Global Hot Tub Market By Type (Potable Hot Tubs, Fixed Hot Tubs), By End-User (Residential, Commercial), By Distribution Channel (Offline, Online), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 64926

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

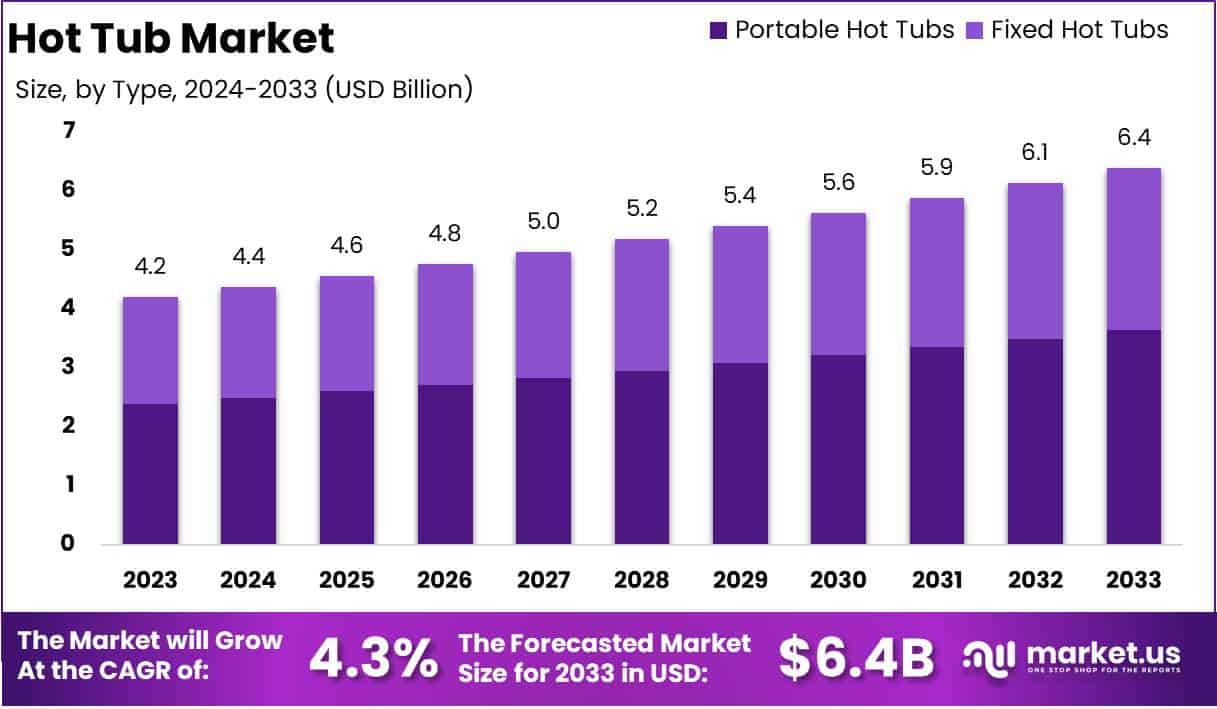

The Global Hot Tub Market size is expected to be worth around USD 6.4 Billion by 2033, from USD 4.2 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

A hot tub is a large, heated tub or small pool filled with water, typically used for hydrotherapy, relaxation, or recreation. It is equipped with powerful jets that circulate water and provide massaging effects, enhancing the user’s comfort. The water temperature in hot tubs is usually maintained at a warm level, allowing for a soothing experience.

They come in various sizes and configurations, ranging from portable models to large, built-in units. Hot tubs are often found in homes, resorts, and wellness centers and are favored for their therapeutic benefits, including stress relief, muscle relaxation, and improved circulation.

The hot tub market encompasses the production, distribution, and sales of hot tubs and related accessories worldwide. It includes a range of products, from inflatable and portable models to high-end luxury spas with advanced features like LED lighting, sound systems, and customizable jets.

The hot tub market encompasses the production, distribution, and sales of hot tubs and related accessories worldwide. It includes a range of products, from inflatable and portable models to high-end luxury spas with advanced features like LED lighting, sound systems, and customizable jets.The market also includes maintenance services, such as cleaning, repair, and water treatment solutions. This market caters to both residential and commercial customers, with demand being driven by leisure, health, and wellness trends. Key market players focus on product innovation, energy efficiency, and enhanced user experience to remain competitive.

The growth of the hot tub market is fueled by several factors, primarily the increasing consumer interest in health and wellness. As awareness of hydrotherapy’s physical and mental health benefits rises, more consumers are integrating hot tubs into their lifestyle as a means of stress relief and muscle recovery.

Demand for hot tubs is largely influenced by seasonal trends, with peaks typically occurring during spring and summer. Residential demand dominates the market, driven by homeowners who view hot tubs as a long-term investment in their well-being and as a means to enhance property value.

Commercial establishments, such as hotels, resorts, and wellness centers, also contribute significantly to market demand, seeking to offer a premium relaxation experience to guests. The post-pandemic shift towards creating personal wellness spaces at home has further fueled consumer interest, as more individuals now prioritize comfort, relaxation, and self-care amenities.

The hot tub market presents significant opportunities, particularly through product innovation and strategic expansion into emerging markets. For instance, the integration of Internet of Things (IoT) technology offers the potential for smart hot tubs that can be remotely controlled via smartphones, enhancing convenience and personalization.

Additionally, expanding into developing regions where the middle class is growing could unlock substantial new demand.

Sustainability trends also present opportunities, as consumers increasingly prefer eco-friendly and energy-efficient models, prompting manufacturers to invest in greener production methods and materials. By capitalizing on these trends, market players can enhance their competitiveness and capture a larger share of the market.

According to ConsumerAffairs, there are approximately 7.3 million hot tubs currently in use across the U.S., with consumers keeping them for an average of seven and a half years. Nearly 40% of hot tubs are sold secondhand or given away, indicating a strong secondary market. The hot tub sector, while niche, comprises around 4,500 retailers nationwide, with each store employing an average of 32 individuals.

In total, the spa industry supports 360,700 jobs, including 4,255 specifically in hot tub manufacturing. The top four hot tub companies generate 58% of the market’s revenue, showcasing market concentration, while the average retail outlet achieves annual revenues of approximately $500,000.

According to Hot Tubs by Hot Spring, the average installation cost of a hot tub in the U.S. is $318, with a range between $157 and $490, largely influenced by the location, size, and installation complexity.

While installation on a concrete pad in a backyard is common, more complex setups, such as rooftop installations using a crane, increase costs. Additionally, running costs for hot tubs range from $10 to $20 per month, highlighting operational affordability.

According to the National Sleep Foundation, 132 million Americans experience sleep disorders weekly. A 15-minute soak, 90 minutes before sleep, can facilitate deeper rest.

The U.S. Consumer Product Safety Commission advises a maximum hot tub temperature of 104°F, recommending 100°F for optimal safety, especially for children.

According to Epic Hot Tubs, a survey of 500 U.S. adults revealed that 8.1% currently own a hot tub, while over 18% have owned one at some point, contributing to approximately 5.8 million hot tubs nationwide. This translates to 4.6% of households and 1.8% of individuals owning hot tubs.

Despite demand, the U.S. hot tub manufacturing sector experienced a 0.6% annual decline from 2017-2022, driven by lower prices, supply chain disruptions, and increased overseas production.

Key Takeaways

- The Global Hot Tub Market is projected to grow from USD 4.2 billion in 2023 to USD 6.4 billion by 2033, registering a CAGR of 4.3% from 2024 to 2033.

- Portable Hot Tubs dominate with 57% market share, driven by ease of installation and affordability.

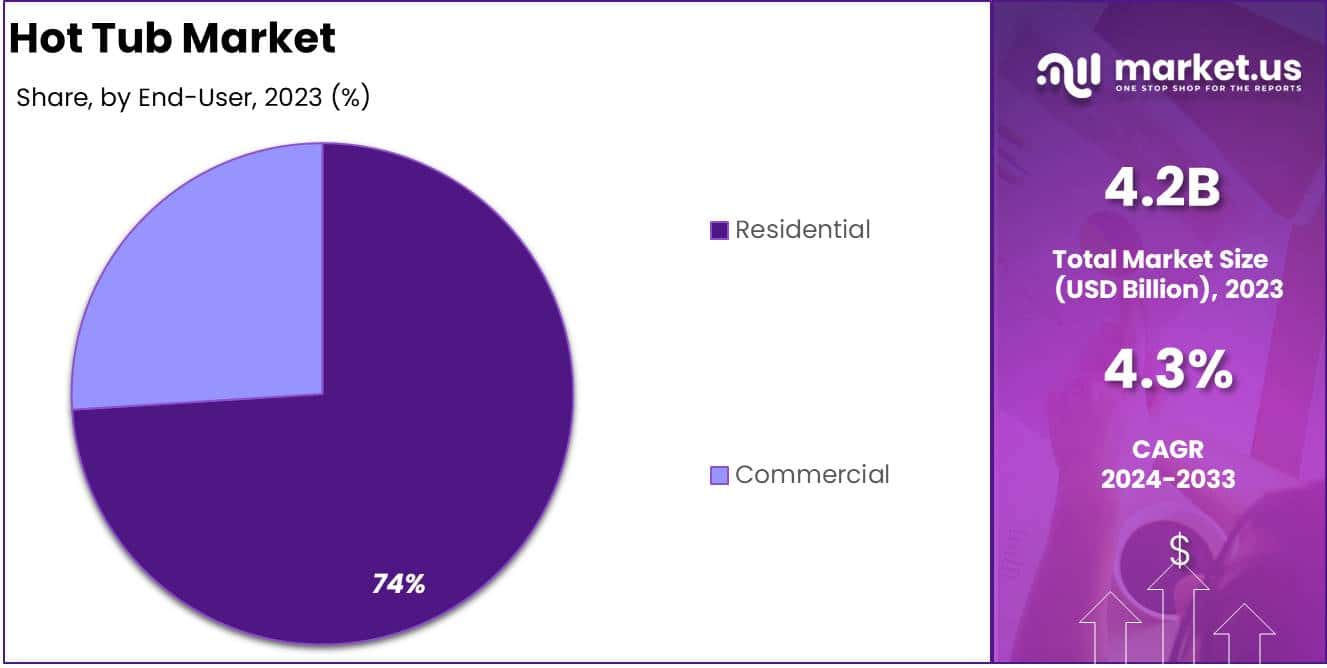

- Residential users hold 74% share, fueled by growing demand for home-based wellness solutions.

- Offline sales lead with 65% share, reflecting consumer preference for in-person experiences and immediate support.

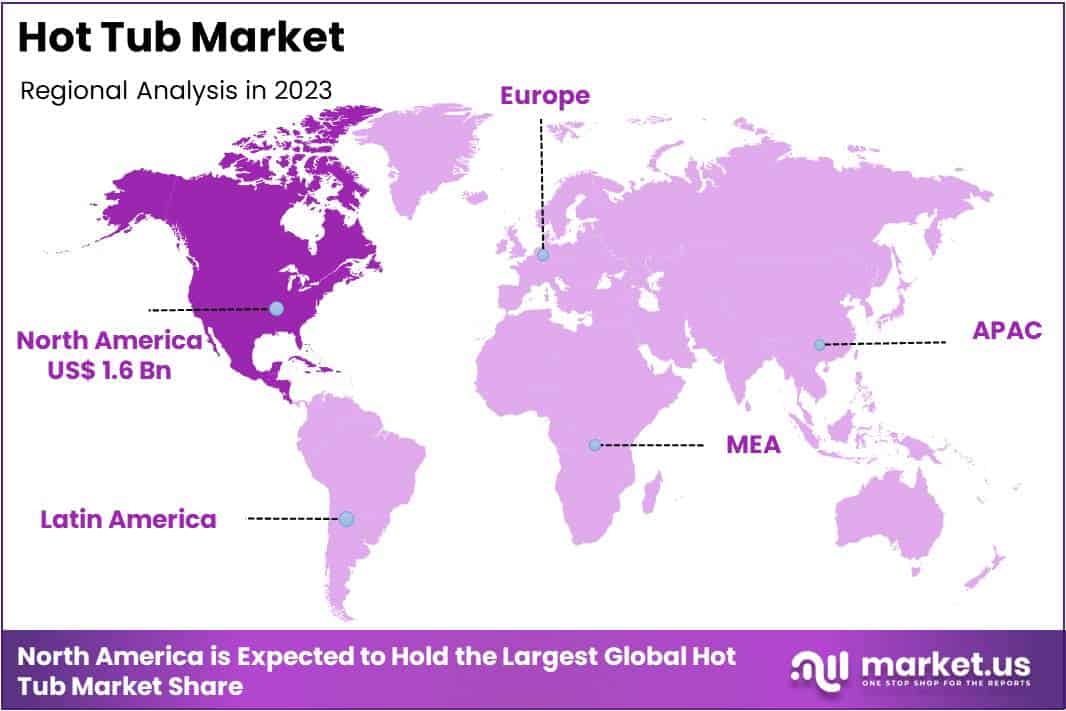

- North America leads with a 38% market share, supported by increasing disposable incomes and a strong culture of outdoor recreation.

By Type Analysis

Portable Hot Tubs Dominating Segment in Hot Tub Market with 57% Share

In 2023, Portable Hot Tubs held a dominant market position in the by type segment of the Hot Tub Market, capturing more than 57% share. The demand for portable hot tubs is primarily driven by their ease of installation, cost-effectiveness, and flexibility in movement, making them a preferred choice among homeowners seeking an affordable and less permanent solution.

These tubs also cater to a wider consumer base, particularly appealing to first-time buyers and those living in rented or temporary accommodations. Additionally, advancements in lightweight materials and inflatable models have contributed to increased adoption rates, supporting sustained growth in this segment.

Fixed Hot Tubs accounted for the remaining 43% of the market share in the by type segment of the Hot Tub Market in 2023. While trailing behind portable options, fixed hot tubs continue to appeal to consumers seeking long-term investments in luxury and wellness amenities.

They are often chosen for their durability, enhanced features, and the potential to add value to properties. Primarily favored by homeowners with larger outdoor spaces, these models benefit from a growing trend of home improvement and the integration of hot tubs into permanent outdoor or indoor spa facilities.

However, higher installation costs and longer setup times may limit their broader adoption compared to portable alternatives.

By End-User Analysis

Residential Dominating Segment in Hot Tub Market with 74% Share

In 2023, Residential held a dominant market position in the by end-user segment of the Hot Tub Market, capturing more than 74% share. The residential segment’s growth is fueled by increasing consumer interest in wellness, relaxation, and home-based leisure activities.

Factors such as rising disposable incomes, expanding home renovation trends, and a growing preference for at-home spa experiences have significantly boosted demand for residential hot tubs. Additionally, the availability of a variety of models, ranging from budget-friendly portable options to premium, feature-rich fixed tubs, has expanded the consumer base within this segment.

The Commercial segment accounted for the remaining 26% of the market share in the by end-user segment of the Hot Tub Market in 2023. This segment primarily includes installations in hotels, resorts, wellness centers, and other commercial facilities, where hot tubs are used to enhance customer experiences.

While the commercial sector lags behind the residential segment in terms of overall volume, the growing focus on wellness tourism and luxury hospitality services has driven demand for high-capacity, feature-rich hot tubs.

However, longer purchasing cycles, higher investment requirements, and stricter regulatory standards contribute to slower adoption rates in this segment compared to the residential market.

By Distribution Channel Analysis

Offline Dominating Segment in Hot Tub Market with 65% Share

In 2023, the Offline channel held a dominant market position in the distribution segment of the Hot Tub Market, capturing over 65% share. This segment continues to thrive due to the consumer preference for in-person product demonstrations, immediate customer support, and the ability to assess quality before purchase.

The tactile nature of offline retail, along with the presence of specialty stores and dealers, facilitates a better understanding of the product features, resulting in higher sales volumes. Furthermore, offline distribution channels often benefit from established trust and reputation, which contribute to customer loyalty and repeat purchases.

The Online distribution channel accounted for approximately 35% of the market share in 2023, reflecting a substantial growth trajectory. Increasing digital penetration, convenience of online shopping, and the availability of wider product ranges have driven this segment’s expansion.

Online platforms enable consumers to compare prices, read reviews, and access a broader variety of brands, which appeals to tech-savvy buyers seeking ease and flexibility.

Additionally, the emergence of e-commerce giants and improvements in virtual product demonstrations have bolstered this channel’s competitive position, attracting more customers over time.

Key Market Segments

By Type

- Portable Hot Tubs

- Fixed Hot Tubs

By End-User

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

Driver

Increasing Health and Wellness Awareness

The global hot tub market is experiencing significant growth, primarily driven by a heightened consumer focus on health and wellness. Hot tubs offer numerous therapeutic benefits, such as stress relief, muscle relaxation, and improved circulation, making them appealing to health-conscious individuals.

As more people prioritize holistic well-being, the demand for hot tubs has risen, positioning them as essential tools for relaxation and therapy.

Additionally, the integration of advanced features like hydrotherapy jets and temperature control has enhanced the user experience, further boosting the adoption of hot tubs. This trend indicates a robust market expansion, with consumers increasingly investing in home wellness amenities.

Restraint

High Initial and Maintenance Costs

Despite the growing interest, the hot tub market faces challenges due to the high initial purchase price and ongoing maintenance expenses. Quality hot tubs require significant investment, which can be a barrier for many potential buyers, especially in regions with lower disposable incomes.

Moreover, maintenance tasks including cleaning, water treatment, and energy consumption entail additional costs and effort, potentially deterring consumers from investing in hot tubs.

These financial considerations are critical, as they can lead to a slower adoption rate, particularly in emerging markets where economic constraints are more pronounced. Addressing these cost concerns through innovative financing options or more affordable product lines could be vital for broader market penetration.

Opportunity

Technological Advancements and Smart Features

Technological innovations present a significant opportunity for growth in the hot tub market. The incorporation of smart features such as remote monitoring, customizable settings, and energy-efficient systems has increased the appeal of hot tubs to a tech-savvy clientele.

For instance, the development of hot tubs with integrated IoT technology allows users to control settings via smartphones, enhancing convenience and user experience.

Furthermore, advancements in energy efficiency not only reduce operational costs but also align with the global shift towards sustainable living, thereby attracting environmentally conscious consumers. Manufacturers that innovate and integrate these technologies are well-positioned to capitalize on this growing segment.

Trends

Rising Demand in Residential Sectors

There is a notable increase in hot tub installations within residential settings, driven by homeowners seeking to enhance their living spaces and invest in personal wellness. The desire for private, at-home relaxation amenities has led to a surge in hot tub purchases for personal use.

This trend is particularly prominent in regions with higher disposable incomes, where consumers view hot tubs as both a luxury and a wellness necessity.

Additionally, the versatility of hot tubs, ranging from compact portable models to elaborate in-ground installations, caters to various preferences and budgets, further propelling their adoption in homes worldwide. This shift towards home-based wellness solutions is expected to continue, significantly contributing to market growth.

Regional Analysis

North America Leads Hot Tub Market with Largest Share at 38% in 2023

In 2023, North America emerged as the leading region in the global hot tub market, capturing 38% of the total market share, with an estimated market value of USD 1.6 billion.

This dominance is driven by a high demand for luxury and recreational products, a robust presence of well-established manufacturers, and increasing consumer inclination towards wellness and leisure activities.

The United States, in particular, contributes significantly to this growth, attributed to rising household incomes, a strong culture of outdoor recreation, and the increasing adoption of energy-efficient hot tubs.

Europe represents a mature market for hot tubs, characterized by strong sales in countries like Germany, the UK, and France. Consumer preference in this region is largely shaped by a focus on health benefits, hydrotherapy, and eco-friendly products, spurring demand for energy-efficient models and smart features.

Meanwhile, Asia Pacific is witnessing rapid growth, driven by rising disposable incomes and an expanding middle class, particularly in countries like China, Japan, and Australia. The region’s growing awareness of hydrotherapy’s health benefits also propels market growth, with manufacturers exploring strategic partnerships to cater to the evolving consumer demands.

The Middle East & Africa market is evolving steadily, buoyed by a rising inclination towards luxury lifestyle products, particularly in the UAE, Saudi Arabia, and South Africa. The region’s increasing tourism sector, coupled with the growing number of wellness resorts, supports demand.

In Latin America, the hot tub market is driven by expanding tourism, a gradual increase in household incomes, and the rise of urban centers in Brazil, Mexico, and Argentina, contributing to increased consumer spending on leisure activities, including hot tubs.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In the dynamic landscape of the Global Hot Tub Market in 2024, several key players are poised to significantly impact the industry’s trajectory. Bullfrog Spas, renowned for its innovative JetPak Therapy System, continues to redefine user customization and comfort, catering to a growing consumer demand for personalized wellness solutions.

Canadian Spa Company amplifies its market presence through a blend of quality craftsmanship and advanced hydrotherapy features, appealing to health-conscious consumers across diverse regions.

Jacuzzi Brands remains a dominant force, with its legacy and continuous innovation in hydrotherapeutic solutions driving its growth. The company’s commitment to high-quality, luxurious spas cements its status as a market leader.

Similarly, Artesian Spas is distinguishing itself through handcrafted designs and exceptional therapeutic features that prioritize consumer wellness, thus securing a loyal customer base.

Blue Falls Manufacturing and Cal Spas are both expanding their market reach by integrating cutting-edge technologies and expansive design options that cater to both residential and commercial markets.

Nordic Hot Tubs focuses on simplicity and efficiency, offering compact, durable models that appeal to budget-conscious segments without compromising on quality.

Coast Hot Tubs and Caldera Spas are enhancing their product lines with eco-friendly features and energy-efficient designs, addressing the increasing consumer interest in sustainability. PDC Spas leverages its expertise in therapeutic design to offer a robust portfolio that includes swim spas, providing a dual benefit of exercise and relaxation.

The segment Other Key Players indicates a vibrant competitive fringe that continuously introduces innovative products and niche offerings, thus keeping the market dynamics fluid and competitive. Collectively, these companies are setting robust industry standards and driving forward the global appeal and technological adoption within the hot tub market.

Top Key Players in the Market

- Bullfrog Spas

- Canadian Spa Company

- Jacuzzi Brands

- Artesian Spas

- Blue Falls Manufacturing

- Cal Spas

- Nordic Hot Tubs

- Coast Hot Tubs

- Caldera Spas

- PDC Spas

- Other Key Others

Recent Developments

- In 2023, Bullfrog Spas, a renowned hot tub manufacturer, introduced its latest A Series line of hot tubs, setting new standards in design and technology. Based in Herriman, Utah, the company’s new A Series™ offers exclusive features, contemporary designs, and advanced technologies aimed at enhancing user comfort and reliability. This launch reflects Bullfrog Spas’ commitment to providing a luxurious hot tub experience aligned with current market trends and consumer demands.

- In 2023, Watkins Wellness, a leader in hot tubs and aquatic fitness, announced its entry into the sauna market through the acquisition of Sauna360 Group Oy by its parent, Masco Corporation. Sauna360, a global sauna manufacturer, offers products like traditional, infrared, wood-burning saunas, and steam solutions, marketed under brands like Tylö, Helo, Kastor, Finnleo, and Amerec, mainly across the U.S. and Europe. The acquisition is set to finalize in the third quarter, pending regulatory approval.

- In 2024, Sundance Spas launched the 880 Series Spas featuring the new SunStrong frame, a galvanized steel structure designed for strength, durability, and sustainability. Built in an eco-friendly facility using recycled materials, the frame is 100% recyclable, reflecting Sundance’s commitment to environmental responsibility.

Report Scope

Report Features Description Market Value (2023) USD 4.2 Billion Forecast Revenue (2033) USD 6.4 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Potable Hot Tubs, Fixed Hot Tubs), By End-User (Residential, Commercial), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bullfrog Spas, Canadian Spa Company, Jacuzzi Brands, Artesian Spas, Blue Falls Manufacturing, Cal Spas, Nordic Hot Tubs, Coast Hot Tubs, Caldera Spas, PDC Spas, Other Key Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bullfrog Spas

- Canadian Spa Company

- Jacuzzi Brands

- Artesian Spas

- Blue Falls Manufacturing

- Cal Spas

- Nordic Hot Tubs

- Coast Hot Tubs

- Caldera Spas

- PDC Spas

- Other Key Others