Global Physiotherapy Equipment Market By Type (Hydrotherapy, Cryotherapy, Continuous Passive Motion Units, Ultrasound, Heat Therapy, Therapeutic Exercise, Other Types), By Application (Musculoskeletal, Neurological, Cardiovascular and Pulmonary, Pediatric, Other Applications), By Demographics (Non-geriatric Population, Geriatric Population), By End-User (Hospitals & Clinics, Physiotherapy Centers, Rehabilitation Centers, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 35191

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

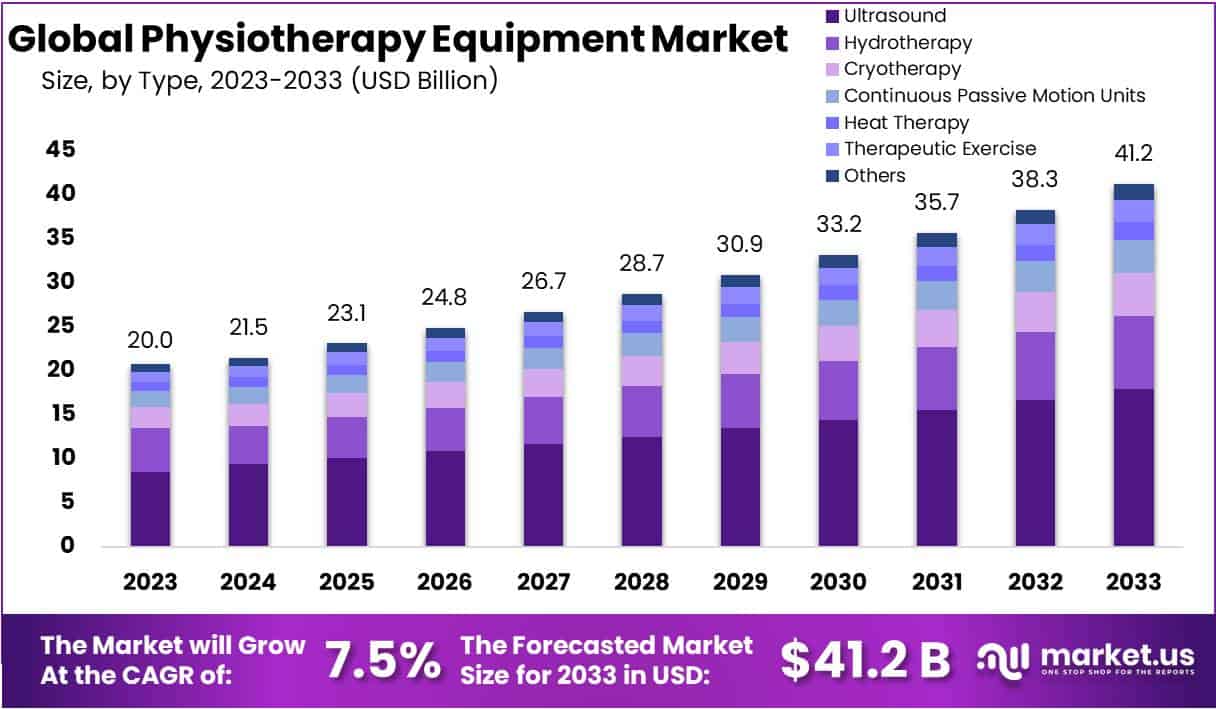

The Global Physiotherapy Equipment Market size is expected to be worth around USD 41.2 Billion by 2033, from USD 20 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

The physiotherapy equipment market is the global market for devices and equipment used in physical therapy and rehabilitation. This includes the tools, machines, and accessories physiotherapists use to help patients recover after injury, surgery, or other medical conditions. The market is driven firstly by the increasing prevalence of chronic diseases, musculoskeletal disorders, and the aging population.

The growing awareness of the advantages of physical therapy and rehabilitation among patients is also dominating the market’s growth. The market includes various types of physiotherapy equipment like therapeutic exercise, electrotherapy, ultrasound, and others. These devices are used to improve muscle strength & flexibility, minimize pain and inflammation, promote healing, and improve overall physical function.

Key Takeaways

- Market Growth: The physiotherapy equipment market to reach USD 41.2 Bn by 2033, growing at 7.5% CAGR from 2024, driven by rising chronic diseases.

- Driving Factors: The aging population and awareness of physical therapy benefits propel the market; chronic diseases like diabetes are increasing globally.

- Type Dominance: Ultrasound equipment dominates with 43.6% market share; advancements improve treatment efficacy, and home-based solutions via telemedicine rising.

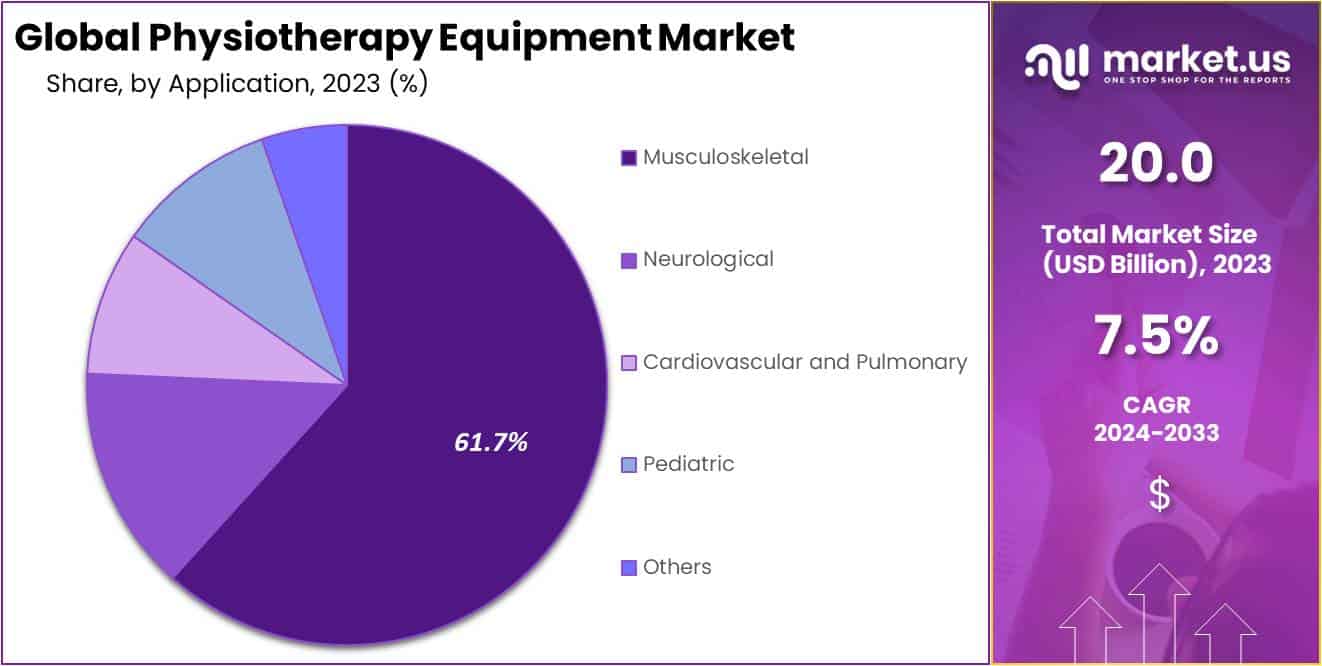

- Application Dominance: Musculoskeletal applications hold a 60% market share; hospitals & clinics lead with 45% market share.

- Demographics Dominance: In 2023, the Non-geriatric Population Segment emerged as the dominant market force, accounting for over 56.1% of the market share.

- End-User Dominance: The Hospitals & Clinics Segment maintained a strong market lead in 2023, securing over 45% of the market share.

- Emerging Opportunities: Focus on R&D for advanced equipment, and partnerships for tailored solutions to drive growth amid rising chronic diseases.

- Trends: Wearable tech and personalized physiotherapy gaining popularity; virtual realities enhance patient engagement.

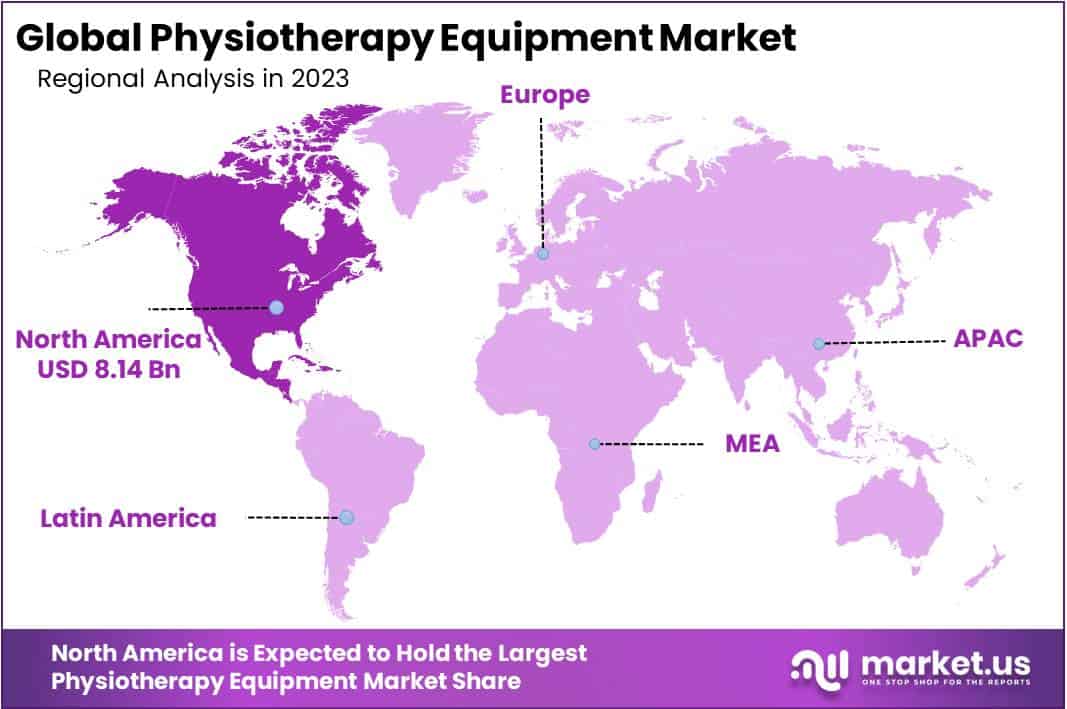

- Regional Insights: North America dominates with a 40.7% market share, and a USD 8.14 Bn value; Asia Pacific is expected to witness the fastest growth.

Driving Factors

The Growing Prevalence of Chronic Diseases and Musculoskeletal Disorders

Chronic diseases like diabetes, cardiovascular diseases, and cancer are rising globally. These diseases can often lead to musculoskeletal disorders like arthritis and back pain, which need physical therapy & rehabilitation. The growing prevalence of these situations is driving the demand for physiotherapy equipment. The aging population is another driving factor for the physiotherapy equipment market.

As people age, they become more susceptible to injuries, chronic conditions, and mobility issues. This has increased the demand for physical therapy & rehabilitation services or equipment. The maximizing demand for non-invasive and effective treatment options also drives the market’s growth. Many patients prefer physical therapy and rehabilitation over invasive treatment options like surgery. This has increased the demand for physiotherapy equipment that effectively treats various conditions.

Technological advancements in physiotherapy equipment are also driving the market’s growth. Improvements in electrotherapy, ultrasound, and therapeutic exercise equipment have led to the most effective and efficient cure for patients. Apart from this, the rising adoption of telemedicine and remote operating technologies has led to the development of home-based physiotherapy solutions, further driving the market’s growth.

Restraining Factors

High Cost of Physiotherapy Equipment and The Lack of Skilled Physiotherapists

One of the major limiting factors of the physiotherapy equipment market is its cost. Numerous physiotherapy devices and equipment can be costly, which limits their adoption in developing nations with limited healthcare infrastructure and where patients might lack enough funds to pay for these items.

Another factor impeding progress in particular regions is a shortage of qualified physiotherapists and healthcare providers; this may limit the use and adoption of physiotherapy equipment since patients do not always have access to skilled professionals capable of operating them effectively and safely. Regulatory obstacles may also hinder market expansion.

Many countries require regulatory approvals before medical devices and equipment used in physiotherapy can be sold commercially. Acquiring these approvals may take time and resources, thus delaying market entry of newly introduced products and restricting growth within their target markets. Additionally, alternative treatment methods such as medications and surgeries could limit the growth of the physiotherapy equipment market. Some patients may prefer these options over physiotherapy therapy which would hamper its expansion.

Type Analysis

In 2023, the Ultrasound Segment segment held a dominant market position, capturing more than a 43.6% share.

Based on type, the market is segmented into hydrotherapy, cryotherapy, continuous passive motion units, ultrasound, heat therapy, therapeutic exercise, and other types. Among these types, the ultrasound segment is expected to be the most lucrative in the global physiotherapy equipment market, with the largest revenue share of 43.6% during the forecast period.

Owing to ultrasound is a type of physiotherapy equipment used for therapeutic purposes. It works by sending the highest frequency sound waves into the body, which penetrate the skin and tissues and make vibrations in the cells. These vibrations can help to promote healing and minimize pain & inflammation. To execute ultrasound therapy, a physiotherapist will apply a small amount of gel to the skin over the affected area.

Application Analysis

In 2023, the Musculoskeletal Segment segment held a dominant market position in the application segment in the Physiotherapy Equipment Market and captured more than a 61.7% share.

Based on application, the market is divided into musculoskeletal, neurological, cardiovascular and pulmonary, pediatric, and other applications. Among these, the musculoskeletal segment is dominant in the application segment in the physiotherapy equipment market, with a market share of 60%.

Musculoskeletal physiotherapy is the assessment and treatment of situations affecting the muscles, bones as well as joints of the body. It is a specified field of physiotherapy that requires a deep knowledge of anatomy, biomechanics, and injury management. Musculoskeletal physiotherapy performs a crucial role in the management of musculoskeletal conditions.

Demographics Analysis

In 2023, Non-geriatric Population Segment held a dominant market position, capturing more than a 56.1% share.

Based on demographics, the market is divided into the non-geriatric population, and geriatric population. Among these, the clinical diagnostics segment dominates the market with a revenue share of 56.1% in the forecasted period. Non-geriatric patients are those younger than 65 who have neurological, cardiovascular, or pulmonary conditions, or musculoskeletal problems. The population includes athletes, children, and young adults who have developmental disorders or injuries.

End-User Analysis

In 2023, Hospitals & Clinics Segment segment held a dominant market position, capturing more than a 45% share.

Based on end-user, the market is divided into hospitals & clinics, physiotherapy centers, rehabilitation centers, and other end-users. Among these, the hospitals & clinics segment is dominant in the end-user segment in the physiotherapy equipment market, with a market share of 45%. In hospitals and clinics, physiotherapy equipment is used to offer rehabilitation to patients suffering from a vast range of ailments. Inpatient or outpatient settings can supply physiotherapy in combination with other treatments.

Market Segments

Based on Type

- Hydrotherapy

- Cryotherapy

- Continuous Passive Motion Units

- Ultrasound

- Heat Therapy

- Therapeutic Exercise

- Other Types

Based on Application

- Musculoskeletal

- Neurological

- Cardiovascular and Pulmonary

- Pediatric

- Other Applications

Based on Demographics

- Non-geriatric Population

- Geriatric Population

Based on End-User

- Hospitals & Clinics

- Physiotherapy Centers

- Rehabilitation Centers

- Other End-Users

Growth Opportunity

Technological Advancements and Increasing Prevalence of Chronic Diseases.

There is a rising requirement for technologically advanced physiotherapy equipment that can offer enhanced outcomes and patient comfort. Manufacturers who spend time in research & development of the latest technologies like robotic-assisted rehabilitation devices, virtual reality, and wearable sensors may have a competitive advantage in the market.

Chronic diseases like arthritis, diabetes, and cardiovascular disease are growing, which is driving demand for physiotherapy equipment. Producers which develop equipment that can effectively manage these conditions may have an advantage in the market. There is an increasing awareness among consumers & healthcare providers towards the benefits of physiotherapy.

As a result, the demand for physiotherapy equipment is expected to maximize in the becoming years. Partnerships & collaborations between producers and healthcare providers may offer increased opportunities in the physiotherapy equipment market. By working together, producers and healthcare providers can develop the latest products and services that better meet the wants of patients.

Latest Trends

Wearable Technology and Growing Trend Towards Personalized Physiotherapy

Virtual and augmented realities are being used more and more in physiotherapy, to improve patient motivation and engagement. These technologies can simulate realistic environments, making therapy more enjoyable and engaging for patients. Wearable sensors and devices have become more popular in physiotherapy because they can provide real-time feedback on patient progress and help track outcomes.

These devices can be used to encourage patients who are self-directed to do physiotherapy at their homes. Telehealth is more common in physiotherapy as patients look for more convenient ways to receive treatment. Telehealth allows for remote physiotherapy consultations and monitoring. In physiotherapy, collaborative care is becoming more important. Healthcare providers from different disciplines work together to provide comprehensive treatment.

This can include physiotherapists collaborating with occupational therapists and orthopedic surgeons to provide a holistic care approach. Overall, the physiotherapy market is changing rapidly. Latest trends and technologies are emerging to meet the evolving wants of patients & healthcare professionals. Manufacturers who can adapt to these trends effectively may have an advantage in the market.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 40.7% share and holds USD 8.14 Billion market value for the year.

North America will be the dominant region in the global physiotherapy equipment market. Owing to well-settled healthcare infrastructure and high healthcare spending in countries like the United States & Canada. The increasing prevalence of chronic diseases and sports injuries also drives the requirement for physiotherapy equipment in this region. Asia Pacific is expected to be the fastest-growing region in the projected period in the physiotherapy equipment market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The physiotherapy equipment market is highly competitive, with a few established players monitoring the market. The market is driven by technological improvement, increasing incidence of musculoskeletal disorders, and the rising geriatric population. The market is also influenced by the growing demand for home healthcare services and rising healthcare spending across the universally.

DJO Global is a leading player in the physiotherapy equipment market, offering a vast range of products for musculoskeletal rehabilitation, pain management, and physical therapy. The company works globally and has a strong presence in North America & Europe.

Market Key Players

- BTL Aesthetic

- EMS Physio Ltd.

- Dynatronics Corporation

- RICHMAR

- Performance Health

- Storz Medical AG

- Zimmer MedizinSysteme GmbH

- ITO Co. Ltd.

- Enraf-Nonius B.V.

- Whitehall Manufacturing

- Other Key Players

Recent Developments

- In December 2023, Performance Health launched the TheraBand Active Recovery System. This comprehensive suite comprises wearable resistance bands equipped with biofeedback technology, aiming to optimize the recovery process.

- In November 2023, ITO Co. Ltd. announced a strategic partnership with the China Rehabilitation Association. The collaboration aims to drive the adoption of cutting-edge physiotherapy technologies across China.

- In September 2023, Zimmer MedizinSysteme GmbH introduced the ARTEMIS 2.0 robotic therapy system. Specifically designed for gait training and rehabilitation, it promises advanced functionality to aid patients in their recovery.

- In March 2023, BTL Industries, which includes BTL Aesthetic, unveiled their latest innovation, the Exogen 2000+ ultrasound therapy system. This system boasts enhanced targeting capabilities and a more user-friendly interface.

Report Scope

Report Features Description Market Value (2023) USD 20 Bn Forecast Revenue (2033) USD 41.2 Bn CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-Hydrotherapy, Cryotherapy, Continuous Passive Motion Units, Ultrasound, Heat Therapy, Therapeutic Exercise, and Other Types; By Application-Musculoskeletal, Neurological, Cardiovascular and Pulmonary, Pediatric, and Other Applications; By Demographics-Non-geriatric Population and Geriatric Population; By End-User- Hospitals & Clinics, Physiotherapy Centers, Rehabilitation Centers, and Other End-Users; Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BTL Aesthetic, EMS Physio Ltd., Dynatronics Corporation, RICHMAR, Performance Health, Storz Medical AG, Zimmer MedizinSysteme GmbH, ITO Co. Ltd., Enraf-Nonius B.V., Whitehall Manufacturing, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Physiotherapy Equipment market in 2023?The Physiotherapy Equipment market size is USD 20 Billion in 2023.

What is the projected CAGR at which the Physiotherapy Equipment market is expected to grow at?The Physiotherapy Equipment market is expected to grow at a CAGR of 7.5% (2024-2033).

List the segments encompassed in this report on the Physiotherapy Equipment market?Market.US has segmented the Physiotherapy Equipment market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Hydrotherapy, Cryotherapy, Continuous Passive Motion Units, Ultrasound, Heat Therapy, Therapeutic Exercise, Other Types. By Application the market has been segmented into Musculoskeletal, Neurological, Cardiovascular and Pulmonary, Pediatric, Other Applications. By Demographics the market has been segmented into Non-geriatric Population, Geriatric Population. By End-User the market has been segmented into Hospitals & Clinics, Physiotherapy Centers, Rehabilitation Centers, Other End-Users.

List the key industry players of the Physiotherapy Equipment market?BTL Aesthetic, EMS Physio Ltd., Dynatronics Corporation, RICHMAR, Performance Health, Storz Medical AG, Zimmer MedizinSysteme GmbH, ITO Co. Ltd., Enraf-Nonius B.V., Whitehall Manufacturing, Other Key Players

Which region is more appealing for vendors employed in the Physiotherapy Equipment market?Europe is expected to account for the highest revenue share of 40.7% and boasting an impressive market value of USD 8.14 Billion. Therefore, the Physiotherapy Equipment industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Physiotherapy Equipment?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Physiotherapy Equipment Market.

Physiotherapy Equipment MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Physiotherapy Equipment MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BTL Aesthetic

- EMS Physio Ltd.

- Dynatronics Corporation

- RICHMAR

- Performance Health

- Storz Medical AG

- Zimmer MedizinSysteme GmbH

- ITO Co. Ltd.

- Enraf-Nonius B.V.

- Whitehall Manufacturing

- Other Key Players