Global Rice Bran Oil Market Size, Share, Business Benefits By Type (Refined, Non-Refined), By Category (Conventional, Organic), By Packaging Type (Bottles, Pouches, Others), By Application (Food Processing, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136348

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

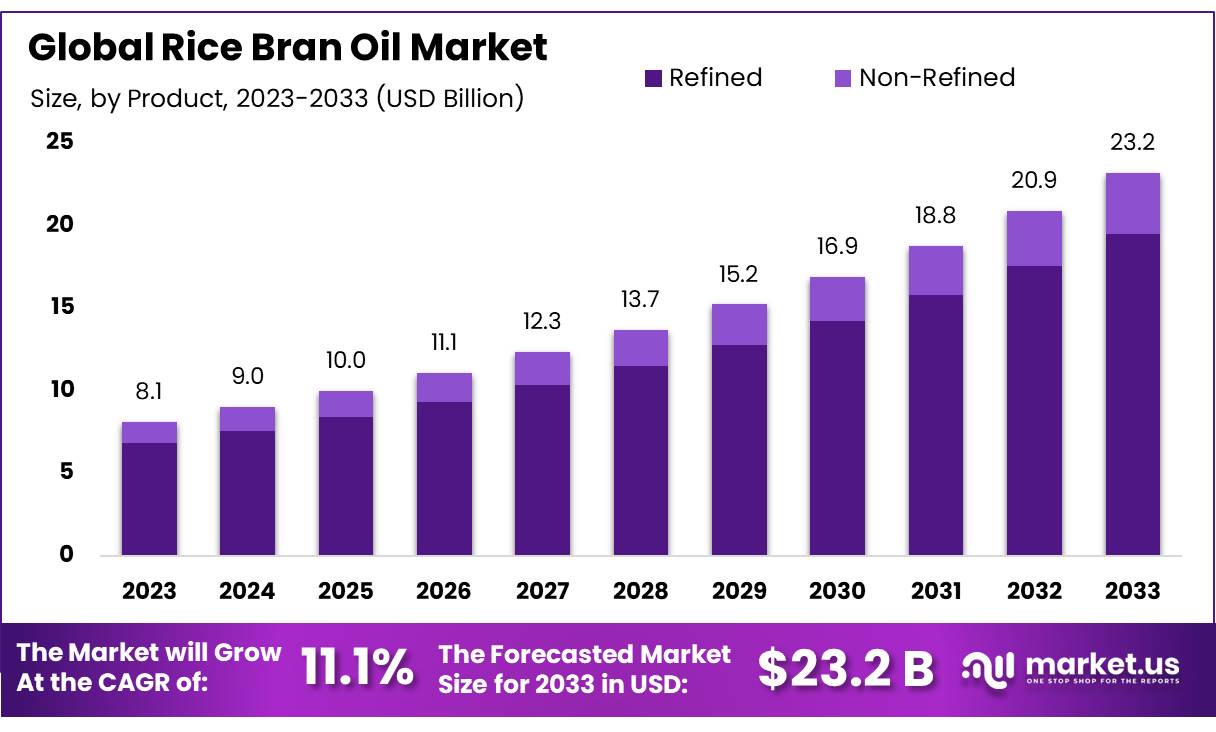

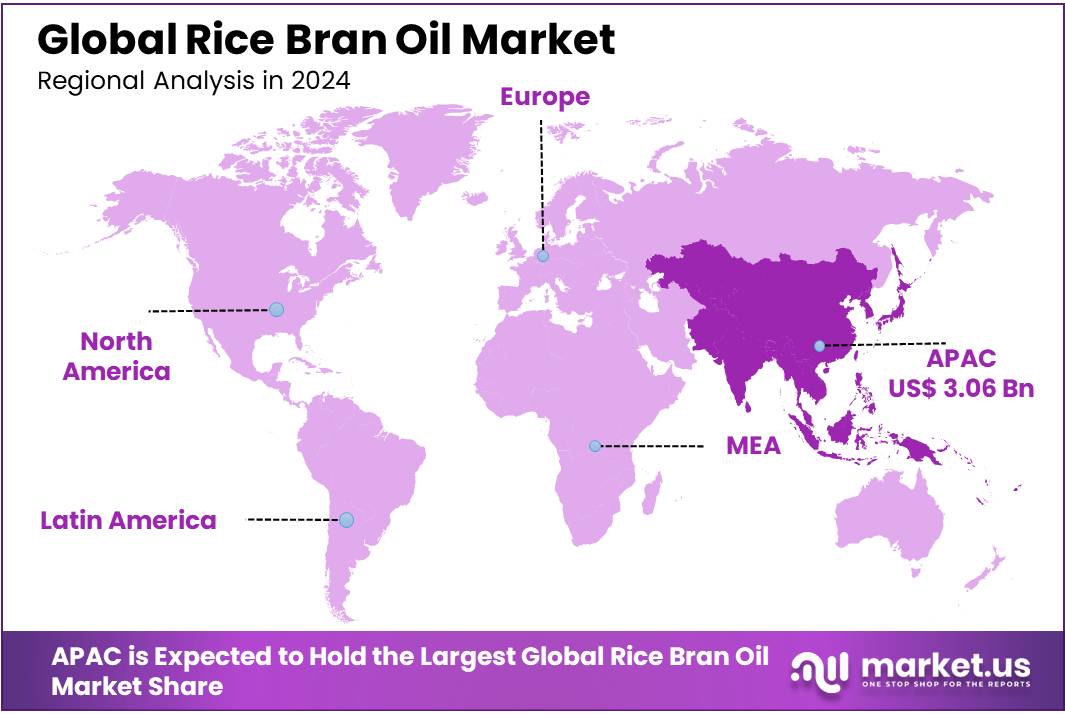

The Global Rice Bran Oil Market size is expected to be worth around USD 23.2 Bn by 2033, from USD 8.1 Bn in 2023, growing at a CAGR of 11.1% during the forecast period from 2024 to 2033. In 2023, Asia Pacific held a dominant position in the Government Cloud market, capturing over 37.9% of the market share, with revenues totaling USD 3.06 billion.

Rice Bran Oil is a vegetable oil extracted from the outer layer (bran) of rice grains. It is known for its light flavor, high smoke point, and nutritional benefits, making it a popular cooking oil in many parts of Asia and increasingly in Western countries.

Rich in monounsaturated and polyunsaturated fats, rice bran oil contains a unique compound called oryzanol, which is believed to have antioxidant properties that can help lower cholesterol levels and support heart health. Additionally, it is a good source of vitamin E, essential fatty acids, and other phytochemicals, which contribute to its health benefits.

Rice bran oil is gaining momentum in the global market due to its health benefits and increasing demand in various food and industrial applications. This growth is being driven by factors such as rising health awareness, government initiatives promoting healthier cooking oils, and innovations in food products.

In particular, the demand for rice bran oil is on the rise in the Asia-Pacific region, which accounted for 65% of the global market share in 2023, with countries like India, China, and Japan being the largest consumers. In India, rice bran oil production is forecasted to reach over 900,000 metric tons by the end of 2024, driven by both domestic consumption and export opportunities.

The increasing demand for healthier, low-cholesterol oils has prompted various governments to encourage the use of rice bran oil as a substitute for other cooking oils. In India, the government has been promoting the use of rice bran oil through policies that support its production and commercialization.

The Ministry of Food Processing Industries (MOFPI) has rolled out initiatives to improve the processing infrastructure, which is expected to boost production by 6-8% annually. Additionally, public-private partnerships, such as the one between Syntel Group and Dabur India, are facilitating rice bran oil’s market expansion in both the food industry and other sectors such as cosmetics and pharmaceuticals.

The rice bran oil market also benefits from an increase in its export potential, particularly to Europe and North America. In 2023, India, the world’s largest producer of rice bran oil, exported approximately 350,000 metric tons of rice bran oil, valued at over USD 400 million. This figure is expected to grow by 10% in 2024 due to increased consumer demand for healthier oils in international markets.

Innovation in rice bran oil products has further propelled its market presence. For instance, Marico Limited launched a new line of rice bran oil products in 2023, aimed at premium health-conscious consumers. The launch has reportedly contributed to a 12% increase in the company’s rice bran oil sales in the first half of 2024. Additionally, rice bran oil’s use in non-food sectors, including personal care products, has seen a surge, with the cosmetic industry adopting it for its moisturizing and antioxidant properties.

Key Takeaways

- Rice Bran Oil Market size is expected to be worth around USD 23.2 Bn by 2033, from USD 8.1 Bn in 2023, growing at a CAGR of 11.1%.

- Refined Rice Bran Oil held a dominant market position, capturing more than a 84.3% share.

- Conventional Rice Bran Oil held a dominant market position, capturing more than 88.4% of the market share.

- Bottles held a dominant market position, capturing more than a 67.4% share.

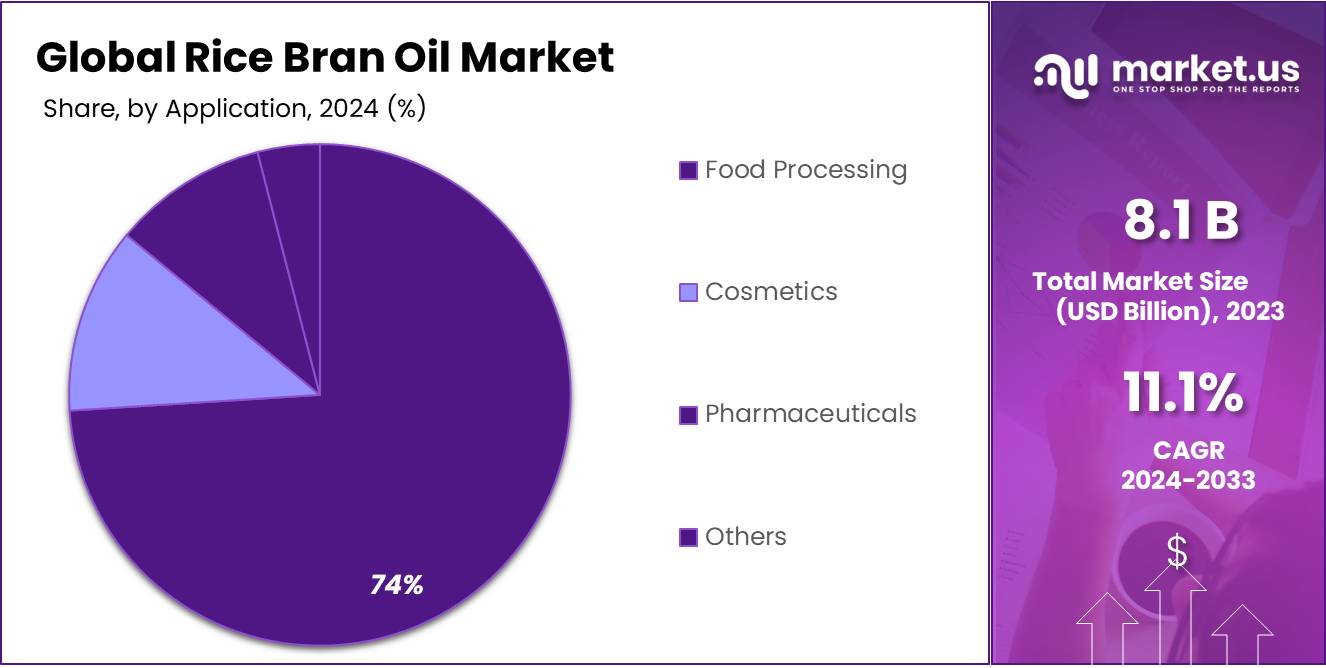

- Food Processing held a dominant market position, capturing more than a 74.4% share.

- Supermarket/Hypermarket held a dominant market position, capturing more than a 56.3% share.

- Asia Pacific (APAC) region dominates the global rice bran oil market, holding a significant share of 37.9%, valued at approximately USD 3.06 billion in 2023.

Business Benefits of Rice Bran Oil Market

In 2023, rice bran oil continued to offer significant business benefits across various industries, especially in the food and beverage sector. With its high smoke point and neutral flavor, rice bran oil is a popular choice for frying and cooking, making it a staple in both households and commercial kitchens.

Its stable demand in the food industry, where it’s used in everything from snacks to deep frying, helped sustain its market position. The oil’s versatility in different cooking applications has been a key driver of its business benefits, as it fits seamlessly into diverse culinary practices across global markets.

With more people prioritizing sustainability and cleaner food options, organic rice bran oil is gaining popularity, especially in markets like North America and Europe. As consumer demand for organic products rises, businesses tapping into this segment can see growth opportunities, particularly as health-conscious consumers seek oils with fewer chemicals and additives.

In 2024, the rice bran oil market is expected to see continued growth, especially with the increased demand for healthier and more sustainable cooking oils. Both conventional and organic rice bran oils are poised to benefit from this trend.

Conventional rice bran oil will maintain its dominant position in the market, with its affordable pricing continuing to appeal to a broad demographic, including price-sensitive consumers in emerging markets. On the other hand, organic rice bran oil is projected to grow at a faster pace, driven by increasing consumer interest in clean-label and organic products. As health trends continue to influence consumer choices, businesses focusing on organic rice bran oil will likely see higher margins and increased sales.

The business advantages of entering the rice bran oil market in 2024 also include expanding product lines to meet growing consumer preferences. Companies can diversify their offerings by introducing various forms of rice bran oil, such as refined, unrefined, and cold-pressed, targeting both health-conscious consumers and those looking for cost-effective cooking solutions.

Additionally, leveraging rice bran oil’s high levels of antioxidants, vitamins, and heart-healthy fats, businesses can market the product as a healthier alternative to other cooking oils, enhancing its appeal in both the retail and foodservice sectors.

By Type

In 2023, Refined Rice Bran Oil held a dominant market position, capturing more than a 84.3% share. This segment’s growth can be attributed to the rising consumer preference for oils with longer shelf life, better taste, and improved cooking properties. Refined oil undergoes a stringent filtration and processing process, making it more suitable for high-temperature cooking, such as frying, which further drives its demand in both domestic and industrial kitchens.

The demand for refined rice bran oil is also supported by the increasing trend of health-conscious consumers due to its higher stability, antioxidant content, and perceived health benefits compared to other oils.

Non-Refined Rice Bran Oil accounts for a smaller portion of the market, with a steadily growing presence in niche segments. In 2023, this segment held a market share significantly lower than the refined category. Non-refined oil is considered by some consumers as a more natural and organic product due to the minimal processing it undergoes.

It is often used in gourmet cooking or for specific health-related purposes, such as skin care. However, its limited shelf life and relatively shorter cooking stability compared to refined oil continue to restrict its wider adoption in mainstream culinary practices. Despite these challenges, the non-refined segment is expected to see gradual growth as consumer interest in organic and minimally processed products rises.

By Category

In 2023, Conventional Rice Bran Oil held a dominant market position, capturing more than 88.4% of the market share. This significant share can be attributed to the widespread availability and cost-effectiveness of conventional production methods. Conventional rice bran oil has been the preferred choice for consumers, particularly due to its affordability and established presence in the market. The oil is widely used in various cooking applications, especially in regions with high rice production, such as India and Southeast Asia.

The demand for conventional rice bran oil remained strong in 2023, largely driven by its use in the food industry, including frying, sautéing, and baking. The oil’s mild flavor and stability at high temperatures make it a popular choice in households and commercial kitchens alike. Additionally, the consistent quality and high smoke point of conventional rice bran oil further enhance its appeal in everyday cooking.

On the other hand, the Organic Rice Bran Oil segment has been gradually expanding. Although it accounted for a smaller portion of the market in 2023, of the overall share, organic rice bran oil has seen steady growth due to increasing consumer awareness regarding health and sustainability. As more individuals adopt healthier lifestyles and seek products free from pesticides and chemicals, the organic variant has gained traction, especially in North America and Europe.

In 2024, the market for rice bran oil is expected to continue following these trends, with conventional rice bran oil maintaining its market dominance. However, the organic segment is anticipated to experience a stronger growth rate, as consumers are expected to gravitate towards products that align with clean and sustainable eating practices.

By Packaging Type

In 2023, Bottles held a dominant market position, capturing more than a 67.4% share. Bottles, particularly plastic and glass, have been the preferred packaging choice for rice bran oil due to their convenience, ease of use, and better preservation qualities. The growing demand for smaller, single-serving packages, as well as larger family-sized bottles, has played a significant role in the strong performance of this segment.

Bottles also offer better visibility of the product, which helps build consumer trust and brand recognition. The segment’s growth has been supported by the increasing popularity of rice bran oil in retail markets and supermarkets, where bottled packaging is more suitable for shelf display. Over the years, bottle packaging has continued to dominate, with innovations in packaging design and eco-friendly materials further strengthening its position in the market.

The Pouches segment, while smaller in comparison, has been gaining traction. In 2023, pouches held a more modest market share, driven primarily by cost-effectiveness and the convenience of lightweight packaging. Pouches are also more flexible, which can be attractive for consumers who prioritize ease of storage. However, this segment is largely focused on value-for-money consumers, and while it has seen growth, it remains behind bottle packaging in terms of volume and revenue. Pouch packaging is particularly favored in emerging markets where affordability and portability are key factors driving purchasing decisions.

By Application

In 2023, Food Processing held a dominant market position, capturing more than a 74.4% share. The food processing industry remains the largest consumer of rice bran oil due to its numerous benefits, including high smoke point, mild flavor, and versatility in cooking. Rice bran oil is widely used in the preparation of snacks, ready-to-eat meals, frying oils, and cooking oils in food processing plants.

Its health benefits, including high antioxidant content and cholesterol-lowering properties, have contributed to the increased adoption by manufacturers aiming to meet the growing demand for healthier food options. Over the years, food processing companies have also embraced rice bran oil due to its affordability and stability, which is essential for mass production and longer shelf-life products. In 2023, this segment continued to lead the market, driven by the consistent growth of the packaged food sector.

The Cosmetics segment, while smaller than food processing, has been experiencing steady growth. In 2023, it held a modest but growing share, driven by increasing consumer interest in natural and plant-based ingredients. Rice bran oil is valued for its skin-nourishing properties, including its ability to moisturize, reduce wrinkles, and improve skin texture.

It is used in a variety of cosmetic products such as lotions, creams, and facial oils. As more consumers shift toward organic and eco-friendly beauty products, rice bran oil’s popularity in cosmetics is expected to continue rising in the coming years, although it still remains a secondary application compared to food processing.

In the Pharmaceuticals segment, rice bran oil is used in the formulation of certain health supplements and topical treatments. In 2023, the pharmaceutical sector captured a smaller share of the market, but it is steadily gaining ground.

The oil’s antioxidant properties and potential health benefits, such as reducing inflammation and improving heart health, have attracted attention for use in pharmaceutical applications. However, the segment remains niche, with more research needed to fully explore its potential.

By Distribution Channel

In 2023, Supermarket/Hypermarket held a dominant market position, capturing more than a 56.3% share. Supermarkets and hypermarkets continue to be the primary distribution channels for rice bran oil, driven by the growing consumer preference for convenience and accessibility. These large retail outlets offer a wide range of rice bran oil brands, catering to both premium and budget-conscious buyers.

The strategic location of supermarkets and hypermarkets makes it easier for consumers to find rice bran oil in close proximity, boosting its sales. Additionally, the increasing demand for packaged food products, especially healthy oils, has contributed to the strong performance of rice bran oil in this channel. Over the years, supermarkets have expanded their focus on health-conscious consumers, further driving the growth of rice bran oil as a staple in many households.

The Personal Care & Cosmetics segment, while not as large, has been steadily increasing in prominence as more consumers turn to natural beauty products. In 2023, this distribution channel held a smaller but growing market share. Rice bran oil’s inclusion in personal care products such as moisturizers, face oils, and hair treatments has been well-received due to its skin-nourishing and anti-aging properties. The rise in demand for organic and plant-based cosmetics has created opportunities for rice bran oil to expand its footprint in beauty stores and online beauty platforms. Although still a secondary distribution channel compared to supermarkets, this segment is expected to grow as consumer interest in natural skincare continues to rise.

In the Animal Feed segment, rice bran oil is used as a nutritional supplement for livestock. In 2023, this channel accounted for a small portion of the market, but it has seen gradual growth. As livestock producers increasingly seek alternative, high-quality feed ingredients that improve animal health and growth, rice bran oil has gained popularity. However, this segment remains niche and is expected to grow at a slower pace compared to food and personal care sectors.

Key Market Segments

By Type

- Refined

- Non-Refined

By Category

- Conventional

- Organic

By Packaging Type

- Bottles

- Pouches

- Others

By Application

- Food Processing

- Cosmetics

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online Retail Stores

- Others

Drivers

Rising Demand for Health-Conscious Food Products

Rice bran oil has gained significant attention due to its health benefits, including high levels of antioxidants, unsaturated fats, and essential fatty acids, which contribute to heart health and overall wellness. This demand is driven by both the growing awareness of healthy eating and the rise of chronic diseases, such as obesity and cardiovascular conditions, which has led consumers to seek oils that offer better health benefits.

One of the key health benefits of rice bran oil is its high content of oryzanol, a mixture of ferulic acid esters of alcohol, which has been shown to help lower cholesterol levels. A study conducted by the American Heart Association found that replacing saturated fats with unsaturated fats, such as those found in rice bran oil, can reduce the risk of heart disease. This scientific backing has encouraged both consumers and food manufacturers to adopt rice bran oil in their products.

In India, one of the largest producers of rice, government initiatives to promote healthier cooking oils have also contributed to the growth of the rice bran oil market. The Indian government has supported the domestic production of rice bran oil under its “Make in India” initiative, encouraging local oil mills to increase production. The government also launched programs to educate consumers on the health benefits of rice bran oil, which helped increase awareness and demand among the population.

Globally, rice bran oil consumption is rising steadily, with the Asia Pacific region leading the charge. The region is projected to grow at a compound annual growth rate (CAGR) of 8.1% between 2023 and 2028, driven by increasing health awareness and government-backed health campaigns. In countries like Japan and China, rice bran oil is already a widely accepted cooking oil, and its popularity is expected to spread further into Western markets as consumers continue to prioritize health-conscious diets.

Restraints

High Production Costs and Limited Availability

The high cost of extraction, limited availability of rice bran, and complex refining processes pose challenges for manufacturers and consumers alike. While rice bran oil is a popular and healthy choice, its cost structure has hindered its broader adoption, especially in price-sensitive markets.

The production of rice bran oil involves several steps, including rice milling and oil extraction, which can be costly. Rice bran, the primary raw material for this oil, is a by-product of rice milling, and its availability is directly linked to rice production.

According to the Food and Agriculture Organization (FAO), rice is one of the most widely grown cereal grains in the world, with over 738 million metric tons produced globally in 2022 (FAO, 2023). However, only a small percentage of rice bran is used for oil extraction, which creates a supply constraint.

In India, one of the largest producers of rice, only about 5-7% of the total rice bran production is used for oil extraction (Indian Ministry of Food Processing Industries, 2023). This limited supply contributes to the relatively high cost of rice bran oil production.

Additionally, the extraction process involves advanced technology, which requires high capital investment and energy consumption, further increasing production costs. For instance, cold pressing or solvent extraction methods, which yield higher-quality oil, can be more expensive than conventional methods used for other oils like sunflower or palm oil.

The higher production costs often result in rice bran oil being priced at a premium compared to more commonly available oils. For example, rice bran oil is generally 10-15% more expensive than sunflower or palm oil in retail markets, which can be a barrier for price-sensitive consumers. In developing regions, where price sensitivity is higher, consumers often opt for cheaper alternatives, limiting the market potential for rice bran oil.

Government initiatives aimed at promoting the use of healthier oils, such as rice bran oil, have not been sufficient to offset these cost challenges. While the Indian government has introduced various schemes to encourage rice bran oil production, such as subsidies for milling infrastructure and the “Make in India” initiative to promote domestic production, the overall impact on production costs has been limited.

According to a report by the Indian Ministry of Food Processing Industries, rice bran oil production in India increased by approximately 12.5% annually from 2018 to 2023 (MoFPI, 2023), but this growth still faces the challenge of high production costs that hinder broader market penetration.

Opportunity

Expanding Demand for Healthier Cooking Oils

A significant growth opportunity for the rice bran oil market lies in the rising global demand for healthier cooking oils. With increasing awareness about the health risks associated with the consumption of oils high in saturated fats, more consumers are turning to healthier alternatives like rice bran oil.

This shift is being driven by both health-conscious individuals and food manufacturers aiming to provide better alternatives to traditional oils. The global trend toward healthier eating is expected to provide a strong growth trajectory for rice bran oil over the next few years.

Rice bran oil is often promoted as a healthier alternative to common cooking oils like palm oil and sunflower oil because it contains a higher proportion of unsaturated fats, such as monounsaturated and polyunsaturated fats, which are known to reduce the risk of heart disease.

Additionally, rice bran oil contains antioxidants like oryzanol and vitamin E, which are beneficial for overall health. These properties align well with the growing consumer preference for products that offer health benefits, which is a key driver of rice bran oil’s market expansion.

The Food and Agriculture Organization (FAO) notes that the global demand for healthy oils has been steadily increasing, with an annual growth rate of 4-6% in regions such as North America, Europe, and Asia.

According to the FAO’s data on edible oil consumption, health-conscious consumers are increasingly prioritizing oils that contribute to heart health and weight management, and rice bran oil fits this demand perfectly. In fact, the Asia-Pacific region, which is the largest consumer of rice bran oil, is expected to continue leading the market, growing at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2028.

In India, one of the largest producers and consumers of rice bran oil, the government has actively promoted the benefits of rice bran oil through various public awareness programs. The Indian Ministry of Food Processing Industries (MoFPI) has emphasized the importance of healthy cooking oils and has introduced incentives to boost the domestic production and consumption of rice bran oil.

In Western markets, there is also a growing trend towards organic and natural foods, which creates an additional opportunity for rice bran oil. As consumers in these regions look for cleaner, plant-based alternatives, rice bran oil’s status as a non-GMO, plant-based oil with a favorable nutritional profile positions it well to capture market share from traditional oils.

According to the U.S. Department of Agriculture (USDA), the market for organic food products has been growing by about 10% annually, and rice bran oil is well-positioned to benefit from this organic trend.

Trends

Growing Popularity of Rice Bran Oil in the Plant-Based and Organic Food Segment

One of the latest trends driving the rice bran oil market is the growing shift toward plant-based and organic food products. As consumers become more health-conscious and environmentally aware, they are increasingly seeking oils that are natural, non-GMO, and plant-based.

Rice bran oil fits perfectly into this trend due to its natural extraction process, absence of additives, and the health benefits it offers, such as being rich in antioxidants, unsaturated fats, and essential fatty acids. This trend is being particularly driven by the rise in veganism, plant-based diets, and the increasing popularity of organic food products.

This market growth is expected to continue, with organic products becoming increasingly mainstream as more consumers prioritize health and sustainability. Rice bran oil, known for its heart-healthy benefits and minimal processing, is aligning well with this shift. Its certification as non-GMO and its position as a more natural, plant-based oil make it an attractive choice for consumers in the organic food segment.

The demand for rice bran oil in the plant-based and organic food sectors is not limited to just cooking oils; it has also found a place in processed food products. As plant-based meat alternatives and ready-to-eat meals gain popularity, rice bran oil is increasingly being used by food manufacturers as an ingredient. Its mild flavor, high smoking point, and health benefits make it a suitable choice for these products, aligning with consumer preferences for oils that support a healthier lifestyle.

Regional Analysis

The Asia Pacific (APAC) region dominates the global rice bran oil market, holding a significant share of 37.9%, valued at approximately USD 3.06 billion in 2023. The demand for rice bran oil in APAC is driven by the region’s high rice production, especially in countries like India, China, and Japan.

India, in particular, is both the largest producer and consumer of rice bran oil, with an annual growth rate of 12.5% in production over the past few years (MoFPI, 2023). The rising health consciousness and increasing consumption of plant-based oils are contributing to the region’s market dominance. Additionally, the government’s initiatives in countries like India and China, promoting healthy cooking oils and local production, are further driving growth.

In North America, rice bran oil is gaining traction, primarily driven by the growing demand for healthier cooking oils. The region’s market is expected to grow steadily, fueled by the rise in health-conscious consumers and the popularity of plant-based diets. The U.S. is seeing an increasing adoption of rice bran oil in both home kitchens and commercial food production due to its heart-health benefits.

Europe is witnessing moderate growth in rice bran oil consumption, as consumers increasingly seek healthier and organic alternatives. However, the market share remains smaller compared to APAC, primarily due to strong competition from other oils like olive and sunflower oil.

The Middle East & Africa and Latin America have relatively smaller shares in the rice bran oil market but are expected to grow at a steady pace as awareness of the health benefits of rice bran oil spreads, especially in urban areas.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Rice Bran Oil market is characterized by the presence of both established players and emerging companies. Leading the market are companies such as 3F Industries Ltd., Adani Wilmar Ltd., and AP Solvex Ltd., which have a strong presence in the APAC region, especially in India.

These companies benefit from large-scale production capacities and wide distribution networks, allowing them to cater to both domestic and international markets. Adani Wilmar Ltd., with its brand “Fortune,” is one of the dominant players in India, contributing significantly to the growth of rice bran oil consumption in the region.

Similarly, Marico Limited and Emami Group (Emami Agrotech Ltd.) have capitalized on the rising health-conscious consumer base by promoting the heart-healthy benefits of rice bran oil, driving their market share in India and beyond.

In the North American and European markets, companies like Cargill, Incorporated and Conagra Foods play a crucial role in expanding the adoption of rice bran oil, especially in the health-conscious food sector. California Rice Oil Company is another prominent player, focused on delivering high-quality rice bran oil to consumers in the U.S., positioning itself as a premium offering due to its natural extraction methods and health benefits.

On the international front, TSUNO Group Co., Ltd. and Zhejiang Delekang Food Co., Ltd. are making significant inroads into markets outside Asia, including Europe and the Middle East, where rice bran oil is gaining popularity as a healthier alternative to other oils. These companies are increasingly investing in innovation and sustainability to meet the growing demand for natural and organic oils.

Top Key Players

- 3F Industries Ltd

- Adani Wilmar Ltd.

- AP Solvex Ltd.

- BCL Industries Limited

- California Rice Oil Company

- Cargill, Incorporated

- Conagra Foods

- Emami Group (Emami Agrotech Ltd.)

- King Rice Oil Group

- Marico Limited

- Modi Naturals Ltd.

- Ricela Health Foods Ltd.

- Sethia Oils Ltd.

- TSUNO Group Co., Ltd

- Zhejiang Delekang Food Co. Ltd

Recent Developments

In 2023 3F Industries Ltd., the company reported a production volume of over 300,000 metric tons of rice bran oil annually, which accounts for a notable share of the Indian market.

In 2024 Adani Wilmar Ltd., the company is expected to expand its production capacity by 15% to meet increasing demand, especially in emerging markets such as Southeast Asia and the Middle East.

Report Scope

Report Features Description Market Value (2023) USD 8.1 Bn Forecast Revenue (2033) USD 23.2 Bn CAGR (2024-2033) 11.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Refined, Non-Refined), By Category(Conventional, Organic), By Packaging Type (Bottles, Pouches, Others), By Application (Food Processing, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3F Industries Ltd, Adani Wilmar Ltd., AP Solvex Ltd., BCL Industries Limited, California Rice Oil Company, Cargill, Incorporated, Conagra Foods, Emami Group (Emami Agrotech Ltd.), King Rice Oil Group, Marico Limited, Modi Naturals Ltd., Ricela Health Foods Ltd., Sethia Oils Ltd., TSUNO Group Co., Ltd, Zhejiang Delekang Food Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3F Industries Ltd

- Adani Wilmar Ltd.

- AP Solvex Ltd.

- BCL Industries Limited

- California Rice Oil Company

- Cargill, Incorporated

- Conagra Foods

- Emami Group (Emami Agrotech Ltd.)

- King Rice Oil Group

- Marico Limited

- Modi Naturals Ltd.

- Ricela Health Foods Ltd.

- Sethia Oils Ltd.

- TSUNO Group Co., Ltd

- Zhejiang Delekang Food Co. Ltd