Global Clean Label Food Ingredients Market Size, Share, And Business Benefits By Form (Powder, Liquids, Others), By Ingredients Type (Natural Flavors, Natural Colors, Fruit and Vegetable Ingredients, Starch and Sweeteners, Flour (Wheat Flour, Corn Flour, Rice Flour, Others), Malt, Others), By Source (Plant-based Source, Animal-based Source, Others), By Application (Food (Bakery, Confectionery, Cereals and Snacks, Processed Food, Others), Pet Food, Dairy, Non-Dairy, and Fermented Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144482

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

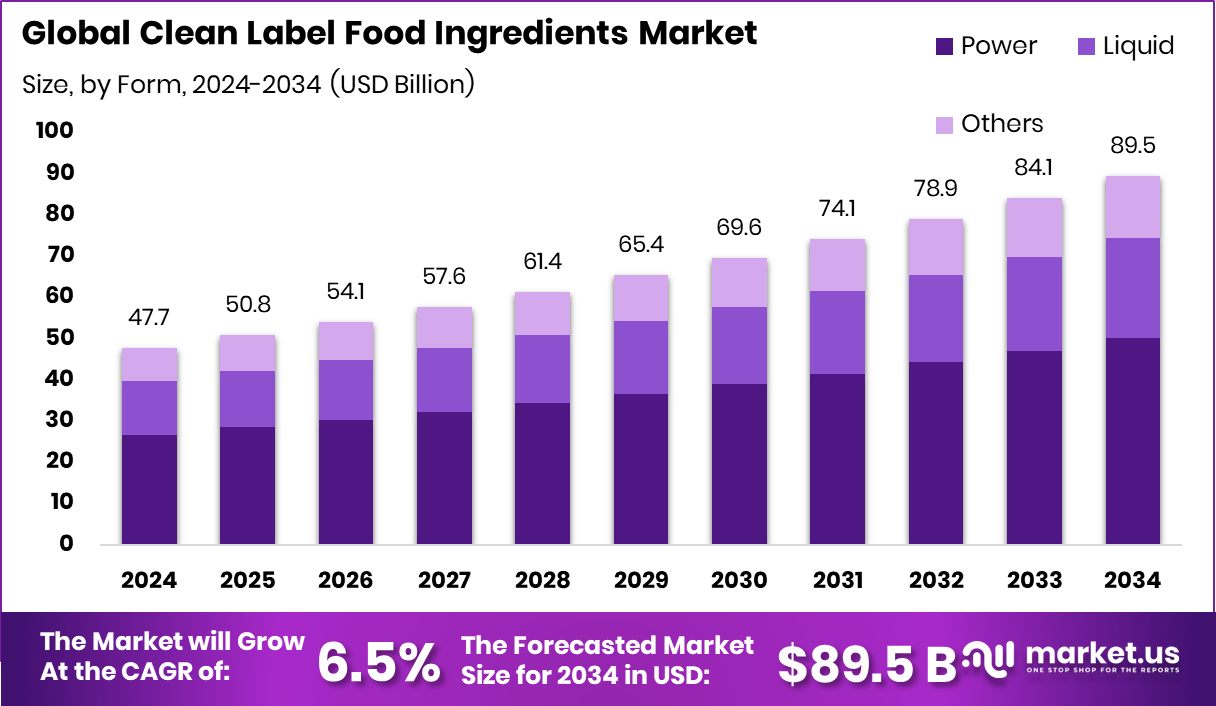

The Global Clean Label Food Ingredients Market is expected to be worth around USD 89.5 billion by 2034, up from USD 47.7 billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034. Clean label awareness in North America drives strong growth at USD 23.5 billion.

Clean label food ingredients are simple, natural, and easily recognizable by consumers. They avoid artificial additives, synthetic chemicals, or complex names, favoring ingredients like fruits, vegetables, spices, and plant-based colors. The clean label trend emphasizes transparency, where consumers can quickly understand what’s in their food without needing a science degree. It’s about trust, authenticity, and feeling confident that food is both safe and wholesome.

The clean label food ingredients market revolves around ingredients that support natural, organic, and health-conscious product formulations. It includes a wide range of items like natural preservatives, sweeteners, emulsifiers, and colors. As more people read labels before buying, brands are shifting to use ingredients with cleaner reputations. This growing market reflects how consumer behavior is reshaping the way food is developed, manufactured, and marketed.

Rising health awareness, especially post-pandemic, is pushing people toward clean, minimally processed food. This shift is encouraging food producers to reformulate with natural alternatives. Regulatory support for transparent labeling is also playing a key role in growth.

Consumers today actively seek food that aligns with wellness and sustainability values. Clean-label products appeal across all age groups, especially millennials and Gen Z, who value ingredient clarity.

There’s growing space in plant-based, dairy alternatives, snacks, and ready meals. Developing clean solutions that maintain taste, shelf life, and texture opens new ground for innovation in everyday food.

In 2024, U.S. milk production reached 226 billion pounds, marking a slight 0.2% decline from 2023, per USDA NASS. Meanwhile, clean-label beverage brand Olipop, offering prebiotic sodas, raised $50 million in Series C funding at a $1.85 billion valuation, per CNBC. Now profitable, Olipop reported over $400 million in annual sales, showcasing strong consumer demand for clean-label food ingredients and healthier drink options.

Key Takeaways

- The Global Clean Label Food Ingredients Market is expected to be worth around USD 89.5 billion by 2034, up from USD 47.7 billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034.

- Powder form dominates clean label food ingredients market, accounting for a significant 56.20% share globally.

- Natural flavors lead by ingredient type, capturing 23.60% of the clean label ingredients segment.

- Plant-based sources constitute 62.30%, indicating a rising demand for sustainable and health-driven ingredient alternatives.

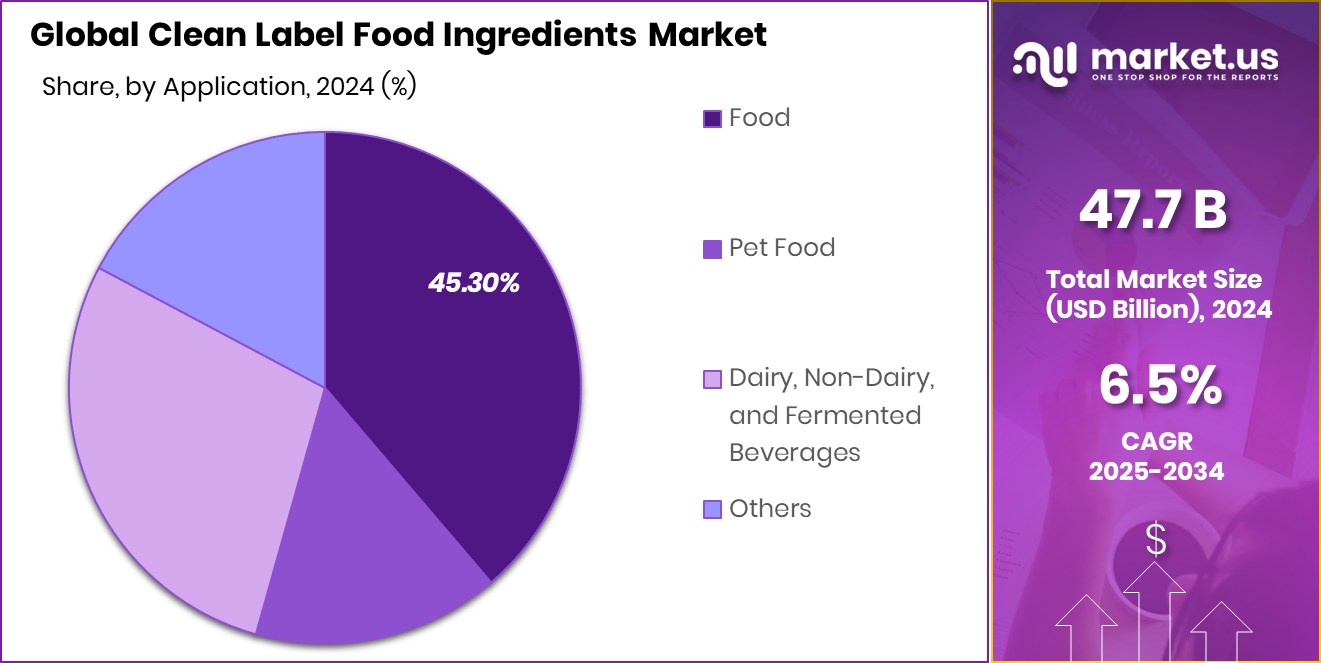

- Food applications hold 45.30% market share, showcasing strong consumer preference for clean label food products.

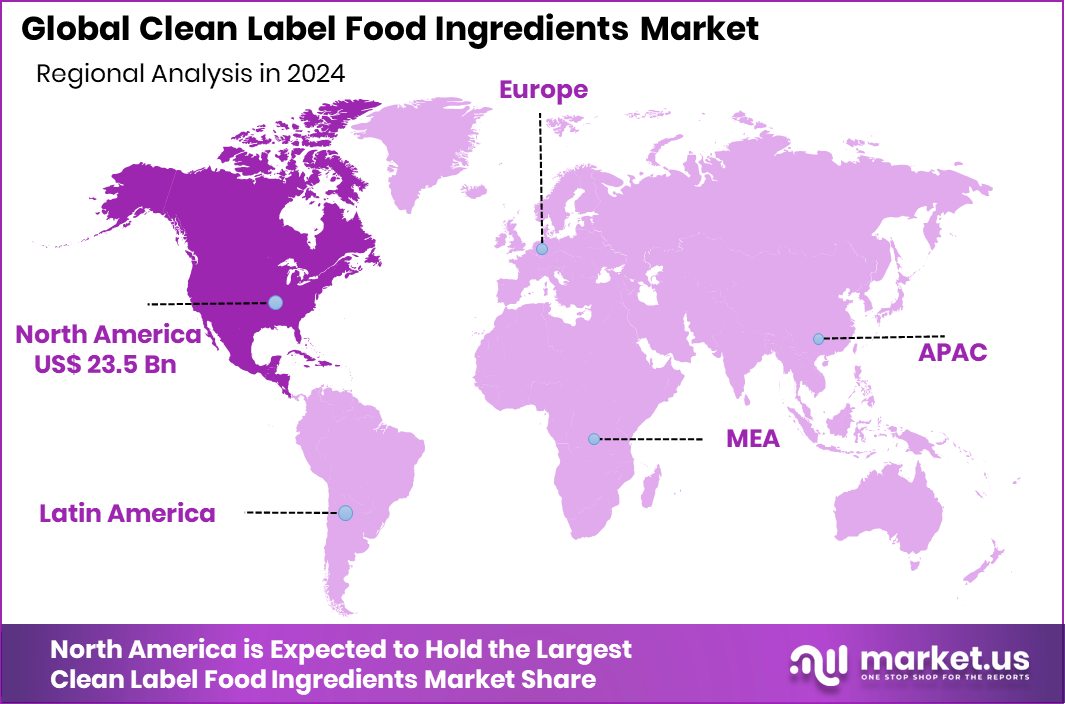

- The regional market value in North America reached USD 23.5 billion in 2024.

By Form Analysis

Powder form dominates the market, holding a 56.20% significant share.

In 2024, Powder held a dominant market position in the By Form segment of the Clean Label Food Ingredients Market, with a 56.20% share. This significant lead can be attributed to its longer shelf life, ease of storage, and compatibility with a wide range of food formulations.

Powdered clean label ingredients, such as natural preservatives, colors, and stabilizers, are increasingly preferred by food manufacturers for their ability to blend seamlessly into dry mixes and processed foods without altering taste or texture.

The format is especially favored in bakery, snacks, and ready-to-eat meals, where convenience and consistency are crucial. Additionally, powdered forms simplify handling and transportation, which reduces logistical costs and wastage. As clean label trends grow stronger, especially across North America and Europe, food producers are leaning toward powdered solutions to meet consumer expectations for transparency, health, and simplicity in product labels.

Moreover, technological advancements in spray drying and freeze-drying techniques have enhanced the quality and functionality of powdered ingredients. This has further reinforced their application in dairy, confectionery, and functional beverages.

By Ingredients Type Analysis

Natural flavors lead ingredient preferences, accounting for 23.60% market penetration globally.

In 2024, Natural Flavors held a dominant market position in the By Ingredient Type segment of the Clean Label Food Ingredients Market, with a 23.60% share. The segment’s lead was driven by rising consumer demand for recognizable and transparent ingredients in food and beverage products. Natural flavors, derived from fruits, vegetables, spices, and other plant sources, are increasingly favored over artificial additives due to growing health consciousness and regulatory push for clean labeling.

Manufacturers across the food industry—particularly in beverages, dairy, and bakery segments—are integrating natural flavors to enhance taste profiles while meeting clean label standards. These ingredients support product differentiation without compromising on consumer expectations for natural, minimally processed content. In addition, clean label product development often prioritizes sensory appeal, where natural flavors play a critical role in masking off notes from other functional ingredients.

The dominance of natural flavors also reflects their adaptability across product categories and geographies. With consumers worldwide becoming more ingredient-aware, the food industry is rapidly reformulating legacy products and innovating new offerings around clean flavor systems.

By Source Analysis

Plant-based sources contribute heavily, capturing a 62.30% market share in total.

In 2024, Plant-based Source held a dominant market position in the By Source segment of the Clean Label Food Ingredients Market, with a 62.30% share. This stronghold can be attributed to rising consumer preference for natural, sustainable, and vegan-friendly ingredients.

With growing awareness around health and clean eating, food manufacturers increasingly turned to plant-based sources such as fruits, vegetables, grains, and legumes to formulate clean label products. The segment’s growth was further reinforced by regulatory support for plant-derived ingredients and a shift away from synthetic additives.

Consumers in North America and Europe drove significant demand, aligning with the broader trend toward environmental responsibility and transparent labeling. Additionally, the expanding plant-based food and beverage sector bolstered the integration of plant-based clean label ingredients across bakery, dairy alternatives, snacks, and beverages

By Application Analysis

Food application remains primary, representing 45.30% of the overall market consumption.

In 2024, Food held a dominant market position in the By Application segment of the Clean Label Food Ingredients Market, with a 45.30% share. This leadership was primarily driven by growing consumer demand for healthier food options made without artificial additives, preservatives, or synthetic colors. Clean label trends gained substantial traction in packaged foods, bakery items, ready-to-eat meals, and savory snacks, where consumers actively sought ingredient transparency.

Manufacturers responded by reformulating existing product lines and launching new offerings that emphasized minimal processing and naturally sourced ingredients. The rise of health-conscious eating habits, combined with the popularity of plant-based and organic food products, further solidified food applications as the primary driver of clean-label ingredient adoption.

Markets across North America and Europe experienced the highest demand, where clean eating and clear labeling significantly influenced purchasing decisions. Product categories such as bakery, dairy, confectionery, and cereals integrated clean label formulations to meet regulatory and consumer expectations.

Key Market Segments

By Form

- Powder

- Liquids

- Others

By Ingredients Type

- Natural Flavors

- Natural Colors

- Fruit and Vegetable Ingredients

- Starch and Sweeteners

- Flour

- Wheat Flour

- Corn Flour

- Rice Flour

- Others

- Malt

- Others

By Source

- Plant-based Source

- Animal-based Source

- Others

By Application

- Food

- Bakery

- Confectionery

- Cereals and Snacks

- Processed Food

- Others

- Pet Food

- Dairy, Non-Dairy, and Fermented Beverages

- Others

Driving Factors

Growing Consumer Demand for Healthier Food Choices

One major reason behind the rise of clean label food ingredients is that people want healthier food. Today’s consumers are checking labels more than ever. They want food with fewer artificial ingredients, chemicals, or preservatives. Shoppers now prefer natural ingredients they can recognize, like fruits, vegetables, or herbs.

This change in eating habits is driven by increasing awareness of how food affects long-term health. Clean label foods are also seen as safer and more transparent. Big food brands are responding by replacing synthetic additives with natural alternatives. This shift is especially strong in Europe and North America, where clean eating is a fast-growing trend.

Restraining Factors

High Cost of Natural Ingredients Limits Growth

One key challenge for the clean label food ingredients market is the high cost of natural options. Clean label ingredients, like plant-based colors or natural preservatives, are usually more expensive than synthetic ones. This raises production costs for food companies, especially smaller brands with limited budgets.

As a result, final product prices also go up, which may reduce consumer demand in price-sensitive regions. In developing countries, affordability often matters more than clean label claims.

Additionally, finding stable, natural alternatives that perform as well as artificial ones can be difficult. This cost-pressure makes it hard for some companies to fully switch to clean label formulas. The high cost factor may slow down clean label adoption in some parts of the world.

Growth Opportunity

Rising Demand in Emerging Markets Drives Expansion

A big growth opportunity for the clean label food ingredients market lies in emerging countries. As incomes grow in places like India, China, Brazil, and Southeast Asia, more people are buying packaged and processed foods. At the same time, awareness about health, nutrition, and food safety is rising fast. Urban consumers in these regions are starting to care more about what’s in their food.

This creates a strong demand for natural, clean-label ingredients. Global food brands are now expanding their clean label product lines in these markets. Local manufacturers are also showing interest in using fewer artificial additives. With changing lifestyles and growing health focus, emerging markets are likely to become major drivers of clean label food growth.

Latest Trends

Plant-Based Ingredients Gaining Clean Label Popularity

A major trend shaping the clean label food ingredients market is the rising use of plant-based ingredients. Consumers are now choosing food made from natural sources like fruits, vegetables, seeds, and herbs. This trend fits well with clean label goals — fewer synthetic additives, more transparency, and healthier choices. Companies are using plant-based alternatives for sweeteners, colors, flavors, and preservatives.

For example, beetroot for coloring, stevia for sweetness, or rosemary extract for preservation. Plant-based options are also linked with sustainability, which appeals to eco-conscious buyers. This trend is not only visible in health foods but also in snacks, beverages, and ready meals. The shift to plant-based, clean label ingredients is expected to grow stronger in the coming years.

Regional Analysis

North America holds a 49.40% share in the clean label food ingredients market.

The global clean label food ingredients market demonstrates significant regional variation, with North America emerging as the dominant region. Holding a commanding 49.40% market share, North America reached a valuation of USD 23.5 billion in 2024. This dominance is attributed to strong consumer demand for transparent labeling, natural ingredients, and health-conscious food choices.

Major food manufacturers in the U.S. and Canada continue to reformulate products to align with clean label trends, reinforcing market growth. Europe also represents a mature and progressive clean label market, with widespread regulatory support and high consumer awareness influencing product formulations.

In contrast, the Asia Pacific region is witnessing rapid development due to rising disposable income and growing awareness around food quality, although specific figures were not disclosed. Meanwhile, the Middle East & Africa, and Latin America are emerging as potential markets, driven by urbanization and increasing interest in healthy lifestyles. However, these regions currently remain smaller in scale when compared to North America and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ajinomoto Co. Inc. has transitioned from a flavor enhancer leader to a clean label innovator, focusing on natural umami-based solutions. The company emphasizes health-oriented reformulations, especially in Asian markets, tapping into regional demand for clean label seasonings and reduced sodium solutions.

Archer Daniels Midland Company (ADM) continues to lead through its diverse portfolio of plant-based and naturally sourced ingredients. ADM’s integrated supply chain and robust R&D capabilities support the development of clean label starches, proteins, and natural colors, addressing both food manufacturer needs and shifting consumer expectations.

Brisan Group, though smaller in scale, has built its brand around transparency and clean sourcing. With a niche focus on minimally processed, plant-derived ingredients, Brisan appeals to boutique food producers and premium product segments in Europe and North America.

Cargill maintains a commanding role in the global market due to its expansive ingredient solutions, including non-GMO and label-friendly starches, sweeteners, and oils. In 2024, Cargill’s strategic investments in clean label product lines and global partnerships have further reinforced its influence across developed and emerging markets.

Top Key Players in the Market

- Ajinomoto Co. Inc.

- Archer Daniel Midland Company

- Brisan Group Cargill

- Cargill Incorporated

- Novonesis Group

- Corbion

- DSM-Firmenich

- Exberry

- Ingredion

- International Flavors & Fragrances Inc.

- Kerry Group PLC

- Limagrain Ingredients

- Sensient Technologies Corporation

- Tate & Lyle PLC

Recent Developments

- In September 2024, Ajinomoto, known for its food and biotechnology products, partnered with Danone to reduce greenhouse gas emissions in the dairy industry. Utilizing Ajinomoto’s AjiPro®-L, the collaboration seeks to improve cow digestion and significantly cut emissions.

- In May 2022, DSM, a global science-based company in nutrition, and Firmenich, a Swiss fragrance and flavor company, merged to form DSM-Firmenich. This union aims to lead in nutrition, beauty, and well-being, enhancing their capabilities with natural and sustainable ingredients.

Report Scope

Report Features Description Market Value (2024) USD 47.7 Billion Forecast Revenue (2034) USD 89.5 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquids, Others), By Ingredients Type (Natural Flavors, Natural Colors, Fruit and Vegetable Ingredients, Starch and Sweeteners, Flour (Wheat Flour, Corn Flour, Rice Flour, Others), Malt, Others), By Source (Plant-based Source, Animal-based Source, Others), By Application (Food (Bakery, Confectionery, Cereals and Snacks, Processed Food, Others), Pet Food, Dairy, Non-Dairy, and Fermented Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Co. Inc., Archer Daniel Midland Company, Brisan Group Cargill, Cargill Incorporated, Novonesis Group, Corbion, DSM-Firmenich, Exberry, Ingredion, International Flavors & Fragrances Inc., Kerry Group PLC, Limagrain Ingredients, Sensient Technologies Corporation, Tate & Lyle PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clean Label Food Ingredients MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Clean Label Food Ingredients MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ajinomoto Co. Inc.

- Archer Daniel Midland Company

- Brisan Group Cargill

- Cargill Incorporated

- Novonesis Group

- Corbion

- DSM-Firmenich

- Exberry

- Ingredion

- International Flavors & Fragrances Inc.

- Kerry Group PLC

- Limagrain Ingredients

- Sensient Technologies Corporation

- Tate & Lyle PLC