Global Baby Stroller Market By Type (Lightweight Strollers, Jogging Strollers, Travel System Strollers, Double Strollers), By Age (0-6 Months, 6-12 Months, 12-36 Months), By Distribution Channel (Online Stores, Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 22899

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

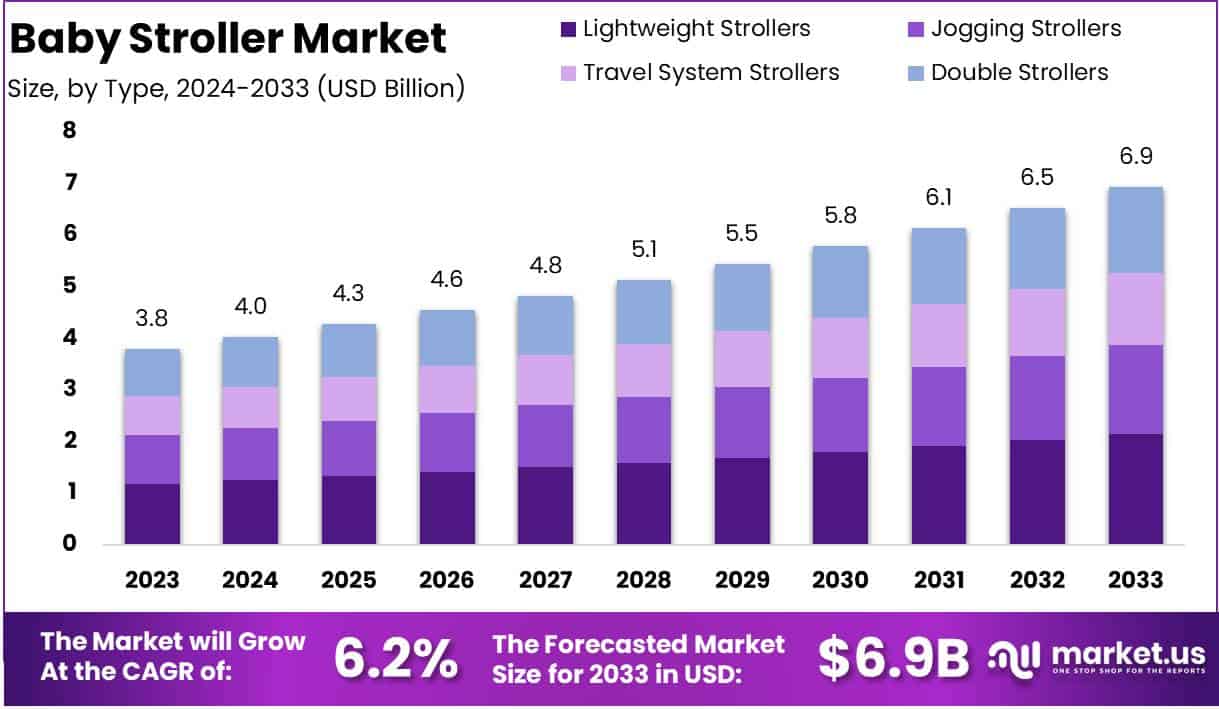

The Global Baby Stroller Market size is expected to be worth around USD 6.9 Billion by 2033, from USD 3.8 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

A baby stroller, also known as a pram or pushchair, is a wheeled device specifically designed for transporting infants and young children. Constructed for safety, comfort, and ease of use, strollers typically include a seating area, protective harnesses, and a hood for sun protection.

They may also come equipped with features such as adjustable handlebars, storage compartments, reclining seats, and shock-absorbent wheels to enhance convenience for parents and caregivers.

Strollers serve as essential mobility tools, allowing families to transport children safely while engaging in various outdoor activities, from casual walks to travel.

The baby stroller market encompasses the industry and activities related to the production, distribution, and sale of strollers and related accessories. This market includes various types of strollers, such as lightweight, jogging, double, and travel systems, catering to diverse consumer needs and lifestyle preferences.

Key players in the market range from established brands to emerging startups, all competing to provide innovative and reliable products that meet evolving safety standards and consumer expectations. The baby stroller market is driven by factors like rising urbanization, increased disposable income, and a growing awareness of child safety among young parents globally.

Key players in the market range from established brands to emerging startups, all competing to provide innovative and reliable products that meet evolving safety standards and consumer expectations. The baby stroller market is driven by factors like rising urbanization, increased disposable income, and a growing awareness of child safety among young parents globally.The growth of the baby stroller market is fueled by several factors, including changing consumer lifestyles, particularly among urban populations, where strollers are viewed as essential baby-care products. A rise in dual-income households and increasing disposable income among millennial parents have also significantly bolstered spending on high-quality baby products.

Moreover, safety awareness has led to stringent regulatory standards, pushing manufacturers to innovate with features like all-terrain wheels, eco-friendly materials, and enhanced suspension systems. Additionally, the expanding e-commerce sector has made strollers more accessible, offering consumers an extensive selection and greater convenience.

The demand for baby strollers is witnessing a steady increase as modern parents prioritize convenience, mobility, and child safety. Demand is especially high for multi-functional and durable strollers that can adapt to various terrains and serve different age groups.

In addition, there is a growing trend towards eco-conscious and ergonomically designed strollers as parents become more environmentally aware and selective about product choices for their children.

Demand fluctuations are also influenced by birth rates, cultural attitudes towards child-rearing, and income levels, with higher demand expected in urbanized and economically stable regions.

Significant opportunities exist within the baby stroller market, driven largely by innovation and evolving consumer preferences. Companies that can capitalize on smart technology integrations, such as app-controlled functionalities, GPS tracking, and customizable designs, are likely to see growth.

There is also potential in expanding sustainable product lines, catering to an eco-conscious segment willing to pay a premium for recyclable or non-toxic materials.

Emerging markets in Asia-Pacific and Latin America present untapped potential, where rising middle-class populations and increased focus on child safety standards could drive adoption. Lastly, expanding direct-to-consumer (DTC) sales channels via online platforms offers another promising avenue for manufacturers to increase reach and customer engagement.

According to NDTV, the baby stroller market is undergoing a notable transformation, with 57% of strollers sold this year catering to pets. This shift reflects broader demographic changes as Korea’s fertility rate reached a historic low of 0.72 in 2023, down from 0.78 in 2022, and projected to decline to 0.68 by 2024.

Only 43% of strollers sold in the first three quarters were designed for human infants, underscoring the implications of declining birth rates on consumer purchasing behavior and signaling emerging opportunities for pet-centric products in traditionally child-focused markets.

According to Bain Capital, Mubadala Capital’s acquisition of a majority stake in Bugaboo Group underscores a significant shift in the Baby Stroller Market. This move not only solidifies Bugaboo’s position but also retains Bain Capital’s influence with a minority stake, highlighting strategic investments in premium children’s consumer goods. The finalization of this transaction awaits approval from regulatory bodies and the works council.

Key Takeaways

- The Global Baby Stroller Market is projected to grow from USD 3.8 billion in 2023 to USD 6.9 billion by 2033, achieving a CAGR of 6.2% over the forecast period.

- Lightweight strollers are the leading segment in the Baby Stroller Market, holding a 31% market share due to their portability and convenience.

- Jogging strollers hold a 20% market share, favored by active parents for their robust build and terrain adaptability.

- Travel system strollers capture 25% of the market, preferred for their all-in-one convenience and versatility.

- Double strollers have a 15% market share, essential for families with multiple young children due to their practical design options.

- North America leads the Baby Stroller Market with a 35% share, driven by high disposable income and a strong preference for premium, multifunctional strollers.

By Type Analysis

Lightweight Strollers: Dominating Segment in Baby Stroller Market with 31% Share

In 2023, lightweight strollers held a dominant market position in the baby stroller market, capturing over 31% of the overall share. Known for their ease of use, portability, and compact design, lightweight strollers have become the preferred choice for urban families and on-the-go parents. These strollers cater to the needs of modern lifestyles, where convenience and mobility are paramount.

Their lightweight frames and foldable structures make them ideal for daily use, especially in crowded city environments where space constraints are common. The increasing demand for easy-to-maneuver and travel-friendly strollers among young parents has significantly bolstered the growth of this segment, positioning it as the market leader.

In 2023, jogging strollers secured approximately 20% of the baby stroller market share, catering specifically to health-conscious and active parents. Designed for durability and performance, jogging strollers feature larger wheels, enhanced suspension, and a sturdy frame to withstand various terrains, making them suitable for outdoor activities like jogging and walking on trails.

The increasing emphasis on health and fitness among parents is driving demand for strollers that support active lifestyles, allowing parents to incorporate their children into their routines without compromising safety or stability.

With a 25% market share in 2023, travel system strollers are increasingly sought after for their versatility and convenience, appealing to parents who prioritize all-in-one solutions. Travel system strollers integrate a car seat and stroller frame into a single unit, allowing seamless transitions from car to stroller without disturbing the child.

This multifunctional feature makes travel systems highly attractive, particularly for parents of newborns and infants. As the popularity of travel and mobility rises, travel system strollers offer a comprehensive solution that meets both safety standards and practical needs, making them a popular choice in both developed and emerging markets.

The growth of this segment is further driven by the convenience factor and the long-term value offered by travel system strollers.

Parents find them practical for frequent trips and outings, as they eliminate the need to purchase separate components. With the increasing prevalence of family travel and a shift towards higher-quality, multipurpose baby products, the travel system stroller segment is poised for continued expansion, maintaining its significant share in the baby stroller market.

In 2023, double strollers captured around 15% of the baby stroller market, driven by the growing need for strollers that can accommodate multiple children. Double strollers are popular among families with twins or siblings close in age, providing a practical solution for managing two children simultaneously.

These strollers come in various configurations, including side-by-side and tandem designs, which allow parents to choose based on their specific needs and preferences. As family dynamics evolve and the trend of having children close in age increases, double strollers have become essential for many households, particularly in regions with higher birth rates.

By Age Analysis

12-36 Months: Dominating Age Segment in Baby Stroller Market with 45% Share

In 2023, the 12-36 months age group held a dominant position in the baby stroller market by age category, capturing more than a 45% share of the overall market. This segment has gained prominence as toddlers in this age range require strollers that support their increased mobility, curiosity, and need for exploration.

Parents prefer durable, versatile strollers for this age group, as children in the 12-36 month range often need both stability and safety for longer outdoor activities and travel. This demand for strollers with enhanced durability and adaptability has contributed significantly to the leading market share of the 12-36 month age group.

Furthermore, strollers designed for the 12-36 month age group typically include features such as reclining seats, footrests, and spacious compartments, making them highly suitable for extended outings.

The global increase in family-oriented outdoor activities and travel has also bolstered demand for strollers that provide both comfort and functionality for toddlers. With rising consumer awareness around child safety and the need for long-lasting products, the 12-36 month age group is expected to maintain its stronghold as the leading age segment in the baby stroller market.

In 2023, the 6-12 months age category represented approximately 30% of the baby stroller market share. This segment is marked by increasing demand as infants grow out of their newborn phase and require strollers that offer additional support and protection.

Strollers designed for this age range often feature adjustable reclining seats and improved harness systems to support the baby’s developing posture and provide a safe and comfortable environment during outings.

Parents of infants in this stage prioritize strollers that combine compactness with stability, making them suitable for both everyday errands and short excursions. The growth of this segment is supported by the increasing awareness among parents regarding ergonomics and safety standards that align with the developmental needs of infants.

In 2023, the 0-6 months age group accounted for about 25% of the baby stroller market, catering to the specific needs of newborns and very young infants. Strollers for this age range prioritize features such as full recline capabilities, padded interiors, and adjustable canopies to protect newborns who require additional head and neck support.

Parents with infants in the 0-6 month stage often look for strollers that offer a secure, cocoon-like environment, ensuring comfort and safety for the youngest riders. These strollers are typically designed with enhanced suspension to ensure a smooth ride, accommodating the delicate needs of newborns.

By Distribution Channel Analysis

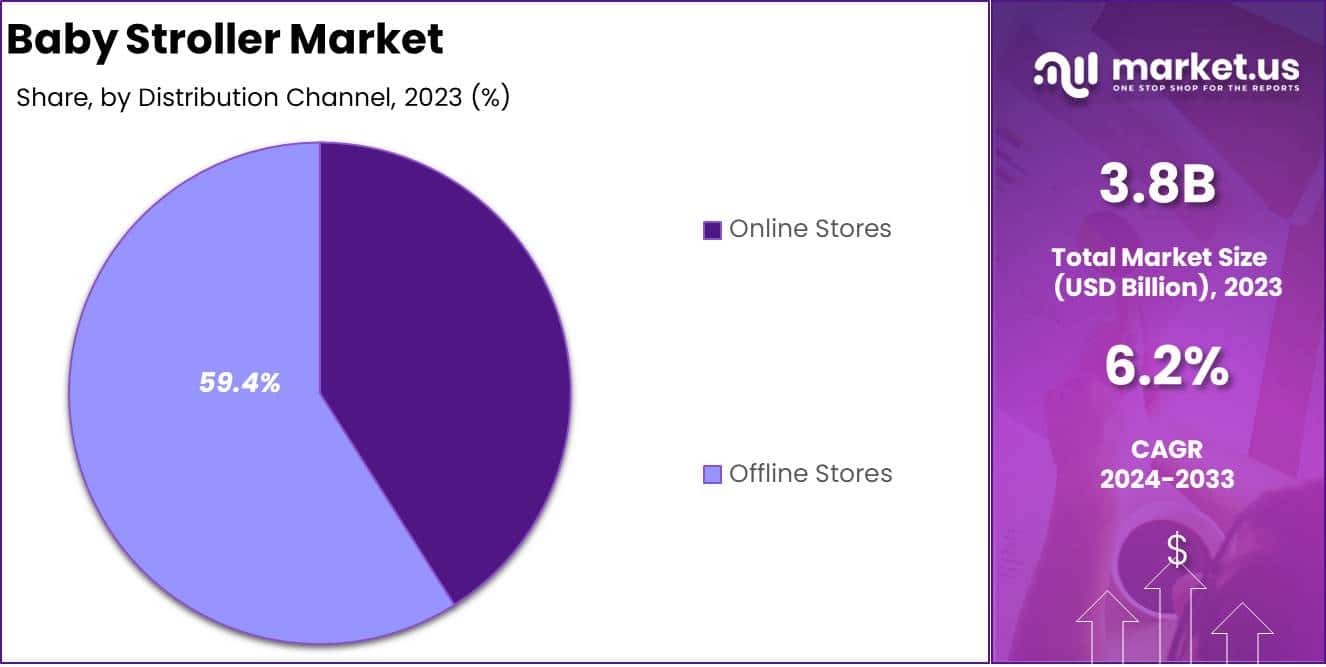

Offline Stores Dominating Distribution Channel in Baby Stroller Market with 59.4% Share

In 2023, offline stores held a dominant market position in the baby stroller market by distribution channel, capturing over 59.4% of the market share. Brick-and-mortar retail outlets remain the preferred purchasing channel for baby strollers, as they allow parents to physically inspect and test stroller features, ensuring they meet their safety, comfort, and durability standards.

Offline stores provide a tactile shopping experience, enabling customers to make confident, informed decisions an important factor when purchasing high-investment items like baby strollers.

Additionally, dedicated baby product stores, department stores, and specialty retailers often employ knowledgeable sales associates who can guide parents through various stroller options and specifications, further supporting offline stores’ strong market position.

Moreover, the trust associated with in-store purchases, along with immediate availability and after-sales support, reinforces offline retail’s appeal among consumers. Parents seeking assurance about their stroller purchase often value the opportunity to compare products in person and consult with staff on features such as safety harnesses, wheel suspension, and folding mechanisms.

While e-commerce channels continue to grow, the offline segment’s emphasis on personalized service and product trial is expected to sustain its significant share in the baby stroller market in the coming years.

In 2023, online stores represented approximately 40.6% of the baby stroller market, reflecting a robust growth trend as digital shopping becomes increasingly popular among parents. The convenience, product variety, and competitive pricing offered by online retailers make them an attractive channel for baby stroller purchases.

Many parents are drawn to the ease of comparing multiple brands and models across e-commerce platforms, often supplemented by customer reviews that provide insights into real-world usage. Online stores also enable easy access to promotions and discounts, making high-quality strollers more affordable for a broader range of consumers.

The expansion of e-commerce, combined with advancements in logistics and delivery services, has further accelerated online sales. Enhanced return policies, customer service support, and detailed product descriptions also build confidence for parents shopping for strollers online.

As digital adoption continues to rise globally, online channels are poised for continued growth, likely capturing an increasing share of the baby stroller market while complementing offline retail’s dominant presence.

Key Market Segments

By Type

- Lightweight Strollers

- Jogging Strollers

- Travel System Strollers

- Double Strollers

By Age

- 0-6 Months

- 6-12 Months

- 12-36 Months

By Distribution Channel

- Online Stores

- Offline Stores

Driver

Rising Disposable Income and Urbanization Fuel Market Expansion

The surge in disposable income, especially in developing economies, has emerged as a major driver for the baby stroller market. As dual-income households become more prevalent, particularly in urban centers, families are increasingly willing to invest in high-quality, multifunctional baby strollers that enhance safety, comfort, and convenience.

Urbanization plays a pivotal role here, as families living in bustling metropolitan areas seek strollers to help navigate city life with ease, whether commuting to work, visiting parks, or running errands.

As urban populations grow, so does the demand for practical mobility solutions like strollers that are durable, adaptable, and capable of withstanding various terrains and climates. This trend is evident in densely populated regions across Asia-Pacific and Latin America, where rising middle-class affluence is contributing to higher discretionary spending on premium baby care products.

Additionally, as awareness of child safety standards rises, particularly among new millennial parents, there is a stronger inclination towards strollers that adhere to the highest safety and quality standards.

Manufacturers are capitalizing on this trend by developing strollers with advanced safety features such as five-point harnesses, adjustable canopies, and impact-resistant frames. With these features, parents feel more confident investing in a stroller that not only meets their needs but also ensures the safety and well-being of their child.

This alignment of rising disposable income, urbanization, and an increased focus on child safety is significantly accelerating the adoption of baby strollers worldwide, making these factors some of the most influential drivers in the current market landscape.

Restraint

High Product Cost and Maintenance Impede Growth in Price-Sensitive Markets

Despite the rising demand for baby strollers, the market faces notable restraints, particularly related to high product costs and ongoing maintenance expenses. Quality strollers often come with a premium price tag, reflecting the costs associated with advanced safety features, durable materials, and ergonomic designs.

This elevated pricing can be prohibitive, especially in price-sensitive markets or among lower-income households, where strollers may be considered a luxury rather than a necessity. In regions with slower economic growth or limited disposable income, this cost factor can significantly dampen demand.

Additionally, high-quality strollers require regular maintenance to ensure safety and performance, adding another layer of cost that may deter potential buyers. Families in such markets may seek alternative solutions, such as borrowing or purchasing used strollers, which further impacts new product sales.

Moreover, the limited resale value of strollers often complicates purchase decisions, as parents recognize that a stroller’s utility may decrease significantly after a few years of use. In certain demographics, parents may prefer alternatives, like baby carriers, that are more affordable, portable, and easier to maintain.

Manufacturers are responding by introducing lower-cost, streamlined models to appeal to this segment, yet challenges remain in balancing affordability with quality and safety standards. For the baby stroller market to fully tap into all income demographics, finding cost-effective production methods without compromising on essential features will be crucial to overcoming these economic restraints.

Opportunity

Sustainability and Eco-Friendly Innovations to Capture Market Attention

Sustainability is becoming a defining factor in consumer choice, and the baby stroller market is no exception. The opportunity to develop eco-friendly strollers is rapidly gaining traction, with parents increasingly prioritizing products that align with their environmental values.

Sustainable strollers made from recyclable materials, organic fabrics, and low-impact manufacturing processes are resonating strongly with eco-conscious consumers.

Brands that can communicate a commitment to sustainability and offer strollers designed with minimal environmental impact stand to gain a competitive edge.

The demand for eco-friendly strollers is particularly strong in North America and Europe, where awareness of sustainable consumer goods is high, yet this trend is also emerging in regions like Asia-Pacific, as eco-consciousness grows globally.

Beyond materials, some manufacturers are innovating with modular designs, allowing strollers to adapt as a child grows, reducing the need for multiple products over time. These adaptable designs not only contribute to a reduction in consumer waste but also appeal to parents seeking long-term, value-driven purchases.

As environmental regulations continue to evolve, especially in developed markets, incorporating sustainability into product design could also become a compliance necessity, positioning early adopters advantageously.

Thus, integrating eco-friendly practices into stroller production represents a valuable opportunity, offering a pathway to differentiate in a competitive market while appealing to a growing segment of environmentally aware consumers.

Trends

Digital Integration and Smart Features Enhance Product Appeal

Digital integration is a rapidly emerging trend in the baby stroller market, as manufacturers explore ways to incorporate smart features that enhance convenience, safety, and user experience. Increasingly, strollers are being equipped with technological innovations such as GPS tracking, temperature sensors, and even smartphone connectivity.

These advancements allow parents to monitor their stroller’s location, track weather conditions, or control features remotely, adding a new layer of convenience and peace of mind. This integration of digital tools is particularly appealing to tech-savvy parents, many of whom are willing to pay a premium for products that align with their digitally integrated lifestyles.

The rise of IoT (Internet of Things) has further propelled this trend, as consumers become accustomed to interconnected devices that offer real-time data and app-controlled functionalities. For instance, a stroller with a connected app might alert a parent if their child has been stationary for an extended period or if the temperature inside the stroller canopy is too high.

These capabilities not only enhance child safety but also align with the broader shift towards personalized, data-driven parenting tools. As digital integration continues to evolve, the market is poised to see even more innovative applications in strollers, making this trend a compelling value-add for the modern consumer and a key driver of market differentiation.

Regional Analysis

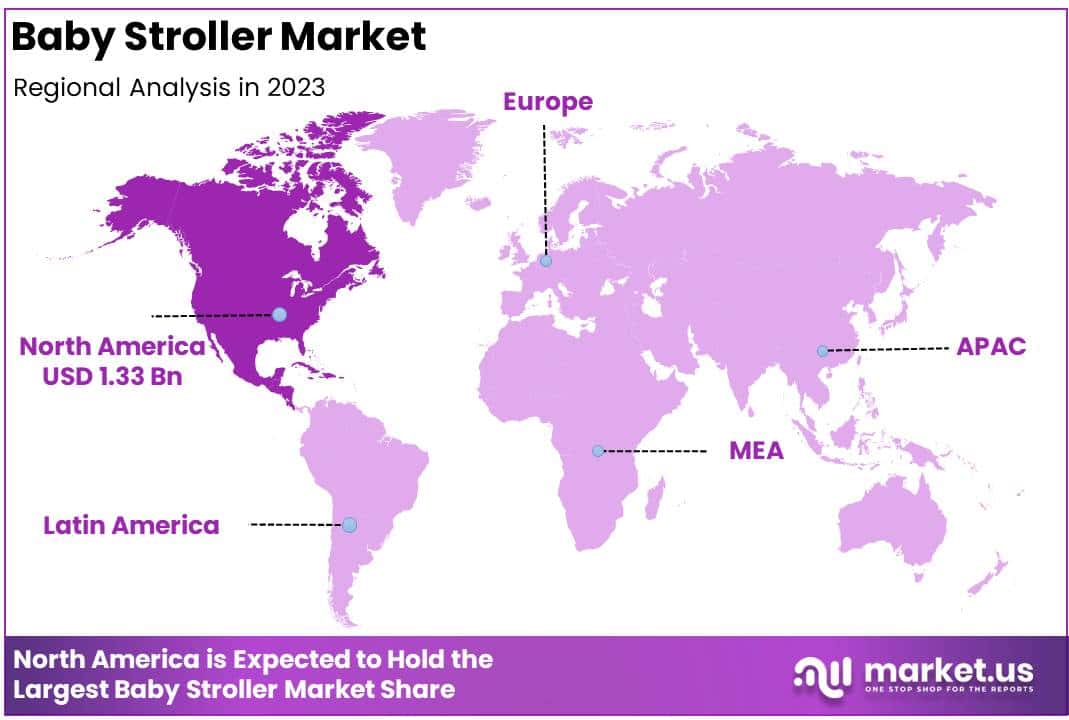

North America Lead Region in Baby Stroller Market with Largest Market Share at 35%

In 2023, North America led the baby stroller market, capturing the largest market share of 35%, valued at approximately USD 1.33 billion. This dominant position is primarily driven by high disposable incomes, an increasing preference for premium baby products, and a strong focus on child safety standards across the United States and Canada.

North American consumers are inclined toward multifunctional, high-quality strollers, supporting demand for advanced features such as adjustable seating, robust safety mechanisms, and eco-friendly materials.

The popularity of active, outdoor lifestyles further boosts demand for specialized stroller types, including jogging and travel system strollers, which align with parents’ mobility needs.

In addition, a well-established retail infrastructure, both online and offline, ensures easy access to a wide range of stroller options, maintaining North America’s lead in the global market.

Europe represents a mature segment of the baby stroller market, reflecting steady demand as parents prioritize sustainable, high-quality products. The region is characterized by a preference for durable and eco-friendly strollers that comply with strict regulatory standards for child safety and environmental impact.

Countries such as Germany, France, and the United Kingdom have shown consistent demand, supported by strong economies and high consumer awareness around product safety.

Furthermore, Europe has a growing market for premium strollers and customizable models, appealing to a segment that values quality over cost, which positions Europe as a significant contributor to the global market.

Asia Pacific is an emerging region in the baby stroller market, driven by rapidly increasing urbanization, rising middle-class incomes, and a growing population in countries like China, India, and Japan.

The expanding middle-class demographic has spurred a demand for affordable yet high-quality strollers that provide both functionality and safety. As birth rates remain high in many parts of the region, demand is projected to surge, especially as disposable incomes increase.

The rise of e-commerce is further fueling market growth, providing wider access to various stroller brands and models for families across diverse income levels. This promising growth trajectory positions Asia Pacific as a key region for future expansion in the baby stroller market.

The Middle East & Africa region holds a developing market position in the baby stroller industry, with steady growth driven by increasing awareness of child safety and the adoption of baby products in urban centers.

While disposable income levels and birth rates vary widely across the region, markets such as the United Arab Emirates and South Africa demonstrate a growing interest in high-quality strollers that meet international safety standards.

The market in this region is primarily fueled by young, urban families who seek practical, durable strollers to support a modern lifestyle. With a growing population and urbanization trends, the Middle East & Africa region is expected to become a gradually increasing contributor to the global market.

Latin America currently represents a niche segment within the baby stroller market but holds potential for expansion due to increasing urbanization and a rising middle class in countries like Brazil, Mexico, and Argentina.

Though constrained by varying income levels and economic challenges, Latin American consumers are increasingly inclined toward strollers that offer a balance of quality and affordability.

The region has a growing young population, which may further stimulate demand for baby strollers as awareness of child safety and quality standards improves. As e-commerce continues to expand across Latin America, access to a broader range of baby stroller brands is expected to rise, fostering gradual growth in the region’s market share.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the competitive landscape of the global baby stroller market is shaped by both established and emerging players striving to capture a larger market share through innovation, product diversification, and strategic positioning.

Leading brands like Graco Inc., Chicco, and Britax are recognized for their strong market presence and reputation for quality, safety, and durability.

These companies leverage advanced safety features, ergonomic designs, and robust distribution networks to appeal to safety-conscious parents globally. Baby Jogger, LLC and Bugaboo are highly favored in the premium stroller segment, focusing on unique, high-performance strollers that cater to urban and lifestyle-centric consumers.

Both brands are known for sleek designs and high-end materials that resonate with parents who seek style and quality.

CYBEX GmbH and Joie are notable for their consistent innovation, often incorporating eco-friendly materials and advanced safety technologies into their product lines. These players cater to eco-conscious consumers and increasingly align their strategies with sustainable manufacturing practices.

Evenflo and UPPAbaby are key players that compete on versatility and affordability, targeting middle-income households with practical, multi-functional strollers that offer high value without compromising quality. Mamas & Papas and Perego focus on design aesthetics and premium appeal, often drawing on European styling to attract fashion-forward parents.

Collectively, these key players, along with other emerging companies, are shaping the baby stroller market’s trajectory. Through continuous R&D investments, strategic partnerships, and expansions into new markets, these brands aim to enhance their competitive positioning, addressing diverse consumer needs and adapting to trends in safety, functionality, and sustainability.

Top Key Players in the Market

- Graco Inc.

- Chicco

- Britax

- Baby Jogger, LLC

- Bugaboo

- CYBEX GmbH

- Joie

- Evenflo

- UPPAbaby

- Mamas & Papas

- Perego

- Other Key Players

Recent Developments

- In 2024, Mubadala Capital, a subsidiary of Mubadala Investment Company, announced its acquisition of a majority stake in Bugaboo Group, a leader in the global market for strollers and premium children’s consumer products. The agreement allows Bain Capital to retain a minority stake. Completion of the deal is pending consultations with the works council and customary regulatory approvals.

- In 2024, Artsana USA introduced a new line of eco-friendly strollers made from recycled materials. This move is in response to increasing consumer demand for sustainable products and reinforces Artsana’s commitment to environmental sustainability through the adoption of relevant certification schemes.

- In 2023, Chicco continued its commitment to sustainability by developing eco-friendly strollers made from sustainable materials, catering to the demands of eco-conscious parents.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Bn Forecast Revenue (2033) USD 6.9 Bn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Lightweight Strollers, Jogging Strollers, Travel System Strollers, Double Strollers), By Age (0-6 Months, 6-12 Months, 12-36 Months), By Distribution Channel (Online Stores, Offline Stores Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Graco Inc., Chicco, Britax, Baby Jogger, LLC, Bugaboo, CYBEX GmbH, Joie, Evenflo, UPPAbaby, Mamas & Papas, Perego, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Graco Inc.

- Chicco

- Britax

- Baby Jogger, LLC

- Bugaboo

- CYBEX GmbH

- Joie

- Evenflo

- UPPAbaby

- Mamas & Papas

- Perego

- Other Key Players