Global Luxury Skincare Market By Ingredient (Natural, Synthetic, Organic), By Product (Creams, Lotions, Serums, Oils, Masks, Others), By Distribution Channel (Online Retail, Specialty Stores, Departmental Stores, Others), By End-User (Women, Men, Unisex), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138195

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

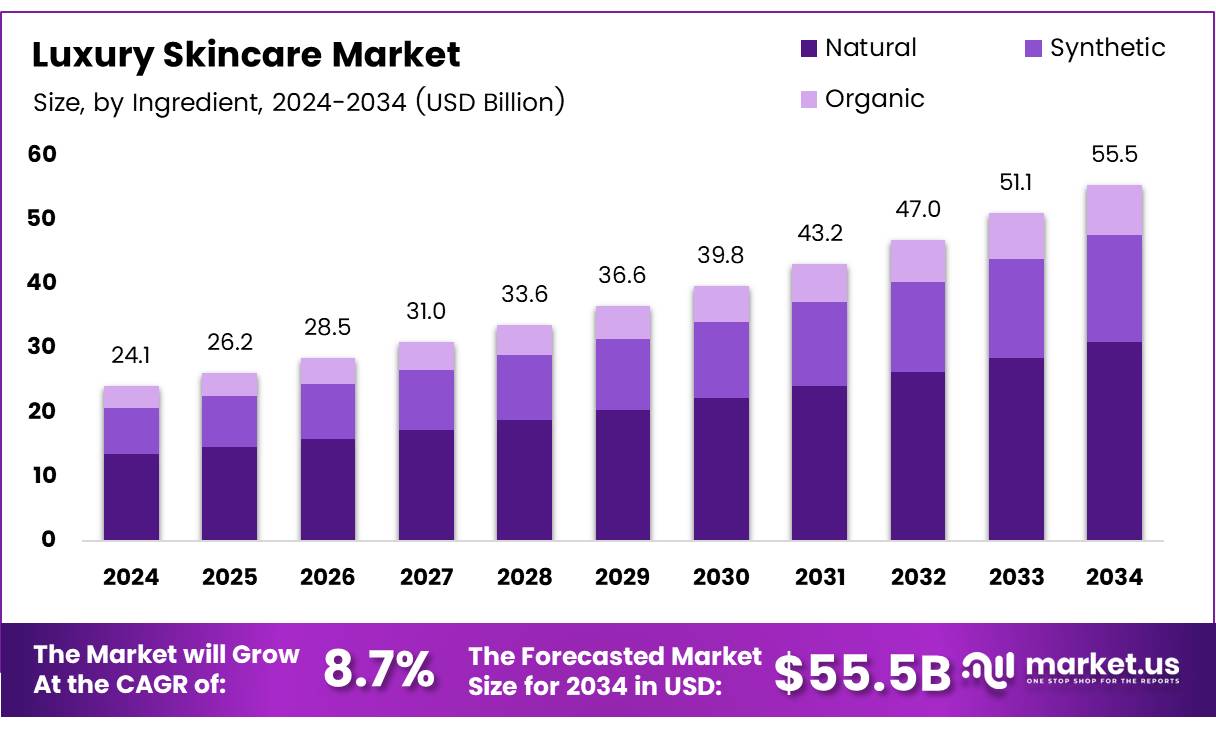

The Global Luxury Skincare Market size is expected to be worth around USD 55.5 Billion by 2034, from USD 24.1 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

Luxury skincare refers to high-end, premium beauty products designed to provide superior results using high-quality ingredients, advanced formulations, and unique textures. These products often target specific skin concerns such as aging, pigmentation, and hydration, combining efficacy with indulgent experiences.

The luxury skincare market represents a niche within the broader beauty and skincare industry, focusing on high-end products that cater to a wealthy consumer base. It is characterized by substantial price points, high-quality ingredients, and exceptional product performance.

Over the last decade, this market has experienced robust growth driven by increasing disposable incomes, a shift in consumer preferences towards premium products, and heightened awareness of skin health and self-care.

According to Market.us Media, 70% of consumers use facial moisturizers in their skincare routines, while sunscreen is regarded as an essential product, with 59% of consumers reporting regular use of sunscreen. The market is also heavily influenced by the growing trend towards natural, organic, and clean beauty products.

In fact, according to ExplodingTopics, 59% of consumers prefer natural or organic skincare products, and 54% actively seek skincare products with clean, transparent ingredient lists (according to ParisJC).

The luxury skincare market has witnessed exponential growth, driven by shifts in consumer behavior that prioritize quality, efficacy, and exclusivity. This market is benefiting from an increased demand for premium, science-backed skincare products, as consumers are increasingly looking for products that not only offer tangible results but also align with their ethical values.

Opportunities are abundant in the rising trends of eco-conscious and sustainable beauty, where brands that emphasize clean ingredients, eco-friendly packaging, and ethical sourcing are seeing rapid adoption. The market is also expanding with innovations in skincare technology, including personalized skincare solutions, anti-aging products, and more advanced formulations.

Government investment in the beauty and skincare industry, particularly in emerging markets, has provided an additional boost. Many countries are seeing the luxury skincare sector as a promising area for growth and are offering incentives for brands to innovate and expand. However, this growth is accompanied by stricter regulations governing product ingredients, manufacturing practices, and advertising claims.

Key Takeaways

- Global luxury skincare market is expected to reach USD 55.5 Billion by 2034, growing at a CAGR of 8.7%.

- Natural ingredients dominate the market due to demand for eco-friendly and skin-friendly products.

- Creams are the leading product type, favored for their moisturizing and anti-aging benefits.

- Online retail is the dominant distribution channel, driven by convenience and competitive pricing.

- North America holds the largest market share, driven by high disposable income and demand for premium skincare.

Ingredient Analysis

Natural Ingredients Lead the Luxury Skincare Market, Capturing a Dominant Share in 2024

In 2024, natural ingredients held a dominant market position in the By Ingredient Analysis segment of the luxury skincare market. This dominance is largely attributed to increasing consumer demand for products that are perceived as more eco-friendly, ethical, and skin-friendly.

The shift toward natural ingredients is driven by growing consumer awareness of sustainability, health benefits, and the desire for clean beauty products. Luxury skincare brands are increasingly incorporating natural extracts such as aloe vera, chamomile, and rosehip oil, which are renowned for their soothing and anti-aging properties.

Natural ingredients are seen as safer alternatives to synthetic chemicals, further fueling their popularity among health-conscious consumers. As a result, natural-based formulations have become synonymous with premium skincare offerings, and brands are capitalizing on this trend by aligning their products with wellness and environmental values.

Organic ingredients, while gaining traction, still represent a smaller portion of the market compared to natural options, due to their higher cost of production. However, as demand for ethically sourced and sustainable products continues to rise, natural ingredients are expected to maintain a strong foothold in the luxury skincare segment.

Product Analysis

Creams Lead the Luxury Skincare Market in 2024

In 2024, creams held a dominant market position in the By Product Analysis segment of the luxury skincare market. This segment has been driven by their exceptional moisturizing and anti-aging benefits, making creams a go-to choice for consumers seeking high-quality, long-lasting skincare solutions.

The thick texture and ability to deliver potent active ingredients have solidified their popularity, especially for those targeting specific concerns such as dryness, fine lines, and skin elasticity.

Lotions, offering lighter hydration with quicker absorption, have carved a niche but remain second to creams in terms of market share. Serums, known for their concentrated formulas, are gaining traction due to their precision in addressing skin issues like pigmentation and wrinkles.

Oils, often used for deeper nourishment, are favored by those with drier skin types or those seeking luxurious indulgence. Masks, typically seen as a more specialized treatment, continue to be a part of consumers’ routines for occasional pampering, while other niche products make up a smaller share of the market.

Together, these segments reflect a clear preference for multifunctional, highly effective skincare products among luxury consumers.

Distribution Channels Analysis

Online Retail Dominates Luxury Skincare Market Distribution Channels in 2024

In 2024, online retail held a dominant position in the luxury skincare market, leading the distribution channel segment. The growing trend of e-commerce shopping, fueled by consumer demand for convenience, variety, and competitive pricing, continues to drive the shift towards online platforms.

These platforms provide a seamless experience with personalized recommendations, easy access to reviews, and direct-to-consumer models, enhancing customer satisfaction and encouraging repeat purchases.

Specialty stores, which are key players in the premium skincare space, have maintained a strong presence, appealing to consumers seeking high-end, curated product offerings and expert consultations. Despite the rise of digital shopping, specialty stores continue to cater to a niche market segment that values the tactile, personalized shopping experience.

Department stores, once the dominant outlet for luxury skincare, have seen a decline in their market share, with more shoppers opting for the convenience and exclusivity of online channels or specialty retail outlets. Meanwhile, other channels, including pharmacies and luxury boutiques, hold a smaller share of the market, largely driven by specific consumer needs and geographic preferences.

Key Market Segments

By Ingredient

- Natural

- Synthetic

- Organic

By Product

- Creams

- Lotions

- Serums

- Oils

- Masks

- Others

By Distribution Channel

- Online Retail

- Specialty Stores

- Departmental Stores

- Others

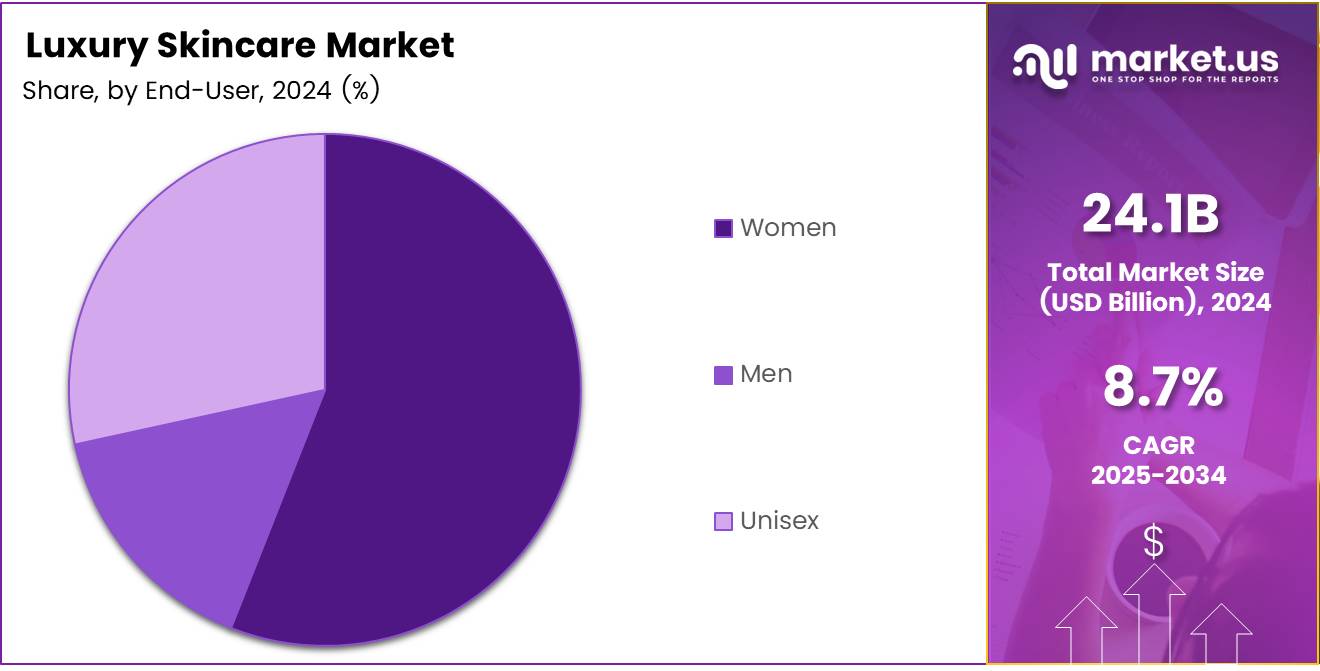

By End-User

- Women

- Men

- Unisex

Drivers

Increasing Disposable Income Boosts Demand for Luxury Skincare

As disposable income levels rise, many consumers are now able to allocate more of their budgets towards premium skincare products. This shift is especially evident in emerging markets, where a growing middle class is eager to invest in high-quality skincare solutions. Luxury skincare brands are benefiting from this trend, as consumers are more willing to pay a premium for products that promise superior results and ingredients.

Additionally, the rise in disposable income often leads to greater access to global markets, enabling consumers to explore international luxury skincare brands that were previously out of reach.

Alongside this, there has been an increase in the overall awareness surrounding skin health, with consumers becoming more educated on the long-term benefits of investing in high-end skincare. This knowledge has driven demand for specialized products, particularly those that offer anti-aging benefits.

High-end skincare brands, which often use advanced formulations and ingredients, are at the forefront of this movement. With more individuals prioritizing skincare as part of their self-care routines, luxury skincare has become a symbol of wellness and personal investment. As a result, the market continues to expand, driven by a combination of higher disposable incomes, greater consumer education, and an increasing desire for advanced anti-aging solutions.

Restraints

High Prices of Luxury Skincare Products Limit Market Expansion

One of the key restraints for the luxury skincare market is the high price of these products, which makes them inaccessible to a significant portion of potential consumers. Luxury skincare brands are often priced at a premium due to factors such as high-quality ingredients, exclusive packaging, and brand prestige.

This limits the market to a smaller, wealthier demographic, and many consumers are unable to justify spending large amounts on skincare, especially when more affordable alternatives are available.

Additionally, the rising cost of living and inflationary pressures can make consumers more cautious with their spending, making luxury products less attractive to the average buyer. Economic downturns also exacerbate this issue, as consumers tend to prioritize essential items and cut back on discretionary spending.

In these times, even those who typically purchase luxury skincare may re-evaluate their choices and opt for more budget-friendly options, further reducing the overall market potential. As a result, high prices and economic instability present significant challenges to the broader growth of the luxury skincare market, as brands must balance their premium pricing with changing consumer behaviors and shifting economic conditions.

Growth Factors

Expanding into Emerging Markets Presents a Major Growth Opportunity for Luxury Skincare Brands

The luxury skincare market has vast growth opportunities in emerging economies like India, China, and Brazil. As these countries experience rising disposable incomes and an expanding middle class, the demand for high-end skincare products is steadily increasing. With their growing interest in premium beauty and wellness, these regions present untapped markets that luxury skincare brands can capitalize on.

Brands that adapt their products to local preferences and skincare needs are well-positioned to thrive. Additionally, there is a rising trend of consumers seeking innovative solutions, such as personalized skincare routines, which can be an attractive offering for these markets.

The luxury segment is also benefiting from growing awareness of skincare health and self-care rituals in these regions, creating a significant potential for growth.

Furthermore, incorporating local ingredients and formulations that cater to specific regional skin concerns can further boost a brand’s appeal. With the right marketing strategies and distribution networks, luxury skincare brands can not only penetrate these emerging markets but also establish a loyal customer base, enhancing long-term growth prospects.

Emerging Trends

Clean Beauty Gaining Ground in Luxury Skincare

The luxury skincare market is experiencing a significant shift as consumers demand products with cleaner, more natural ingredients. Clean beauty, which emphasizes the use of organic and non-toxic materials, is becoming a key trend.

As concerns about harmful chemicals in beauty products grow, high-end brands are reformulating their products to align with this demand, often focusing on sustainability and ethical sourcing. This shift is not just about eliminating harmful substances; consumers are also looking for skincare that promotes long-term health and wellness.

Alongside clean beauty, the trend of holistic wellness is influencing the market, where skincare products go beyond physical benefits, incorporating elements that support mental and emotional well-being. Luxury brands are responding with offerings that promise more than just skin deep results, integrating calming, therapeutic ingredients like CBD or adaptogens. Another notable factor is the increasing demand for ingredient transparency.

Shoppers are becoming more educated and conscious of what goes into their skincare products, prompting luxury brands to disclose detailed ingredient lists and to ensure authenticity in their formulations.

These trends reflect a growing shift in consumer preferences towards products that align with their values, focusing on health, sustainability, and transparency, while also enhancing the luxurious experience that high-end skincare offers. As these preferences continue to evolve, luxury skincare brands are increasingly adopting these principles to maintain a competitive edge in a rapidly changing market.

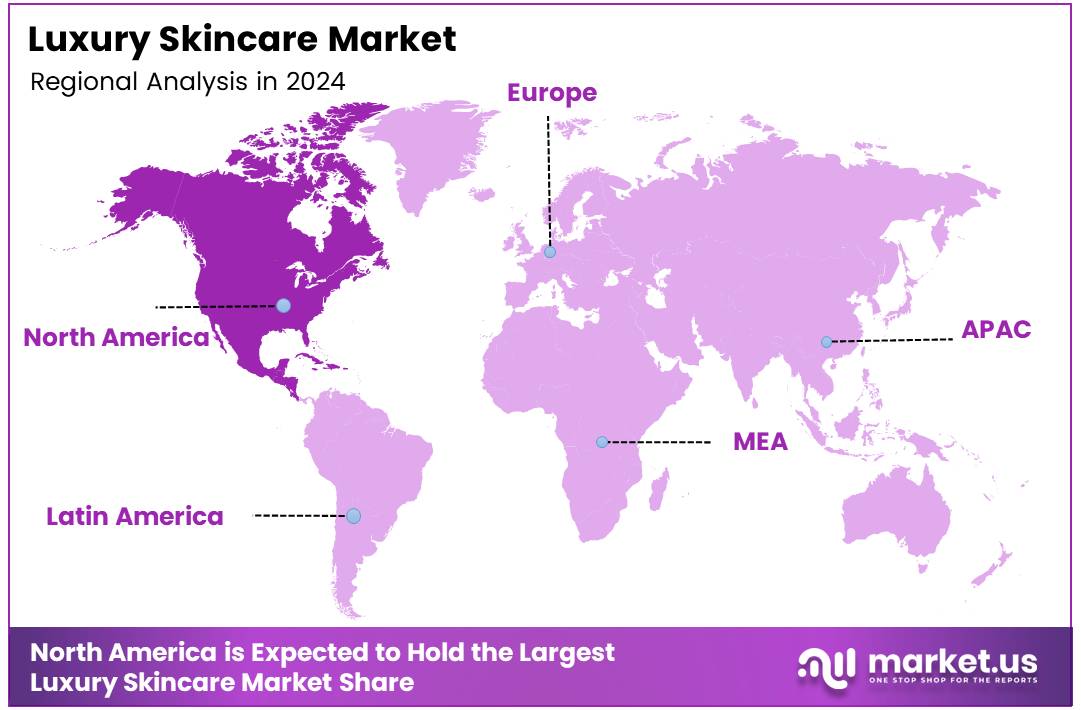

Regional Analysis

North America Leads the Luxury Skincare Market with High Consumer Demand

North America holds the dominant share of the global luxury skincare market, driven by a strong consumer base in the United States and Canada. The region benefits from high disposable income, an increasing preference for premium, personalized skincare products, and heightened awareness of anti-aging and wellness-focused solutions.

Key drivers in this region include a growing demand for clean beauty, sustainability, and transparency in ingredients. The robust presence of global luxury skincare brands and the advancement of e-commerce platforms further fuel market growth.

Regional Mentions:

Europe remains a significant market for luxury skincare, with countries like France, the United Kingdom, and Germany leading in consumer demand for high-end products. The region’s market is underpinned by a strong tradition of skincare, particularly in France and Italy, where luxury beauty brands have a rich history. European consumers increasingly prefer natural, organic, and eco-friendly ingredients, contributing to the popularity of clean beauty.

Asia Pacific, particularly China, Japan, and South Korea, has emerged as a high-growth region for luxury skincare. Rising disposable incomes, changing beauty standards, and a heightened interest in anti-aging products are major market drivers. Consumer preferences are increasingly leaning toward technologically advanced skincare products and formulations that address skin health.

The luxury skincare market in the Middle East and Africa is expanding rapidly, particularly within the Gulf Cooperation Council (GCC) countries, including Saudi Arabia, the UAE, and Qatar. Affluent consumers, a rising beauty consciousness, and the demand for premium products contribute significantly to market growth. The region is also supported by tourism, where visitors often seek luxury skincare products, creating additional demand.

In Latin America, the luxury skincare market is in the early stages but showing strong growth potential. Countries like Brazil and Mexico are leading the demand for premium skincare products, driven by a growing middle class and increasing disposable income. Urbanization and the influence of social media and beauty influencers also play a significant role in shaping purchasing decisions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global luxury skincare market in 2024 is poised for robust growth, driven by increasing consumer demand for premium products that offer advanced formulations, natural ingredients, and holistic skincare solutions. Among the leading players, established brands like P&G, Estee Lauder Companies, and LVMH continue to dominate, leveraging their strong market presence and innovative product offerings to capture a large share of the market.

P&G, with its broad portfolio across various skincare segments, focuses on integrating high-end technology and sustainability into its luxury skincare lines. By enhancing product efficacy and environmental responsibility, it appeals to an eco-conscious consumer base.

Estee Lauder, known for its high-performance skincare brands like La Mer, is at the forefront of luxury skincare, employing cutting-edge research and deep consumer insights to deliver effective anti-aging solutions and targeted skin treatments. The company’s strong focus on digital and direct-to-consumer strategies, especially in Asia, has helped to solidify its market position.

LVMH, a leader in luxury brands, integrates skincare into its broader beauty and fashion ecosystem, offering exclusive and high-quality skincare lines that resonate with high-net-worth individuals. Their commitment to luxurious experiences and premium ingredients continues to boost their appeal in the market.

Brands like Chanel, Coty, and AmorePacific maintain their competitive edge by combining heritage with innovation. Chanel focuses on exclusivity and prestige, while AmorePacific leverages cutting-edge Korean skincare formulations to tap into the rising demand for Asian beauty trends. Meanwhile, Natura Bissé has carved a niche in professional skincare and is known for its high-end treatments in spas and luxury skincare boutiques.

The competitive landscape remains dynamic, with these players constantly evolving to meet the growing desire for premium, efficacious skincare solutions.

Top Key Players in the Market

- P&G

- Avon

- LVMH

- Coty

- Chanel

- Estee Lauder Companies

- Natura Bissé

- Kose

- AmorePacific

Recent Developments

- In June 2024, skincare startup CHOSEN successfully raised $1.2 million in seed funding to enhance its product offerings and scale its operations in the competitive skincare market. The funding will support the brand’s growth initiatives and its expansion into new consumer segments.

- In January 2025, direct-to-consumer (D2C) skincare brand Foxtale raised $30 million in a Series C funding round to fuel its market expansion and bolster its product development. The funding will enable the brand to strengthen its position in the skincare industry, increasing its digital marketing efforts and retail partnerships.

- In July 2024, skincare brand SkinInspired secured $1.5 million in seed funding, led by Unilever Ventures, to accelerate its product innovation and expand its brand reach. The investment will support SkinInspired’s vision of offering science-backed, eco-conscious skincare solutions to a growing global audience.

- In January 2025, Foxtale closed an additional $30 million in Series C funding to expand its presence in the skincare market. The new capital will be used for strategic partnerships, enhanced customer engagement, and expansion into international markets to meet growing demand.

Report Scope

Report Features Description Market Value (2024) USD 24.1 Billion Forecast Revenue (2034) USD 55.5 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient (Natural, Synthetic, Organic), By Product (Creams, Lotions, Serums, Oils, Masks, Others), By Distribution Channel (Online Retail, Specialty Stores, Departmental Stores, Others), By End-User (Women, Men, Unisex) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape P&G, Avon, LVMH, Coty, Chanel, Estee Lauder Companies, Natura Bissé, Kose, AmorePacific Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- P&G

- Avon

- LVMH

- Coty

- Chanel

- Estee Lauder Companies

- Natura Bissé

- Kose

- AmorePacific