Global E-Liquids Market Type(Bottled, Pre-filled), Base Liquid Type(Propylene Glycol (PG), Vegetable Glycerin (VG), PG & VG), Flavors(Menthol, Dessert, Tobacco, Chocolate, Fruits & Nuts, Others), Distribution Channel(Online, Retail Store, Convenience Stores, Newsstands, Drug Stores, Specialty Stores, Tobacconists), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 51918

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

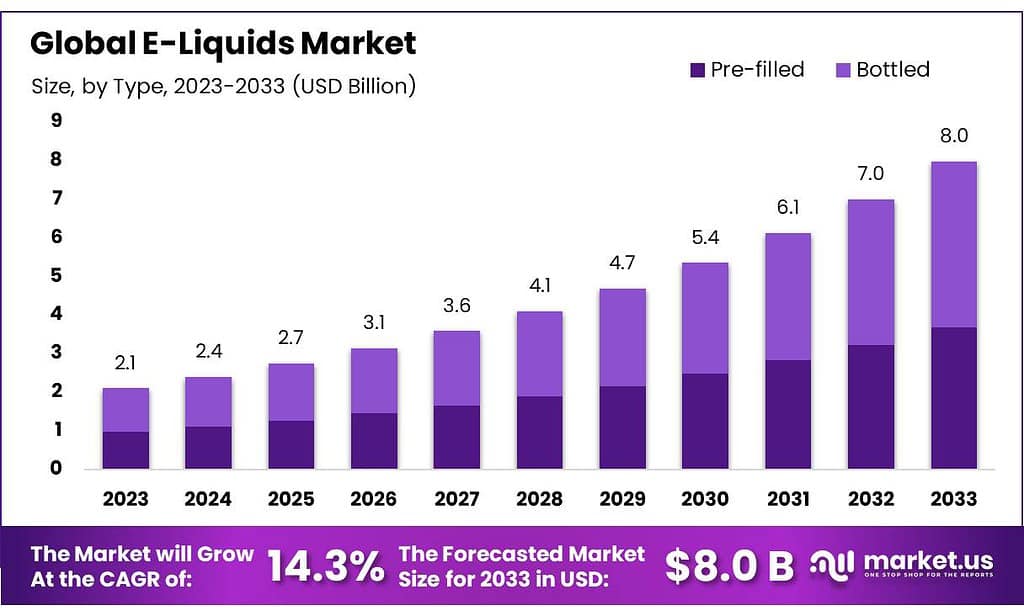

The E-Liquids Market size is expected to be worth around USD 8.0 billion by 2033, from USD 2.1 Bn in 2023, growing at a CAGR of 14.3% during the forecast period from 2023 to 2033.

Over the forecast period, e-cigarettes are expected to be more popular due to safer alternatives to smoking. The availability of e-liquids with different flavors like tobacco or menthol, fruit & nuts, chocolate, and cocoa is expected to increase e-liquid usage. Market growth is expected to be driven by a growing awareness of health and the availability of e-liquids containing low levels of toxicants.

The term “E-Liquids Market” refers to the market for electronic liquids, commonly used in electronic cigarettes (e-cigarettes) and other vaping devices. E-liquids, also known as vape juice or vape liquid, are a crucial component of vaping products. They are typically composed of a base of propylene glycol (PG) and vegetable glycerin (VG), along with flavorings and nicotine (although nicotine-free options are also available).

The E-Liquids Market encompasses the production, distribution, and sale of these liquids, catering to a growing consumer base of individuals who use vaping as an alternative to traditional tobacco smoking. The market includes various flavors and nicotine strengths to meet the diverse preferences of users.

Key Takeaways

- Impressive Growth: E-Liquids Market to grow at a 14.3% CAGR, reaching USD 8.0 billion by 2033 from USD 2.1 billion in 2023.

- Safer Alternatives: E-cigarettes gain popularity as safer smoking alternatives due to reduced toxicants.

- Composition: E-Liquids contain Propylene Glycol (PG), Vegetable Glycerin (VG), flavorings, and nicotine (or nicotine-free).

- Bottled Dominance: Bottled E-Liquids lead with a 53.8% market share in 2023.

- Balanced Experience: PG & VG E-Liquids capture 48.4% of the market, offering flavor and thick vapor.

- Tobacco Favorite: Tobacco-flavored E-Liquids dominate at 35.9% in 2023.

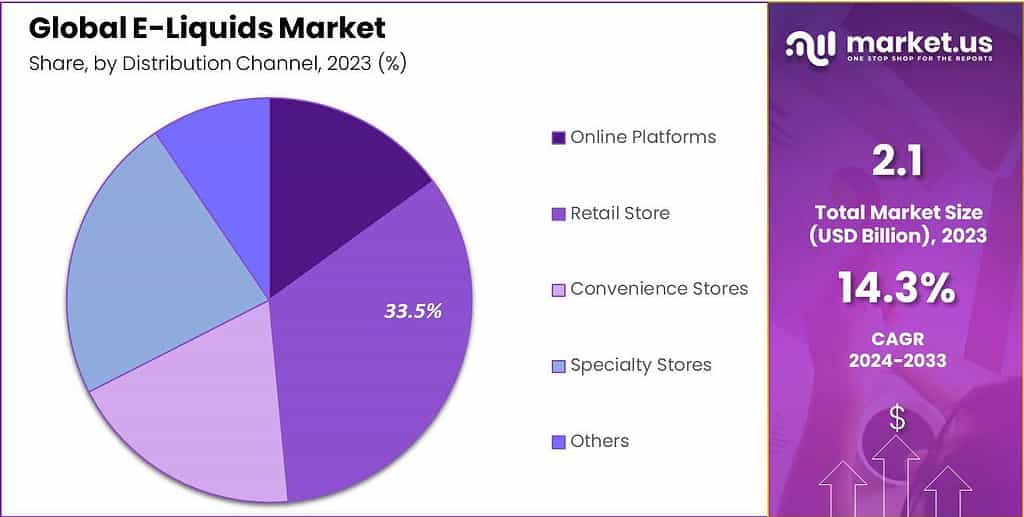

- Retail Dominance: Retail segment holds 33.5% revenue share in 2023.

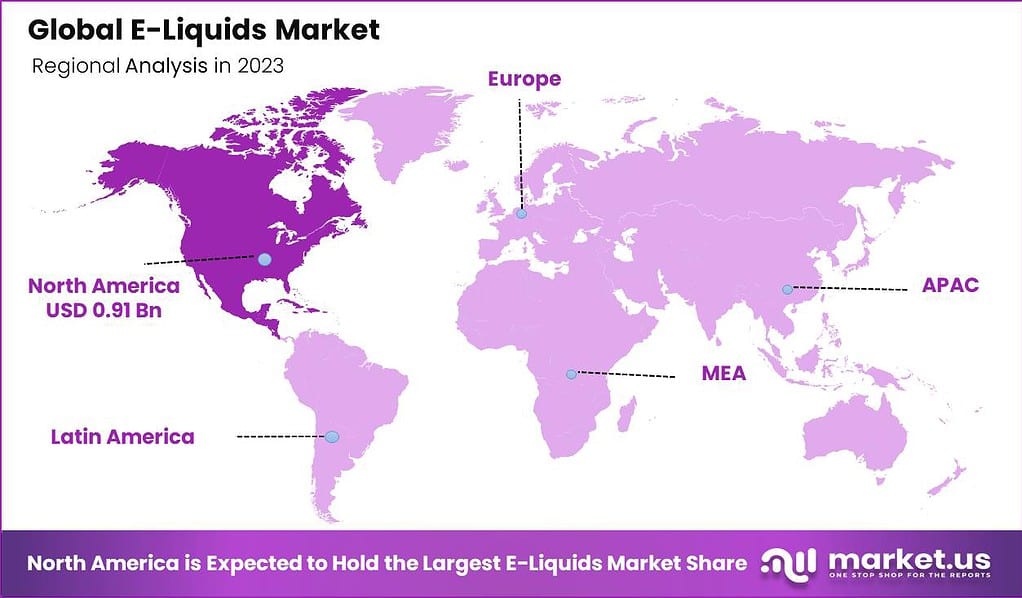

- North America Leader: North America commands 43.2% of the market in 2023.

Type Analysis

In 2023, Bottled E-Liquids took the lead in the market, securing a strong position with more than a 53.8% share. This indicates that bottled E-Liquids were more popular compared to the pre-filled ones. Bottled E-Liquids are those where users can fill their vaping devices manually.

The dominant market share in 2023 suggests that many people preferred the flexibility and customization offered by bottled E-liquids. Users have the option to choose from a variety of flavors and nicotine concentrations, providing a personalized vaping experience. Pre-filled E-Liquids come ready to use, with the liquid already filled in the vaping device.

While holding a smaller market share, pre-filled options offer convenience and simplicity, especially for users who prefer a hassle-free and straightforward vaping experience. The bottled segment’s dominance could be attributed to the growing number of vaping enthusiasts who enjoy experimenting with different flavors and adjusting nicotine levels according to their preferences.

Additionally, the popularity of refillable vaping devices contributes to the demand for bottled E-liquids. As the E-Liquids market continues to evolve, the balance between bottled and pre-filled options may shift based on consumer preferences, technological advancements, and regulatory developments. Both segments cater to diverse user needs, reflecting the dynamic nature of the vaping industry.

By Base Liquid Type

In 2023, PG & VG E-Liquids were the most popular, holding a big part of the market with more than a 48.4% share. This shows that many people preferred E-Liquids made with both Propylene Glycol (PG) and Vegetable Glycerin (VG).

PG & VG E-Liquids are popular because they offer a balanced vaping experience. Propylene Glycol (PG) is good at carrying flavors, making the taste enjoyable. Meanwhile, Vegetable Glycerin (VG) is known for creating thick vapor clouds, adding to the overall vaping experience.

Many users in 2023 liked PG & VG E-Liquids a lot, showing that people enjoy having both great flavor and impressive vapor. These E-Liquids are well-liked by vapers who want a versatile and well-rounded experience. You can adjust the balance between Propylene Glycol and Vegetable Glycerin to fit your own likes.

Some people might want more PG for a stronger flavor, while others could choose more VG for denser vapor clouds. This flexibility makes PG & VG E-Liquids even more appealing. As time goes on in the E-Liquids market, what people like might change. It depends on what users prefer, new vaping tech, and any new rules. But for now, PG & VG E-Liquids are popular because they offer a lot of options and are liked by many in the vaping community.

Flavor Analysis

In 2023, Tobacco-flavored E-Liquids were the top choice, making up more than 35.9% of the market. This means that a lot of people preferred the taste of Tobacco when it came to their vaping experience. Tobacco-flavored E-Liquids are popular because they give a vaping experience similar to traditional tobacco smoking. Many vapers like it because it feels familiar and has that classic taste. But, the E-Liquids market has more than just Tobacco flavors.

There are choices like Menthol for a cool and refreshing feeling, Fruits & Nuts for a fruity and nutty taste, and Chocolate for a sweet treat. There are many other flavors too, so everyone can find what they like. Even though Tobacco-flavored E-Liquids were the top choice in 2023, there are lots of different flavors to try.

People can explore and find the one that fits their taste the best. As time goes on, what flavors people like might change as trends and new tastes come in. With so many options, users can always pick E-Liquids that match what they enjoy, making the vaping industry always exciting and changing.

Distribution Channel Analysis

In 2023, the retail segment was the dominant market player and earned the highest revenue share at over 33.5%. The fact that many retail stores offer customers the opportunity to sample different e-liquid flavors and e-cigarette products before they purchase can explain this. Based on distribution channels, the market can be segmented into online and retail stores. The market is further divided into convenience stores, specialty shops, and drug stores.

The online segment is forecast to experience significant growth during the forecast period. Over the forecast period, the online market is expected to grow due to improvements in online distribution platforms. These platforms are designed to limit the sale of nicotine products to underage users. JUUL Labs Inc. has implemented an online verification system for age verification to increase the efficiency of its electronic commerce platform. This system relies on third-party verification to prevent underage users from accessing the site.

The new verification system offers four new features: photo upload, public records check, two-factor authentication, protection from fake ID, and protection against false ID. However, governments around the globe have implemented lockdowns to prevent the spread of COVID-19. The lockdowns have prompted vendors to temporarily cease production and logistic providers to stop transporting goods across borders and within the country. Online shopping has been temporarily suspended by many retailers worldwide due to various levels of lockdowns during the pandemic.

Key Market Segments

Type

- Bottled

- Pre-filled

Base Liquid Type

- Propylene Glycol (PG)

- Vegetable Glycerin (VG)

- PG & VG

Flavors

- Menthol

- Dessert

- Tobacco

- Chocolate

- Fruits & Nuts

- Others

Distribution Channel

- Online

- Retail Store

- Convenience Stores

- Newsstands

- Drug Stores

- Specialty Stores

- Tobacconists

Drivers

The E-Liquids market is doing well because of some important reasons. One big reason is the many different flavors available. You can find E-Liquids in Tobacco, Menthol, Fruits & Nuts, Chocolate, and more. Having lots of choices lets vapers try different flavors and make their vaping experience better.

Another important reason is that companies keep coming up with new and interesting flavors. They use new technologies to create unique tastes. This makes the market always changing and exciting for users who like to try something new.

E-liquids give users the choice of how much nicotine they want, making the experience customizable. This is helpful for people trying to quit smoking, allowing them to gradually reduce nicotine. It also suits those who prefer higher nicotine levels. Many people are becoming more aware of the health risks linked to regular smoking.

Because of this, users are turning to alternatives like vaping. E-liquids don’t have the harmful chemicals found in tobacco smoke, making them a potentially less harmful choice. This health-conscious trend is making more people consider vaping as a substitute for smoking, contributing to the market’s growth.

The social aspect of vaping is another driver, with many users enjoying the communal aspect of sharing flavors and experiences. Vaping communities and social platforms play a role in fostering this shared enjoyment, contributing to the overall appeal of the E-Liquids market. As the market continues to evolve, factors like flavor variety, innovation, nicotine flexibility, health considerations, and the social aspect are expected to drive sustained growth and keep the E-Liquids market vibrant and dynamic.

Restraints

Even though the E-Liquids market is doing well, it has some challenges that could slow down its growth. One big challenge is the uncertainty around regulations and rules for vaping. Changes in these rules can affect how products are available, how they can be advertised, and how the whole market works. This uncertainty makes it tough for both makers and users.

Another challenge is the ongoing debate about the long-term health effects of vaping. While E-Liquids are seen as a less harmful choice compared to regular smoking, there aren’t enough studies on the long-term health impact of vaping. This lack of information makes some people unsure about using vaping as an alternative to smoking. The rules getting stricter on advertising and promoting vaping products is also a problem.

As regulations become tighter, companies find it harder to promote their E-Liquids. This affects how well-known their brands are and how many people they can reach. This becomes a big obstacle, especially in reaching people who could benefit from vaping as a way to quit smoking. Another challenge is the worry that vaping might attract younger people.

The appeal of flavored E-Liquids to younger individuals and the concern about them starting to use nicotine is a big focus of rules. Trying to deal with these worries while still making sure adult smokers can get E-Liquids is a tough balance for the industry.

In summary, the E-Liquids market faces challenges like uncertain rules, health concerns, restrictions on advertising, and worries about youth using vaping products. Handling these challenges well is important to keep the growth going and to make sure vaping stays a good choice for those looking to quit smoking.

Opportunities

The E-Liquids market has a good chance to keep growing. One big opportunity is the chance for new and better technologies in vaping devices. By making devices that work better and are easier to use, the overall vaping experience can get better.

Companies that spend money on research and development for these new technologies can become more competitive and get more users. Another chance is the growing interest in eco-friendly products. Companies can think about making E-Liquids with ingredients and packaging that are good for the environment. This matches with what more people want – products that don’t harm the environment as much.

In short, there are good opportunities to make better vaping devices and focus on eco-friendly options. By doing these things, companies can keep growing and meet the changing needs of consumers. E-liquid makers have a chance to make more flavors and options for users.

By introducing new and exciting flavors and allowing customization, they can attract more people. This helps to keep the market interesting and caters to the changing tastes of users. Working together with healthcare professionals and programs to help people quit smoking is another opportunity.

By teaming up with organizations focused on helping people quit smoking, E-Liquid makers can show that vaping can be a helpful tool for quitting. This can make E-Liquids more accepted as an alternative to smoking. Using online platforms to sell E-Liquids is also a way to grow the market. With more people shopping online, manufacturers can reach a bigger audience globally.

This makes E-Liquids available to a wide range of consumers. In short, the E-Liquids market has opportunities to make new flavors work with programs helping people quit smoking, use online sales, and focus on sustainability and new technologies. By taking advantage of these opportunities, manufacturers can keep the market growing and contribute to the changes happening in the vaping industry.

Challenges

The E-Liquids market has some problems that might affect how much it grows. One big problem is that people are still talking and thinking about how vaping might affect health. Even though it’s seen as a choice that might be less harmful than smoking, worries about what E-Liquids could do to health, in the long run, make some people unsure about trying them.

Another problem comes from the strict rules and changing laws about vaping. Companies have to figure out how to work with these rules that keep changing. This affects how easy it is for people to get these products, how they can be advertised, and how the whole market works. Companies find it hard to make long-term plans and investments with all this uncertainty.

In short, the challenges in the E-Liquids market involve health concerns and dealing with changing rules and laws. Figuring out how to overcome these problems is important for the market to keep growing.

There’s also a worry about young people starting to use vaping, especially flavored E-Liquids. People are looking more closely at this and talking about how to stop young individuals from starting to use nicotine through these appealing flavors. It’s tricky for the industry to make flavors that adults like while also making sure they don’t attract young people.

Besides that, some rules limit how companies can advertise and promote vaping products. As these rules get stricter, it becomes hard for companies to let more people know about E-Liquids and reach those who could use them to quit smoking.

To sum it up, the challenges in the E-Liquids market include not being sure about health effects, dealing with complicated rules, worries about young people starting to vape, and limits on advertising. Figuring out how to tackle these challenges is important for the market to keep growing, and for more people to accept vaping as a choice instead of traditional smoking.

Regional Analysis

North America held the highest revenue share at over 43.2% in 2023. Key vendors like Philip Morris International Inc., JUULLabs Inc., Turning Point Brands Inc., and Nicquid are responsible for this dominance.

Additionally, these vendors are focused on expanding their regional presence through acquisitions and mergers. This trend is expected to further propel North America’s market growth. Turning Points Brands Inc. purchased International Vapor Group LLC in September 2018. Turning Point Brands Inc. could implement a vapor B2C platform into its electronic vapes, and component distribution channel.

It is expected that the Asia Pacific region market will experience significant growth during the forecast period. This is due to the rising number of lung carcinoma cases from tobacco smoking. It’s also because e-cigarettes/e-liquids are perceived as safer than traditional cigarettes. According to an Oxford University Press article, China had reported over 690,000. High taxes on Japanese traditional cigarettes will encourage people to smoke e-cigarettes. This is expected to stimulate the market’s growth.

Key Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market leaders are investing in new product development, partnerships, and acquisitions to enhance their position in the market as well as expand their operations around the world. Turning Point Brands, Inc. bought Vapor Supply assets, including VaporSupply.com, and a portion of its affiliates, in April 2018. The former was able to sell e-liquids in America and it also allowed for the expansion of its presence in the vaping market.

Manufacturers depend on a variety of small and medium-sized third-party suppliers. The market growth is expected to be limited by the inability to renew contracts or failure to distribute third-party supplier products through established distribution channels. E-liquids are being developed according to local guidelines. Key players have been investing heavily in this area. Turning Point Brands Inc., which invests US$ 2.5 million in R&D to develop high-quality products, was one example.

Key Market Players

- Black Note Inc.

- Breazy

- BSMW Ltd.

- Crystal Canyon Vapes LLC

- eLiquid Factory

- Mig Vapor LLC

- Molecule Labs, Inc.

- Nicopure Labs LLC

- Philip Morris International Inc.

- Turning Point Brands, Inc.

- VMR Products LLC

- Others

Report Scope

Report Features Description Market Value (2023) US$ 2.1 Bn Forecast Revenue (2033) US$ 8.0 Bn CAGR (2024-2033) 14.3 % Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Natural Fluorite, and Synthetic), By Product Form (Anhydrous, and Aqueous), By Application (Refrigerants, Pharmaceuticals, Herbicides, Aluminum, Electrical Components, and Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Solvay, Honeywell International Inc., Stella Chemifa Corp, Arkema Group, Lanxess AG, Navin Fluorine International Limited, Foosung Co Ltd, Fluorchemie Dohna GmbH, Orbia, Derivados Del Fluor, Sinochem Lantian Co., Ltd., and Fluorsid S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of E-Liquids Market?E-Liquids Market size is expected to be worth around USD 8.0 billion by 2033, from USD 2.1 Bn in 2023

What CAGR is projected for the E-Liquids Market?The E-Liquids Market is expected to grow at 14.3% CAGR (2024-2033).Name the major industry players in the E-Liquids Market?Black Note, Inc., Breazy, BSMW Ltd., Crystal Canyon Vapes LLC, eLiquid Factory, Mig Vapor LLC, Molecule Labs, Inc., Nicopure Labs LLC, Philip Morris International Inc., Turning Point Brands, Inc., VMR Products LLC, Others

-

-

- Black Note Inc.

- Breazy

- BSMW Ltd.

- Crystal Canyon Vapes LLC

- eLiquid Factory

- Mig Vapor LLC

- Molecule Labs, Inc.

- Nicopure Labs LLC

- Philip Morris International Inc.

- Turning Point Brands, Inc.

- VMR Products LLC

- Others