Global Baby Car Seat Market By Type ( Infant, Convertibles, Booster, Combination, All In One Seat), By Installation Type (Rear-Facing Car Seats, Forward-Facing Car Seats), By Functionality (1-Stage, 2-Stage, 3-Stage), By Material (Plastic, Steel, Foam, Others (Rubber, Nylon, etc.)), By Age Group (Below 3 Months, 4 to 7 Months, 8 to 11 Months, 12 to 23 Months, Above 24 Months), By Distribution Channel (Online, E-commerce Channel , Company Website, Offline, Specialty Stores, Mega Retail Stores, Others (Individual Stores, Departmental Stores, etc.)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 12395

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

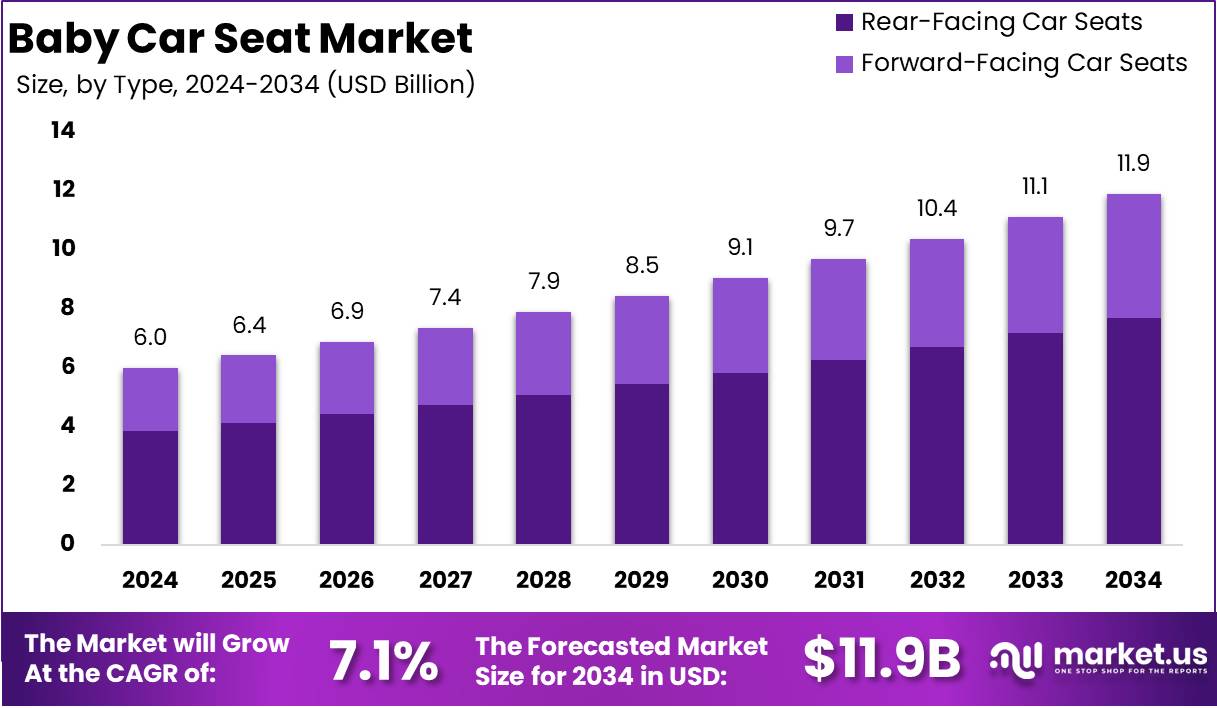

The Global Baby Car Seat Market size is expected to be worth around USD 11.9 Billion by 2034 from USD 6.0 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

A baby car seat is a child safety device designed to protect infants and young children while traveling in a vehicle. These seats are engineered to minimize the risk of injury or fatality in the event of a collision. Baby car seats come in various designs based on age, weight, and height, such as rear-facing seats for newborns, forward-facing seats for toddlers, and booster seats for older children. The primary function of a baby car seat is to ensure the child’s safety, aligning with national and international safety regulations such as the ECE R44/04 or FMVSS 213 standards.

The baby car seat market is a segment within the broader automotive safety and child products industry. This market encompasses the manufacturing, distribution, and retailing of car seats for children, including the development of innovative features such as improved impact protection, ease of installation, and enhanced comfort for children.

The market has evolved significantly in recent years, driven by technological advancements and increasing awareness about child safety during car travel. Moreover, the market also includes the aftermarket sales of car seats, which may vary in terms of materials, design, and installation options.

Several key factors have contributed to the expansion of the baby car seat market. First and foremost, stringent regulations regarding child safety in vehicles have significantly increased demand for reliable and certified car seats. These regulations are enforced by both government bodies and safety organizations, which ensure that car seats meet established safety standards.

The demand for baby car seats is predominantly driven by demographic factors, such as population growth and an increase in birth rates in specific regions. Emerging markets, in particular, have witnessed a surge in demand for baby car seats due to growing awareness of child safety and rising standards of living.

In developed regions, while demand remains steady, the trend is leaning towards premium products that offer advanced safety features, such as side-impact protection and anti-rebound bars. Another emerging trend is the integration of car seats with advanced technologies, including sensors, smart features, and compatibility with other in-car devices.

The baby car seat market presents numerous growth opportunities, particularly in emerging economies where rising incomes and an increased focus on child safety are driving demand. Manufacturers that can innovate to create lightweight, easier-to-install seats that cater to both safety and comfort will likely capture significant market share. There is also a notable opportunity for eco-friendly and sustainable product development, as parents become more environmentally conscious.

According to Incar Safety Centre, 10 children aged seven or younger are killed or seriously injured on British roads every week, with the risk increasing significantly as children approach the age of 11. Rear-facing seats can reduce the risk of injury and death by up to 90% during a collision and also minimize neck strain. For instance, a 15kg child in a forward-facing seat could experience 180-220kg of neck strain at 31 mph, while a rear-facing seat reduces this to just 40-60kg. Moreover, high-back boosters can lower the risk of injury by 77% in children aged 4-10, yet many remain unaware of their necessity until a child reaches 135cm or 12 years old.

According to Parentingmode, motor vehicle traffic crashes are a leading cause of death among children in the U.S., with approximately 5,000 children involved in car accidents annually, 18% of whom are unrestrained. Notably, child safety seats are proven to reduce fatal injuries by 71% for infants and 54% for toddlers. Despite these benefits, 49% of child safety seats are either improperly installed or used.

Children under 12 months have the highest restraint use at 91%, while those aged 13 to 14 show the lowest at 29%. Approximately 7.5% of children between 1 and 3 years are prematurely transitioned to booster seats, and one in five parents consider it acceptable to drive without restraining their child for short trips. Furthermore, 56% of children are unrestrained when the driver is alcohol-impaired. The economic toll of car crash injuries in the U.S. totals $283 billion annually.

Key Takeaways

- The global baby car seat market is expected to grow from USD 6.0 billion in 2024 to USD 11.9 billion by 2034, with a CAGR of 7.1%, driven by increasing awareness of child safety and technological advancements in car seat design.

- Infant Baby Car Seats dominate the market, holding over 34.5% of the market share in 2024, reflecting parents’ primary focus on newborn safety and comfort.

- Rear-Facing Car Seats lead the installation type segment, accounting for more than 64.5% of the market in 2024, driven by strong safety recommendations for infants.

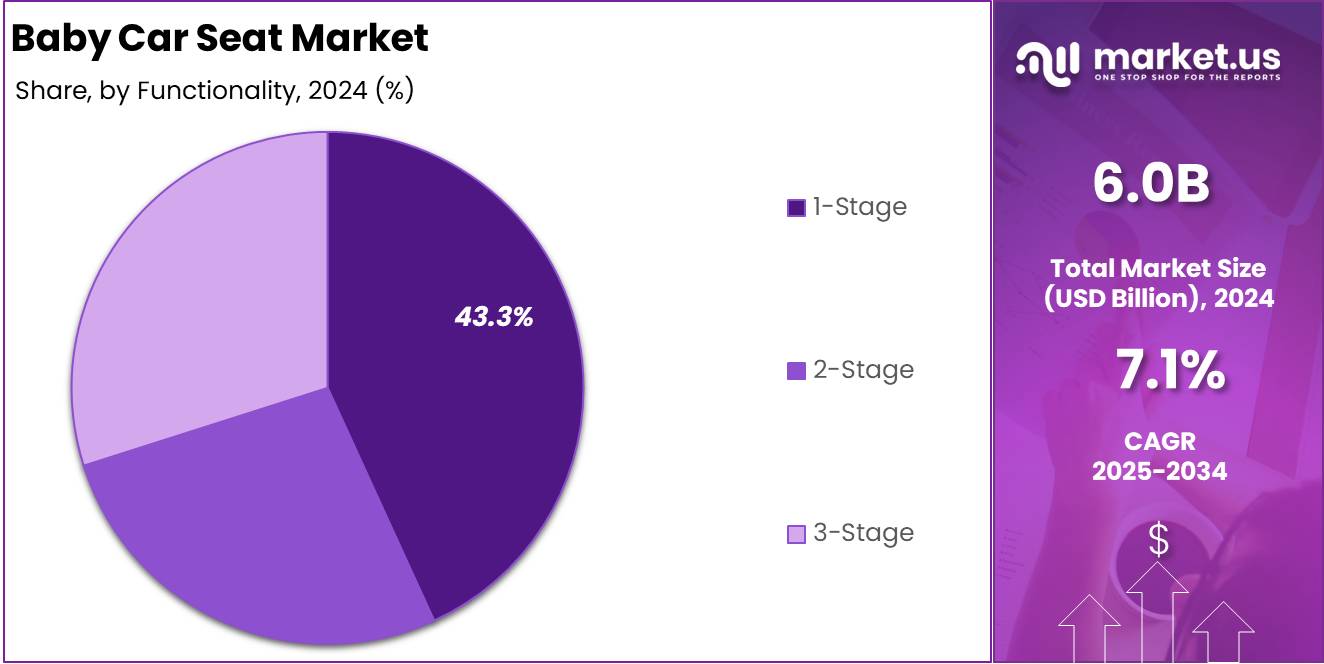

- The 1-Stage baby car seat is the most dominant, capturing over 43.3% of the market share in 2024, favored for its simplicity and long-term use for newborns.

- Plastic dominates the baby car seat market, making up over 54.4% of the market in 2024, valued for its lightweight, durability, and cost-effectiveness.

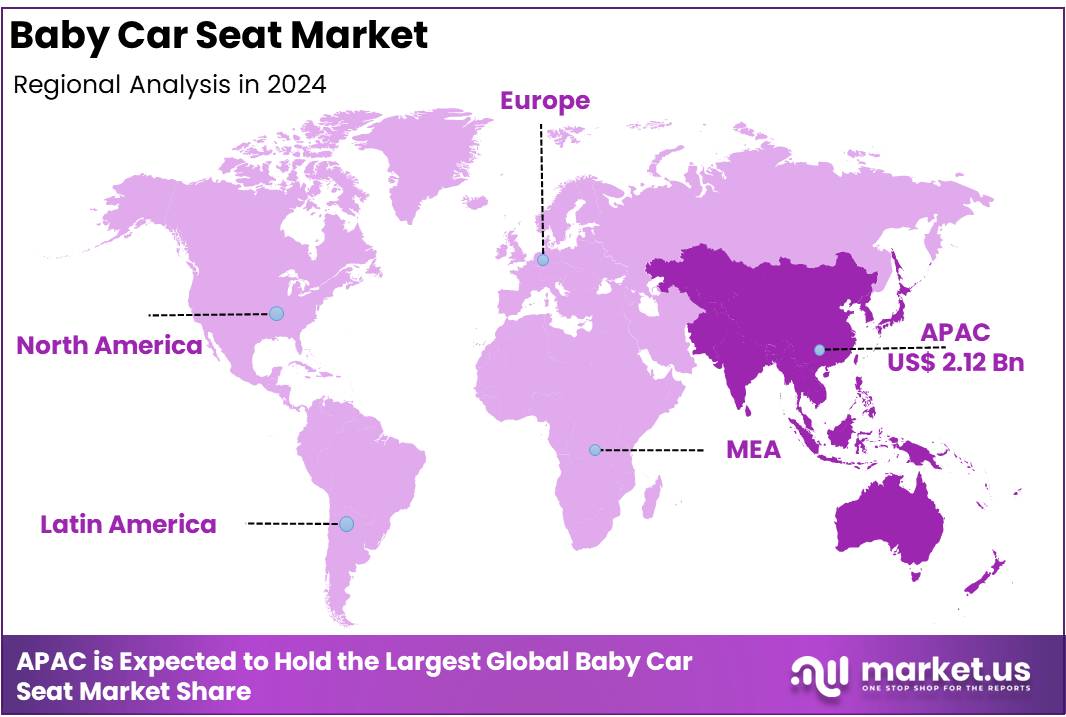

- The APAC region leads the global baby car seat market, holding a 35.4% share in 2024, driven by rising awareness of child safety in rapidly growing markets like China and India.

By Type Analysis

In 2024, Infant Baby Car Seats dominate the market with over 34.5% of the share, highlighting the ongoing priority parents place on safety and comfort for their newborns. Designed for infants up to 35 pounds, these seats provide secure, cozy travel and are often the first choice for new parents. The demand for infant car seats continues to rise, driven by increasing awareness around safety standards, ease of installation, and the convenience of transitioning between car and stroller. Manufacturers are enhancing features such as side-impact protection, base stability, and adjustable harness systems to meet these needs.

Convertible Baby Car Seats are also a significant player in the market, valued for their adaptability. Initially used as rear-facing infant seats, these car seats can be converted into forward-facing or booster seats as a child grows. The flexibility and long-term usability of convertible seats make them a favorite among parents who want both value and security. With durable designs and advanced safety features, convertible seats offer peace of mind throughout multiple stages of a child’s development.

Booster Baby Car Seats continue to play a vital role in keeping older children safe. Once a child outgrows a forward-facing seat, booster seats elevate them so the vehicle seatbelt fits properly, reducing the risk of injury during an accident. Their portability and ease of use make booster seats an essential part of the child’s journey toward independence while maintaining a high level of safety.

Combination Baby Car Seats provide a versatile solution, offering a forward-facing car seat that easily converts into a booster seat as the child grows. These multi-functional seats are a popular choice for parents seeking flexibility and longevity in a single product. The convenience of having one seat that adapts to a child’s changing needs, while ensuring top-notch safety, makes combination seats a top pick.

All-in-One Baby Car Seats are becoming an increasingly popular choice for families seeking long-term value. These seats transition through all stages from rear-facing to forward-facing and then to a booster seat offering a comprehensive solution for child safety in cars. While they come with a higher upfront cost, many parents find the lifetime use of an All-in-One seat to be a worthwhile investment, eliminating the need for multiple seats as the child grows. This trend reflects a broader move toward sustainable, cost-effective purchases in the baby products market.

By Installation Type Analysis

In 2024, Rear-Facing Car Seats hold a dominant position in the By Installation Type segment of the Baby Car Seat market, capturing more than 64.5% of the market share. This segment’s popularity is primarily driven by the safety advantages it offers for infants, as it supports the baby’s neck and spine in the event of a crash.

Regulatory bodies such as the American Academy of Pediatrics and various governments emphasize the importance of rear-facing seats for young children, further driving demand. In addition, technological advancements in rear-facing car seats, such as improved safety features, comfort, and ease of installation, have made them the preferred choice for parents. As a result, this segment is expected to maintain a strong market share throughout the forecast period.

Forward-Facing Car Seats represent a significant segment in the Baby Car Seat market. While not as dominant as rear-facing seats, they still capture a large portion of the market due to their practicality and continued relevance in child safety. These seats are primarily used once a child has outgrown their rear-facing car seat, typically around the age of two, and are designed to provide optimal protection as the child grows older.

Forward-facing car seats come with enhanced features, such as five-point harness systems, adjustable headrests, and side-impact protection, which contribute to their ongoing popularity. Additionally, the flexibility they offer in accommodating different sizes and growth stages makes them a preferred choice for parents looking for long-term solutions. As safety regulations continue to evolve, forward-facing seats remain a crucial part of ensuring children’s protection in vehicles.

By Functionality Analysis

In 2024, the 1-Stage baby car seat holds a dominant market position in the segment of Baby Car Seats by functionality, capturing more than 43.3% of the market share. This dominance is driven by the growing demand for simplicity and convenience among parents who seek a one-time, long-term solution for infant car seat needs.

Typically designed for newborns and infants, 1-Stage car seats are highly favored due to their ease of use, lightweight design, and ability to provide a secure and comfortable ride. With increasing awareness about infant safety, these seats offer a practical solution that aligns well with parents’ priorities, which has led to their wide adoption in the market.

The 2-Stage baby car seat segment is also experiencing steady demand due to its versatility. These seats typically start as rear-facing for infants and can be converted to a forward-facing position as the child grows, offering extended use. Parents appreciate the cost-effectiveness of 2-Stage seats, which provide both infant safety and the capability to transition into a toddler car seat. As a result, this segment continues to gain traction in the market, particularly among parents seeking a product that grows with their child.

While not as widely adopted as the 1-Stage segment, the 3-Stage baby car seat is gaining momentum. These seats are designed to accommodate children as they grow, with the ability to be used in rear-facing, forward-facing, and booster seat configurations.

The long-term value and flexibility offered by 3-Stage car seats make them an appealing choice for parents who are looking for a single car seat to cover the entire early childhood period. However, the 3-Stage seats generally come at a higher price point compared to the 1-Stage and 2-Stage options, which can impact their adoption rate, despite the added functionality.

By Material Analysis

In 2024, Plastic holds a dominant market position in the segment of Baby Car Seats by material, capturing more than 54.4% of the market share. The popularity of plastic in baby car seats can be attributed to its lightweight nature, durability, and ability to be molded into various shapes and sizes, making it ideal for creating ergonomic, safe, and comfortable seating solutions for infants.

Plastic’s cost-effectiveness also makes it a preferred choice for manufacturers, contributing to the widespread availability and affordability of plastic-based baby car seats. Additionally, the material’s ease of cleaning and ability to withstand wear and tear further solidify its dominant role in the market.

Steel baby car seats, while less common than plastic models, offer exceptional strength and safety benefits. Steel provides a robust structure that enhances the durability and crash protection of car seats, making it a preferred choice for premium models. These seats are often designed for higher-end, safety-conscious consumers who prioritize advanced security features and long-lasting materials. The superior strength of steel can provide added peace of mind for parents seeking top-tier protection for their children in case of an accident.

Foam is another significant material used in the production of baby car seats. Known for its shock-absorbing properties, foam is commonly used in combination with other materials, such as plastic, to enhance comfort and safety. Foam car seats are lightweight, breathable, and soft, providing a cozy seating experience for infants. The material’s ability to absorb impact forces also helps in protecting the baby during a collision. Foam is especially popular in mid-range car seats, as it strikes a balance between comfort, safety, and cost.

Other materials, such as rubber, nylon, and fabric blends, are also utilized in the manufacturing of baby car seats. These materials are often used for padding, covers, and additional support structures. While not as dominant as plastic or steel, these materials offer specific advantages like enhanced flexibility, comfort, and moisture-wicking properties. They are commonly incorporated into car seats to add extra layers of protection and comfort, contributing to the overall user experience.

By Age Group Analysis

In 2024, the 8 to 11 Months age group holds a dominant market position in the Baby Car Seat segment by age group, capturing more than 28.5% of the market share. This dominance is driven by the critical need for specialized car seats for infants in this transitional stage of development.

Babies between 8 and 11 months are typically ready to move from rear-facing infant car seats to more advanced seats, such as convertible car seats or those that can support both rear and forward-facing configurations. Parents in this age group prioritize safety, comfort, and growth-adjustable features, which has led to strong demand for baby car seats designed for this stage.

The Below 3 Months age group requires highly specific car seat designs to ensure maximum safety for newborns. These car seats are usually rear-facing, offering crucial head, neck, and spine support to protect the infant in the event of a crash. While this segment does not dominate the market share, it is essential for parents of newborns who are seeking car seats with strict safety features. These car seats are often used for a limited time but are highly prioritized in terms of safety standards.

The 4 to 7 Months age group represents a growing segment as infants begin to outgrow their newborn car seats but still require additional safety measures. At this stage, babies are becoming more alert and may be ready for extended periods of travel in a car seat.

Car seats designed for this age group are typically rear-facing and offer better comfort, often with more padding and adjustable reclining positions. While this group’s market share is significant, it is overshadowed by the transition phase that occurs around 8 to 11 months.

The 12 to 23 Months segment focuses on toddlers who require forward-facing car seats with higher weight and height limits. These car seats are designed to provide additional comfort and safety as children grow, offering features like five-point harnesses and side-impact protection. While this group does not dominate the market in comparison to the 8 to 11 months segment, it is essential for parents who need car seats that accommodate their child’s growth beyond the infancy stage.

Above 24 Months car seats typically transition into booster seats, offering more flexibility for growing toddlers. These seats are designed for children who have outgrown their forward-facing car seats but still require additional safety features.

The Above 24 Months segment continues to grow, especially as the importance of long-term safety solutions remains high. However, the market share for this group is smaller compared to the younger age groups as the baby car seat needs evolve into booster and backless booster seat options.

By Distribution Channel Analysis

In 2024, Offline retail channels dominate the Baby Car Seat market, capturing more than 82.3% of the market share. Traditional brick-and-mortar stores, including specialty and mega retail stores, continue to be the preferred shopping method for parents. These stores allow customers to physically inspect, test, and seek expert advice on baby car seats, which remains a key factor in purchasing decisions. The ability to see product quality firsthand and receive immediate support has kept offline channels strong in the market.

Online sales of baby car seats are growing but still represent a smaller share compared to offline sales. E-commerce platforms, including large retailers like Amazon, provide the convenience of shopping from home, allowing customers to compare prices, read reviews, and access a wider range of products. Despite these advantages, many parents still prefer offline stores for such critical purchases, particularly when it comes to ensuring the safety and comfort of their children.

E-commerce channels are seeing increased adoption, especially with the rise of convenience-focused consumers. Online marketplaces and retailers offer a broad selection, often at competitive prices, but the need for physical inspection and personalized assistance limits the overall market share. However, the growing trend of online shopping is likely to continue to capture more of the market over time.

Purchasing directly from company websites provides parents with access to exclusive models, offers, and detailed product information. Though this channel offers benefits like direct customer service and brand-specific guarantees, it remains a smaller segment compared to larger, multi-brand e-commerce platforms and offline retail stores.

Specialty stores, such as baby gear or car seat-focused shops, cater specifically to parents looking for expert advice and high-quality products. These stores are trusted for their specialization and knowledge but hold a smaller market share compared to larger retail outlets.

Mega retail stores, such as large chain stores or supermarkets with dedicated baby sections, offer a broad selection of baby car seats at competitive prices. Their convenience and accessibility make them a popular choice, but the overall market share remains smaller than that of offline specialty stores.

Other retail formats, such as individual or departmental stores, contribute to the overall market but represent a smaller segment in comparison to mega retail stores or specialty shops. These stores may carry limited selections but can still attract customers based on location or brand offerings.

Key Market Segments

By Type

- Infant

- Convertibles

- Booster

- Combination

- All In One Seat

By Installation Type

- Rear-Facing Car Seats

- Forward-Facing Car Seats

By Functionality

- 1-Stage

- 2-Stage

- 3-Stage

By Material

- Plastic

- Steel

- Foam

- Others (Rubber, Nylon, etc.)

By Age Group

- Below 3 Months

- 4 to 7 Months

- 8 to 11 Months

- 12 to 23 Months

- Above 24 Months

By Distribution Channel

- Online

- E-commerce Channel

- Company Website

- Offline

- Specialty Stores

- Mega Retail Stores

- Others (Individual Stores, Departmental Stores, etc.)

Driver

Increased Awareness of Child Safety

The heightened global awareness surrounding child safety is one of the main drivers of growth in the baby car seat market. With increasing concerns about road safety, governments, and advocacy groups have ramped up efforts to educate parents about the necessity of using child car seats. This has resulted in stricter regulations and laws around child car seat usage, which has contributed to the demand for high-quality, compliant products.

For example, countries with stricter car seat regulations, such as those in the European Union and the United States, have seen a consistent rise in the adoption of child car seats. This heightened awareness has spurred a shift from traditional, less safe options to more advanced models, including those that offer higher levels of comfort, protection, and ease of use.

The influence of safety-conscious parents is undeniable. As millennial parents—who are generally more informed and tech-savvy—become the dominant consumer group, they place higher value on the safety features and the quality of car seats. This demographic is more likely to conduct extensive research before making purchasing decisions, opting for car seats with additional features such as side-impact protection, adjustable harness systems, and crash-test certification.

This shift in consumer behavior is significantly contributing to market growth. The trend is supported by a growing body of evidence linking car seat use with a reduction in child injuries and fatalities, further emphasizing the importance of adopting safety standards.

Restraint

High Price of Premium Car Seats

The price barrier remains a significant restraint for the growth of the global baby car seat market, especially in low-income regions. While there is a broad range of car seats available, premium models with advanced features such as smart technology, multiple recline positions, and enhanced safety measures often come with a high price tag.

For many parents, particularly in developing countries, the cost of these high-end models can be prohibitive. Even in developed regions, budget-conscious consumers may opt for less expensive options that still meet basic safety standards, but lack the advanced features of higher-priced seats.

This price disparity poses a challenge, particularly in emerging markets where disposable income is limited. In such markets, affordability is a key determinant in purchasing decisions, and many parents are reluctant to invest in high-end baby car seats. Additionally, while some governments subsidize or offer incentives to purchase car seats, these measures are not universally available.

As a result, the market is somewhat limited to higher-income brackets and affluent consumers who are more likely to invest in premium models. Although demand for high-quality, well-designed car seats remains strong, manufacturers need to find ways to balance safety, comfort, and affordability to appeal to a broader audience and drive further growth.

Opportunity

Growing Demand in Emerging Markets

The growing population and urbanization of emerging markets present significant growth opportunities for the global baby car seat market. Countries in regions such as Asia-Pacific, Latin America, and the Middle East are experiencing rapid economic development and an increase in the middle class, leading to greater car ownership and a rising awareness of child safety.

As disposable incomes rise in these regions, more parents are able to invest in baby car seats, thus expanding the market potential. In particular, countries like China, India, and Brazil are seeing significant growth in the adoption of car seats as awareness about road safety increases and local governments implement stricter regulations.

Furthermore, the rise of e-commerce platforms is making it easier for parents in these regions to access and purchase a wider variety of baby car seats. Online retail offers a broad selection of products, often at competitive prices, which can overcome the distribution challenges that may exist in more rural or remote areas.

This trend is expected to contribute to the expansion of the market, particularly in countries where traditional brick-and-mortar retail infrastructures are still developing. Manufacturers who can offer affordable, high-quality products that comply with local safety standards are well-positioned to capitalize on this growing demand, making emerging markets a key opportunity for the industry in the coming years.

Trends

Smart Baby Car Seats with Advanced Features

The baby car seat market is witnessing a rise in demand for smart and technologically advanced car seats, which is reshaping the industry’s landscape. Parents increasingly value convenience and safety, leading manufacturers to integrate technology such as sensors, real-time monitoring, and even connectivity features into their products.

These smart car seats are designed to alert parents if their child is improperly positioned, if the seatbelt is not properly secured, or if the car seat is exposed to extreme temperatures. The incorporation of these advanced features adds an extra layer of reassurance to parents who are concerned about their child’s safety during travel.

In addition to safety features, many of these high-tech seats also come with comfort-enhancing features such as adjustable recliners, temperature regulation, and self-adjusting harnesses that adapt as the child grows. The trend is particularly prevalent among tech-savvy, millennial parents who are more likely to embrace innovative solutions in products they use. The demand for connected devices is further driven by the increasing use of smartphone apps, enabling parents to track important data related to their child’s well-being during travel.

As these advanced features continue to evolve, the market for high-tech baby car seats is expected to grow, with consumers willing to invest in products that offer both technological advancements and superior safety benefits. This trend is setting the stage for a new era of car seat design, where comfort, safety, and innovation converge.

Regional Analysis

APAC Region – Baby Car Seat Market with Largest Market Share of 35.4%

The Baby Car Seat Market exhibits varied growth patterns across different regions, driven by diverse factors such as population growth, consumer preferences, and economic conditions. Among these regions, the Asia Pacific (APAC) market stands as the dominant player, commanding the largest market share of 35.4% in 2024, valued at USD 2.12 billion.

This substantial share is primarily attributed to the region’s increasing population, particularly in countries like China and India, where the demand for child safety products is on the rise due to growing awareness of road safety and child protection.

North America follows closely, accounting for a significant portion of the global market. With high standards of safety regulations and a well-established awareness of child safety, the North American market continues to be robust. The region is expected to maintain steady growth, driven by continuous innovations and increasing adoption of premium and safety-focused baby car seats.

Europe, known for its stringent safety standards and a well-regulated automotive market, holds a prominent position in the global baby car seat industry. The European market is characterized by high demand for technologically advanced baby car seats, with increased consumer preference for products offering superior safety features and comfort. As a result, this region is projected to see moderate yet steady growth in the coming years, bolstered by favorable government regulations on child safety.

The Middle East and Africa (MEA) market shows potential for growth, though it currently holds a smaller market share compared to other regions. Increasing urbanization and rising disposable income in key countries contribute to the growing adoption of baby car seats. However, challenges such as the varying regulatory standards and fluctuating economic conditions in certain countries could affect the pace of growth in this region.

Latin America presents a mixed outlook for the baby car seat market. While some countries in the region are witnessing growth driven by improving socio-economic conditions, others face barriers such as limited awareness about child safety regulations and the need for lower-cost alternatives. Despite these challenges, the market in Latin America is gradually expanding as awareness campaigns and urbanization continue to promote the use of baby car seats.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global baby car seat market in 2024 remains competitive, with key players focusing on innovation, safety, and expanding product portfolios. Britax, a long-standing leader, continues to emphasize cutting-edge safety features, positioning itself as a top choice among safety-conscious parents. Chicco has strengthened its market position through diverse product offerings and a focus on comfort and ease of use, appealing to a wide demographic of new parents.

Cybex remains a premium player, distinguished by its stylish, high-quality designs and robust safety innovations. Meanwhile, Dorel Industries Inc. has a broad reach with its affordable range, making car seats accessible to a large customer base. Evenflo stays competitive by integrating advanced technology, such as its unique sensor technology for monitoring child safety. Goodbaby International Holdings leverages its global presence and diverse portfolio, catering to emerging markets and seeking growth opportunities.

Graco is a top contender, offering a mix of affordability, safety features, and user-friendly designs. InfaSecure and Joie have carved out strong niches in regional markets by emphasizing both safety and convenience. Maxi-Cosi, known for its premium product line, continues to innovate with high-quality, user-centric car seats. Mothercare plc maintains its position through strong retail partnerships, focusing on a broad customer base with mid-range products.

Newell Brands is enhancing its market share by expanding its product offerings and focusing on expanding its global reach. RECARO Holding GmbH delivers high-end performance-oriented seats with a focus on ergonomic design and safety. RENOLUX FRANCE INDUSTRY brings localized, affordable options while maintaining strong safety standards. Safety 1 and UPPAbaby differentiate themselves by targeting the premium segment, offering innovative, feature-rich car seats aimed at higher-end consumers.

Top Key Players in the Market

- Britax

- Chicco

- Cybex

- Dorel Industries Inc.

- Evenflo

- Goodbaby International Holdings

- Graco

- InfaSecure

- Joie

- Maxi-Cosi

- Mothercare plc

- Newell Brands

- RECARO Holding GmbH

- RENOLUX FRANCE INDUSTRY

- Safety 1

- UPPAbaby

Recent Developments

- In February 2025, Graco®, a leader in baby gear solutions, introduced the EasyTurn™ 360° 2-in-1 Convertible Car Seat. This innovative car seat offers a 360° rotating feature that allows parents to easily access their child, whether rear-facing or forward-facing. Designed for children from 4 to 65 lbs., the car seat provides both comfort and safety while optimizing space in the back seat.

- In 2025, Evenflo, a trusted name in child products, revealed SensorySoothe™ at CES Las Vegas. This groundbreaking technology helps calm babies and reduce stress for parents during travel.

- In 2023, Maxi-Cosi, renowned for its commitment to child safety, launched the 360 Pro Family car seat series. This unique range features a rotating and sliding design, aimed at improving comfort for parents when placing their children in and out of the car.

Report Scope

Report Features Description Market Value (2024) USD 6.0 Billion Forecast Revenue (2034) USD 11.9 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type ( Infant, Convertibles, Booster, Combination, All In One Seat), By Installation Type (Rear-Facing Car Seats, Forward-Facing Car Seats), By Functionality (1-Stage, 2-Stage, 3-Stage), By Material (Plastic, Steel, Foam, Others (Rubber, Nylon, etc.)), By Age Group (Below 3 Months, 4 to 7 Months, 8 to 11 Months, 12 to 23 Months, Above 24 Months), By Distribution Channel (Online, E-commerce Channel , Company Website, Offline, Specialty Stores, Mega Retail Stores, Others (Individual Stores, Departmental Stores, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oura Health Ltd., Motiv Inc., McLear Ltd., NFC Ring, Ringly Inc., Jakcom Technology Co., Ltd., Kerv Wearables, Tokenize Inc., Prevention Circul+, Sleepon, Thim, Hecere NFC Ring, ORII by Origami Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Britax

- Chicco

- Cybex

- Dorel Industries Inc.

- Evenflo

- Goodbaby International Holdings

- Graco

- InfaSecure

- Joie

- Maxi-Cosi

- Mothercare plc

- Newell Brands

- RECARO Holding GmbH

- RENOLUX FRANCE INDUSTRY

- Safety 1

- UPPAbaby