Global Liquid Smoke Market By Product Type(Hickory, Mesquite, Applewood, Others), By Application(Meat Product, Seafood, Sauces, Marinades, Bakery/Confectionery, Others), By Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, E-Commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 33501

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

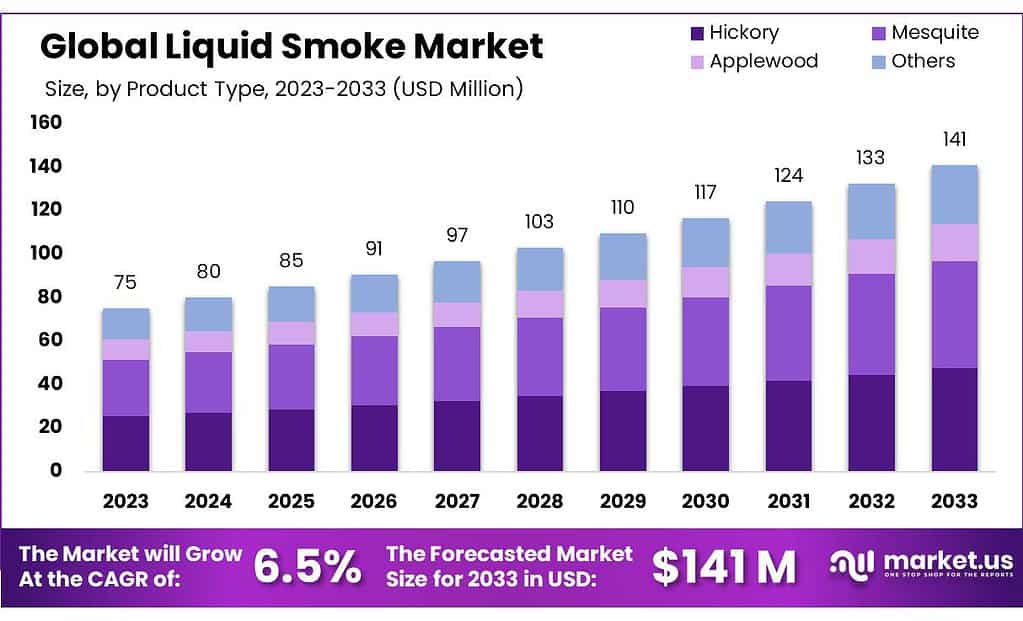

The Liquid Smoke Market size is expected to be worth around USD 141 Mn by 2033, from USD 75 Mn in 2023, growing at a CAGR of 6.5% during the forecast period from 2023 to 2033.

The Liquid Smoke Market encompasses the production, distribution, and sale of liquid smoke products, which are used as flavoring agents to impart a smoky taste to foods without the need for traditional smoking processes. Liquid smoke is created by condensing smoke from wood chips or sawdust, then dissolving it in water or other solvents, resulting in a concentrated liquid that offers the smoky flavor of wood smoke.

This product is widely utilized in the food industry, particularly in meat processing, to achieve a smoked flavor in products like sausages, bacon, and barbecue sauces. Additionally, liquid smoke is employed in vegan and vegetarian cuisine to add depth and a smoky nuance to plant-based dishes. The market for liquid smoke reflects consumer demand for convenient, flavor-enhancing ingredients that offer the authentic taste of smoked foods with less time and effort involved in preparation.

Key Takeaways

- Market Growth: Expected to expand from USD 75 million in 2023 to USD 141 million by 2033, growing at a CAGR of 6.5%.

- Hickory Flavor Preference: Dominates with over 33.4% market share in 2023, favored for its deep, rich smoky taste in various culinary applications.

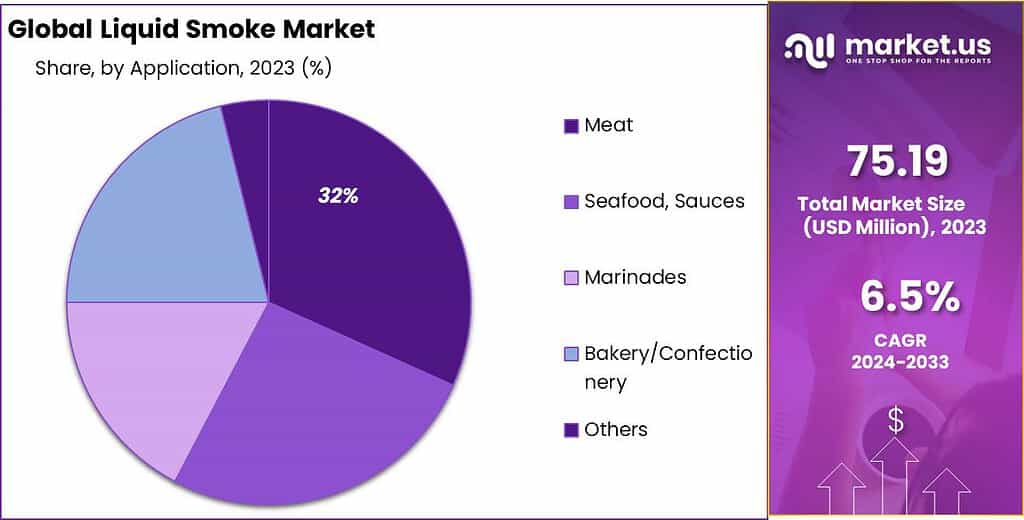

- Meat Products Lead: The largest application segment, capturing over 33.2% of the market, highlighting the significance of Liquid Smoke in meat processing.

- Primary Distribution Channels: Supermarkets and Hypermarkets hold more than 47.4% of sales, proving to be crucial for Liquid Smoke’s market accessibility.

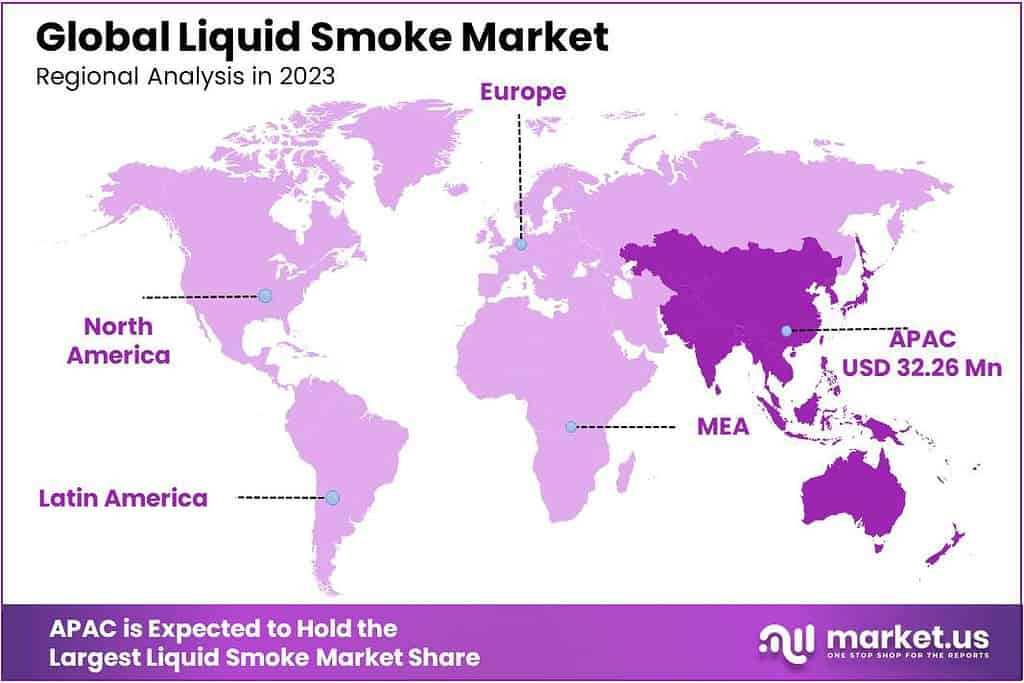

- Regional Dynamics: Asia Pacific leads with 42.9% revenue share in 2023, with North America and Europe also key markets, driven by consumer preferences for smoky flavors.

By Product Type

In the dynamic landscape of the Liquid Smoke market, various product types contribute to the diverse world of culinary experiences. As of 2023, Hickory has firmly established its dominance, capturing an impressive market share exceeding 33.4%.

This revelation underscores the distinctive preference consumers exhibit for the rich and robust smokiness that Hickory brings to the table. Hickory’s ascendancy is not merely a testament to its prevalence but also indicative of its widespread acceptance as the go-to Liquid Smoke variant.

Its deep and flavorful profile has positioned it as a staple in kitchens, offering chefs and home cooks alike a versatile tool to infuse a delightful smokiness into an array of dishes. The market’s inclination towards Hickory suggests a nuanced understanding of taste preferences among consumers.

Whether used in barbecue sauces, marinades, or other culinary applications, Hickory Liquid Smoke continues to reign supreme, enriching gastronomic experiences with its distinctive and savory essence. This market trend emphasizes the enduring popularity and culinary significance of Hickory in the evolving world of Liquid Smoke.

By Application

In the intricate tapestry of Liquid Smoke applications, distinct segments cater to diverse culinary preferences, providing a nuanced array of flavor experiences. As of 2023, Meat Products emerge as the undisputed leader, commanding a significant market position with a dominant share exceeding 33.2%. This revelation underscores the pronounced inclination towards infusing Liquid Smoke into the world of meat-based culinary creations, revealing its central role in shaping the flavor landscape.

The pervasive presence of Liquid Smoke in Meat Products signifies its transformative impact on various meat dishes, offering a distinctive smokiness that amplifies the savory depth of flavors. From sizzling barbecues to expertly grilled steaks, Liquid Smoke has become an indispensable ingredient, contributing to the rich tapestry of global culinary traditions.

This strong affinity towards Meat Products not only highlights the widespread acceptance but also the culinary indispensability of Liquid Smoke in the dynamic realm of gastronomy. The enduring popularity of Liquid Smoke in the Meat Products segment suggests a harmonious interplay between consumer preferences and the sensory allure of smoky flavors.

The culinary world’s continued reliance on Liquid Smoke in meat-centric applications showcases its role as a key enabler of innovation and creativity in kitchens worldwide. This trend serves as a testament to the enduring appeal and transformative potential of Liquid Smoke, marking its presence as an essential element in the evolving narrative of culinary excellence.

By Distribution Channel

As of 2023, Supermarkets and Hypermarkets emerge as the dominant distribution channel in the Liquid Smoke market, securing a substantial market position with a share exceeding 47.4%. This revelation underscores the significant role played by these large-scale retail outlets in facilitating the accessibility and availability of Liquid Smoke to consumers. The prevalence of Liquid Smoke in Supermarkets and Hypermarkets highlights the strategic placement of this culinary enhancer in mainstream retail spaces.

The expansive reach and convenience offered by these retail giants contribute to the widespread adoption of Liquid Smoke among consumers. The dominance of Supermarkets and Hypermarkets as the primary distribution channels signifies the alignment of Liquid Smoke with the preferences and shopping habits of a diverse consumer base.

The prominent position of Liquid Smoke in Supermarkets and Hypermarkets serves as a testament to its integration into mainstream culinary practices. The convenience of finding Liquid Smoke alongside other cooking essentials in these retail spaces reinforces its status as a key ingredient for consumers seeking flavor enhancement in their culinary endeavors.

This market trend suggests a symbiotic relationship between Liquid Smoke manufacturers and large-scale retailers, ensuring a seamless supply chain that meets the demands of a broad and diverse audience.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Hickory

- Mesquite

- Applewood

- Others

By Application

- Meat Product

- Seafood, Sauces

- Marinades

- Bakery/Confectionery

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- E-Commerce

- Others

Drivers

The Liquid Smoke market is experiencing robust growth, driven by several key factors that resonate with evolving consumer preferences and culinary trends. One significant driver is the increasing demand for enhanced and authentic flavors in food. As consumers seek unique and savory taste experiences, Liquid Smoke emerges as a versatile and convenient solution for infusing smoky nuances into a variety of dishes, ranging from meats to sauces and marinades.

Health consciousness also contributes to the growth of the Liquid Smoke market. With the increasing awareness of the potential health risks associated with traditional smoking methods, consumers are turning to Liquid Smoke as a safer alternative. This shift aligns with the broader trend of seeking healthier and cleaner options in food preparation without compromising on flavor.

The versatility of Liquid Smoke as a flavoring agent represents another driving force. Its ability to impart a smoky essence to different culinary creations caters to the diverse preferences of chefs, home cooks, and food enthusiasts. This adaptability positions Liquid Smoke as a go-to ingredient for enhancing the taste profile of various dishes, contributing to its rising popularity.

The influence of global culinary trends and the growing popularity of barbecue and smoked flavors contribute to the market’s momentum. Liquid Smoke’s ability to capture the essence of traditional smoking methods without the need for complex equipment aligns with the convenience-seeking behavior of modern consumers, driving its adoption in households and commercial kitchens alike. These drivers collectively contribute to the expanding appeal and sustained growth of the Liquid Smoke market.

Restraints

Despite the positive trajectory, the Liquid Smoke market faces certain restraints that warrant consideration. One significant challenge is the perception of artificiality associated with liquid smoke products. Some consumers express concerns about the use of liquid smoke as a flavoring agent, viewing it as a synthetic or processed ingredient. Overcoming this perception and educating consumers about the natural origins and controlled manufacturing processes of liquid smoke products is crucial for building trust and ensuring wider acceptance.

Another restraint is the potential impact on the environment. Traditional smoking methods often use natural wood, contributing to the culinary experience but also raising questions about sustainability. Liquid Smoke, as a manufactured product, can be perceived as a more environmentally friendly option. However, the packaging and production processes associated with liquid smoke may still pose environmental challenges. Addressing these concerns through sustainable practices and transparent communication is essential to mitigate potential restraints.

The presence of alternative flavoring methods and substitutes poses a challenge to the Liquid Smoke market. As culinary trends evolve, consumers may explore other ways to achieve smoky flavors, such as using smoked salts or experimenting with natural smoking techniques. Liquid Smoke manufacturers need to stay innovative and address these alternatives to maintain their market position.

Navigating these restraints requires a holistic approach, including consumer education, sustainable practices, and continuous product innovation to address evolving preferences and concerns. By addressing these challenges, the Liquid Smoke market can sustain its growth trajectory and meet the changing demands of consumers.

Opportunities

The liquid smoke market is getting bigger because people want healthier and more natural food. Liquid smoke is good for this because it doesn’t have many calories and no fat, making it a better choice than traditional smoking methods. People who follow plant-based or vegan diets also like liquid smoke because it adds a smoky taste to non-meat foods like tofu or meat substitutes.

People around the world love trying different types of food, and liquid smoke can be used in many cuisines. It makes dishes taste smoky, adding a special touch to Mexican, Asian, and other foods. For those with busy lives, liquid smoke is handy for quick and ready-to-eat meals, making it easier for people who don’t have much time to cook.

Many people enjoy barbecues and grilling, and liquid smoke can make these dishes taste even better. It gives a real smoky flavor to homemade barbecue meals. Liquid smoke is also a good choice for those who care about clean and natural ingredients. Manufacturers can show that liquid smoke comes from natural sources, meeting the demand for honest and clear ingredient lists.

Packaging can also make a difference in the liquid smoke market. Easy-to-use packages like spray bottles or small pouches can attract people who like simple and controlled ways to add flavor. Working together with other food companies or chefs can also help promote liquid smoke and show how versatile it is in different types of cooking. So, to make the most of the liquid smoke market, it’s important to advertise well, position the product smartly, and come up with new ideas.

Challenges

The liquid smoke market confronts several challenges that demand strategic solutions for sustainable growth. There’s a perceptual hurdle to overcome – some consumers view liquid smoke as artificial or processed. Educating the public about the natural origins and production methods is crucial to dispel misconceptions and build trust. Regulatory compliance is another significant challenge.

Meeting stringent standards for food safety, labeling, and ingredient sourcing requires continuous attention, adding complexity to the operational aspects of the business. Ensuring that products adhere to these regulations is essential for maintaining consumer confidence.

The competition with traditional smoking methods presents an ongoing challenge. Many consumers associate traditional methods with authenticity and superior flavor. Convincing them that liquid smoke can offer comparable or better taste without the drawbacks of traditional methods requires effective marketing and communication efforts. Consistency in flavor profiles poses a challenge for manufacturers.

Achieving uniformity in taste across batches is critical for building consumer trust and satisfaction. Additionally, the demand for clean-label products necessitates addressing concerns about additives or preservatives to meet evolving consumer expectations.

Cost considerations add another layer of complexity. Balancing the production cost, especially if derived from high-quality natural sources, while delivering a premium product is a delicate task. Companies need to find a sweet spot that ensures competitiveness without compromising quality.

Limited awareness about the versatility of liquid smoke hampers market growth. Effective marketing strategies and educational campaigns are essential to broaden consumer knowledge and encourage experimentation with this unique ingredient.

Packaging and shelf stability are practical challenges. Finding sustainable packaging solutions that maintain the quality and shelf stability of liquid smoke without resorting to artificial additives is an ongoing concern for manufacturers. Global sourcing challenges, such as fluctuations in raw material availability and pricing, can impact production and cost-effectiveness. A robust supply chain strategy is necessary to navigate these challenges effectively.

Staying ahead of evolving consumer trends and preferences requires continuous market research and adaptability in product development. Understanding shifts in taste preferences, dietary choices, and culinary trends is vital for remaining relevant and responsive to consumer demands. In addressing these challenges, the liquid smoke market can foster innovation, enhance transparency, and build stronger connections with consumers, ensuring its resilience and competitiveness in the ever-changing food industry landscape.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 42.9% in 2023. There has been a significant increase in demand for smoky-flavored meats, sauces, pet food products, and other products. This has helped to propel the industry forward.

Red Arrow International LLC, Colgin, and other top-producing liquid smokers in the region are all listed. More than 35 processed meat plants in North America use liquid smoking in large quantities. It is the largest consumer and producer of liquid smoke in the world.

This industry is very important in Europe. Between 2023 and 2032, it is expected to increase by 7%. France, Germany, and the U.K. are important markets in this region. Manufacturers are compelled to invest in R&D because of the industry’s increasing revenue. This will increase the liquid smoke market growth. High spending power drives this market. These products are popular because they mimic the smokey flavor of real wood smoking. They can also be used in many other foods.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The liquid smoke market is also being driven by the presence of companies such as Azelis, Kerry Group, Besmoke, Red Arrow International LLC, Baumer Foods Inc., and B&G Foods Inc. are key players in this market. Red Arrow International LLC and Baumer Foods Inc. are the top manufacturers in the global industry.

Маrkеt Кеу Рlауеrѕ

- Azelis

- Kerry Group

- Besmoke

- Red Arrow International LLC

- Baumer Foods Inc.

- B&G Foods Inc.

- MSK Ingredients

- Redbrook Ingredients Services Ltd.

- Other Key Players

Recent Development

2023 Archer Daniels Midland (ADM): Launched a new line of organic liquid smoke products under its Red Arrow brand. These products are made with USDA-certified organic wood and meet the growing demand for clean-label ingredients.

Report Scope

Report Features Description Market Value (2022) USD 75 Mn Forecast Revenue (2032) USD 141 Mn CAGR (2023-2032) 6.5% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Product Type(Hickory, Mesquite, Applewood, Others), By Application(Meat Product, Seafood, Sauces, Marinades, Bakery/Confectionery, Others), By Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, E-Commerce, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Azelis, Kerry Group, Besmoke, Red Arrow International LLC, Baumer Foods Inc., B&G Foods Inc., MSK Ingredients, Redbrook Ingredients Services Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What is the size of Liquid Smoke MarketLiquid Smoke Market size is expected to be worth around USD 141 Mn by 2033, from USD 75 Mn in 2023

What is the CAGR for the Liquid Smoke Market?The Liquid Smoke Market is expected to grow at a CAGR of 6.5% during 2023-2033.Who are the key companies/players in the Liquid Smoke Market?Azelis, Kerry Group, Besmoke, Red Arrow International LLC, Baumer Foods Inc., B&G Foods Inc., MSK Ingredients, Redbrook Ingredients Services Ltd., Other Key Players

-

-

- Azelis

- Kerry Group

- Besmoke

- Red Arrow International LLC

- Baumer Foods Inc.

- B&G Foods Inc.

- MSK Ingredients

- Redbrook Ingredients Services Ltd.

- Other Key Players