiya Home Collection Co., Ltd. and Hanssem Corporation specialize in custom-made furniture, appealing to customers looking for tailored designs.

Many key players have a global presence. Inter IKEA Systems B.V., Siemens AG, and Koninklijke Philips N.V. have established strong distribution networks in multiple regions, allowing them to dominate markets across Europe, Asia, and North America. Companies like Hanssem Corporation and Suofeiya Home Collection Co., Ltd. have a strong base in Asia, expanding their reach through e-commerce and regional partnerships.

Innovation is a major focus for many of these companies. Siemens AG and Koninklijke Philips N.V. lead in the smart home segment, offering technologically advanced lighting and home automation products. Springs Window Fashions LLC and Conair Corporation focus on improving traditional home products like curtains and home appliances with modern designs and new features.

Top Key Players in the Market

- Inter IKEA Systems B.V.

- Kimball International Inc.

- Herman Miller, Inc.

- Home24

- Hanssem Corporation

- Koninklijke Philips N.V.

- Conair Corporation

- Suofeiya Home Collection Co., Ltd.

- Springs Window Fashions LLC

- Siemens AG

- Other Key Players

Recent Developments

- IKEA India: In September 2024, IKEA India introduced a new 365-day return and exchange policy to enhance customer experience, allowing returns in both original packaging and assembled states. This policy applies to furniture and accessories, giving customers a full year to test products for fit and comfort at home.

- Vita Moderna: In May 2024, Vita Moderna opened an 8,000-square-foot experience centre in Mumbai’s Raghuvanshi Mills. This showroom blends luxury with innovation, featuring high-end Italian brands like Elie Saab Maison and Delta Lights.

- Kmart Australia: In October 2024, Kmart Australia relaunched its popular Smart Wi-Fi LED Sunset Light, focusing on affordability and modern technology in home decor. The device creates ambient lighting effects controlled via a smartphone app, appealing to tech-savvy consumers seeking cost-effective solutions to enhance their home atmosphere.

- Tesco: In June 2024, Tesco expanded into home decor with the launch of its F&F Home line, tapping into the growing demand for affordable home furnishings. The range includes furniture and decorative accessories with a contemporary design focus at accessible prices.

Report Scope

Report Features Description Market Value (2023) USD 696.4 Billion Forecast Revenue (2033) USD 991.9 Billion CAGR (2024-2033) 3.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Home Textile, Floor Covering, Furniture, Other Types), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Other Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Inter IKEA Systems B.V., Kimball International Inc., Herman Miller, Inc., Home24, Hanssem Corporation, Koninklijke Philips N.V., Conair Corporation, Suofeiya Home Collection Co., Ltd., Springs Window Fashions LLC, Siemens AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Inter IKEA Systems B.V.

- Kimball International Inc.

- Herman Miller, Inc.

- Home24

- Hanssem Corporation

- Koninklijke Philips N.V.

- Conair Corporation

- Suofeiya Home Collection Co., Ltd.

- Springs Window Fashions LLC

- Siemens AG

- Other Key Players