Global Xylitol Market Report By Form (Liquid, Powder), By Application (Food & Beverages, Pharmaceuticals, Cosmetics & Toiletries, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123185

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

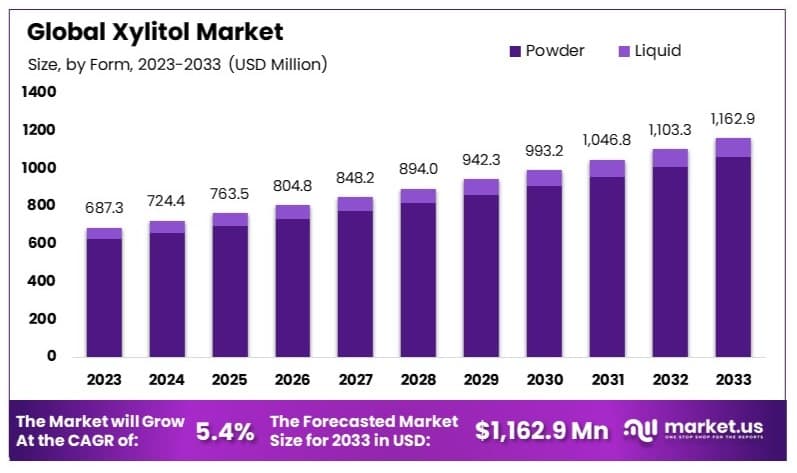

The Global Xylitol Market size is expected to be worth around USD 1,162.9 Million by 2033, from USD 687.3 Million in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Xylitol Market involves the manufacturing and commercialization of xylitol, a naturally occurring alcohol found in most plant material. It is extensively used as a sugar substitute due to its lower caloric value and dental benefits.

Xylitol is particularly popular in chewing gums, mints, and diabetic-friendly foods. Its market expansion is supported by growing consumer awareness of health issues related to sugar consumption, including dental problems and diabetes, alongside an increasing preference for healthier alternatives.

The Xylitol Market is experiencing substantial growth, propelled by its favorable profile as a sugar substitute. Xylitol, a naturally occurring alcohol found in most plant material, including many fruits and vegetables, is especially popular in the food industry for its low glycemic index and dental benefits. It is extensively used in sugar-free chewing gums, confections, and oral care products.

The expansion is further supported by trade also significantly influence the xylitol market. In 2022, the United States imported approximately 20,000 metric tons of xylitol, primarily from China and Finland, highlighting the importance of international trade in meeting domestic demand. Conversely, Finland, a leading producer of xylitol, exported nearly 15,000 metric tons to various countries, including Germany, the United Kingdom, and Japan.

Innovations in xylitol production have also been notable. Researchers are exploring alternative raw materials, such as agricultural residues, to produce xylitol more sustainably. This shift towards eco-friendly production methods is expected to reduce the environmental impact and production costs, thereby making xylitol more accessible and appealing to a broader range of consumers and industries.

Key Takeaways

- Xylitol Market was valued at USD 687.3 million in 2023, and is expected to reach USD 1,162.9 million by 2033, with a CAGR of 5.4%.

- Powder dominates the form segment with 91.2% due to its versatility in various applications.

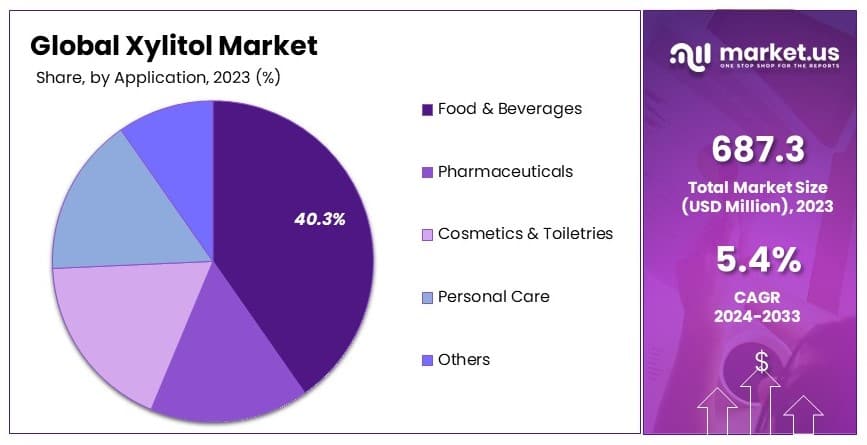

- Food & Beverages lead the application segment with 40.3% owing to high demand in sugar-free products.

- North America holds the largest market share at 35.4%, attributed to significant consumption in the food and beverage industry.

Driving Factors

Increasing Health Consciousness Drives Market Growth

There is a growing trend towards healthier lifestyles and a preference for low-calorie, natural sweeteners. Xylitol, a natural sugar alcohol derived from plant sources like birch wood or corn cobs, has gained popularity among health-conscious consumers. As an alternative to regular sugar, xylitol offers significant health benefits. Its low glycemic index makes it suitable for diabetic-friendly and sugar-free products, which has broadened its market appeal.

Furthermore, awareness campaigns about the adverse effects of excessive sugar consumption have pushed consumers to look for alternatives like xylitol. This factor, combined with rising incidences of diabetes and obesity, underscores the increasing demand for low-calorie sweeteners. The growing popularity of xylitol in various health-centric food products reflects this shift, as consumers prioritize ingredients that support their well-being.

Expanding Applications in the Food and Beverage Industry Drives Market Growth

Xylitol’s expanding applications in the food and beverage industry are a key driver of market growth. It is widely used in confectionery items, chewing gums, baked goods, and beverages. The demand for xylitol-based products has risen due to their perceived health benefits and appealing taste. For instance, major confectionery brands have introduced xylitol-sweetened candies and gums, catering to the growing demand for healthier alternatives.

In addition to confectionery and beverages, xylitol’s application in baked goods and dairy products has also seen a rise. This expansion is driven by the ingredient’s versatility and its ability to enhance the taste and texture of products without adding extra calories. The synergistic effect of consumer demand for healthier food options and the industry’s push for innovative products underscores the importance of xylitol in driving market growth.

Oral Health Benefits Drive Market Growth

Xylitol’s proven benefits for dental health significantly contribute to its market growth. It inhibits the growth of harmful bacteria in the mouth, reducing the risk of tooth decay and cavities. This has led to its incorporation in various oral care products like toothpastes, mouth rinses, and chewing gums. For example, many leading toothpaste brands now offer xylitol-containing variants to promote dental hygiene.

Additionally, increasing awareness about oral health and the importance of preventive care has bolstered the use of xylitol in dental products. Consumers are more informed about the benefits of xylitol, leading to a higher preference for xylitol-based oral care products. This trend, coupled with the rise in dental care awareness, highlights the significant impact of xylitol on market expansion.

Restraining Factors

Higher Cost Compared to Traditional Sweeteners Restrains Xylitol Market Growth

Xylitol is generally more expensive than conventional sweeteners like sucrose or high-fructose corn syrup. This higher cost can be a barrier for widespread adoption, especially in price-sensitive markets or for large-scale industrial applications.

For instance, some food manufacturers may hesitate to switch to xylitol due to the associated cost implications. The cost factor limits the appeal of xylitol, making it less competitive compared to cheaper alternatives, and restraining its market growth.

Limited Production Capacity and Supply Constraints Restrain Xylitol Market Growth

The production of xylitol involves a complex fermentation process, leading to supply constraints and limited availability. Increasing demand may outpace the existing production capacity, resulting in potential shortages and price fluctuations.

This could hinder the market’s growth potential, especially in regions with limited access to xylitol suppliers. The challenges in scaling up production to meet growing demand make it difficult for the xylitol market to expand consistently, thus restraining its overall growth.

Form Analysis

Powder dominates with 91.2% due to its ease of integration into various product formulations and superior stability.

The Xylitol market is segmented into two main forms: Liquid and Powder. The Powder form of xylitol is overwhelmingly dominant, capturing 91.2% of the market. This dominance is attributed to the form’s versatility and convenience in use across a broad range of applications. Powder xylitol is highly favored in food production, particularly in baked goods, confectioneries, and chewing gums, where it serves as a low-calorie, tooth-friendly sugar substitute. Its granular, crystalline structure closely mimics that of sugar, making it an ideal replacement in recipes aiming for reduced sugar content without compromising on taste or texture.

Furthermore, powder xylitol’s stability under various temperature conditions and its ability to blend well with other ingredients enhance its applicability in both food and non-food products, including pharmaceuticals where it is used as a sweetening agent in chewable tablets and sugar-free formulations.

While the Powder form holds the major market share, Liquid xylitol also plays a crucial role in certain niches such as beverages and liquid medications. It offers specific benefits where liquid consistency is necessary, although its use is more limited compared to the powder form.

Application Analysis

Food & Beverages dominates with 40.3% due to rising consumer demand for healthier, sugar-free alternatives in diets.

Xylitol is used across several application sectors, with the Food & Beverages segment being the most significant, holding a market share of 40.3%. This segment’s leadership is fueled by the increasing consumer awareness of the health benefits associated with reducing sugar intake, which includes better dental health and lower glycemic index foods. Xylitol’s ability to provide a sweet flavor similar to sugar with fewer calories and no aftertaste makes it a preferred choice in the formulation of a wide range of food and beverage products.

In the Food & Beverages sector, xylitol is extensively utilized in products like sugar-free chewing gums, candies, and as a tabletop sweetener. Its anti-cariogenic properties, which reduce the risk of dental caries, make it particularly popular in oral care products such as chewing gum. Additionally, xylitol is used in the production of sugar-free beverages, dairy products, and baked goods, where it substitutes traditional sweeteners.

Beyond Food & Beverages, xylitol finds important applications in Pharmaceuticals, where it helps in formulating sugar-free medicinal syrups and chewable tablets, particularly for diabetic patients and children. In Cosmetics & Toiletries, xylitol is valued for its moisturizing properties and is used in products like skin creams and lotions.

The Personal Care segment, including products such as toothpaste and mouthwash, benefits from xylitol’s oral health advantages. The ‘Others’ category, which includes niche applications such as dietary supplements and pet food, further showcases xylitol’s versatility.

Key Market Segments

By Form

- Liquid

- Powder

By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Toiletries

- Personal Care

- Others

Growth Opportunities

Expanding Personal Care and Cosmetic Applications Offer Growth Opportunity

Xylitol is carving out a significant niche in the personal care and cosmetics industry due to its beneficial properties as an antimicrobial agent and humectant. These attributes make it ideal for formulations in skincare, haircare, and other personal care products. With the consumer shift towards natural and eco-friendly personal care solutions, xylitol stands out as a preferred ingredient, aligning with market demands for sustainable and gentle products.

As manufacturers continue to innovate and include more natural ingredients in their offerings, the use of xylitol is likely to increase, providing extensive growth opportunities within this sector. Companies investing in research and development to explore further applications of xylitol in personal care will potentially gain a competitive advantage and capture a larger market share.

Growing Popularity of Clean Label and Natural Ingredients Offers Growth Opportunity

The clean label movement is gaining momentum, with consumers increasingly favoring products that contain natural, easy-to-understand ingredients. Xylitol, a naturally derived sweetener from plant fibers, perfectly meets this demand within the food and beverage industry. Its ability to replace sugar and artificial sweeteners in a wide range of products—from baked goods to beverages—offers manufacturers a substantial opportunity to appeal to health-conscious consumers.

By incorporating xylitol into their products, brands can not only enhance the product’s appeal through its natural sweetening properties but also leverage the growing consumer preference for wellness-oriented diets. This trend provides a clear pathway for growth and innovation in the use of xylitol as a key ingredient in clean and natural product formulations.

Trending Factors

Focus on Sustainable and Eco-friendly Production Are Trending Factors

The focus on sustainable and eco-friendly production is a significant trend in the xylitol market. With growing environmental concerns, manufacturers are exploring more efficient and environmentally friendly processes for xylitol production. These methods can potentially reduce production costs and attract eco-conscious consumers.

By adopting sustainable practices, companies can enhance their brand image and appeal to a broader audience. The emphasis on eco-friendly production is expected to drive market expansion as consumers increasingly prioritize sustainability in their purchasing decisions. This trend aligns with global efforts to reduce environmental impact and promote green manufacturing practices.

Innovation in Delivery Forms and Applications Are Trending Factors

Innovation in delivery forms and applications is driving growth in the xylitol market. Researchers and manufacturers are exploring new ways to incorporate xylitol into various products, including nutraceuticals, functional foods, and medical applications. These novel formulations create new market opportunities and cater to diverse consumer needs.

For instance, xylitol-based functional foods offer health benefits while satisfying taste preferences. By developing innovative delivery forms, companies can differentiate their products and capture new market segments. This trend towards innovation is expected to expand the xylitol market by introducing versatile and appealing products that meet evolving consumer demands.

Regional Analysis

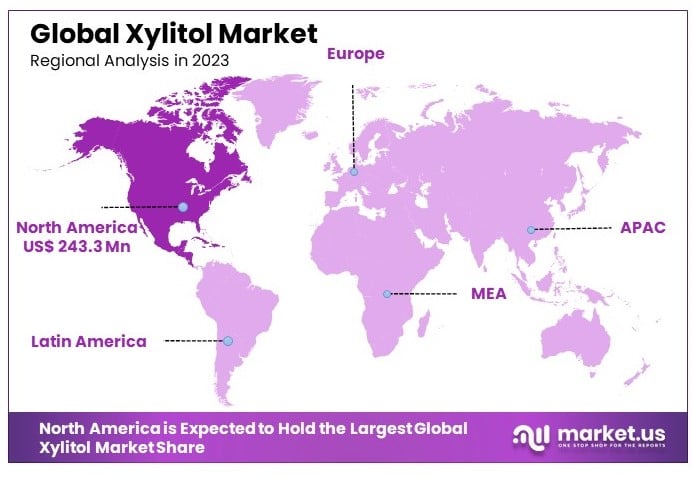

North America Dominates with 35.4% Market Share in the Xylitol Market

North America holds a commanding 35.4% market share in the xylitol market, valued at USD 243.3 billion. This dominance is largely due to the region’s strong health consciousness and increasing demand for low-calorie, sugar-free alternatives. The prevalence of obesity and diabetes has driven consumers towards healthier dietary choices, with xylitol being favored for its dental benefits and low glycemic index.

The regional market dynamics are characterized by high consumer awareness and robust regulatory support for healthier food additives. North America’s advanced food processing industry and substantial investment in new product development significantly contribute to the extensive use of xylitol in various applications such as confectionery, oral care products, and as a sugar substitute in baked goods.

Europe: Europe accounts for 29.6% of the global xylitol market, with a value of USD 203.67 billion. The region’s strict food safety regulations and high consumer preference for natural and organic products boost the demand for xylitol. Additionally, European manufacturers are leading in sustainability practices, which enhances the appeal of naturally derived xylitol.

Asia Pacific: Asia Pacific holds 27.0% of the market share, translating to USD 185.79 billion. This growth is fueled by rising health awareness and increasing disposable incomes, especially in major economies like China and India. The expansion of the food and beverage sector in the region also supports the growing demand for xylitol.

Middle East & Africa: The MEA region has a smaller market share of 4.0%, valued at USD 27.52 billion. While currently a minor player, the potential for growth is significant due to urbanization and changing consumer habits towards healthier lifestyles.

Latin America: Latin America possesses 4.0% of the market, with a valuation of USD 27.52 billion. The region shows potential for growth driven by increasing health awareness and the expansion of the food processing industry.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Xylitol Market features several key players with strong market influence. Cargill Inc. and ZuChem Inc. lead with their extensive production capabilities and global distribution networks. DuPont Danisco and Roquette Frères leverage their innovative solutions and strategic partnerships to maintain competitive positions.

Thomson Biotech (Xiamen) Co. Ltd. and Zhejiang Huakang Pharmaceutical Co. Ltd. focus on high-quality products and expanding their market reach. NovaGreen, Inc. and DFI Corp. emphasize sustainable practices and strong customer relationships. Jining Hengda Green Engineering Co. Ltd. and Mitsubishi Shoji Foodtech Co. Ltd. invest heavily in research and development to drive product innovation.

Foodchem International Corp. maintains a robust market position through its diversified product portfolio and strong customer relationships. These companies collectively ensure a steady supply of high-quality xylitol, meeting global demand and fostering industry growth.

Their strategic positioning, commitment to innovation, and robust supply chains influence market trends and set industry standards. Through continuous improvement and strategic initiatives, these market leaders shape the future of the xylitol market.

Market Key Players

- Cargill Inc.

- ZuChem Inc.

- DuPont Danisco

- Roquette Frères

- Thomson Biotech (Xiamen) Co. Ltd.

- Zhejiang Huakang Pharmaceutical Co. Ltd.

- NovaGreen, Inc.

- DFI Corp.

- Jining Hengda Green Engineering Co. Ltd.

- Mitsubishi Shoji Foodtech Co. Ltd.

- Foodchem International Corp.

Recent Developments

- January 2024: Cargill Inc. reported a significant revenue increase to $177 billion for the fiscal year ending in May 2023, reflecting a 7% rise from the previous year. This growth was driven by robust demand for food, animal feed, and biofuels, coupled with global supply chain adaptations.

- January 2024: Mitsubishi Shoji Foodtech Co. Ltd. experienced a positive trend in 2023, with annual revenues reaching approximately $1.2 billion. The company benefited from increased demand for their seasonings, sweeteners, and food additives.

Report Scope

Report Features Description Market Value (2023) USD 687.3 Million Forecast Revenue (2033) USD 1,162.9 Million CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Application (Food & Beverages, Pharmaceuticals, Cosmetics & Toiletries, Personal Care, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cargill Inc., ZuChem Inc., DuPont Danisco, Roquette Frères, Thomson Biotech (Xiamen) Co. Ltd., Zhejiang Huakang Pharmaceutical Co. Ltd., NovaGreen, Inc., DFI Corp., Jining Hengda Green Engineering Co. Ltd., Mitsubishi Shoji Foodtech Co. Ltd., Foodchem International Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size for the Global Xylitol Market by 2033?The Xylitol market size is expected to reach USD 1,162.9 million by 2033. The market is anticipated to grow at a CAGR of 5.4% from 2024 to 2033.

Which region holds the largest share in the Global Xylitol Market?North America holds the largest market share at 35.4%.

Which companies are the key players in the Xylitol Market?Key players include Cargill Inc., ZuChem Inc., DuPont Danisco, Roquette Frères, and several others.

-

-

- Cargill Inc.

- ZuChem Inc.

- DuPont Danisco

- Roquette Frères

- Thomson Biotech (Xiamen) Co. Ltd.

- Zhejiang Huakang Pharmaceutical Co. Ltd.

- NovaGreen, Inc.

- DFI Corp.

- Jining Hengda Green Engineering Co. Ltd.

- Mitsubishi Shoji Foodtech Co. Ltd.

- Foodchem International Corp.