Global Precision Fermentation Market Size, Share, Upcoming Investments Report By Microbe (Yeast, Algae, Fungi, Bacteria), By Ingredients(Whey and Casein Protein, Egg White, Collagen Protein, Heme Protein, Enzymes, Others), By Fermentation Type (Precision Fermentation, Biomass Fermentation, Traditional Fermentation), By Application (Meat and Seafood, Dairy Alternatives, Egg Alternatives, Miscellaneous, Others), By End Use (Food and Beverages, Pharmaceutical, Cosmetics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136486

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

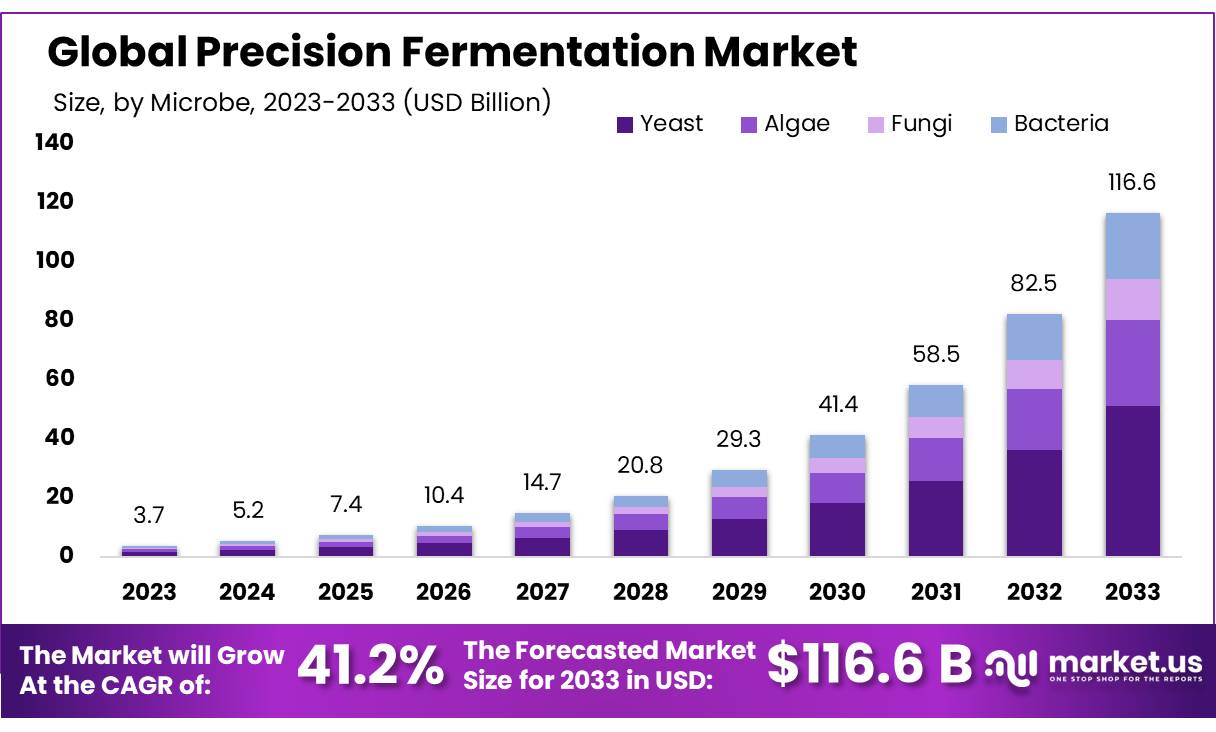

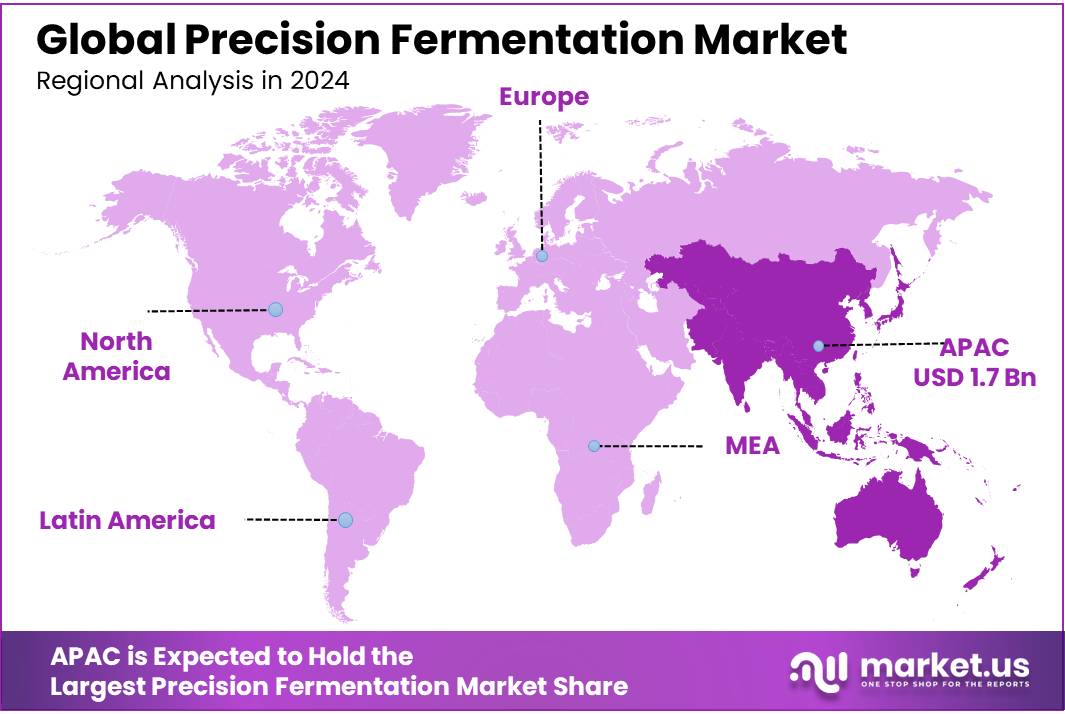

The Global Precision Fermentation Market size is expected to be worth around USD 116.6 Bn by 2033, from USD 3.7 Bn in 2023, growing at a CAGR of 41.2% during the forecast period from 2024 to 2033. In 2023, Asia Pacific (APAC) captured a dominant market position in the precision fermentation market, accounting for more than 47.1% of the market share, with a revenue of USD 1.7 billion.

The global precision fermentation market is a dynamic and rapidly growing sector that combines biotechnology and food production. This innovative technology uses genetically engineered microbial hosts like yeast, fungi, or bacteria to produce specific proteins or ingredients. Precision fermentation has become a groundbreaking solution for creating sustainable, scalable, and animal-free alternatives, with applications spanning industries such as food and beverage, pharmaceuticals, and cosmetics.

This process enables the development of high-value compounds, including enzymes, proteins, and bioactive molecules, with unmatched precision and quality. Compared to traditional fermentation or chemical synthesis, precision fermentation offers significant environmental benefits, making it a preferred method for industries seeking efficient and eco-friendly production solutions.

The precision fermentation market is experiencing rapid growth, driven by increasing environmental concerns and the push to reduce greenhouse gas emissions from conventional animal agriculture. Consumers are increasingly favoring ethical and cruelty-free products, further fueling demand for sustainable production methods. Advances in synthetic biology and metabolic engineering have also made precision fermentation more cost-effective, positioning it as a viable alternative to traditional processes.

A key advantage of precision fermentation lies in its ability to produce complex compounds that are difficult to obtain through conventional methods. This capability has broadened its applications across various industries, from food and beverage to pharmaceuticals. Additionally, its potential to reduce dependence on finite natural resources and address global food security challenges highlights its critical role in building a sustainable future.

The precision fermentation market is poised for significant growth, driven by technological advancements and increasing adoption across industries. The use of artificial intelligence (AI) and machine learning to optimize fermentation processes is set to enhance efficiency, scalability, and cost-effectiveness. Emerging economies represent untapped opportunities, as awareness of sustainable production methods continues to grow, fostering greater market penetration.

In addition to food and beverage applications, the development of novel uses, such as bio-based materials and specialty chemicals, is expected to broaden the market’s scope. Strategic collaborations among industry stakeholders, including technology providers, manufacturers, and end-users, will be pivotal in driving innovation, achieving economies of scale, and shaping the future of precision fermentation.

Heightened consumer awareness of sustainability and ethical consumption is a key driver of the precision fermentation market. A 2024 report by the Good Food Institute reveals that 71% of global consumers prefer sustainable products, underscoring the growing demand for environmentally friendly solutions. This trend is propelling the adoption of precision fermentation as a viable alternative to conventional methods.

The environmental advantages of precision fermentation are profound, with studies showing that fermentation-based protein production can reduce greenhouse gas emissions by up to 90% compared to traditional animal agriculture. As scalability increases and production costs decrease, these benefits are expected to further accelerate market growth, solidifying precision fermentation’s role in sustainable innovation.

Key Takeaways

- Precision Fermentation Market size is expected to be worth around USD 116.6 Bn by 2033, from USD 3.7 Bn in 2023, growing at a CAGR of 41.2%.

- Yeast held a dominant market position in the precision fermentation sector, capturing more than a 44.1% share.

- Whey & Casein Protein held a dominant market position in the precision fermentation sector, capturing more than a 34.1% share.

- Precision Fermentation held a dominant market position, capturing more than a 58.1% share.

- Meat & Seafood held a dominant market position, capturing more than a 38.1% share of the Precision Fermentation market.

- Food & Beverages held a dominant market position, capturing more than a 54.1% share.

- Asia Pacific (APAC) leads the market, holding a dominant share of 47.1%, with a market value of USD 1.7 billion.

Upcoming Investments of Precision Fermentation

Precision fermentation is attracting growing investment as it revolutionizes industries like food, pharmaceuticals, and biotechnology. This cutting-edge technology uses microorganisms to produce proteins, enzymes, and bio-based compounds, offering sustainable alternatives to traditional production methods.

Key investments are being made in developing alternative proteins, such as dairy-free milk, animal-free cheese, and plant-based meats. Startups and established companies alike are pouring funds into scaling production facilities to meet the rising demand for these innovative products.

Governments and private investors in North America and Europe are leading funding efforts, focusing on building advanced research centers and pilot plants. In the Asia-Pacific region, increasing consumer demand for sustainable and innovative food products is driving investments in precision fermentation technologies.

Additionally, partnerships between biotech firms and food manufacturers are on the rise, aiming to commercialize precision fermentation products at a larger scale. Funding is also directed toward improving the efficiency and cost-effectiveness of the technology, ensuring it becomes more accessible.

By Microbe

In 2023, Yeast held a dominant market position in the precision fermentation sector, capturing more than a 44.1% share. Yeast is widely used due to its versatility in producing a wide range of products, from biofuels and pharmaceuticals to alternative proteins and functional food ingredients. Its role in the food industry, particularly in the production of sustainable protein sources, continues to grow, with yeast-based products being key to the development of plant-based meat and dairy alternatives.

The Algae segment is expected to witness significant growth in 2024, driven by its ability to produce valuable proteins, oils, and other nutrients. Algae-based fermentation offers a more sustainable alternative to traditional agriculture and is increasingly used in the production of omega-3 fatty acids, which are in high demand due to their health benefits. As the demand for plant-based products and functional foods continues to increase, algae’s role in the fermentation market is set to expand rapidly.

Fungi, including various types of molds and mushrooms, are also making their mark, contributing to the production of enzymes, natural flavorings, and protein alternatives. In 2023, fungi captured a notable share of the market as the demand for fungal-based proteins and mycelium products in the food and materials industries surged. The growth of this segment is expected to continue as companies explore the potential of fungi for creating sustainable, scalable food solutions.

Bacteria hold a smaller but steadily growing share of the market. Bacterial fermentation processes are primarily used in the production of enzymes, probiotics, and fermented foods like yogurt and cheese. In 2023, bacteria represented a key segment in the pharmaceutical industry, particularly in the production of biopharmaceuticals and bio-based chemicals, with an increasing focus on utilizing bacteria for sustainable manufacturing processes.

By Ingredients

In 2023, Whey & Casein Protein held a dominant market position in the precision fermentation sector, capturing more than a 34.1% share. These proteins, derived from milk, are in high demand due to their high nutritional value, making them key ingredients in the food, beverage, and supplement industries. Whey and casein proteins are particularly popular in the production of protein powders and bars, commonly used by athletes and fitness enthusiasts.

The Egg White segment, while smaller, is growing steadily due to its versatility and functionality in various food products such as meringues, baked goods, and protein supplements. In 2023, egg white proteins produced through precision fermentation gained traction as a more sustainable alternative to conventionally farmed eggs. This trend is fueled by growing consumer concerns about animal welfare and environmental sustainability, leading to an increasing preference for egg-white proteins sourced through fermentation technologies.

Collagen Protein is another rapidly growing segment, driven by increasing consumer interest in beauty-from-within products, joint health supplements, and functional food. Collagen, traditionally sourced from animal bones and skin, can now be produced through precision fermentation, offering a cruelty-free, plant-based alternative. This segment is projected to expand significantly by 2024 as demand for collagen-based products continues to rise in the beauty and wellness industries.

Heme Protein, primarily known for its role in plant-based meat products, captured an increasing share of the market in 2023. Heme is the molecule responsible for the “meaty” taste and texture in products like plant-based burgers and sausages. Precision fermentation allows for the production of heme without the need for animal farming, making it a highly sought-after ingredient in the sustainable food sector.

The Enzymes segment is also significant, with enzymes produced through precision fermentation playing a crucial role in various industries, including food, pharmaceuticals, and biofuels. In 2023, enzymes sourced through fermentation technologies were in demand for their applications in baking, brewing, dairy processing, and plant-based food production. The ability to produce enzymes efficiently and sustainably through fermentation processes is driving this segment’s growth.

By Fermentation Type

In 2023, Precision Fermentation held a dominant market position, capturing more than a 58.1% share. Precision fermentation, the most advanced form of fermentation technology, uses microorganisms like yeast, bacteria, or fungi to produce specific proteins, enzymes, and other ingredients with high accuracy. This method has gained significant attention in industries such as food, health supplements, and bio-based materials due to its precision, scalability, and ability to create high-value, tailored products without relying on traditional agricultural processes.

Biomass Fermentation is another important segment, though it held a smaller market share in comparison. Biomass fermentation involves growing microorganisms on organic matter, like sugars, to produce a variety of byproducts, including biofuels, proteins, and organic acids. While biomass fermentation is less targeted than precision fermentation, it is still widely used in the production of bulk chemicals and biofuels.

Traditional Fermentation, which has been used for centuries in the production of foods like beer, yogurt, and bread, represents the oldest form of fermentation technology. While it continues to be essential for many food products, it accounts for a smaller share in the overall market for fermentation-based products in 2023. Traditional fermentation is less efficient and less scalable than newer methods, and as a result, its use in industrial applications has been increasingly overtaken by more advanced technologies like precision and biomass fermentation.

By Application

n 2023, Meat & Seafood held a dominant market position, capturing more than a 38.1% share of the Precision Fermentation market. The growing demand for plant-based and lab-grown alternatives to traditional animal products has driven innovation in the production of meat and seafood through precision fermentation. Companies in the food industry are using this technology to create plant-based meats and seafood with enhanced texture, flavor, and nutritional profiles. These products, made from proteins and other ingredients produced through fermentation, offer a more sustainable and ethical alternative to conventional meat and seafood, which have a significant environmental impact.

Dairy Alternatives is another significant segment within the precision fermentation market, with a strong growth trajectory in 2023. This segment benefits from the increasing popularity of dairy-free products due to health concerns, lactose intolerance, and ethical considerations regarding animal welfare. Precision fermentation plays a key role in the production of plant-based dairy alternatives such as cheese, yogurt, and milk. By using fermentation, companies can recreate the taste, texture, and nutritional content of traditional dairy without the need for animals.

Egg Alternatives are also experiencing strong growth, accounting for a growing portion of the precision fermentation market. As more consumers turn to plant-based diets, the demand for egg alternatives in cooking and baking has surged. Precision fermentation is being used to create egg substitutes that mimic the functionality of eggs in terms of texture, taste, and protein content.

The Miscellaneous category, which includes applications such as alternative sweeteners, vitamins, and specialty ingredients, also plays an important role in the precision fermentation market. This segment is driven by the need for more sustainable and efficient production of niche ingredients used in the food, beverage, and nutrition industries. While the miscellaneous segment does not dominate the market as much as meat, dairy, or egg alternatives, it is gaining traction due to increased demand for specialized, high-value ingredients.

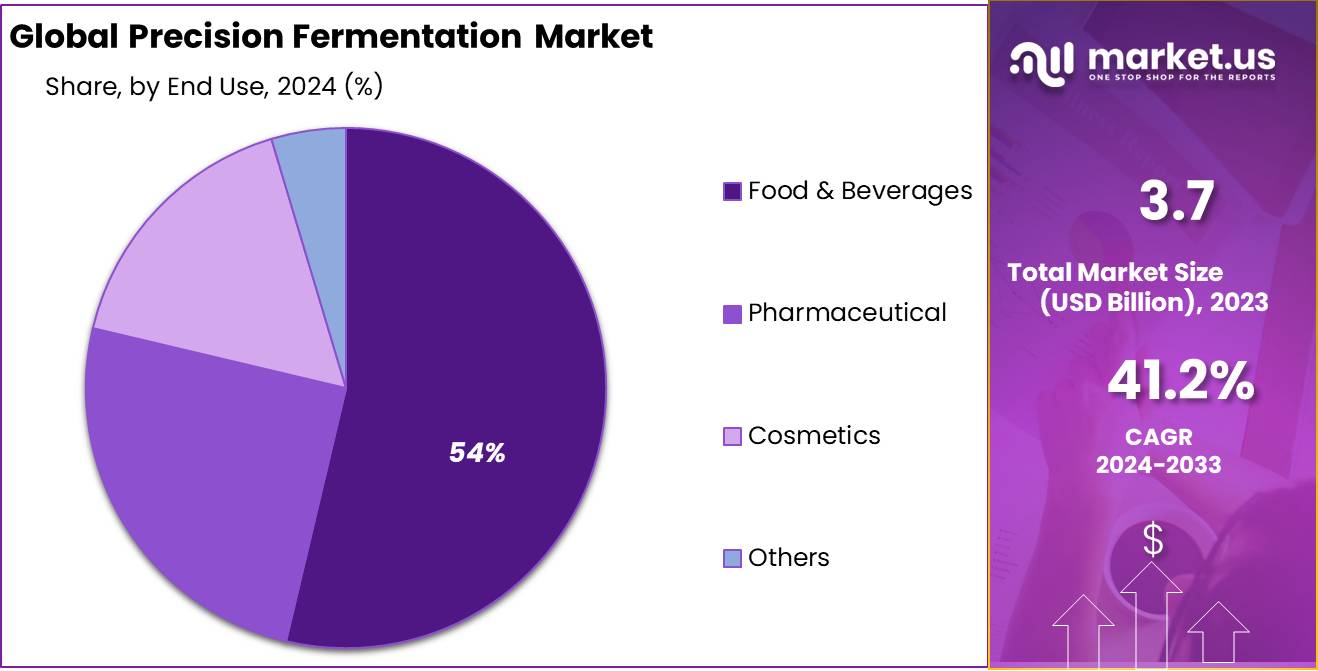

By End Use

In 2023, Food & Beverages held a dominant market position, capturing more than a 54.1% share of the Precision Fermentation market. The increasing consumer demand for plant-based, sustainable, and functional foods has significantly contributed to this segment’s growth. Precision fermentation is being widely used in the production of meat alternatives, dairy alternatives, and other specialty ingredients, all of which have gained significant traction in the global food and beverage industry.

The Pharmaceutical sector is another key end-use industry for precision fermentation, experiencing steady growth in 2023. This segment focuses on the use of fermentation technology for the production of active pharmaceutical ingredients (APIs), vaccines, and biologics. The rising demand for biologic drugs and vaccines, particularly post-pandemic, has led to increased investments in precision fermentation as a way to produce complex and high-value ingredients more efficiently.

In the Cosmetics sector, precision fermentation is gaining traction for the production of bio-based ingredients used in skincare and personal care products. As consumers become more aware of the impact of synthetic chemicals on their health and the environment, there is a growing demand for natural and sustainable alternatives in cosmetics.

Key Market Segments

By Microbe

- Yeast

- Algae

- Fungi

- Bacteria

By Ingredients

- Whey & Casein Protein

- Egg White

- Collagen Protein

- Heme Protein

- Enzymes

- Others

By Fermentation Type

- Precision Fermentation

- Biomass Fermentation

- Traditional Fermentation

By Application

- Meat & Seafood

- Dairy Alternatives

- Egg Alternatives

- Miscellaneous

- Others

By End Use

- Food & Beverages

- Pharmaceutical

- Cosmetics

- Others

Drivers

Rising Demand for Sustainable and Plant-Based Alternatives

A major driving factor for the growth of the precision fermentation market is the increasing consumer demand for sustainable, plant-based alternatives in food, beverages, and other industries. As consumers shift toward more environmentally friendly and health-conscious lifestyles, the demand for plant-based products, which often rely on fermentation technologies, has soared.

This trend is not only driven by changing dietary habits but also by the need to address environmental concerns such as reducing greenhouse gas emissions, land usage, and water consumption associated with traditional animal-based production methods.

Government initiatives have also accelerated the adoption of precision fermentation. For example, in 2023, the U.S. Department of Agriculture (USDA) announced a grant of USD 1.5 million for projects that advance sustainable agricultural practices, including those using precision fermentation.

The European Union has also been supportive, with investments in sustainable food production as part of the Green Deal, which includes funding to support innovation in bio-based alternatives. These investments signal a growing governmental recognition of the importance of precision fermentation in achieving sustainability goals.

Precision fermentation is helping companies like Perfect Day and New Culture develop dairy proteins without the use of cows. This innovation is critical to meeting both environmental goals and consumer preferences for dairy alternatives that maintain the nutritional profile and sensory qualities of traditional dairy.

Restraints

High Production Costs and Technological Barriers

In 2023, the cost of production for precision fermentation products was estimated to be 2 to 5 times higher than traditional methods, depending on the type of product being produced. For example, in the case of plant-based proteins produced through fermentation, the production costs are still significantly higher than for proteins derived from crops like soy or pea.

According to a report by Rabobank, while precision fermentation has the potential to scale up and reduce costs over time, the upfront investment in research and development (R&D), production facilities, and specialized equipment remains a barrier for many companies, especially startups.

For instance, Perfect Day, a company that uses precision fermentation to produce dairy proteins, invested USD 300 million in 2022 to scale up its production capacity. However, even with this large investment, the cost of producing precision-fermented dairy proteins was still higher than that of traditional dairy. According to the company, the price of their product is expected to fall significantly once they achieve economies of scale, but this is a long-term process that requires significant capital and time to achieve.

Furthermore, the technological infrastructure required to carry out precision fermentation at scale is still evolving. In 2024, companies may need to make further advances in bioreactor technology, yeast strain optimization, and fermentation process efficiency to make the process cost-competitive with traditional methods. Additionally, the fermentation process often requires specific conditions, such as temperature control, nutrient balance, and pH levels, which can complicate the production and increase operational costs.

Governments and industry players are working to address these challenges, but the high capital expenditure required to develop and maintain such technologies remains a significant obstacle. According to McKinsey & Company, the precision fermentation industry will need USD 10-15 billion in investments by 2030 to reduce costs and make the technology more accessible for wider commercial use. Without these investments and continued innovation, precision fermentation may face difficulties in competing with established production systems.

Opportunity

Increasing Consumer Demand for Sustainable and Plant-Based Products

A major growth opportunity for the precision fermentation market lies in the increasing consumer demand for sustainable, plant-based, and alternative protein products. As more consumers seek environmentally friendly and health-conscious food options, the demand for precision fermentation products, such as plant-based proteins, dairy alternatives, and functional ingredients, is growing significantly. This trend is driven by both consumer preferences and the growing awareness of the environmental and ethical issues related to conventional animal agriculture.

A significant portion of this market growth is driven by the demand for plant-based dairy products and meat alternatives—segments that are increasingly being addressed through precision fermentation technologies. For example, companies like Perfect Day and Impossible Foods have already gained traction in the market by using precision fermentation to produce dairy proteins and meat substitutes, respectively, that are identical to their animal-derived counterparts but without the environmental impact.

Additionally, the global alternative protein market, which includes products made using precision fermentation, is expected to grow to USD 27.6 billion by 2026, driven by rising consumer awareness about the environmental benefits of plant-based diets.

According to the Good Food Institute (GFI), the alternative protein market could represent 10% of the global protein market by 2035, with fermentation-based products accounting for a significant share due to their sustainability and scalability. These numbers illustrate the rapidly expanding opportunity for precision fermentation to meet rising consumer demand for alternative proteins.

Governments and organizations are also supporting this growth. For instance, in 2023, the European Union introduced several green initiatives aimed at reducing carbon emissions and promoting sustainable food systems.

The Farm to Fork Strategy aims to reduce the EU’s carbon footprint from food production by 50% by 2030, which aligns with the objectives of precision fermentation, as it offers a more sustainable method of producing food ingredients with lower greenhouse gas emissions compared to traditional animal farming. Similarly, the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA) have also provided regulatory frameworks that support the development of lab-grown and fermentation-based food products.

Furthermore, leading companies in the space are scaling up production capacities. For instance, TurtleTree Labs, a company focusing on precision fermentation for the production of dairy ingredients, raised USD 30 million in Series A funding in 2024 to expand its production capabilities.

This is part of a broader trend where venture capital investments in precision fermentation reached USD 1.5 billion in 2023, a 20% increase from the previous year. These investments are expected to accelerate technological advancements and lower production costs, making the technology more competitive with traditional animal-based products.

Trends

Expansion of Precision Fermentation in Dairy and Meat Alternatives

One of the most significant trends in the precision fermentation market is the rapid growth of dairy and meat alternatives, fueled by increasing consumer demand for plant-based and sustainable food products. The use of precision fermentation to create dairy proteins and meat substitutes that are identical to their animal-based counterparts has garnered considerable attention. This trend is driven by a rising awareness of health concerns, environmental impact, and animal welfare issues.

Companies such as Perfect Day, which uses fermentation to produce dairy proteins, have raised USD 350 million in funding in 2023, highlighting investor confidence in this technology. Their products are now available in over 2,000 stores across the U.S., indicating robust market adoption. Perfect Day’s innovation allows them to produce dairy proteins with a much smaller environmental footprint compared to traditional dairy farming.

Precision fermentation is crucial in developing high-quality alternatives to meat, particularly in creating complex flavors and textures found in traditional animal proteins. Companies like Impossible Foods and Eat Just are using fermentation to produce meat proteins and ingredients that mimic the taste, texture, and nutritional benefits of animal-derived meat. In 2024, Eat Just raised USD 170 million to expand its fermentation-based meat products and improve its production scalability.

Moreover, governments and regulators have been actively supporting the growth of these markets, recognizing the potential of precision fermentation to contribute to sustainable food systems. In 2023, the U.S. Department of Agriculture (USDA) allocated USD 10 million in funding for research and development of alternative protein technologies, including fermentation-based methods.

Regional Analysis

Asia Pacific (APAC) leads the market, holding a dominant share of 47.1%, with a market value of USD 1.7 billion. The region is expected to maintain its leadership due to the rapidly growing biotechnology and food processing industries in countries like China, Japan, and India.

The expansion of plant-based food innovations and the adoption of alternative protein sources have further fueled the demand for precision fermentation technologies in this region. Additionally, government initiatives promoting sustainable agricultural practices and food security contribute to the growth of the market.

North America is another key region, experiencing robust growth. The United States, with its strong focus on innovation and large-scale production capabilities, is the major contributor to this market. Increased demand for alternative proteins and clean-label products has led to advancements in precision fermentation technologies, particularly in the food and beverage sector. North America’s market growth is also supported by strong investments in biopharmaceuticals and a growing focus on environmental sustainability.

Europe is witnessing steady expansion, driven by the region’s focus on sustainability, food security, and plant-based food systems. The European Union’s stringent regulations on food safety and environmental concerns have accelerated the adoption of fermentation-based processes in food and bio-based products.

Middle East & Africa and Latin America are emerging markets, albeit with slower growth, primarily driven by increasing awareness and the need for sustainable food production and waste management solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The precision fermentation market is rapidly growing, driven by a surge in demand for sustainable and alternative food products. Key players in this space include Change Foods, Eden Brew, and Formo, which focus on developing dairy and protein alternatives using precision fermentation to produce products such as cheese and milk without the need for animals.

Impossible Foods Inc. and Perfect Day, Inc. are notable for their advancements in plant-based and dairy-free proteins, leveraging fermentation technology to improve the taste and nutritional value of their offerings.

Other prominent companies include Motif FoodWorks Inc., MycoTechnology, and New Culture, which are innovating with fungi-based and microbial fermentation processes to create novel food ingredients. Companies like Geltor and Helaina Inc. are focusing on bioengineering to produce animal-free proteins, collagen, and other bioactive ingredients.

Startups such as Triton Algae Innovations and Mycorena are exploring algae-based protein sources, while Shiru, Inc. and The Every Co. are working on fermenting novel proteins from crops and microorganisms for food applications. With a combination of established players and emerging innovators, the market is witnessing significant advancements across various sectors, including dairy alternatives, meat substitutes, and bio-based ingredients.

Top Key Players

- Change Foods

- Eden Brew

- Formo

- Fybraworks Foods

- Geltor

- Helaina Inc

- Imagindairy Ltd.

- Impossible Foods Inc.

- Melt&Marble

- Motif FoodWorks Inc.

- Myco Technology

- Mycorena

- MycoTechnology

- New Culture

- Nourish Ingredients Pty Ltd.

- Perfect Day, Inc.

- Remilk Ltd.

- REVYVE

- Shiru, Inc.

- The Every Co.

- Triton Algae Innovations

Recent Developments

In 2023, Change Foods raised $12 million in funding to accelerate the development of its animal-free cheese products, positioning itself as a strong player in the plant-based dairy market.

In 2023 Eden Brew, the company secured $15 million in funding to further develop its production processes and scale up its operations.

Report Scope

Report Features Description Market Value (2023) USD 3.7 Bn Forecast Revenue (2033) USD 116.6 Bn CAGR (2024-2033) 41.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Microbe (Yeast, Algae, Fungi, Bacteria), By Ingredients(Whey and Casein Protein, Egg White, Collagen Protein, Heme Protein, Enzymes, Others), By Fermentation Type (Precision Fermentation, Biomass Fermentation, Traditional Fermentation), By Application (Meat and Seafood, Dairy Alternatives, Egg Alternatives, Miscellaneous, Others), By End Use (Food and Beverages, Pharmaceutical, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Change Foods, Eden Brew, Formo, Fybraworks Foods, Geltor, Helaina Inc, Imagindairy Ltd., Impossible Foods Inc., Melt&Marble, Motif FoodWorks Inc., Myco Technology, Mycorena, MycoTechnology, New Culture, Nourish Ingredients Pty Ltd., Perfect Day, Inc., Remilk Ltd., REVYVE, Shiru, Inc., The Every Co., Triton Algae Innovations Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Precision Fermentation MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Precision Fermentation MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Change Foods

- Eden Brew

- Formo

- Fybraworks Foods

- Geltor

- Helaina Inc

- Imagindairy Ltd.

- Impossible Foods Inc.

- Melt&Marble

- Motif FoodWorks Inc.

- Myco Technology

- Mycorena

- MycoTechnology

- New Culture

- Nourish Ingredients Pty Ltd.

- Perfect Day, Inc.

- Remilk Ltd.

- REVYVE

- Shiru, Inc.

- The Every Co.

- Triton Algae Innovations