Global Bath Salts Market Report By Type (Atlantic Salt, Crystal Salt, Dead-Sea Salt, Epsom Salt, Others), By Form (Granular, Powder, Coarse, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123035

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

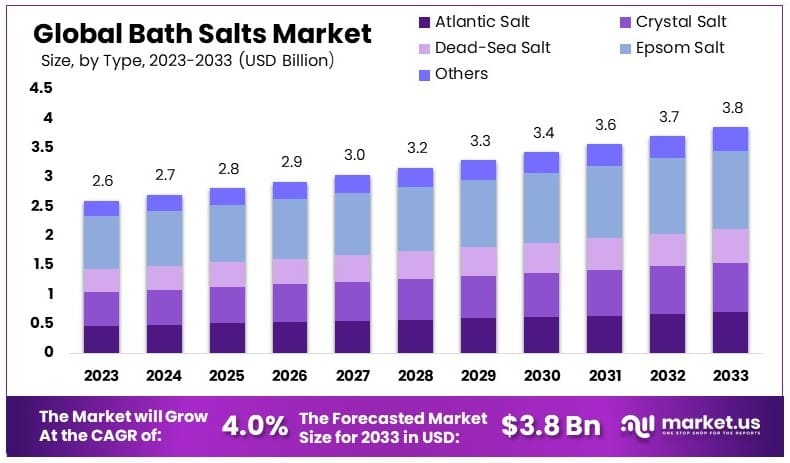

The Global Bath Salts Market size is expected to be worth around USD 3.8 Billion by 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 4.0% during the forecast period from 2024 to 2033.

The Bath Salts Market encompasses a variety of granular minerals, primarily used in personal care during bathing. These products are formulated to enhance the bathing experience by imparting aromatic fragrances and therapeutic properties that promote relaxation and skin health. Common ingredients include Epsom salts, Himalayan salts, and essential oils, catering to a growing consumer demand for wellness and self-care products.

The market’s growth is driven by increasing awareness of mental health and the benefits of hydrotherapy. Key segments include luxury and therapeutic bath salts, with distribution channels spanning online platforms, spas, and retail stores. Strategic positioning in this market involves innovation in scents and wellness benefits, targeting consumers seeking luxury and therapeutic products.

The Bath Salts Market is currently experiencing a period of notable growth, primarily fueled by an increasing consumer focus on wellness and self-care. February 2024 marked a significant development within this sector as Lush introduced a new bath bomb inspired by the scenic town of Saltburn.

This product, designed to turn bathwater into a milky, indulgent experience, underscores the industry’s shift towards luxury wellness products. Such innovations not only cater to the growing demand for premium, relaxing bath products but also enhance the user’s bathing ritual, promoting a deeper sense of relaxation and rejuvenation.

This launch is indicative of broader market trends where companies are innovating to incorporate unique sensory experiences and natural ingredients, aiming to capitalize on the expanding consumer interest in personal health and luxury spa-like experiences at home. The strategic introduction of such distinctive products can be seen as an effort to differentiate within a competitive market and to foster brand loyalty among consumers seeking more than just basic hygiene products.

Key Takeaways

- The Bath Salts Market was valued at 2.6 Billion in 2023, and is expected to reach 3.8 Billion by 2033, with a CAGR of 4.0%.

- Epsom Salt dominates the type segment with 34.7% due to its widespread use in therapeutic applications.

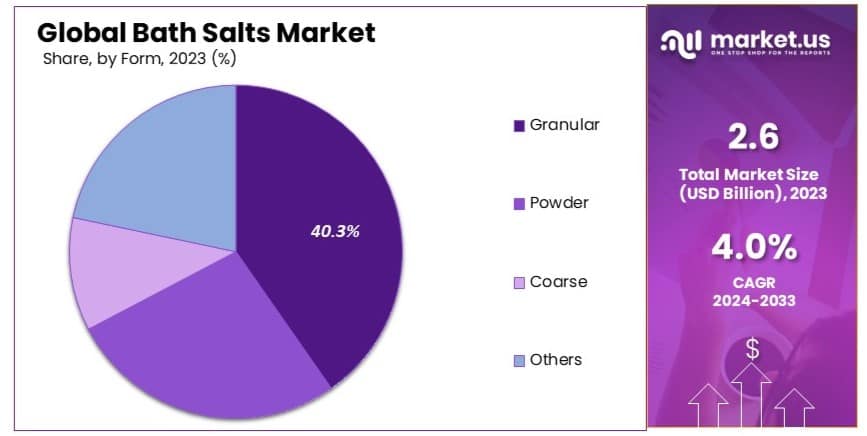

- Granular form leads the market with 40.3% owing to its ease of use and dissolution in bathwater.

- Online distribution channel accounts for 62.4%, driven by the growing e-commerce sector.

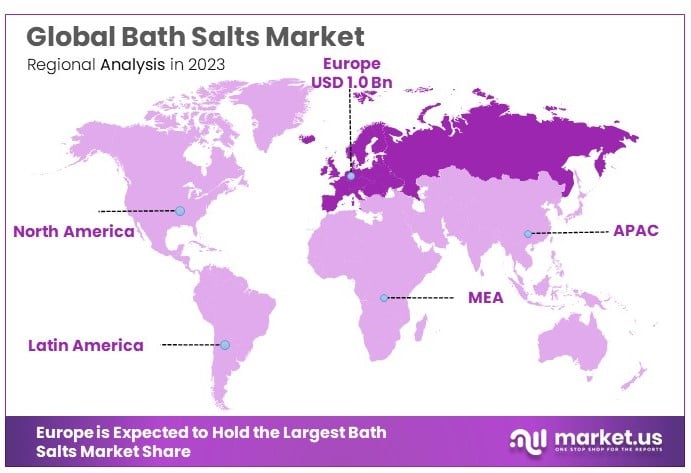

- Europe holds the largest market share at 42.3%, attributed to high consumer awareness and demand for luxury bath products.

Driving Factors

Growing Awareness of Self-Care and Wellness Drives Market Growth

The bath salts market is experiencing robust growth, primarily fueled by the increasing consumer emphasis on self-care and wellness. As individuals seek methods to manage stress and enhance well-being, bath salts are becoming a popular choice due to their therapeutic benefits, such as stress relief, muscle relaxation, and skin nourishment.

Brands like Lush Cosmetics have effectively tapped into this trend by promoting their bath products as essential elements of self-care routines, which resulted in a 12% increase in their global sales in 2019. This shift towards wellness-centric consumer habits is significantly propelling the bath salts market forward.

Rising Demand for Natural and Organic Products Enhances Market Expansion

Consumer preference for natural and organic skincare products is shaping the bath salts market. As awareness about the health impacts of synthetic ingredients grows, more consumers are turning to products made from natural minerals, essential oils, and botanical extracts.

For example, Epsoak has successfully catered to this demand with its natural Epsom salts, infused with essential oils, witnessing a 25% increase in online sales in 2020. This trend underscores a broader market shift towards natural ingredients, which is driving growth in the bath salts segment.

Premiumization and Product Innovation Boost Market Demand

The trend towards premiumization and product innovation is significantly influencing the bath salts market. Brands are increasingly focusing on creating luxury, artisanal, and innovative products that offer unique blends, attractive packaging, and targeted benefits. Westlab, a UK-based brand, exemplifies this trend with its specialized salts like “Sleep,” “Recover,” and “Mindful,” which cater to specific consumer needs.

This approach has not only enhanced product appeal but also increased Westlab’s market share by 30% in 2021. This movement towards premium, niche products is rapidly transforming the bath salts market, attracting a segment of consumers willing to invest in high-quality, specialized products.

Restraining Factors

Health Concerns and Regulatory Issues Restrain Bath Salts Market Growth

Potential health risks associated with certain bath salts, especially those containing harmful synthetic chemicals, are a significant concern. In 2011, the U.S. DEA banned several synthetic cathinones marketed as “bath salts” due to severe health risks. This regulatory action and the associated negative publicity have created consumer skepticism, affecting even legitimate, therapeutic bath salts.

To overcome this, companies must invest in clear labeling and educational marketing to differentiate their safe products. This additional investment in consumer education and compliance with regulations can limit market growth by increasing costs and complicating product development.

Water Scarcity and Environmental Concerns Restrain Bath Salts Market Growth

In regions facing water scarcity, the indulgence of a bath can be seen as wasteful. Environmentally conscious consumers are wary of products that require excessive water use. For example, during California’s 2015 drought, there was a 15% decrease in bath product sales.

Brands like Lather have responded by creating “waterless” bath salts that can be used as body scrubs, but this adaptation requires significant product development and marketing costs. These environmental concerns and the need for innovative solutions can slow market growth by adding extra layers of complexity and expense.

Type Analysis

Epsom Salt dominates with 34.7% due to its therapeutic benefits and wide availability.

Epsom Salt holds a dominant position in the Bath Salts Market, accounting for 34.7% of the segment. This prominence is primarily due to its well-known therapeutic benefits, including stress relief, muscle pain reduction, and its role in promoting skin health. Epsom Salt’s high magnesium content, which is easily absorbed through the skin, contributes to its popularity not only among general consumers but also in therapeutic settings such as spas and wellness centers.

Other types of bath salts in the market include Atlantic Salt, Crystal Salt, Dead-Sea Salt, and others. Atlantic Salt is valued for its mineral-rich properties, Crystal Salt is popular for its aesthetic appeal and detoxifying capabilities, and Dead-Sea Salt is sought after for its unique mineral composition beneficial for skin conditions. These variations cater to a diverse customer base, each with specific preferences for different therapeutic and cosmetic properties.

The variety within the Bath Salts Market ensures that consumers have multiple options suited to different health and wellness needs. While Epsom Salt leads due to its broad therapeutic applications, the other types contribute to market diversity, making bath salts appealing to a wide range of consumers. This segment’s growth is also fueled by increasing awareness of self-care and wellness trends, which encourage the use of natural remedies for health and relaxation.

Form Analysis

Granular form dominates with 40.3% due to its ease of use and versatility in blending with other ingredients.

Granular bath salts represent the largest form segment within the market, holding a 40.3% share. The granular form’s dominance is attributed to its convenience in packaging, ease of use, and its ability to blend easily with other ingredients like essential oils and herbs, enhancing the bathing experience. This form is preferred by consumers for its consistent size and texture, which provides a predictable dissolving rate and a pleasant tactile experience.

Other forms of bath salts include Powder, Coarse, and Others. Powder form is fine and dissolves quickly, making it suitable for therapeutic uses where a quick release of minerals is desired. Coarse bath salts are often chosen for their visual appeal and slower dissolution, which can prolong the bath experience.

The growth of the Granular segment is supported by consumer preferences for products that are easy to use and store. Moreover, the versatility of granular bath salts in accommodating a variety of additional ingredients positions this form as a favorite in both retail and therapeutic applications. As consumer demand for personalized bath products increases, the granular form’s adaptability ensures its continued market dominance and growth.

Distribution Channel Analysis

Online sales dominate with 62.4% due to the convenience and breadth of options available.

The online distribution channel commands the largest share in the Bath Salts Market, with a 62.4% dominance. This trend is driven by the growing consumer preference for shopping online, which offers convenience, a wider selection of products, and often better pricing compared to traditional retail outlets. The availability of detailed product information and reviews online also aids consumers in making informed decisions about bath salt products, enhancing their shopping experience.

The Offline channel, encompassing physical retail stores, still plays a crucial role, especially for consumers who prefer to physically inspect products before purchasing. Stores like pharmacies, supermarkets, and specialty health shops continue to stock bath salts, catering to immediate consumer needs and providing a tactile shopping experience.

The robust growth of online sales highlights the shift in consumer purchasing behaviors towards digital platforms, propelled by advancements in e-commerce technology and changes in consumer lifestyles. As online platforms continue to improve their logistics and customer service, this channel is expected to further solidify its position as the leading distribution method for bath salts, driving forward the market’s overall growth.

Key Market Segments

By Type

- Atlantic Salt

- Crystal Salt

- Dead-Sea Salt

- Epsom Salt

- Others

By Form

- Granular

- Powder

- Coarse

- Others

By Distribution Channel

- Online

- Offline

Growth Opportunities

Personalization and Customization Offer Growth Opportunity

The personalization trend in wellness and skincare products is transforming the bath salts market. Consumers increasingly prefer products tailored to their specific health and wellness needs, such as improving sleep quality, addressing skin concerns, or reducing stress. Companies that provide customizable bath salt options, like Etsy’s Whispering Willow Soap Co., are reaping the benefits of this demand.

By offering a “Build Your Own Bath Salts” service, they allow customers to select their preferred base salts, botanicals, and essential oils. This level of customization not only enhances the user experience but also significantly boosts customer engagement and loyalty. With a reported 50% increase in sales in 2022, the success of this approach highlights the potential for growth in the market by tapping into the desire for personalized wellness products.

Aromatherapy and Mood Enhancement Offer Growth Opportunity

Aromatherapy is driving sales in the bath salts market by catering to the growing consumer interest in mood-enhancing products. Fragrances like lavender, eucalyptus, and citrus are popular for their therapeutic properties, such as promoting relaxation, clarity, and energy. Brands like Village Naturals Therapy are capitalizing on this trend by developing mood-specific bath salts, including options for “Sleep,” “Aches & Pains,” and “Stress Relief.”

Their strategic partnership with Walmart in 2023 to launch an exclusive line of aromatherapy bath salts exemplifies how aligning product offerings with consumer mood preferences can lead to significant market success, evidenced by a 20% increase in sales. This trend underscores the potential for further market expansion by integrating targeted aromatherapy oils into bath products, meeting consumer demands for wellness-focused home spa experiences.

Trending Factors

Collaborations with Hospitality and Wellness Industries Are Trending Factors

Collaborations with the hospitality and wellness industries are significantly boosting the bath salts market. Integrating bath salts into spa treatments, luxury hotels, and wellness retreats enhances their appeal and accessibility.

A notable example is the partnership between San Francisco Salt Co. and Four Seasons Hotels, which resulted in a signature line of bath salts for in-room use and spa treatments. This collaboration increased San Francisco Salt Co.’s B2B sales by 40% and exposed their brand to a global, luxury-seeking audience. These partnerships are expected to drive market expansion by tapping into the high-end wellness and hospitality sectors, attracting customers seeking premium relaxation experiences.

Focus on Specific Health Benefits Are Trending Factors

The trend of targeting specific health benefits is driving growth in the bath salts market. Products are being developed to address particular health concerns, such as magnesium-rich salts for muscle recovery, colloidal oatmeal salts for eczema, and melatonin-infused salts for better sleep.

Dr. Teal’s “Pre & Post Workout” Epsom salts, endorsed by athletes, saw a 35% increase in sales among fitness enthusiasts. This focus on health benefits appeals to a diverse range of consumers with specific needs, expanding the market by offering tailored solutions. The increasing demand for health-oriented bath salts is expected to continue driving market growth.

Regional Analysis

Europe Dominates with 42.3% Market Share in the Bath Salts Market

Europe’s dominant position in the bath salts market, holding a 42.3% share with a market value of USD 1.0 billion, is largely due to its long-standing tradition of spa and wellness culture. The region’s high consumer demand for luxury wellness products and natural remedies drives substantial use of bath salts. Additionally, Europe’s stringent regulations on cosmetic and wellness products ensure high standards, enhancing consumer trust and preference for bath salts perceived as high-quality and beneficial for health.

The European market benefits from a well-established distribution network of both luxury and consumer wellness products, making bath salts readily available to a broad audience. The popularity of organic and natural products among European consumers further propels the market, with many opting for bath salts as a natural alternative for relaxation and therapeutic benefits. The presence of numerous local and international brands also fosters a competitive and innovative market environment.

Regional Market Share Analysis:

- North America: Holds approximately 28.5% of the global market. The region’s growth is supported by similar trends as in Europe, with increasing consumer interest in self-care and wellness driving demand for bath salts.

- Asia Pacific: Accounts for 19.7% of the market share. Rapid urbanization and growing middle-class populations with disposable income contribute to the rising popularity of wellness and spa products, including bath salts.

- Middle East & Africa: This region has a smaller share at 3.8%, but it is growing due to rising tourism and the incorporation of spa culture into luxury hotels and resorts.

- Latin America: With a market share of 5.7%, growth in this region is influenced by increasing consumer awareness and adoption of personal wellness products, although at a slower pace compared to other regions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Bath Salts Market is dominated by several key players. Bathclin Corp. and Watson’s lead with their extensive product lines and strong market presence. Shanghai Jahwa United Co. Ltd and Kneipp leverage their innovative solutions and strategic partnerships to maintain competitive positions.

L’Occitane en Provence and Nesalla Bath Salt focus on quality control and expanding their global reach. Pretty Valley and Borghese Inc. emphasize sustainable practices and customer-focused approaches. Soothing Touch and The Kalm Co. invest heavily in product innovation and market-driven strategies.

PDC Brands and Westlab Ltd maintain robust market positions through strong distribution networks and diversified product portfolios. These companies collectively drive market growth by ensuring high-quality bath salts, meeting global consumer demands.

Their strategic positioning, commitment to sustainability, and focus on innovation influence market trends and set industry standards. Through continuous improvement and strategic initiatives, these market leaders shape the future of the bath salts market.

Market Key Players

- Bathclin Corp.

- Watson’s

- Shanghai Jahwa United Co. Ltd

- Kneipp

- L’Occitane en Provence

- Nesalla Bath Salt

- Pretty Valley

- Borghese Inc.

- Soothing Touch

- The Kalm Co.

- PDC Brands

- Westlab Ltd

Recent Developments

- June 2023: Lush reported a robust fiscal performance with a total brand turnover of £816 million for the financial year 2023. This financial success underpins the brand’s commitment to expanding its global reach and enhancing customer experience. Lush’s performance showed considerable growth due to a unique retail strategy, which included launching a spa experience tied to its popular Snow Fairy range.

- January 2023: In January 2023, L’Occitane en Provence experienced significant growth in China, contributing to an overall 18.9% increase in net sales compared to the previous year. The strong performance in the Chinese market was driven by effective marketing campaigns and an expanding retail presence. Sales in China alone saw a 24.6% rise, highlighting the brand’s growing popularity in the region.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Billion Forecast Revenue (2033) USD 3.8 Billion CAGR (2024-2033) 4.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Atlantic Salt, Crystal Salt, Dead-Sea Salt, Epsom Salt, Others), By Form (Granular, Powder, Coarse, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bathclin Corp., Watson’s, Shanghai Jahwa United Co. Ltd, Kneipp, L’Occitane en Provence, Nesalla Bath Salt, Pretty Valley, Borghese Inc., Soothing Touch, The Kalm Co., PDC Brands, Westlab Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Bath Salts Market by 2033?The Global Bath Salts Market is expected to reach USD 3.8 billion by 2033. It is expected to grow at a CAGR of 4.0% during the forecast period from 2024 to 2033.

Which region holds the largest market share in the Bath Salts Market?Europe holds the largest market share at 42.3%.

Which brands are key players in the Bath Salts Market?Key players include Bathclin Corp., Watson’s, Shanghai Jahwa United Co. Ltd, Kneipp, L’Occitane en Provence, Nesalla Bath Salt, Pretty Valley, Borghese Inc., Soothing Touch, The Kalm Co., PDC Brands, and Westlab Ltd.

How does the market for bath salts vary by region?The market is largest in Europe due to its spa and wellness culture, with North America and Asia Pacific also holding significant shares. Middle East & Africa and Latin America show growth potential influenced by regional factors.

-

-

- Bathclin Corp.

- Watson’s

- Shanghai Jahwa United Co. Ltd

- Kneipp

- L’Occitane en Provence

- Nesalla Bath Salt

- Pretty Valley

- Borghese Inc.

- Soothing Touch

- The Kalm Co.

- PDC Brands

- Westlab Ltd