Global Nicotine Gum Market, By Type (2 mg/piece of gum dosage, 4 mg/piece of gum dosage, and 6 mg/piece of gum dosage), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 21191

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

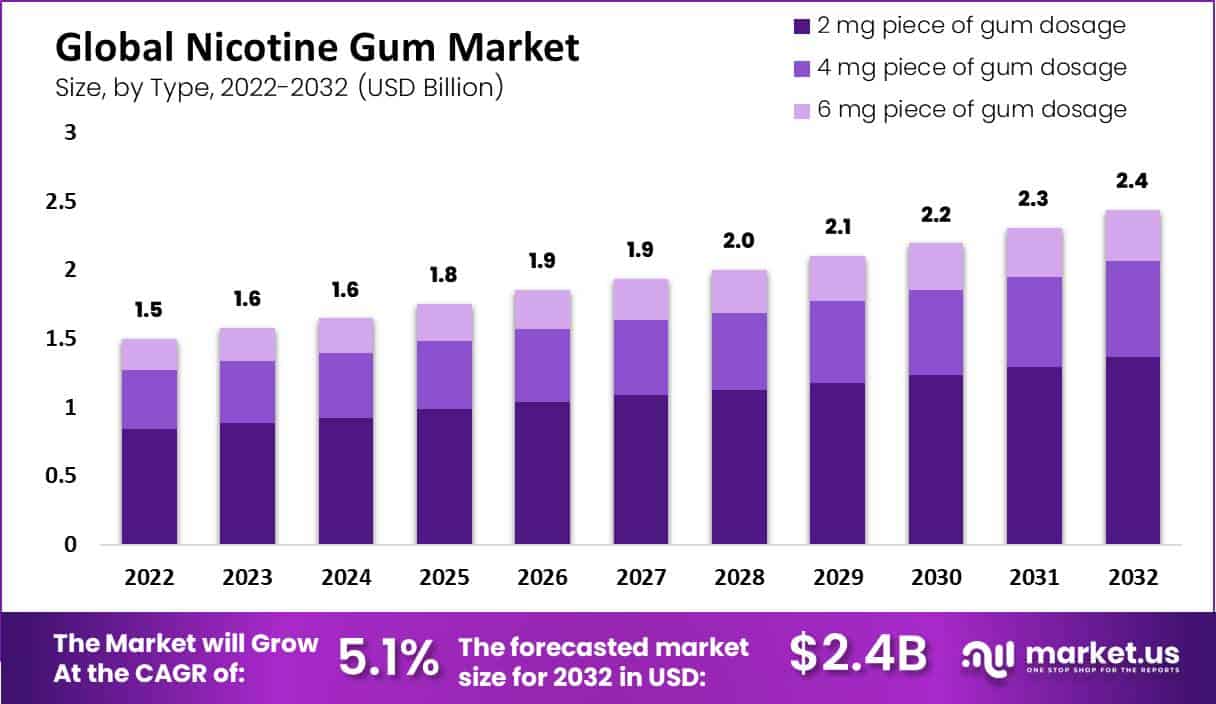

In 2022, the global nicotine gum market size accounted for USD 1.5 billion. Between 2023 and 2032, this market is estimated to register a CAGR of 5.1% and is expected to reach a value of USD 2.4 billion by 2032.

The global nicotine gum market is composed of chewing gum products with nicotine as an active ingredient. Nicotine gum is an NRT (nicotine replacement therapy) commonly used to help people quit smoking, providing a small amount of nicotine into the body to reduce cravings and withdrawal symptoms.

The market is on the rise due to factors such as growing awareness about smoking’s harmful effects, rising demand for cessation aids, and government initiatives to reduce tobacco consumption. This highly competitive industry boasts several major players such as GlaxoSmithKline, Johnson & Johnson, and Perrigo Company plc among others.

Key Takeaways

- Market Growth: The nicotine gum market was valued at USD 1.5 billion in 2022 and is projected to grow at a CAGR of 5.1%, reaching a value of USD 2.4 billion by 2032. This signifies a substantial growth opportunity in the coming years.

- Smoking Cessation Programs Drive Demand: Governments and health organizations are actively promoting smoking cessation programs to reduce smoking prevalence. Nicotine gum, as a nicotine replacement therapy, plays a vital role in helping people quit smoking.

- OTC Availability: Nicotine gum is readily available as an over-the-counter (OTC) product in many countries, making it a popular choice for smokers looking to quit. This easy accessibility contributes to market growth.

- Effectiveness of NRT: Nicotine replacement therapy products, including nicotine gum, have proven effective in reducing nicotine cravings and withdrawal symptoms. They offer smokers a way to cut down on nicotine intake while still satisfying their cravings.

- Type Analysis: The 2 mg/piece of gum dosage segment is the most lucrative, with a projected CAGR of 5.4%. This dosage is suitable for individuals who smoke less than 25 cigarettes per day and serves as an initial starting dose for those trying to quit.

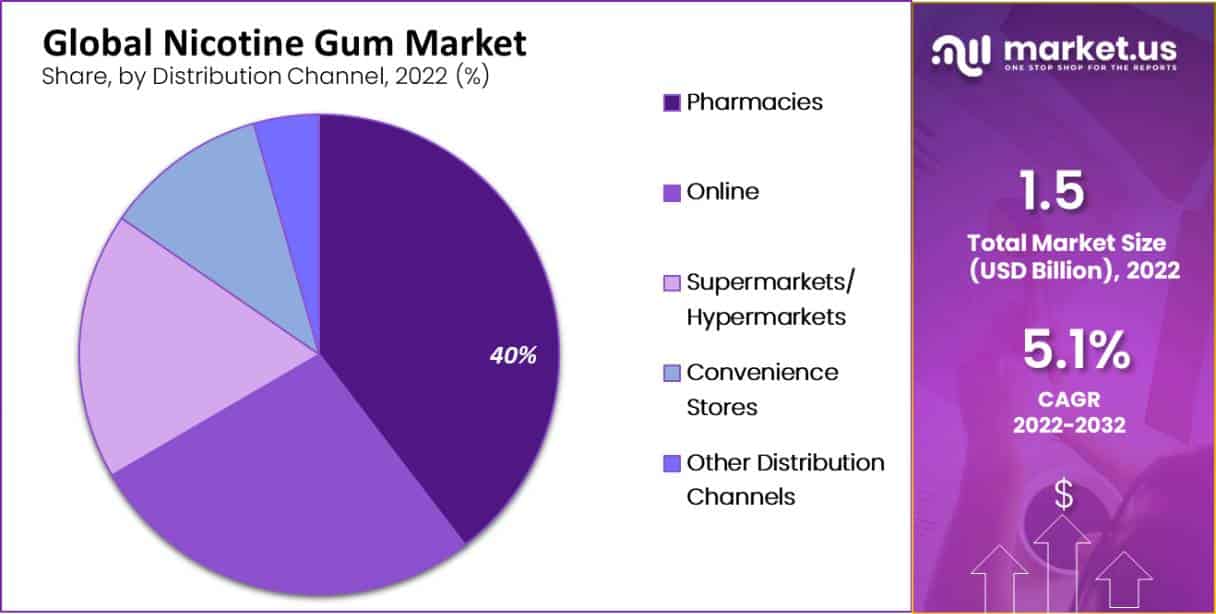

- Pharmacies Lead in Distribution: Pharmacies accounted for the largest revenue share (40%) in the nicotine gum market in 2022. People prefer buying nicotine gum from pharmacies for access to medical advice and support.

- Online Sales on the Rise: The online segment is expected to be the fastest-growing distribution channel, with a CAGR of 6.1% in 2022. Online platforms and e-commerce websites are becoming popular avenues for purchasing nicotine gum.

- Increasing Awareness: Growing awareness of the health risks associated with smoking is driving more people towards nicotine gum as a safer alternative. This is particularly significant in regions with high smoking rates.

- Market Leader: GlaxoSmithKline plc is a global leader in the nicotine gum market, but competition is expected to intensify as new players enter and existing companies expand their product lines.

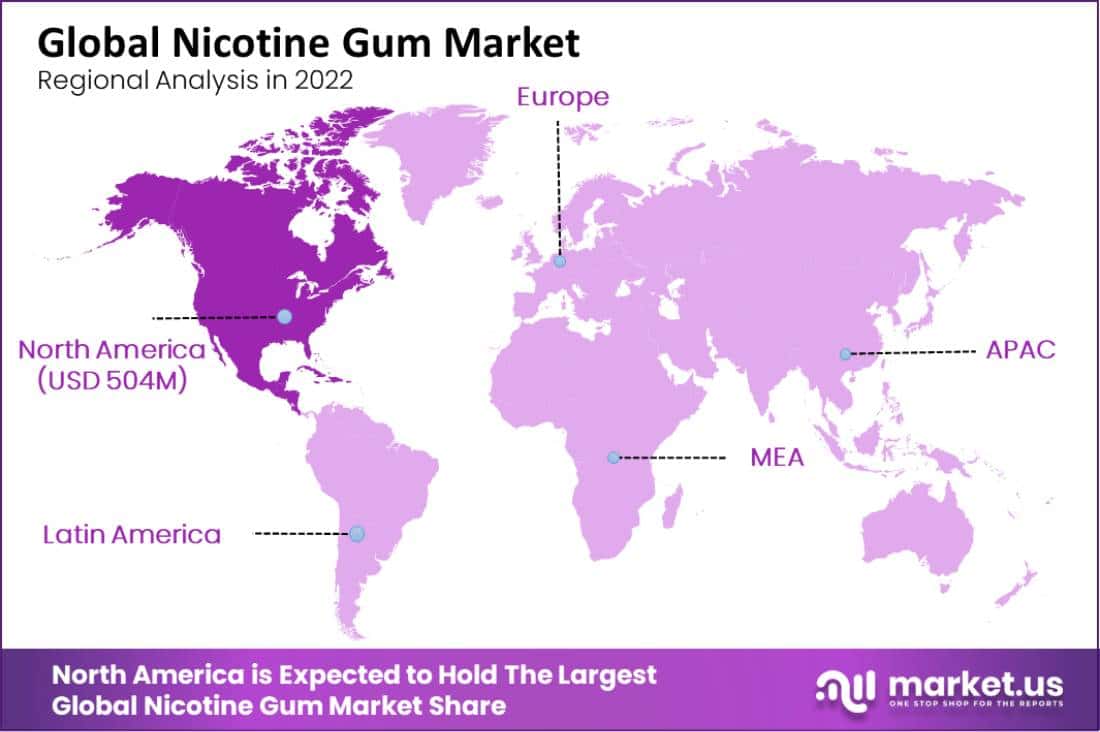

- Regional Dominance: North America accounted for the largest revenue share (33.6%) in the nicotine gum market in 2022, while the Asia-Pacific region is expected to be the fastest-growing market.

Drivers

Smoking Cessation Programs, Availability of Over-the-Counter Products, and Technological Advancements Drive the Market Growth of the Nicotine Gum Market

Governments and health organizations around the world are actively encouraging smoking cessation programs to reduce its prevalence. Nicotine gum is often utilized in these initiatives to assist smokers in quitting. Nicotine gum is readily available as an OTC product in many countries, making it a go-to choice for smokers looking to quit.

Nicotine replacement therapy, such as nicotine gum, patches, lozenges, and inhalers is becoming more and more popular among smokers looking to quit due to its effectiveness in relieving cravings for nicotine and relieving withdrawal symptoms. These products have proven successful at helping smokers reduce their nicotine intake while still enjoying some of the benefits they crave.

Globally, there is a rise in smoke-free zones which has resulted in an uptick in demand for nicotine gum as an alternative to smoking. Technological advances have enabled the creation of novel nicotine gum products with improved taste, faster delivery of nicotine, and longer-lasting effects. This has further fueled the demand for nicotine gum across the global market.

Restraints

Stringent Regulations, Competition, and Limited Awareness are Some Restraints for the Nicotine Gum Market.

Nicotine gum is a nicotine replacement therapy and may be subject to regulations in various countries. Governments usually control the production, distribution, and sale of nicotine gum, which may restrict its accessibility to consumers. The nicotine gum market is highly competitive, with numerous established players and new entrants constantly entering the space. This competition can result in price pressure, reduced profit margins, and limited market share for companies operating within this space.

Despite the health advantages of nicotine gum, many people remain unaware of its potential advantages. This lack of awareness can hinder demand for the product and limit its market potential. Nicotine gum may cause various side effects, such as mouth irritation, hiccups, and indigestion. These effects may deter some consumers from using the product and limit its market potential. There are various nicotine replacement therapies on the market, such as nicotine patches and lozenges that can be used instead of nicotine gum. This has limited demand for nicotine gum and curbed its market potential.

Type Analysis

The 2mg/piece Gum Dosage Segment is the Most Lucrative Segment in the Type Analysis of the Nicotine Gum Market

Based on type, the market for nicotine gum is segmented into 2 mg/piece of gum dosage, 4 mg/piece of gum dosage, and 6 mg/piece of gum dosage. Among these types, the 2 mg/piece of gum dosage segment is the most lucrative in the global nicotine gum market, with a projected CAGR of 5.4%. The total revenue share of 2 mg/piece gum dosage type in the nicotine gum market is 56.2% in 2022.

The 2 mg/piece dosage is a commonly available nicotine gum option on the global market. This dosage is generally recommended for individuals who smoke less than 25 cigarettes daily and acts as an initial starting dose for those trying to quit smoking. Nicotine gum works by releasing nicotine into the bloodstream through the mouth’s lining, helping reduce cravings and withdrawal symptoms associated with nicotine addiction. However, it’s essential to follow the recommended dosage and usage instructions in order to minimize negative side effects.

The 4 mg/piece of Gum Dosage Segment is Expected to Grow Faster in the Projected Period in the Nicotine Gum Market.

Followed by the 4 mg/piece of gum dosage segment type, which accounted for the fastest-growing type segment in the nicotine gum market from 2022 to 2031, with the highest CAGR of 5.9% in 2022. Heavy smokers who smoke more than 25 cigarettes per day typically receive this dosage as a recommended starting point.

Furthermore, it can serve as a step-down dosage for people starting on the 2 mg/piece of gum and gradually decreasing their nicotine intake over time. Increased dosages could have more adverse reactions, such as nausea, headaches, and dizziness.

Distribution Channel Analysis

The Pharmacies Segment Accounted for the Largest Revenue Share in the Nicotine Gum Market in 2022.

Based on distribution channels, the market is segmented into supermarkets/ hypermarkets, convenience stores, pharmacies, online, and other distribution channels. Among these, the pharmacies segment dominates the nicotine gum market with the largest share of 40% in 2022.

Due to the following reasons, people buy nicotine gum from pharmacies for access to medical advice & support, the ease of buying it with other health-related products, and the availability of the product. The pharmacists have trained staff who can offer advice & information on nicotine gum and other nicotine replacements.

The Online Segment is Expected to be the Fastest Growing Distribution Channel Segment in Nicotine Gum Market.

Followed by the online segment type, which accounted for the fastest-growing type segment in the nicotine gum market from 2022 to 2031, with the highest CAGR of 6.1% in 2022. Companies can sell nicotine gum to consumers directly on the E-commerce platforms like Walmart, and Amazon. Also, customers can buy nicotine gum through their own companies’ websites. Online pharmacies are also available in the market such as Walgreens, CVS, etc.

Key Market Segments

Based on Type

- 2 mg/piece of gum dosage

- 4 mg/piece of gum dosage

- 6 mg/piece of gum dosage

Based on the Distribution Channel

- Supermarkets/ Hypermarkets

- Convenience Stores

- Pharmacies

- Online

- Other Distribution Channels

Opportunity

Increasing Awareness About Health Benefits, Increasing Use of E-Cigarettes Creates Opportunities in Nicotine Gum Market.

There is an ever-increasing market for products to help people quit smoking, as it is one of the leading causes of preventable deaths worldwide. Nicotine gum has proven highly effective at relieving cravings and withdrawal symptoms, making it a popular smoking cessation aid.

Nicotine gum, which doesn’t contain tar or carbon monoxide, offers a safer alternative to smoking. With increasing awareness about the health risks associated with smoking, more people are turning towards nicotine gum as a smoking cessation solution. Recently, e-cigarettes have grown in popularity as an alternative to smoking. Unfortunately, many e-cigarettes still contain nicotine, so those looking to reduce or stop their nicotine consumption might want to consider nicotine gum instead.

In developing regions such as Asia and Africa, where smoking rates are high and there is a pressing need for smoking cessation treatments, the market for nicotine gum has immense potential for expansion. By creating innovative goods, manufacturers can take advantage of the potential in the international nicotine gum market. For instance, adding new flavors or improving delivery methods can attract more people and boost revenue.

Trends

Increased Use of Online Sales Channels the Development of New and Innovative Products are Some Recent Trends in the Nicotine Gum Market.

As smoking rates around the world decrease, an increasing number of smokers are turning to nicotine replacement medications such as nicotine gum for assistance in quitting smoking. As e-commerce continues to evolve, more customers can now purchase nicotine gum online from the convenience of their homes.

Manufacturers are creating innovative nicotine gum products to reach more customers and boost sales. To enhance the user experience, some producers have improved the delivery method or added new tastes for added enjoyment. Some customers are seeking alternatives to standard nicotine gum that contain less or no nicotine, due to health concerns and the desire to reduce nicotine dependence.

Many countries have regulatory oversight for nicotine gum, with producers required to adhere to stringent requirements regarding product labeling, advertising, and sales. With the public health focus on nicotine gum regulation likely getting even tighter in the future, this environment could become even more scrutinized.

Regional Analysis

North America Accounted for the Largest Revenue Share in the Nicotine Gum Market in 2022.

North America is estimated to be the most lucrative market in the global nicotine gum market, with the largest market share of 33.6% in 2022. With an elevated smoking prevalence rate and well-developed healthcare systems that promote cessation efforts, this region offers major opportunities in terms of nicotine replacement therapy (NRT) products – particularly in the United States and Canada.

APAC is Expected as Fastest Growing Region in Projected Period in Nicotine Gum Market.

Asia Pacific is expected as the fastest-growing region in the Nicotine Gum Market with a CAGR of 5.6%. As public awareness about smoking grows and the demand for cessation aids increases, the market for nicotine gum in Asia-Pacific is expanding rapidly. Major markets in this region include China, Japan, and India where there is a high prevalence of smoking and an increasing need for NRT solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on exploring nicotine gum in various forms such as new flavors, strengths, etc. Globally, GlaxoSmithKline plc holds the top spot in the nicotine gum market. However, as new players enter and established firms expand their product lines, competition is expected to intensify in the years ahead.

Market Key Players

- GlaxoSmithKline plc

- Fertin Pharma A/S

- Johnson & Johnson

- Cambrex Corporation

- Perrigo Company plc

- Alchem International Pvt. Ltd.

- Reynolds American Inc.

- Reddy’s Laboratories Ltd.

- Novartis International AG

- Swedish Match AB

- Other Key Players

Recent Developments

- In 2020, Perrigo Company plc recently unveiled a store-brand nicotine gum product in the United States, designed to aid smokers in quitting by gradually decreasing their nicotine intake.

- In 2019, GlaxoSmithKline recently unveiled Nicorette Coated Ice Mint, a nicotine gum product designed to provide an extended cooling sensation in the mouth while providing nicotine for smokers looking to quit.

Report Scope

Report Features Description Market Value (2022) USD 1.5 Bn Forecast Revenue (2032) USD 2.4 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (2 mg/piece of gum dosage, 4 mg/piece of gum dosa, 6 mg/piece of gum dosage), By Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, Pharmacies, Online, Other Distribution Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GlaxoSmithKline plc, Fertin Pharma A/S, Johnson & Johnson, Cambrex Corporation, Perrigo Company plc, Alchem International Pvt. Ltd., Reynolds American Inc., Dr. Reddy’s Laboratories Ltd., Novartis International AG, Swedish Match AB, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the estimated value of the nicotine gum market by 2032?The global nicotine gum market is estimated to reach a value of USD 2.4 billion by 2032.

What is the projected CAGR for the nicotine gum market between 2023 and 2032?The nicotine gum market is estimated to register a CAGR of 5.1% between 2023 and 2032.

What are the drivers of the nicotine gum market?The drivers of the nicotine gum market include growing awareness about smoking's harmful effects, rising demand for cessation aids, and government initiatives to reduce tobacco consumption.

Who are the major players in the nicotine gum market?The major players in the nicotine gum market include GlaxoSmithKline, Johnson & Johnson, and Perrigo Company plc among others.

What are the restraints for the nicotine gum market?The restraints for the nicotine gum market include stringent regulations, competition, and limited awareness among consumers.

What is the most lucrative segment in the type analysis of the nicotine gum market?The 2 mg/piece of gum dosage segment is the most lucrative in the global nicotine gum market, with a projected CAGR of 5.4% and a total revenue share of 56.2% in 2022.

What are the distribution channels for nicotine gum?Nicotine gum is available in various distribution channels, including supermarkets/hypermarkets, convenience stores, pharmacies, online stores, and other distribution channels.

-

-

- GlaxoSmithKline plc

- Fertin Pharma A/S

- Johnson & Johnson

- Cambrex Corporation

- Perrigo Company plc

- Alchem International Pvt. Ltd.

- Reynolds American Inc.

- Reddy's Laboratories Ltd.

- Novartis International AG

- Swedish Match AB