Global Luxury Hair Care Market By Product (Shampoos, Conditioners, Hair Coloring Products, Hair Styling Products, Hair Oil, Others), By Price Range (USD 30 to USD 65, USD 65 to USD 100, USD 100 to USD 150, USD 150 to USD 200, Above USD 200), By Delivery Mode (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133955

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

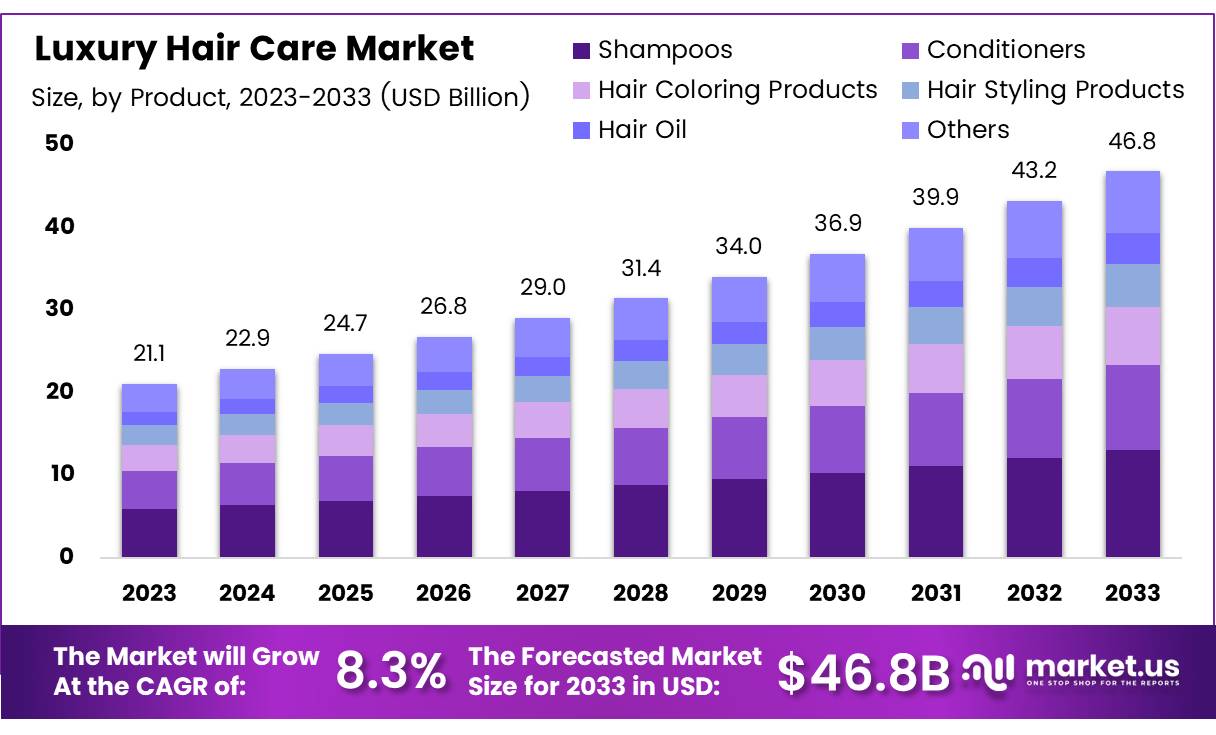

The Global Luxury Hair Care Market size is expected to be worth around USD 46.8 Billion by 2033, from USD 21.1 Billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2024 to 2033.

Luxury hair care refers to high-end products designed for consumers who seek superior quality, effectiveness, and indulgence in their hair care routines. These products often feature advanced formulations and premium ingredients, offering benefits such as improved hair health, shine, and texture.

They typically include shampoos, conditioners, masks, serums, and styling products tailored to different hair types or specific concerns, like anti-aging, frizz control, or hair loss.

The luxury hair care market, a segment of the broader beauty and personal care industry, has been growing rapidly. This growth is driven by rising disposable incomes, increasing awareness of hair health, and a growing demand for personalized beauty products.

Consumers are becoming more discerning in their purchasing decisions, prioritizing quality and efficacy over quantity. According to Poweryourcurls, 21.8% of consumers’ beauty budgets are now allocated to hair care, reflecting the sector’s increasing importance within the overall beauty industry.

North America, particularly the United States, is a key region for luxury hair care. U.S. sales are projected to reach $13.6 billion in 2024, driven by strong consumer demand for premium hair care solutions. This growth is also supported by a broader trend toward premiumization in the beauty industry, with more consumers opting for high-quality products rather than mass-market alternatives.

A significant trend within the luxury hair care market is the growing preference for natural, vegan, and cruelty-free products. About 22% of hair care products are now considered vegan, aligning with the rising consumer demand for ethical and sustainable beauty solutions.

Government investments and regulations in the beauty industry are further supporting market growth. Policies aimed at sustainability, such as incentives for eco-friendly packaging and the development of sustainable ingredients, offer opportunities for luxury brands to meet evolving consumer expectations.

Consumer spending is increasingly influenced by preferences for products that offer both aesthetic benefits and long-term solutions, such as anti-aging products and hair restoration treatments. The demand for these specialized products provides lucrative opportunities for luxury brands to innovate in areas like hair thinning treatments, further driving market growth.

Key Takeaways

- The global luxury hair care market is expected to grow from USD 21.1 billion in 2023 to USD 46.8 billion by 2033, at a CAGR of 8.3%.

- Shampoos lead the market with a 30.8% share, driven by demand for premium formulations offering hair nourishment and protection.

- The USD 30 to USD 65 price range dominates the market, accounting for 40.5% of the segment, due to a demand for quality and affordability.

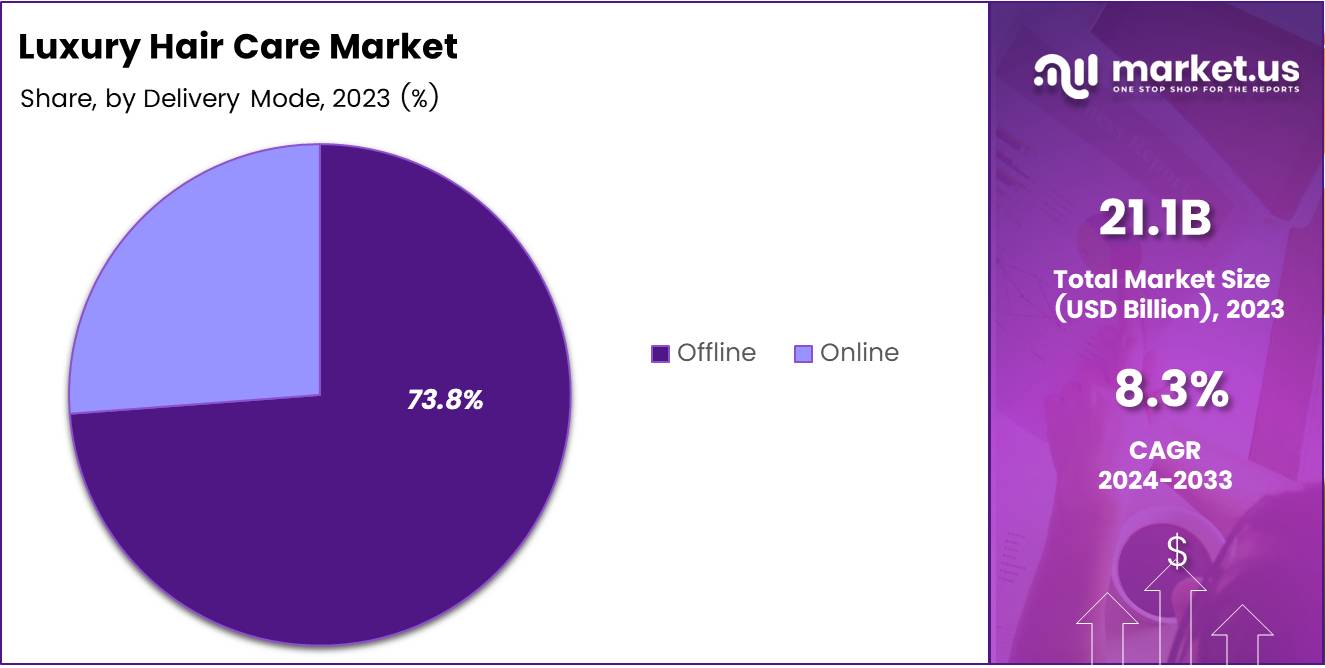

- Offline sales hold a dominant 73.8% share in the market, driven by consumers’ preference for the tactile shopping experience.

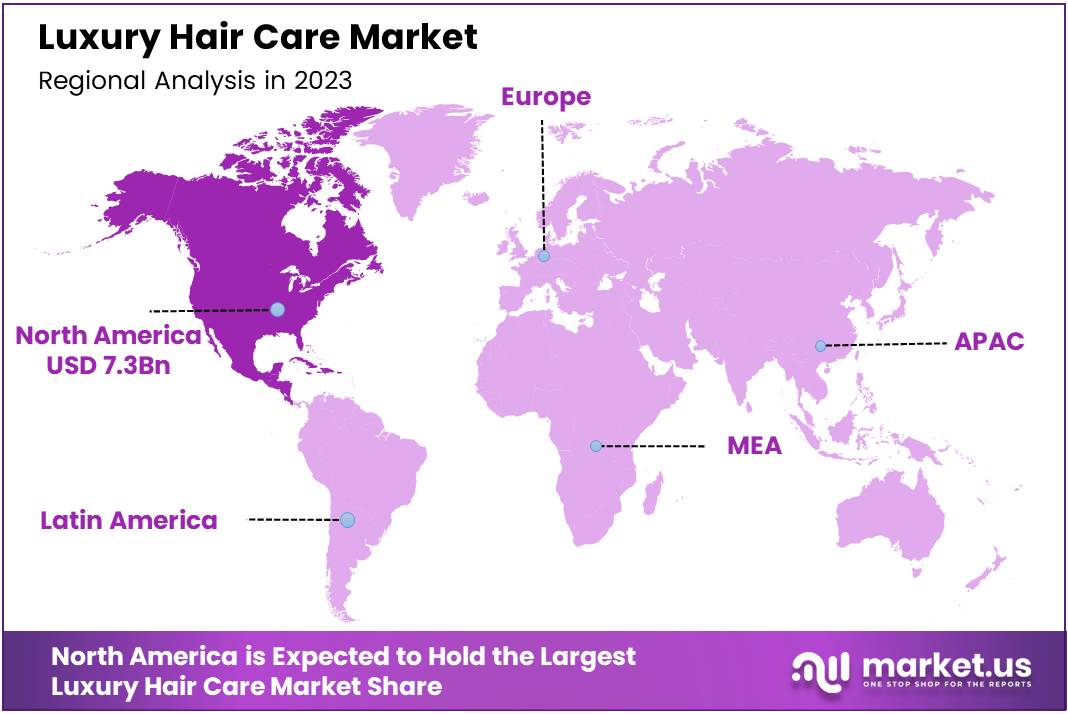

- North America leads the market with a 35% share, valued at USD 7.3 billion, fueled by strong purchasing power and a preference for organic products.

Product Analysis

Shampoos Lead the Luxury Hair Care Market with 30.8% Share in 2023

In 2023, shampoos held a dominant market position in the By Product Analysis segment of the luxury hair care market, with a 30.8% share. This category’s strong performance can be attributed to increasing consumer demand for premium formulations that offer enhanced hair health benefits, such as nourishment, repair, and protection. The growing preference for sulfate-free and natural ingredient-based shampoos is further contributing to the category’s expansion.

Conditioners followed closely, capturing a significant share of the market. As consumers increasingly seek comprehensive hair care routines, conditioners have become an essential complement to shampoos, contributing to their widespread use in both professional and at-home settings.

Hair coloring products(Natural Hair Dye) have also shown steady growth, driven by a rise in personal grooming and a growing trend for customized, vibrant shades. Meanwhile, hair styling products, including gels, creams, and sprays, are gaining traction as consumers invest in long-lasting, high-performance products to achieve specific hair looks.

Hair oils continue to maintain a strong presence in the luxury segment, particularly among consumers seeking natural and nourishing treatments for dry or damaged hair. The Others category includes specialized treatments and serums, which have also gained consumer interest as targeted solutions for various hair concerns.

Price Range Analysis

USD 30 to USD 65 Dominates Luxury Hair Care in 2023

In 2023, the price range of USD 30 to USD 65 held a dominant market position in the By Price Range Analysis segment of the luxury hair care market, with a 40.5% share. This range represents the largest portion of the market, driven by consumer demand for high-quality hair care products that offer a balance of premium ingredients and affordability.

Consumers in this price bracket seek products that combine efficacy with perceived luxury, often opting for salon-grade formulations or brand names with strong reputations for performance.

The USD 65 to USD 100 price range followed closely, capturing a significant portion of the market share. Products within this range typically offer advanced formulations, with added benefits such as anti-aging properties or specialized ingredients for particular hair concerns.

The USD 100 to USD 150 range continues to grow as consumers with higher disposable incomes are increasingly investing in professional-grade products. Meanwhile, the USD 150 to USD 200 range and the above USD 200 segment represent niche markets catering to the ultra-premium end, where exclusivity, luxury, and innovation in ingredients are key selling points.

These high-end price ranges appeal to a small but affluent consumer base, seeking the finest formulations and cutting-edge hair care technologies.

Delivery Mode Analysis

Offline Delivery Mode Dominates Luxury Hair Care Market in 2023

In 2023, Offline held a dominant market position in the By Delivery Mode Analysis segment of the Luxury Hair Care Market, with a 73.8% share. The preference for offline purchasing in the luxury segment is driven by the tactile experience it offers—customers can physically evaluate the products, sample fragrances, and interact with knowledgeable staff.

High-end department stores, luxury salons, and specialty beauty boutiques remain the primary channels for luxury hair care products, providing consumers with a premium, personalized shopping experience that fosters brand loyalty.

Despite the growth of e-commerce platforms, offline retail continues to hold sway in the luxury sector. The sensory elements of hair care products, along with the desire for expert recommendations, encourage shoppers to visit brick-and-mortar stores.

Additionally, in-store promotions and the ability to engage directly with products remain strong drivers of offline sales in the luxury hair care market. While online retail is gradually increasing, especially with the rise of direct-to-consumer brands, offline retail continues to dominate due to its ability to deliver a more immersive and confident purchasing experience for luxury customers.

Key Market Segments

By Product

- Shampoos

- Conditioners

- Hair Coloring Products

- Hair Styling Products

- Hair Oil

- Others

By Price Range

- USD 30 to USD 65

- USD 65 to USD 100

- USD 100 to USD 150

- USD 150 to USD 200

- Above USD 200

By Delivery Mode

- Offline

- Online

Drivers

Key Drivers of Growth in the Luxury Hair Care Market

The luxury hair care market is experiencing notable growth, driven by several factors that reflect changing consumer preferences and market dynamics. One of the key drivers is the growing consumer awareness of hair and scalp health. With more consumers prioritizing their well-being, there is a heightened demand for specialized products that offer solutions for various hair concerns such as dryness, thinning, and scalp irritation.

As a result, high-quality, premium hair care products are increasingly sought after. Another significant trend is the shift toward natural and organic ingredients in hair care formulations.

Consumers are becoming more conscious of the potential harm caused by synthetic chemicals, leading them to prefer products made with natural or sustainably sourced ingredients. This shift is particularly evident in the luxury segment, where consumers expect both efficacy and purity in their hair care choices.

Furthermore, celebrity endorsements and the influence of social media have become powerful catalysts in driving consumer interest in premium products. Social media platforms, particularly Instagram and TikTok, have amplified the visibility of luxury hair care brands, with influencers and celebrities showcasing their personal experiences with high-end hair treatments.

This trend has contributed to a growing consumer base, as individuals seek to replicate the beauty routines of their favorite public figures. Together, these factors are creating a dynamic market environment, fueling both demand and innovation in the luxury hair care sector.

Restraints

Economic Uncertainty & Counterfeit Products as Barriers to Market Growth

The luxury hair care market faces several constraints that can hinder its growth potential. One of the primary challenges is economic uncertainty, which affects consumer spending habits. During periods of economic downturn or recession, discretionary spending tends to decrease, and luxury items, including high-end hair care products, are often viewed as non-essential. This shift in consumer priorities leads to reduced demand, impacting overall market growth.

Additionally, the rise of counterfeit products is another significant issue. Fake luxury hair care items flood the market, often sold at lower prices, which can confuse consumers and harm the reputation of established luxury brands. Counterfeiting not only leads to financial losses for legitimate companies but also erodes consumer trust in the authenticity and quality of premium products.

As consumers become more cautious, they may hesitate to purchase expensive hair care products due to fears of being deceived by imitations. The combined effect of these challenges could slow down the expected growth of the luxury hair care market, as both economic conditions and brand integrity are key drivers of consumer purchasing decisions. Addressing these issues will be crucial for companies looking to maintain consumer confidence and safeguard market share in an increasingly competitive environment.

Growth Factors

Growth Opportunities in the Luxury Hair Care Market

The luxury hair care market is poised for growth through several key opportunities. One of the most significant drivers is the introduction of personalized hair care solutions. With increasing consumer interest in products tailored to individual needs, luxury brands can create customized offerings based on hair type, concerns, and personal preferences. This trend toward personalization not only meets rising demand for specialized products but also strengthens customer loyalty.

Additionally, product diversification presents a substantial growth avenue. By expanding into specialized treatments, such as anti-hair loss products, intensive hair repair treatments, or scalp care solutions, luxury brands can attract a broader customer base, appealing to consumers seeking targeted results.

Moreover, partnerships and collaborations with premium salons offer another promising growth opportunity. These collaborations can significantly enhance brand visibility and credibility, as high-end beauty professionals often serve as trusted influencers in the industry.

By aligning with top-tier salons, luxury hair care brands can gain access to a more discerning clientele, which is increasingly looking for expertise-backed and high-quality solutions. These strategies, when combined, position luxury hair care brands to leverage current market trends and meet evolving consumer expectations for quality, personalization, and professional endorsement.

Emerging Trends

Key Trends Shaping the Luxury Hair Care Market

The luxury hair care market is experiencing significant shifts driven by evolving consumer preferences and an increased focus on self-care. One notable trend is the growing demand for luxury spa treatments at home, with consumers seeking to replicate salon-quality experiences using premium hair masks, serums, and oils. This demand is being fueled by both the convenience of at-home treatments and a heightened desire for indulgence.

Alongside this, there is a clear shift towards vegan and cruelty-free products, as consumers increasingly prioritize sustainability and ethical considerations in their purchasing decisions. The luxury hair care sector has responded with a range of high-end, plant-based products that cater to this conscientious consumer base.

Another important trend is the rise of anti-pollution hair care, as environmental concerns, such as exposure to pollution and UV damage, have led to an uptick in demand for products designed to protect and repair hair. These products, often enriched with antioxidants and other protective ingredients, appeal to affluent consumers who are particularly concerned with the long-term health of their hair.

Collectively, these trends are shaping the luxury hair care market, with brands adjusting their offerings to meet the growing demand for both performance and ethical responsibility. As consumer awareness of environmental and social issues grows, these factors are likely to continue driving innovation in the sector.

Regional Analysis

North America Dominating the Luxury Hair Care Market with USD 7.3 Billion (35% Market Share)

The luxury hair care market is experiencing dynamic growth across various regions, with North America, Europe, and the Asia Pacific emerging as key contributors to market expansion.

North America dominates the global luxury hair care market, holding a substantial market share of approximately 35%, valued at USD 7.3 billion. This dominance is attributed to the region’s strong purchasing power, high consumer demand for premium products, and a growing preference for organic and natural hair care formulations.

Regional Mentions:

Europe holds the second-largest market share, with strong demand for luxury hair care products driven by established beauty and personal care industries. The European market is particularly influenced by the growing trend of sustainability and ethical consumption, with consumers in countries like France, Germany, and the UK showing a preference for eco-friendly, high-quality hair care products.

In Asia Pacific, the market is expanding rapidly due to rising disposable incomes, urbanization, and the increasing influence of Western beauty standards. With countries such as China, Japan, and South Korea leading the charge, there is a growing demand for premium hair care solutions, particularly in the urban centers. The market in this region is also witnessing a shift toward personalized and salon-quality products, as well as a rising inclination towards luxury hair treatments.

Middle East & Africa and Latin America are smaller but promising markets, with a growing inclination towards high-end beauty products driven by increasing consumer awareness and a burgeoning middle class. While these regions currently contribute a smaller percentage to the global market, their growth potential remains significant, especially in the luxury hair care segment, as consumer spending power continues to rise.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global luxury hair care market is characterized by robust competition and innovation, with several key players maintaining a significant share. Companies such as L’Oréal Groupe, KOSÉ Corporation, and Estée Lauder Companies continue to dominate through their strong brand equity, extensive product portfolios, and deep investments in research and development (R&D).

L’Oréal Groupe remains a market leader, leveraging its diverse range of high-end brands like Kérastase and Matrix to cater to a wide demographic of affluent consumers. The company’s emphasis on sustainability and innovation in product formulations is also a critical factor driving its growth.

KOSÉ Corporation, with its luxury brands such as Sensai, is capitalizing on the rising consumer demand for products with premium ingredients and eco-friendly packaging. The company’s strong presence in the Asia-Pacific region also positions it favorably in the global market.

Estée Lauder Companies, with brands like Aveda, is leveraging its reputation for natural and organic formulations to meet the growing demand for clean herbal beauty products in the luxury hair care space. RAHUA and KEVIN.MURPHY, both recognized for their commitment to sustainable sourcing and environmental responsibility, are gaining traction, especially among eco-conscious consumers.

Smaller but influential players such as Jose Eber, SEVEN, LLC, and Alcora Corporation are carving niches in premium hair care, with a focus on personalized and high-performance products. As the market trends toward sustainability and clean beauty, these brands are likely to experience sustained growth.

Top Key Players in the Market

- L’Oréal Groupe

- KOSÉ Corporation

- Jose Eber

- PHILIP KINGSLEY PRODUCTS LTD.

- EstéeLauder Companies, Inc.

- RAHUA

- KEVIN.MURPHY

- SEVEN, LLC

- Alcora Corporation

- Kao Corporation

Recent Developments

- In September 2024, SEEN, the award-winning haircare brand developed by dermatologist Iris Rubin, MD, secured $9 million in Series A funding to further its product development and expand market reach.

- In January 2024, Jupiter, a hair and scalp care brand, raised $3 million in a funding round to support the growth and innovation of its hair health solutions.

- In August 2024, Great Many, a company focused on accessible hair growth solutions, successfully raised $3.6 million in pre-seed funding to enhance its product offerings and market presence.

- In September 2024, Copenhagen-based Scandinavian Biolabs secured €4 million in funding to expand its hair-loss products across the European market.

Report Scope

Report Features Description Market Value (2023) USD 21.1 Billion Forecast Revenue (2033) USD 46.8 Billion CAGR (2024-2033) 8.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Shampoos, Conditioners, Hair Coloring Products, Hair Styling Products, Hair Oil, Others), By Price Range (USD 30 to USD 65, USD 65 to USD 100, USD 100 to USD 150, USD 150 to USD 200, Above USD 200), By Delivery Mode (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L’Oréal Groupe, KOSÉ Corporation, Jose Eber, PHILIP KINGSLEY PRODUCTS LTD., EstéeLauder Companies, Inc., RAHUA, KEVIN.MURPHY, SEVEN, LLC, Alcora Corporation, Kao Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L’Oréal Groupe

- KOSÉ Corporation

- Jose Eber

- PHILIP KINGSLEY PRODUCTS LTD.

- EstéeLauder Companies, Inc.

- RAHUA

- KEVIN.MURPHY

- SEVEN, LLC

- Alcora Corporation

- Kao Corporation