Global Baby Nail Care Products Market By Product (Nail Clippers, Nail Trimmers, Nail Scissors, Nail Files, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135873

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

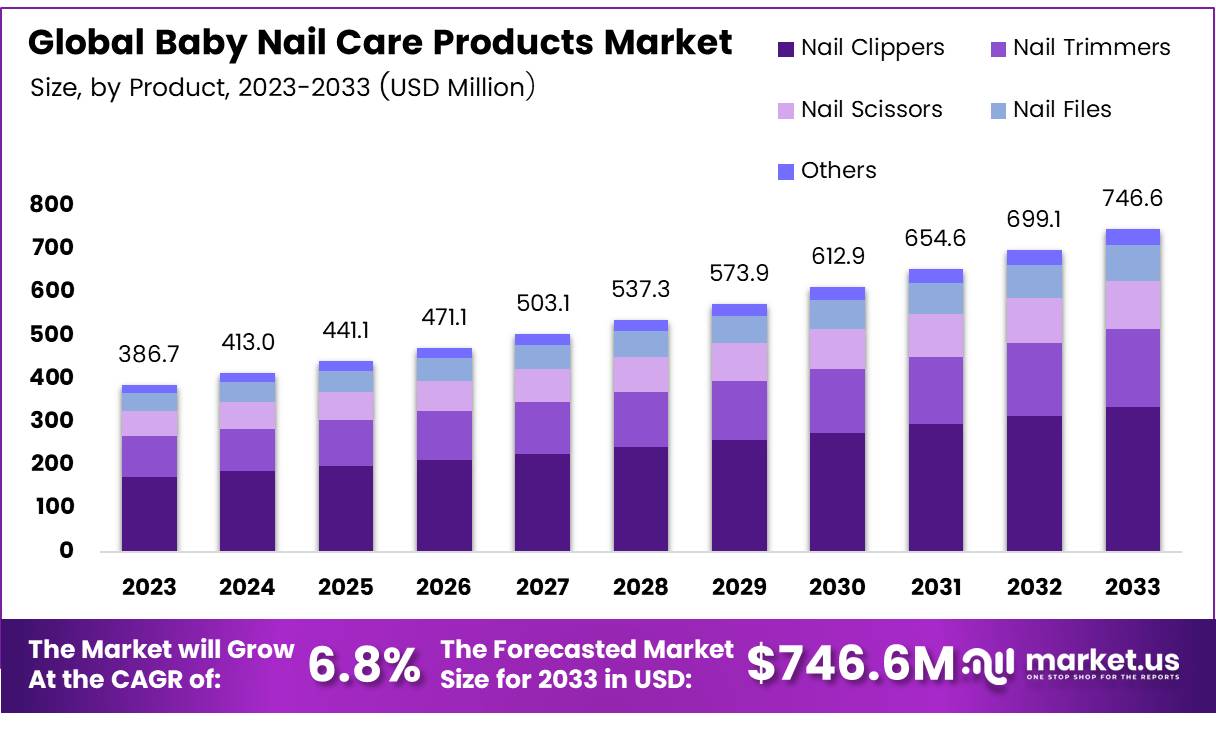

The Global Baby Nail Care Products Market size is expected to be worth around USD 746.6 million by 2033, from USD 386.7 million in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

Baby Nail Care Products encompass a range of grooming and hygiene items designed specifically for the delicate nails of infants and young children. These products typically include nail clippers, nail files, scissors, nail polish removers, and nail polishes that are formulated to be gentle on the sensitive skin and nail beds of babies.

The Baby Nail Care Products Market refers to the commercial sector that includes the manufacturing, distribution, and sale of these specialized grooming products for infants. It encompasses both online and offline retail channels, with products ranging from basic grooming tools to more advanced offerings like electrical nail files designed for babies.

The market is driven by the growing awareness of infant care, an increase in disposable incomes, and a shift towards premium baby personal care products. As parents continue to prioritize the safety and well-being of their children, the demand for these products is expected to expand.

The Baby Nail Care Products Market has demonstrated consistent growth over the past few years, driven by rising disposable income, changing consumer preferences, and an increasing focus on baby health and safety. The demand for specialized products that are safe, gentle, and easy to use has created significant opportunities for growth in this sector.

Government investments in healthcare, especially in early childhood care, have further supported market expansion. For instance, governmental initiatives aimed at improving pediatric care, including the training of specialists in infant nail care, have contributed to a more informed and health-conscious consumer base.

Moreover, as more families, particularly in developed markets, are willing to spend on high-quality baby care products, opportunities for innovation and luxury product for kids offerings are on the rise.

According to Smart Cells, families in the UK, on average, spend around £6,000 during the first year of their baby’s life, which underscores the potential of the baby care market. This substantial spending capacity opens avenues for high-end brands to introduce advanced nail care solutions, including electric nail files and organic nail polishes.

Governments have also been playing a crucial role in regulating baby care products to ensure safety standards are met. Stringent regulations regarding product ingredients and manufacturing processes ensure that baby nail care products are safe for use. This has fostered consumer confidence in these products, further driving the market’s expansion.

Additionally, the increasing frequency of pediatric nailbed injuries being addressed by specialists, with 72.2% of pediatric nailbed injuries being treated by pediatric emergency doctors according to PubMed, signifies a growing awareness of the need for specialized care, further promoting the demand for safe and effective baby nail care products.

According to NCBI, in 2023, 70% of children aged 12 and under in the United States had used children’s makeup and body products (CMBPs), which include nail care items, indicating the significant role these products play in the daily care routine of children. Furthermore, the use of CMBPs was notably higher among female children (76%) compared to male children (63%) in 2023, reflecting gender-specific preferences and purchasing behavior.

Key Takeaways

- The global baby nail care products market is projected to reach USD 746.6 million by 2033, growing at a CAGR of 6.8% from 2024 to 2033.

- Nail clippers accounted for a 39.1% share of the product segment in 2023.

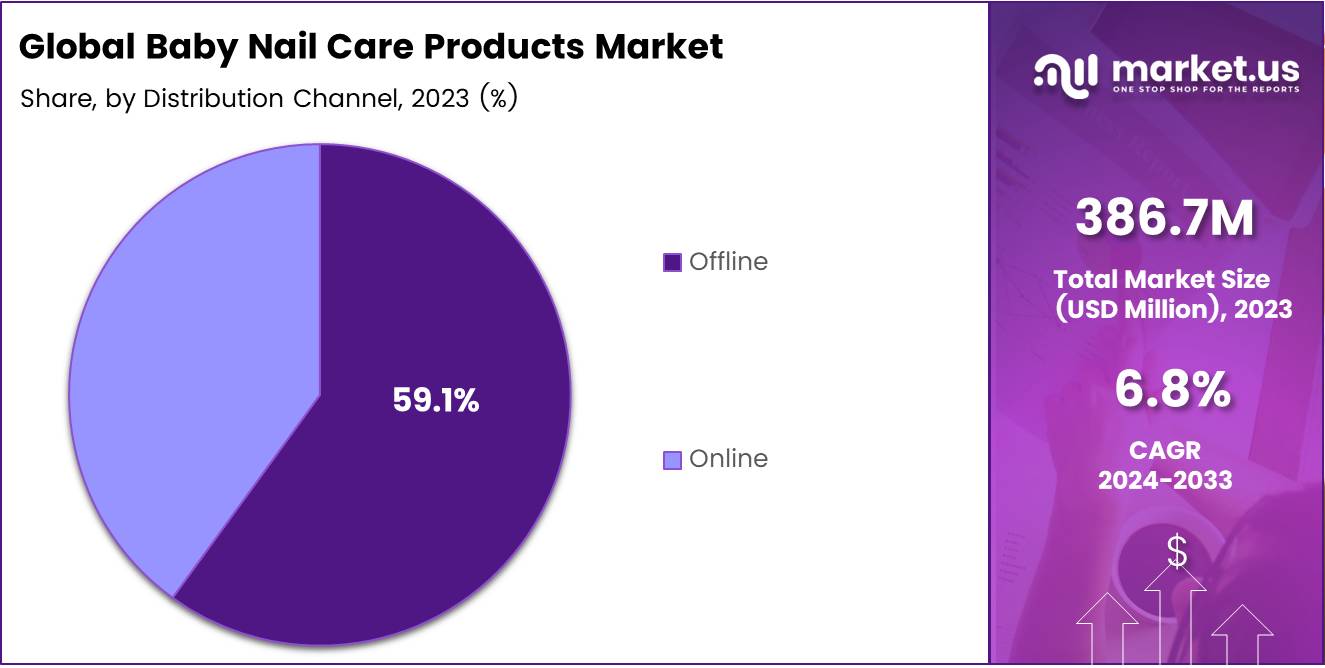

- Offline channels dominated the distribution segment with a 59.1% market share in 2023, driven by consumer preference for physical retail outlets.

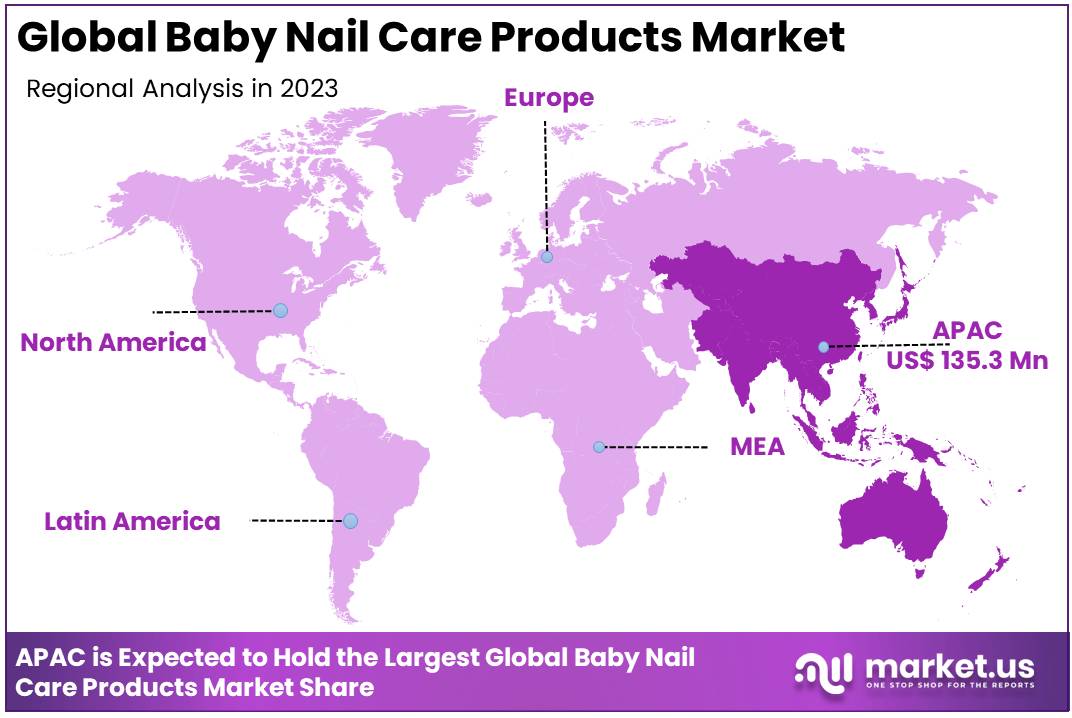

- Asia Pacific (APAC) is the leading regional market, holding 35.7% of the market share (USD 135.3 million) in 2023.

Product Analysis

Nail Clippers Lead the Baby Nail Care Products Market in 2023 with 39.1% Share

In 2023, Nail Clippers held a dominant market position in the By Product Analysis segment of the Baby Nail Care Products Market, with a 39.1% share.

This strong market presence can be attributed to their efficiency and ease of use, making them the preferred choice for parents when trimming their babies’ nails. Nail clippers offer a precise, safe, and quick solution for managing infant nails, contributing significantly to their widespread adoption.

Nail Trimmers followed as a close competitor, accounting for a substantial share of the market. These products are appreciated for their gentle and rounded edges, providing additional safety for parents concerned about accidental cuts.

While Nail Scissors maintain a steady market presence due to their fine control and precision, they are less favored compared to clippers and trimmers due to their slightly higher risk of causing injury.

Nail Files, while essential for smoothing rough edges, held a smaller share in the overall market as their primary function is more supplementary rather than a core product for nail trimming. Others in the category, including specialized grooming tools, have a niche market but remain a minor portion of the overall baby nail care products segment.

The trend in the market shows an increasing preference for safety, ease of use, and effectiveness, positioning nail clippers as the leading product choice for baby nail care.

Distribution Channel Analysis

Offline Channel Dominates Baby Nail Care Products Market with 59.1% Share in 2023

In 2023, Offline held a dominant market position in the Baby Nail Care Products Market, with a 59.1% share. This channel’s strong performance is driven by the physical presence of retail outlets, such as pharmacies, supermarkets, and baby care stores, where consumers prefer to purchase products after evaluating them firsthand.

Offline retail offers the advantage of immediate product availability, which appeals to consumers seeking convenience and assurance in their purchasing decisions.

On the other hand, the Online distribution channel accounted for the remaining market share. The growth of e-commerce platform has gradually increased its market presence, as consumers enjoy the convenience of shopping from home, accessing a broader product range, and leveraging customer reviews.

However, the online segment remains smaller compared to offline due to factors like the inability to physically inspect products and concerns about product authenticity. Both distribution channels are expected to evolve as consumer shopping behaviors continue to shift, with a gradual increase in the online share over time.

Key Market Segments

By Product

- Nail Clippers

- Nail Trimmers

- Nail Scissors

- Nail Files

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Birth Rates and Increased Parental Awareness Drive Growth in Baby Nail Care Products Market

The baby nail care products market is seeing significant growth due to several key factors. One of the primary drivers is the increasing birth rates in various regions, which naturally leads to a higher demand for baby care products, including specialized nail care items. As more parents look to ensure their children’s safety and comfort, baby nail care products have become a priority in daily grooming routines.

Another important driver is the growing parental awareness regarding hygiene and the importance of proper grooming. Parents today are more informed about the potential risks of improperly trimmed nails, such as accidental scratches, which has increased the need for safer, user-friendly nail care tools.

Furthermore, the influence of e-commerce is playing a pivotal role in driving market growth. The rise of online shopping platforms has made it easier for parents to access a wide variety of baby nail care products, often with the added convenience of home delivery.

These online platforms also offer detailed product reviews and recommendations, helping parents make informed purchasing decisions. Together, these factors—higher birth rates, increased awareness among parents, and the expansion of online shopping—are significantly contributing to the growing demand for baby nail care products.

Restraints

Lack of Awareness and Availability of Substitutes Limit Growth in Baby Nail Care Products Market

Despite the growth of the baby nail care products market, several challenges hinder its full potential. One major restraint is the lack of awareness, particularly in underdeveloped regions, where many parents may not recognize the importance of proper nail care for their babies.

In these areas, traditional methods of nail trimming, such as using regular scissors or biting nails, are still common, and specialized baby nail care products may be considered unnecessary. This limited awareness affects demand and restricts market expansion in these regions.

Additionally, the availability of substitutes poses another challenge. Many parents continue to use general grooming tools, such as regular nail clippers or files, instead of investing in specialized baby nail care products. These alternatives are often perceived as more cost-effective and readily available, leading to less inclination toward purchasing branded or specialized baby nail care items.

The competition from these traditional grooming methods, combined with lower awareness in certain markets, slows the adoption of more tailored solutions, limiting the market’s overall growth. Consequently, overcoming these barriers by improving awareness and educating consumers will be crucial to expanding the market for baby nail care products, particularly in regions with lower product penetration.

Growth Factors

Growth Opportunities in the Baby Nail Care Products Market Driven by Sustainability, Innovation, and Personalization

The baby nail care products market is experiencing significant growth driven by several key factors. One of the major opportunities lies in the increasing demand for organic and sustainable products. Parents are becoming more conscious of the ingredients used in baby products, seeking out chemical-free and eco-friendly options for their children’s safety.

Additionally, technological advancements present a promising area for growth. The development of smart nail trimmers, designed with precision and ease of use, caters to the growing need for convenience and safety.

Another opportunity stems from the rising trend of personalized baby care, where products tailored to individual needs such as customized nail care kits are gaining traction. This shift towards personalized offerings allows companies to tap into a more targeted consumer base.

Finally, innovative packaging solutions are enhancing product appeal. Child-safe and visually engaging packaging that ensures ease of use while maintaining safety standards is attracting more parents. These trends indicate a promising outlook for the baby nail care market as demand for safer, more efficient, and environmentally conscious products continues to rise.

Emerging Trends

Trending Factors in the Baby Nail Care Products Market Driven by Safety, Convenience, and Personalization

Several key trends are shaping the baby nail care products market, reflecting the evolving preferences of parents and caregivers. One notable trend is the rising popularity of electric nail clippers. These battery-operated tools offer convenience, speed, and precision, catering to the growing demand for efficient and safe baby grooming solutions.

Another significant trend is the heightened focus on safety, which has led to increased demand for rounded-edge and anti-slip tools. Parents are prioritizing products that reduce the risk of injury, ensuring a safer grooming experience for their babies.

Additionally, compact and travel-friendly designs are gaining traction, as consumers seek portable, easy-to-carry products for on-the-go use. These compact tools are designed for convenience without compromising on safety or functionality.

Furthermore, there is a noticeable shift towards gender-specific designs, with companies introducing products tailored to the preferences of both male and female consumers. This customization is resonating with parents who prefer products that reflect their baby’s gender, offering a more personalized touch to baby care.

As these trends continue to evolve, the baby nail care products market is poised for steady growth, driven by safety, convenience, and personalization.

Regional Analysis

Asia Pacific Leads Baby Nail Care Market with 35.7% Share Worth USD 135.3 Million

Asia Pacific (APAC) stands as the dominant region in the baby nail care products market, accounting for 35.7% of the market share, valued at approximately USD 135.3 million. This region is witnessing rapid growth due to the increasing population of infants and young children, coupled with growing awareness among parents regarding infant hygiene and health.

Countries such as China, India, and Japan contribute significantly to the market’s expansion, with higher disposable incomes, evolving lifestyles, and a rising demand for safe and natural baby care products. The increasing trend of organic and chemical-free baby care products further drives the market in this region.

Regional Mentions:

North America holds a significant share of the market, driven by the high adoption of premium baby care products in countries like the United States and Canada. The North American market benefits from advanced healthcare standards, increased awareness regarding child safety, and a strong preference for quality products.

Europe is also a strong market, with countries such as the United Kingdom, Germany, and France leading in the adoption of baby care products. The market in Europe is supported by stringent safety regulations and a high level of consumer awareness about baby health. The demand for organic and eco-friendly products continues to grow, contributing to market growth in the region.

Middle East & Africa (MEA) relatively smaller markets but are expected to grow steadily in the coming years. In MEA, rising urbanization, increased health consciousness, and a growing middle class are driving demand for baby care products.

Latin America, with its growing population and increasing economic development, presents emerging opportunities for market growth, albeit at a slower pace compared to other regions.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Baby Nail Care Products Market continues to be dominated by established players that offer a wide array of innovative and safety-conscious products.

Companies such as Mayborn Group Limited (Tommee Tippee) and Little Martin’s Drawer are well-positioned, leveraging their strong brand identities to attract parents seeking reliable, high-quality baby care solutions. These companies focus on consumer safety and ease of use, with products like baby nail clippers, emery boards, and electric nail trimmers, which have become increasingly popular due to their convenience and effectiveness.

Béaba, known for its ergonomic baby care products, remains a significant player in the market. The brand’s commitment to design and functionality has allowed it to cater to a premium segment, offering products that emphasize both safety and comfort. Meanwhile, Chicco and Pigeon, as longstanding leaders in the global baby care industry, continue to maintain a strong market presence with trusted, quality products.

Safety 1st and Fridababy, LLC are highly regarded for their focus on infant care essentials, offering a variety of safety-first products, including nail care tools that are gentle on delicate baby nails. The First Years and Philips Avent further complement this growing trend, expanding their portfolios to meet the increasing demand for products that promote ease and peace of mind for parents.

Finally, PIYO PIYO has positioned itself as a cost-effective alternative, providing accessible, high-quality nail care products to a wider audience. These key players, each with their unique strengths, contribute significantly to the market’s competitive landscape, highlighting the growing demand for baby nail care products that are both safe and easy to use.

Top Key Players in the Market

- Mayborn Group Limited (Tommee Tippee)

- Little Martin’s Drawer

- Béaba

- Chicco

- Pigeon

- Safety 1st

- Fridababy, LLC.

- The First Years

- Philips Avent

- PIYO PIYO

Recent Developments

- In October 2024, Millenium Babycares secured $14.5 million in a funding round led by Bharat Value Fund, with plans to use the capital to expand its operations and enhance product offerings across the baby care market.

- In November 2024, All Things Baby raised $3.6 million in funding, alongside announcing India deals worth $423 million, solidifying its position as a key player in the country’s rapidly growing baby care industry.

- In November 2024, All Things Baby successfully closed a Rs. 300 million Series A funding round, aimed at boosting its product innovation and accelerating market expansion in India’s competitive baby care sector.

- In August 2023, SuperBottoms secured $5 million in its Series A1 funding round, aiming to revolutionize the baby care industry with sustainable and innovative products designed for the modern parent.

Report Scope

Report Features Description Market Value (2023) USD 386.7 million Forecast Revenue (2033) USD 746.6 million CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Nail Clippers, Nail Trimmers, Nail Scissors, Nail Files, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mayborn Group Limited (Tommee Tippee), Little Martin’s Drawer, Béaba, Chicco, Pigeon, Safety 1st, Fridababy, LLC., The First Years, Philips Avent, PIYO PIYO Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Baby Nail Care Products MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Baby Nail Care Products MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Mayborn Group Limited (Tommee Tippee)

- Little Martin's Drawer

- Béaba

- Chicco

- Pigeon

- Safety 1st

- Fridababy, LLC.

- The First Years

- Philips Avent

- PIYO PIYO