Global Natural Sweeteners Market By Type (Honey, Molasses, Date Palm, Sugar Alcohol, Xylitol, Mannitol, Sorbitol, Maltitol, Stevia and Others) By Application (Food and Beverage, Bakery Confectionary, Beverages, Pharmaceuticals, Personal Care and Cosmetics and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Jan 2024

- Report ID: 112327

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

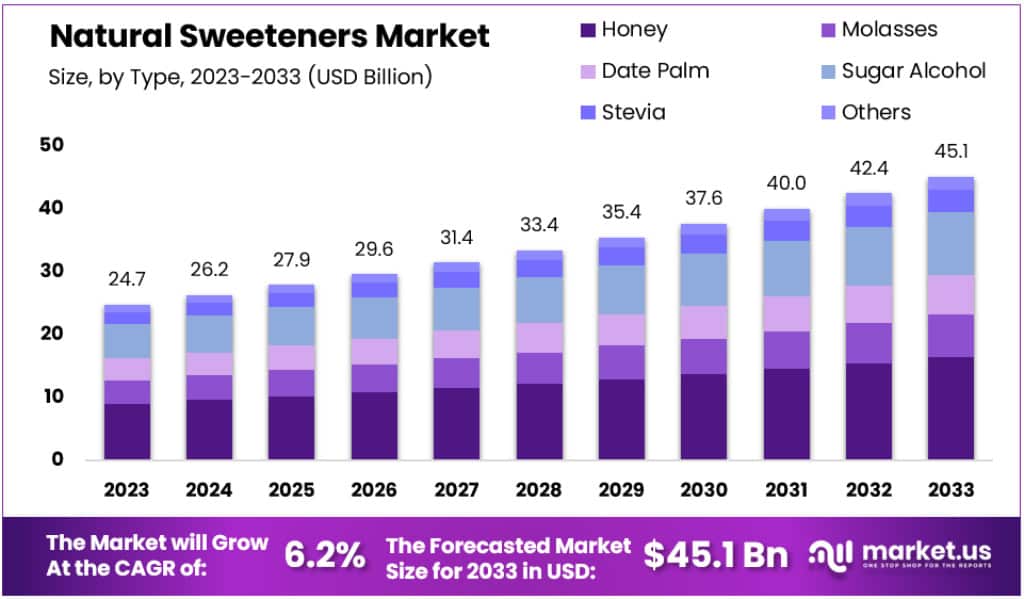

The Global Natural Sweeteners Market size is expected to be worth around USD 45.1 Billion by 2033, from USD 24.7 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

Natural sweeteners are alternatives to refined sugar that are considered to be more natural or unprocessed. They include honey, agave nectar, maple syrup, stevia, erythritol, xylitol, yacon syrup, monk fruit sweetener, and others. These sweeteners are favored for being more natural or unprocessed than table sugar.

The Natural Sweeteners market is booming due to several factors. One of the main drivers is the rising health awareness and increasing prevalence of chronic diseases, obesity, and Type 2 diabetes, which have shifted a wide population towards low-calorie foods, increasing the consumption of natural sweeteners. Additionally, there is a growing demand for sugar alternatives in various applications in the food & beverage industry, and consumers are increasingly concentrating on maintaining weight and following different diets for health reasons.

Key Takeaways

- The Global Natural Sweeteners Market is projected to reach approximately USD 45.1 Billion by 2033, up from USD 24.7 Billion in 2023.

- This market is expected to grow at a CAGR of 6.2% during the forecast period from 2023 to 2033.

- In 2023, honey dominated the market with a substantial share of 36.4%, thanks to its natural origin and health benefits.

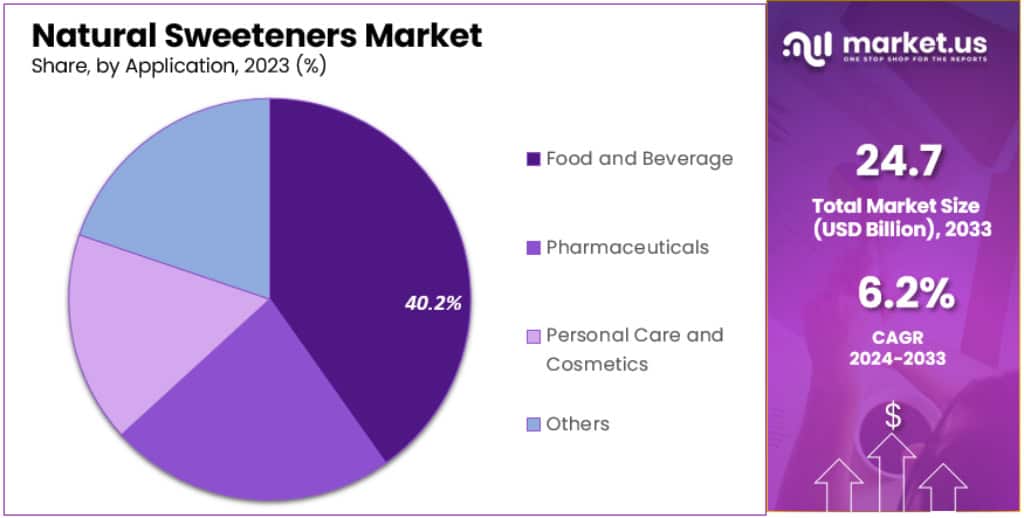

- The Food and Beverage sector held the dominant market position, with a share of 40.2%, driven by high sugar consumption in various products.

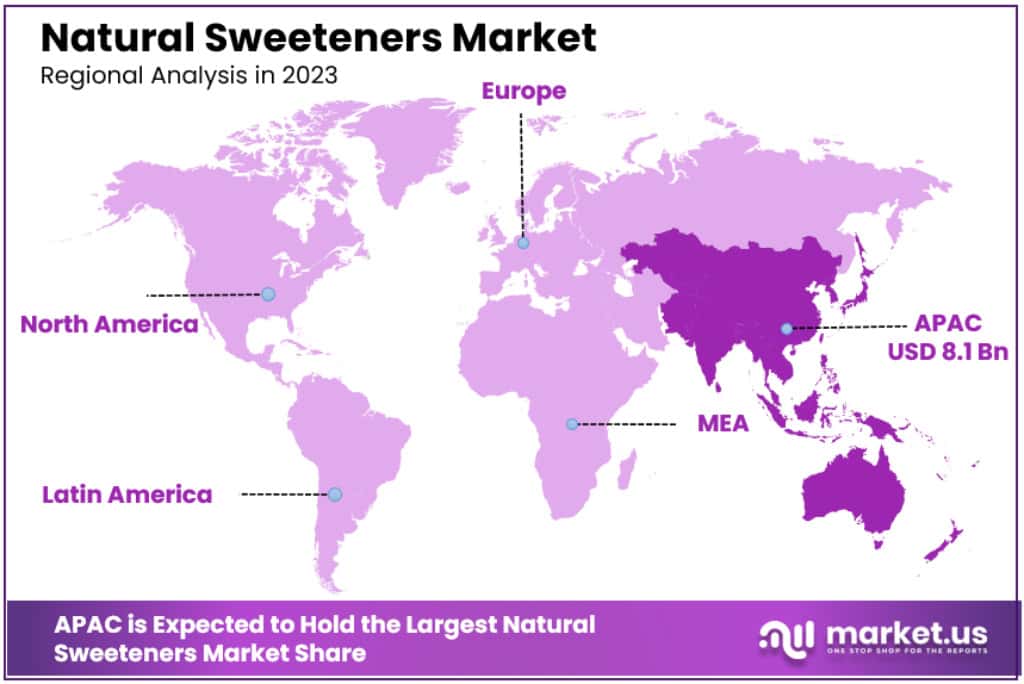

- Asia Pacific dominates the market with a 32.8% share in 2023, driven by rapid urbanization and increasing per capita income in developing countries.

Type Analysis

In 2023, Honey held a dominant market position, capturing more than a significant 36.4% share. This popularity stems from honey’s natural origin and its wide use as a healthier alternative to regular sugar. It’s favored for its rich flavor and varied health benefits, making it a top choice in both home kitchens and commercial food production.

Molasses and Date Palm are other notable segments in the natural sweeteners market. Molasses, known for its rich flavor, and Date Palm, with its distinct taste and nutritional benefits, are gaining popularity. They are especially preferred in regions where they are easily available.

Stevia is the star performer, expected to grow the fastest with a CAGR of ~7.5% over the next five years. It’s 200 times sweeter than regular sugar but doesn’t add calories or affect blood sugar, making it perfect for people with diabetes and those watching their weight. In 2022, new stevia products were introduced, showing its increasing use in food and beverages.

Sugar Alcohols like Xylitol, Mannitol, Sorbitol, and Maltitol are also key players. They provide sweetness without raising blood sugar levels much. For example, Xylitol made from oat hulls was introduced in May 2022 and has 40% fewer calories than regular sugar.

The market is also seeing a rise in the use of other natural sweeteners like Palm Sugar, Coconut Sugar, Maple Syrup, Monk Fruit Sugar, Agave Syrup, Lucuma Fruit Sugar, and various Natural Sweetener Blends. These are popular for their unique flavors and health benefits. The blends, in particular, are expected to grow rapidly with a CAGR of ~8%. They’re used in everything from food to pharmaceuticals and oral care products.

Application Analysis

In 2023, the Food and Beverage sector held a dominant market position, capturing more than a significant 40.2% share. This sector is the fastest-growing segment, largely due to high sugar consumption in a wide range of products. As people seek healthier options, natural sweeteners are becoming popular in this industry, especially as companies innovate and create new products to meet the rising demand.

The International Food Information Council (IFIC) Foundation found that a significant majority of people prefer products with no artificial ingredients and are willing to pay more for them. This trend, coupled with the growing awareness and preference for healthier options, is driving the growth of natural sweeteners in various sectors.

The Beverage segment, specifically, is experiencing rapid growth. Natural sweeteners are preferred in diet carbonated drinks, flavored water, and other beverages. Stevia, with its zero calories and no impact on blood sugar, is particularly popular in energy drinks, fruit juices, and soft drinks. Other sweeteners like erythritol and xylitol are also gaining traction in the beverage industry.

The Food and Beverage application leads mainly due to the tax imposed on sugar drinks in several countries. This tax has encouraged manufacturers to adopt natural sweeteners, especially in beverages like soft drinks, fruit juices, and dairy products. Bakery is another major area benefitting from these sweeteners, with manufacturers launching products suitable for cookies, pies, and cakes. The unique flavors of natural sweeteners enhance the taste of these bakery items.

In the Pharmaceuticals segment, natural sweeteners are used to mask the flavor and odor of drugs and syrups. This sector is estimated to grow with the fastest CAGR of ~7.5% over the forecast period. The demand is driven by the need for better-tasting and healthier medicinal products.

The Personal Care and Cosmetics sector is also incorporating natural sweeteners. Products like stevia and mannitol improve the binding capacity and taste of personal care items, helping ingredients blend well.

Key Market Segments

By Type

- Honey

- Molasses

- Date Palm

- Sugar Alcohol

- Xylitol

- Mannitol

- Sorbitol

- Maltitol

- Stevia

- Others

By Application

- Food and Beverage

- Bakery

- Confectionary

- Beverages

- Pharmaceuticals

- Personal Care and Cosmetics

- Others

Drivers

- Shift to Healthier Choices: There’s a growing trend towards healthier food and beverage choices. More people are aware of their nutritional needs and are choosing low-calorie, reduced sugar, and natural products. This shift is driven by the rising incidence of chronic diseases linked to unhealthy diets. According to a study by the U.S. Department of Health & Human Services, 10.5% of the U.S. population had diabetes in 2018, highlighting the need for healthier alternatives like natural sweeteners.

- Obesity and Diabetes Concerns: The prevalence of obesity and diabetes is a significant driver for the natural sweeteners market. As obesity rates climb, with 40.0% of young adults aged 20 to 39 years being obese, the demand for low-calorie, sugarless food and beverages has surged. Natural sweeteners, which have virtually no calories and do not raise blood sugar levels, are increasingly preferred.

Restraints

- Health Concerns Over Overconsumption: Overconsumption of natural sweeteners can lead to health issues like tooth decay, weight gain, and poor nutrition. Some consumers are wary of potential side effects. For instance, the FDA only considers high-purity steviol glycosides safe, creating ambiguity and concern among consumers about the safety of other forms of stevia and natural sweeteners.

Opportunities

- Rising R&D for Advanced Sweeteners: There’s a growing opportunity in research and development to create advanced natural sweetening products. Companies are introducing innovative products like monk fruit sweeteners, which are 150-200 times sweeter than sugar and calorie-free. Such advancements are expected to drive market growth further.

Challenges

- Premium Pricing Due to High Production Costs: Natural sweeteners often come with a higher price tag due to the costlier raw materials and more complex production processes compared to artificial sweeteners. This premium pricing could challenge market growth, particularly in price-sensitive markets.

Trends

- Increasing Health Consciousness Among Consumers: A study by the Health Survey for England in 2021 revealed that over a quarter of adults in England are obese. This rising awareness is boosting the demand for natural, low-calorie sweeteners. For instance, in August 2022, researchers at the Indian Institute of Technology produced xylitol, a natural sweetener, highlighting the innovation in the field.

- Adoption of Advanced Technology in Extraction: Manufacturers are leveraging new technologies to develop and extract new sweeteners. For example, MycoTechnology’s extraction of honey from a white honey truffle in 2023 demonstrates the industry’s move towards innovative, clean-label products.

- Immunity Boosting Properties of Natural Sweeteners: Honey, molasses, and dates, enriched with vitamins and minerals, offer health-boosting properties. With approximately 422 million people worldwide having diabetes, according to the WHO, the demand for health-beneficial natural sweeteners is on the rise.

- Imposition of Sugar Tax: To combat health issues related to sugar consumption, several countries are imposing sugar taxes, compelling manufacturers to shift towards natural sweeteners. The U.K.’s Soft Drinks Industry Levy is an example of such an initiative driving the adoption of natural sweeteners.

- Availability of Adulterated Materials: Adulteration of natural sweeteners hampers market growth. Issues like reduced fruit production, climate change, and deforestation also negatively impact the quality and availability of natural sweeteners.

Regional Analysis

Asia Pacific

Asia Pacific is dominating the Natural Sweeteners Market with an impressive 32.8% share, valued at USD 8.1 billion in 2023. It’s expected to grow at the highest rate during the forecast period. The region’s dynamic nature, characterized by rapid urbanization, diet diversification, and liberal trade policies in the food sector, is fueling this growth. A surge in per capita income and purchasing power in developing countries like India and China is also creating significant opportunities for natural sweetener manufacturers. The market is driven by an aging and diabetic population demanding low or no-calorie food options.

Furthermore, the region’s millennials are increasingly health-conscious, favoring clean-label, natural ingredients. For instance, Japanese brand Lakanto launched a Monkfruit-based sweetener in India in November 2022, reflecting the growing industrial demand for plant-based ingredients. Policies like “Healthy China 2030” aim to reduce sugar consumption and are driving manufacturers to innovate, as seen with Coca-Cola’s honey-infused beverage “Vita Punch” in India.

Middle East & Africa

This region is a significant market for natural sweeteners, with local production and consumption of dates, molasses, and honey. The Middle East, especially, is known for its date production, often used in various forms in food and beverages. Government collaborations are encouraging sugar reduction and the use of natural sweetening products. For example, Tate and Lyle’s partnership with the UAE Ministry of Industry and Advanced Technology and their USD 2 million investment in Dubai showcases the region’s commitment to innovation in natural sweeteners.

Europe

European governments and health professionals are actively working to reduce sugar intake due to the adverse health impacts of sugar-incorporated ultra-processed food. Countries like France, the U.K., Finland, and others in the European Union have implemented sugar taxes, prompting food manufacturers to switch to natural sweeteners like stevia, honey, and molasses. This regulatory environment supports the market’s growth, with companies increasingly turning to natural alternatives to comply with the policies and meet consumer demand for healthier options.

North America

In North America, there’s a growing demand for natural sweeteners despite the popularity of other sugar substitutes. The adverse health impacts of artificial sweeteners are prompting consumers to seek natural alternatives like dates, honey, and molasses. The region’s increasing adoption of vegan diets is also driving the demand for natural and healthier food options, leading food manufacturers to replace refined sugar with natural sweeteners.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In the market for natural sweeteners, some big companies like Tate and Lyle PLC, Ingredion Incorporated, and Pure Circle Ltd are leading the way. These companies are working closely with those who make food and drinks to create healthier products. They are coming up with new ways to use these sweeteners so they can improve the taste and look of food and drinks. Some companies are also making new personal care items, like toothpaste, that use natural sweeteners. For example, in September 2023, the brand Hello, owned by Colgate, introduced a toothpaste range called “Seriously Friendly Collection” that uses natural sweeteners.

This market is quite competitive, with many big and small companies. Other key players include Archer Danials Midland Company, Cargill Incorporated, and Sunwin Stevia International. They are all trying to meet the growing demand for natural ingredients. These companies often join forces or buy others to get bigger and reach more customers. Governments also play a role by setting rules that these companies need to follow. This leads them to expand their business to new areas. For instance, in July 2021, the European Commission gave the green light to Sweegen Inc’s Bestevia Reb M, a non-GMO stevia leaf sweetener, for use in foods and drinks.

Key Market Players

- Cargill

- DuPont

- Tate & Lyle PLC

- Archer Daniels Midland Company

- Ingredion Incorporated

- Roquette Frères

- MacAndrews & Forbes Holdings Inc

- PureCircle Ltd

- Fooditive B.V.

- XiliNat

- Saganà Association

- Hearthside Food Solutions LLC

- FoodChem International Corporation

- Pyure Brands LLC

- Stevia Hub India

- Others

Recent Developments

- July 2023: Tate & Lyle PLC introduced TASTEVA SOL Stevia Sweetener, aimed at the global market for healthier food and beverages. This launch signifies the company’s ongoing commitment to meeting the rising demand for low-calorie options.

- November 2022: Tate & Lyle Plc launched “Erytesse” Erythritol, a new natural sweetener with 70% the sweetness of sucrose and zero calories. Its application across beverages, dairy, bakery, and confectionery demonstrates the broad potential and adaptability of healthier sweetening agents.

- July 2022: Sweegen unveiled Bestevia LQ in the U.S. This product is crafted to cut down sugar usage in a variety of items like soft drinks and syrups, aligning with the growing consumer preference for less sugary diets.

- March 2022: Cargill Inc. launched EverSweet + ClearFlo, a zero-calorie sweetener gaining traction in the food and beverage industry. Its use spans a wide range of products from dairy to flavored waters, indicating its versatility and appeal.

- March 2022: Sweegen Inc. expanded its Signature Stevia range into Mexico following the country’s adoption of Codex specifications for steviol glycosides. This move taps into Mexico’s growing market for natural sweeteners as health awareness rises.

- January 2022: Sweet Harvest Foods acquired Nature Nate’s Honey Co, significantly expanding its footprint in the U.S. honey market. This strategic move underscores the increasing demand for natural and wholesome sweeteners in North America.

- April 2021: Manus Bio Inc. launched two significant products. NutraSweet Natural in the U.S. and NutraSweet Natural Stevia, both zero-calorie, plant-based sweeteners. These launches cater to the escalating consumer demand for natural and calorie-conscious sweetening options.

Report Scope

Report Features Description Market Value (2023) USD 24.7 Billion Forecast Revenue (2033) USD 45.1 Billion CAGR (2023-2032) 6.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Honey, Molasses, Date Palm, Sugar Alcohol, Xylitol, Mannitol, Sorbitol, Maltitol, Stevia and Others) By Application (Food and Beverage, Bakery, Confectionary, Beverages, Pharmaceuticals, Personal Care and Cosmetics and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cargill, DuPont, Tate & Lyle PLC, Archer Daniels Midland Company, Ingredion Incorporated, Roquette Frères, MacAndrews & Forbes Holdings Inc, PureCircle Ltd, Fooditive B.V., XiliNat, Saganà Association, Hearthside Food Solutions LLC, FoodChem International Corporation, Pyure Brands LLC, Stevia Hub India and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill

- DuPont

- Tate & Lyle PLC

- Archer Daniels Midland Company

- Ingredion Incorporated

- Roquette Frères

- MacAndrews & Forbes Holdings Inc

- PureCircle Ltd

- Fooditive B.V.

- XiliNat

- Saganà Association

- Hearthside Food Solutions LLC

- FoodChem International Corporation

- Pyure Brands LLC

- Stevia Hub India

- Others