Global Men's Personal Care Market By Product (Skin Care, Hair Care, Personal Grooming), By Distribution Channel (Hypermarkets and Supermarkets, Pharmacy and Drugstores, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137219

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Men’s Personal Care Market size is expected to be worth around USD 77.9 Billion by 2034, from USD 33.2 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The men’s personal care market includes a wide range of products and services designed to address men’s grooming, skincare, and hygiene needs. This market includes items such as moisturizers, face washes, hair care products, shaving creams, deodorants, and fragrances.

These products are specially formulated to meet the distinct requirements of male skin and hair, reflecting the growing demand for personalized grooming solutions.

In recent years, there has been a significant shift in consumer behavior, with more men seeking specialized products for their grooming routines. The trend towards self-care, along with an increased awareness of skincare and personal hygiene, has led to an expansion of the market. As societal norms evolve, grooming and personal care are increasingly seen as essential for men of all ages.

The men’s personal care industry has evolved into a multi-billion-dollar market, driven by factors such as rising disposable income, changing attitudes toward masculinity, and increased availability of tailored products.

Men’s skincare, in particular, has experienced substantial growth, with many brands launching men-specific product lines to cater to this demand. The market is expected to continue expanding as more consumers embrace grooming routines.

Younger male demographics, particularly Generation Z, are becoming more conscious of their grooming habits. According to Study, nearly 70% of Gen Z men in the U.S. used facial skincare products in 2024.

Products such as moisturizers, day/night creams, and lotions accounted for over 40% of male skincare usage in 2023, indicating a clear preference for maintaining healthy skin. Additionally, men are increasingly spending more time on their grooming routines, with data from Geehair showing they spend an average of 37 minutes per day on hair care.

The demand for hair care products tailored specifically for men is also on the rise. In 2023, 45% of Gen Z males adopted hair care routines, highlighting the untapped potential in this segment. This increasing focus on grooming and self-care, coupled with higher disposable incomes, provides significant opportunities for companies in the men’s personal care market.

Governments are recognizing the economic importance of the personal care sector, with some countries introducing favorable regulations to encourage product development and consumer engagement.

At the same time, stricter health and safety regulations are helping improve product quality and consumer trust, which can drive market growth.

e-commerce platforms and social media, have also played a crucial role in expanding the market. With more consumers searching for men’s skincare products online, brands are leveraging these channels to connect with customers and offer personalized grooming solutions.

The surge in interest during the 2023 holiday season exemplifies the growing readiness of consumers to invest in men’s personal care products.

Key Takeaways

- The Global Men’s Personal Care Market is projected to reach USD 77.9 billion by 2034, expanding at a CAGR of 8.9% from 2024 to 2034.

- Skin Care dominated the product segment in 2023, holding a 46.3% share, propelled by increased focus on men’s skincare routines and health.

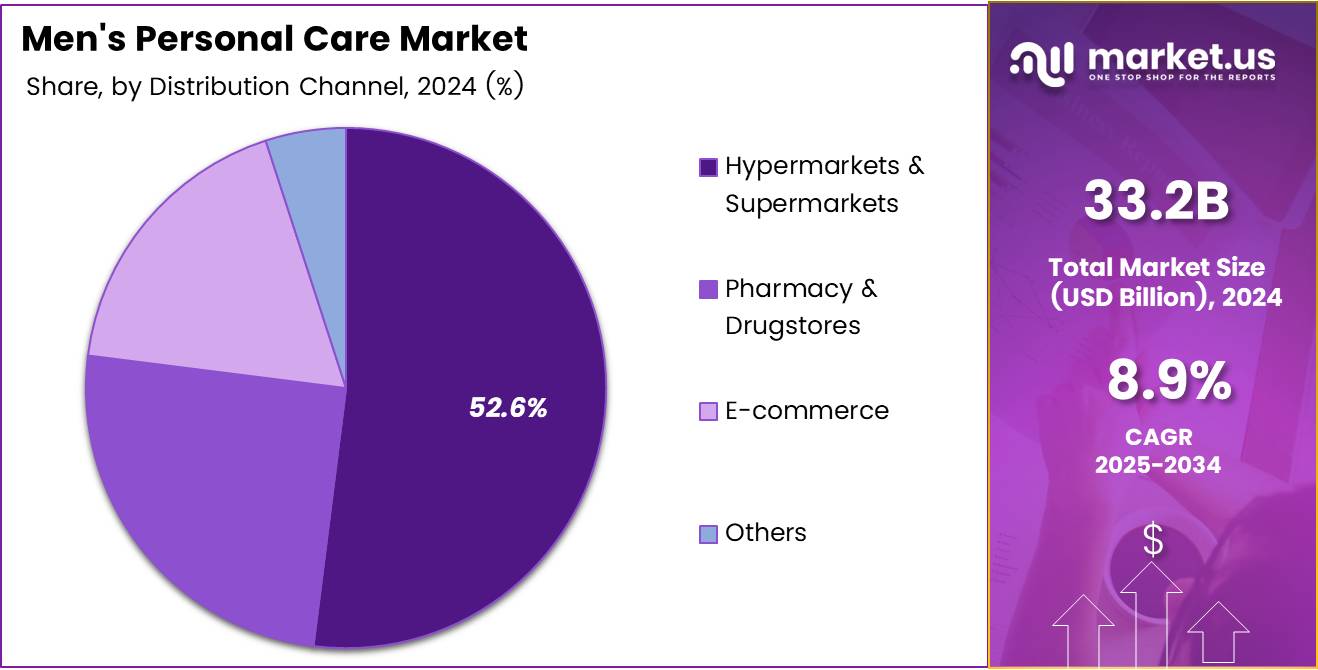

- Hypermarkets & Supermarkets were the leading distribution channel in 2023, with a 52.6% market share.

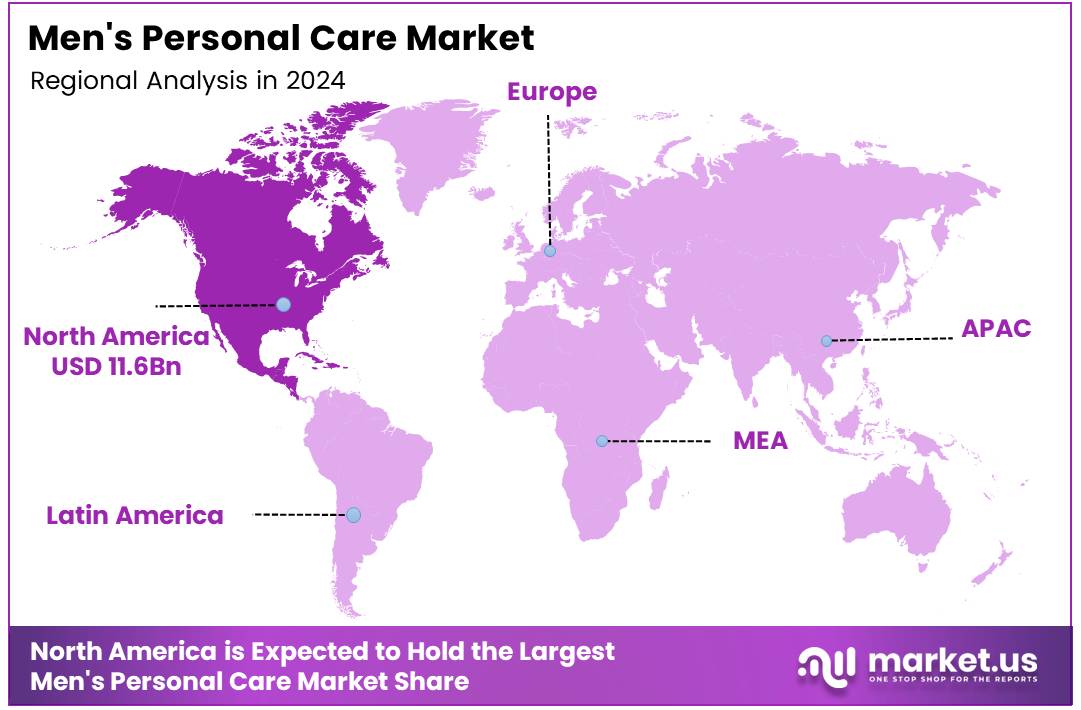

- North America led the regional market in 2023, representing 35.6% of the global market at USD 11.6 billion.

Product Analysis

Skin Care Leads the Men’s Personal Care Market in 2023

In 2023, Skin Care held a dominant market position in the By Product Analysis segment of the Men’s Personal Care Market, with a 46.3% share. This growth can be attributed to the increasing focus on skincare routines and the rising awareness of skin health among men.

Products such as moisturizers, cleansers, and anti-aging solutions are gaining popularity, driven by shifting consumer behaviors toward self-care and appearance improvement.

The Shampoo segment remains a key player in the market, with growing interest in products targeting specific hair concerns such as dandruff, hair thinning, and scalp health. The trend toward specialized and premium shampoos, particularly among younger male consumers, indicates a strong future for this segment.

Personal Grooming, which includes products like shaving creams, trimmers, and beard oils, is also seeing a rise in demand, propelled by the growing popularity of beard grooming and at-home grooming routines.

This shift reflects broader changes in male grooming habits, with an increasing number of men seeking personalized care solutions. These trends highlight the evolving landscape of men’s personal care, with a notable emphasis on both skincare and grooming.

Distribution Channel Analysis

Hypermarkets & Supermarkets Lead Men’s Personal Care Market Distribution Channels with 52.6% Share in 2023

In 2023, Hypermarkets & Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Men’s Personal Care Market, with a 52.6% share.

This segment’s growth can be attributed to the wide variety of products offered in these retail settings, along with the convenience of in-store shopping. Hypermarkets and supermarkets are favored for their expansive product ranges, competitive pricing, and accessibility, making them a go-to option for male consumers seeking personal care products.

Pharmacy & Drugstores, while second in market share, also played a key role in the distribution of men’s personal care items, capturing a significant portion of the market. These outlets are preferred for their specialized products, including grooming essentials and healthcare-oriented items, which cater to the health-conscious consumer.

E-commerce has emerged as a growing channel, especially with the rise in online shopping. In 2023, e-commerce contributed a notable share to the market, driven by the convenience of home delivery and the increasing trend toward digital shopping experiences.

Other distribution channels, including specialty stores and direct-to-consumer services, hold a smaller but expanding role, serving niche markets with tailored product offerings. The diversified approach to distribution channels ensures broad access to men’s personal care products across varying consumer preferences.

Key Market Segments

By Product

- Skin Care

- Face Care

- Body Care

- Hair Care

- Shampoo

- Conditioners

- Others

- Personal Grooming

- Shaving Cream &Gel

- After Shave Lotion

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy & Drugstores

- E-commerce

- Others

Drivers

Growing Awareness and Changing Attitudes Drive Men’s Personal Care Market

The men’s personal care market is experiencing significant growth, fueled by a variety of key drivers. One of the primary factors is the increasing awareness surrounding male grooming and personal appearance.

Men are more conscious of their looks than ever before, which has led to greater demand for a wide range of grooming products.

Alongside this, rising disposable incomes in emerging economies are enabling consumers to spend more on personal care items. As financial conditions improve, men are investing in premium products that cater to their grooming and self-care needs.

Additionally, the influence of social media has been crucial in shaping new trends. Platforms like Instagram, YouTube, and TikTok have introduced grooming routines and beauty standards, encouraging men to take more interest in skincare and grooming products.

Finally, there has been a cultural shift in attitudes towards male beauty and self-care. Society’s evolving perception of masculinity has made it more acceptable for men to indulge in beauty and personal care routines.

This transformation has expanded the market for products such as skincare, hair care, and fragrances. As these factors continue to evolve, the men’s personal care market is expected to see sustained growth and further product diversification in the coming years.

Restraints

High Price Point and Limited Awareness Restricting Market Growth

The men’s personal care market faces challenges due to the high price point of premium products and limited awareness in certain regions. Premium personal care products, often featuring advanced formulations and high-quality ingredients, are priced significantly higher than mass-market alternatives. This pricing creates a barrier for consumers in price-sensitive regions, limiting their ability to adopt such products.

Additionally, in several regions, the concept of men’s grooming and personal care is still in its early stages. Cultural perceptions and traditional gender norms often lead to a lack of awareness about the importance of personal care among men.

As a result, product penetration remains low in these areas. This limited understanding, combined with high prices, narrows the market’s growth potential, particularly in emerging economies where disposable income levels and education about such products are still developing.

To overcome these restraints, companies may need to focus on affordability, targeted education campaigns, and localized marketing strategies to ensure broader accessibility and acceptance of men’s personal care products.

Growth Factors

Unlocking Growth Opportunities in Men’s Personal Care Market

The men’s personal care market is poised for expansion, driven by several promising opportunities. One key growth avenue lies in emerging economies, particularly in Asia-Pacific and Latin America, where the rising middle class is increasing its spending on grooming products.

Moreover, the rapid growth of e-commerce allows brands to connect with a wider audience through online platforms, enhancing accessibility and personalized customer engagement. Additionally, the growing preference for natural and eco-friendly products offers room for innovation. Brands introducing grooming solutions with sustainable ingredients can cater to environmentally conscious consumers.

Another promising trend is the rise of subscription-based models, enabling customers to conveniently receive grooming kits or products at regular intervals, fostering brand loyalty and consistent revenue streams.

Together, these factors highlight significant opportunities for brands to diversify offerings, strengthen their presence in untapped markets, and align with evolving consumer preferences in the global men’s personal care industry.

Emerging Trends

Rising Demand for Men’s Personal Care Products

The men’s personal care market has experienced significant growth, driven by changing perceptions about masculinity and self-care. One of the most prominent trends is the rise of male skincare products, including cleansers, moisturizers, and anti-aging creams.

This shift is partly due to a growing awareness among men about the importance of skincare in maintaining healthy, youthful skin. Additionally, the popularity of beard styles has led to an increase in demand for beard care products such as oils, shampoos, and conditioners.

As more men embrace facial hair, these specialized grooming items have become essential in daily routines. Another key trend is the shift toward personalized grooming regimens. Many brands now offer customized kits and routines, tailored to meet the specific needs of individual consumers, which has significantly increased customer engagement.

Alongside these trends, there is also a rising focus on wellness. More personal care products are being marketed not just for appearance but for their health benefits, emphasizing natural ingredients and promoting overall well-being.

This wellness-centric approach is appealing to an increasing number of consumers who seek products that align with a more holistic approach to self-care. Together, these factors indicate a robust and evolving market with growing opportunities for brands that can meet the diverse needs of today’s male consumers.

Regional Analysis

North America Leads the Men’s Personal Care Market with 35.6% Share at USD 11.6 Billion

The global men’s personal care market exhibits distinct regional dynamics, shaped by varying consumer behaviors, economic factors, and cultural trends. North America is the leading region, accounting for 35.6% of the market, valued at USD 11.6 billion.

The region’s dominance is driven by a strong preference for premium grooming products, particularly in the United States and Canada, where male grooming routines are well-established. Increasing awareness around skincare, the rise of male-specific beauty products, and a high level of disposable income contribute to the robust market performance.

Regional Mentions:

In Europe, the men’s personal care market is similarly strong, driven by a growing focus on personal well-being and grooming routines. The market in this region benefits from well-established retail channels, high disposable incomes, and an inclination toward both luxury and organic products.

Countries such as Germany, the UK, and France are significant contributors, with demand growing for advanced skincare and haircare solutions tailored for men.

Asia Pacific is witnessing the fastest growth in the men’s personal care sector. The region’s market expansion is fueled by rapid urbanization, increasing disposable incomes, and greater exposure to Western beauty and grooming standards.

While still emerging, countries such as China, India, and Japan are experiencing a rising adoption of grooming products, particularly in skincare, shaving, and haircare categories, with the demand for male-specific products gradually increasing.

Latin America and the Middle East & Africa, market growth is moderate but shows promise. Latin America is seeing a rise in demand for skincare products, particularly among younger consumers, while the Middle East benefits from high disposable incomes and growing grooming awareness, particularly in markets such as Saudi Arabia and the UAE.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global men’s personal care market in 2023 is characterized by intense competition and dynamic growth, driven by evolving consumer preferences, increased awareness of grooming, and a shift towards premium and natural products.

Key players such as Procter & Gamble (P&G), Reckitt Benckiser, Unilever, L’Oréal, Beiersdorf AG, Johnson & Johnson, Coty Inc., Estée Lauder Companies, Inc., Edgewell Personal Care Company, and Kao Corporation are at the forefront of this transformation.

Procter & Gamble, with brands like Gillette, continues to dominate the shaving and grooming segments, leveraging a strong distribution network and innovative technologies like razor blade subscription models.

Reckitt Benckiser, through brands like Lysol and Clearasil, capitalizes on expanding male hygiene routines, while Unilever, with Dove Men+Care, is well-positioned in the skincare and body care sectors, promoting inclusivity and natural ingredients.

L’Oréal and Beiersdorf AG, with their Nivea Men and L’Oréal Men Expert lines, focus heavily on skincare innovation and premium offerings. Johnson & Johnson, under brands like Neutrogena, blends dermatological expertise with consumer trust, especially in facial care. Coty Inc. and Estée Lauder excel in fragrance and luxury grooming products, expanding their footprint among high-end consumers.

Edgewell Personal Care and Kao Corporation maintain significant shares in shaving, hair care, and skincare segments, with Edgewell pushing sustainability initiatives and Kao emphasizing Asian consumer trends.

Top Key Players in the Market

- Procter & Gamble

- Reckitt Benckiser

- Unilever

- L’Oréal

- Beiersdorf AG

- Johnson & Johnson

- Coty Inc.

- Estee Lauder Companies, Inc.

- Edgewell Personal Care Company

- Kao Corporation

Recent Developments

- In October 2024, Caldera + Lab, a premium men’s skincare brand, successfully secured $6 million in funding to expand its product range and market reach.

- In July 2024, W, a men’s personal care brand co-founded by Jake Paul, announced a successful $14 million Series A funding round aimed at enhancing product innovation and marketing strategies.

- In May 2023, Cleverman, a brand specializing in men’s grooming products, raised $1.8 million to bolster its manufacturing capabilities and broaden its distribution channels.

Report Scope

Report Features Description Market Value (2023) USD 33.2 Billion Forecast Revenue (2033) USD 77.9 Billion CAGR (2024-2033) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Skin Care, Hair Care, Personal Grooming), By Distribution Channel (Hypermarkets and Supermarkets, Pharmacy and Drugstores, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter and Gamble, Reckitt Benckiser, Unilever, L’Oréal, Beiersdorf AG, Johnson and Johnson, Coty Inc., Estee Lauder Companies, Inc., Edgewell Personal Care Company, Kao Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble

- Reckitt Benckiser

- Unilever

- L'Oréal

- Beiersdorf AG

- Johnson & Johnson

- Coty Inc.

- Estee Lauder Companies, Inc.

- Edgewell Personal Care Company

- Kao Corporation