Global Baby Personal Care Market By Product (Skin and Body Care Products (Lotions, Creams, Oils, Powders, Soaps & Bath Washes, Others), Haircare Products (Shampoos & Conditioners, Hair Oils, Others), Oral Care, Others), By Price (Mass, Premium), By Gender (Boys, Girls, Unisex), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 64833

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

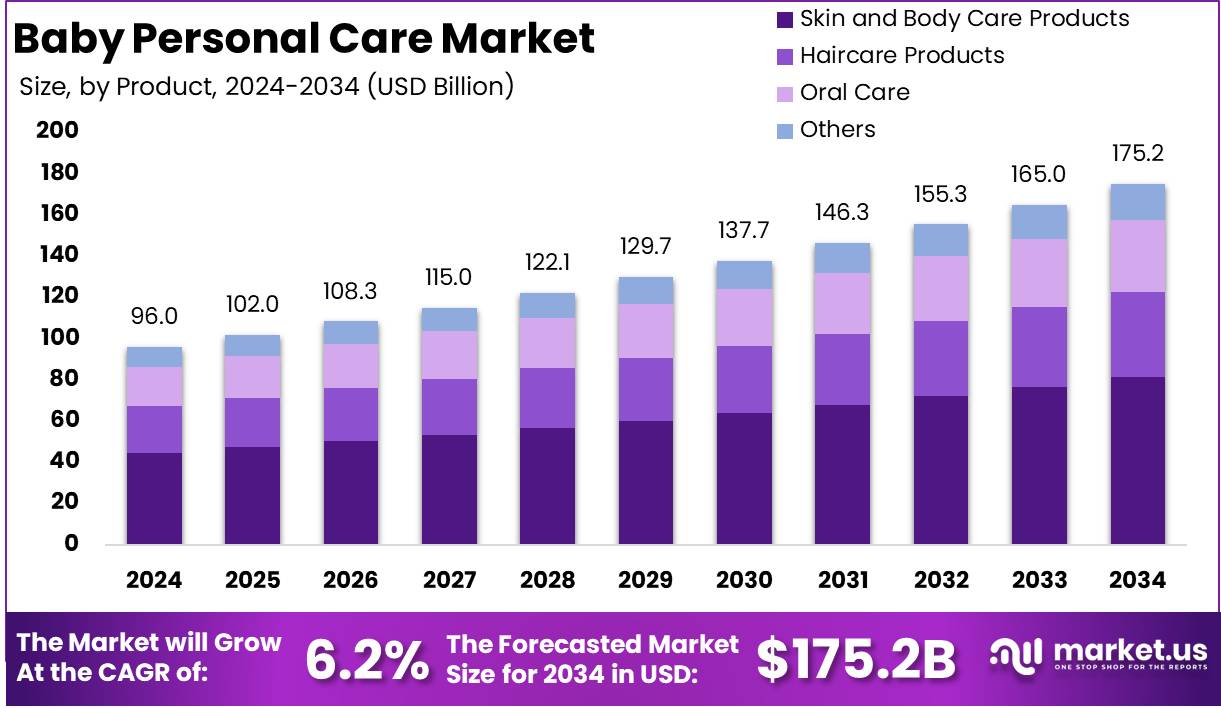

The Global Baby Personal Care Market size is expected to be worth around USD 175.2 Billion by 2034 from USD 96.0 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Baby personal care refers to a range of hygiene and skincare products specifically formulated for infants. These products are developed with a focus on gentle, non-irritating ingredients to accommodate the delicate skin of babies. They include cleansers, shampoos, lotions, oils, and creams designed to provide effective cleansing, moisturization, and protection without compromising safety.

The baby personal care market encompasses the entire value chain involved in the production, distribution, and sale of these specialized products. This market is characterized by a broad spectrum of offerings, ranging from mass-market to premium segments, and is subject to rigorous regulatory standards to ensure product safety and efficacy. It is driven by a combination of traditional retail channels and the increasing influence of digital commerce.

The growth of this market can be attributed to several key factors. There has been a significant increase in consumer awareness regarding the unique skincare needs of infants, coupled with a rising preference for products that are free from harmful chemicals. Technological advancements in product formulation and a global shift toward natural and organic ingredients have also contributed to market expansion. Additionally, enhanced product safety protocols and innovative packaging solutions have bolstered consumer confidence.

Demand for baby personal care products has been steadily increasing, influenced by demographic trends such as a growing global birth rate and increased urbanization. Consumers are increasingly inclined toward products that not only ensure safety but also deliver superior performance, prompting brands to invest in research and development. This heightened focus on quality and efficacy has sustained consumer demand, even in competitive market conditions.

The baby personal care market are emerging across various fronts. In emerging economies, rising disposable incomes and changing consumer lifestyles are driving a transition toward premium and specialty products.

According to PARIDNYA- The MIBM Research Journal, shopping for baby and kids’ products indicates that 37% of consumers opt for online shopping, while the majority, 63%, still favor offline purchasing.

A baby bath 2-3 times a week is considered sufficient to maintain cleanliness, as suggested by Raising Children Network. The bath duration is recommended to be 5-10 minutes, particularly crucial for babies with dry or sensitive skin. Additionally, the water temperature should be monitored, with the ideal range being 37-38°C.

According to Saicmknowledg, a newborn baby typically requires about 8-9 diapers daily during the first year, which adds up to around 3100 diapers annually. As the child grows, this number decreases, and by the second year, the average daily diaper use drops to 5-6, totaling approximately 1950 diapers per year. Babies generally continue to wear diapers until they reach the age of 3-4 years.

Key Takeaways

- The global baby personal care market is expected to grow from USD 96.0 billion in 2024 to USD 175.2 billion by 2034, reflecting a CAGR of 6.2% during the forecast period.

- Skin and body care products dominated the baby personal care market in 2024, capturing more than 46.4% of the market share.

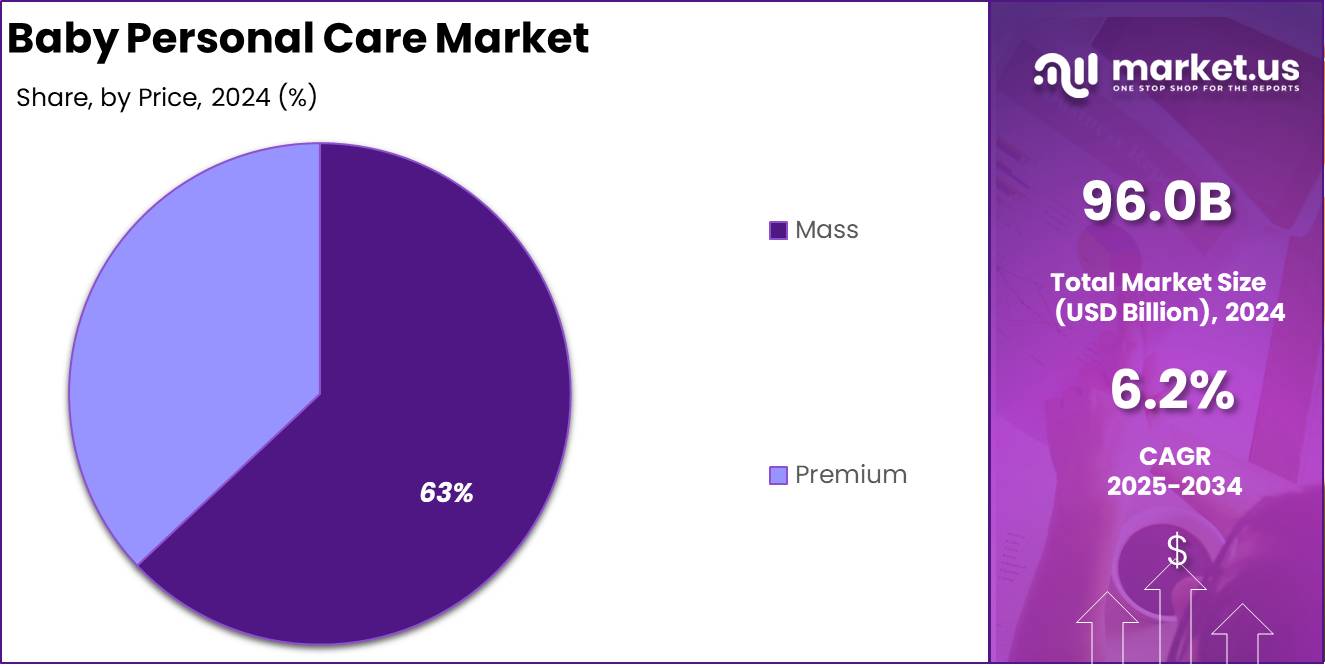

- The mass segment led the baby personal care market by price in 2024, holding over 63% of the market share.

- In 2024, girls dominated the baby personal care market by gender, capturing more than 45% of the market share.

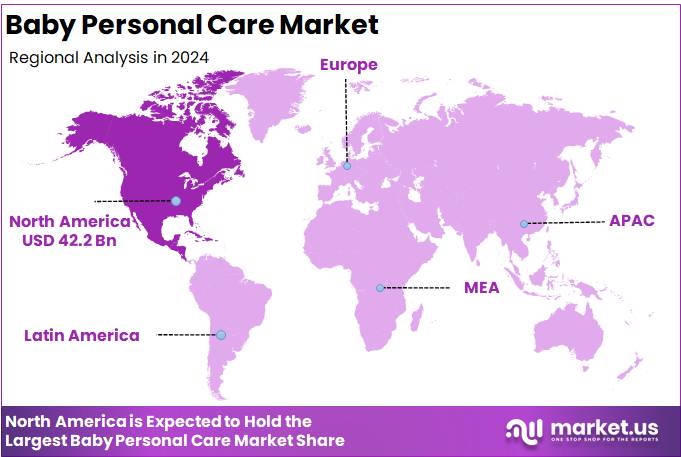

- North America emerged as the dominant region in the global baby personal care market in 2024, accounting for 44% of the market share, valued at USD 42.2 billion.

By Product

In 2024, Skin and Body Care Products Dominated the Baby Personal Care Market, Capturing More than 46.4% Market Share

In 2024, the baby personal care market experienced significant growth across various segments. Skin and body care products were the leading category, capturing more than 46.4% of the market share. This dominance can be attributed to the increasing awareness among parents about the importance of safe, gentle, and nourishing products for their baby’s skin.

Skin and body care products, which include lotions, creams, oils, and bath gels, are widely preferred due to their vital role in keeping the baby’s skin soft, hydrated, and free from irritation. The market for these products continues to thrive as brands introduce formulations with natural ingredients to meet the rising consumer demand for chemical-free alternatives.

Haircare products also accounted for a substantial portion of the market in 2024. This segment includes baby shampoos, conditioners, and hair oils, all of which are formulated to be gentle on sensitive scalp and hair.

The growing preference for natural and organic haircare options has contributed to the steady rise in demand for these products. As more parents seek safe and mild solutions for their babies’ hair, the market for haircare products has seen steady growth.

Oral care products for babies, including toothpaste, toothbrushes, and teething gels, held a significant share in 2024. This category’s growth is driven by heightened awareness regarding early dental hygiene and the importance of starting oral care at an early age.

Toothpaste and toothbrush sets designed for babies are specially formulated to ensure safety, offering fluoride-free and non-toxic ingredients that cater to young children. As the health and well-being of babies continue to be a top priority for parents, the demand for baby oral care products remains robust.

The Others category, which includes baby wipes, diaper creams, and sunscreens, contributed to the overall growth of the baby personal care market.

These products continue to gain popularity as they address the varying needs of babies, including protection against rashes, sun exposure, and maintaining cleanliness. The Others segment is expected to expand as manufacturers innovate new products to meet the diverse and evolving demands of parents looking for complete care solutions for their babies.

By Price Analysis

In 2024, Mass Segment Dominated the Baby Personal Care Market by Price, Capturing More Than 63% Market Share

In 2024, the mass segment held a dominant position in the baby personal care market by price, accounting for over 63% of the total market share. The mass-priced products are particularly popular due to their affordability and wide availability. These products cater to a large consumer base, offering essential baby care items such as lotions, shampoos, and diaper creams at accessible price points.

The continued demand for mass-priced products can be attributed to the growing number of budget-conscious parents seeking high-quality, yet cost-effective, solutions for everyday baby care needs. The widespread presence of mass-market brands in retail outlets further reinforces the segment’s strong market position.

The premium segment in the baby personal care market also showed a steady presence in 2024, though with a smaller market share compared to mass products. The premium category, accounting for a significant portion of the market, offers high-end baby care products that focus on superior quality, organic ingredients, and specialized formulations.

Parents who prioritize premium baby care products tend to seek out items that are more gentle, luxurious, or specific to their baby’s skin or health needs. This segment is driven by an increasing consumer willingness to invest in premium-quality products that promise safety and enhanced features. With the growing interest in organic, chemical-free, and dermatologically tested products, the premium segment continues to appeal to a niche but growing audience.

By Gender

In 2024, Girls Dominated the Baby Personal Care Market by Gender, Capturing More Than 45% Market Share

In 2024, the girls’ segment held a dominant position in the baby personal care market by gender, accounting for more than 45% of the market share. The significant demand for baby personal care products targeted towards girls can be attributed to the growing variety of specially formulated items that cater to the unique needs of female infants.

Products such as gentle lotions, shampoos, and skin care formulations designed for girls have been widely embraced by parents seeking high-quality, gender-specific solutions. The continued growth in the girls’ segment reflects parents’ increasing preference for personalized baby care products that cater to their children’s needs.

The boys’ segment also holds a notable share of the baby personal care market, although it remains smaller compared to the girls’ segment. Products for boys, such as hair care items, bath gels, and lotions, are designed to meet the basic hygiene and care needs of male infants.

While there is steady demand for these products, the market for boys’ specific personal care items has not expanded at the same rate as the girls’ segment. However, the segment continues to grow as more brands tailor their offerings to meet the preferences and needs of parents of boys, with an emphasis on mild, safe, and effective formulations.

The unisex category, which includes baby care products designed for both genders, also holds a significant portion of the market. Unisex products, such as gentle soaps, shampoos, and moisturizing creams, are preferred by parents looking for versatile and neutral options.

The growing awareness about product safety and the desire for functional baby care solutions have contributed to the steady demand for unisex products. This segment appeals to a wide consumer base, as parents often prefer to purchase products that can be used for both boys and girls, promoting convenience and cost-efficiency.

Segmentation Details Analysis 2024

Segmentation Type Dominating Segment 2024 By Product Skin and Body Care Products 46.4% By Price Mass 63% By Gender Girls 63% Regional Analysis North America 44% Key Market Segments

By Product

- Skin and Body Care Products

- Lotions

- Creams

- Oils

- Powders

- Soaps & Bath Washes

- Others

- Haircare Products

- Shampoos & Conditioners

- Hair Oils

- Others

- Oral Care

- Others

By Price

- Mass

- Premium

By Gender

- Boys

- Girls

- Unisex

Driver

Enhanced Consumer Awareness and Demand for Safe, Natural Baby Care

Increasing consumer awareness regarding the safety and quality of baby personal care products has emerged as a significant driver in the global market. Parents are increasingly scrutinizing product ingredients and opting for formulations that are gentle and free from harmful chemicals. This heightened vigilance is fostered by a growing body of scientific research and consumer education, which has led to a shift toward products that feature natural and organic ingredients.

As families become more informed about potential allergens and irritants, the demand for hypoallergenic and dermatologically tested products has seen a marked rise. Recent industry insights indicate that a notable proportion of new parents now prioritize safety and sustainability, thereby reinforcing the market’s focus on transparency in ingredient sourcing and manufacturing practices. This change in consumer mindset has led to a robust preference for brands that can substantiate their safety claims with rigorous testing and certifications.

Furthermore, the overall market growth is bolstered by rising disposable incomes and evolving lifestyles in both developed and emerging economies. Urbanization and the increasing participation of women in the workforce have accelerated the adoption of premium baby personal care products. Digital media and social platforms have played a pivotal role in disseminating product information and fostering peer-to-peer recommendations, which further amplifies consumer trust.

The confluence of these factors has contributed to an environment where premium, safe, and natural baby care products are experiencing sustained demand, thereby underpinning the overall market expansion. Enhanced consumer education, coupled with a drive for safer alternatives, continues to provide momentum to the industry, setting the stage for continued market growth in the upcoming years.

Restraint

Regulatory Hurdles and Safety Concerns Impeding Market Expansion

Stringent regulatory frameworks and escalating safety concerns represent notable restraints within the global baby personal care market. Governments and regulatory agencies have imposed rigorous standards on product formulations to safeguard infant health, resulting in complex compliance procedures for manufacturers. The need to adhere to diverse regulatory requirements across multiple regions increases production costs and delays market entry.

These challenges are compounded by the necessity for comprehensive clinical and dermatological testing, which further escalates time-to-market and limits the agility of product innovation. As regulatory bodies continue to tighten safety standards, manufacturers face increased pressure to invest in extensive research and development to meet evolving guidelines, thereby constraining profit margins.

Additionally, heightened consumer scrutiny regarding product efficacy and safety has generated a cautious market sentiment. Incidents related to product recalls or adverse skin reactions, although infrequent, have heightened public apprehension and necessitated transparent quality assurance practices.

The potential for legal liabilities and reputational damage compels manufacturers to adopt conservative formulations, which may stifle creativity and delay the introduction of innovative solutions. Furthermore, the heterogeneity in regulatory standards across different markets adds layers of complexity for global brands seeking uniform product portfolios.

Collectively, these regulatory and safety challenges exert a dampening effect on rapid market expansion, as companies must carefully balance innovation with compliance. Consequently, while the market retains its growth potential, the constraints imposed by rigorous regulatory oversight and consumer expectations necessitate a cautious approach to product development and market strategy.

Opportunity

Innovative Product Development and Expanding Market Segments

The baby personal care market are being unlocked through innovative product development and strategic expansion into untapped segments. Manufacturers are increasingly investing in research and development to create formulations that combine natural ingredients with advanced technology, addressing both safety concerns and consumer demand for enhanced efficacy.

This drive for innovation has led to the development of multifunctional products that not only provide effective cleansing and moisturizing benefits but also offer additional skin-protective properties. Enhanced product performance, achieved through the integration of organic extracts and naturally derived preservatives, has resonated well with health-conscious consumers.

As parents seek products that are both effective and gentle, these innovations are proving to be critical in differentiating brands and capturing market share. Moreover, expanding market segments offer significant growth potential as brands diversify their portfolios to cater to varied consumer needs. Emerging markets, characterized by rising disposable incomes and an increasing focus on child health, present fertile ground for market expansion.

The evolution of digital retail channels further facilitates access to these new consumer bases, enabling brands to bypass traditional distribution barriers. Tailored marketing strategies that emphasize transparency, safety, and efficacy are effectively engaging diverse demographics, thereby broadening the overall market reach.

In addition, collaboration between research institutions and manufacturers is fostering the development of next-generation baby care products that align with evolving consumer preferences. This strategic focus on innovation and market expansion is anticipated to drive sustained growth and position the industry favorably for future opportunities.

Trends

Digital Transformation and Shifting Consumer Behavior Reshaping the Market

The baby personal care market is undergoing a dynamic transformation driven by digital innovation and evolving consumer behavior. The integration of digital technologies into marketing and distribution strategies has fundamentally altered how products are researched, selected, and purchased by consumers. Online platforms, e-commerce, and social media have become pivotal in shaping purchasing decisions, with consumers relying on product reviews, influencer endorsements, and digital testimonials.

This digital transformation has enabled brands to communicate product benefits more transparently and directly to a global audience, thereby enhancing consumer trust and brand loyalty. Furthermore, the accessibility of digital information has empowered parents to make well-informed decisions regarding product safety and efficacy, which in turn has spurred the adoption of premium baby personal care products.

Concurrently, shifting consumer behavior is reflected in an increased emphasis on ethical production, sustainability, and product personalization. Modern parents are progressively favoring brands that not only deliver superior performance but also adhere to sustainable manufacturing practices and environmentally friendly packaging.

This trend has stimulated the reformulation of products to eliminate potentially harmful chemicals and incorporate eco-friendly ingredients.

Additionally, the demand for personalized product recommendations, driven by data analytics and consumer insights, is steering the market toward tailored solutions that address specific skin care needs. As digital channels continue to evolve and consumer expectations become more refined, the market is witnessing a surge in innovative product offerings that align with these progressive trends.

The combined effect of digital transformation and the evolution of consumer preferences is reshaping market dynamics, paving the way for sustained growth and competitive differentiation in the global baby personal care industry.

Regional Analysis

North America Baby Personal Care Market with Largest Market Share 44%

The global baby personal care market has exhibited significant regional diversity, with North America emerging as the dominant region. In 2024, North America is projected to account for 44% of the global market, with an impressive valuation of USD 42.2 Billion. This commanding presence is primarily attributed to high consumer awareness, advanced product innovation, and stringent regulatory standards that ensure product safety and quality.

Robust economic conditions and high disposable incomes have further bolstered market growth in this region, enabling a wide range of premium and specialized products to flourish.

In Europe, the market is steadily growing as consumer demand is driven by focus on health, hygiene, and environmental sustainability. The region’s consumers exhibit a preference for products that deliver both safety and efficacy, which has led to consistent demand and incremental market expansion. Well-established distribution channels and proactive regulatory measures have reinforced market stability in Europe, ensuring that product quality remains paramount.

The Asia Pacific region is witnessing rapid expansion fueled by a large, youthful population and increasing urbanization. Rising disposable incomes and evolving consumer preferences are encouraging the adoption of premium and innovative baby care solutions. Manufacturers in this region have emphasized localized product development, catering to diverse cultural and economic requirements, thereby creating a competitive landscape that is both dynamic and responsive to market trends.

Similarly, the Middle East & Africa region is gradually emerging as a noteworthy segment in the global market. Improvements in economic conditions and a growing awareness regarding the importance of product quality have contributed to modest market growth. Strategic marketing initiatives and educational campaigns have played an integral role in boosting consumer confidence and acceptance of specialized baby personal care offerings.

Latin America, though in an early phase of market development, is experiencing a steady rise in activity. Demographic trends and shifting lifestyle patterns have begun to influence consumer behavior, resulting in increased demand. Investments in distribution networks and a focus on product innovation are expected to further propel market growth in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global baby personal care market is characterized by a competitive landscape driven by innovation, consumer trust, and strategic market expansions. Key players such as Bio Veda Action Research have carved out a niche through emphasis on natural ingredients and research-backed product formulations, appealing to the increasing consumer preference for organic care solutions.

Multinational giants Johnson & Johnson, Kimberly-Clark Corp., The Procter & Gamble Co., and Unilever have continued to reinforce their market leadership by leveraging extensive research and development capabilities, expansive distribution networks, and robust brand portfolios.

Concurrently, companies like Mothercare IN Ltd. and Me n Moms Pvt Ltd. have secured strong regional presences, tailoring product offerings to local market nuances and cultural preferences. Nestle SA and Pigeon Corp.

have further diversified their product ranges by integrating nutritional insights with personal care solutions, thereby addressing the comprehensive needs of infant care. The Himalaya Drug Co. has maintained a competitive edge through its focus on herbal formulations and sustainable practices, meeting the rising demand for eco-friendly baby care options.

Collectively, these players have not only driven product innovation but also bolstered consumer confidence through rigorous safety standards and quality certifications. The competitive strategies, ranging from aggressive marketing and extensive research to strategic alliances and digital transformation initiatives, have been instrumental in capturing market share in an increasingly fragmented industry.

Overall, the strategic initiatives of these market leaders have contributed to the dynamic evolution of the global baby personal care market in 2024. Overall, the outlook remains robust and promising.

Top Key Players in the Market

- Bio Veda Action Research

- Johnson & Johnson

- Kimberly-Clark Corp.

- Me n Moms Pvt Ltd.

- Mothercare IN Ltd.

- Nestle SA

- Pigeon Corp.

- The Himalaya Drug Co.

- The Procter & Gamble Co.

- Unilever

Recent Developments

- In 2023, Herby Angel secured $2.5 million in its first funding round from JCBL Group. The funds will boost business expansion, improve technology, broaden its product range, and strengthen research and marketing. Launched in January 2023, the brand uses both online and traditional channels to reach its customers.

- In 2024, The Good Glamm Group completed the full acquisition of The Moms Co, further expanding its portfolio alongside investments in other key brands following a major transaction.

- In 2025, The Procter & Gamble Company reported Q2 fiscal 2025 net sales of $21.9 billion, marking a 2% increase from the previous year. Organic sales grew by 3%, and net earnings per share rose by 34% due to adjustments, with core earnings per share showing a modest 2% improvement.

- In 2024, Procter & Gamble’s Luvs brand maintained its partnership with Feeding America by donating over 225,000 diapers to families in Cincinnati and Milwaukee. The initiative also featured a social giveaway offering a year’s supply of diapers and a chance to support a Feeding America food bank.

Report Scope

Report Features Description Market Value (2024) USD 96.0 Billion Forecast Revenue (2034) USD 175.2 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Skin and Body Care Products (Lotions, Creams, Oils, Powders, Soaps & Bath Washes, Others), Haircare Products (Shampoos & Conditioners, Hair Oils, Others), Oral Care, Others), By Price (Mass, Premium), By Gender (Boys, Girls, Unisex) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bio Veda Action Research, Johnson & Johnson, Kimberly-Clark Corp., Me n Moms Pvt Ltd., Mothercare IN Ltd., Nestle SA, Pigeon Corp., The Himalaya Drug Co., The Procter & Gamble Co., Unilever Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bio Veda Action Research

- Johnson & Johnson

- Kimberly-Clark Corp.

- Me n Moms Pvt Ltd.

- Mothercare IN Ltd.

- Nestle SA

- Pigeon Corp.

- The Himalaya Drug Co.

- The Procter & Gamble Co.

- Unilever