Global Virtual Fitness Market Report By Session (Group, Solo), By Streaming (Live, On-demand), By Device (Smart TV, Smartphones, Laptops & Desktops, Tablets, Other Devices), By End-User (Professional Gyms, Educational & Sports Institutes, Corporate Institutions, Individuals, Defense Institutes, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 100038

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

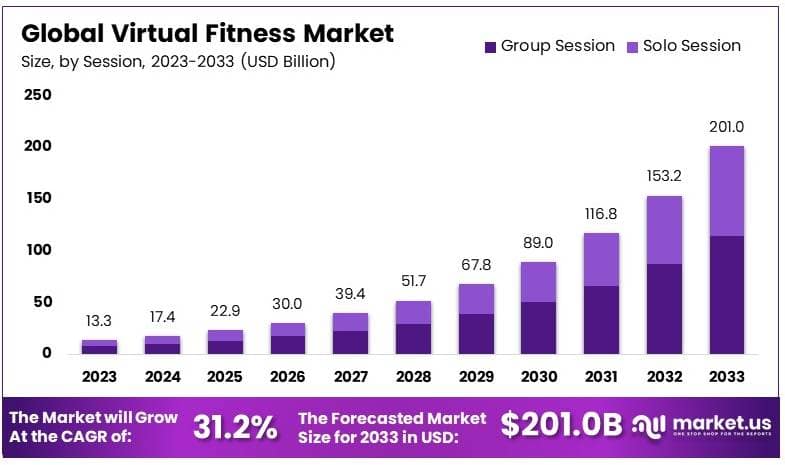

The Global Virtual Fitness Market size is expected to be worth around USD 201.0 Billion by 2033, from USD 13.3 Billion in 2023, growing at a CAGR of 31.2% during the forecast period from 2024 to 2033.

Virtual fitness refers to fitness programs and classes that are offered online, allowing individuals to exercise remotely through digital platforms. These classes can include live-streamed sessions or pre-recorded videos, covering various types of workouts like yoga, strength training, and cardio. Users can access virtual fitness sessions from home or any location with an internet connection, making it a flexible and convenient option for staying active.

The growth of virtual fitness is linked to the increasing use of digital platforms. More people are working out from home, especially since the pandemic. Technology improvements, like fitness apps and online classes, make it easier to access workouts. People want flexible options that fit their schedules, which is driving more interest in virtual fitness.

The demand for virtual fitness is growing because people want convenient ways to exercise. Many people with busy lifestyles prefer to work out at home. There is also demand for personalized fitness plans that can be tailored to each person’s goals. Online fitness platforms make these options widely available.

There is a big opportunity for companies offering virtual fitness programs, especially in regions where gyms are not easily accessible. The use of artificial intelligence and virtual reality in fitness programs can make workouts more engaging. Partnerships between fitness companies and tech firms can create new experiences for users.

Platforms like Peloton, Strava, and Fitbit have gained widespread popularity, offering users the convenience of exercising from home. In March 2022, MyFitnessPal generated close to $10 million in in-app revenue, followed by Fitbit with $9 million and Strava with $5.6 million. This surge in revenue highlights the growing consumer interest in digital fitness solutions.

Additionally, 41% of fitness enthusiasts reported paying for live-streamed classes through monthly subscriptions, even though free content is readily available online. This trend suggests that consumers are willing to invest in high-quality, interactive fitness experiences.

The rise of virtual fitness is closely linked to changes in consumer behavior, especially during and after the COVID-19 pandemic. Before the pandemic, 75% of Mindbody app users exercised three or more times a week. This figure increased to 78% during the pandemic, demonstrating that virtual fitness helped users maintain their exercise routines despite restrictions on physical gyms.

Yoga and high-intensity interval training (HIIT) are particularly popular, with 32% of users booking virtual yoga sessions and 15.6% participating in HIIT classes. This growing demand for accessible, home-based fitness solutions continues to drive the virtual fitness industry forward.

Government support for public health initiatives and wellness programs is expected to play a role in the virtual fitness industry’s growth. Many governments are emphasizing the importance of physical activity and its role in preventing chronic diseases. This focus on health promotion could lead to greater adoption of virtual fitness platforms, particularly as part of larger public health campaigns.

Key Takeaways

- Virtual Fitness Market was valued at USD 13.3 Billion in 2023, and is expected to reach USD 201.0 Billion by 2033, with a CAGR of 31.2%.

- In 2023, Group sessions dominate with 56.7%, reflecting the popularity of social fitness activities and community engagement.

- In 2023, On-demand streaming leads with 54.2%, offering flexibility for users to exercise at their convenience.

- In 2023, Smartphones hold a 32.4% share due to the widespread use of mobile fitness apps and ease of access.

- In 2023, North America leads with 48.2% market share, driven by high digital fitness adoption and tech-savvy consumers.

Session Analysis

Group sessions dominate with 56.7% due to their community engagement and motivational aspects.

In the Virtual Fitness Market, group sessions have emerged as the dominant sub-segment, holding 56.7% of the market share. This substantial presence is largely attributed to the community engagement and motivational aspects these sessions provide. Group workouts offer a sense of camaraderie and competition that many users find inspiring and enjoyable, which helps to increase adherence to fitness routines.

The success of group virtual fitness sessions can also be linked to the way they replicate traditional gym classes, allowing participants to experience the guidance of an instructor and the support of a community from the comfort of their homes. This format is particularly appealing in a socially distanced world where many are seeking connections and a sense of normalcy through digital means.

Solo sessions, while smaller in market share, cater to those who prefer a more personalized workout experience or have specific fitness goals that require individual attention. These sessions leverage tailored workouts and flexible scheduling, making them suitable for users with unpredictable lifestyles or those who feel more comfortable exercising alone.

The combined growth of group and solo virtual fitness sessions is driven by technological advancements that enable interactive and immersive workout experiences. As technology continues to evolve, both sub-segments are expected to expand, fueled by increasing consumer demand for convenient, effective, and engaging ways to stay fit.

Streaming Analysis

On-demand streaming dominates with 54.2% due to its flexibility and accessibility.

On-demand streaming holds the majority in the Virtual Fitness Market, with a 54.2% share, underscoring its dominance due to unmatched flexibility and accessibility. This format allows users to access workout sessions at their convenience, eliminating the need to schedule around live classes. The ability to pause, rewind, and replay sessions also adds to the appeal, catering to all fitness levels and schedules.

The preference for on-demand streaming is particularly strong among those with busy lifestyles or in different time zones than their preferred instructors. It also serves those who may feel intimidated by live classes, offering a private space to learn and exercise without pressure.

Live streaming, though less predominant, remains vital for delivering real-time interaction and creating a dynamic workout environment that mimics the energy of a live class. This segment appeals to users who appreciate the structure of scheduled sessions and the motivation of real-time feedback.

The growth trajectory of both live and on-demand streaming is likely to continue upward as more fitness enthusiasts turn to virtual platforms. Innovations in streaming technology and broadband capabilities will further enhance the user experience, supporting the ongoing expansion of both segments.

Device Analysis

Smartphones dominate with 32.4% due to their portability and widespread usage.

In the terms of devices used for accessing virtual fitness services, smartphones emerge as the dominant device with a 32.4% market share. This dominance is attributed to the portability and widespread usage of smartphones, allowing users to access fitness sessions anytime and anywhere. The convenience of having a personal fitness studio in one’s pocket appeals to a vast array of consumers, from busy professionals to active travelers.

Moreover, the integration of fitness apps and wearable technology enhances the functionality of smartphones, making them even more attractive for fitness enthusiasts who wish to track their progress and maintain fitness routines during their daily activities.

While smartphones lead, other devices like smart TVs, laptops, desktops, and tablets also play crucial roles in the virtual fitness ecosystem. Smart TVs offer a more immersive experience with larger screens, suitable for group sessions or families working out together. Laptops and desktops provide versatility, often preferred by those who may also use their workout time to engage in educational webinars or professional development sessions.

As technology continues to integrate more seamlessly with personal devices, the growth across all device segments is expected to rise. Innovations that enhance user experience and engagement will drive the expansion of the virtual fitness market, offering numerous opportunities for development in device-specific fitness applications and services.

End-User Analysis

Professional gyms dominate with 34.2% due to their comprehensive service offerings and expert guidance.

Professional gyms hold the largest market share in the end-user segment of the Virtual Fitness Market at 34.2%. This leading position is driven by the comprehensive services these institutions offer, including expert guidance and structured fitness programs.

Many gyms have embraced virtual fitness as a way to extend their reach beyond physical locations, offering members the flexibility to engage in fitness activities at their convenience while maintaining a connection to their gym community.

The dominance of professional gyms in the virtual space is also supported by their ability to provide high-quality content and access to certified trainers, which can be a major draw for users seeking professional workout guidance without the need to visit a physical gym.

Other end-user segments, including educational and sports institutes, corporate institutions, and individual users, also contribute to the market dynamics. These segments leverage virtual fitness for various purposes, such as enhancing student and employee well-being, offering tailored fitness programs, and accommodating the diverse needs of individual fitness enthusiasts.

The continuous evolution of virtual fitness technology, along with the growing emphasis on health and wellness across all sectors, suggests a promising growth path for all end-user segments. Enhancements in content quality, accessibility, and user engagement strategies will further solidify the role of virtual fitness within each segment, expanding market potential.

Key Market Segments

By Session

- Group

- Solo

By Streaming

- Live

- On-demand

By Device

- Smart TV

- Smartphones

- Laptops & Desktops

- Tablets

- Other Devices

By End-User

- Professional Gyms

- Educational & Sports Institutes

- Corporate Institutions

- Individuals

- Defense Institutes

- Other End-Users

Driver

Convenience and Flexibility Drives Market Growth

The Virtual Fitness Market is experiencing rapid growth driven by the increasing demand for convenience and flexibility in workout routines. Consumers are opting for virtual fitness solutions that allow them to exercise at their own pace, location, and time. This flexibility appeals particularly to busy individuals and those seeking to avoid crowded gyms.

Additionally, the proliferation of digital devices and smartphones has made it easier to access virtual fitness platforms, further expanding the market reach. Affordable subscription-based models are another key factor, making these fitness solutions accessible to a wider audience, including those who find traditional gym memberships costly.

Moreover, the growing awareness of health and wellness, accelerated by global health concerns, has pushed consumers to prioritize fitness from home. These driving factors collectively contribute to the increased adoption of virtual fitness solutions, creating a solid foundation for market expansion.

Restraint

High Initial Setup Costs Restraints Market Growth

The Virtual Fitness Market faces challenges due to high initial setup costs, especially for advanced virtual fitness solutions that require specialized equipment. Consumers may find the cost of purchasing items like smart mirrors, fitness trackers, or VR-enabled workout equipment prohibitive, limiting market penetration.

Additionally, a lack of technological literacy among some segments of the population acts as a barrier. Elderly users or those less familiar with digital platforms may struggle to adapt to virtual fitness solutions, reducing potential market growth. Connectivity issues, such as unreliable internet access, further restrain the market, particularly in rural or underserved areas.

Another factor is the high competition within the fitness industry, with many traditional fitness centers offering hybrid models that combine in-person and virtual experiences. These restraining factors create barriers to widespread adoption and hinder the consistent expansion of the virtual fitness market.

Opportunity

Expansion of Personalized Fitness Programs Provides Opportunities

The Virtual Fitness Market has immense growth potential through the expansion of personalized fitness programs. The integration of AI and machine learning into fitness platforms offers users customized workout plans based on their fitness levels, goals, and preferences, enhancing user engagement and retention.

The increasing popularity of wearable fitness technology also presents opportunities for market players. Devices like fitness trackers and smartwatches allow users to track their progress in real-time, creating a more interactive and data-driven workout experience.

Another key opportunity lies in the global expansion of virtual fitness platforms. As more regions gain internet access and smartphone penetration increases, market players can tap into new, underserved markets. Partnerships with corporate wellness programs further offer companies the chance to provide fitness solutions for employees, expanding their customer base and driving revenue growth.

Challenge

User Retention and Engagement Challenges Market Growth

Despite the growth potential, the Virtual Fitness Market faces challenges in user retention and engagement. Many users struggle to maintain long-term commitment to virtual fitness platforms due to a lack of social interaction and motivation, compared to traditional gyms where personal trainers and group classes offer accountability.

Technical issues such as app malfunctions or poor streaming quality can negatively impact user experience, causing frustration and leading to churn. In addition, maintaining fresh and engaging content is a significant challenge for providers, as users expect a variety of workouts and regular updates to keep their routines interesting.

Moreover, security and privacy concerns regarding personal data on fitness platforms may deter potential users from fully engaging with virtual fitness services. These challenges require continuous innovation and user-centric strategies to sustain long-term growth.

Growth Factors

Increased Health Awareness and Smart Technology Adoption Are Growth Factors

The increasing global focus on health and wellness is a significant growth factor for the Virtual Fitness Market. More consumers are becoming conscious of the importance of maintaining a healthy lifestyle, leading to a surge in demand for fitness solutions that can be easily accessed from home.

Simultaneously, the widespread adoption of smart technology, such as fitness wearables, enhances the appeal of virtual fitness platforms. These devices provide users with real-time feedback and detailed insights into their workout performance, increasing motivation and engagement.

Another growth factor is the integration of AI and machine learning into fitness platforms. These technologies allow for the creation of personalized fitness plans, tailored to individual user preferences and progress, making workouts more efficient and effective.

Emerging Trends

Live Streaming and On-Demand Workouts Are Latest Trending Factor

Live streaming and on-demand workouts have emerged as the latest trending factor in the Virtual Fitness Market. Consumers are increasingly drawn to the flexibility of accessing workout classes at any time, without the constraints of scheduled in-person classes. This trend offers a convenient solution for individuals who prefer to work out at non-traditional hours.

Additionally, social media integration has become a key trend, enabling users to share their progress, participate in challenges, and build communities within virtual fitness platforms. This feature enhances engagement and promotes a sense of accountability.

The rise of virtual reality (VR) fitness is also gaining momentum, providing an immersive experience that makes workouts more enjoyable and interactive. Finally, the use of celebrity trainers and influencers to promote virtual fitness platforms is a growing trend, helping companies reach a wider audience and increase brand loyalty.

Regional Analysis

North America Dominates with 48.2% Market Share

North America leads the Virtual Fitness Market with a commanding 48.2% market share and was valued at USD 6.41 Bn. This dominance is driven by widespread adoption of digital technologies, a health-conscious population, and the presence of major fitness platforms and technology companies. The region’s high disposable income also supports consumer willingness to invest in online fitness subscriptions and virtual fitness equipment.

Key factors contributing to this large market share include the popularity of home fitness solutions, especially after the COVID-19 pandemic, which increased the demand for virtual workouts. Advanced infrastructure, including high-speed internet and wide access to smart devices, allows consumers to participate in virtual fitness classes with ease. Moreover, North American fitness companies have developed a strong market presence by partnering with tech giants, creating comprehensive virtual fitness platforms that cater to individual preferences and fitness goals.

The dynamics of this market are shaped by a growing interest in health and wellness, with consumers seeking convenient and flexible workout options. The trend of remote working has further fueled the adoption of virtual fitness as more people integrate fitness routines into their daily schedules from home. The variety of services, ranging from personalized training sessions to group classes, also appeals to diverse fitness needs in the region.

Regional Mentions:

- Europe: Europe’s virtual fitness market is driven by a focus on wellness and self-care. The demand for virtual fitness platforms is increasing, particularly in urban areas, with a growing interest in personalized fitness solutions.

- Asia Pacific: Asia Pacific is rapidly growing in the virtual fitness space, fueled by the rise of digital platforms and a tech-savvy population. Increasing health awareness in countries like China and India supports market expansion.

- Middle East & Africa: The market in the Middle East and Africa is emerging, with virtual fitness adoption driven by urbanization and the growing popularity of fitness and wellness apps. Infrastructure development is key to future growth.

- Latin America: Latin America’s virtual fitness market is growing steadily, with consumers increasingly adopting virtual solutions due to limited access to physical gyms in some regions. The market is expanding, especially in Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Virtual Fitness Market, three companies stand out for their significant impact and market influence: MINDBODY, Inc., ClassPass Inc., and Fitness On Demand. These companies leverage technology, consumer engagement, and strategic partnerships to drive growth and establish themselves as key players in the rapidly expanding virtual fitness sector.

MINDBODY, Inc. has emerged as a leading player, offering a robust platform for fitness and wellness professionals to manage their businesses while connecting consumers to virtual fitness experiences. The company’s strategic positioning in both the wellness and fitness industries allows it to cater to a wide range of users, from individual consumers to large fitness chains. MINDBODY’s advanced booking and management software enhances user experience, making it a preferred choice for fitness providers.

ClassPass Inc. has revolutionized the fitness industry by offering a flexible membership model that provides access to a variety of virtual fitness classes. The company’s strategic partnerships with gyms and fitness studios across the globe have strengthened its market presence. With the surge in demand for at-home fitness during the pandemic, ClassPass quickly adapted, offering on-demand and live-streaming classes that cater to changing consumer preferences.

Fitness On Demand focuses on delivering a comprehensive virtual fitness experience, with a strong emphasis on offering a wide range of fitness content to gyms, hotels, and wellness facilities. The company’s scalable platform and broad content library have made it a popular choice for fitness centers looking to integrate virtual fitness into their services. Fitness On Demand’s ability to adapt to market needs and provide high-quality virtual workouts has positioned it as a key player in the industry.

These companies have leveraged technology and strategic partnerships to lead the virtual fitness market. Their ability to innovate and adapt to shifting consumer demands ensures their continued influence and growth in the industry.

Top Key Players in the Market

- MINDBODY, Inc.

- ClassPass Inc.

- Fitness On Demand

- Sworkit Health

- WELLBEATS

- FitnFast Health Clubs & Gyms

- Conogitness

- Move Technologies

- Wexer Virtual Corporation

- Other Key Players

Recent Developments

- SOLE Fitness: September 2024 – Sole Fitness appointed Brad White as its new CEO, marking a shift toward virtual fitness offerings with the launch of Sole+ Studios. This platform will provide accessible online fitness classes, reinforcing the company’s commitment to high-quality home fitness equipment. Sole+ Studios aims to deliver engaging, instructor-led virtual fitness classes to meet the increasing demand for virtual workout solutions.

- Civilian Health Promotion Service (CHPS): October 2024 – The Civilian Health Promotion Service (CHPS) introduced additional free virtual fitness and health programs aimed at improving employee well-being. These initiatives, available through the Air Force Materiel Command (AFMC), cover topics like stress management, fitness, and nutrition, promoting a healthier work-life balance.

- Supernatural: 2024 – The Supernatural fitness app revolutionized home workouts by incorporating virtual reality (VR), making exercise more immersive and engaging. Users can access various workout options through VR headsets, offering an innovative way to stay fit with tailored fitness routines.

- University of New Haven: 2020 – The University of New Haven adapted to the pandemic by launching Virtual ChargerREC, a digital platform offering fitness classes and wellness programs. This initiative provided students and faculty with access to remote fitness resources, including virtual exercise classes and wellness challenges.

Report Scope

Report Features Description Market Value (2023) USD 13.3 Billion Forecast Revenue (2033) USD 201.0 Billion CAGR (2024-2033) 31.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Session (Group, Solo), By Streaming (Live, On-demand), By Device (Smart TV, Smartphones, Laptops & Desktops, Tablets, Other Devices), By End-User (Professional Gyms, Educational & Sports Institutes, Corporate Institutions, Individuals, Defense Institutes, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape MINDBODY, Inc., ClassPass Inc., Fitness On Demand, Sworkit Health, WELLBEATS, FitnFast Health Clubs & Gyms, Conogitness, Move Technologies, Wexer Virtual Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- MINDBODY, Inc.

- ClassPass Inc.

- Fitness On Demand

- Sworkit Health

- WELLBEATS

- FitnFast Health Clubs & Gyms

- Conogitness

- Move Technologies.

- Wexer Virtual Corporation

- Other Key Players