Cream Market Size, Share, And Strategic Business Review By Source (Dairy, Non-dairy), By Nature (Pasteurized, Ultra-pasteurized), By Type (Fresh, Table, Heavy, Whipping, Others), By Application (Commercial, Household), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136307

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Strategic Business Review of Cream

- By Source Analysis

- By Nature Analysis

- By Type Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

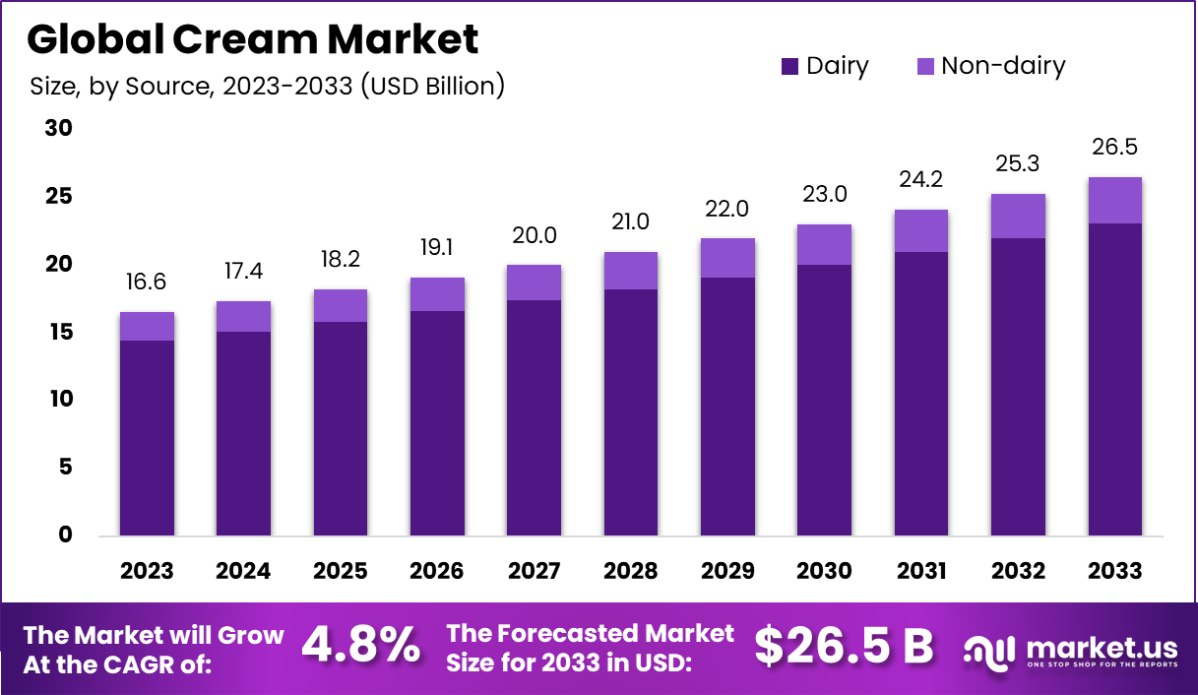

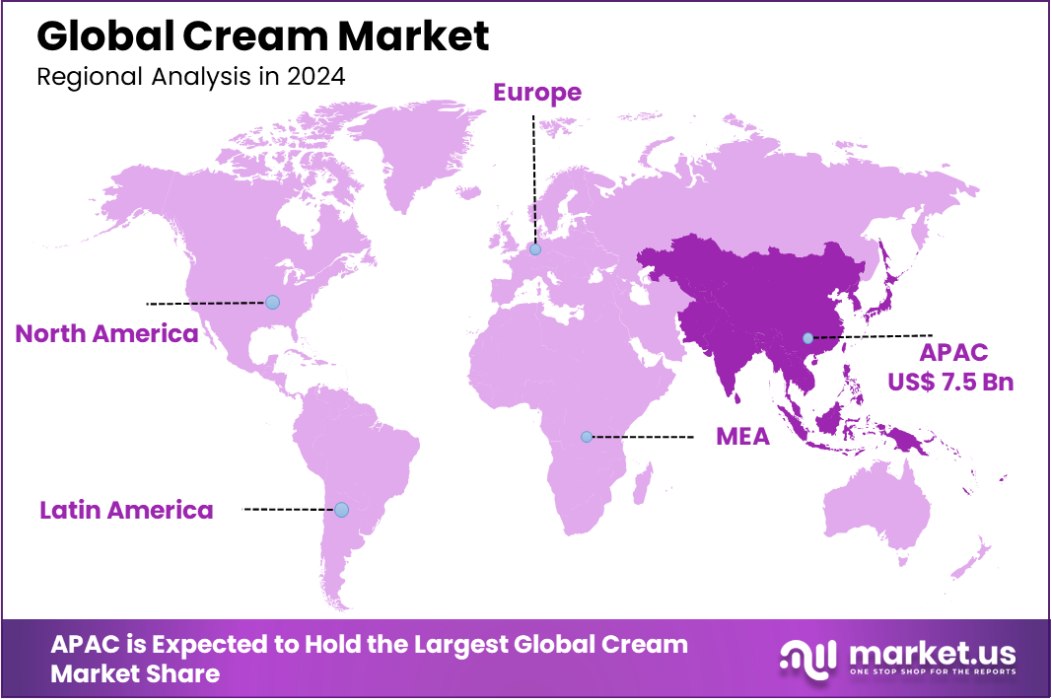

The Global Cream Market is expected to be worth around USD 26.5 Billion by 2033, up from USD 16.6 Billion in 2023, and grow at a CAGR of 4.8% from 2024 to 2033. In 2023, Asia-Pacific’s cream market held 45.6% share, valued at USD 7.5 billion.

Cream is a dairy product that contains a high percentage of milk fat, typically obtained by skimming the upper layer of milk before homogenization. It comes in various forms and fat contents, such as heavy cream, whipping cream, and light cream, each used for different culinary purposes.

Cream is widely utilized in cooking and baking for its rich texture and flavor-enhancing properties, and it is a staple ingredient in sauces, desserts, and beverages. The cream market refers to the commercial industry focused on the production, distribution, and sale of cream and cream-based products.

This market caters to both consumer and industrial needs, ranging from household consumption to use in professional kitchens and food manufacturing. The market is segmented based on product type, distribution channel, and application, each influencing the dynamics and growth trends within the industry.

The growth of the cream market is primarily driven by increasing consumer preference for rich, flavorful dairy products and the rising demand for premium food ingredients. Innovations in product offerings, such as flavored and organic creams, also contribute to market expansion.

Demand for cream is bolstered by its essential role in numerous traditional and modern recipes. The growing popularity of gourmet cooking and the global expansion of Western cuisine has further increased its usage in diverse culinary traditions.

The market presents significant opportunities in expanding into emerging economies, where changing lifestyles and rising disposable incomes are leading to greater consumption of dairy products. Additionally, the trend toward natural and organic food products offers potential for premium segments within the cream market, catering to health-conscious consumers.

The cream market is undergoing a significant transformation, driven by evolving consumer preferences and robust investment activity. In 2024, the sector has witnessed substantial financial injections, underscoring a bullish outlook among investors.

Notably, Hangyo Ice Creams garnered a noteworthy Rs 211 crore (approximately $25 million) from Faering Capital, highlighting the confidence in the brand’s growth trajectory and innovation capabilities.

Similarly, Hocco Ice Cream’s acquisition of Rs 100 crore ($12 million) in funding, led by the founding Chona family and Sauce VC, reinforces the market’s dynamism and the growing investor interest in niche brands with strong differentiation strategies.

These investments are reflective of a broader trend where consumer demand for premium and artisanal cream products is on the rise. Market dynamics are increasingly influenced by the preference for high-quality, unique flavors, and sustainable practices.

The influx of capital is enabling companies like Hangyo and Hocco to expand their product lines, enhance distribution capabilities, and increase market penetration. Furthermore, these developments are indicative of the potential for innovative marketing strategies and expansion into new geographical markets.

Overall, the cream market’s current investment landscape presents a promising outlook, suggesting a period of accelerated growth and innovation. Companies are poised to leverage these investments to cater to the sophisticated palate of modern consumers, potentially leading to a reshaping of market hierarchies and the emergence of new market leaders.

Key Takeaways

- The Global Cream Market is expected to be worth around USD 26.5 Billion by 2033, up from USD 16.6 Billion in 2023, and grow at a CAGR of 4.8% from 2024 to 2033.

- Dairy-based creams dominate the market, accounting for 87.1% of the cream industry.

- Pasteurized creams represent 65.1% of the market, preferred for their safety and freshness.

- Fresh cream varieties hold a 29.1% market share, popular for their rich, authentic taste.

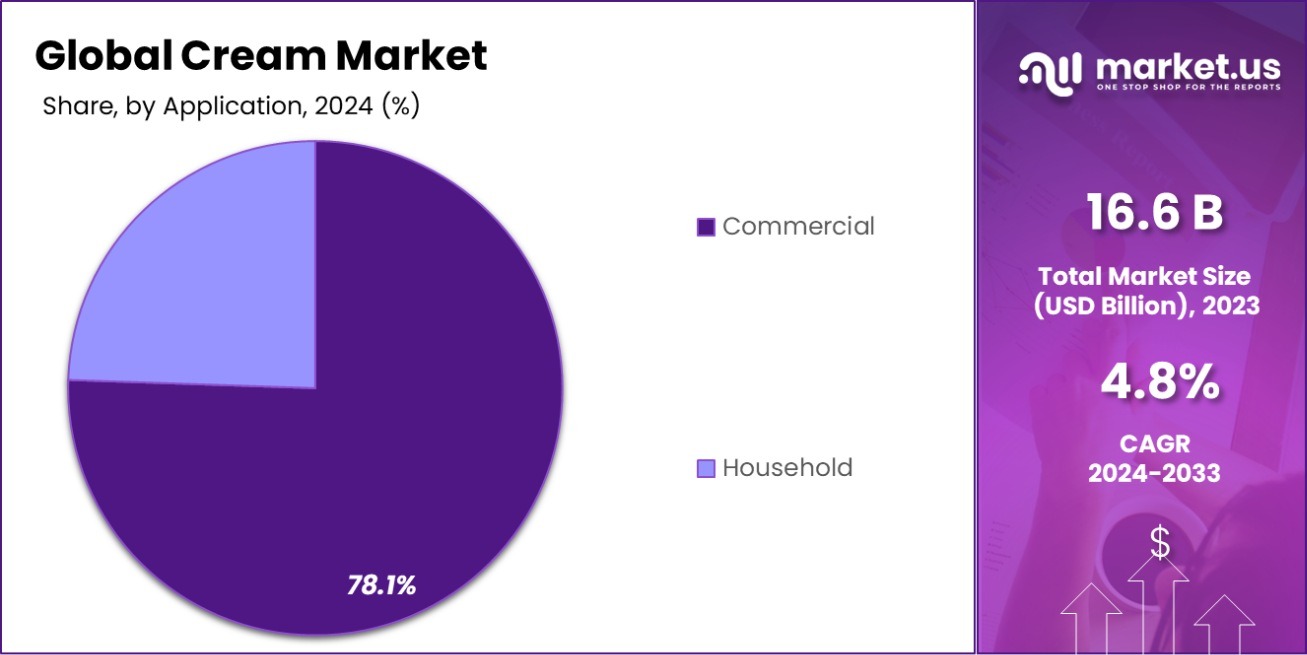

- The commercial sector uses 78.1% of all cream, highlighting its broad utility in food service.

- Supermarkets and hypermarkets distribute 58.1% of the cream, making them key retail channels.

- In 2023, the Asia-Pacific cream market captured a 45.6% share, valued at USD 7.5 billion, indicating robust growth.

Strategic Business Review of Cream

A strategic business review of the cream industry, based solely on governmental reports, highlights a sector influenced by evolving consumer preferences and regulatory standards. According to the U.S. Department of Agriculture (USDA), the dairy market, including cream products, is subject to fluctuations in pricing and production that significantly affect market dynamics.

As of their latest report, cream production has seen an uptick in response to increased demand for high-fat dairy products among health-conscious consumers, indicating a shift towards premium dairy offerings.

Environmental regulations also play a crucial role in shaping the industry. The Environmental Protection Agency (EPA) has implemented stricter waste management and emissions standards for dairy operations, which include cream production facilities. These regulations aim to reduce the environmental impact of dairy production, compelling manufacturers to invest in cleaner, more sustainable practices.

Furthermore, the Food and Drug Administration (FDA) mandates strict labeling and safety standards for all dairy products, including cream. This ensures product quality and safety, fostering consumer trust and compliance. The FDA’s oversight is particularly stringent concerning the pasteurization process and the use of additives, which are critical aspects of cream production.

Overall, the strategic outlook for the cream industry must consider these regulatory landscapes and shifting consumer trends to navigate future challenges effectively. These governmental insights provide a clear framework for anticipating market movements and adjusting business strategies accordingly.

By Source Analysis

In the Cream Market, dairy sources overwhelmingly dominate, constituting 87.1% of the market share.

In 2023, Dairy held a dominant market position in the “By Source” segment of the Cream Market, with an 87.1% share. Non-dairy alternatives, although growing in popularity, accounted for the remainder of the market.

This distinction underscores a significant consumer preference towards dairy-based products, driven by traditional consumption patterns and a perceived richness in flavor and texture that dairy provides.

Dairy creams are extensively used across various applications, from culinary preparations to confectioneries and beverages. The wide acceptance of dairy cream is bolstered by its versatility and integral role in numerous traditional recipes worldwide.

Meanwhile, the non-dairy segment is gradually expanding, fueled by rising veganism, lactose intolerance among a substantial population, and increasing health consciousness. Non-dairy cream options typically include those derived from almonds, soy, and coconut.

These alternatives are gaining traction, particularly in urban areas and among millennials and Gen Z consumers, who are more inclined towards plant-based diets.

Despite the growth in the non-dairy sector, dairy creams continue to dominate due to their entrenched position in culinary traditions and ongoing innovation in product offerings aimed at improving taste and nutritional profiles. As market dynamics evolve, both segments are expected to witness innovations that cater to shifting consumer preferences and environmental considerations.

By Nature Analysis

Pasteurized cream varieties are favored, accounting for 65.1% of the market by nature.

In 2023, Pasteurized held a dominant market position in the “By Nature” segment of the Cream Market, securing a 65.1% share. This substantial market presence underscores the consumer preference for pasteurized products, perceived for their safety and shelf life.

Ultra-pasteurized cream, while offering extended shelf stability, captured a smaller market share, highlighting a significant consumer inclination towards minimally processed options within the cream category.

The growth of the pasteurized cream segment can be attributed to increasing consumer awareness about food safety and quality, coupled with regulatory support for pasteurization processes. Market analysis indicates that the preference for pasteurized cream is reinforced by its widespread availability and the trust established by long-standing dairy brands in the market.

On the other hand, the ultra-pasteurized cream segment faces challenges in market penetration, primarily due to perceptions of over-processing and a preference for fresh taste profiles among consumers.

In the broader context, the cream market’s dynamics are influenced by evolving consumer preferences and technological advancements in dairy processing. As market trends lean towards healthier and safer food options, pasteurized products are likely to maintain their lead, supported by both consumer trust and regulatory frameworks that favor pasteurization for dairy safety.

By Type Analysis

Fresh cream types capture a smaller segment, holding a 29.1% share of the market.

In 2023, Fresh cream held a dominant market position in the “By Type” segment of the Cream Market, with a 29.1% share. This category led ahead of Table, Heavy, and Whipping cream types, reflecting a strong consumer preference for fresh cream’s versatility and perceived freshness.

Fresh cream’s market superiority can be attributed to its widespread use in both cooking and direct consumption, which appeals to a broad demographic seeking natural and minimally processed dairy products.

Table cream, with a lower fat content, caters to a niche market looking for lighter cream options, while Heavy and Whipping creams are preferred in culinary contexts where richer textures and flavors are desired. Despite their specific uses, these segments have not matched the market penetration achieved by Fresh Cream.

The preference for Fresh cream is further supported by shifting consumer behaviors towards healthier lifestyle choices, where the demand for natural and less processed foods is increasing. The market dynamics are also influenced by the expansion of retail distribution channels that have made Fresh cream readily accessible to a wider audience.

Overall, the Cream Market is witnessing a significant inclination towards products that offer both quality and versatility, with Fresh cream leading the trend.

By Application Analysis

Commercial applications of cream significantly lead, with a substantial 78.1% market penetration.

In 2023, Commercial applications held a dominant market position in the “By Application” segment of the Cream Market, with a 78.1% share. This segment significantly outperformed Household applications, underscoring the substantial demand within food service industries, including restaurants, bakeries, and catering services.

The Commercial segment’s dominance can be attributed to the extensive use of cream products in professional kitchens, where their application in diverse culinary preparations is valued for adding flavor, texture, and richness.

The robust growth in the Commercial segment is propelled by the expanding food service sector, which relies heavily on bulk cream purchases to meet the culinary needs of an ever-growing customer base. In contrast, the Household segment, while stable, has a relatively smaller share due to the periodic and lower-volume usage of cream in home cooking.

The market’s orientation towards Commercial uses is further influenced by ongoing trends in dining out and the increasing popularity of gourmet and artisanal food preparations. As the market evolves, the Commercial sector is expected to maintain its lead, driven by innovation in food service and the consistent quality demand for cream products by professional chefs and culinary establishments.

By Distribution Channel Analysis

Supermarkets and hypermarkets are major distribution channels, controlling 58.1% of the market.

In 2023, Supermarkets and Hypermarkets held a dominant market position in the “By Distribution Channel” segment of the Cream Market, capturing a 58.1% share. This significant market share is reflective of consumer preference for purchasing cream from large retail outlets, where variety and availability enhance the shopping experience.

Supermarkets and Hypermarkets outpaced other channels such as Convenience Stores and Online Retail Stores, showcasing their central role in the consumer purchase journey.

The success of Supermarkets and Hypermarkets in this segment can be attributed to their ability to offer a wide range of cream products under one roof, coupled with the advantage of physical product inspection, which is preferred by consumers when buying dairy products. Moreover, the strategic placement of these outlets in accessible locations contributes to their high sales volume.

While Convenience Stores provide the benefit of proximity and quick shopping for essentials, they typically offer a more limited selection of cream products, which may affect their market share. Online Retail Stores are growing but still face challenges such as consumer concerns over product freshness and delivery logistics.

As consumer behaviors continue to evolve, Supermarkets and Hypermarkets are expected to maintain their lead by adapting to market trends and enhancing consumer shopping experiences.

Key Market Segments

By Source

- Dairy

- Non-dairy

By Nature

- Pasteurized

- Ultra-pasteurized

By Type

- Fresh

- Table

- Heavy

- Whipping

- Others

By Application

- Commercial

- Household

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Driving Factors

Increasing Demand for Gourmet and Artisanal Products

The cream market is experiencing significant growth due to rising consumer interest in gourmet and artisanal food products. Cream, a key ingredient in many high-quality culinary creations, is increasingly sought after in professional kitchens and by home cooks aspiring to elevate their cooking to a professional standard.

This trend is supported by the expanding number of cooking shows and culinary schools, which inspire consumers to experiment with premium ingredients, driving higher demand for various types of cream.

Expansion of Food Service Industries

The ongoing expansion of the food service industry is a crucial driver for the cream market. As restaurants, cafes, and bakeries proliferate, the need for high-quality cream as a staple ingredient grows. These establishments rely on cream to enhance the texture and flavor of dishes, ranging from soups and sauces to desserts.

The growth of this sector directly correlates with increased cream consumption, supported by urbanization and the global spread of Western dining concepts that heavily utilize dairy products.

Enhanced Retail Distribution Networks

Improvements in retail distribution networks have made cream products more accessible to a wider audience, significantly influencing the cream market’s growth. Supermarkets and hypermarkets, in particular, play a pivotal role by offering a diverse array of cream products, catering to varying consumer needs.

The convenience of one-stop shopping and the ability to choose from a wide selection encourage consumers to purchase more cream, both for immediate use and experimentation with new recipes.

Restraining Factors

Rising Health Concerns Over High-Calorie Dairy Products

Increasing awareness of health and wellness is shaping consumer preferences, positioning health concerns as a significant restraining factor in the cream market. Many consumers are reducing their intake of high-calorie and high-fat foods, including creams, due to links with obesity and heart disease.

This shift is prompting some shoppers to opt for lighter, lower-fat, or dairy-free alternatives, impacting the demand for traditional cream products in various segments of the market.

Volatility in Dairy Production Costs

The cream market faces challenges from the volatility in dairy production costs. Fluctuations in the prices of raw milk due to seasonal variations, feed costs, and changes in agricultural regulations can lead to unstable cream pricing.

This unpredictability can deter budget-conscious consumers and strain the profit margins of producers, impacting the overall stability and growth potential of the cream market.

Consumer Shift Towards Plant-Based Alternatives

The growing popularity of vegan and plant-based diets is a key restraining factor for the cream market. More consumers are now choosing plant-based alternatives over traditional dairy products for ethical, environmental, or health reasons.

This trend is supported by improvements in the taste and texture of plant-based creams, which are increasingly seen as viable substitutes for dairy-based cream. This shift not only divides consumer preferences but also intensifies competition within the cream market.

Growth Opportunity

Innovation in Dairy-Free and Low-Fat Cream Alternatives

There is a significant growth opportunity within the cream market through the innovation of dairy-free and low-fat alternatives. As health consciousness rises and dietary preferences shift, consumers increasingly seek products that align with their health and wellness goals but do not compromise on taste or texture.

Developing cream alternatives that meet these criteria can capture a growing segment of the market. This innovation not only caters to health-conscious consumers but also appeals to those with dietary restrictions such as lactose intolerance or vegan lifestyles.

Strategic Expansion in Emerging Markets

Emerging markets present a substantial growth opportunity for the cream market. These regions often exhibit rising incomes and an increasing propensity for Western-style diets, which include richer, cream-based dishes. By strategically expanding into these markets, cream producers can tap into new consumer bases eager to adopt international culinary trends.

Effective market entry strategies, such as local partnerships and tailored marketing campaigns, can help maximize penetration and acceptance of cream products in these diverse markets.

Enhanced Marketing Strategies and Brand Positioning

Optimizing marketing strategies and brand positioning offers a vital growth opportunity for players in the cream market. By effectively communicating the quality, versatility, and culinary importance of cream through targeted marketing campaigns, brands can enhance consumer perception and increase usage occasions.

Such strategies can include chef endorsements, recipe integration, and highlighting the sensory benefits of using cream in cooking and baking. Well-executed campaigns can strengthen brand loyalty and encourage both initial trial and repeated purchases.

Latest Trends

Surge in Organic and Natural Cream Product Demand

The cream market is witnessing a significant trend towards organic and natural products. Consumers are increasingly prioritizing health and environmental sustainability, leading them to choose products perceived as safer and more eco-friendly.

This shift is driving demand for cream made from organically raised cows, free from antibiotics and hormones. As awareness grows and distribution improves, this segment is poised for continued growth, attracting health-conscious consumers willing to pay a premium for products aligning with their values.

Growth of Culinary Enthusiasm and Home Cooking

A notable trend in the cream market is the rising enthusiasm for home cooking and gourmet cuisine, fueled by digital media such as food blogs, cooking channels, and social media platforms. This trend has led to increased consumer experimentation with diverse culinary techniques that often involve cream, such as sauces, pastries, and exotic dishes.

The demand for specialized cream types, like whipping or double cream, has grown as home cooks seek to replicate restaurant-quality meals, presenting an opportunity for market expansion through educational and inspirational content.

Increased Adoption of Flavor-Infused Creams

Flavor-infused creams are gaining traction as a key trend in the cream market. Consumers looking for new taste experiences are driving demand for creams enhanced with flavors like vanilla, chocolate, or coffee. These products appeal particularly to the younger demographics and those keen to explore new culinary creations with minimal effort.

This trend is facilitating new product developments and innovations, allowing brands to differentiate their offerings and tap into niche markets that desire a combination of convenience and gourmet flavor profiles.

Regional Analysis

In 2023, the Asia-Pacific cream market dominated with a 45.6% share, valued at USD 7.5 billion.

The global cream market is distinctly segmented by regions including North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Dominating the market, Asia-Pacific holds a substantial 45.6% share, with a market value of USD 7.5 billion, reflecting the region’s deep-rooted dairy consumption culture and growing affluence that increases demand for premium dairy products.

In Europe, traditional consumption patterns and high dairy production capabilities support a robust market, although growth rates are moderated by mature market conditions. North America, characterized by high per capita dairy consumption and a preference for convenience and premium products, continues to show steady growth in cream demand.

The Middle East & Africa, though a smaller segment, is experiencing rapid growth due to urbanization and changing dietary habits, with international cuisine influencing cream usage. Latin America, with its developing dairy alternatives industry, is seeing gradual growth influenced by increasing disposable incomes and the expanding presence of global food chains.

Collectively, these regions underscore the diverse and dynamic nature of the global cream market, with Asia-Pacific leading the charge due to its significant market share and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global cream market sees significant contributions from a variety of key players, each bringing distinct strengths and strategies to the table, helping shape the competitive landscape.

Agropur Cooperative and Lactalis stand out for their expansive product lines and deep penetration in multiple markets, leveraging both organic growth and strategic acquisitions to expand their footprint and product offerings.

These companies benefit from robust supply chain efficiencies and a strong emphasis on sustainability, appealing to a consumer base increasingly concerned with environmental impact.

Arla Foods and Royal FrieslandCampina N.V. focus on innovation in product development, particularly in the areas of health-oriented and specialty creams, such as lactose-free and high-protein options. Their market approach is enhanced by strong branding strategies that emphasize product quality and purity, aligning with global consumer trends toward healthier dietary choices.

Dairy Farmers of America Inc. and Saputo Inc. excel in operational excellence, ensuring high product availability and consistent quality, which is critical in maintaining consumer trust and satisfaction. Their strategies often involve enhancing production capabilities and optimizing distribution networks to effectively meet growing demand.

Nestle S.A. and The Kraft Heinz Company (Lactalis) leverage their vast distribution networks and strong brand recognition to drive growth. Their focus on catering to evolving consumer preferences with new flavors and convenience-focused packaging solutions has helped them maintain a strong market presence.

Emerging players like Fauji Foods Limited (Nurpur) and Gujarat Co-operative Milk Marketing Federation Ltd (Amul) capitalize on regional growth opportunities, particularly in Asia, where rising disposable incomes and westernizing diets contribute to increased cream consumption. Their regional focus and understanding of local consumer preferences allow them to capture significant market shares in their respective territories.

Prairie Farms Dairy and Organic Valley represent a growing segment of the market that prioritizes organic and locally sourced products, which are gaining traction, especially in North America and Europe.

Together, these companies not only drive competition but also foster market growth through continuous innovation, strategic market expansion, and alignment with consumer trends toward healthier and more sustainable lifestyles. Their collective actions and strategies are pivotal in shaping the dynamics of the global cream market in 2023.

Top Key Players in the Market

- Agropur

- Arla Foods

- Dairy Farmers of America Inc.

- Dean Foods

- Dean Foods Company

- Fauji Foods Limited (Nurpur)

- Fonterra Co-operative Group

- Graham’s Family Dairy

- Gujarat Co-operative Milk Marketing Federation Ltd (Amul)

- Lactalis

- Land O Lacks Inc.,

- Nestle S.A.

- Organic Valley

- Prairie Farms Dairy

- Royal FrieslandCampina N.V.

- Saputo Inc.

- Schreiber Foods

- The Kraft Heinz Company (Lactalis)

- Woodlands Dairy

Recent Developments

- In 2023, Agropur focused on enhancing its cream and dairy operations through environmentally responsible practices and community engagement. The cooperative aimed to strengthen its ties with communities and pursued more sustainable dairy processing. These initiatives were part of Agropur’s broader Environmental, Social, and Governance (ESG) efforts to reduce greenhouse gas emissions.

- In 2023, Arla Foods advanced sustainability within its cream sector by integrating a new incentive model into the milk pricing system, rewarding farmers for adopting eco-friendly practices, aimed at reducing the company’s overall carbon footprint.

Report Scope

Report Features Description Market Value (2023) USD 16.6 Billion Forecast Revenue (2033) USD 26.5 Billion CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Dairy, Non-dairy), By Nature (Pasteurized, Ultra-pasteurized), By Type (Fresh, Table, Heavy, Whipping, Others), By Application (Commercial, Household), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agropur, Arla Foods, Dairy Farmers of America Inc., Dean Foods, Dean Foods Company, Fauji Foods Limited (Nurpur), Fonterra Co-operative Group, Graham’s Family Dairy, Gujarat Co-operative Milk Marketing Federation Ltd (Amul), Lactalis, Land O Lacks Inc., Nestle S.A., Organic Valley, Prairie Farms Dairy, Royal FrieslandCampina N.V., Saputo Inc., Schreiber Foods, The Kraft Heinz Company (Lactalis), Woodlands Dairy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agropur

- Arla Foods

- Dairy Farmers of America Inc.

- Dean Foods

- Dean Foods Company

- Fauji Foods Limited (Nurpur)

- Fonterra Co-operative Group

- Graham's Family Dairy

- Gujarat Co-operative Milk Marketing Federation Ltd (Amul)

- Lactalis

- Land O Lacks Inc.,

- Nestle S.A.

- Organic Valley

- Prairie Farms Dairy

- Royal FrieslandCampina N.V.

- Saputo Inc.

- Schreiber Foods

- The Kraft Heinz Company (Lactalis)

- Woodlands Dairy