Global Corn Silage Market Size, Share, And Business Benefits By Type (Conventional Field Corn, Brown Mid-rib, Leafy), By Nutrients (Net Energy for Lactation (NEL), Rumen Degradable Protein (RDP), Rumen Undegradable Protein (RUP), Effective Neutral Detergent Fiber (eNDF)), By End Use (Milking Cattle, Beef Cattle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 135007

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

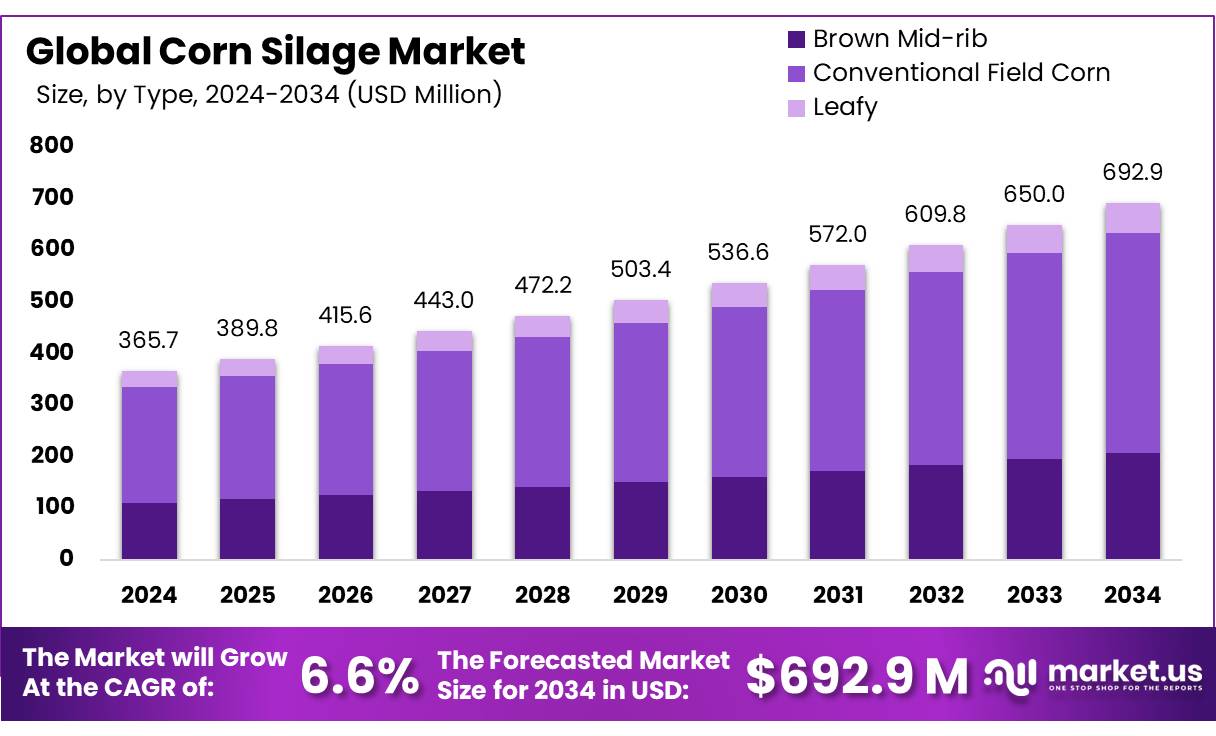

The Global Corn Silage Market size is expected to be worth around USD 692.9 million by 2034, from USD 365.7 million in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

Corn silage is a high-quality forage crop that is used on many dairy farms and some beef cattle farms in Tennessee. Its popularity is due to the high yield of a very digestible, high-energy crop, and the ease of adapting it to mechanized harvesting and feeding. During Silage preparation, the grass is allowed to wilt in the field for a few hours to reduce the moisture content to around 60-75%, as this is the optimum level.

Corn products are undeniably an important source of feed for cattle in the United States. Whole-plant corn silage is one of the most essential corn products used for dairy operations; approximately 89% of dairy farms incorporated WPCS in diets for lactating cows. Globally, the United States produced the most corn at 327 million tonnes, with approximately 14% of total corn production devoted to the production of WPCS.

A good field of corn silage can yield 20-25 tons of wet forage per acre. A 20-ton yield will remove approximately 150 pounds of nitrogen (N), 65 pounds of phosphate (P2O5), and 160 pounds of potash (K2O) per acre. In comparison, a 100-bushel corn crop will only remove 100 pounds of N, 35 pounds of P2O5, and 35 pounds of K2O.

Be sure to fertilize and lime according to a current soil test. Proper pH and nutrient levels are necessary to raise a good corn crop. The University of Tennessee recommends planting approximately 20% more plants when corn is grown for silage than when grown for grain. The proper moisture content of corn chopped for silage is between 60% and 70%.

In bunker and trench silos, where packing is a problem, the upper side of this range is recommended. If the silage is going into an upright silo, packing is generally not a problem, so the lower end of this range will work satisfactorily. The kernel milk line can be used to help estimate moisture. The milk line proceeds from the top to the bottom of the kernel as the plant matures. Generally, when the milk line is 1/2 to 2/3 down the kernel.

Key Takeaways

- The Corn Silage Market is projected to grow from USD 365.7 million in 2024 to USD 692.9 million by 2034, at a 6.6% CAGR.

- Conventional Field Corn dominates with a 61.4% share due to high yields, low costs, and compatibility with livestock feed.

- Net Energy for Lactation (NEL) holds a 37.5% demand share, driven by its role in enhancing dairy milk production.

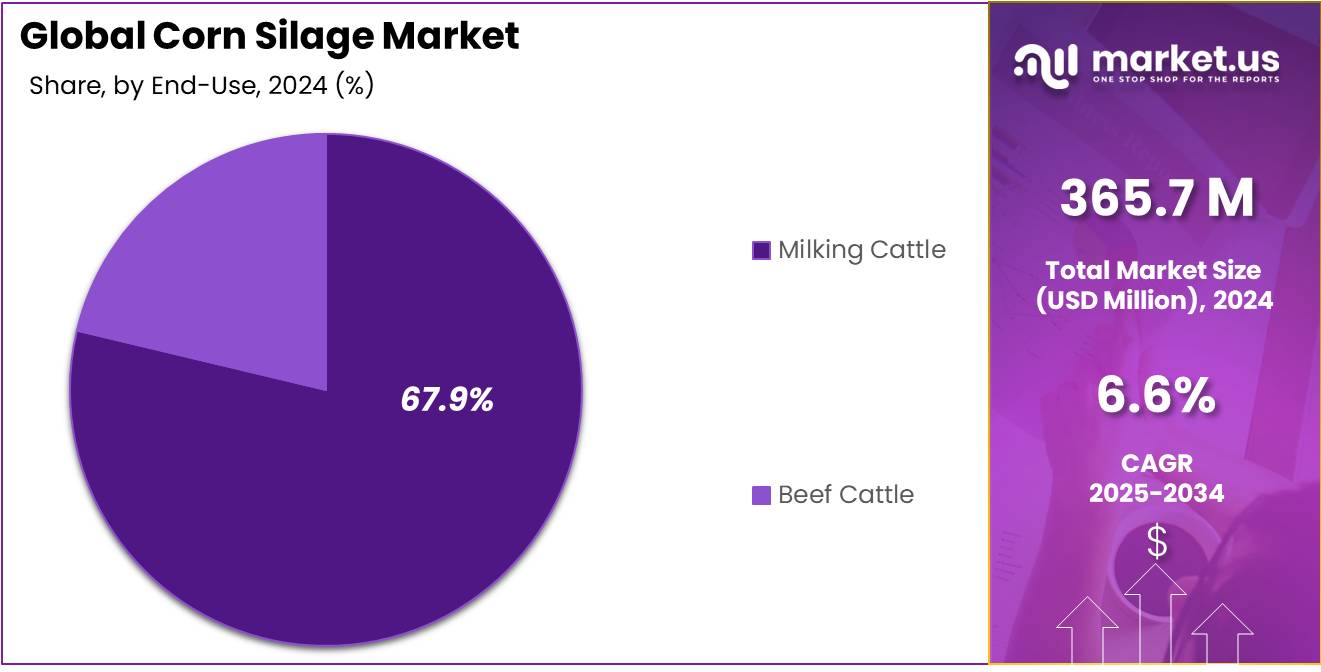

- Milking Cattle account for 67.9% of corn silage consumption, essential for dairy farm productivity.

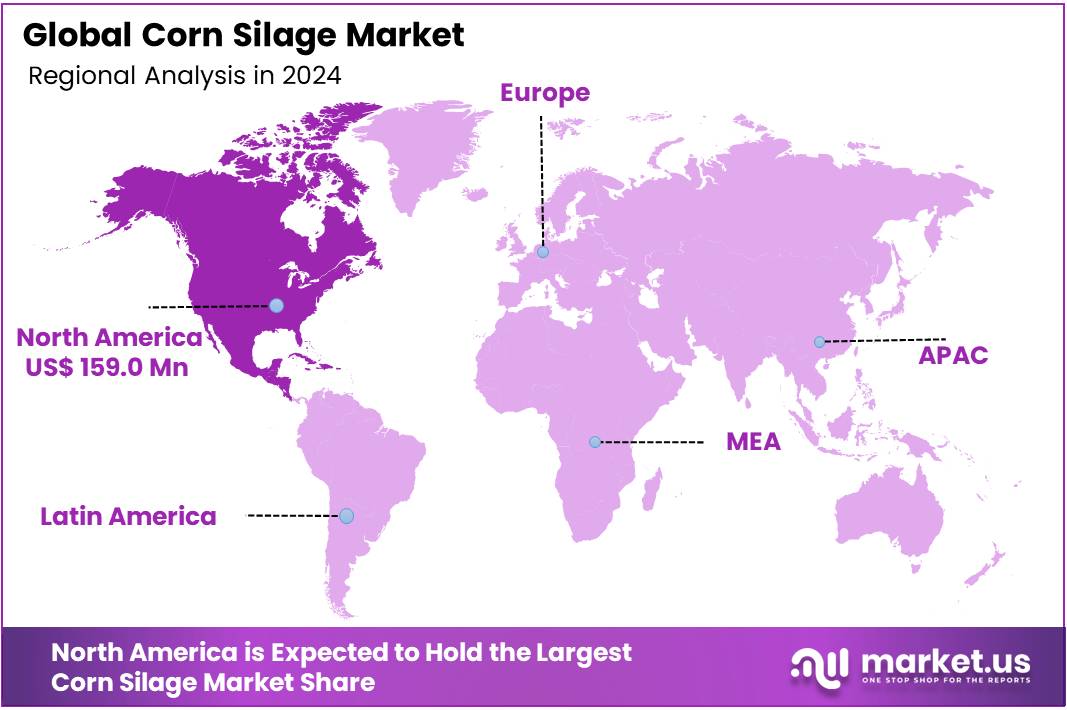

- North America leads with a 43.5% share, valued at USD 159.0 million in 2024, reflecting strong regional demand.

Analyst Viewpoint

Corn silage presents a compelling opportunity, driven by rising demand in livestock feed and biofuel production. The global push for sustainable agriculture and renewable energy has boosted its appeal, Key opportunities lie in high-yield hybrid seed adoption, precision farming tech, and expanding dairy/beef sectors in emerging markets.

However, risks include volatile corn prices and increasing regulatory scrutiny on methane emissions from silage-fed cattle, which could reshape demand. Farmers increasingly prioritize cost-effective, nutrient-rich feed, making corn silage a staple, especially in North America and Europe.

Shifting consumer preferences toward grass-fed and organic dairy/meat could pressure conventional silage demand. On the regulatory front, governments are tightening environmental policies, such as the EU’s CAP reform, promoting low-emission farming. Investors should watch for subsidies for climate-smart silage practices and potential carbon credit incentives.

By Type

Conventional Field Corn Dominates Corn Silage Market with 61.4% Share in 2024

In 2024, Conventional Field Corn held a dominant market position, capturing more than 61.4% of the global corn silage market. Its widespread adoption is driven by higher yield predictability, lower production costs, and strong compatibility with existing livestock feed systems.

Farmers prefer conventional varieties due to their established seed supply chains and adaptability across diverse climates, particularly in major agri-markets like the U.S., Brazil, and Europe. While alternative silage crops and GMO-free options are gaining traction, conventional field corn remains the go-to choice for large-scale dairy and beef operations.

The market stability hinges on corn price trends and climate resilience, as extreme weather events in 2024-2025 could impact harvests. However, with no major disruptive shifts expected in the short term, conventional field corn is likely to retain its lead, supported by consistent feed-quality performance and cost advantages over niche alternatives.

By Nutrients

Net Energy for Lactation (NEL) Leads with 37.5% Market Share in 2024

In 2024, Net Energy for Lactation (NEL) secured a dominant position in the corn silage market, accounting for more than 37.5% of demand. Dairy farmers are driving this trend, as high NEL content directly boosts milk production efficiency, making it a top choice for large-scale dairy operations.

Demand is expected to hold steady, supported by rising global dairy consumption and tighter farm profit margins pushing efficiency-focused feeding strategies. However, advancements in alternative high-energy forage crops could introduce competition, though NEL corn’s proven performance and widespread availability should keep it in the lead for now.

By End Use

Milking Cattle Drive Corn Silage Demand with 67.9% Market Share in 2024

In 2024, Milking Cattle Emerged as the powerhouse of corn silage consumption, claiming a whopping 67.9% share of total demand. Dairy farms simply can’t function without high-quality silage—it’s the backbone of milk production, providing the perfect balance of energy and digestibility for lactating cows. With global dairy demand on the rise, especially in developing markets, farmers are leaning harder than ever on corn silage to keep herds productive and feed costs manageable.

This segment shows no signs of slowing down. However, rising feed efficiency standards and sustainability pressures could push dairy operators toward silage blends with higher protein or lower methane impact. Yet, for now, corn silage remains the undisputed king of milking cattle rations—cheap, reliable, and backed by decades of farming know-how.

Key Market Segments

By Type

- Conventional Field Corn

- Brown Mid-rib

- Leafy

By Nutrients

- Net Energy for Lactation (NEL)

- Rumen Degradable Protein (RDP)

- Rumen Undegradable Protein (RUP)

- Effective Neutral Detergent Fiber (eNDF)

By End Use

- Milking Cattle

- Beef Cattle

Drivers

Corn Silage: A Vital Feed for Dairy Cattle

Corn silage plays a crucial role in dairy farming, serving as a primary feed source for cattle. Its significance stems from its high energy content, palatability, and digestibility, which are essential for maintaining the health and productivity of dairy herds.

In India, the Indian Council of Agricultural Research (ICAR) has emphasized the importance of corn silage in enhancing dairy farm profitability. According to the USDA Agricultural Research Service, certain corn hybrids have demonstrated impressive yields.

The Pioneer 34M95 hybrid achieved a dry matter yield of 20,473 kg/ha, highlighting the potential of selecting appropriate hybrids to maximize silage production. Moreover, integrating alfalfa with corn silage has shown promising results.

Restraints

Lack of Storage Facilities: A Major Barrier to Corn Silage Adoption

Corn silage is a valuable feed for dairy cattle, offering high energy and digestibility. However, many small and marginal farmers in India face challenges in adopting silage practices due to inadequate storage facilities.

A study conducted in western Maharashtra, covering districts like Pune, Ahmednagar, Satara, and Sangli, revealed that 62.5% of dairy farmers identified the unavailability of storage facilities as a significant constraint in silage production and utilization.

This lack of proper storage leads to spoilage and reduced feed quality, discouraging farmers from investing in silage-making processes. The absence of appropriate storage solutions, such as silos or silage bags, results in exposure to air and moisture, causing fermentation issues and mold growth. Consequently, the nutritional value of the silage diminishes, affecting cattle health and milk production.

Opportunity

Government Support and Improved Fodder Availability: Driving Corn Silage Adoption

In India, the dairy sector is a vital part of the rural economy, yet it faces challenges due to inadequate fodder availability. The Indian Council of Agricultural Research (ICAR) has highlighted a significant deficit in green fodder, estimated at 36%, and dry fodder at 11%.

This shortage adversely affects milk production, as feed constitutes approximately 60-70% of the daily income of dairy farmers. To address this issue, the Indian government has initiated programs promoting the use of corn silage as a sustainable fodder alternative.

Corn silage, being a fermented, high-moisture stored fodder, offers a solution to bridge the gap between fodder demand and supply. Its adoption helps in reducing feed volume and cost while meeting the nutritional requirements of dairy cattle.

Trends

Emerging Factor: Technological Advancements in Corn Silage Production

One of the significant emerging factors driving the growth of corn silage in India is the adoption of advanced technologies in silage production and storage. Innovations such as mechanized silage balers and improved storage solutions are transforming traditional practices, making silage production more efficient and accessible to farmers.

The introduction of machines like the Mini Silage Baler MSB500 AT Pro by Cornext has revolutionized the way silage is prepared. This machine produces 50 kg bales with a compaction rate of 650 kg/m³, ensuring optimal fermentation and preservation of nutrients. The baler also features automatic wrapping with UV-protected film, enhancing the shelf life of the silage.

Such technological interventions reduce manual labor, minimize wastage, and ensure consistent quality, encouraging more farmers to adopt silage-making practices. The Indian government’s National Livestock Mission (NLM) provides subsidies for purchasing silage-making equipment, aiming to promote fodder availability and improve livestock productivity.

Regional Analysis

North America: Leading the Global Corn Silage Market

North America stands as the dominant region in the global corn silage market, commanding a substantial 43.5% share, equating to approximately USD 159.0 million in 2024. This leadership is primarily driven by the United States, which, as the world’s largest corn producer, dedicates a significant portion of its vast cornfields to silage production.

Advanced agricultural practices, including precision farming and mechanized harvesting, further enhance the efficiency and quality of silage production in the region. The extensive dairy and beef industries in North America necessitate a steady supply of nutritious feed, with corn silage serving as a vital component due to its high energy content and digestibility.

The adoption of precision agriculture techniques, such as GPS-guided planting and soil moisture monitoring, allows farmers to optimize crop yields and improve silage quality. A study by the American Society of Agronomy found that implementing precision agriculture can increase corn yields, contributing to more sustainable farming practices by reducing resource waste and enhancing profitability for farmers.

North America’s dominance in the corn silage market is a result of its extensive livestock industries, advanced agricultural technologies, and commitment to sustainable farming practices. These factors collectively position the region as a leader in meeting the global demand for high-quality animal feed.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- AGFEED VN specializes in high-nutrient corn silage for dairy and beef sectors across Southeast Asia. Known for hybrid seed innovation and precision silage techniques, the company helps farmers maximize yield and feed efficiency. With Vietnam’s dairy industry expanding, AGFEED VN is gaining traction through customized silage solutions tailored to tropical climates.

- Barr-Ag Ltd provides premium-quality corn silage optimized for North American dairy farms. Their expertise in fermentation control and storage solutions ensures superior feed preservation. The company invests heavily in R&D for high-energy silage, catering to large-scale milk producers. Barr-Ag’s reputation for consistent quality makes it a trusted supplier in competitive markets.

- Cornext Agri focuses on cost-effective silage production for small and mid-sized dairy farms. Their compact baling technology and moisture-resistant silage appeal to farmers in humid regions. With India’s dairy demand surging, Cornext’s affordable, high-digestibility silage supports rural livestock productivity.

Top Key Players in the Market

- AGFEED VN

- Barr-Ag Ltd

- Cornext Agri Products Private Limited

- EXACT Silage

- Janta Corn Silage

- KIM NGHIA CO,.LTD

- Nippon UN (Thailand) co.,Ltd.

- RICH MOON CO., LTD

- Silage Agro Private Limited

- Vishwa Agro Tech

Recent Developments

- Barr-Ag Ltd, located in Olds, Alberta, Canada, is a leading exporter of dehydrated corn silage, timothy hay, and non-GMO alfalfa hay. Their dehydrated corn silage boasts over 30% starch content and NDFD 30-hour levels above 60%, making it highly digestible for livestock.

- Cornext supplies baled corn silage and manufactures silage baler machines, having delivered over 100,000 metric tonnes of baled silage across various Indian states. Cornext’s efforts have been recognized with national awards, highlighting their contribution to sustainable dairy farming practices.

Report Scope

Report Features Description Market Value (2024) USD 365.7 Million Forecast Revenue (2034) USD 692.9 Million CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Conventional Field Corn, Brown Mid-rib, Leafy), By Nutrients (Net Energy for Lactation (NEL), Rumen Degradable Protein (RDP), Rumen Undegradable Protein (RUP), Effective Neutral Detergent Fiber (eNDF)), By End Use (Milking Cattle, Beef Cattle) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGFEED VN, Barr-Ag Ltd, Cornext Agri Products Private Limited, EXACT Silage, Janta Corn Silage, KIM NGHIA CO. LTD, Nippon UN (Thailand) Co. Ltd., RICH MOON CO. LTD, Silage Agro Private Limited, Vishwa Agro Tech Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGFEED VN

- Barr-Ag Ltd

- Cornext Agri Products Private Limited

- EXACT Silage

- Janta Corn Silage

- KIM NGHIA CO,.LTD

- Nippon UN (Thailand) co.,Ltd.

- RICH MOON CO., LTD

- Silage Agro Private Limited

- Vishwa Agro Tech