Global Confectionery Market Size, Share, And Growth Analysis Report By Product Type ( Chocolate Confectionery (Dark, Milk and White), Sugar Confectionary (Boiled Sweets, Mints, Lollipops, Toffees, Caramels and Nougats, Pastilles and Jellies and Others), and Gum (Chewing Gum and Bubble Gum)), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail and Others), By Age Group (Upto 18 years, 19 to 34 Years, 35 to 44 Years and Above 45 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 22184

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

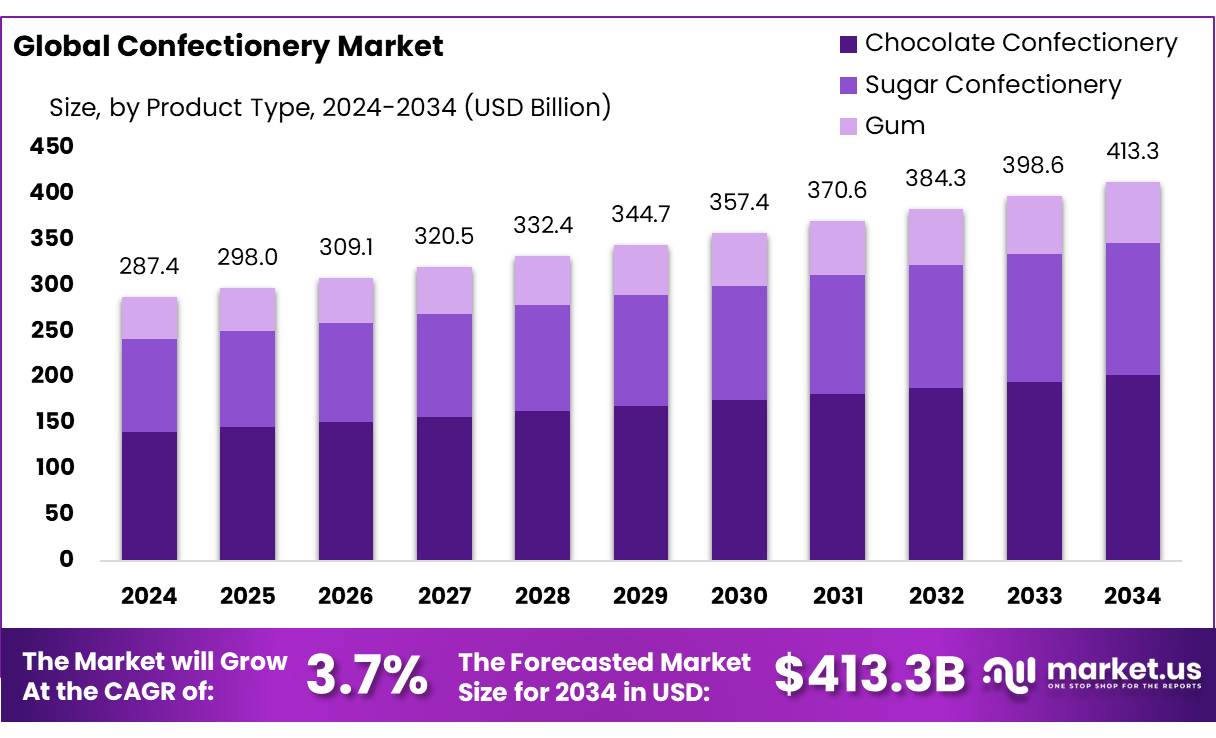

The Global Confectionery Market size is expected to be worth around USD 413.3 billion by 2034, from USD 287.4 Billion in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034.

The global confectionery market has undergone significant transformation in recent years, driven by evolving consumer preferences and continuous innovation across product development and sourcing practices. Brands are increasingly redefining indulgence by incorporating health-conscious ingredients, bold and exotic flavor combinations, and sustainable production methods. The industry encompasses a broad range of food products, including chocolates, gums, and sugar-based confections, and remains one of the most resilient and high-performing segments within the global food and beverage market.

For instance, Barry Callebaut, the largest manufacturer of chocolate and cocoa products, exemplifies this industrial strength. In 2023, the company operated 66 manufacturing facilities worldwide and recorded a product sales volume of 2.3 million tonnes.

Furthermore, European policies, regulations, and national sustainability initiatives are playing a pivotal role in driving the demand for cocoa that complies with Voluntary Sustainability Standards (VSS). Countries such as Switzerland, Germany, Belgium, and the Netherlands have established national sustainable cocoa platforms aimed at encouraging the consumption of sustainably sourced cocoa (CBI Ministry of Foreign Affairs).

In the forecast period, confectionery trends are expected to be comprehensively influenced by consumer demand for health-oriented treats. This includes products that are low in sugar, high in protein, and made from plant-based ingredients. Additionally, there is a notable shift toward the inclusion of functional ingredients, such as adaptogens, which are believed to help manage stress and improve well-being. These innovations reflect the growing convergence of indulgence and wellness, enabling confectionery manufacturers to cater to health-aware consumers without compromising on taste and sensory appeal.

Simultaneously, the market is witnessing a strong consumer inclination toward premium and indulgent confectionery experiences. High-quality ingredients, artisanal production techniques, and distinctive flavor profiles are increasingly appealing to consumers that are willing to pay a premium for differentiated and superior offerings. This has fueled the expansion of luxury chocolate collections and the introduction of limited-edition confections, contributing to market premiumization and brand differentiation.

Europe continues to hold a pivotal role in the global confectionery value chain, both as a leading consumer market and as a critical trade hub for cocoa and chocolate-based products. The region is the world’s largest importer of cocoa beans, cocoa paste, cocoa butter, and cocoa powder—ingredients most commonly used in chocolate confectionery. In addition to its consumption strength, Europe is intensed by the headquarters of numerous global cocoa and chocolate companies, reinforcing its strategic importance in the industry.

Key Takeaways

- In 2024, the global Confectionery market was valued at USD 287.4 Billion

- By product type, the chocolate confectionery held a major market share of 44.4% in 2024

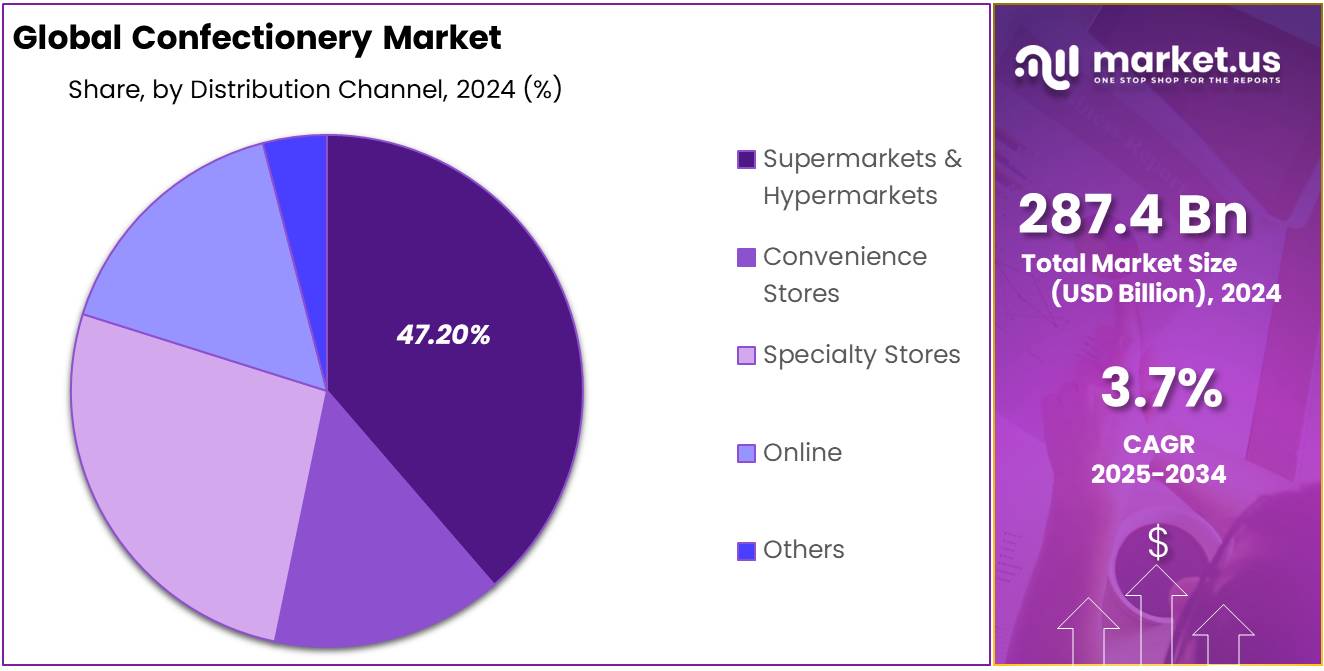

- Based on distribution channel, the supermarkets/hypermarkets distribution channel dominated the global Confectionery market with market share of 47.2% in 2024

- Among the age group analysis, the 19 to 34 years segment has led the market in 2024 with 38.7% market share.

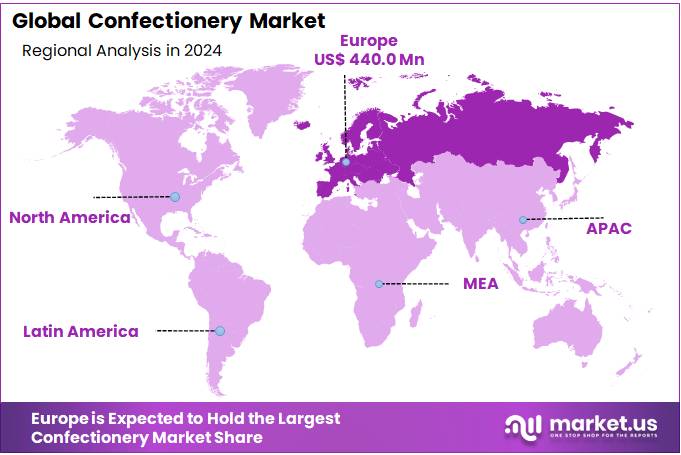

- In 2024, Europe dominated the global market with the highest revenue share of 39.2%.

By Product Type Analysis

The chocolate confectionery segment is projected to witness substantial growth in the coming years, accounting for 44.4% of the global market in 2024. Chocolate remains one of the most widely consumed confectionery products worldwide and is commonly categorized into milk, dark, and white varieties. Derived from cocoa beans, chocolate is increasingly being recognized for its functional benefits in addition to indulgence. Products infused with mood-enhancing compounds such as phenylethylamine (PEA) and polyphenols are gaining consumer traction due to their antioxidant properties and ability to stimulate endorphin release.

Dark chocolate, in particular, contains natural stimulants like caffeine and theobromine, which enhance alertness and energy. These attributes have strengthened chocolate’s positioning as a mood-boosting confectionery option that supports emotional well-being. In line with evolving consumer preferences, manufacturers are expanding offerings; for instance, in September 2024, Ferrero introduced a plant-based version of its iconic Nutella spread, reflecting ongoing innovation in the segment.

By Distribution Channel Analysis

The supermarkets and hypermarkets segment dominated the global confectionery market, accounting for a significant revenue share of 47.2%. These large-scale retail formats continue to lead due to their broad product assortments, housing both mainstream and artisanal confectionery offerings. Their ability to provide a one-stop shopping experience, often integrating frozen desserts and ice cream, enhances consumer convenience and drives foot traffic.

The segment benefits from ample shelf space and inventory capacity, enabling the effective display of diverse product variants across flavors, formats, and packaging sizes. This retail environment appeals to a wide consumer base seeking variety and accessibility.

Additionally, ongoing expansion strategies by major retail chains are expected to positively influence market dynamics. For instance, in January 2024, Walmart announced plans to construct or convert over 150 stores in the next five years while continuing to remodel existing locations.

By age group Analysis

By age group, 19 to 34 years segment dominated the market with significant market revenue share of 38.7% in 2024. Consumers within this age bracket often seek indulgent yet functional confectionery options, such as products infused with mood-enhancing, energy-boosting, or wellness-promoting ingredients like adaptogens, vitamins, and plant-based components.

Additionally, this group demonstrates a preference for ethically sourced and sustainably produced confectionery, reflecting their values around environmental and social responsibility. Digital engagement and social media influence also significantly shape their purchasing behaviors, with packaging innovation, limited-edition releases, and brand storytelling playing pivotal roles. Moreover, the willingness to explore unique, global, and culturally inspired flavors further drives product diversification.

Confectionery Market Key Segmentation

Based on Product Type

- Chocolate Confectionery

- Dark

- Milk

- White

- Sugar Confectionery

- Boiled Sweets

- Mints

- Lollipops

- Toffees, Caramels & Nougats

- Pastilles & Jellies

- Others

- Gum

- Chewing Gum

- Bubble Gum

Based on Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Based on age group

- Up to 18 Years

- 19 to 34 Years

- 35 to 44 Years

- Above 45 Years

Driving Factors

Premiumization and indulgence in the confectionery sector

Premiumization and indulgence are emerging as major growth drivers in the global confectionery market. There is a notable shift in consumer behavior, with growing inclination towards premium and indulgent confectionery experiences. Consumers are increasingly seeking unique and culturally resonant flavor profiles that go beyond traditional offerings, prompting leading manufacturers to adopt new product development strategies aimed at capturing greater market share.

Indulgence in confectionery is evolving to represent more than just taste—it is about crafting memorable, high-quality experiences that resonate with consumers on an emotional level. As a result, products featuring high-quality ingredients, artisanal production methods, and distinctive flavor combinations are gaining strong traction. This dynamic is fueling the expansion of luxury confectionery lines and the launch of limited-edition offerings, enabling brands to strengthen their positioning in the premium segment.

For instance, in December 2024, Lindt & Sprungli launched its handmade Lindt Dubai Chocolate as a limited-edition offering exclusively through its own retail stores. Following the overwhelming success and positive consumer response, the company subsequently developed the Lindt Dubai Style Chocolate, featuring a similar recipe, for broader distribution through wholesale channels.

In addition to sensory appeal, there is rising consumer interest in confectionery products that deliver added health benefits. Manufacturers are innovating with formulations that incorporate vitamins, minerals, probiotics, and other functional ingredients, thereby aligning indulgence with wellness. This dual appeal of taste and health is opening new avenues for growth, particularly among health-conscious consumers seeking permissible indulgence.

Restraining Factors

Stringent regulatory framework and rising health concerns

The growth of the global confectionery market is increasingly constrained by the intensifying regulatory landscape and growing public health consciousness. Regulatory authorities across key markets have introduced stringent guidelines related to sugar content, nutritional labeling, and permissible ingredients, thereby reshaping product formulation and marketing strategies. These evolving frameworks have introduced additional operational complexities and compliance costs, particularly for manufacturers aiming to align with health-driven consumer expectations.

Confectionery products—traditionally high in added sugars, saturated fats, and calories—are under increased scrutiny due to their potential contribution to obesity, diabetes, and other non-communicable diseases. This has led to a significant shift in consumer behavior, with rising demand for reformulated offerings that deliver healthier nutritional profiles without compromising on taste. Manufacturers now face the dual challenge of meeting regulatory mandates while maintaining the sensory appeal and indulgence factor that defines the confectionery category.

Moreover, compliance with regional food safety and nutritional standards adds layers of complexity, especially when catering to international markets. For example, the U.S. Food and Drug Administration (FDA) enforces the “Detention Without Physical Examination of Confectionery Products Containing Non-Nutritive Components.” According to Section 402(d)(1) of the Federal Food, Drug, and Cosmetic Act, confectionery products containing partially or fully embedded non-nutritive objects are deemed adulterated unless deemed functionally necessary and non-hazardous by FDA regulations.

Growth Opportunities

Emergence of sugar-free confectionery with adaptogenic ingredients

The global shift toward healthier eating habits is significantly influencing the confectionery sector, as consumers become increasingly aware of the health risks associated with high sugar intake. Sugar has long been identified as a major contributor to lifestyle-related diseases, prompting a surge in demand for sugar-free and reduced-sugar confectionery alternatives. In 2025, this evolving consumer behavior is presenting manufacturers with a compelling opportunity to innovate within the better-for-you product segment.

Health-conscious consumers are actively seeking confections that support wellness without compromising on indulgence. In align with this concern, confectionery brands are introducing sugar-free and low-sugar products that incorporate functional and adaptogenic ingredients designed to promote mental and emotional well-being. Ingredients such as ashwagandha, functional mushrooms, and cannabidiol (CBD) are being integrated into chocolates, gummies, and other sweet products to deliver benefits such as stress relief, enhanced focus, and relaxation. These offerings meet consumer expectations for both taste and functionality, creating a differentiated value proposition.

The formulation of such products relies heavily on alternative sweeteners capable of delivering the desired flavor profile. Natural options like stevia, agave, and maltitol are increasingly used to replicate the sweetness of sugar while significantly lowering caloric content. Stevia, in particular, continues to dominate this space. Earlier stevia-based ingredients offered sugar reductions of 30% to 70%, whereas the latest innovations—specifically those utilizing steviol glycosides such as Reb M and Reb D—are capable of achieving up to 100% calorie reduction in certain applications without sacrificing taste or mouthfeel.

Latest Trends

Growing demand for vegan confectionery

The increasing popularity of veganism represents a pivotal shift in global dietary and ethical preferences, with far-reaching implications for the confectionery and broader food industries. Although only around 1% of the global population currently identifies as vegan, regional variations are notable—9% in Asia Pacific, 6% in the Middle East and Africa, and 4% in Latin America, compared to 2% in both North America and Europe.

This growing movement, driven by concerns for sustainability, health, and animal welfare, has prompted manufacturers to innovate within the vegan confectionery segment. Advancements in food technology have significantly improved the taste and texture of vegan sweets, narrowing the gap with traditional products. The segment has also gained momentum through high-profile endorsements and expanding mainstream acceptance. Thus, manufacturers are increasingly investing in plant-based formulations, such as vegan fudge, and pursuing strategic acquisitions to expand product portfolios, reflecting the industry’s agility in catering to evolving consumer demands.

Geopolitical Impact Analysis

Globally, cocoa farmers produce approximately five million tonnes of cocoa beans annually, with Cote d’Ivoire and Ghana collectively accounting for around 50% of total global production. Europe processes more than one-third of these beans, reflecting the region’s critical role in the cocoa value chain. Over the past four decades, cocoa production has experienced consistent growth, with up to 95% of cocoa beans traded on international commodity markets. However, the cocoa market remains highly volatile, influenced by a range of factors including political instability, weather-induced production disruptions, and overproduction in key producing nations.

In a remarkable geopolitical development, the US administration proposed a 21% tariff—the highest in West Africa—on cocoa imports from Cote d’Ivoire. Although the administration later announced a 90-day pause on the tariffs, Cote d’Ivoire signaled intentions to implement countermeasures that could raise cocoa prices if the tariffs proceed. In 2024, U.S. cocoa imports from Cote d’Ivoire and Ghana were valued at approximately $800 million and $200 million, respectively. Escalating tariffs on these imports may increase consumer prices, despite the potential for short-term revenue gains.

Regional Analysis

Europe held a significant share in the global confectionery market, accounting for approximately 39.2% in 2024, and recorded the highest growth rate during the year. According to CAOBISCO, the European confectionery association, the region is home to over 12,000 companies producing 14.7 million tons of confectioneries annually. Finland ranks among the top five chocolate-consuming countries in Europe, alongside Switzerland, Germany, Estonia, and the UK.

The region’s market expansion is primarily driven by continuous innovation in product formulations, processing technologies, and packaging solutions. Additionally, the development of the retail sector and overall economic progress across both progressive and emerging European economies further supports market growth. Leading players in the region are enhancing their brand presence by offering a wide array of products, including chocolate-based candies, chocolate bars, chocolate-covered biscuits, filled chocolates with liqueurs, moulded chocolates, panned chocolates, caramel, toffee, nut candies, nougat, lollipops, jellies, marshmallows, fudge, and gum.

Furthermore, companies are actively investing in advertising and marketing strategies, including positioning products as premium gifting options for weddings and other occasions. Emerging trends such as rising demand for low-calorie, sugar-free, and functional confectionery present rewarding opportunities. Notably, chocolate products with organic claims have increased by 6% over the past two years. Demand is further driven by clean-label products marketed as “all-natural” or “preservative-free,” as well as high-cocoa chocolates and boxed assortments supported by seasonal gifting trends, premium positioning, and attractive packaging.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

Key players in the global confectionery market include Mondelez International, Inc., Nestle S.A., Ferrero International SpA, The Hershey Company, Mars, Incorporated, Meiji Co., Ltd. and more. They are focusing on product innovation, continuously introducing new flavors and formats to cater to changing consumer preferences.

Additionally, strategic partnerships and acquisitions are common tactics for market expansion, allowing companies to reach new markets and demographics. Pricing strategies, including promotional offers and bundle deals, are used to attract price-sensitive consumers. Strong branding and marketing efforts are also prevalent, creating a strong brand image and consumer loyalty. Furthermore, a growing emphasis on health-conscious options, such as low-fat, dairy-free, and plant-based products, has prompted several key players to diversify their product portfolios to meet evolving dietary trends.

Market Key Players

- Mondelez International, Inc.

- Nestlé S.A.

- Ferrero International SpA

- The Hershey Company

- Mars, Incorporated

- Meiji Co., Ltd.

- Chocoladefabriken Lindt & Sprüngli AG

- Pladis Global

- HARIBO GmbH & Co. KG

- Perfetti Van Melle

- Ezaki Glico Co., Ltd.

- Lotte Wellfood Co., Ltd.

- Barry Callebaut Group

- AUGUST STORCK KG

- General Mills Inc.

- Other Key Players

Recent Developments

- In November 2024, The Hershey Company announced the acquisition of Sour Strips, a rapidly expanding sour candy brand known for its strong social media presence and growing consumer appeal. This strategic acquisition aligns with Hershey’s broader objective to diversify its confectionery portfolio and strengthen its position within the sour candy segment.

- In May 2024, Chocoladefabriken Lindt & Sprüngli AG announced the completion and official opening of an extension to its Lindt Cocoa Center located in Olten, Switzerland. The company invested approximately 100 million Swiss francs in the plant expansion, which is designed to enhance the production capacity of cocoa mass.

Report Scope

Report Features Description Market Value (2024) USD 287.4 Bn Forecast Revenue (2034) USD 413.3 Bn CAGR (2025-2034) 3.7 % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Geopolitical Impact Analysis, Competitive Landscape, Recent Developments Segments Covered By Product Type ( Chocolate Confectionery (Dark, Milk and White), Sugar Confectionery (Boiled Sweets, Mints, Lollipops, Toffees, Caramels & Nougats, Pastilles & Jellies and Others), and Gum (Chewing Gum and Bubble Gum)), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail and Others), By Age Group (Upto 18 years, 19 to 34 Years, 35 to 44 Years and Above 45 Years) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Mondelez International, Inc., Nestlé S.A., Ferrero International SpA, The Hershey Company, Mars, Incorporated, Meiji Co., Ltd., Chocoladefabriken Lindt & Sprüngli AG, Pladis Global, HARIBO GmbH & Co. KG, Perfetti Van Melle, Ezaki Glico Co., Ltd., Lotte Wellfood Co., Ltd., Barry Callebaut Group, AUGUST STORCK KG, General Mills Inc. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mondelez International, Inc.

- Nestlé S.A.

- Ferrero International SpA

- The Hershey Company

- Mars, Incorporated

- Meiji Co., Ltd.

- Chocoladefabriken Lindt & Sprüngli AG

- Pladis Global

- HARIBO GmbH & Co. KG

- Perfetti Van Melle

- Ezaki Glico Co., Ltd.

- Lotte Wellfood Co., Ltd.

- Barry Callebaut Group

- AUGUST STORCK KG

- General Mills Inc.

- Other Key Players