Global Botanical Beverages Market Size, Share, And Business Benefits By Botanical Ingredients Type (Herbal Teas, Roots and Barks, Floral Extract, Spices, Others), By Product Type (Ready-to-Drink Beverages, Concentrates, Infusions, Mixers), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144688

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

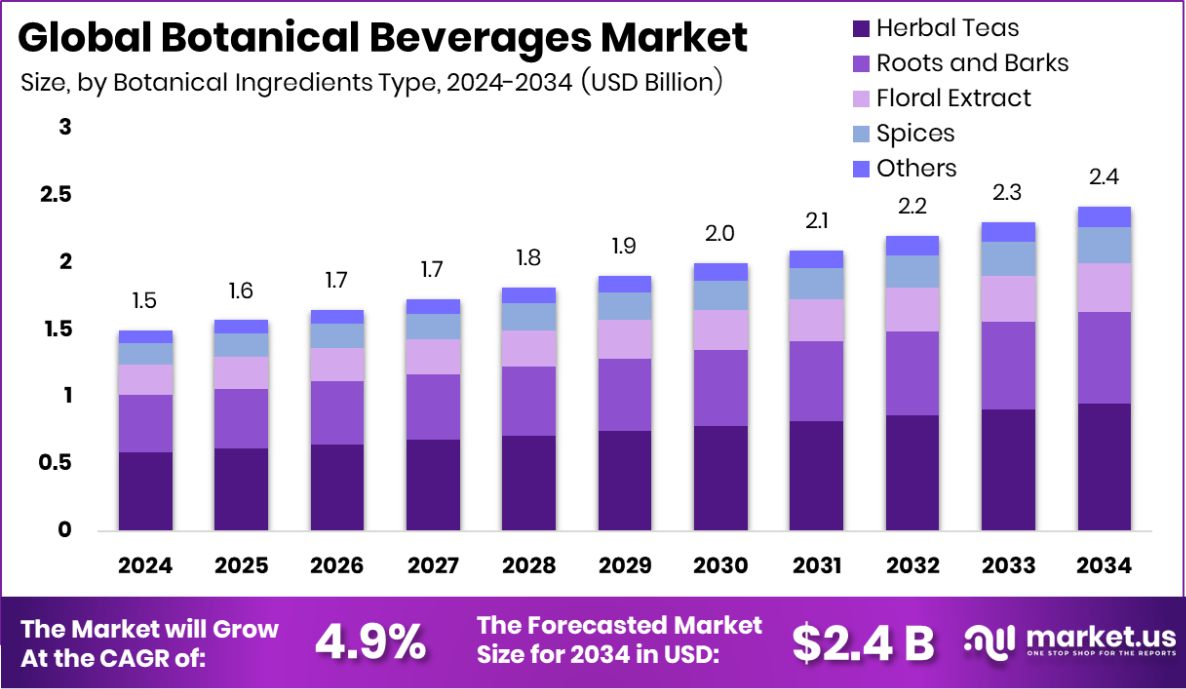

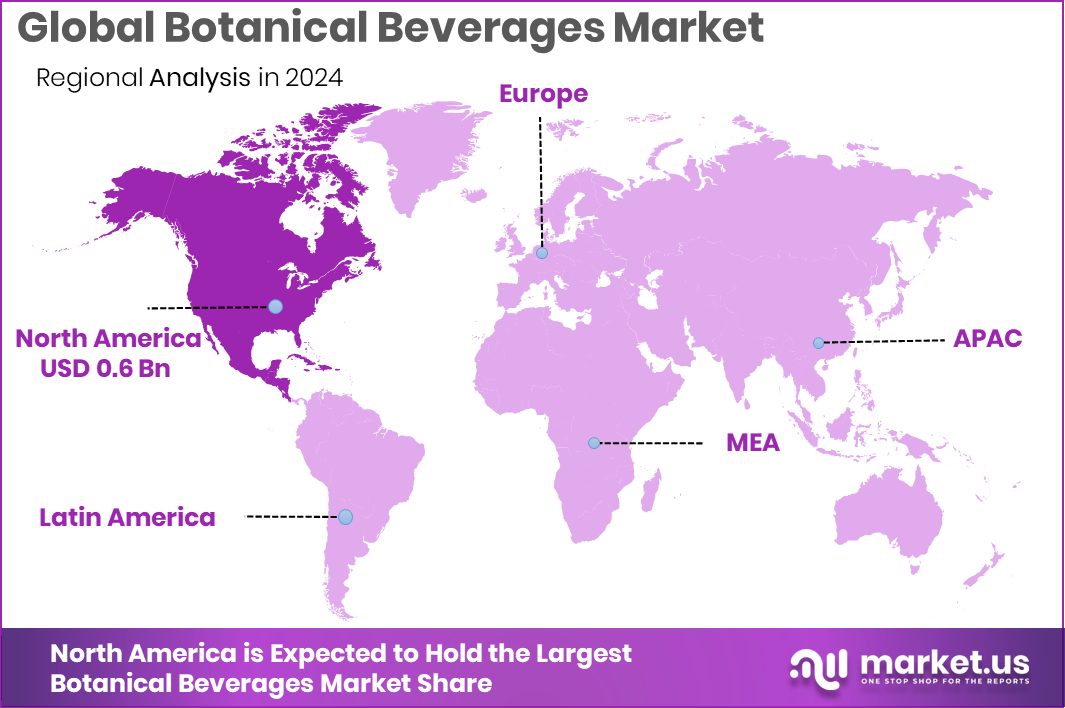

The global botanical beverages market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.5 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034. Growing health awareness in North America supports its USD 0.6 billion market value.

Botanical beverages are drinks crafted using plant-derived ingredients such as herbs, flowers, fruits, seeds, and roots. These natural components are infused or extracted to create flavorful and aromatic beverages, often celebrated for their potential health benefits. Common examples include herbal teas, floral infusions, and spiced drinks, each offering a unique sensory experience rooted in nature’s diversity.

The market for botanical beverages has been experiencing notable growth, driven by increasing consumer interest in health and wellness. As individuals seek natural and functional drinks, the appeal of botanical ingredients has surged. These beverages are perceived as premium and health-enhancing, aligning with the clean-label movement that emphasizes transparency and natural sourcing.

Several factors contribute to the rising demand for botanical beverages. The growing awareness of the health benefits associated with plant-based ingredients has led consumers to explore alternatives to traditional sugary or artificially flavored drinks. Additionally, the desire for unique and exotic flavors has prompted beverage companies to innovate, incorporating botanicals to cater to evolving taste preferences.

Nirvana Tea Inc., a U.S.-based organization, secured a $47,890 grant from the National Institute of Food and Agriculture to empower socially disadvantaged farmers involved in herbal tea production—a growing niche within the botanical beverages market.

These efforts are reinforced by broader agricultural initiatives like the Local Agriculture and Seafood Act (LASA), which, over five years, catalyzed $14 million in additional sales across agriculture and seafood sectors. Herbal teas, as a key segment of botanical beverages, are increasingly supported through such grants, driving both community development and market growth in the U.S. botanical beverage landscape.

Key Takeaways

- The global botanical beverages market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.5 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034.

- Herbal teas dominate botanical beverages, contributing around 39.20% of the overall market share globally.

- Ready-to-drink beverages lead the botanical beverage market, accounting for about 48.20% of total sales.

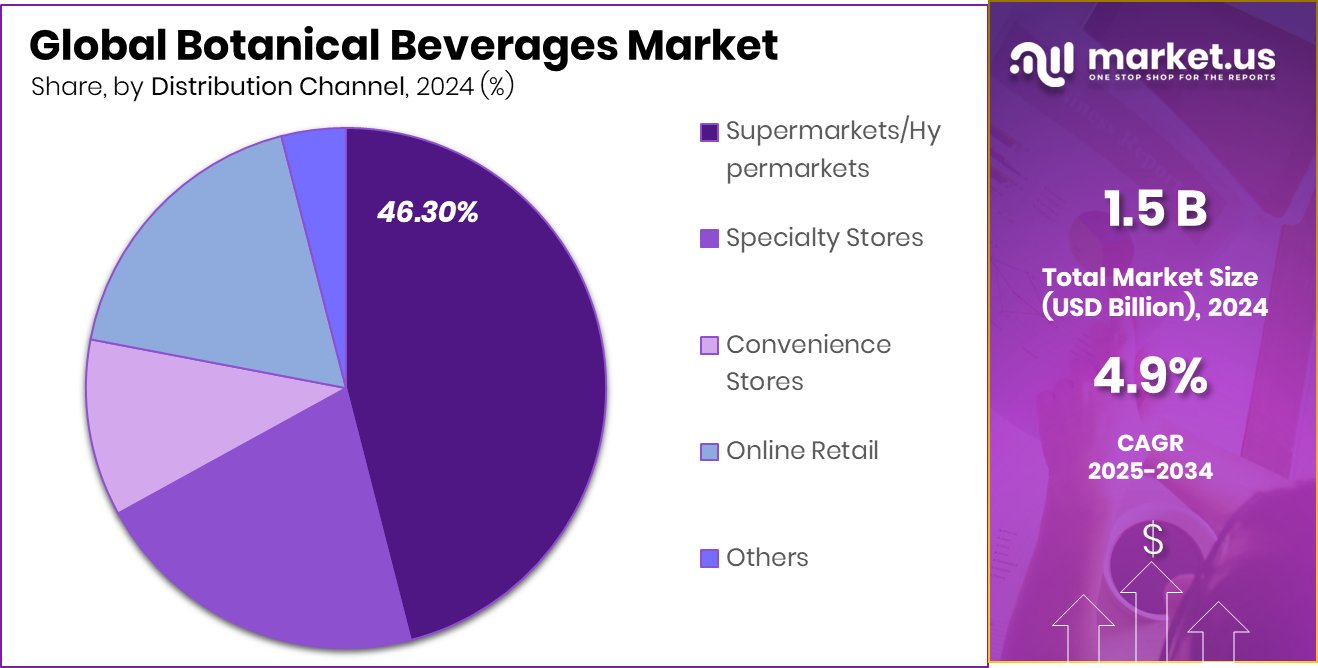

- Supermarkets and hypermarkets capture 46.30% of the distribution share within the global botanical beverages market.

- North America generated USD 0.6 billion in botanical beverage revenue during 2024.

By Botanical Ingredients Type Analysis

Herbal teas dominate the botanical beverages market with a 39.20% strong market share.

In 2024, Herbal Teas held a dominant market position in the By Botanical Ingredients Type segment of the Botanical Beverages Market, with a 39.20% share. This leadership is primarily driven by growing consumer preference for caffeine-free and health-promoting beverages.

Herbal teas, often infused with ingredients like chamomile, peppermint, hibiscus, and rooibos, are increasingly perceived as natural remedies supporting digestion, relaxation, and immunity. Their appeal is particularly strong among health-conscious consumers and aging populations seeking alternatives to traditional caffeinated drinks.

The segment’s robust performance also reflects expanding product innovations, such as flavored blends and cold-brew herbal infusions. Brands are capitalizing on functional health trends, promoting herbal teas as solutions for stress, sleep disorders, and detoxification. Additionally, the rising demand for clean-label and organic options is accelerating the segment’s momentum.

Distribution through online platforms and specialty health stores further enhances consumer accessibility. The global shift toward plant-based lifestyles also supports the growing adoption of herbal teas, especially in North America and Europe, where wellness-centric consumption patterns dominate.

With functional benefits and a broad demographic appeal, Herbal Teas are well-positioned to maintain their stronghold within the Botanical Beverages Market’s Botanical Ingredients Type segment in the foreseeable future, backed by both traditional usage and modern health trends.

By Product Type Analysis

Ready-to-drink botanical beverages lead the market, capturing 48.20% of the market.

In 2024, Ready-to-Drink Beverages held a dominant market position in the By Product Type segment of the Botanical Beverages Market, with a 48.20% share. This dominance is attributed to increasing consumer demand for convenient, health-oriented beverages that require no preparation. Ready-to-drink (RTD) botanical beverages, often infused with natural plant extracts, appeal to busy lifestyles and on-the-go consumption trends, especially among urban populations.

The segment’s growth is fueled by rising awareness of functional health benefits, with RTD options featuring ingredients that support immunity, digestion, and mental clarity. Popular formulations include botanical infusions with green tea, ginseng, turmeric, and elderberry, catering to wellness-focused consumers. The appeal of clean-label products and natural flavoring has further accelerated adoption, particularly among millennials and Gen Z consumers.

Packaging innovation and enhanced shelf-stability have made RTD beverages more accessible across retail and e-commerce platforms. Leading brands have also expanded product lines to include sparkling botanical drinks, low-calorie options, and sugar-free variants.

These developments have strengthened consumer trust and loyalty in the segment. With nearly half of the Botanical Beverages Market share, Ready-to-Drink Beverages are set to retain their lead, supported by the demand for functional, portable, and naturally formulated refreshment alternatives.

By Distribution Channel Analysis

Supermarkets dominate sales in the botanical beverages market with a 46.30% distribution reach.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Botanical Beverages Market, with a 46.30% share. This significant share reflects consumer preference for one-stop shopping experiences and immediate product availability.

Supermarkets and hypermarkets offer a broad range of botanical beverages under one roof, enabling customers to compare brands, prices, and product claims directly. Their strategic shelf placement and in-store promotions further drive visibility and impulse purchases.

These retail channels benefit from strong supply chain networks and established brand partnerships, ensuring consistent product availability and attractive pricing. The presence of dedicated health and wellness sections in major retail chains has also boosted the visibility of botanical beverage categories, including herbal teas, functional drinks, and ready-to-drink botanical infusions.

Consumer trust in large retail formats, combined with the ability to physically inspect product labels, ingredients, and packaging, supports higher in-store conversions. Furthermore, supermarkets and hypermarkets serve as key launchpads for new botanical beverage products due to their high footfall and wide demographic reach.

As demand for natural and functional drinks continues to grow, supermarkets/hypermarkets remain the leading distribution channel, leveraging convenience, variety, and promotional strength to maintain their dominance in the Botanical Beverages Market.

Key Market Segments

By Botanical Ingredients Type

- Herbal Teas

- Roots and Barks

- Floral Extract

- Spices

- Others

By Product Type

- Ready-to-Drink Beverages

- Concentrates

- Infusions

- Mixers

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Driving Factors

Rising Health Awareness Boosting Natural Drink Demand

One of the biggest drivers for the Botanical Beverages Market is growing health awareness among consumers. People are now more careful about what they drink, and many are shifting away from sugary sodas and artificial beverages.

Botanical drinks, made from natural herbs, fruits, flowers, and roots, are seen as healthier choices. These drinks often come with added benefits like improving digestion, reducing stress, and boosting energy.

As more people look for clean-label and plant-based products, botanical beverages are becoming a go-to option. This trend is especially strong among younger consumers and urban populations. The focus on immunity and wellness, especially after the COVID-19 pandemic, has further increased the demand for natural and functional drinks across all age groups.

Restraining Factors

High Production Costs Limit Market Growth Potential

One key factor holding back the Botanical Beverages Market is the high cost of production. Making these drinks involves sourcing natural ingredients like herbs, roots, flowers, and plant extracts, which are often expensive and need careful handling. Many botanical ingredients are seasonal, hard to cultivate, or imported, which adds to the cost.

On top of that, companies must invest in research and testing to prove health benefits and ensure safety. Packaging and shelf-life stability for natural drinks also require extra spending. These costs often lead to higher prices for consumers, making botanical beverages less competitive than regular soft drinks.

Growth Opportunity

Innovative Products Attract Health-Conscious Consumers

The botanical beverages market is experiencing significant growth due to continuous product innovation. Companies are developing new flavors and functional drinks that cater to health-conscious consumers seeking natural and beneficial ingredients. For example, the rise of prebiotic sodas, which support digestive health, have gained popularity as consumers look for healthier alternatives to traditional sugary drinks.

Brands like Olipop and Poppi have successfully introduced such products, prompting major companies like Coca-Cola and PepsiCo to enter the market with their own versions. This trend of innovation not only attracts new customers but also encourages existing ones to explore a wider range of botanical beverage options, driving market expansion.

Latest Trends

Functional Beverages Enhance Health and Wellness

A significant trend in the botanical beverages market is the rise of functional drinks that promote health and wellness. Consumers are increasingly seeking beverages infused with natural ingredients like herbs, spices, and adaptogens, believed to offer benefits such as improved digestion, enhanced immunity, and stress relief. For instance, prebiotic sodas containing ingredients like ginger and turmeric are gaining popularity for their potential to support gut health.

Brands like Olipop and Poppi have introduced such products, blending traditional botanical knowledge with modern tastes. This shift reflects a broader consumer movement towards natural, health-focused alternatives to sugary soft drinks, driving innovation and growth in the botanical beverages sector.

Regional Analysis

In 2024, North America led the Botanical Beverages Market with a 43.20% share.

In 2024, North America dominated the Botanical Beverages Market, accounting for 43.20% of the global share, with a market value of USD 0.6 billion. This leading position is driven by a strong consumer preference for health-centric and plant-based beverages, supported by high disposable income and an advanced retail network.

The region also benefits from the growing demand for ready-to-drink and functional beverages across the U.S. and Canada. Europe followed as a significant market, backed by increasing awareness of herbal remedies and clean-label consumption trends. Asia Pacific showed notable potential, supported by the traditional use of botanicals in countries like China, Japan, and India.

However, the market remains fragmented due to varying consumer preferences and the availability of ingredients. The Middle East & Africa region is emerging, albeit at a slower pace, with rising interest in wellness products among urban consumers.

Latin America contributed modestly, with steady demand for traditional herbal drinks, especially in Brazil and Mexico. Across these regions, market performance is shaped by cultural acceptance, pricing sensitivity, and product accessibility.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global botanical beverages market experienced significant growth, driven by increasing consumer demand for natural and health-enhancing products. Key players such as Archer Daniels Midland Company (ADM), Bumblezest, and Cotswolds Distillery have strategically positioned themselves to capitalize on this trend.

Archer Daniels Midland Company (ADM) As a global leader in nutrition, ADM has leveraged its extensive expertise to innovate within the botanical beverages sector. In 2024, ADM unveiled its Flavor and Color Trends Report, highlighting consumer preferences for natural ingredients and authentic regional flavors. This initiative underscores ADM’s commitment to aligning product development with evolving consumer tastes, thereby strengthening its market presence.

Bumblezest Known for its health-focused formulations, Bumblezest has carved a niche in the botanical beverages market by offering drinks infused with functional ingredients aimed at promoting wellness. The company’s emphasis on clean-label products and transparency resonates with health-conscious consumers seeking beverages that support holistic well-being.

Cotswolds Distillery While traditionally recognized for its premium spirits, Cotswolds Distillery has expanded into the botanical beverages arena, introducing products that blend artisanal craftsmanship with natural botanicals. This diversification reflects the company’s adaptability and responsiveness to the growing consumer appetite for botanical-infused drinks.

Top Key Players in the Market

- Archer Daniels Midland Company

- Bell Flavors & Fragrances

- Blue Sky Botanics Ltd.

- Botanical Blends Inc.

- Bumblezest

- Cotswolds Distillery

- Danone S.A.

- Döhler GmbH

- Fever Tree

- Givaudan

- Koninklijke Euroma BV

- Martin Bauer Group

- Nestlé S.A.

- Nutrasorb, LLC

- Pure Botanicals LLC

- The Herbal Brew Company

Recent Developments

- In January 2024, Cotswolds Distillery signed a distribution agreement with ILLVA Saronno Holding to handle its sales in the UK and Benelux markets. This partnership aims to leverage ILLVA Saronno’s strong portfolio and extensive sales network to boost Cotswolds Distillery’s presence both locally and internationally.

- In 2024, Danone made a significant move by proposing to acquire Lifeway Foods, a company known for its kefir and probiotic products, for approximately $283 million. This acquisition aligns with Danone’s strategy to expand its health and wellness portfolio, particularly in the area of probiotics, which are essential for gut health.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.4 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Botanical Ingredients Type (Herbal Teas, Roots and Barks, Floral Extract, Spices, Others), By Product Type (Ready-to-Drink Beverages, Concentrates, Infusions, Mixers), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Bell Flavors & Fragrances, Blue Sky Botanics Ltd., Botanical Blends Inc., Bumblezest, Cotswolds Distillery, Danone S.A., Döhler GmbH, Fever Tree, Givaudan, Koninklijke Euroma BV, Martin Bauer Group, Nestlé S.A., Nutrasorb, LLC, Pure Botanicals LLC, The Herbal Brew Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Botanical Beverages MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Botanical Beverages MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Bell Flavors & Fragrances

- Blue Sky Botanics Ltd.

- Botanical Blends Inc.

- Bumblezest

- Cotswolds Distillery

- Danone S.A.

- Döhler GmbH

- Fever Tree

- Givaudan

- Koninklijke Euroma BV

- Martin Bauer Group

- Nestlé S.A.

- Nutrasorb, LLC

- Pure Botanicals LLC

- The Herbal Brew Company