Global Ethanol Market Size, Share, And Growth Analysis Report By Type (Synthetic Ethanol, Bioethanol), By Purity (Denatured, Undenatured), By Source (Corn, Sugarcane, Wheat, Cellulose, Petrochemical), By Application (Pharmaceuticals, Fuel, Personal Care and Cosmetics, Beverages), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 22444

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

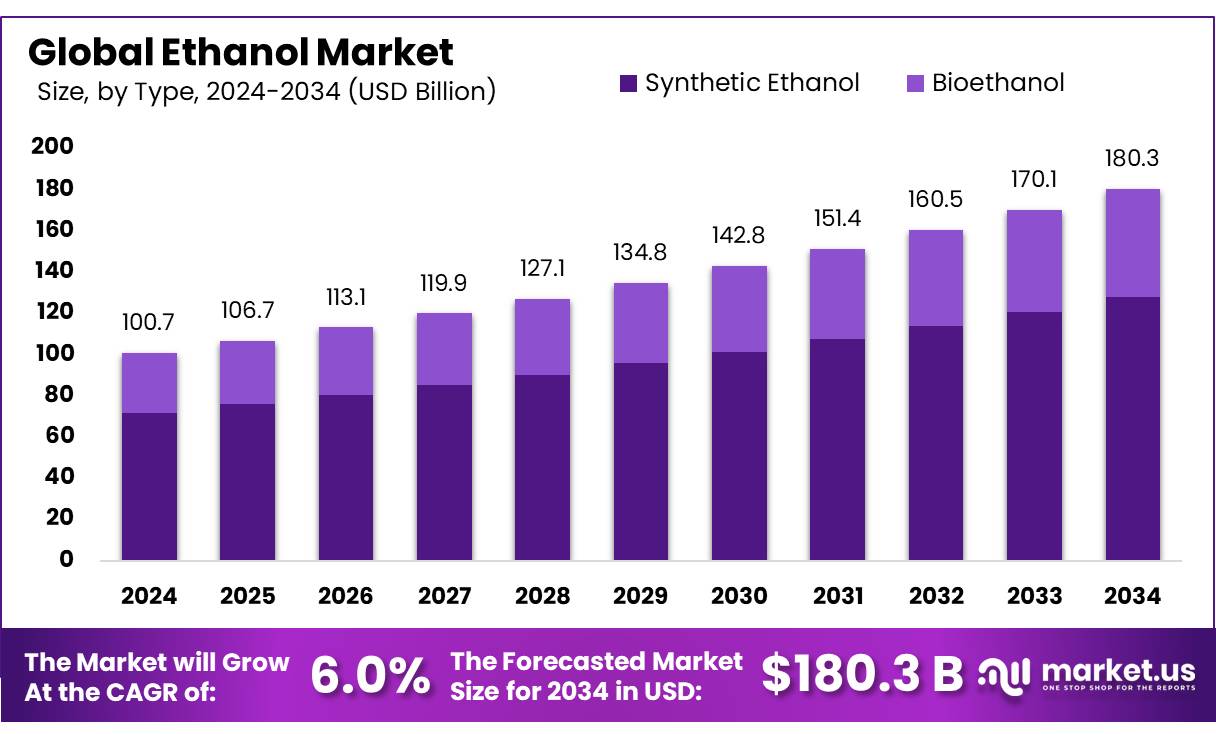

The Global Ethanol Market size is expected to be worth around USD 180.3 billion by 2034, from USD 100.7 billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Ethanol is a renewable fuel made from various plant materials collectively known as biomass. More than 98% of U.S. gasoline contains ethanol to oxygenate the fuel. Typically, gasoline contains E10 (10% ethanol, 90% gasoline), which reduces air pollution. Ethanol is also available as E85 (or flex fuel), which can be used in flexible fuel vehicles, designed to operate on any blend of gasoline and ethanol up to 83%.

In the United States, 94% of ethanol is produced from the starch in corn grain. Energy is required to turn any raw feedstock into ethanol. Ethanol produced from corn demonstrates a positive energy balance, meaning that the process of producing ethanol fuel does not require more energy than the amount of energy contained in the fuel itself.

Ethanol produced either by fermentation or by synthesis is obtained as a dilute aqueous solution and must be concentrated by fractional distillation. Direct distillation can yield at best the constant-boiling-point mixture containing 95.6% by weight of ethanol. Dehydration of the constant-boiling-point mixture yields anhydrous, or absolute, alcohol. Ethanol intended for industrial use is usually denatured (rendered unfit to drink), typically with methanol, benzene, or kerosene.

The best preservative is ethyl alcohol (sometimes abbreviated as ethanol or EtOH), diluted no more than 70% with water. Isopropyl alcohol will work, but ethyl alcohol is required for any later genetic studies. Specimens needed for genetic studies should be preserved in 90% or stronger ethyl alcohol. Glycerin can also be used (and may prevent desiccation if a container lid is loose), but it tends to make most arthropod specimens brittle.

Key Takeaways

- The Global Ethanol Market is projected to grow from USD 100.7 billion in 2024 to USD 180.3 billion by 2034, at a 6.0% CAGR.

- Synthetic ethanol dominates the market by type, holding over 71.2% share due to cost-effective production and industrial use.

- Denatured ethanol leads in purity, capturing 59.2% share, driven by its use in industrial and fuel applications.

- Corn is the top source for ethanol, holding a 48.2% share, supported by strong biofuel demand and agricultural infrastructure.

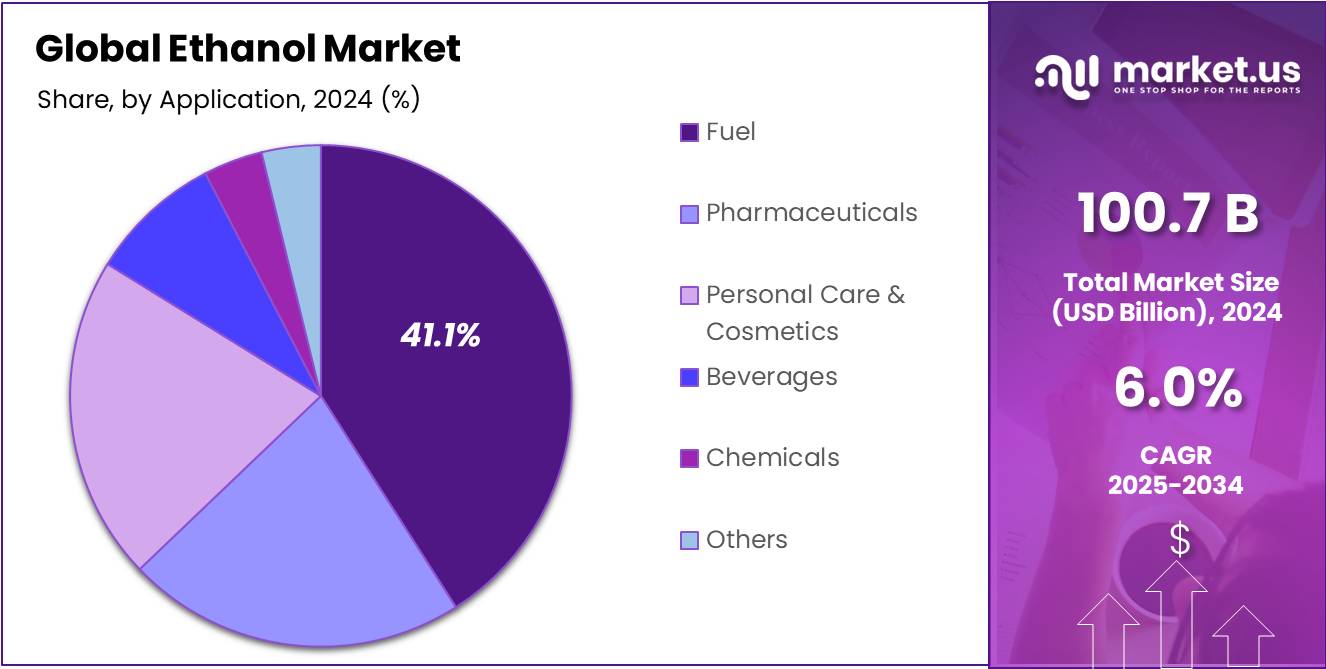

- Fuel is the largest application segment, with a 41.1% share, as ethanol is widely used as a renewable fuel additive.

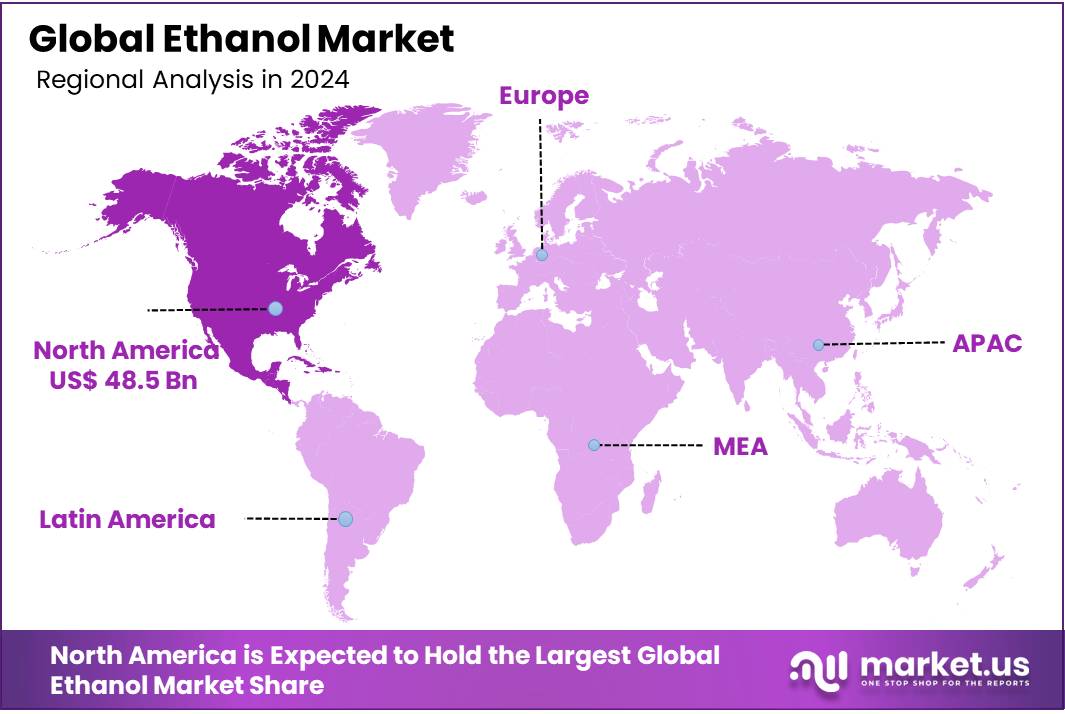

- North America leads the ethanol market with a 48.2% share, generating USD 48.5 billion, driven by the U.S. as the top producer and consumer.

Analyst Viewpoint

The Ethanol Market is buzzing with potential for investors, driven by a global push for cleaner energy and supportive policies, but it’s not without its hurdles. Investment opportunities shine in next-generation biofuels like cellulosic ethanol, which uses agricultural waste and could tap into the growing demand for sustainable fuels.

The Greenhouse Gas savings compared to fossil petrol make ethanol a darling of environmentally conscious markets, particularly in Europe. Yet, risks loom large: volatile raw material costs, competition from electric vehicles, and trade barriers like Brazil’s tariff-rate quota or China’s restrictive tariffs can dent profitability.

Technological advancements, such as improved fermentation processes and carbon capture in production like Alto’s Pekin project, are boosting efficiency and sustainability, making ethanol more appealing to eco-minded consumers. However, the regulatory environment is a double-edged sword. Policies like India’s E20 blending mandate and U.S. tax credits for biofuels spur growth, but regulatory uncertainty, especially with potential shifts under new administrations, could disrupt long-term planning.

By Type

Synthetic Ethanol Captured Over 71.2% Market Share in 2024

In 2024, Synthetic Ethanol held a dominant market position, capturing more than a 71.2% share of the global ethanol market by type. This strong lead reflects its widespread industrial usage and cost-effective production, especially in regions with abundant petrochemical feedstocks.

Synthetic ethanol, typically derived from ethylene, remains a preferred choice for applications where food-grade purity is not essential, such as in industrial solvents, chemical intermediates, and personal care formulations. Its reliable availability and consistent quality continue to support steady demand in sectors like cosmetics, paints, and pharmaceuticals.

The share of synthetic ethanol is expected to stay strong as industries prioritize consistent supply and low processing costs. Although bioethanol is gaining policy momentum in transportation fuel, synthetic ethanol maintains an edge in specific non-fuel applications where fermentation-based alternatives face cost and purity limitations.

By Purity

Denatured Ethanol Held 59.2% Market Share in 2024

In 2024, Denatured Ethanol held a dominant market position, capturing more than a 59.2% share in the ethanol market by purity. This segment’s strength comes largely from its extensive use in industrial and fuel applications, where it is chemically treated to make it unfit for human consumption.

Governments across many countries support the use of denatured ethanol as a biofuel blend, especially for reducing emissions in the transportation sector. Its lower cost compared to undenatured ethanol also adds to its preference in manufacturing and energy-related sectors.

The demand for denatured ethanol is expected to remain steady, especially in countries like India and Brazil, where ethanol blending mandates are expanding. With increasing interest in replacing fossil fuels with renewable alternatives, denatured ethanol is playing a key role due to its ease of storage, distribution, and blending compatibility.

By Source

Corn accounted for 48.2% of the Ethanol Market Share in 2024

In 2024, Corn held a dominant market position, capturing more than a 48.2% share in the global ethanol market by source. Corn-based ethanol remains the leading choice, particularly in the United States, where it is widely used as a biofuel and supported by long-standing agricultural infrastructure.

The processing of corn into ethanol not only supports rural economies but also aligns with national energy strategies aimed at reducing petroleum imports and greenhouse gas emissions. Corn ethanol’s steady supply chain and proven fermentation technology continue to make it a dependable feedstock for large-scale fuel blending.

Corn is expected to maintain its lead due to strong domestic demand and government blending mandates. However, challenges such as rising feedstock prices and land-use concerns are prompting producers to focus on improving yield efficiencies and investing in sustainable farming practices. Even with ongoing debates around food-versus-fuel issues, corn’s role in ethanol production remains critical.

By Application

Fuel Application Held 41.1% Market Share in 2024

In 2024, Fuel held a dominant market position, capturing more than a 41.1% share in the global ethanol market by application. Ethanol’s role as a renewable fuel additive continues to expand, especially in countries aiming to reduce their reliance on fossil fuels. Blending ethanol with petrol helps cut emissions, improve engine performance, and support energy independence.

Many governments have introduced blending mandates like E10 and E20 to reduce carbon intensity in transportation fuels, and this has directly supported demand for fuel-grade ethanol. Fuel is expected to remain the leading application segment as blending programs grow stronger in regions like Asia-Pacific and Latin America.

Ethanol’s cleaner combustion, wide availability, and cost advantages over some fossil fuels make it a practical solution in both developed and developing markets. While electric vehicles are gaining attention, ethanol will likely continue to serve as a key alternative fuel during this energy transition phase, especially for internal combustion engine vehicles still in use.

Key Market Segments

By Type

- Synthetic Ethanol

- Bioethanol

By Purity

- Denatured

- Undenatured

By Source

- Corn

- Sugarcane

- Wheat

- Cellulose

- Petrochemical

- Others

By Application

- Pharmaceuticals

- API

- Disinfectants

- Herbal Medicinal Products

- Syrups

- Others

- Fuel

- E5

- E10

- E15 to E70

- E75 and E85

- Others

- Personal Care and Cosmetics

- Perfumes and Fragrances

- Hair Care

- Hygiene Products

- Skin Care

- Others

- Beverages

- Chemicals

- Others

Drivers

Government-Led Ethanol Blending Targets

One of the most significant factors propelling the ethanol market forward is the Indian government’s ambitious Ethanol Blended Petrol (EBP) Programme. In 2024, India achieved a 15% ethanol blending rate in petrol, marking a substantial increase from previous years.

The government has set an aggressive target to reach a 20% blending rate. This initiative is not only aimed at reducing the country’s dependence on imported fossil fuels but also at promoting cleaner energy alternatives. By increasing ethanol blending, India aims to cut down on carbon emissions and enhance energy security.

The government has implemented several measures, including expanding the range of feedstocks for ethanol production and reducing the Goods and Services Tax (GST) on ethanol to 5% under the EBP Programme.

Restraints

Feedstock Constraints

India’s ambitious target to achieve 20% ethanol blending in petrol by 2025 faces a significant hurdle: the availability of adequate feedstock. Ethanol production in the country primarily relies on sugarcane and grains like maize and rice. However, fluctuations in agricultural output due to climatic conditions, such as erratic monsoons, have led to inconsistent feedstock supply.

For instance, a poor monsoon season in 2023 adversely affected sugarcane yields, prompting the government to restrict the diversion of sugar for ethanol production to ensure sufficient sugar availability for domestic consumption. The increased use of food grains for ethanol has sparked concerns about food security and price inflation.

In 2024, India transitioned from being a net exporter to a net importer of corn, with imports estimated at 1 million tons, primarily to meet the rising demand for ethanol production. This shift has strained the poultry and starch industries, which rely heavily on corn, leading to increased feed costs and potential disruptions in these sectors.

Opportunity

Government-Led Ethanol Blending Targets

One of the most significant factors propelling the growth of the ethanol market in India is the government’s ambitious Ethanol Blended Petrol (EBP) Programme. In 2024, India achieved a 15% ethanol blending rate in petrol, marking a substantial increase from previous years.

This initiative aims to reduce the country’s dependence on imported fossil fuels and promote cleaner energy alternatives. By increasing ethanol blending, India seeks to cut down on carbon emissions and enhance energy security. The move is also expected to provide a significant boost to the agricultural sector, as ethanol production primarily utilizes crops like sugarcane and corn, thereby offering farmers additional income streams.

These concerted efforts have led to a significant increase in ethanol supply, with the Ministry of Petroleum and Natural Gas reporting a jump from 380 million liters in 2013-14 to 7.074 billion liters in 2023-24. This upward trajectory indicates that India is well on its way to achieving the 20% blending target by 2025, which will require approximately 1,016 crore liters of ethanol.

Trends

Second-Generation (2G) Ethanol – Transforming Agricultural Waste into Sustainable Fuel

India’s ethanol industry is undergoing a significant transformation with the emergence of Second-Generation (2G) ethanol, which utilizes agricultural residues like rice straw, wheat straw, and sugarcane bagasse. This shift addresses the dual challenges of sustainable fuel production and environmental conservation.

To promote 2G ethanol, the Indian government launched the Pradhan Mantri JI-VAN (Jaiv Indhan – Vatavaran Anukool Fasal Awashesh Nivaran) Yojana, providing financial support of ₹1,969.50 crore for 12 integrated bio-ethanol projects using lignocellulosic biomass. These projects are expected to significantly boost ethanol production capacity and reduce reliance on food crops for fuel.

Oil Public Sector Undertakings (PSUs) are investing in 12 2G bio-refineries across the country, with a total investment of ₹14,000 crore. These facilities aim to convert agricultural waste into ethanol, providing a cleaner alternative to fossil fuels and reducing air pollution caused by stubble burning.

Regional Analysis

North America Leads Global Ethanol Market with 48.2% Share in 2024

In 2024, North America solidified its position as the leading region in the global ethanol market, commanding a substantial 48.2% share and generating approximately USD 48.5 billion in revenue. This dominance is primarily driven by the United States, which has established itself as the world’s largest ethanol producer and consumer.

The region’s leadership is underpinned by robust government policies, technological advancements, and a strong agricultural base. The U.S. Renewable Fuel Standard (RFS) has been instrumental in promoting ethanol use, mandating the blending of renewable fuels into the national fuel supply.

This policy has spurred significant investments in ethanol production infrastructure, particularly in the Midwest, where corn-based ethanol is prevalent. In 2024, the U.S. ethanol industry achieved a record export volume of 1.9 billion gallons, valued at USD 4.3 billion, highlighting its growing influence in the global market.

Technological innovations have further bolstered North America’s ethanol industry. Advancements in enzyme technologies and fermentation processes have enhanced production efficiency, reducing costs and environmental impact.

North America’s commanding share in the global ethanol market is a result of supportive policies, technological progress, and a commitment to sustainable energy solutions. As the region continues to innovate and expand its ethanol capabilities, it is well-positioned to maintain its leadership in the years ahead.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Archer Daniels Midland Company (ADM) is a global leader in ethanol production, operating seven facilities. In March 2024, ADM restarted ethanol plants in Iowa and Nebraska, capitalizing on export demand. It sold its Peoria facility to BioUrja Group, focusing on high-value assets. ADM’s Illinois ICCS project advances CO2 capture, enhancing sustainability.

- Valero Energy Corporation operates 13 ethanol plants in the U.S. In 2024, its Texas sustainable aviation fuel project, using ethanol feedstock, went operational. A carbon capture pipeline partnership with BlackRock and Navigator enhances sustainability. Valero’s Diamond Green Diesel venture targets renewable diesel, leveraging ethanol-related feedstocks, solidifying its leadership in renewable fuels.

- Advanced BioEnergy LLC operates ethanol facilities in Nebraska and South Dakota, focusing on corn-based ethanol and distiller’s grains. With limited recent updates, it benefits from favorable Iowa and Nebraska regulations. Its smaller scale compared to giants like POET or ADM suggests steady operations without major expansions.

Top Key Players in the Market

- The Archer Daniels Midland Company

- POET, LLC

- Valero Energy Corporation

- Green Plains

- Advanced BioEnergy LLC

- Cargill, Incorporated

- INEOS

- HBL

- LyondellBasell Industries

- Sasol

- Marquis Energy LLC

- Pannonia Bio

- BIOAGRA SA

- Balrampur Chini Mills Ltd

- Shree Renuka Sugars Ltd

- The Andersons Inc.

- Bajaj Hindusthan Limited

- Triveni Group

- Raízen

Recent Developments

- In 2024, ADM reported improved results for its Carbohydrate Solutions segment, driven by strong demand for ethanol exports and higher production volumes. The company restarted ethanol production at its Vantage Corn Processors facilities in Iowa and Nebraska to capitalize on favorable market conditions.

- In 2024, Valero’s sustainable aviation fuel (SAF) project in Texas became fully operational, using ethanol as a feedstock, marking a step toward aviation decarbonization. Valero’s Diamond Green Diesel joint venture with Darling Ingredients also expanded, with plans to increase renewable diesel production

Report Scope

Report Features Description Market Value (2024) USD 100.7 Billion Forecast Revenue (2034) USD 180.3 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic Ethanol, Bioethanol), By Purity (Denatured, Undenatured), By Source (Corn, Sugarcane, Wheat, Cellulose, Petrochemical), By Application (Pharmaceuticals, Fuel, Personal Care and Cosmetics, Beverages) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Archer Daniels Midland Company, POET, LLC, Valero Energy Corporation, Green Plains, Advanced BioEnergy LLC, Cargill, Incorporated, INEOS, HBL, LyondellBasell Industries, Sasol, Marquis Energy LLC, Pannonia Bio, BIOAGRA SA, Balrampur Chini Mills Ltd, Shree Renuka Sugars Ltd, The Andersons Inc., Bajaj Hindusthan Limited, Triveni Group, Raízen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- The Archer Daniels Midland Company

- POET, LLC

- Valero Energy Corporation

- Green Plains

- Advanced BioEnergy LLC

- Cargill, Incorporated

- INEOS

- HBL

- LyondellBasell Industries

- Sasol

- Marquis Energy LLC

- Pannonia Bio

- BIOAGRA SA

- Balrampur Chini Mills Ltd

- Shree Renuka Sugars Ltd

- The Andersons Inc.

- Bajaj Hindusthan Limited

- Triveni Group

- Raízen