Global Baby Powder Market By Product (Talc-based, Talc-free), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 26813

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

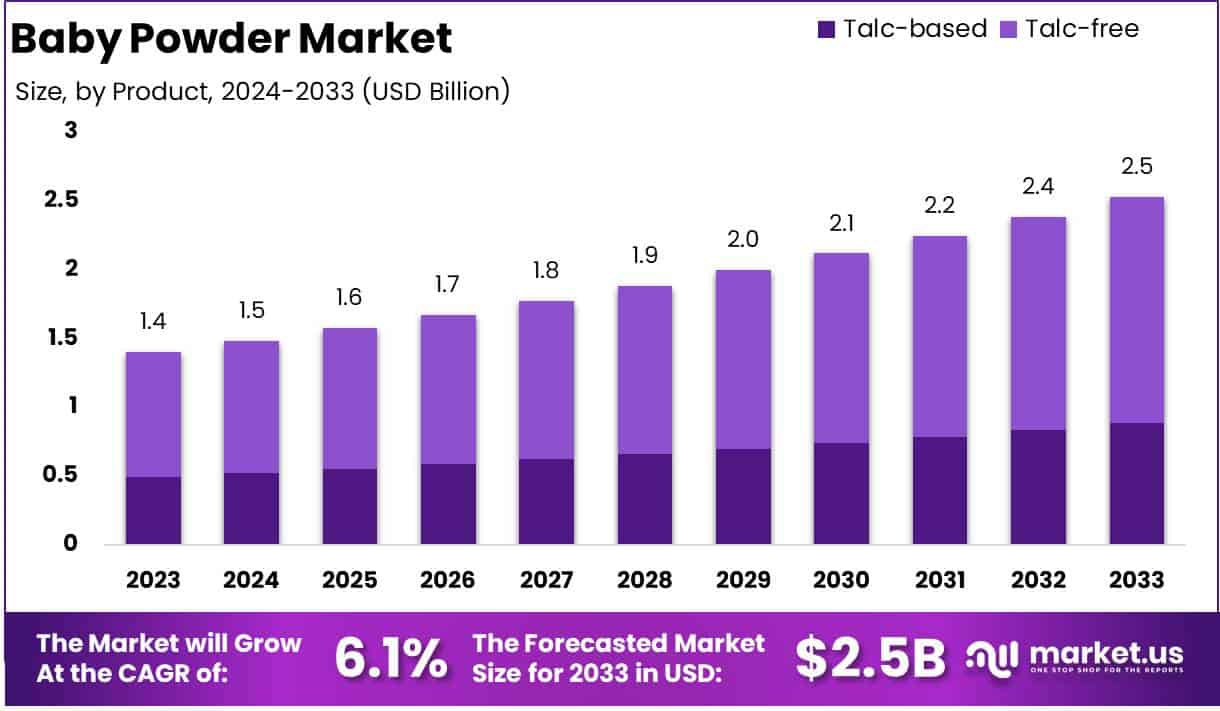

The Global Baby Powder Market size is expected to be worth around USD 2.5 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

Baby powder is a finely milled, often scented powder typically made from talcum or cornstarch. It is primarily used to absorb moisture and reduce friction, thereby helping to prevent rashes and skin irritation in infants.

In addition to its core use in baby care, it is sometimes employed in adult personal care routines and in other household applications. The product’s formulation is designed to be gentle and safe for sensitive skin, making it a staple in many households globally.

The baby powder market encompasses the production, distribution, and sale of baby powder products across various channels such as supermarkets, specialty stores, pharmacies, and e-commerce platforms. This market is a sub-segment of the broader baby care industry, which includes products like baby lotions, shampoos, and wipes.

The baby powder market is shaped by consumer preferences for quality, safety, and convenience, as well as regulatory standards regarding product ingredients and safety.

The growth of the baby powder market is driven by several key factors. Increasing birth rates in emerging economies, coupled with rising disposable incomes, have expanded the customer base for baby care products.

Additionally, heightened awareness about infant hygiene and skin care has spurred demand for premium, hypoallergenic, and organic baby powders. Innovations in product formulations, such as talc-free and cornstarch-based powders, also cater to safety-conscious consumers, boosting market growth.

Demand for baby powder remains steady, particularly in regions with high population growth and a strong cultural emphasis on infant care. However, evolving consumer preferences are reshaping the market.

There is a noticeable shift towards natural and organic products, driven by health concerns and regulatory scrutiny over traditional talc-based powders. In developed markets, demand is increasingly influenced by sustainability and environmental considerations, with consumers favoring brands that prioritize eco-friendly packaging and ethical sourcing.

The baby powder market presents significant opportunities for innovation and market expansion. Companies can capitalize on the growing demand for organic and talc-free products by investing in R&D to develop safer and more effective formulations.

Emerging markets, particularly in Asia-Pacific and Africa, offer untapped potential due to their rising middle class and increasing awareness of infant care. Furthermore, the growing popularity of e-commerce provides a lucrative channel for reaching a broader consumer base with tailored marketing strategies and subscription-based product offerings.

According to Vogue Business, Unilever Ventures’ investment of over £2 million in Luna Daily, bringing the brand’s total funding to £4.7 million, underscores the significant growth potential within the intimate care sector.

This strategic move reflects a broader industry trend towards expanding product portfolios to meet evolving consumer demands. In the baby powder market, companies are increasingly focusing on product innovation and safety to maintain competitiveness and address shifting consumer preferences.

According to CBS News, the Baby Powder Market is critically examined following Johnson & Johnson’s decision to settle allegations for $700 million nationwide. This settlement, addressing concerns over the safety of talcum-based products, marks a significant shift towards heightened transparency and safety standards in the industry.

Key Takeaways

- The global baby powder market is projected to grow from USD 1.4 billion in 2023 to approximately USD 2.5 billion by 2033, reflecting a CAGR of 6.1% over the forecast period from 2024 to 2033.

- Talc-free baby powder dominates with over 65% market share in 2023, driven by health-conscious consumer preferences.

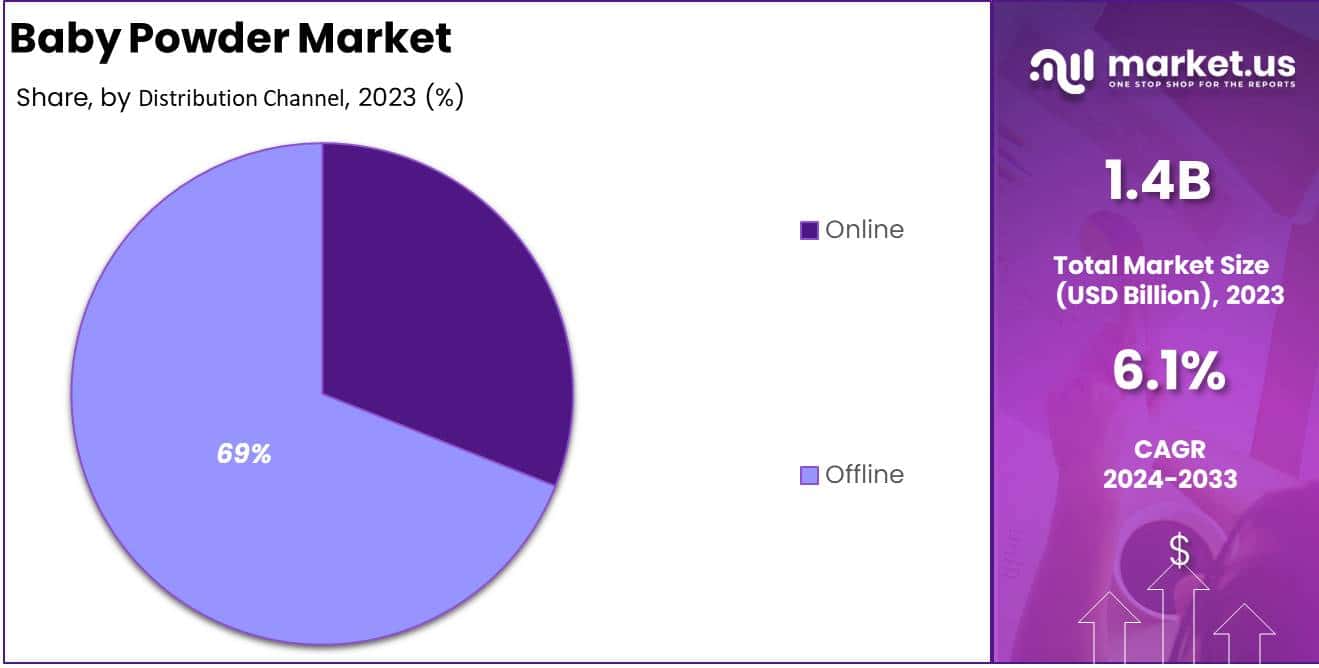

- Offline distribution channels hold over 69% market share, favored for accessibility and instant product availability.

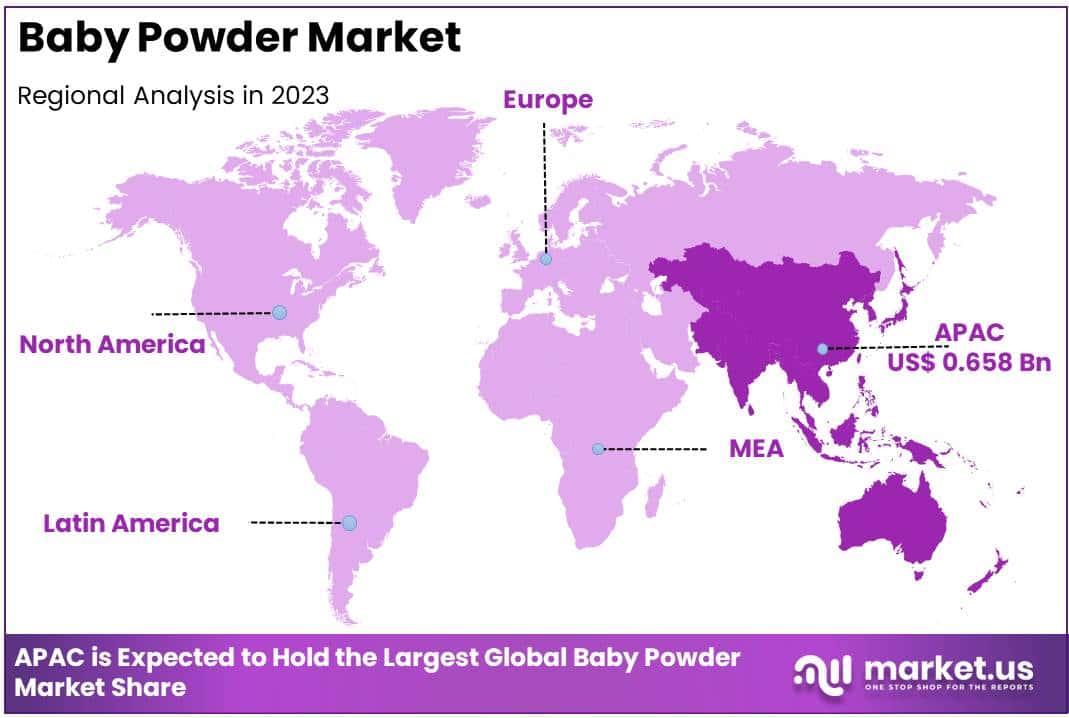

- Asia-Pacific leads with a 47% market share, driven by high birth rates and rising disposable incomes in populous countries.

By Product Analysis

Talc-Free Baby Powder The Dominating Segment with Over 65% Market Share

In 2023, Talc-free baby powder held a dominant position in the market by product type, capturing more than 65% of the total market share. This segment’s leadership is primarily driven by growing consumer awareness of potential health risks associated with talc-based products, alongside rising demand for natural and hypoallergenic alternatives.

Talc-free baby powders, often formulated with cornstarch and other organic ingredients, are perceived as safer for infant skin, aligning with a broader shift toward cleaner and more sustainable personal care products. Moreover, regulatory scrutiny and litigation risks around talc-containing products have further accelerated the adoption of talc-free formulations.

Despite its historical dominance, talc-based baby powder witnessed a decline in market share in 2023, now accounting for less than 35% of the market. Concerns over the potential links between talc and health risks, including respiratory issues and carcinogenicity, have significantly impacted consumer confidence.

However, talc-based products continue to find usage in certain markets where price sensitivity and product availability remain key factors. Manufacturers are now exploring ways to address these challenges through product innovation and enhanced safety assurances.

By Distribution Channel Analysis

Offline Distribution Channel The Dominating Segment with Over 69% Market Share

In 2023, the offline distribution channel held a dominant position in the baby powder market, capturing more than 69% of the total market share. Traditional brick-and-mortar retail outlets, including supermarkets, hypermarkets, and pharmacy chains, remain the primary purchasing avenue for consumers.

These channels offer the advantage of instant product availability, tactile evaluation, and personalized shopping experiences, which are highly valued by parents seeking baby care products.

Additionally, the widespread presence of offline stores in both urban and rural areas ensures easy accessibility, further solidifying their market dominance. Promotional activities such as in-store discounts and bundling offers also contribute to the sustained preference for offline purchasing.

The online distribution channel, while accounting for less than 31% of the market share in 2023, is experiencing rapid growth driven by increasing internet penetration and the convenience of home delivery.

E-commerce platforms provide consumers with a wide array of choices, competitive pricing, and the ease of reviewing product feedback, making them an attractive option, particularly for tech-savvy and time-constrained shoppers.

Key Market Segments

By Product

- Talc-based

- Talc-free

By Distribution Channel

- Online

- Offline

Driver

Rising Disposable Incomes and Urbanization

The global baby powder market is experiencing significant growth, primarily driven by increasing disposable incomes and rapid urbanization. As economies develop, particularly in emerging markets, households have greater financial resources, enabling parents to invest more in premium baby care products.

This financial empowerment allows for the purchase of higher-quality items, including baby powders that offer enhanced safety and efficacy.

Urbanization further amplifies this trend as families migrate to urban centers, they gain better access to diverse retail options and are exposed to a wider array of consumer goods. Urban living often correlates with heightened awareness of hygiene and health standards, prompting parents to prioritize products that ensure their infants’ well-being.

Consequently, the convergence of increased disposable income and urban lifestyles is propelling the demand for baby powder, as parents seek reliable solutions to maintain their babies’ skin health in bustling city environments.

Moreover, urbanization brings about lifestyle changes that influence purchasing behaviors. Urban parents, often balancing professional commitments, tend to favor convenient and effective baby care products. The availability of baby powders in various formulations and packaging caters to this need for convenience.

Additionally, urban areas typically offer better access to information and education, leading to informed consumer choices. Parents are more likely to be aware of the benefits of using baby powder to prevent diaper rash and maintain skin dryness, further driving market growth.

Restraint

Health Concerns Over Talc-Based Baby Powders

The baby powder market faces significant challenges due to growing health concerns associated with talc-based products. Studies have raised questions about the safety of talc, particularly its potential links to respiratory issues and other health problems. These concerns have led to increased scrutiny from regulatory bodies and a surge in consumer apprehension.

As a result, there has been a noticeable decline in the demand for talc-based baby powders, with consumers seeking safer alternatives.

This shift in consumer preference poses a substantial restraint on the market, compelling manufacturers to reassess their product formulations and marketing strategies. The need to address these health concerns is paramount, as failure to do so could result in further erosion of consumer trust and market share.

In response to these challenges, the industry is witnessing a transition towards talc-free formulations, utilizing ingredients such as cornstarch and other natural components. While this shift presents an opportunity for innovation, it also introduces complexities in terms of product development and regulatory compliance.

Manufacturers must invest in research and development to ensure that alternative formulations meet safety standards and consumer expectations. Additionally, clear and transparent communication regarding product ingredients and safety is essential to rebuild consumer confidence.

The ongoing health concerns related to talc-based baby powders underscore the importance of proactive measures by industry stakeholders to adapt to evolving consumer preferences and regulatory landscapes, thereby mitigating the restraining impact on the market.

Opportunity

Expansion into Emerging Markets with High Birth Rates

The global baby powder market is poised for substantial growth through strategic expansion into emerging markets characterized by high birth rates and increasing disposable incomes. Regions such as Asia-Pacific, Africa, and Latin America present lucrative opportunities for market players. In these areas, higher birth rates naturally lead to a larger consumer base for baby care products.

Coupled with economic development, there is a rising middle class with greater purchasing power, enabling families to invest more in quality baby care items, including baby powders. This demographic and economic landscape creates a fertile ground for market expansion, as companies can tap into the growing demand for infant hygiene products.

To capitalize on this opportunity, manufacturers should tailor their products to meet the specific needs and preferences of consumers in these regions. This includes considering cultural practices, local skin care requirements, and climate conditions that may influence product formulation and packaging.

Additionally, establishing robust distribution networks is crucial to ensure product availability and accessibility. Collaborating with local retailers and leveraging e-commerce platforms can enhance market penetration. Investing in targeted marketing campaigns that educate consumers about the benefits of baby powder and proper infant care practices can further drive adoption.

By aligning product offerings with the unique characteristics of emerging markets, companies can effectively harness the growth potential these regions offer, thereby strengthening their global market position.

Trends

Shift Towards Natural and Organic Baby Powder Formulations

The baby powder market is experiencing a significant trend towards natural and organic formulations, driven by increasing consumer awareness of health and environmental sustainability.

Parents are becoming more cautious about the ingredients in baby care products, seeking options that are free from synthetic chemicals and potential allergens. This shift is leading to a growing demand for baby powders made from natural ingredients such as cornstarch, arrowroot powder, and plant-based extracts.

These formulations are perceived as safer and gentler on infants’ delicate skin, aligning with the preferences of health-conscious consumers. The trend towards natural and organic products is not only influencing purchasing decisions but also encouraging manufacturers to innovate and reformulate their offerings to meet this evolving demand.

In response to this trend, companies are investing in research and development to create baby powders that are not only effective but also adhere to natural and organic standards. This includes obtaining certifications from recognized bodies to validate the authenticity of their products.

Additionally, transparent labeling and marketing that highlight the natural composition and benefits of these products are becoming essential to attract and retain consumers.

The emphasis on sustainability is also prompting manufacturers to adopt eco-friendly packaging solutions, further appealing to environmentally conscious buyers. Overall, the shift towards natural and organic baby powder formulations represents a transformative trend in the market, reflecting broader consumer movements towards health, safety, and environmental responsibility.

Regional Analysis

Asia-Pacific Leads Baby Powder Market with Largest 47% Market Share

The Baby Powder market showcases distinct dynamics across various global regions, with Asia-Pacific at the forefront, holding a dominant 47% share in 2023, which translates to significant revenue of USD 0.658 billion.

This dominance is driven by high product adoption rates in populous countries like China and India, supported by growing consumer awareness about child care products and increasing per capita spending on baby care essentials.

North America maintains a robust market presence, characterized by advanced consumer awareness and stringent regulatory standards that ensure product safety and quality. These factors, combined with a preference for premium, hypoallergenic, and organic baby powder formulations, drive the regional market.

In Europe, the market trends towards natural and organic products continue to influence consumer choices, with an increasing number of European parents seeking baby powders free from synthetic additives, reflecting the region’s strong focus on sustainability and health.

Latin America and the Middle East & Africa are witnessing growth due to economic improvements and enhanced distribution networks. Latin America benefits from the rising influence of Western lifestyle patterns among the middle class, whereas the Middle East & Africa sees growth spurred by increasing urbanization and the gradual expansion of retail sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global baby powder market is characterized by a diverse array of key players, each contributing uniquely to the industry’s landscape.

Adidas AG, traditionally recognized for its athletic apparel, has diversified into personal care products, including baby powder. Leveraging its strong brand equity, Adidas aims to capture health-conscious consumers seeking trusted brands for their infants.

Baby Forest and GLUKi Organics represent the niche segment of organic baby care. These companies cater to a growing demographic of parents prioritizing natural and chemical-free products, aligning with the increasing demand for organic baby powders.

California Baby and Himalaya Wellness focus on herbal and plant-based formulations. Their emphasis on natural ingredients appeals to consumers concerned about synthetic additives, positioning them favorably in markets valuing traditional and holistic care.

Church & Dwight, through its Arm & Hammer brand, and Clorox, with its Burt’s Bees Baby line, have expanded their portfolios to include baby powders. These companies utilize their extensive distribution networks and brand recognition to penetrate the baby care segment effectively.

Cooney Medical and Pigeon specialize in medical-grade and hypoallergenic baby powders. Their products are tailored for infants with sensitive skin, addressing a critical need among parents seeking specialized care solutions.

Johnson & Johnson, a longstanding leader in the baby powder market, continues to innovate amidst challenges. The company is focusing on reformulating products and enhancing transparency to regain consumer trust and maintain its market position.

Kimberly-Clark, known for its Huggies brand, and Procter & Gamble, with its Pampers line, have integrated baby powders into their comprehensive baby care offerings. Their extensive market reach and brand loyalty provide a competitive advantage in this segment.

Prestige Consumer Healthcare offers baby powders under various brands, targeting value-conscious consumers. Their strategy focuses on affordability without compromising quality, appealing to a broad customer base

Top Key Players in the Market

- Baby Forest

- California Baby

- Church & Dwight

- Clorox

- Cooney Medical

- GLUKi Organics

- Himalaya Wellness

- Johnson & Johnson

- Kimberly-Clark

- Pigeon

- Prestige Consumer Healthcare

- Procter & Gamble

Recent Developments

- In 2024, Johnson & Johnson announced that its subsidiary, Red River Talc LLC, filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Southern District of Texas. The filing seeks to resolve all current and future ovarian cancer claims related to talc litigation in the U.S.

- In 2024, Unilever Ventures invested in Luna Daily, an intimate body care brand. The funding, exceeding £2 million, brings the brand’s total raised to £4.7 million, highlighting growth potential in the intimate care sector.

- In 2024, Reckitt Benckiser Group Plc outlined plans to streamline its operations and refine its brand portfolio. The initiative aims to strengthen its position in consumer health and hygiene and deliver long-term shareholder value.

- In 2024, FirstCry, a leading Indian baby products retailer, attracted $3.4 billion in bids for its $501 million IPO. The strong response reflects growing investor interest in India’s expanding child care market.

Report Scope

Report Features Description Market Value (2023) US$ 1.4 Bn Forecast Revenue (2033) US$ 2.5 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Talc-based, Talc-free), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Baby Forest, California Baby, Church & Dwight, Clorox, Cooney Medical, GLUKi Organics, Himalaya Wellness, Johnson & Johnson, Kimberly-Clark, Pigeon, Prestige Consumer Healthcare, Procter & Gamble Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Johnson & Johnson

- Prestige Consumer Healthcare

- Pigeon Corp.

- Burt's Bees

- Тhе Ніmаlауа Drug Соmраnу

- Моthеrсаrе

- Кіmbеrlу-Сlаrk Соrр

- Рrосtеr & Gаmblе Со. (Р&G)

- Other Key Players