Global Sugar Reduction Market Size, Share, And Business Benefits By Type (Artificial Intensity Sweeteners, Naturally Derived Intensity Sweeteners, Sugar Alcohols), By Functionality (Sweetening Agents, Preservatives, Mouthfeel, Flavor Enhancers), By Formulation Type (Liquid, Powder, Granular, Tablets and Capsules), By Application (Bakery, Beverages, Confectionery, Dairy, Snacks, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144536

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

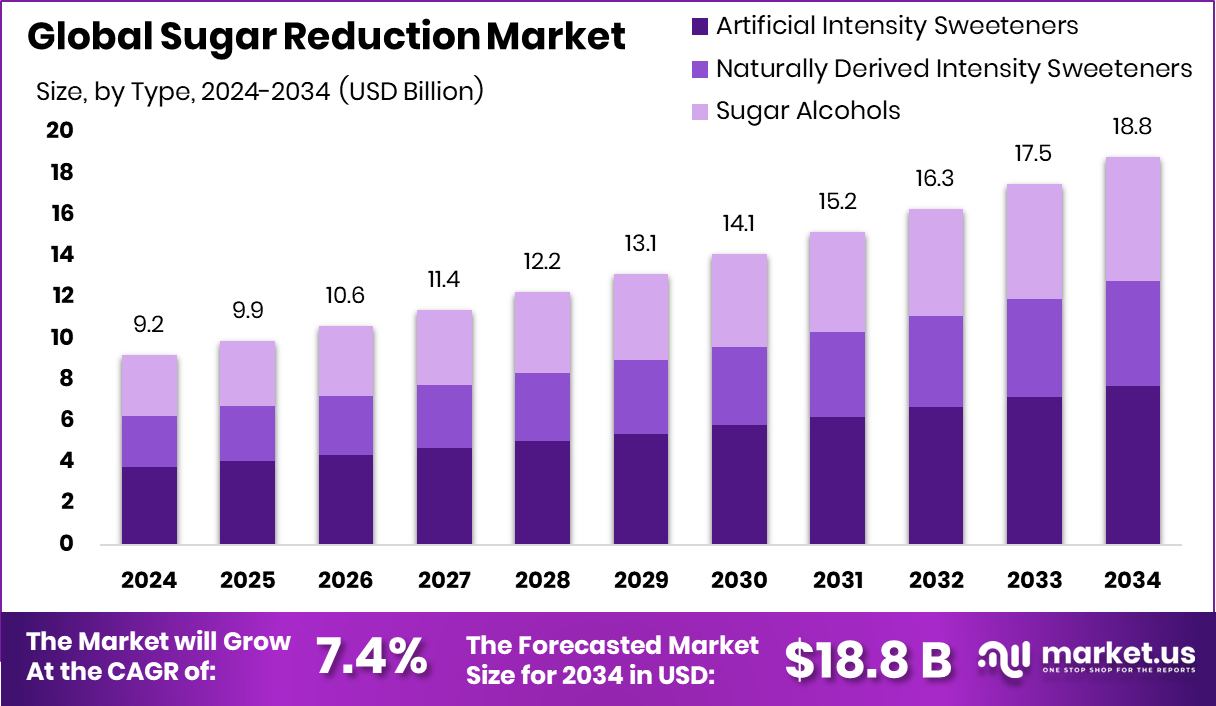

The Global Sugar Reduction Market is expected to be worth around USD 18.8 billion by 2034, up from USD 9.2 billion in 2024, and grow at a CAGR of 7.4% from 2025 to 2034. North America’s 46.20% high share reflects strong demand for healthier, low-sugar food alternatives.

Sugar reduction refers to the process of lowering the amount of added sugars in foods and beverages. This can be done through reformulation, using natural or artificial sweeteners, or enhancing flavors to maintain taste while reducing sugar content. The goal is to support healthier diets, especially as high sugar intake is linked to obesity, diabetes, and other health issues.

The sugar reduction market revolves around products, ingredients, and technologies aimed at lowering sugar content across food and drink categories. It includes sweetener alternatives, low-calorie formulations, and sugar-free product innovations. This market is shaped by consumer health awareness, regulatory guidelines, and food industry innovation aimed at meeting clean-label and low-sugar demands.

One of the major growth drivers is rising public awareness around sugar-related health issues. Consumers are reading labels more carefully, pushing brands to reduce sugar without compromising flavor. Government regulations and global health campaigns are further motivating food producers to invest in sugar-reduction strategies.

Demand is soaring among fitness-conscious individuals and diabetics who are actively seeking low-sugar or sugar-free options. Parents are also looking for healthier products for their kids, especially in snacks and beverages. This demand is making reduced-sugar options more mainstream rather than niche.

There’s a huge opportunity in developing natural sugar alternatives that taste close to real sugar. Innovation in flavor masking and product reformulation is also opening doors in categories like bakery, dairy, and beverages. Additionally, emerging markets offer untapped potential where sugar awareness is just beginning to grow.

In the U.S., the Special Diabetes Program has invested about $3.55 billion in type 1 diabetes research over 27 years. Meanwhile, India’s government allocated ₹2,500 crore to the sugar industry for FY 2024/25 via the National Cooperative Development Corporation (NCDC). The NCDC also lowered interest rates to 8.5% for term loans and 8% for working capital loans to cooperative sugar factories.

Key Takeaways

- The Global Sugar Reduction Market is expected to be worth around USD 18.8 billion by 2034, up from USD 9.2 billion in 2024, and grow at a CAGR of 7.4% from 2025 to 2034.

- Artificial sweeteners dominate sugar reduction, with a 41.30% market share in 2024.

- Sweetening agents hold a 63.30% share, leading functional use in sugar reduction.

- Powder form leads at 43.20%, offering stability and ease in processing.

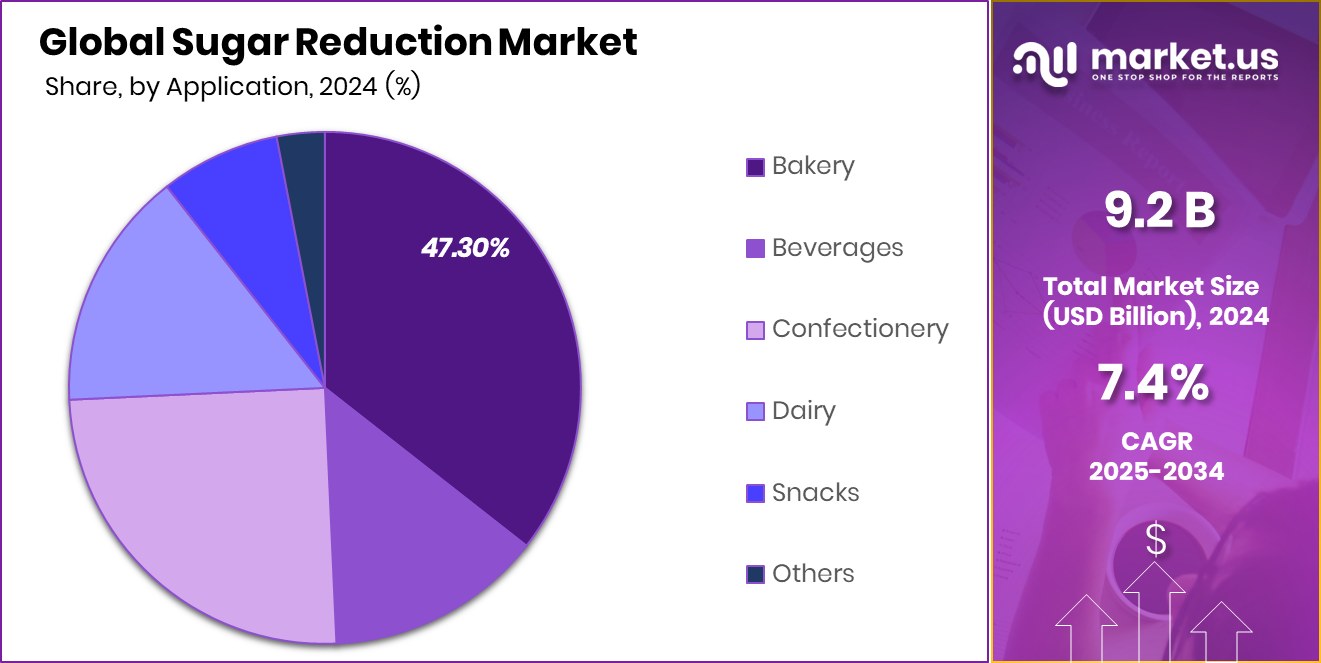

- Bakery applications dominate with a 47.30% share in the sugar reduction market.

- The market value reached USD 4.2 Bn across North American regions last year.

By Type Analysis

Artificial intensity sweeteners hold a 41.30% share in the sugar reduction market globally.

In 2024, the “By Type” segment of the Sugar Reduction Market saw Artificial Intensity Sweeteners holding a dominant position, securing a substantial market share of 41.30%. This segment’s strong performance underscores a growing consumer preference for sugar alternatives that offer the sweetness of sugar without the associated calories. This trend is largely driven by increasing health consciousness among consumers and rising awareness of the health risks associated with high sugar intake, such as diabetes and obesity.

The substantial market share of Artificial Intensity Sweeteners indicates a robust consumer trust in these products’ ability to provide a desirable sweet taste while contributing to a healthier lifestyle. The preference for these sweeteners over other types, such as natural sweeteners or sugar alcohols, suggests that efficacy in taste and calorie reduction are key factors influencing consumer choices in the sugar reduction market.

As the market continues to evolve, the dominance of Artificial Intensity Sweeteners highlights the significant impact of consumer health trends on product innovation and market dynamics. Companies in the sector are likely to continue investing in research and development to enhance the taste profile and health benefits of these sweeteners to capitalize on consumer preferences and expand their market share.

By Functionality Analysis

Sweetening agents account for 63.30% of the overall sugar reduction market by functionality.

In 2024, Sweetening Agents held a dominant market position in the “By Functionality” segment of the Sugar Reduction Market, commanding a significant 63.30% share. This dominance underscores the central role that sweetening agents play in the strategies of manufacturers aiming to meet consumer demand for reduced-sugar products without compromising on taste.

The considerable market share captured by Sweetening Agents indicates that they are the preferred choice for food and beverage manufacturers looking to innovate and expand their product offerings in the low-sugar category. This trend is motivated by growing consumer health awareness and regulatory pressures to reduce overall sugar consumption across various demographics.

Given their critical role in product reformulation and innovation, Sweetening Agents are likely to remain a focal point in the development strategies of companies operating within the sugar reduction space. As the market progresses, these agents will continue to evolve, potentially incorporating advanced formulations that offer enhanced taste profiles and health benefits, thereby reinforcing their position in the market and attracting a broader consumer base.

By Formulation Type Analysis

Powder formulation leads with 43.20% market share in the sugar reduction product range.

In 2024, Powder held a dominant market position in the “By Formulation Type” segment of the Sugar Reduction Market, with a 43.20% share. This notable share highlights the strong demand for powdered sugar reduction solutions across various food and beverage applications. Powder formulations are widely favored due to their ease of blending, longer shelf life, and compatibility with multiple product formats, including beverages, bakery items, and dairy products.

The 43.20% market share captured by the powder segment reflects its extensive adoption by manufacturers aiming for precise dosing and consistent sweetness levels in end products. Additionally, powder forms are often cost-effective in production and transport, making them a preferred choice in both large-scale food production and consumer retail offerings.

The widespread use of powdered sugar-reduction ingredients indicates a stable demand base that values formulation flexibility and efficient processing. As manufacturers continue to reformulate products to meet sugar reduction targets, powdered options are expected to remain integral due to their functionality, stability, and performance in a variety of product matrices.

By Application Analysis

Bakery applications hold a strong 47.30% share in the sugar reduction market segment.

In 2024, Bakery held a dominant market position in the “By Application” segment of the Sugar Reduction Market, with a 47.30% share. This significant share reflects the strong consumer demand for low-sugar bakery products, such as bread, cakes, pastries, cookies, and muffins. As health-conscious eating continues to shape food preferences, the bakery industry has emerged as a key application area for sugar-reduction solutions.

The 47.30% market share indicates that manufacturers are actively reformulating traditional bakery products to cater to consumers seeking healthier indulgence without compromising on taste. This trend is particularly strong in urban markets, where lifestyle-related health concerns like obesity and diabetes are influencing purchase decisions.

Bakery products often rely on sugar not only for sweetness but also for structure, texture, and shelf life. The demand for sugar reduction in this category has driven innovation in alternative sweetening systems that replicate sugar’s functional role while reducing calorie content.

Key Market Segments

By Type

- Artificial Intensity Sweeteners

- Naturally Derived Intensity Sweeteners

- Sugar Alcohols

By Functionality

- Sweetening Agents

- Preservatives

- Mouthfeel

- Flavor Enhancers

By Formulation Type

- Liquid

- Powder

- Granular

- Tablets and Capsules

By Application

- Bakery

- Beverages

- Confectionery

- Dairy

- Snacks

- Others

Driving Factors

Growing Health Awareness Drives Sugar Reduction Demand

One of the main drivers of the Sugar Reduction Market is the growing health awareness among consumers. People today are more informed about the risks of high sugar intake, such as obesity, diabetes, and heart problems.

This has created a strong demand for low-sugar and sugar-free products across all age groups. Food and beverage companies are responding by reformulating their products with reduced sugar content, using alternatives like artificial and natural sweeteners.

Consumers are now reading labels more carefully and actively choosing healthier options, even for snacks and desserts. This shift in behavior is encouraging manufacturers to innovate and launch new products that offer the same great taste with less sugar, making health-conscious choices more accessible and appealing.

Restraining Factors

Taste and Texture Challenges Limit Product Acceptance

A key restraining factor in the Sugar Reduction Market is the difficulty in matching the original taste and texture of full-sugar products. When sugar is reduced or replaced, it often affects how a product feels and tastes. Many consumers notice these changes and may reject low-sugar alternatives if they don’t enjoy the experience.

Sugar not only adds sweetness but also impacts mouthfeel, color, and shelf life. Even with advanced sweeteners and technologies, replicating the exact characteristics of sugar remains a challenge for manufacturers.

This barrier makes it harder for brands to retain loyal customers or attract new ones, slowing down wider acceptance of reduced-sugar products, especially in categories like bakery and confectionery.

Growth Opportunity

Rising Demand for Natural Sweeteners Boosts Growth

A major growth opportunity in the Sugar Reduction Market is the rising demand for natural sweeteners. Consumers are becoming more cautious about artificial ingredients and are actively seeking clean-label products.

Natural sweeteners like stevia, monk fruit, and allulose are gaining popularity because they offer sweetness without the calories and are plant-based. This shift is opening up new opportunities for food and beverage companies to create innovative, healthier products.

As more people look for natural and recognizable ingredients, especially in health-focused and organic categories, manufacturers are investing in natural sugar alternatives. This trend is expected to fuel market expansion, especially in regions where wellness and sustainability are key buying factors for modern consumers.

Latest Trends

Natural Sweeteners Gain Popularity in Market

A significant trend in the Sugar Reduction Market is the increasing preference for natural sweeteners. Consumers are moving away from artificial additives, favoring options like stevia, monk fruit, and allulose, which are perceived as healthier alternatives. This shift is driven by a growing awareness of health risks associated with high sugar consumption and a desire for clean-label products.

Manufacturers are responding by incorporating these natural sweeteners into various food and beverage products to meet consumer demand. The trend is particularly evident in the beverage sector, where products with sugar reduction claims have become prominent.

As this movement continues, it is expected to shape product development strategies, leading to a broader range of reduced-sugar offerings that align with health-conscious consumer preferences.

Regional Analysis

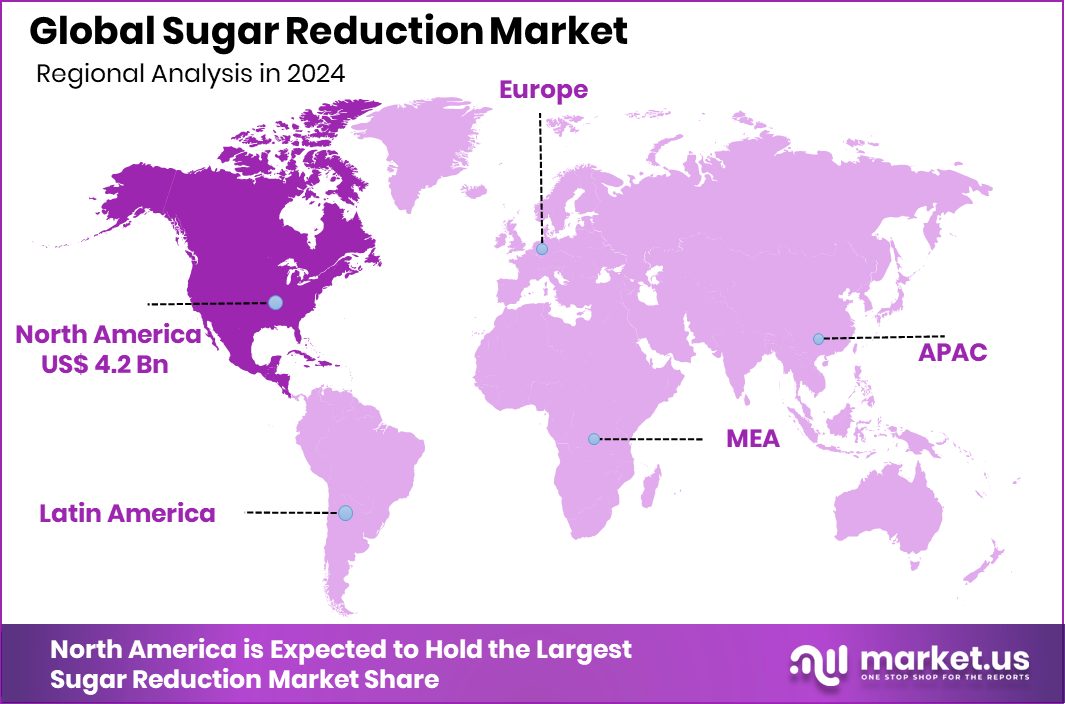

In North America, the Sugar Reduction Market captured a 46.20% share in 2024.

In 2024, North America dominated the Sugar Reduction Market, accounting for 46.20% of the global share and reaching a market value of USD 4.2 billion. This leading position is supported by high health awareness, increased consumption of low-sugar products, and strong demand for natural sweeteners across the United States and Canada.

In Europe, the market continues to grow steadily due to regulatory pressure to reduce sugar in processed foods and rising consumer demand for clean-label alternatives.

Asia Pacific is emerging as a promising region, driven by urbanization, changing lifestyles, and increasing health consciousness in countries like China, Japan, and India. Meanwhile, the Middle East & Africa region shows gradual growth, with health trends beginning to influence purchasing behavior, especially in the Gulf countries.

Latin America also contributes to market expansion, with countries like Brazil and Mexico adopting sugar taxes and promoting reduced-sugar food options. However, North America remains the dominant regional force in this market, both in terms of percentage share and revenue.

The region’s established food industry, combined with consumer preference for innovative, health-driven products, continues to drive momentum in sugar reduction strategies across multiple application sectors, including beverages, bakery, and dairy.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global sugar reduction market is experiencing significant growth, driven by increasing consumer awareness of health issues associated with high sugar intake, such as obesity and diabetes. Key players like Ajinomoto Co., Alchemy Foodtech Pte. Ltd., and Amalgamated Sugar are actively contributing to this evolving landscape.

Ajinomoto Co., a prominent player in the food and biotechnology sectors, has been focusing on health and nutrition initiatives. By April 2024, the company had launched 54 low-sodium products under 23 brands across seven countries, emphasizing its commitment to healthier food options. Although these efforts primarily target sodium reduction, they reflect Ajinomoto’s broader dedication to improving public health through product innovation.

Singapore-based Alchemy Foodtech Pte. Ltd. specializes in creating ingredients aimed at reducing sugar content and lowering the glycemic index in carbohydrate-based foods. Their patented Alchemy Fibre™ technology has been successfully applied to various products, including reducing the sugar content in chocolate chip cookies by nearly half without compromising taste.

In 2023, the company expanded into sugar reduction solutions for cakes, cookies, beverages, and ice creams, aligning with its mission to “Make Carbs Good” and promote healthier eating habits globally.

Amalgamated Sugar, known for producing White Satin® sugar, has a longstanding presence in the sugar industry. While traditionally focused on sugar production, the company’s role in the sugar reduction market appears limited based on available information. Their product portfolio includes various sugar granulations and animal feed products derived from sugarbeets.

Top Key Players in the Market

- Ajinomoto Co

- Alchemy Foodtech Pte. Ltd.

- Amalgamated Sugar

- Bayn Europe AB

- Cargill Inc.

- Celanese Corporation

- Danone S.A.

- Givaudan SA

- Hain Celestial Group

- Ingredion

- JK Sucralose Inc

- Mondelēz International

- NOW Foods

- PepsiCo

- PureCircle Limited

- Roquette Freres SA

- Tate & Lyle

- The Coca-Cola Company

- Unilever plc

Recent Developments

- In 2024, Ajinomoto Co., Inc. collaborated with Shiru to develop sweet proteins aimed at reducing sugar use. This partnership, leveraging AI, focuses on creating proteins that replicate the sweetness of sugar, with commercial applications expected soon.

- In 2023, Alchemy Foodtech launched SweetFibre, significantly cutting sugar in food. They partnered with Ting Li in November 2023, enhancing sugar reduction efforts in instant foods. Plans for 2025 include launching GI-lowering baking premixes.

Report Scope

Report Features Description Market Value (2024) USD 9.2 Billion Forecast Revenue (2034) USD 18.8 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Artificial Intensity Sweeteners, Naturally Derived Intensity Sweeteners, Sugar Alcohols), By Functionality (Sweetening Agents, Preservatives, Mouthfeel, Flavor Enhancers), By Formulation Type (Liquid, Powder, Granular, Tablets and Capsules), By Application (Bakery, Beverages, Confectionery, Dairy, Snacks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Co, Alchemy Foodtech Pte. Ltd., Amalgamated Sugar, Bayn Europe AB, Cargill Inc., Celanese Corporation, Danone S.A., Givaudan SA, Hain Celestial Group, Ingredion, JK Sucralose Inc, Mondelēz International, NOW Foods, PepsiCo, PureCircle Limited, Roquette Freres SA, Tate & Lyle, The Coca-Cola Company, Unilever plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ajinomoto Co

- Alchemy Foodtech Pte. Ltd.

- Amalgamated Sugar

- Bayn Europe AB

- Cargill Inc.

- Celanese Corporation

- Danone S.A.

- Givaudan SA

- Hain Celestial Group

- Ingredion

- JK Sucralose Inc

- Mondelēz International

- NOW Foods

- PepsiCo

- PureCircle Limited

- Roquette Freres SA

- Tate & Lyle

- The Coca-Cola Company

- Unilever plc