Artichokes Market Size, Share, And Strategic Business Review By Form (Fresh, Frozen, Canned), By Origin (Organic, Conventional), By Product Type (Globe, Elongated), By Application (Medical Research, Liqueur, Herbal Tea, Cooking, Personal Care, Dietary Supplements, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136435

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Strategic Business Review of Artichokes

- By Form Analysis

- By Origin Analysis

- By Product Type Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

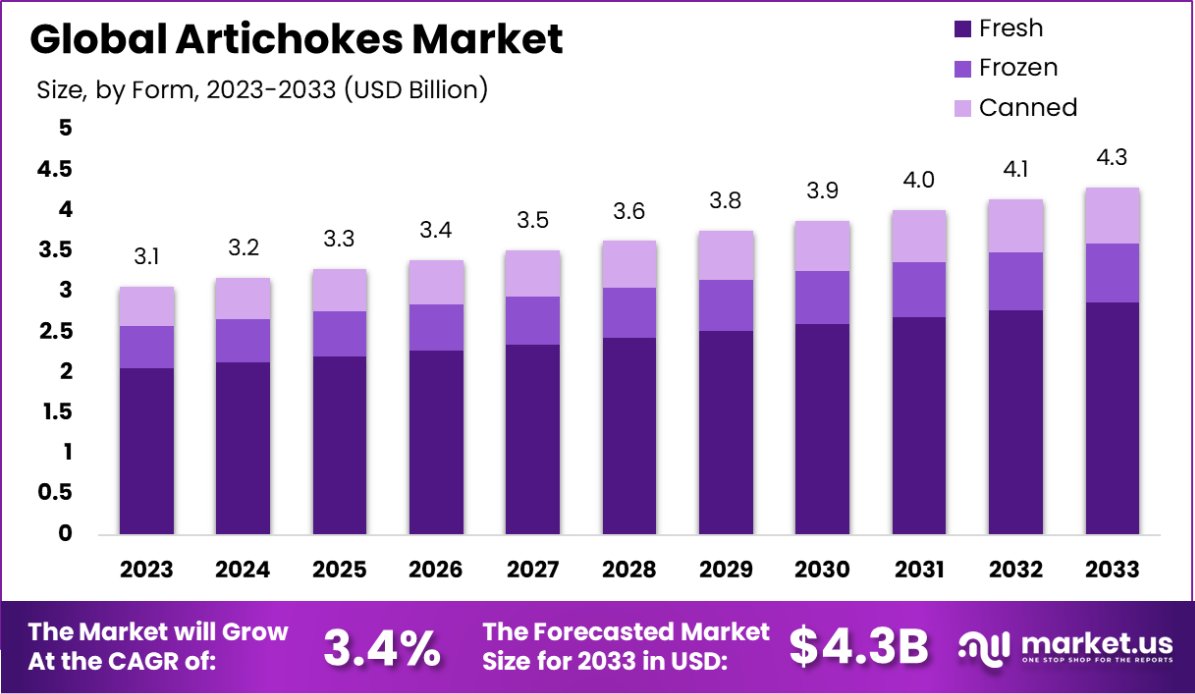

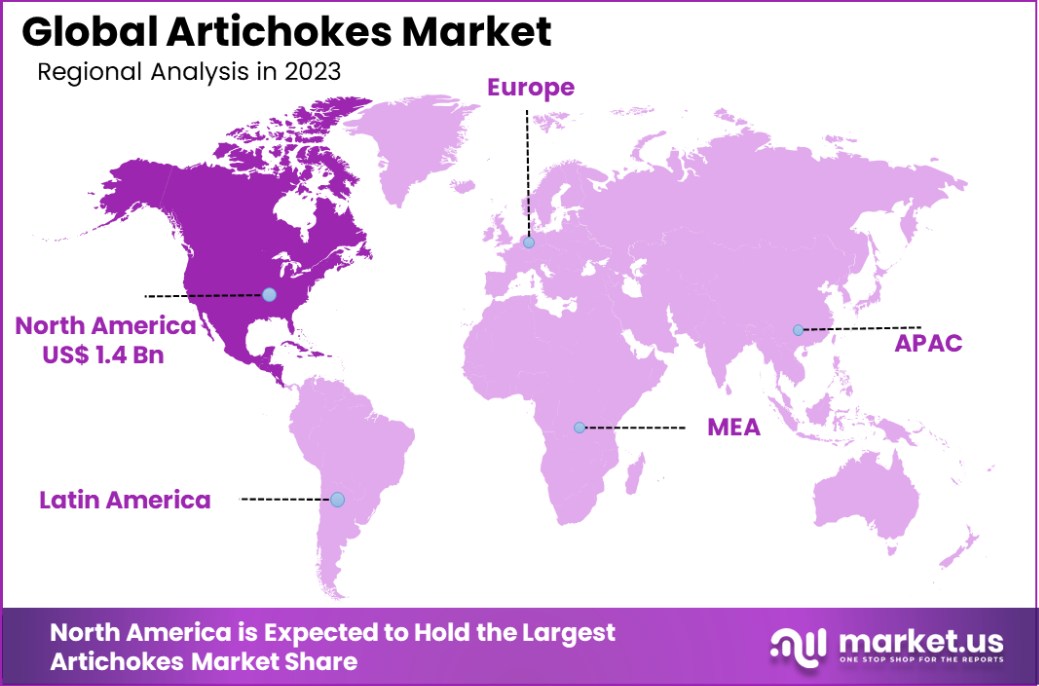

The Global Artichokes Market is expected to be worth around USD 4.3 Billion by 2033, up from USD 3.1 Billion in 2023, and grow at a CAGR of 3.4% from 2024 to 2033. In North America, the artichokes market holds 47.2% with a value of USD 1.4 billion.

Artichokes are a type of vegetable from the thistle family, primarily grown for their edible buds. The edible parts of the artichoke include the fleshy leaves and heart, which have a unique, slightly bitter flavor.

They are rich in antioxidants, vitamins, and minerals, and are often used in Mediterranean cuisine. There are two main types of artichokes: globe artichokes (the most common variety) and Jerusalem artichokes, which are not true artichokes but are tubers related to sunflowers.

The growth of the artichokes market is driven by increasing consumer awareness of the health benefits associated with these vegetables, including their ability to support digestive health and provide antioxidants.

Moreover, the growing popularity of Mediterranean diets and organic food products has positively influenced demand. Advancements in farming techniques, along with better storage and smart transportation methods, have also contributed to steady market growth.

Demand for artichokes is rising globally, particularly in North America and Europe, driven by the increasing adoption of healthy, plant-based diets. The versatility of artichokes in dishes like salads, dips, and pasta also fuels consumer interest.

Opportunities in the artichokes market lie in expanding their use in processed food products, such as canned or frozen artichokes, and tapping into emerging markets in Asia and Latin America, where demand for nutritious foods is growing.

The Artichokes Market presents a dynamic landscape characterized by strong production concentrations in specific regions, driven by a mix of global demand and climatic conditions. As of 2022, global production reached 1,584,514 tonnes, marking a slight decline of 4.78% from the previous year, though it still showed a modest growth of 1.76% over the past decade (Helgilibrary).

This indicates a stabilization trend despite occasional fluctuations in output. The market remains heavily dependent on a few key players: Egypt, Italy, and Spain, which together contribute to 65.5% of the global artichoke supply. In total, the top ten producing countries account for an overwhelming 93.8% of the global harvest, underscoring the highly concentrated nature of artichoke cultivation.

The United States, with California as the undisputed leader, primarily dominates domestic production. Nearly 100% of U.S. artichokes are grown in California, with Monterey County accounting for about 80% of the state’s total output (WorldAtlas). This concentration presents a significant vulnerability to local environmental changes but also offers opportunities for agricultural innovations and efficiencies within the region.

The market’s growth prospects are influenced by increasing consumer awareness of the health benefits of artichokes, which have prompted rising demand for fresh and processed forms. However, challenges such as climate change and water scarcity, particularly in leading production regions like California, could disrupt supply chains and pressure prices.

Additionally, consumer preferences toward organic and sustainably sourced produce are expected to shape the future of artichoke cultivation. Ultimately, the market’s future trajectory will be shaped by a combination of regional supply dynamics and evolving global consumption patterns.

Key Takeaways

- The Global Artichokes Market is expected to be worth around USD 4.3 Billion by 2033, up from USD 3.1 Billion in 2023, and grow at a CAGR of 3.4% from 2024 to 2033.

- Fresh artichokes dominate the market, accounting for 67.44% of the overall market share.

- Conventional artichokes are the preferred choice, making up 77.5% of the total market.

- Globe artichokes lead product types, with 79.3% of the market focused on this variety.

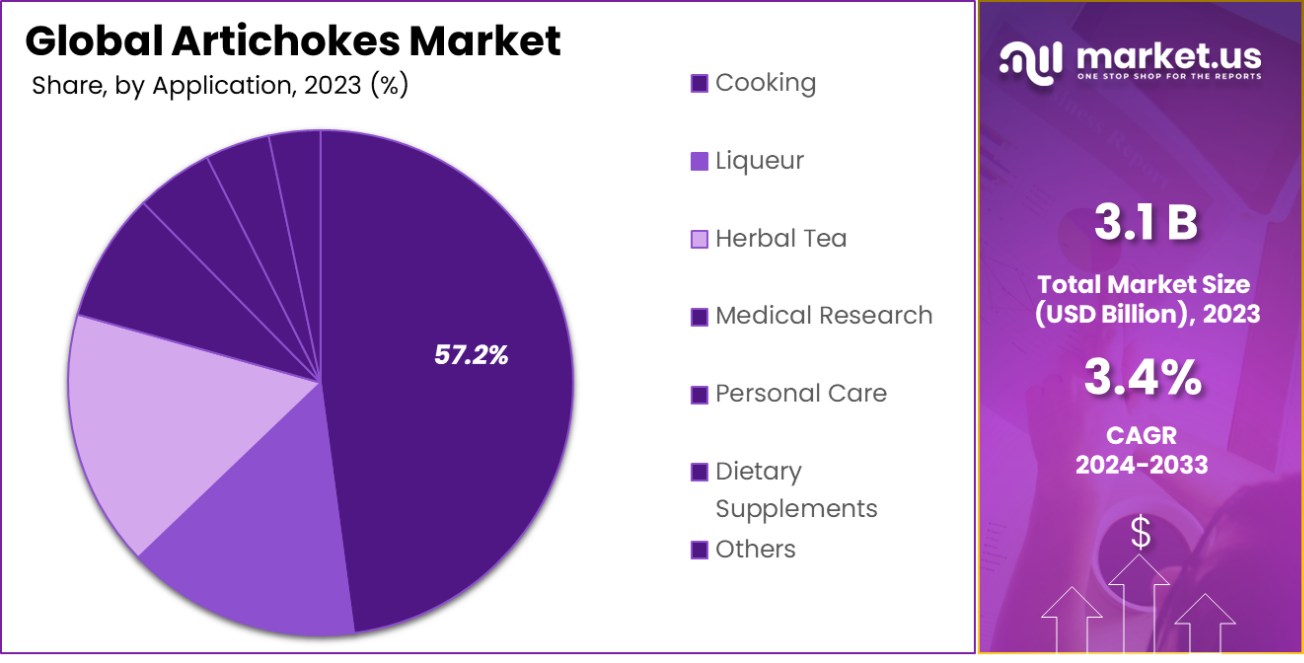

- The cooking application holds the largest share, representing 57.2% of artichoke market usage.

- In North America, the Artichokes Market accounts for 47.2% with a valuation of USD 1.4 billion.

Strategic Business Review of Artichokes

The strategic overview of artichokes in the United States reveals a concentrated production primarily in California, which accounts for nearly all of the country’s artichoke output. The Globe Artichoke is the predominant variety grown, with commercial production heavily localized to California’s coastal areas, benefitting from the mild climate that supports year-round cultivation.

Key statistics from the USDA indicate that the artichoke crop undergoes a seasonal production cycle, with the highest yields typically recorded between March and May each year. The crop has adapted well to California’s diverse climates, and recent efforts have been made to breed varieties that require less cold exposure, expanding potential growing areas within the state and beyond.

California’s role as a dominant player in the U.S. artichoke market is underpinned by its substantial contributions to the national agriculture sector, with artichokes being one of the many specialty crops that bolster the state’s agricultural economy. Despite this prominence, the industry faces challenges such as climate change, which necessitates ongoing research and adaptation strategies to sustain production levels.

By Form Analysis

The Artichokes Market is driven by fresh artichokes, which account for 67.44% of tthe otal market share.

In 2023, Fresh held a dominant market position in the By Form segment of the Artichokes Market, capturing a 67.44% share. This significant portion reflects consumer preferences for fresh produce, driven by its perceived higher quality and nutritional benefits compared to other forms.

Frozen artichokes accounted for 21.89% of the market, appreciated for their convenience and longer shelf life, which cater to the demand for year-round availability. Canned artichokes made up the smallest share at 10.67%, often favored for their ready-to-use feature, facilitating quick meal preparations and serving as a staple in pantry storage.

The market dynamics indicate a robust preference for fresh artichokes, underscoring their prominence in both retail and culinary applications. The fresh segment’s dominance is further reinforced by growing consumer awareness of the health benefits associated with fresh vegetables, as well as increasing availability in supermarkets and farmer’s markets.

Meanwhile, frozen artichokes continue to gain traction as consumers seek convenient, yet healthy, food options that align with busy lifestyles. The canned segment, while smaller, remains relevant in markets where preservation and storage longevity are valued. Overall, the By Form segment of the Artichokes Market demonstrates a diverse consumer base with varying preferences that drive the demand across different form types.

By Origin Analysis

Conventional artichokes dominate the market, holding 77.5% of the global artichoke supply in all product segments.

In 2023, Conventional held a dominant market position in the By Origin segment of the Artichokes Market, with a 77.5% share. This substantial market share is indicative of the established supply chains and the scalability of conventional farming practices, which often offer lower prices and higher availability of artichokes compared to their organic counterparts.

Organic artichokes accounted for the remaining 22.5% of the market, signaling a robust but smaller niche that caters to health-conscious consumers who prioritize produce grown without synthetic pesticides or fertilizers.

The significant preference for conventional artichokes can be attributed to their widespread availability in global markets and their price advantage, making them more accessible to a broader consumer base. Moreover, conventional artichokes benefit from higher-yield farming techniques and extensive distribution networks, ensuring consistent supply to meet the high demand in both fresh and processed forms.

Meanwhile, the organic segment is growing as consumers become more environmentally conscious and willing to invest in premium products perceived as healthier and more sustainable.

The trend towards organic eating is supported by an increase in organic farming initiatives and the expansion of retail spaces dedicated to organic produce. Although smaller in scale, the organic segment is expected to grow steadily as consumer preferences shift towards sustainability and health-conscious eating habits.

By Product Type Analysis

Globe artichokes lead the product type category, representing 79.3% of the global market share for artichokes.

In 2023, Globe Artichokes held a dominant market position in the By Product Type segment of the Artichokes Market, with a 79.3% share. This dominance is reflective of the variety’s widespread popularity due to its large, meaty leaves and mild, nutty flavor, which are preferred in both culinary applications and direct consumption.

Elongated artichokes, with a 20.7% market share, cater to a more niche market, appreciated for their elongated, more tapered shape and slightly more intense flavor, which is particularly favored in certain regional cuisines.

The preference for Globe Artichokes can be attributed to their versatility and substantial presence in the retail and food service sectors. They are a staple in Mediterranean diets and are increasingly incorporated into diverse culinary traditions worldwide. Their large size and dense heart make them ideal for a variety of dishes, from steamed and grilled preparations to being a key ingredient in dips and salads.

Despite the smaller market share, Elongated artichokes are gaining traction among gourmet chefs and food enthusiasts who seek different flavors and textures. The distinct characteristics of Elongated artichokes provide a unique culinary experience, promoting their use in specialty dishes and high-end dining.

The ongoing exploration of diverse artichoke types in global cuisines suggests potential growth opportunities for Elongated artichokes as consumer palates become more adventurous.

By Application Analysis

Cooking applications make up 57.2% of the artichokes market, reflecting their importance in culinary uses worldwide.

In 2023, Cooking held a dominant market position in the By Application segment of the Artichokes Market, with a 57.2% share. This significant dominance underscores the primary use of artichokes in culinary applications, where they are prized for their flavor and nutritional benefits.

Dietary Supplements followed with a 14.3% share, reflecting a growing consumer interest in artichokes’ health-promoting properties, such as liver support and cholesterol management.

Herbal Tea accounted for 11.8% of the market, favored for its digestive and detoxifying benefits. The Liqueur segment captured 8.6%, where artichoke’s unique bitter flavor is utilized in specialty spirits.

Medical Research and Personal Care segments accounted for smaller shares of 4.6% and 3.5% respectively, indicating niche but important uses of artichokes in pharmaceutical research and skincare products due to their antioxidant content.

The substantial share of Cooking can be attributed to the increasing incorporation of artichokes into diverse cuisines globally, driven by a rising interest in Mediterranean diets known for their health benefits and flavorful dishes.

As consumers continue to seek out nutritious and versatile ingredients, the prominence of artichokes in cooking is expected to remain strong, supported by their growing availability in fresh, frozen, and canned forms.

Key Market Segments

By Form

- Fresh

- Frozen

- Canned

By Origin

- Organic

- Conventional

By Product Type

- Globe

- Elongated

By Application

- Medical Research

- Liqueur

- Herbal Tea

- Cooking

- Personal Care

- Dietary Supplements

- Others

Driving Factors

Increasing Health Awareness Boosts Artichoke Consumption

As consumers become more health-conscious, they seek out foods with notable health benefits. Artichokes are rich in fiber, antioxidants, and vitamins, which positions them as a desirable choice for health-minded individuals.

This trend is significantly driving the artichoke market’s growth, as more people incorporate these nutritious vegetables into their diets to improve digestion, lower cholesterol, and support overall health.

Growth of Mediterranean Cuisine Globally

The global popularity of Mediterranean cuisine, known for its use of fresh, high-quality ingredients, including artichokes, is a major driving factor for the artichoke market. As more people worldwide embrace these dietary patterns, the demand for artichokes increases, not just in traditional markets but also in regions where Mediterranean food is becoming more popular. This culinary trend promotes higher consumption of artichokes both in homes and restaurants.

Expansion of Retail and Distribution Channels

The expansion of retail formats and distribution channels has made artichokes more accessible to a broader audience. Supermarkets, hypermarkets, and online grocery platforms now often feature fresh, frozen food, and canned artichokes, enhancing consumer convenience and availability.

This accessibility allows consumers to purchase artichokes more easily, supporting the growth of the market as these vegetables are integrated into more diverse cooking practices and dietary habits worldwide.

Restraining Factors

High Cost of Production and Maintenance

Artichokes are particularly labor-intensive to grow and require specific climate conditions, which significantly raises their production costs. These high costs are then passed on to consumers, making artichokes more expensive compared to other vegetables.

This price factor can restrain market growth, as higher costs may deter budget-conscious consumers from purchasing artichokes, especially in price-sensitive markets.

Limited Consumer Awareness Outside Traditional Markets

In regions where artichokes are not traditionally consumed, there is limited consumer awareness about how to prepare and use them. This lack of familiarity can hinder market expansion, as potential consumers might be reluctant to buy artichokes due to uncertainty about their culinary uses or benefits. Increasing consumer education and culinary exposure could mitigate this factor but currently serves as a restraint.

Seasonal Availability and Supply Chain Disruptions

Artichokes have a peak season, and their availability can be significantly affected by seasonal changes and unfavorable weather conditions, leading to fluctuations in supply. Additionally, disruptions in the supply chain, such as transportation delays or logistical challenges, can hinder the consistent availability of artichokes in the market. This variability can make it difficult for suppliers to meet consumer demand consistently, impacting the market’s overall stability and growth.

Growth Opportunity

Expansion into Emerging Markets with Health Trends

Emerging markets present significant growth opportunities for the artichokes market, particularly as health and wellness trends gain momentum globally. As consumers in these regions become more health-conscious and open to trying new foods, introducing artichokes as a nutritious and versatile vegetable can capture this growing demographic.

Marketing efforts focused on the health benefits of artichokes, along with recipes and usage tips, can help cultivate demand and familiarity in these new markets.

Development of Value-Added Artichoke Products

The development of value-added products such as marinated artichokes, artichoke dips, and ready-to-eat artichoke meals offers substantial growth opportunities. These products cater to the increasing consumer demand for convenience without sacrificing health benefits.

By expanding product lines to include these more convenient, processed options, producers can tap into the busy lifestyles of modern consumers who prioritize quick and easy meal solutions but are also mindful of nutritional content.

Leveraging Organic and Sustainable Practices

Capitalizing on the organic food movement provides a promising growth avenue for the artichoke market. By promoting artichokes grown under organic and sustainable practices, producers can attract environmentally conscious consumers willing to pay a premium for products that are both healthy and environmentally friendly.

This trend is supported by increasing consumer awareness about the environmental impact of their food choices and a growing preference for products that are certified organic and sustainably sourced.

Latest Trends

Rise of Plant-Based Diets Enhances Artichoke Popularity

The surge in plant-based eating habits is a significant trend influencing the artichokes market. As more consumers opt for diets centered around vegetables and plant-based meats for health and environmental reasons, artichokes are increasingly valued for their versatility and nutritional profile.

This trend is promoting the use of artichokes in a variety of dishes, from vegan main courses to health-focused snacks, supporting a broader integration into daily diets and menu offerings in restaurants.

Increased Use of Artichokes in Functional Foods

Artichokes are being increasingly recognized for their health benefits, including liver health support and cholesterol management, leading to their expanded use in functional foods. Manufacturers are incorporating artichoke extracts into supplements and health products to leverage their bioactive compounds, such as cynarin and luteolin.

This trend towards health-focused food innovations is driving new product development and marketing strategies, highlighting the functional benefits of artichokes beyond their culinary use.

Culinary Innovation Drives New Artichoke Applications

Culinary innovation is a driving trend in the artichokes market, as chefs and food enthusiasts explore new ways to incorporate this vegetable into modern and traditional cuisines. From gourmet restaurant dishes to home-cooking recipes, artichokes are being used in novel ways, such as in artisan pizzas, upscale pasta dishes, and even desserts.

This trend is facilitated by the growing cultural exchange in global cuisine, encouraging consumers to experiment with artichokes in unexpected and delightful ways.

Regional Analysis

In North America, the artichokes market holds 47.2% with a valuation of USD 1.4 billion.

The Artichokes Market exhibits notable regional disparities, reflecting varying consumer preferences and culinary traditions across the globe. North America dominates the market, holding a substantial 47.2% share with a market value of USD 1.4 billion, driven by increasing health awareness and the popularity of Mediterranean cuisine.

Europe follows closely, renowned for its rich culinary heritage that prominently features artichokes, especially in Mediterranean countries such as Italy and Spain. This region capitalizes on traditional uses and a strong local production base.

In contrast, the Asia Pacific region presents rapid growth opportunities, albeit from a smaller base, fueled by expanding urbanization and the rising middle class adopting more diverse diets.

Latin America and the Middle East & Africa regions, while smaller in terms of market share, are experiencing gradual growth due to the increasing influence of Western eating habits and the introduction of foreign vegetables into local diets.

These regions offer potential for market expansion as consumer awareness and availability of artichokes increase. Overall, while North America currently leads the market, other regions are poised to contribute to the global growth of the artichokes market as dietary trends evolve.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global artichokes market will be significantly influenced by the activities and strategies of key players. These companies, spanning from dedicated artichoke cultivators to diverse agricultural conglomerates, play pivotal roles in shaping market dynamics.

Agro T18 and Italia Srl are examples of firms that focus on optimizing cultivation techniques and expanding distribution networks across Europe, leveraging Italy’s robust position in the artichoke market. Their efforts are complemented by Agroittica Lombarda, known for innovative agribusiness strategies that enhance artichoke yield and quality, positioning them as leaders in the European sector.

In the arena of value-added products, companies like Gaia Herbs Inc. and Anklam Extrakt GmbH excel by incorporating artichokes into health and wellness products, tapping into the growing demand for functional foods. This approach not only broadens their market reach but also diversifies their product lines into supplements and herbal extracts.

D’Arrigo Bros. and Ocean Mist Farms, prominent in North America, focus on extensive marketing and brand recognition strategies to maintain their dominance in the region. They invest in sustainable farming practices and consumer education to boost demand for artichokes.

Castellini Company and Mastronardi Produce exemplify how integrating advanced agricultural technologies and efficient supply chain management can cater to the expansive North American and European markets, ensuring freshness and availability.

Moreover, Master Fruit Srl and The Sa Marigosa Op, among others, have been pivotal in exploring new market segments, including organic and GMO-free products, responding to consumer demands for transparency and sustainability in food sources.

Lastly, companies like Tanimura & Antle and Valpredo Enterprises highlight the role of strategic regional expansion and partnerships in accessing emerging markets, particularly in Asia Pacific and Latin America, where there is a growing affinity for Western vegetables.

These key players, through their diverse and innovative approaches, not only drive competition within the artichokes market but also contribute to its global expansion and the introduction of artichokes into new culinary landscapes.

Top Key Players in the Market

- Agro T18

- Italia Srl

- Agroittica Lombarda

- Anklam Extrakt GmbH

- Caprichos del Paladar S.L.U.

- Castellini Company

- D’Arrigo Bros.

- Fontanara

- Gaia Herbs Inc.

- Gold Coast Packing

- Green Globe Produce

- Groupe Soufflet

- Herrawi Group

- King Herbs Ltd.

- Master Fruit Srl

- Mastronardi

- Produce Europe

- Ocean Mist Farms

- Ole

- Tanimura & Antle

- The Sa Marigosa Op

- Trapani Artichokes

- Valpredo Enterprises

- W. Noordam & Zonen BV

Recent Developments

- In 2023, Fontanara focused on optimizing artichoke yield and quality through advanced agricultural techniques and sustainable practices. Their efforts aimed to ensure high-quality produce supply and boost productivity while maintaining environmental sustainability in the artichoke sector.

- In 2023, Gold Coast Packing supplied various produce including artichokes, emphasizing food safety and innovative supply solutions tailored for food service providers, ensuring high-quality, fresh products to enhance customer management and satisfaction.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Billion Forecast Revenue (2033) USD 4.3 Billion CAGR (2024-2033) 3.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Fresh, Frozen, Canned), By Origin (Organic, Conventional), By Product Type (Globe, Elongated), By Application (Medical Research, Liqueur, Herbal Tea, Cooking, Personal Care, Dietary Supplements, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agro T18, Italia Srl, Agroittica Lombarda, Anklam Extrakt GmbH, Caprichos del Paladar S.L.U., Castellini Company, D’Arrigo Bros., Fontanara, Gaia Herbs Inc., Gold Coast Packing, Green Globe Produce, Groupe Soufflet, Herrawi Group, King Herbs Ltd., Master Fruit Srl, Mastronardi, Produce Europe, Ocean Mist Farms, Ole, Tanimura & Antle, The Sa Marigosa Op, Trapani Artichokes, Valpredo Enterprises, W. Noordam & Zonen BV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agro T18

- Italia Srl

- Agroittica Lombarda

- Anklam Extrakt GmbH

- Caprichos del Paladar S.L.U.

- Castellini Company

- D'Arrigo Bros.

- Fontanara

- Gaia Herbs Inc.

- Gold Coast Packing

- Green Globe Produce

- Groupe Soufflet

- Herrawi Group

- King Herbs Ltd.

- Master Fruit Srl

- Mastronardi

- Produce Europe

- Ocean Mist Farms

- Ole

- Tanimura & Antle

- The Sa Marigosa Op

- Trapani Artichokes

- Valpredo Enterprises

- W. Noordam & Zonen BV