Global Alcohol Ethoxylates Market By Product (Fatty Alcohol Ethoxylates, Lauryl Alcohol Ethoxylates, Linear Alcohol Ethoxylates and Others) By Application (Emulsifier, Dispersing Agent, Wetting Agent and Others) By End-Use (Cleaning, Textile Processing, Paper Processing, Agrochemicals, Pharmaceuticals and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 55073

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

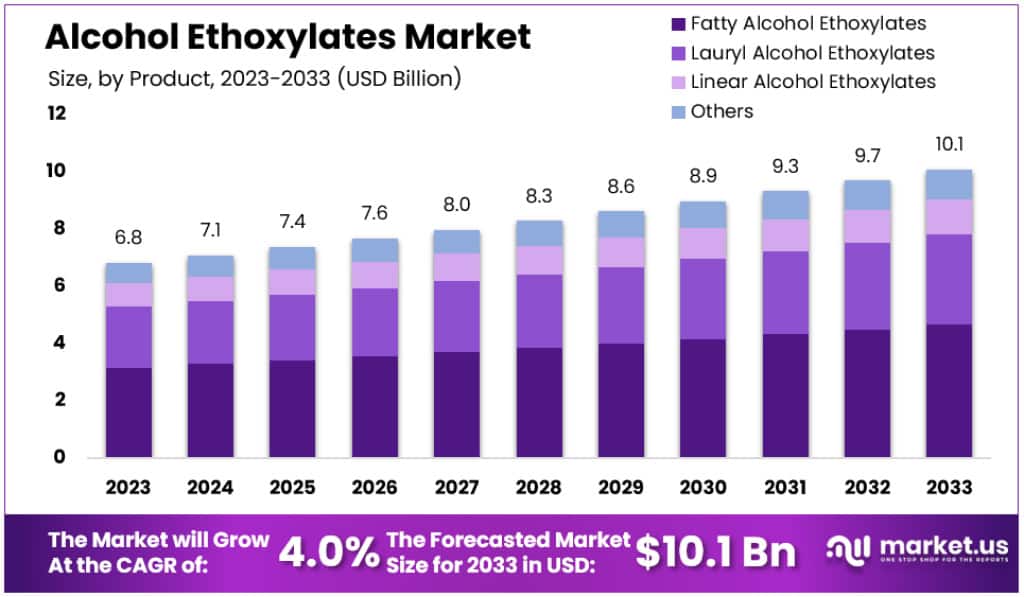

The Alcohol Ethoxylates Market size is expected to be worth around USD 10.1 billion by 2033, from USD 6.8 Bn in 2023, growing at a CAGR of 4% during the forecast period from 2023 to 2033.

Alcohol ethoxylates are a class of organic compounds derived from the ethoxylation process, involving the reaction of alcohols with ethylene oxide. These surfactants find widespread use in various industries due to their excellent emulsifying, dispersing, and wetting properties.

Often employed in the production of detergents, emulsifiers, and foaming agents, alcohol ethoxylates play a crucial role in enhancing the performance of cleaning and personal care products. Their versatility extends to applications in agriculture, textiles, and industrial processes, contributing to the market’s significance in diverse sectors.

The global market for alcohol ethoxylates is forecasted to experience significant growth, primarily driven by the increasing demand for high-grade industrial, institutional, and household cleaners. A key factor contributing to this growth is the rising preference for biodegradable surfactants, especially in application industries. Lauryl alcohol ethoxylates, known for their effectiveness in cleaning applications, are anticipated to see a rise in demand in both industrial and household sectors. This trend is expected to continue over the next eight years.

In the U.S. market, the alcohol ethoxylates industry is characterized by a high level of diversity and integration. Many manufacturers are involved in both the production of alcohol ethoxylates and their raw materials, such as ethylene oxide. This vertical integration is instrumental in boosting profit margins. A significant portion of the total production cost for alcohol ethoxylates is attributed to the sourcing of raw materials. However, the demand for ethylene oxide in other industries poses a potential constraint on market growth.

Environmental regulations play a crucial role in shaping the industry. These regulations, which limit the use of toxic chemicals in surfactants, coupled with consumer preference for environmentally safe products, have led to the production of low VOC (Volatile Organic Compound) content alcohol ethoxylates. For instance, in Canada, the Environmental Protection Act of 1999 sets controls over the manufacture and use of such chemicals, emphasizing their lower environmental impact and toxicity.

Key Takeaways

- The Alcohol Ethoxylates Market is projected to reach a value of USD 10.1 billion by 2033.

- In 2023, the market was valued at USD 6.8 billion.

- The market is expected to grow at a CAGR of 4% from 2023 to 2033.

- Cleaning is the largest end-use segment with a share of 47.8%.

- Asia-Pacific led the market in 2023 with over 41.5% revenue share.

Product Type Analysis

In 2023, the Alcohol Ethoxylates market, particularly focusing on products like Fatty Alcohol Ethoxylates, Lauryl Alcohol Ethoxylates, and Linear Alcohol Ethoxylates, exhibits a dynamic landscape. Each segment contributes uniquely to the market’s growth, driven by distinct factors and applications.

Fatty Alcohol Ethoxylates: As of 2023, Fatty Alcohol Ethoxylates hold a dominant position in the market, capturing a significant 46.2% share. This dominance is underpinned by their widespread use in cleaning applications in both household and industrial settings. These ethoxylates are prized for their low toxicity levels and efficacy in cleaning. Additionally, their application in cream bases within the personal care industry is a key growth driver. This segment generated substantial revenue and continues to be a cornerstone of the market, particularly due to their use as cleaning and wetting agents in washing detergents and various process industries like agriculture, paper, and textiles.

Lauryl Alcohol Ethoxylates: This segment is primarily driven by the demand for advanced low-foaming detergents and cleaners in industrial applications. Lauryl Alcohol Ethoxylates are versatile, available in colorless liquid or water-soluble white waxy states, with their applications ranging from emulsification to use in industrial and institutional cleaners and agricultural chemicals. Their physical state can vary with the number of carbon atoms in their chemical composition, offering flexibility in various applications.

Linear Alcohol Ethoxylates: The production of Linear Alcohol Ethoxylates involves both natural and synthetic sources. They find significant use in cleaning applications and are integral to detergent formulations. Their low to negligible toxicity levels make them a preferable choice in various industries. Major players like Stepan Company and Evonik AG extensively manufacture these products, which are known for their high degree of primary and ultimate biodegradability. Approximately 80% of these substances degrade within 25 days, making them a popular choice among consumers worldwide.

Application Analysis

In 2023, the Alcohol Ethoxylates market is segmented by applications such as Emulsifiers, Dispersing Agents, Wetting Agents, and Others. Each segment contributes to the market’s growth with unique characteristics and widespread applications across various industries.

Emulsifiers: Dominating the market, the emulsifier segment held the largest revenue share of 35.5% in 2022. Alcohol Ethoxylates are renowned for their exceptional surfactant properties, enabling them to effectively blend substances like oil and water. This makes them highly sought-after in industries ranging from food & beverages to cosmetics, agrochemicals, and cleaning products. Their ability to create stable and consistent emulsions and enhance the visual appeal of products is crucial for this segment’s dominance.

Dispersing Agents: The demand for dispersing agents is expected to be driven by the growing consumption of paints and industrial coatings. Developments in the building and construction industry are anticipated to foster market growth for products like tridecyl alcohol ethoxylate, with their superior stabilizing properties in dispersions playing a key role.

Wetting Agents: Fatty alcohols are in high demand as wetting agents, particularly due to their superior low foaming characteristics. The demand for branched alcohol ethoxylates as hard surface wetting agents is expected to emerge as a significant growth driver over the forecast period, with the segment projected to realize revenue of USD ~2,000 million by 2025.

End-Use Analysis

In 2023, the Alcohol Ethoxylates market is segmented by end-use into categories such as Cleaning, Textile Processing, Paper Processing, Agrochemicals, Pharmaceuticals, and Others. Each segment has distinct characteristics and contributes uniquely to the market dynamics.

Cleaning: This segment holds a predominant position in the market, with a significant share of 47.8%. Alcohol Ethoxylates are extensively used in cleaning agents for their excellent surfactant characteristics. These agents are effective in removing dirt, stains, and oils, making them vital in laundry and household cleaning solutions. The rising demand in personal care and cosmetics, fueled by increasing disposable incomes and lifestyle changes, further amplifies their use in surfactants. Environmental regulations, such as those specified in the Canadian Environmental Protection Act of 1999, also contribute to their growing popularity, emphasizing their lower environmental impact and toxicity.

Textile Processing: In textile processing, Alcohol Ethoxylates are used for their ability to reduce surface tension, which is essential in various stages of textile manufacturing like lubricating, finishing, and dyeing fabrics.

Paper Processing: The paper and pulp industry uses Alcohol Ethoxylates, particularly in the de-inking of waste paper. While their use in this sector is limited, it still contributes to the overall market dynamics.

Agrochemicals: In the agrochemicals segment, Alcohol Ethoxylates are used to lower the surface tension in pesticide solutions, enhancing their distribution on plant surfaces. This makes them valuable in the formulation of biocides, insecticides, herbicides, and spermicides.

Pharmaceuticals: A significant growth driver for the Alcohol Ethoxylates market is their use in the pharmaceutical industry. They are frequently used in formulations such as creams, lotions, and ointments due to their superior performance and emulsification properties. This segment’s demand is expected to increase substantially over the forecast period.

Metal Working: The metal working segment, which includes the use of Alcohol Ethoxylates in metalworking fluids, is projected to capture around ~30% market share by 2036. These fluids are essential in various metalworking processes like cutting, drawing, forging, and drilling, to reduce damage caused by friction.

Key Market Segments

Product Type

- Fatty Alcohol Ethoxylates

- Lauryl Alcohol Ethoxylates

- Linear Alcohol Ethoxylates

- Other Product Types

Application

- Emulsifier

- Dispersing Agent

- Wetting Agent

- Other Applications

End-Use

- Cleaning

- Metal Working

- Pharmaceuticals

- Textile Processing

- Paper Processing

- Agrochemicals

- Pharmaceuticals

- Other End-Uses

Drivers

- Diverse Industrial Applications: The market is driven by rising demand from industries like personal care and pharmaceuticals, where alcohol ethoxylates are used for emulsifying, solubilizing, and wetting properties. They are key components in personal care products like shampoos, soaps, and lotions, as well as in pharmaceutical applications due to their ability to enhance the bioavailability of poorly soluble active pharmaceutical ingredients.

- Environmental Awareness: There’s a growing trend towards environmentally friendly surfactants, with alcohol ethoxylates being considered more environmentally friendly because of their biodegradable nature compared to traditional surfactants.

- Demand for Advanced Cleaning Solutions: Due to their superior ability to break down oils and dirt, Alcohol Ethoxylates are crucial in cleaning products. Rising demand for more effective cleaning solutions for household and industrial applications bolsters their market presence.

- Growth in Key Industries: Expansion in textiles, paper, and agriculture sectors enhances the demand for Alcohol Ethoxylates. They are vital in improving product quality across these industries.

Opportunities

- Agrochemical Industry: There is potential growth in the agrochemical industry, as alcohol ethoxylates are used in pesticides and herbicides as emulsifiers and dispersants. They aid in the effective application and distribution of these products, enhancing crop protection efficiency.

- Eco-Friendly Product Development: There’s a significant opportunity for growth by developing Alcohol Ethoxylates from sustainable or less environmentally impactful materials.

- Innovation and R&D: Technological advances in formulations can result in eco-friendlier Alcohol Ethoxylates, attracting industries seeking better functionalities while being environmentally responsible.

- Market Diversification: Exploring new applications beyond traditional uses could widen market scope, tapping into sectors like food, agriculture, or cosmetics.

- Partnerships for Innovation: Collaborations with other industries or research institutions could lead to novel applications and drive market growth.

Challenges

- Health and Safety Concerns: The use of alcohol ethoxylates, especially in high concentrations, can cause skin and eye irritation, impacting consumer perception and market growth. Prolonged or repeated exposure may lead to skin issues like dermatitis.

- Volatility of Raw Material Prices: The cost of production is affected by the fluctuation in the prices of raw materials like alcohol and ethylene oxide. Supply chain disruptions and geopolitical factors contribute to this volatility.

- Regulatory Compliance: Diverse and stringent industry regulations pose challenges for manufacturers, potentially creating barriers for new market entrants and complexities for existing players.

- Competition from Alternatives: The presence of alternative materials or technologies offering similar benefits at potentially lower costs impacts Alcohol Ethoxylates’ market share.

- Cost Constraints: Production expenses could render Alcohol Ethoxylates less attractive in cost-sensitive industries.

Trends

- Growing Personal Care Industry Demand: With increasing consumer focus on personal hygiene and self-care, the demand for Alcohol Ethoxylates in personal care products like shampoos and bath gels is rising. The global beauty and personal care market is projected to reach significant heights, with notable revenues generated by countries like the United States, China, and Japan.

- Increased Demand for Soaps and Detergents: The expanding production of soaps and detergents in major manufacturing countries is fueling the demand for Alcohol Ethoxylates. Their role as key ingredients in these products due to their surfactant properties is crucial.

- Eco-Friendly Product Development: The trend towards developing environmentally friendly Alcohol Ethoxylates aligns with growing consumer and regulatory demand for sustainable products.

- Rising Demand in Paint & Coatings and Oil & Gas Industries: The use of Alcohol Ethoxylates in these sectors, particularly for their stabilizing properties in oil-water emulsions, opens new avenues for market growth.

- Shift to Higher Molecular Weight Ethoxylates: This trend, driven by the need for better application performance, indicates a market leaning towards compounds with superior emulsifying properties, used in industries like textiles and paper manufacturing.

- Demand in Emerging Economies: Rising population and disposable income in emerging economies are boosting the demand for Alcohol Ethoxylates in personal care and household cleaning products.

- Continuous Research and Innovation: The ongoing research and development in the chemical industry are leading to new formulations and applications for alcohol ethoxylates, such as their use in enhanced oil recovery chemicals in the oil and gas sector.

Regional Analysis

Asia-Pacific Region

- Dominant Market Share: In 2023, Asia-Pacific led the market with over 41.5% revenue share, amounting to USD 2.8 billion. The region is expected to see a rise in industrial cleaners’ consumption due to the presence of numerous manufacturers.

- Growth in Key Countries: China and India, being the largest consumers of soaps and detergents worldwide, are pivotal in driving the market in this region. The Home & Laundry Care industry in China is anticipated to grow to USD ~30 billion by 2026, with the personal care market expected to reach USD ~45.5 billion in 2023. Japan’s robust beauty care industry, with over 3,000 companies, also contributes significantly.

- Forecasted Growth Rate: Predicted to grow at a 5.5% CAGR from 2024 to 2033, this region’s market is bolstered by the rapid industrial development and growing demand for front-loading washing machines in developing countries.

Europe

- Substantial Market Presence: In 2023, Europe accounted for ~35% of the global revenue, driven by high product adoption and a developed industrial sector. However, the market growth is expected to be limited due to the maturity of application industries.

North America

- Growth Factors: The North American market is poised for growth, driven by the rising demand for low rinse and low foam detergents. The presence of a large number of manufacturers and the increasing consumption of industrial cleaners are key growth drivers.

- Environmental Compliance: Stringent environmental regulations, such as the Canadian Environmental Protection Act of 1999, advocating for eco-friendly and biodegradable chemicals, are also pivotal in driving the market in this region.

Key Regions

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

With the presence of many multinational companies in the major economies, the industry is highly competitive. Companies operate from multiple locations using a mix of manufacturing facilities and sales offices. Multiple sales offices are located in the region and distribute products via direct distribution or third-party distributors.

To increase annual revenues, the companies offer the product at affordable prices. The growth is expected to be driven by the major manufacturers’ development of advanced ethoxylates that have low VOC content.

Key Market Players

- Clariant AG

- Dow Chemical Company

- AkzoNobel N.V.

- Huntsman International LLC

- Stepan Company

- India Glycols Limited

- BASF SE

- SABIC

- DuPont

- Evonik Industries AG

- Sasol Limited

- Solvay S.A.

- Mitsui Chemicals, Inc.

- Royal Dutch Shell plc

Recent Developments

- In December 2022, Clariant recently unveiled an investment of CHF 80 Million (around USD 86.08 Million) to expand their Care Chemicals facility in Daya Bay, China. The expansion aims to strengthen customer support in pharmaceutical, personal care, home care and industrial sectors while increasing production capacity of Ethylene Oxide Derivatives (EODs) such as alcohol ethoxylates and other chemicals.

Report Scope

Report Features Description Market Value (2023) USD 6.8 Bn Forecast Revenue (2033) USD 10.1 Bn CAGR (2024-2033) 4.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Fatty Alcohol Ethoxylates, Lauryl Alcohol Ethoxylates, Linear Alcohol Ethoxylates and Others) By Application (Emulsifier, Dispersing Agent, Wetting Agent and Others) By End-Use (Cleaning, Textile Processing, Paper Processing, Agrochemicals, Pharmaceuticals and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Clariant AG, Dow Chemical Company, AkzoNobel N.V., Huntsman International LLC, Stepan Company, India Glycols Limited, BASF SE, SABIC, DuPont, Evonik Industries AG, Sasol Limited, Solvay S.A., Mitsui Chemicals, Inc., Royal Dutch Shell plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Clariant AG

- Dow Chemical Company

- AkzoNobel N.V.

- Huntsman International LLC

- Stepan Company

- India Glycols Limited

- BASF SE

- SABIC

- DuPont

- Evonik Industries AG

- Sasol Limited

- Solvay S.A.

- Mitsui Chemicals, Inc.

- Royal Dutch Shell plc