Global Sun Care Products Market By Product (Sun-protection, After-sun, Tanning), By Form (Lotion, Spray, Stick, Others), By SPF (0-29, 30-50, >50), Distribution Channel (Hypermarket and supermarket, Pharmacy and drug store, Specialty store, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Key Trends, and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 17663

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

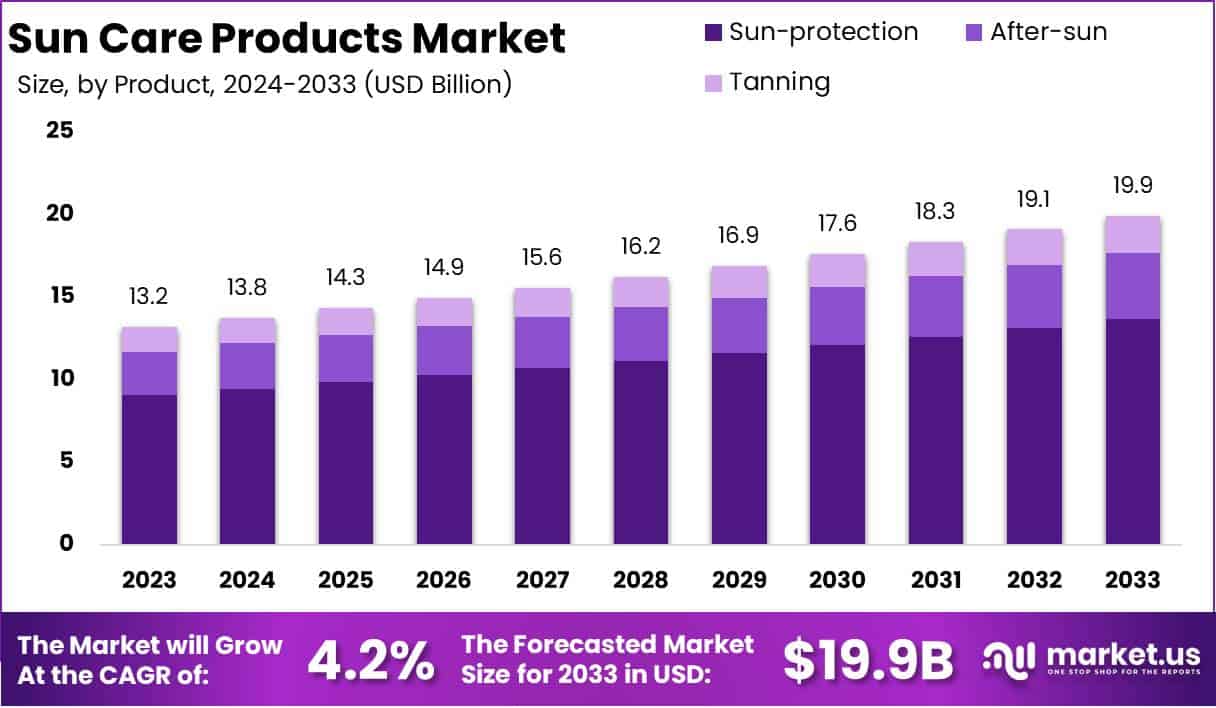

The Global Sun Care Products Market size is expected to be worth around USD 19.9 Billion by 2033, from USD 13.2 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

Sun care products are formulations designed to protect the skin from the harmful effects of ultraviolet (UV) radiation. These products include sunscreens, sunblocks, after-sun lotions, and lip balms with SPF. They come in various forms such as creams, lotions, sprays, and gels, offering diverse options to suit different skin types and consumer preferences.

Their primary function is to prevent sunburn, reduce the risk of skin cancer, and minimize signs of premature aging, such as wrinkles and dark spots, caused by prolonged sun exposure.

The sun care products market encompasses the global industry focused on the development, production, and distribution of sun protection and after-sun care solutions. This market includes a range of products catering to varying levels of UV protection and skin care needs, often segmented by SPF levels, product types, and target demographics.

Key stakeholders include manufacturers, suppliers, and retailers, serving both individual consumers and institutions such as hotels and resorts. The market is characterized by its competitive nature, with companies continuously innovating to meet evolving consumer expectations and regulatory standards.

Several factors drive the growth of the sun care products market. Rising awareness about the harmful effects of UV radiation, including increased risks of skin cancer and photoaging, is a primary driver. Additionally, growing health consciousness among consumers has led to a surge in demand for preventive skincare products.

The expansion of e-commerce platforms and the proliferation of social media have further facilitated consumer access and awareness. Moreover, regulatory mandates in various countries requiring the use of sunscreens in cosmetics and personal care products contribute to market growth.

Demand for sun care products is influenced by several demographic and lifestyle trends. An increasing number of consumers prioritize skin health, viewing sun care as an essential part of their daily skincare routine.

Demand is particularly high in regions with strong sunlight exposure, such as Asia-Pacific and Latin America, as well as among individuals who engage in outdoor recreational activities. Furthermore, rising disposable incomes in emerging markets have made premium sun care products more accessible to a broader audience.

The sun care products market presents significant opportunities for innovation and growth. There is a rising trend toward natural and organic formulations, driven by consumer demand for clean and sustainable products.

Additionally, advancements in product formulations, such as water-resistant and multi-functional sun care solutions, cater to a growing base of active and health-conscious consumers.

Emerging markets, particularly in Asia-Pacific and Africa, offer untapped potential due to increasing awareness and improving economic conditions. Lastly, the integration of digital tools for personalized skincare recommendations could further enhance consumer engagement and loyalty.

According to Business Standard, Sun Pharmaceutical Industries completed the acquisition of Taro Pharmaceutical Industries on June 24, 2024, for $347.73 million. This strategic move, resulting in Taro’s delisting from the NYSE and full ownership by Sun Pharma, is poised to enhance Sun Pharma’s capabilities in the sun care products market, leveraging Taro’s dermatological expertise to meet growing consumer demand.

According to General Atlantic, Southern Californian performance lifestyle brand Vuori announced an $825 million investment led by General Atlantic and Stripes, along with additional investors. This investment, structured as a secondary tender offer, elevates Vuori’s valuation to $5.5 billion, marking a significant milestone in the company’s journey to becoming a category leader.

Key Takeaways

- The global sun care products market is projected to grow from USD 13.2 billion in 2023 to USD 19.7 billion by 2033, at a CAGR of 4.2%, driven by rising UV awareness and health-conscious consumer behavior.

- Sun-protection products dominated the market with a 68.7% share in 2023, reflecting heightened consumer focus on UV protection and skin health.

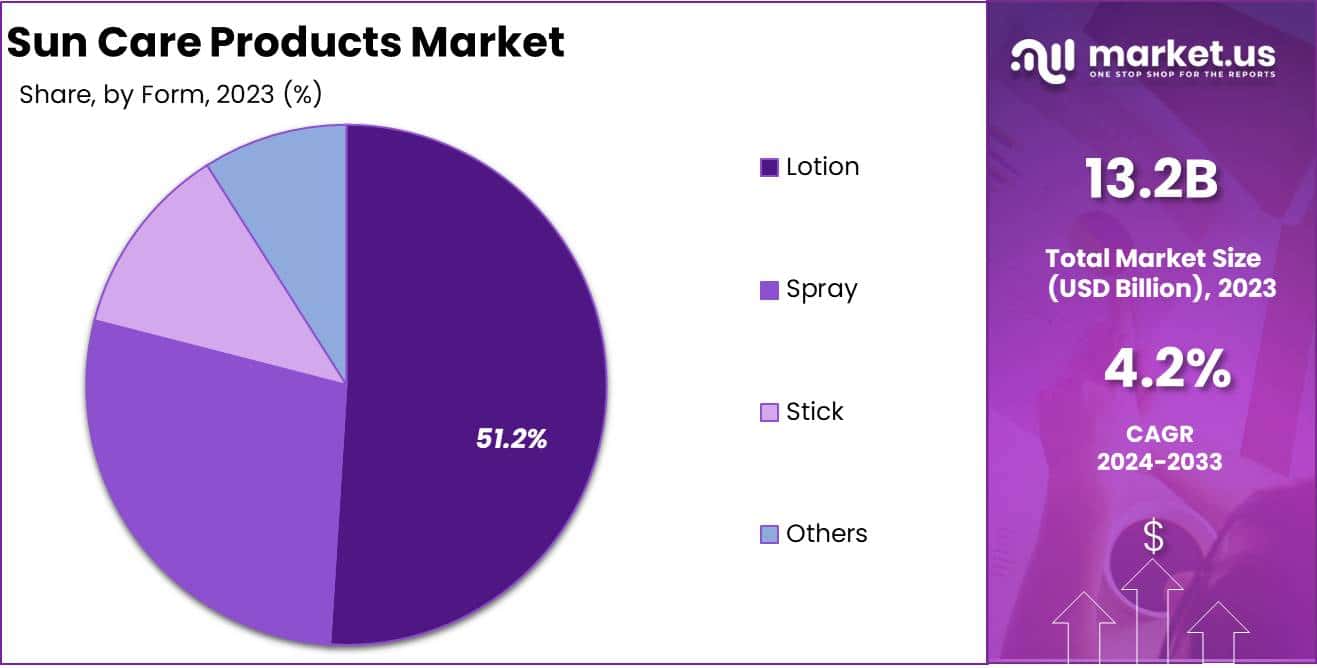

- Lotion-based products held a 51.2% market share in 2023, driven by their multifunctional benefits and ease of application.

- Products with 30-50 SPF dominated with a 62.8% market share in 2023, offering optimal daily protection for a broad consumer base.

- Hypermarkets and supermarkets led the distribution channel with a 41.4% market share in 2023, capitalizing on convenience and product variety.

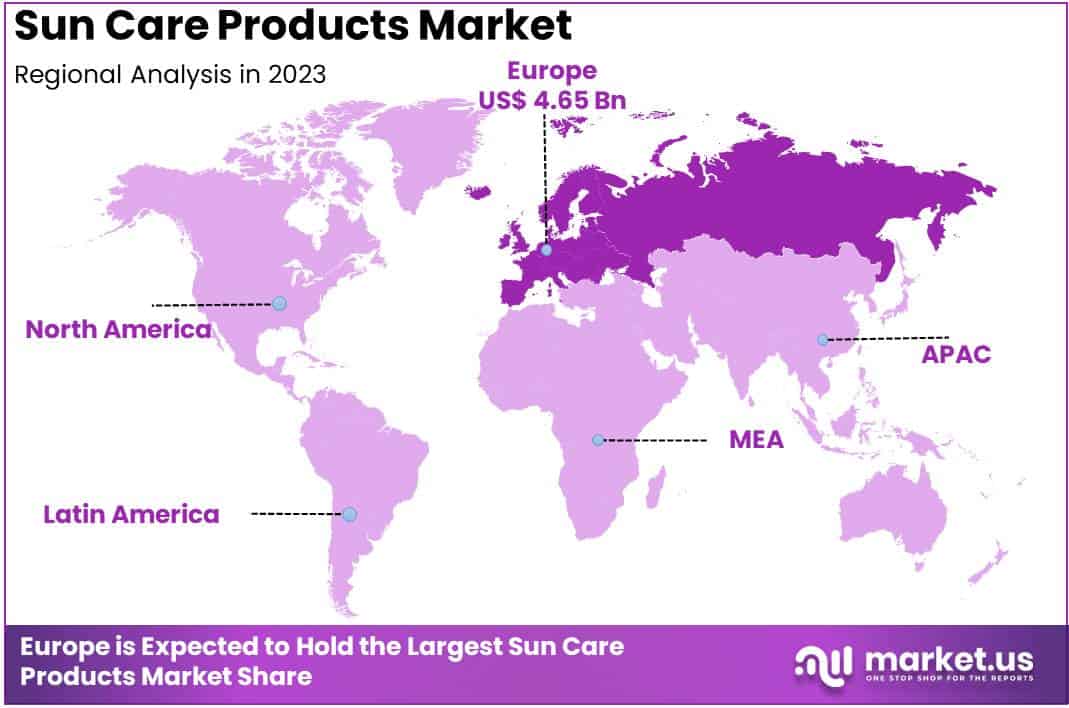

- Europe led the global sun care products market with a 35.3% share in 2023, supported by high awareness, premium product demand, and favorable regulations.

By Product Analysis

Sun-Protection Dominating the Sun Care Products Market with a 68.7% Share

In 2023, Sun-protection products secured a dominant position within the Sun Care Products market, capturing more than 68.7% of the market share. This segment includes a wide range of sunscreens, sprays, and lotions designed to protect against harmful UV rays. The growing awareness of skin cancer risks and increasing consumer demand for broad-spectrum protection have been key drivers of this segment’s growth.

After-sun products accounted for 20.4% of the market share in 2023. This category includes soothing lotions, gels, and creams that cater to consumers seeking relief from sunburn and skin hydration post-sun exposure. Rising interest in skincare routines and the demand for products with natural and organic ingredients have contributed to the segment’s expansion.

Tanning products held a 10.9% share of the Sun Care Products market in 2023. This segment includes self-tanning lotions, sprays, and oils, which continue to attract consumers looking for a bronzed appearance without direct sun exposure. The rising popularity of year-round tanning solutions, particularly among younger demographics, has supported consistent growth in this category.

By Form Analysis

Lotion Dominating the Sun Care Products Market by Form with a 51.2% Share

In 2023, lotion-based sun care products captured a dominant 51.2% share of the market. Their widespread appeal lies in their ease of application, moisturizing benefits, and availability across a broad spectrum of SPF levels. The growing preference for multifunctional products, such as tinted and antioxidant-enriched lotions, has further bolstered their demand.

Spray formulations held a significant 28.7% share of the Sun Care Products market in 2023. Valued for their convenience and even application, sprays are particularly popular among active consumers and families. Their quick-drying and non-greasy properties have made them a preferred choice in outdoor and sports settings.

Stick sun care products accounted for 12.4% of the market in 2023. These compact, travel-friendly options are favored for targeted application, particularly for sensitive areas like the face and lips. Increasing awareness of the benefits of reapplying sunscreen throughout the day has driven the demand for stick formats.

The Others segment, which includes gels, powders, and wipes, captured 7.7% of the market share in 2023. These products cater to niche consumer needs, offering unique application methods and innovative formulas. Demand in this category is fueled by a growing preference for lightweight, non-traditional sun care solutions.

By SPF Analysis

30-50 SPF Dominating the Sun Care Products Market with a 62.8% Share

In 2023, products with an SPF range of 30-50 captured a dominant 62.8% share of the Sun Care Products market. This SPF range is widely regarded as offering optimal daily protection against harmful UV rays, striking a balance between high efficacy and skin-friendliness. The segment’s growth is driven by increased consumer awareness of the need for effective sun protection in both outdoor and urban environments.

Sun care products with SPF levels ranging from 0-29 accounted for 22.3% of the market share in 2023. These products appeal to consumers seeking light protection, often in the form of moisturizers or cosmetic products with added sun care benefits. Their demand is fueled by preferences for everyday, low-intensity sun exposure protection.

The >50 SPF segment held a 14.9% share of the market in 2023. These products are primarily targeted at individuals with sensitive skin or those exposed to intense sun conditions. Rising health concerns and increasing consumer demand for high-protection solutions have supported the steady growth of this segment.

Distribution Channel Analysis

Hypermarkets & Supermarkets Dominating the Sun Care Products Market with 41.4% Share

In 2023, Hypermarkets & Supermarkets maintained a dominant position in the distribution of sun care products, capturing over 41.4% of the market share. This leadership is attributed to their expansive reach, diverse product offerings, and competitive pricing, making them a preferred choice for consumers seeking convenience and variety in a single location.

Pharmacies and drug stores accounted for 24.6% of the sun care products market in 2023. Their role as a trusted source for skincare solutions, coupled with expert advice from pharmacists, drives consumer loyalty, particularly for premium and dermatologist-recommended products.

Specialty stores secured a 16.8% market share, reflecting their appeal to consumers seeking premium and specialized sun care products. These stores are often preferred for their curated selections and personalized shopping experiences.

E-commerce platforms represented 12.3% of the sun care products market in 2023, underscoring the rising preference for online shopping. Factors such as convenience, detailed product reviews, and the availability of a wider range of products at competitive prices fuel this growth.

The Others category, including department stores and local retail outlets, accounted for 4.9% of the market share. These channels cater to specific consumer preferences and offer additional avenues for market penetration in varied regions.

Key Market Segments

By Product

- Sun-protection

- After-sun

- Tanning

By Form

- Lotion

- Spray

- Stick

- Others

By SPF

- 0-29

- 30-50

- >50

Distribution Channel

- Hypermarket & supermarket

- Pharmacy & drug store

- Specialty store

- Online

- Others

Driver

Rising Consumer Awareness of UV Radiation Risks

In 2024, the global sun care products market is significantly propelled by heightened consumer awareness regarding the detrimental effects of ultraviolet (UV) radiation. This increased consciousness stems from widespread educational campaigns and public health initiatives that emphasize the correlation between UV exposure and skin-related ailments, including skin cancer and premature aging.

As a result, consumers are more vigilant about incorporating sun protection into their daily routines, leading to a surge in demand for sun care products. This shift is evident across various demographics, with individuals seeking products that offer effective UV protection, thereby driving market growth.

Moreover, the proliferation of information through digital platforms has empowered consumers to make informed decisions about sun care. Access to scientific research and expert opinions has reinforced the importance of regular sunscreen use, not only during outdoor activities but also as a daily skincare essential.

This behavioral change has expanded the market for sun care products beyond seasonal peaks, ensuring a steady demand throughout the year. Consequently, manufacturers are innovating to meet this demand by developing products that cater to diverse skin types and preferences, further fueling the market’s expansion.

Restraint

Regulatory Challenges and Ingredient Restrictions

The sun care products market faces significant constraints due to stringent regulatory frameworks and ingredient restrictions imposed by health authorities worldwide. These regulations are designed to ensure consumer safety by scrutinizing the chemical components used in sun care formulations.

However, compliance with varying international standards presents a formidable challenge for manufacturers, often leading to increased production costs and extended time-to-market for new products. Such regulatory hurdles can impede innovation and limit the availability of certain products in specific regions, thereby restraining market growth.

Additionally, the growing consumer preference for natural and organic ingredients adds another layer of complexity. Manufacturers are compelled to reformulate products to exclude certain chemicals deemed harmful or undesirable, which can be a costly and time-consuming process.

The necessity to balance efficacy, safety, and consumer appeal within the confines of regulatory requirements necessitates substantial investment in research and development. This dynamic creates a barrier to entry for new players and can stifle the introduction of innovative products, ultimately affecting the market’s overall growth trajectory.

Opportunity

Expansion into Emerging Markets

The global sun care products market is poised for substantial growth through strategic expansion into emerging markets. Regions such as Asia-Pacific, Latin America, and parts of Africa present untapped potential due to increasing urbanization, rising disposable incomes, and a growing middle class.

As these populations become more aware of the health implications associated with UV exposure, there is a corresponding surge in demand for sun care products. Companies that can effectively penetrate these markets stand to gain a significant competitive advantage and drive overall market expansion.

To capitalize on this opportunity, manufacturers must tailor their products to meet the specific needs and preferences of consumers in these regions. This includes developing formulations suitable for diverse skin types and climates, as well as implementing culturally relevant marketing strategies.

Establishing robust distribution networks and partnerships with local retailers can further facilitate market entry and growth. By addressing the unique demands of emerging markets, companies can not only enhance their global footprint but also contribute to the broader adoption of sun care practices, thereby fostering long-term market development.

Trends

Integration of Multifunctional Skincare Benefits

A prominent trend shaping the sun care products market in 2024 is the integration of multifunctional skincare benefits into sun protection formulations. Consumers increasingly seek products that offer comprehensive skincare solutions, combining UV protection with additional benefits such as anti-aging properties, hydration, and antioxidant effects.

This demand has led to the development of innovative products that serve multiple purposes, streamlining skincare routines and enhancing user convenience. The convergence of sun care and skincare not only meets consumer expectations but also drives product differentiation in a competitive market.

Manufacturers are investing in research and development to create advanced formulations that deliver broad-spectrum UV protection while addressing other skin concerns. The incorporation of ingredients like hyaluronic acid for moisture retention, peptides for skin repair, and vitamins for nourishment exemplifies this trend.

Such multifunctional products appeal to time-conscious consumers seeking efficient skincare solutions, thereby boosting market demand. This trend underscores a shift towards holistic skincare approaches, where sun care products play a pivotal role in maintaining overall skin health and appearance.

Regional Analysis

Europe The Lead Region in Sun Care Products with Largest Market Share of 35.3%

The global sun care products market exhibits notable regional disparities, with Europe emerging as the dominant region, capturing 35.3% of the market share in 2023. This leadership is underpinned by robust consumer demand and heightened awareness of skin protection across the region. Valued at approximately USD 4.65 billion, the European market reflects a strong preference for premium and innovative sun care formulations.

Favorable regulatory frameworks promoting the use of safe and effective sun care ingredients further contribute to market expansion in this region. The prevalence of high per capita income and a well-established retail sector also bolster product accessibility, ensuring widespread adoption.

In North America, the market demonstrates steady growth, driven by a health-conscious consumer base and increased spending on skincare products. The region’s diverse climate and lifestyle trends, including outdoor recreational activities, amplify the need for comprehensive sun protection solutions.

While not the leading market, North America remains a significant contributor to the overall industry, with a particular focus on products offering dual benefits, such as sun care and anti-aging properties.

The Asia Pacific region is poised as a high-growth market, driven by rising disposable incomes, increasing urbanization, and growing awareness of UV-related skin damage. This region is marked by a dynamic consumer base with a keen interest in beauty and skincare, including sun care products.

Emerging economies within the region, such as China and India, are experiencing rapid market penetration, supported by expanding e-commerce platforms and rising skincare trends among younger demographics.

In the Middle East & Africa, market growth is supported by increasing consumer awareness of the harmful effects of prolonged sun exposure, particularly in regions with intense solar radiation. However, the adoption rate varies widely across the region, influenced by socio-economic disparities and climatic conditions.

While relatively nascent, this market holds potential for growth, particularly with rising urbanization and the introduction of affordable product lines tailored to local preferences.

Latin America presents a growing market, characterized by rising disposable incomes and increasing consumer education on the benefits of sun protection. Brazil and Mexico, in particular, are leading contributors, driven by a culture of outdoor lifestyles and a strong inclination towards skincare.

Despite economic volatility in some parts of the region, the demand for sun care products remains resilient, supported by favorable demographic trends and the expansion of retail networks.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global sun care products market is characterized by the strategic maneuvers of several key players, each leveraging their unique strengths to capture market share and drive innovation.

Adidas AG, traditionally renowned for its athletic apparel, has expanded into the personal care sector, including sun care products. Leveraging its strong brand association with sports and outdoor activities, Adidas offers sun protection solutions tailored for active consumers, emphasizing sweat-resistant and long-lasting formulations.

Beiersdorf AG, the parent company of Nivea, maintains a significant presence in the sun care market. The company’s focus on research and development has led to advanced sun protection technologies, catering to diverse skin types and preferences. Beiersdorf’s extensive distribution network ensures widespread availability of its products globally.

Groupe Clarins positions itself in the premium segment, offering sun care products that combine protection with skincare benefits. Emphasizing natural ingredients and luxurious formulations, Clarins appeals to consumers seeking high-quality sun protection integrated with anti-aging and moisturizing properties.

Johnson & Johnson, through its Neutrogena brand, continues to be a formidable player in the sun care market. The company’s commitment to dermatologist-recommended products and broad-spectrum protection has solidified its reputation among health-conscious consumers. Innovations such as lightweight, non-greasy formulations cater to evolving consumer preferences.

Coty Inc. has diversified its portfolio to include sun care products under various brands. By leveraging its extensive brand portfolio and global reach, Coty addresses different market segments, from mass-market to premium consumers, offering a range of sun protection solutions.

Shiseido Co. Ltd., a leader in skincare innovation, integrates advanced technologies into its sun care products. The company’s research-driven approach results in formulations that provide effective UV protection while addressing specific skin concerns, appealing to consumers seeking multifunctional products.

L’Oréal maintains a robust presence in the sun care market through its diverse brand portfolio, including La Roche-Posay and Garnier. The company’s focus on scientific research and consumer education promotes the importance of sun protection, driving demand for its products across various demographics.

The Estée Lauder Companies Inc. offers sun care products through brands like Clinique and Estée Lauder. Positioned in the premium segment, these products emphasize skincare benefits alongside sun protection, catering to consumers seeking comprehensive skincare solutions.

Burt’s Bees, known for its natural and environmentally friendly products, extends its philosophy to sun care. The brand offers mineral-based sunscreens that appeal to eco-conscious consumers, aligning with the growing demand for clean beauty products.

Bioderma Laboratories focuses on dermatological expertise, providing sun care products suitable for sensitive skin. The company’s emphasis on skin health and safety resonates with consumers seeking gentle yet effective sun protection solutions.

Unilever, through brands like Dove and Vaseline, offers sun care products that combine affordability with quality. The company’s extensive distribution channels and strong brand recognition enable it to reach a broad consumer base, particularly in emerging markets.

Top Key Players in the Market

- Beiersdorf AG

- Groupe Clarins

- Johnson & Johnson

- Coty Inc.

- Shiseido Co. Ltd.

- L’oreal

- The Estee Lauder Companies Inc.

- Burt’s Bees

- Bioderma Laboratories

- Unilever

Recent Developments

- In 2024, Vuori, a Southern Californian performance lifestyle brand, secured an $825 million investment led by General Atlantic and Stripes. This secondary tender offer boosted Vuori’s valuation to $5.5 billion, reinforcing its leadership in the activewear market.

- In 2024, Sun Pharmaceutical Industries completed the merger of Taro Pharmaceutical Industries. With a deal value of $347.73 million, Sun Pharma now fully owns Taro, which has been delisted from the NYSE.

- In 2024, skincare brand REOME raised over £1.1 million in its first seed round, led by Rianta Capital. The funds will support its expansion in domestic and international markets.

- In 2023, Shiseido Company, Limited, announced the acquisition of DDG Skincare Holdings LLC. The deal enhances Shiseido’s portfolio with DDG’s dermatologist-led, science-based skincare products.

- In 2024, Yellow Wood Partners announced that Suave Brands Company will acquire the ChapStick brand from Haleon. The transaction is expected to close in the first half of 2024.

- In February 2024, Gryphon Investors finalized the sale of RoC Skincare to Bridgepoint Europe VII. Financial details of the transaction were not disclosed.

Report Scope

Report Features Description Market Value (2023) USD 19.9 Bn Forecast Revenue (2033) USD 13.2 Bn CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sun-protection, After-sun, Tanning), By Form (Lotion, Spray, Stick, Others), By SPF (0-29, 30-50, >50), Distribution Channel (Hypermarket and supermarket, Pharmacy and drug store, Specialty store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Beiersdorf AG, Groupe Clarins, Johnson & Johnson, Coty Inc., Shiseido Co. Ltd., L’oreal, The Estee Lauder Companies Inc., Burt’s Bees, Bioderma Laboratories, Unilever Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Beiersdorf AG

- Groupe Clarins

- Johnson & Johnson

- Coty Inc.

- Shiseido Co. Ltd.

- L'oreal

- The Estee Lauder Companies Inc.

- Burt's Bees

- Bioderma Laboratories

- Unilever