Global Folding Furniture Market By Product (Sofa, Table & Chair, Bed and Other Product Types ), By Application ( Residential, Commercial), By Distribution Channel (Online and Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 18664

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Folding Furniture Market size is expected to be worth around USD 20.7 Billion by 2033, from USD 11.9 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

Folding furniture refers to a range of compact and space-saving furnishings designed to be folded, collapsed, or stored when not in use. Common items include folding chairs, tables, beds, and storage solutions. These pieces offer versatility and convenience, making them popular for homes with limited space and flexible use.

The folding furniture market encompasses the production, distribution, and sales of space-efficient, collapsible furnishings. It serves residential, commercial, and hospitality sectors, offering products that address the need for adaptable, space-saving solutions. This market has gained traction due to urbanization, smaller living spaces, and increased demand for multifunctional interiors.

The growth of the folding furniture market is driven by increasing urbanization, smaller living spaces, and the growing trend of compact and modular furniture solutions. The rise of e-commerce platforms has also boosted accessibility and visibility of these products, making them popular among millennial and Gen Z consumers.

Additionally, sustainability concerns encourage consumers to choose multifunctional, durable, and space-saving designs. Growing interest in home makeovers, remote work setups, and flexible interiors further contribute to market growth, as consumers seek products that optimize space without compromising on style or comfort.

The folding furniture is fueled by its adaptability and convenience, making it suitable for compact urban apartments, home offices, and event setups. With rising trends like remote work and flexible living, consumers are increasingly inclined toward practical solutions that maximize space utility while ensuring ease of use.

The folding furniture market lie in product innovation, such as integrating smart technology, improved designs, and sustainable materials. Expanding into emerging markets with rising urban populations and space constraints offers further growth potential. Moreover, targeting niche markets like the outdoor and travel sectors can also help manufacturers diversify their portfolios.

According to Cherrypick India, the lifespan of folding furniture varies by type and material, reflecting overall durability trends in the furniture market. Sofas typically last 7-15 yrs, while dining and coffee tables can last 15-25 yrs based on usage and materials.

Chairs made from quality craftsmanship can last 10-30 yrs, while beds of teak or mahogany can range from 8-30 yrs in longevity. Outdoor furniture, built to withstand the elements, has a lifespan of 5-15 yrs depending on materials like metal or glass.

According to IKEA, in 2023, the company introduced a new line of multifunctional furniture designed for compact living environments. This included a foldable bed/desk combination specifically crafted to enhance space efficiency in urban homes.

The market’s expansion is also fueled by increased urbanization rates, projected to reach 68% by 2050, emphasizing the need for adaptable furniture options in smaller residential spaces.

Key Takeaways

- The Global Folding Furniture Market is projected to grow from USD 11.9 Billion in 2023 to USD 20.7 Billion by 2033, driven by a CAGR of 5.7%.

- The Table and Chair sub-segment led the market with a 46.5% share in 2023, driven by strong demand across residential and commercial spaces.

- The Residential application segment dominated with a 68.1% share in 2023, reflecting high adoption of folding furniture in urban homes.

- The Offline distribution channel held the largest market share of 67.4% in 2023, as consumers prefer inspecting products before purchase.

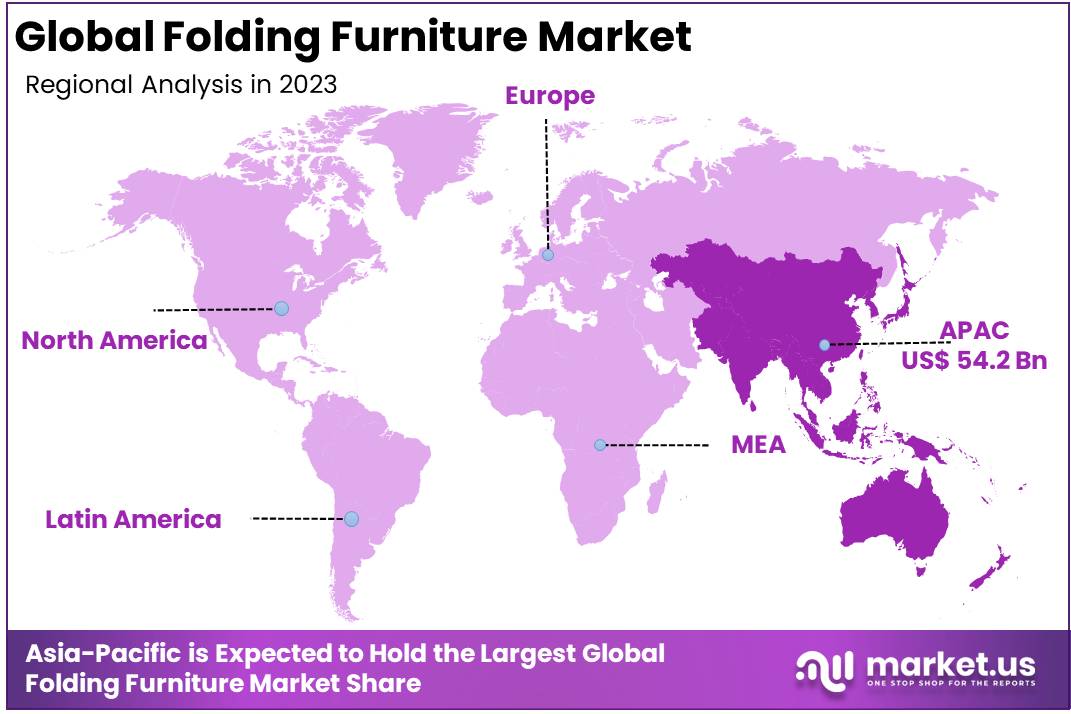

- Asia-Pacific led the regional market, capturing 38.3% share in 2023, driven by rapid urbanization and increased consumer spending on space-efficient solutions.

- Asia-Pacific is the key growth region with rapid urbanization and increasing e-commerce penetration, valued at USD 54.2 Billion.

By Product Analysis

Table and Chair Leading the Folding Furniture Market with 46.5% Share

In 2023, Table and Chair held a dominant market position in the product type segment of the folding furniture market, capturing more than a 46.5% share. This segment benefits from the increasing demand for space-saving solutions in residential and commercial applications, including homes, offices, and hospitality settings.

The versatility of folding tables and chairs, combined with easy storage and portability, has driven substantial adoption across various consumer demographics.

Additionally, rising urbanization and smaller living spaces contribute to the sustained demand for this product type. The segment is expected to maintain its leading position, driven by ongoing innovations focused on lightweight materials, affordability, and enhanced durability.

The Sofa segment is witnessing rapid growth as consumers increasingly seek multi-functional furniture to maximize space usage in compact living environments. Folding sofas offer both seating and sleeping options, making them highly attractive for urban households and studio apartments.

In 2023, this segment experienced significant momentum due to heightened interest in transforming living spaces with practical, dual-purpose furniture. The trend towards flexible living solutions, coupled with evolving design aesthetics, is expected to bolster the growth of this segment in the coming years.

The Bed segment continues to capture a solid share of the folding furniture market, driven by rising consumer preference for space-efficient bedding options. These foldable beds cater particularly to urban dwellers and those with smaller living spaces, where functionality and convenience are prioritized.

The market demand is further fueled by the increasing popularity of rental homes and compact apartments, where foldable beds are essential for efficient space management.

The Other Product Types segment encompasses folding furniture solutions like storage units, desks, and modular kitchen furniture. While this segment holds a smaller share compared to tables, chairs, and beds, it is witnessing steady growth, supported by demand for customized and modular space-saving solutions.

As consumer preferences lean towards personalization and innovative designs, this segment is poised to expand its market footprint, especially in specialized residential and commercial spaces.

By Application Analysis

Residential Leading the Folding Furniture Market with 68.1% Share

In 2023, Residential held a dominant market position in the application segment of the folding furniture market, capturing more than a 68.1% share. This growth is primarily attributed to rising consumer demand for compact and versatile furniture solutions in urban households, where optimizing space is crucial.

The adoption of folding furniture in residential settings, including apartments, small homes, and rental units, is driven by affordability, ease of use, and enhanced mobility. Factors such as increased urbanization, the popularity of studio apartments, and the growing trend of home offices are expected to sustain the leading position of this segment in the coming years.

The Commercial segment is steadily gaining traction as businesses and organizations increasingly prioritize flexible, adaptable workspaces. Folding furniture is in demand for office spaces, educational institutions, hospitality venues, and event management companies, driven by the need for efficient space utilization and easy reconfiguration.

Although it accounted for a smaller share compared to residential applications in 2023, this segment is poised for notable growth, fueled by the hybrid work model, co-working spaces, and the expanding hospitality sector. Innovations in design and materials are expected to further enhance the appeal of folding furniture in commercial settings.

By Distribution Channel Analysis

Offline Leading the Folding Furniture Market with 67.4% Share

In 2023, Offline held a dominant market position in the distribution channel segment of the folding furniture market, capturing more than a 67.4% share. This segment benefits from consumers’ preference for direct product inspection before purchase, which remains crucial for furniture buyers.

Brick-and-mortar stores, including specialty furniture shops, home improvement centers, and department stores, continue to be popular due to personalized services, immediate product availability, and the ability to offer after-sales support. Additionally, strong retail networks and showrooms in emerging markets have further boosted offline sales, maintaining its lead within the distribution landscape.

The Online segment is experiencing rapid growth, driven by the expanding e-commerce landscape and increasing consumer preference for digital convenience. In 2023, this channel saw a significant uptick as consumers favored online platforms for their broad product selections, competitive pricing, and ease of doorstep delivery.

Enhanced digital marketing, user-friendly interfaces, and innovative virtual product visualization tools are driving the popularity of online purchases. While it held a smaller share compared to offline, the online segment is anticipated to grow robustly, fueled by digital adoption and improvements in logistics and customer service.

Key Market Segments

By Product Type

- Sofa

- Table and Chair

- Bed

- Other Product Types

By Application

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

Driver

Growing Demand for Space-Saving Solutions in Urban Areas

The surge in urbanization globally has significantly driven the demand for space-efficient solutions, propelling the folding furniture market’s growth. As cities become more densely populated, living spaces tend to shrink, particularly in major metropolitan areas. This shift has prompted consumers to seek furniture that optimizes limited space without compromising on functionality or aesthetic appeal.

Folding furniture, including tables, chairs, beds, and storage units, addresses this need by offering versatile and compact designs. Such furniture can be easily folded, stored, and rearranged, making it a preferred choice for small apartments, co-working spaces, and other limited-space environments.

According to recent data, nearly 56% of the global population resides in urban areas, a number projected to increase in the coming years. As this trend continues, the demand for folding furniture is expected to grow, reflecting the market’s ability to adapt to evolving consumer lifestyles.

Moreover, the increase in single-person households and nuclear families further supports the demand for folding furniture. Smaller households often seek multipurpose furniture that can adapt to different uses throughout the day, such as folding desks that serve as both workstations and dining tables.

This need for flexibility not only influences residential consumers but also extends to commercial sectors like hotels, cafes, and restaurants, where space utilization is critical to maximizing capacity.

As real estate prices soar in urban centers, both individuals and businesses are prioritizing cost-effective, space-saving solutions, which are directly contributing to the rising sales and adoption of folding furniture. The appeal of such adaptable and mobile furniture aligns with the broader trend toward minimalist lifestyles, further driving market growth.

Restraint

High Competition from Alternative Furniture Solutions

Despite the advantages of folding furniture, its market growth faces substantial challenges due to competition from alternative furniture solutions. Fixed, modular, and multifunctional furniture types provide robust competition, as they often offer greater durability, stability, and aesthetic integration within interior designs.

Many consumers still associate folding furniture with lower quality or lesser comfort compared to traditional, fixed furniture. These perceptions can deter potential buyers, particularly in markets where consumers prioritize long-term investment in home decor and furnishings.

Additionally, folding furniture’s mechanical components may present wear-and-tear issues over time, raising concerns about longevity, which could limit its adoption among consumers who are seeking long-lasting solutions. The competitive landscape is further intensified by the availability of other space-saving furniture innovations, such as wall-mounted units, convertible sofas, and expandable dining tables, which do not require folding mechanisms.

These products often offer a similar level of flexibility but with improved design aesthetics and functionality, making them more appealing to a broader consumer base. This competition can reduce folding furniture’s market share, especially in regions where consumers have higher disposable income and seek premium, multifunctional designs.

Price sensitivity is also a factor; consumers may opt for alternative solutions that are perceived as more cost-effective over time, impacting folding furniture’s growth potential. As a result, the folding furniture market needs to continuously innovate in terms of design, material quality, and cost-efficiency to maintain a competitive edge.

Opportunity

Technological Advancements in Materials and Design

Technological advancements in materials and design present a significant opportunity for the folding furniture market. Innovations in manufacturing processes and materials, such as lightweight metals, durable plastics, and eco-friendly composites, have enhanced the quality, durability, and aesthetics of folding furniture.

These advancements allow manufacturers to create products that are not only easier to handle but also more resilient, making them suitable for a wider range of environments, including outdoor settings and high-traffic commercial spaces.

Additionally, cutting-edge designs that focus on ease of use, safety, and space maximization have improved the market’s appeal across various consumer segments, including millennials, who value both style and practicality in their furniture choices.

Furthermore, smart technologies are being integrated into folding furniture, creating new possibilities for functionality and convenience. For instance, furniture equipped with smart locks, sensors, and automated folding mechanisms provides users with enhanced ease of operation and security.

The use of augmented reality (AR) in the design and marketing phases has also improved consumer engagement, allowing customers to visualize how folding furniture will look and fit in their spaces before purchasing. Such innovations align well with the growing consumer preference for furniture that offers both utility and style.

By leveraging these technological advancements, the folding furniture market can expand its consumer base, attract premium buyers, and establish a stronger presence in both residential and commercial sectors. As a result, manufacturers are well-positioned to capitalize on the growing demand for technologically advanced, user-friendly furniture solutions.

Trends

Rising Popularity of Sustainable and Eco-Friendly Furniture

The growing emphasis on sustainability has emerged as a key trend shaping the folding furniture market. As environmental awareness increases, consumers are seeking eco-friendly furniture options, including folding furniture made from sustainable materials like bamboo, reclaimed wood, recycled plastics, and low-VOC (volatile organic compound) finishes.

This shift aligns with a broader consumer preference for products that contribute to environmental preservation, support sustainable practices, and reduce carbon footprints. In response, manufacturers are increasingly adopting green manufacturing processes and sustainable materials in their production lines to cater to eco-conscious consumers, which has driven demand in the folding furniture sector.

This trend is further supported by regulatory measures promoting sustainability in manufacturing and product design. For example, government incentives and certifications for eco-friendly products encourage manufacturers to innovate and offer folding furniture that complies with environmental standards.

The growing demand for sustainable folding furniture is not limited to individual consumers but extends to businesses, schools, and public institutions that are increasingly committed to green procurement policies. With an increasing number of consumers willing to pay a premium for sustainable products, this trend presents both a challenge and an opportunity for folding furniture manufacturers.

Companies that can successfully balance eco-friendly production with cost-effectiveness and quality will be able to tap into a lucrative segment of the market, sustaining growth while aligning with global sustainability goals.

Regional Analysis

Asia-Pacific Leads Folding Furniture Market with Largest Market Share of 38.3%

Asia-Pacific dominates the global folding furniture market, accounting for a 38.3% market share in 2023, with the region valued at USD 54.2 billion. The rapid urbanization, particularly in countries like China, India, and Japan, is a significant factor driving this growth, as rising urban populations increase demand for space-saving solutions in residential and commercial sectors.

The expanding middle class in these countries is fueling consumer spending on innovative furniture that balances functionality with affordability. In addition, the growing adoption of e-commerce platforms in the region has improved accessibility to a variety of folding furniture designs, boosting market penetration.

Moreover, government initiatives to promote affordable housing, coupled with increased investments in infrastructure, have further supported the demand for versatile furniture options like folding tables, beds, and chairs. As a result, the Asia-Pacific region is expected to maintain its leading position in the market over the forecast period.

North America holds a substantial share of the global folding furniture market, with the U.S. and Canada being key contributors. The region’s growth is driven by strong consumer preferences for multipurpose and modular furniture, fueled by an increasing number of small apartments and co-living spaces.

The high prevalence of home offices in the post-pandemic era has also spurred demand for foldable desks and workstations. With a focus on high-quality materials and innovative designs, North American consumers are willing to invest in durable folding furniture solutions. Additionally, the rising popularity of outdoor activities and recreational furniture further contributes to the market’s expansion in the region.

Europe represents a mature market for folding furniture, with steady growth attributed to high consumer awareness of sustainable and eco-friendly products. Countries like Germany, France, and the U.K. have seen increasing demand for folding furniture made from recycled or sustainably sourced materials.

This aligns with regional regulatory measures that encourage the use of environmentally friendly products, boosting the market for green furniture solutions. The demand for compact furniture designs is also driven by urban apartment living and co-working trends, particularly in Western Europe. As a result, European consumers prioritize space-efficient, stylish, and sustainable options, contributing to consistent market growth.

Latin America is experiencing gradual growth in the folding furniture market, driven by increasing urbanization and a growing awareness of space-saving solutions in countries such as Brazil, Mexico, and Argentina. The rising number of single-person households and smaller living spaces is fueling demand for folding beds, tables, and chairs.

However, the market faces challenges related to price sensitivity, which has prompted manufacturers to focus on cost-effective designs that meet local consumer needs. The expanding middle class, combined with improving e-commerce infrastructure, is expected to further drive market growth in the region.

The Middle East & Africa region holds a relatively smaller share of the folding furniture market but presents niche growth opportunities, particularly in urban centers like Dubai, Riyadh, and Johannesburg. The demand is primarily driven by a growing expatriate population, smaller apartment sizes, and an increasing trend towards furnished rentals.

The hospitality sector’s expansion, coupled with infrastructural developments, is also expected to support the demand for folding furniture in this region. Despite challenges such as high import costs and limited local manufacturing, the region shows potential for growth, especially in mid- to high-income segments seeking versatile, space-saving furniture solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global folding furniture market in 2024 is defined by a competitive landscape driven by established players and innovative entrants catering to evolving consumer demands. Inter IKEA Holding B.V. maintains a dominant position by leveraging its extensive distribution network and focus on cost-effective, space-saving solutions, making it a preferred choice for urban households.

Meanwhile, Meco Corp. and Lifetime Products, Inc. continue to demonstrate strong performance, capitalizing on their broad product portfolios and consistent innovation in outdoor folding furniture. Both companies emphasize durability and multi-functionality, addressing growing consumer interest in versatile and sustainable options.

La-Z-Boy Incorporated and Haworth, Inc. have carved out niche segments, targeting customers seeking ergonomic designs for home offices and co-working spaces, a trend propelled by the hybrid work model.

Similarly, Steelcase Inc. is poised to benefit from increased demand for flexible workspace solutions, reflecting its strategic investments in adaptable, compact furniture designs. Resource Furniture stands out with its premium offerings in the multi-functional, high-end segment, appealing to affluent urban consumers who prioritize quality and aesthetic appeal.

Ashley Global Retail, LLC and Hussey Seating Company emphasize affordability and robust distribution, especially in emerging markets, positioning themselves well for growth. Leggett & Platt, Incorporated continues to innovate, focusing on foldable bed solutions, which are increasingly popular in smaller living spaces.

Other key players contribute to market diversity by offering customized solutions, aiming to capture specific consumer needs across regions. The market in 2024 is anticipated to remain dynamic, with competitive pricing, innovation, and sustainability being critical drivers for success.

Top Key Players in the Market

- Inter IKEA Holding B.V.

- Meco Corp.

- Lifetime Products, Inc.

- La-Z-Boy Incorporated

- Haworth, Inc.

- Steelcase Inc.

- Resource Furniture

- Ashley Global Retail, LLC

- Hussey Seating Company

- Leggett & Platt, Incorporated

- Other Key Players

Recent Developments

- In 2023, IKEA launched a new line of multifunctional furniture tailored for compact living spaces, including an innovative foldable bed/desk combo aimed at optimizing space utilization in urban homes.

- In 2023, ITALICA (PIL Italica Lifestyle Ltd.), a renowned brand in stylish and functional furniture solutions, proudly introduced India’s first fully plastic folding chair, the Phoenix Folding Chair. With the tagline “Unfold comfort anywhere,” this chair promises a unique blend of design, durability, and convenience, redefining portable seating solutions in the Indian market.

- In 2023, Logitech G, in collaboration with Playseat, unveiled the Playseat Challenge X – Logitech G Edition, a state-of-the-art sim racing chair. Designed to work seamlessly with Logitech G racing wheels and pedals, this chair features a lightweight, foldable carbon steel frame with a fully adjustable seat made from Playseat’s Actifit™️ breathable material, ensuring sim racers enjoy maximum comfort, flexibility, and immersion during gameplay.

Report Scope

Report Features Description Market Value (2023) USD 11.9 Bn Forecast Revenue (2033) USD 20.7 Bn CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sofa, Table & Chair, Bed and Other Product Types ), By Application ( Residential, Commercial), By Distribution Channel (Online and Offline). Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Inter IKEA Holding B.V., Meco Corp., Lifetime Products, Inc., La-Z-Boy Incorporated, Haworth, Inc., Steelcase Inc., Resource Furniture, Ashley Global Retail, LLC, Hussey Seating Company, Leggett & Platt, Incorporated, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Inter IKEA Holding B.V.

- Meco Corp.

- Lifetime Products, Inc.

- La-Z-Boy Incorporated

- Haworth, Inc.

- Steelcase Inc.

- Resource Furniture

- Ashley Global Retail, LLC

- Hussey Seating Company

- Leggett & Platt, Incorporated

- Other Key Players