Europe Liquid Sugar Market By Product Type (Liquid Sucrose, Fructose Syrup, Glucose Syrup, Inverted Sugar Syrup, Mixed Syrups), By Form (Organic, Conventional), By Source (Sugarcane, Sugar Beet, Others), By Application (Dairy, Beverages, Bakery, Confectionary, Ice Cream, Confiture and Fruit Spreads), By Distribution Channel (Direct Sales, Retail Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 76090

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

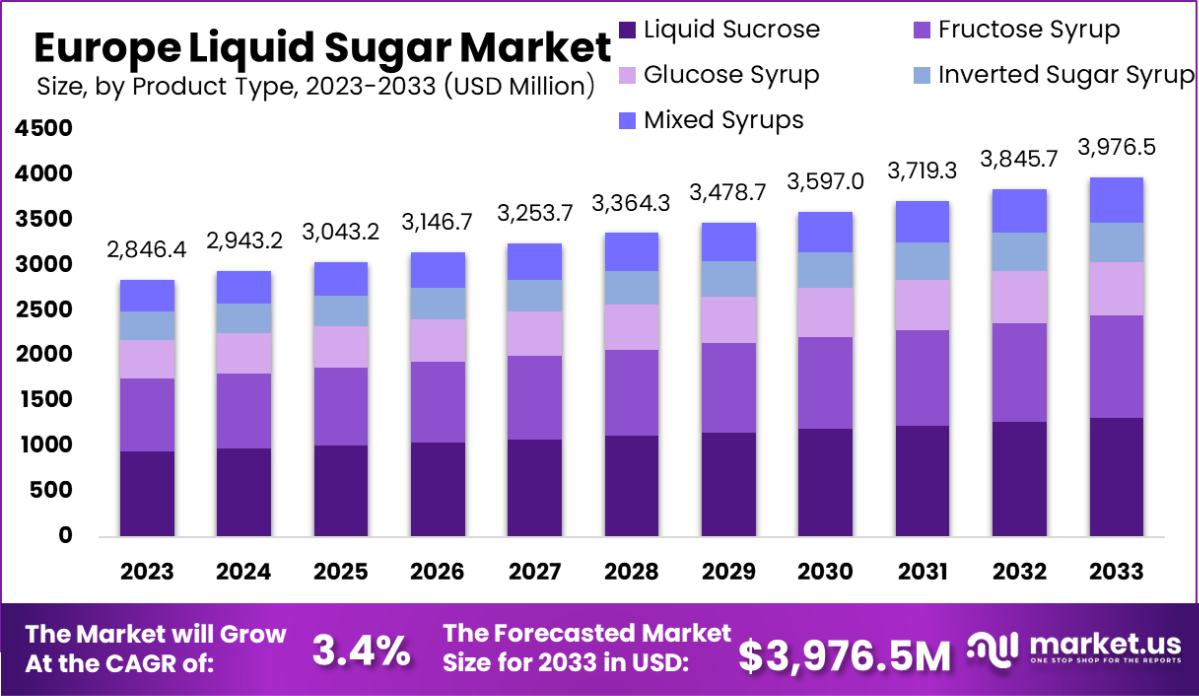

The Europe Liquid Sugar Market is expected to be worth around USD 3,976.5 Million by 2033, up from USD 2846.4 Million in 2023, and grow at a CAGR of 3.4% from 2024 to 2033.

Europe Liquid Sugar refers to a sweet, syrupy solution made by dissolving sugars such as sucrose, glucose, or fructose in water. Commonly used in the beverage, bakery products, confectionery, and dairy industries, this product offers consistency in sweetness and flavor, enhancing product quality and shelf life.

The Europe Liquid Sugar Market is seeing growth driven by the rising demand for processed foods and convenience products among European consumers. As lifestyles become busier, the preference for quick and easy culinary solutions is boosting the use of liquid sugar in various applications.

Growth factors for this market include the increasing automation in food processing and a strong trend towards natural and organic ingredients, which are pushing manufacturers to innovate and expand their liquid sugar product lines. The demand for liquid sugar is primarily fueled by the beverage industry, where it is indispensable for creating soft drinks, juices, and other flavored drinks.

Additionally, there is a significant opportunity in the expanding health-conscious segment, which seeks alternatives to traditional sweeteners, prompting the development of organic and reduced-calorie liquid sugar options.

The Europe Liquid Sugar Market is poised at a strategic intersection of evolving consumer preferences and stringent regulatory frameworks, presenting unique opportunities for industry players. The continent’s sugar consumption patterns, particularly in the realm of beverages, illustrate a significant demand vector.

Data from the National Library of Medicine indicates variable consumption rates of soft drinks, with average daily intakes of total soft drinks at 43 grams per day and median values at 29 grams per day. These beverages, often laden with added sugars, highlight the persistent demand for sweetened products despite health-centric shifts in consumer behavior.

Simultaneously, the European Union’s sugar production is robust, estimated at 15.6 million metric tons for the 2023/24 period, according to reports from the USDA. This production capacity not only meets internal demand but also positions Europe as a key player in the sugar market.

Further shaping the market dynamics are the EU’s ambitious sustainability and renewable energy initiatives. The Circular Bio-based Europe Joint Undertaking (CBE JU), with a funding pool of €2 billion, underscores the commitment to fostering bio-based industries.

Notably, the €215.5 million allocation for 2023 to enhance wood-based value chains and retrofit biorefineries signifies a move towards more sustainable, high-value bio-based products.

Additionally, the EU’s Renewable Energy Directive II (RED II), aiming for a 14% renewable energy quota in the transport sector by 2030, could indirectly influence the liquid sugar sector by integrating sugar-derived biofuels into the energy mix.

This confluence of high consumption, substantial production capabilities, and forward-thinking environmental policies creates fertile ground for innovation and growth in the European liquid sugar market. Stakeholders are encouraged to leverage these insights to navigate the complexities of market expansion and sustainability challenges effectively.

Key Takeaways

- The Europe Liquid Sugar Market is expected to be worth around USD 3,976.5 Million by 2033, up from USD 2846.4 Million in 2023, and grow at a CAGR of 3.4% from 2024 to 2033.

- Europe’s liquid sugar market primarily features liquid sucrose, accounting for 33.4% of the product type.

- Conventional forms dominate the market, making up 83.4% of Europe’s liquid sugar sales.

- Sugarcane is the leading source of liquid sugar in Europe, comprising 53.2% of the market.

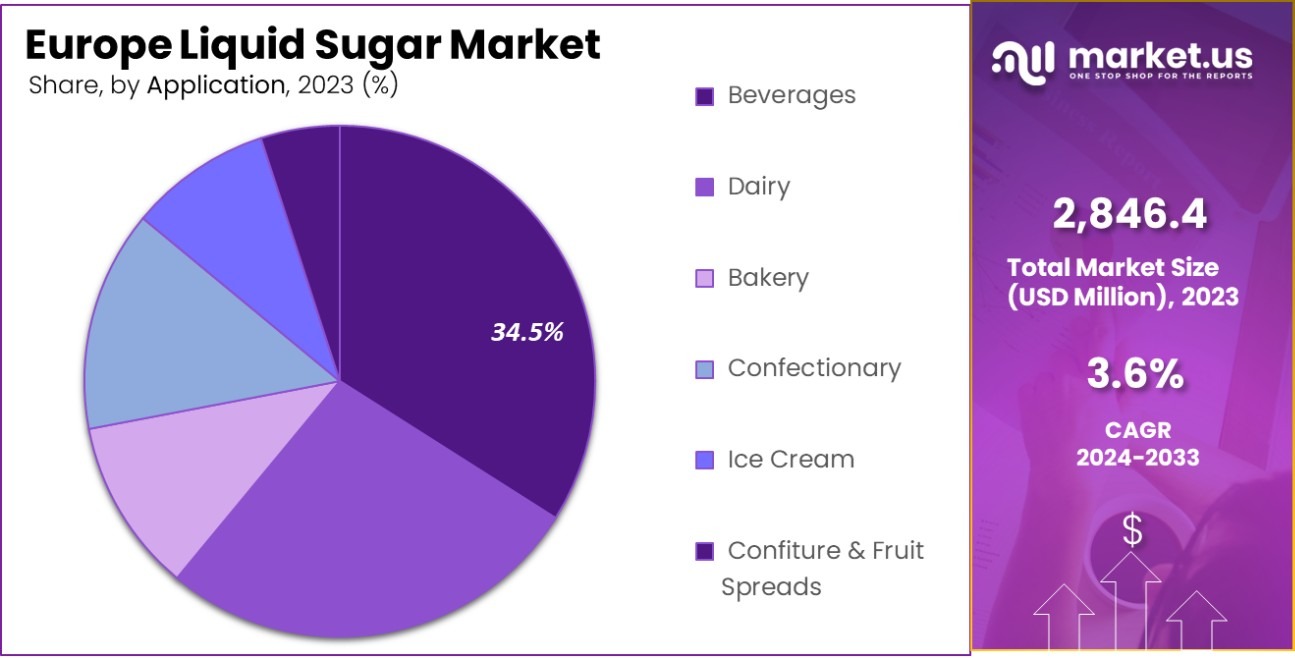

- Beverages are a major application of liquid sugar in Europe, representing 34.5% of usage.

- Direct sales are the most popular distribution channel, capturing 60% of the market in Europe.

By Product Type Analysis

Europe’s liquid sugar market sees liquid sucrose claiming a 33.4% share, indicating a strong preference.

In 2023, Liquid Sucrose held a dominant market position in the By Product Type segment of the Europe Liquid Sugar Market, with a 33.4% share. This dominance can be attributed to its extensive use in various food and beverage applications, where it is prized for its ability to enhance flavor without altering the product’s inherent properties.

Following Liquid Sucrose, Glucose Syrup captured a significant market share of 26.1%, driven by its versatility and widespread application in confectioneries, baked goods, and beverages.

Fructose Syrup, known for its enhanced sweetness compared to conventional sugars, accounted for 20.5% of the market. Its preference for dietetic and low-calorie food products helped sustain its market share. Inverted Sugar Syrup and Mixed Syrups held smaller shares of 11.6% and 8.4%, respectively.

The demand for Inverted Sugar Syrup has been bolstered by its use in products requiring high solubility and moisture retention, whereas Mixed Syrups have found niche applications where specific flavor profiles and functional properties are desired.

Overall, the market dynamics within the European liquid Sugar Market reflect a strong preference for product types that offer specific benefits such as taste enhancement, functional properties in food processing, and suitability for varied dietary requirements.

By Form Analysis

Conventional forms dominate the market, with an overwhelming 83.4% in Europe’s liquid sugar sales.

In 2023, Conventional held a dominant market position in the By Form segment of the European liquid Sugar Market, with an 83.4% share. This considerable market share is largely due to the widespread availability and cost-effectiveness of conventional liquid sugar, making it a preferred choice for large-scale manufacturers in the food and beverage industry.

Conventional liquid sugars are extensively used due to their versatility in various applications, including beverages, baked goods, and confectioneries, where they provide essential properties like sweetness, texture, and preservation.

On the other hand, Organic liquid sugar, although holding a smaller share of 16.6%, has been gaining traction among consumers increasingly concerned with health, environmental sustainability, and ethical production practices.

The organic segment is driven by a growing segment of consumers willing to pay a premium for products perceived as healthier or more natural. This trend is supported by stricter EU regulations on organic farming and labeling, which bolster consumer confidence in organic products.

The stark contrast in market share between conventional and organic liquid sugars underscores the current market dynamics where price sensitivity and supply chain maturity favor conventional products, while niche markets that focus on product provenance and sustainability are emerging strongly.

By Source Analysis

Sugarcane emerges as the chief source of Europe’s liquid sugar, comprising 53.2% of production.

In 2023, Sugarcane held a dominant market position in the By Source segment of the Europe Liquid Sugar Market, with a 53.2% share. Sugarcane’s prominence in the market is attributed to its high efficiency in sugar production and its established agricultural and processing infrastructure.

This crop is favored for its ability to produce a greater volume of sugar per hectare compared to other sources, making it a cost-effective option for large-scale liquid sugar manufacturers.

Following Sugarcane, Sugar Beet accounted for 39.6% of the market. The significant share of Sugar Beet is driven by its adaptability to the cooler European climates, where it is extensively cultivated, particularly in countries like France, Germany, and Poland.

This source is integral to the local economies and is heavily supported by European agricultural policies that aim to sustain the internal market and production capabilities.

The remaining 7.2% share is grouped under “Others,” which includes sources like coconut sugar, date sugar, and corn syrup. These alternative sources are gradually capturing interest as consumers seek diverse and sometimes perceived healthier sugar options.

This segment benefits from niche markets that are focused on sustainability and less common sugar varieties, often used in specific gourmet or health-oriented products.

By Application Analysis

In Europe, beverages lead as a primary application for liquid sugar, accounting for 34.5%.

In 2023, Beverages held a dominant market position in the By Application segment of the Europe Liquid Sugar Market, with a 34.5% share. This leading position is underscored by the widespread use of liquid sugar in various beverage formulations, ranging from soft drinks to alcoholic beverages, where it serves as a key ingredient for flavor enhancement, consistency, and fermentation processes.

The versatility and solubility of liquid sugar make it particularly suited for the beverage industry, ensuring a smooth blend with other components without sedimentation.

Following closely, the Bakery and Confectionary segments accounted for 22.3% and 18.2% of the market, respectively. Liquid sugar’s application in bakery products enhances moisture retention, leading to softer, longer-lasting freshness in breads and pastries. In confectionaries, it aids in the control of crystallization, a critical factor in the texture and quality of sweets.

Dairy and Ice Cream applications together captured 15.6% of the market, leveraging liquid sugar’s role in flavoring and textural improvements. Confiture and Fruit Spreads, though smaller at 9.4%, utilize liquid sugar to enhance shelf stability and flavor intensity.

This segmentation reveals a robust demand across diverse food sectors, each benefiting from the unique properties that liquid sugar offers.

By Distribution Channel Analysis

Direct sales are pivotal in Europe’s liquid sugar market, making up 60% of distribution.

In 2023, Direct Sales held a dominant market position in the By Distribution Channel segment of the Europe Liquid Sugar Market, with a 60% share. This significant market preference for direct sales channels is primarily driven by the bulk purchasing behaviors of large-scale food and beverage manufacturers and industrial buyers.

Direct sales channels offer these large purchasers cost efficiencies, customized product formulations, and reliable supply chains, which are crucial for maintaining production schedules and quality standards in industries heavily reliant on sugar inputs.

Retail Sales accounted for the remaining 40% of the market. This channel caters primarily to smaller businesses, specialty food producers, and end consumers looking for liquid sugar products suitable for household or small-scale commercial use.

Retail sales benefit from the increasing consumer interest in gourmet cooking and artisanal baking, where liquid sugar is appreciated for its convenience and consistent quality. This segment also captures sales through online platforms and physical retail stores, providing accessibility to a wider range of customers, including those interested in niche and organic liquid sugar products.

The division between direct and retail sales highlights the dual nature of the market, where efficiency and customization drive large volume transactions, while accessibility and consumer preference bolster retail market strength.

Key Market Segments

By Product Type

- Liquid Sucrose

- Fructose Syrup

- Glucose Syrup

- Inverted Sugar Syrup

- Mixed Syrups

By Form

- Organic

- Conventional

By Source

- Sugarcane

- Sugar Beet

- Others

By Application

- Dairy

- Beverages

- Bakery

- Confectionary

- Ice Cream

- Confiture & Fruit Spreads

By Distribution Channel

- Direct Sales

- Retail Sales

Driving Factors

Rising Demand for Convenience Foods and Beverages

The Europe liquid sugar market is primarily driven by the growing consumer preference for convenience foods and beverages, which require easy-to-mix sweeteners like liquid sugar. As lifestyles become busier, there is a significant increase in the consumption of ready-to-drink beverages, instant coffee, and quick dessert mixes, all of which frequently utilize liquid sugar for solubility and consistency.

This trend is expected to continue as more people seek out convenient and time-saving food options that still offer the desired taste and quality.

Increased Focus on Natural and Organic Ingredients

In recent years, there has been a notable shift towards natural and organic products across Europe, impacting the liquid sugar market. Consumers are increasingly aware of the health implications of artificial additives and are turning to natural sweeteners, including organic liquid sugars derived from sources like cane sugar.

This trend is bolstered by stringent EU regulations on food additives, compelling manufacturers to adopt more natural ingredients in their products, which in turn fuels the demand for naturally sourced liquid sugars.

Technological Advancements in Food Processing

Technological advancements in food processing techniques have significantly influenced the liquid sugar market in Europe. Modern processing technologies have improved the efficiency and cost-effectiveness of producing liquid sugar, making it a more attractive option for food and beverage manufacturers.

These advancements also allow for better control over the properties of liquid sugar, such as purity, concentration, and flavor profile, enhancing its appeal across various applications, from baking to beverage manufacturing.

Restraining Factors

Health Concerns Over Sugar Consumption Affect Market Growth

Growing health concerns about sugar intake are significantly restraining the Europe liquid sugar market. As awareness of diabetes, obesity, and other health issues increases, consumers are reducing their sugar consumption, which directly impacts the demand for liquid sugar.

Governments and health organizations are also promoting healthier diets and implementing sugar taxes, which discourage the use of added sugars in foods and beverages. This shift towards healthier eating habits challenges the growth of the liquid sugar market as manufacturers look for alternative sweeteners that align with consumer health preferences.

Intense Competition from Artificial and Natural Sweeteners

The market for liquid sugar in Europe faces intense competition from both artificial and natural sweeteners. Artificial sweeteners like aspartame and sucralose, often preferred for their low-calorie profile, are common in diet and reduced-sugar products.

On the other hand, natural sweeteners such as stevia and agave syrup are gaining popularity due to their perceived health benefits and minimal processing. This competition affects the liquid sugar market as food and beverage manufacturers opt for these alternatives to cater to the evolving consumer tastes and health-conscious trends.

Fluctuations in Sugar Prices and Supply Stability

Price volatility and supply instability of raw sugar can significantly restrain the Europe liquid sugar market. Factors such as unpredictable weather conditions, changes in farming practices, and political instability in sugar-producing countries can affect the cost and availability of sugar.

These fluctuations make it difficult for liquid sugar producers to maintain consistent pricing and supply chains, impacting profitability and operational planning. As a result, manufacturers may seek more stable and predictable ingredient options, further challenging the demand for liquid sugar in the European market.

Growth Opportunity

Expansion into Emerging Markets with Growing Sweetener Demand

There’s significant growth potential for the Europe liquid sugar market to expand into emerging markets where the demand for sweeteners is rising. Many regions are experiencing increased urbanization and a growing middle class, which leads to higher consumption of processed foods and beverages that use liquid sugar.

European producers can leverage their advanced manufacturing technologies and high-quality standards to capture these new markets, offering a reliable source of liquid sugar that adheres to international health and safety regulations.

Innovation in Low-Calorie and Specialty Liquid Sugars

In response to health concerns over sugar intake, there is a notable opportunity for growth in the development of low-calorie and specialty liquid sugars. By creating innovative products that offer the sweetness of sugar with fewer calories or added health benefits, companies can meet the changing consumer preferences.

For example, liquid sugars infused with vitamins or made from alternative sources like coconut and dates could attract health-conscious consumers and differentiate products in a competitive market.

Collaborations with Food and Beverage Industries

Forging strategic collaborations with key players in the food and beverage industry presents a substantial growth opportunity for the Europe liquid sugar market. By partnering with large-scale manufacturers of beverages, confectioneries, and baked goods, liquid sugar producers can secure stable demand channels and enhance their market reach.

These partnerships could involve co-developing products tailored to specific consumer tastes and preferences, ensuring a steady application of liquid sugars in popular consumer products, and fostering mutual business growth.

Latest Trends

Increasing Use of Liquid Sugar in Artisanal Products

The Europe liquid sugar market is seeing a trend where artisanal and gourmet food producers increasingly prefer liquid sugar for its ability to blend seamlessly into products. This trend is driven by the artisanal sector’s growth, where there is a focus on high-quality, handcrafted products such as specialty chocolates, bespoke beverages, and premium baked goods.

Liquid sugar’s quick-dissolving nature enhances texture and consistency, making it ideal for these applications. This shift is influencing more small-scale producers to choose liquid sugar, expanding its market presence.

Eco-Friendly and Sustainable Sugar Production Practices

Sustainability has become a significant trend in the Europe liquid sugar market, with consumers and businesses increasingly prioritizing environmental impact in their purchasing decisions. Producers are responding by adopting more eco-friendly practices, such as using organic sugar cane or beets, reducing water and energy consumption during production, and improving waste management.

These sustainable practices not only help reduce the environmental footprint but also appeal to eco-conscious consumers, potentially boosting sales and brand loyalty in the competitive sweetener market.

Technological Innovations in Liquid Sugar Production

Technological innovation is a key trend in the Europe liquid sugar market, enhancing production efficiency and product quality. Advances in filtration and purification technology allow producers to achieve higher purity and consistency in liquid sugar, which is critical for food and beverage manufacturers.

Automation in production lines is also becoming more prevalent, reducing labor costs and improving safety. These technological improvements are setting new industry standards and helping European liquid sugar manufacturers stay competitive in a market.

Key Regions and Countries

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Key Players Analysis

In 2023, the Europe liquid sugar market is prominently shaped by several key players, each bringing unique strengths and strategies to the table. Companies like Archer Daniels Midland Company and Cargill Incorporated leverage their vast networks and comprehensive product portfolios to meet diverse customer needs across Europe.

Their significant investments in technology and sustainability initiatives position them well within an increasingly environmentally conscious market.

Associated British Foods Plc and Südzucker AG stand out due to their deep integration across the sugar supply chain, from cultivation to distribution. These companies are not only major producers of liquid sugar but also key innovators in developing low-calorie and specialty liquid sugars, responding effectively to the growing health consciousness among European consumers.

Nordzucker AG and Tereos focus on expanding their footprint in emerging markets, utilizing their expertise in sugar production to tap into new segments that show increased demand for liquid sugar. Their strategic collaborations with food and beverage industries help secure stable demand channels and facilitate mutual growth.

Smaller specialized players like Zukan S.L.U. and Synova differentiate themselves by offering niche products tailored to specific market segments, such as organic and all-natural liquid sugars, which appeal to health-focused consumers.

Boettger Gruppe and Roquette Frères emphasize innovation in production techniques, which improve efficiency and product quality. Their approach not only addresses operational excellence but also enhances competitive positioning by adhering to stringent European standards for food safety and quality.

Top Key Players in the Market

- Archer Daniels Midland Company

- Associated British Foods Plc

- Boettger Gruppe

- Cargill Incorporated

- Cristal Union

- Galam Group

- Kent Foods Limited

- Louis Dreyfus Company B.V.

- Nordzucker AG

- Roquette Frères

- Sedamyl Group

- Sucroliq S.A.P.I DE C.V.

- Südzucker AG

- Nordzucker AG

- Sugar Australia Company Ltd

- Synova

- Tereos

- Toyo Sugar Refining Co. Ltd

- Zukan S.L.U.

Recent Developments

- In 2023, Cargill expanded liquid sugar production in Europe, introducing reduced-calorie and specialty sugar formulations. They partnered with local refiners and invested in sustainability, focusing on carbon emission reduction. Cargill emphasized innovation and technology in the European sugar market.

- In 2023, Kent Foods Limited focused on increasing its liquid sugar supply for Europe’s food and beverage market. They worked on creating customized sugar solutions and partnered with leading industry players to optimize production processes.

Report Scope

Report Features Description Market Value (2023) USD 2846.4 Million Forecast Revenue (2033) USD 3,976.5 Million CAGR (2024-2033) 3.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid Sucrose, Fructose Syrup, Glucose Syrup, Inverted Sugar Syrup, Mixed Syrups), By Form (Organic, Conventional), By Source (Sugarcane, Sugar Beet, Others), By Application (Dairy, Beverages, Bakery, Confectionary, Ice Cream, Confiture and Fruit Spreads), By Distribution Channel (Direct Sales, Retail Sales) Regional Analysis Europe – Germany, France, The UK, Spain, Italy, Rest of Europe Competitive Landscape Archer Daniels Midland Company, Associated British Foods Plc, Boettger Gruppe, Cargill Incorporated, Cristal Union, Galam Group, Kent Foods Limited, Louis Dreyfus Company B.V., Nordzucker AG, Roquette Frères, Sedamyl Group, Sucroliq S.A.P.I DE C.V. , Südzucker AG, Nordzucker AG, Sugar Australia Company Ltd, Synova, Tereos, Toyo Sugar Refining Co. Ltd, Zukan S.L.U. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company

- Associated British Foods Plc

- Boettger Gruppe

- Cargill Incorporated

- Cristal Union

- Galam Group

- Kent Foods Limited

- Louis Dreyfus Company B.V.

- Nordzucker AG

- Roquette Frères

- Sedamyl Group

- Sucroliq S.A.P.I DE C.V.

- Südzucker AG

- Nordzucker AG

- Sugar Australia Company Ltd

- Synova

- Tereos

- Toyo Sugar Refining Co. Ltd

- Zukan S.L.U.