Global Propylene Glycol Market, By Source (Petroleum Based and Bio-Based), By Grade (Industrial Grade, Pharmaceutical Grade, and Other Grades), By End-User (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Construction, Transportation, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 33883

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

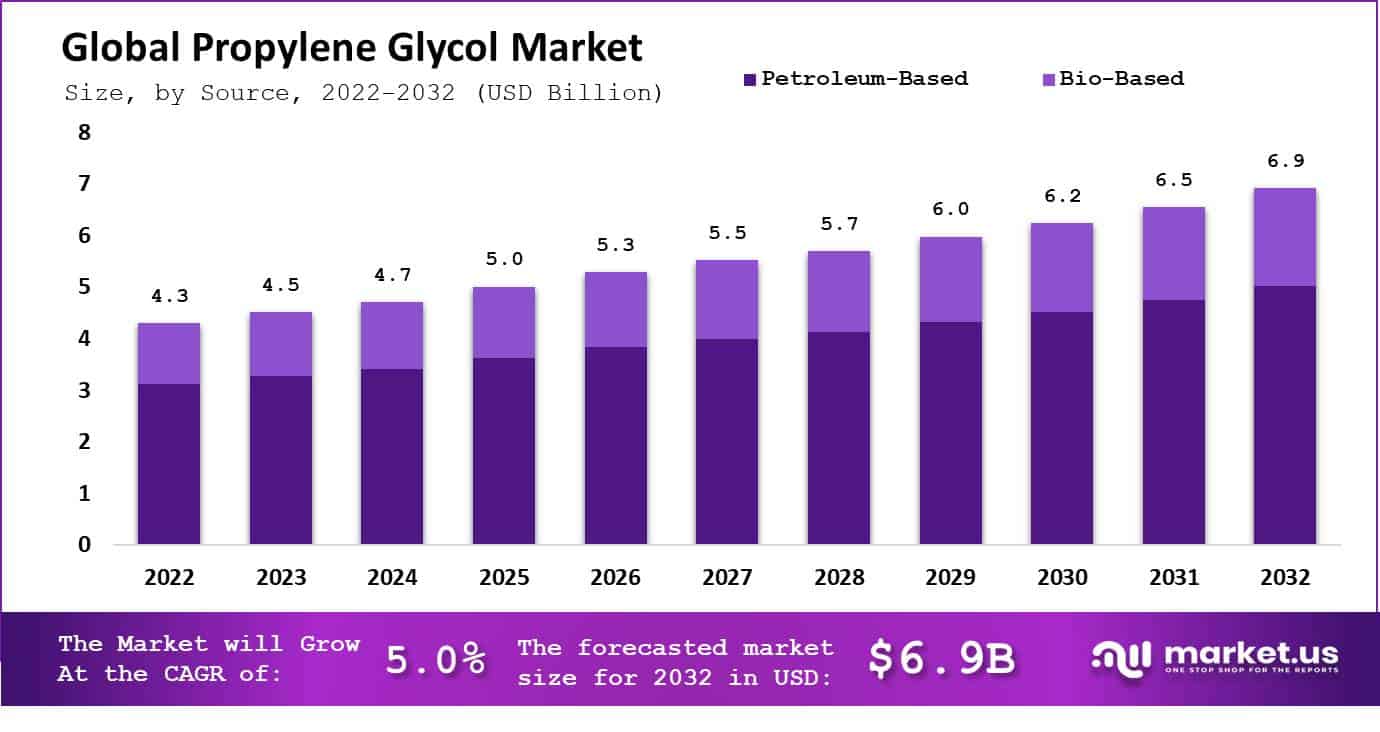

The Propylene Glycol Market Was Valued At USD 4.3 Bn In 2022 and Is Expected To Reach USD 6.9 Bn In 2032, with A CAGR of 5.0% From 2023 To 2032.

The increasing demand for propylene glycol in several applications, like pharmaceuticals, cosmetics, automotive, and food & beverages is driving the market growth. The APAC region is the largest consumer of propylene glycol.

The key players are focusing on strategic partnerships, mergers & acquisitions, and collaborations to increase their market share & expand their global presence. Raising awareness about the injurious effects of ethylene glycol also drives the demand for propylene glycol as a substitute in various applications, especially in the automotive industry.

However, the fluctuation of raw material prices & the availability of substitutes are some of the key challenges faced by the market players. Overall, the propylene glycol market is expected to observe substantial growth during the forecasted period.

Key Takeaways

- Market size: The propylene glycol market is predicted to see an annual compound growth of (CAGR) that is 5.0% from 2023 through 2032.

- Market Trends: The market for propylene Glycol has seen a rise in the market, especially in sectors that focus on environmentally sustainable and eco-friendly options.

- Source Analysis: Among the segments, the petroleum-based type is anticipated to dominate the global propylene glycol market, holding the largest revenue share of 72.4% and projecting a CAGR of 5.7% throughout the forecast period.

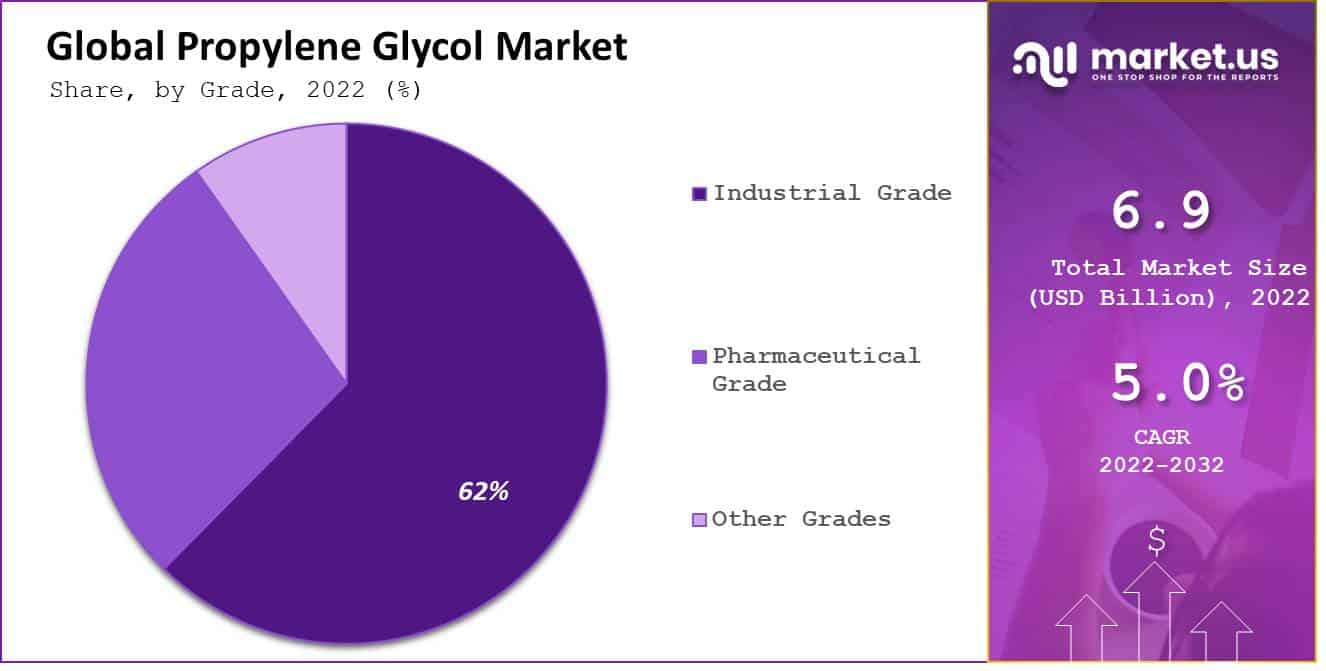

- Grade Analysis: Among the grading segments, industrial-grade propylene glycol holds dominance in the propylene glycol market, commanding a market share of 62.4% and exhibiting a CAGR of 5.8%. This is attributed to its suitability for a wide array of applications across diverse industries.

- End User Analysis: Among these, the construction segment is the market leader, holding a revenue share of 39.7% and anticipated to grow at a CAGR of 6.2% during the forecasted period.

- Drivers: Growing awareness of sustainable solutions, the versatility of propylene glycol applications, and its eco-friendly nature.

- Restraints: Price fluctuations and concerns related to raw material supply affecting production costs.

- Opportunities: Rising demand for propylene glycol in emerging markets and increased adoption in the manufacture of non-toxic antifreeze and de-icing solutions.

- Challenges: Meeting regulatory requirements, ensuring product quality, and managing competitive pricing.

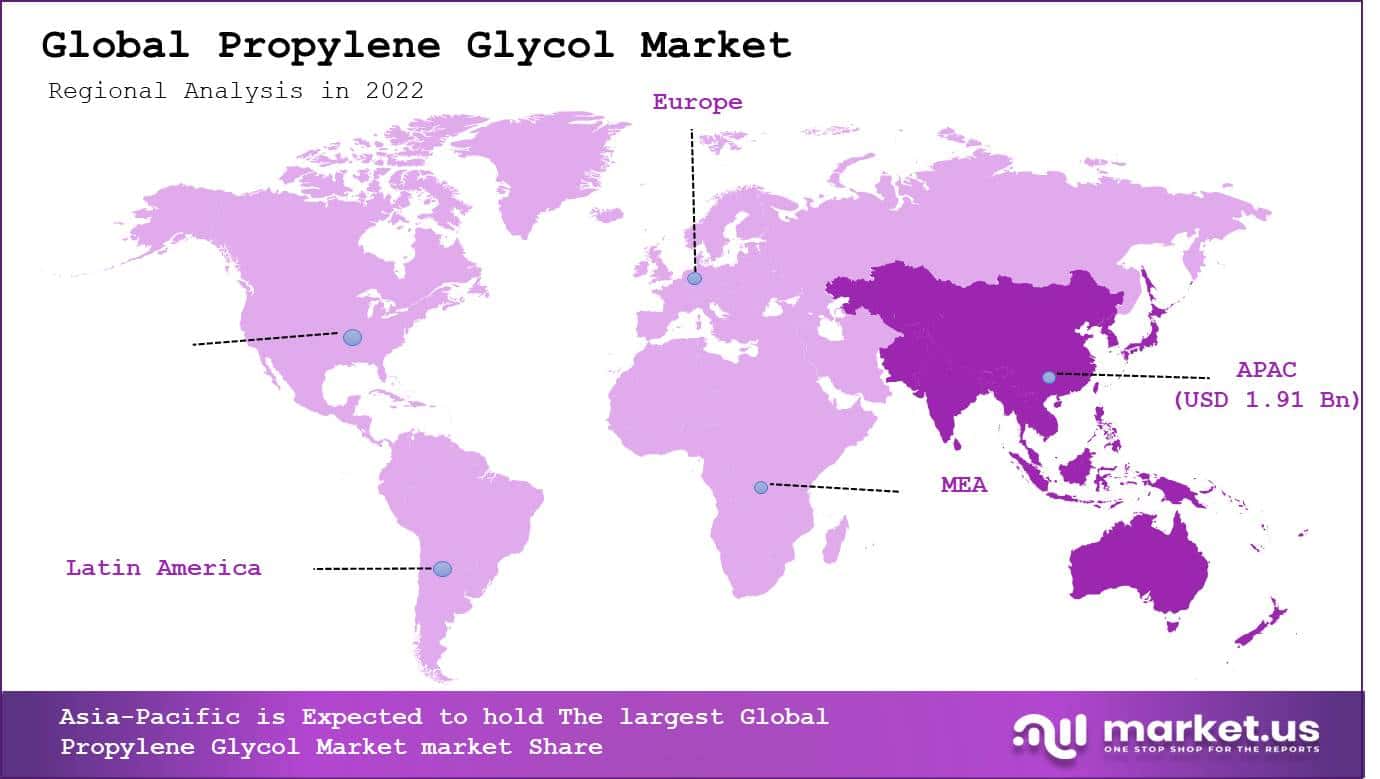

- Regional Analysis: It is predicted that in the Asia-Pacific (APAC) APAC region will have the most lucrative revenue share of 44.6%. APAC is expected to see a consistent CAGR of 5.4% up to 5.4% over the period of forecast.

- Key Players Analysis: Major players in the propylene glycol market include The Dow Chemical Company, BASF SE, INEOS Oxide, Shell Plc., Adeka Corporation, Huntsman International LLC., LyondellBasell Industries Industries N.V., Archer Danials Midland Company, Global Bio-Chem Technology Group Co., Ltd., DuPont Tate & Lyle Bio Products LLC, Temix International S.R.L., Other Key Players.

Driving Factors

Increased Use as Substitute for Ethylene Glycol Drives the Growth

Propylene glycol is a useful organic compound that is extensively used in several industrial applications. One of the main drivers for the propylene glycol market is its increasing use as a substitute for ethylene glycol in the automotive industry due to its less harmfulness & biodegradability.

Propylene glycol is also used as the main component in the production of unsaturated polyester resins, which are broadly used in the construction & transportation industries. Additionally, the increasing demand for personal care & pharmaceutical products, like toothpaste, cough syrups, and moisturizers is expected to drive the propylene glycol market growth.

Furthermore, the rise in demand for food & beverage products, like frozen foods, alcoholic beverages, and packaged food is expected to propel the growth of the propylene glycol market. It is widely used in food additives with excellent stability & solubility properties. Overall, the expanding use of propylene glycol in many industries, coupled with its helpful properties, is driving the growth of the propylene glycol market.

Restraining Factors

Health Concerns, Availability of Raw Materials Can Restrain the Propylene Glycol Market Growth

Though the propylene glycol industry offers numerous opportunities, there are also challenges the sector must contend with. Firstly, health concerns related to propylene glycol like skin irritation & respiratory problems led to increased regulations on the use of the chemical in certain applications like personal care & cosmetics.

Secondly, the availability & price of raw materials, which are derived from petroleum, can impact the price & profitability of propylene glycol producers.

Thirdly, propylene glycol faces competition from substitutes like ethylene glycol, butylene glycol, and glycerin which can be used in similar applications. Additionally, environmental concerns related to the production & disposal of propylene glycol can lead to an increase in regulations & impact the industry’s profitability.

Finally, volatility in end-use markets like construction, food & beverages, and automation also impact the demand for propylene glycol & its profitability.

By Source Analysis

The Petroleum Segment Accounted for the Largest Revenue Share in the Propylene Glycol Market in 2022.

Based on source, the market is segmented into petroleum-based and bio-based. Among these types, the petroleum-based segment is expected to be the most lucrative in the global propylene glycol market, with the largest revenue share of 72.4% and a projected CAGR of 5.7% during the forecast period.

Petroleum-based propylene glycol is cheaper and more readily available than bio-based propylene glycol. It is derived from crude oil & natural gas, which are easily accessible sources of hydrocarbons. Additionally, the production process for petroleum-based propylene glycol is well-established & has been optimized over the years which results in a cost-effective & efficient manufacturing process.

The Bio-Based Segment is the Fastest Growing Source Segment in the Propylene Glycol Market.

The bio-based segment is projected to fastest-growing source segment in the propylene glycol market from 2022 to 2031. Owing to bio-based propylene glycol is derived from renewable resources like soybeans, sugarcane, and corn, which are environmentally friendly & sustainable. Additionally, bio-based propylene glycol is a safer alternative for human health & the environment.

Furthermore, the production of bio-based propylene glycol is becoming more efficient & cost-effective which makes it more accessible and affordable for consumers. Furthermore, the increasing demand for the bio-based propylene glycol market is expected to grow rapidly in the coming years.

By Grade Analysis

The Industrial Grade Segment Holds a Significant Share in the Grade Segment Propylene Glycol Market.

Based on grade, the market is divided into industrial grade, pharmaceutical grade, and other grades. Among these, the industrial grade segment is dominant in the grading segment in the propylene glycol market, with a market share of 62.4% and a CAGR of 5.8%. This is due to it being suitable for a broad range of applications in various industries.

Industrial-grade propylene glycol has a purity level of 99%, which makes it suitable for use in industrial processes where high purity is not required. This segment is also cost-effective, which makes it an attractive option for manufacturers who need a large volume of propylene glycol for their processes.

Additionally, industrial-grade propylene glycol has a longer life & is more stable than other grades, which makes it an ideal choice for applications where the product will be stored for an extended period.

Pharmaceutical is Identified as Fastest Growing Grade Segment in Projected Period.

Pharmaceutical is also an important grade segment in the propylene glycol market and it is expected to grow faster in the format segment in the propylene glycol market with a CAGR of 6.2% and a market value is 27.8.%. It is the fastest growing due to it having a higher level of purity than industrial-grade propylene glycol which is nearly 99.5% which makes it suitable for use in pharmaceutical & medical applications.

A high purity level ensures that the product is free from impurities & contaminants, which is crucial for safety & efficiency. Pharmaceutical grade is manufactured under strict quality-controlled conditions, adhering to regulatory standards like United States Pharmacopeia (USP).

By End-User Analysis

Construction Holds the Significant Share in End-User Segment of Propylene Glycol Market.

Based on end-users, the market is divided into food & beverages, pharmaceuticals, cosmetics & personal care, construction, transportation, and other end-users. Among these, the construction segment dominates the market with a revenue share of 39.7% and it is expected to grow at a CAGR of 6.2% in the forecasted period. Owing to propylene glycol is used as a major ingredient in the production of construction materials like coatings, adhesives, and insulation foam.

Additionally, propylene glycol is used as a heat transfer fluid in geothermal systems, which are increasingly being used in building applications for their energy-efficient & environment-friendly features. The growth of this industry is driven by factors like infrastructure development & urbanization.

The Transportation is Expected as Fastest Growing End-User Segment in Forecasted Period in Propylene Glycol Market.

Transportation is projected as the fastest-growing end-user segment with a CAGR of 6.7% in the forecasted period. Owing to propylene glycol is used as a coolant & antifreeze in various transportation applications which include aircraft, marine vessels, and automobiles.

The increasing demand for fuel-efficient glycol in transportation applications. Additionally, the increasing demand for air travel & maritime transportation is also driving the growth of the transportation segment in the propylene glycol market.

Key Market Segments

Based on Source

- Petroleum Based

- Bio-Based

Based on Grade

- Industrial Grade

- Unsaturated Polyester Resin

- Antifreeze & Functional Fluids

- Liquid Detergents

- Plasticizers

- Paints & Coating

- Pharmaceutical Grade

- Food & Beverage

- Pharmaceuticals

- Cosmetics

- Other Grades

- Animal Feed

- Tobacco Humectants

- Inks

- Lacquers

- Varnishes

Based on End-User

- Construction

- Transportation

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Other End-Users

Growth Opportunity

Expansion of the Healthcare Industry and Increasing Demand for Bio-Based Propylene Glycol

The future looks bright for the propylene glycol market because there are various opportunities for growth in the coming years. One of the major opportunities is the growing demand for bio-based propylene glycol, which is made from renewable resources & considered more environmentally friendly. Another opportunity is the development of new applications for propylene glycol, like in the production of renewable chemicals & bioplastics. As the world moves towards a more & more sustainable future, propylene glycol is expected to perform a key role in these areas.

Additionally, the expansion of the healthcare industry, driven by factors like population growth is expected to increase demand for propylene glycol in pharmaceuticals. Overall, the propylene glycol market is composed for growth in the future as new applications & demand from various industries continue to occur.

Latest Trends

Growing Demand for Bio-Based Propylene Glycol Trending in the Market

The propylene glycol industry has witnessed several recent trends like demand for sustainable and environment-friendly products. One of the major trends is the rising demand for bio-based propylene glycol which is made from renewable sources like sugarcane & corn. This trend is driven by the growing demand for sustainable products in various industries. The second trend is the increasing use of propylene glycol in the food & beverage industry.

Propylene glycol is used as a preservative, humectant, and solvent in the food & beverage industry & has witnessed a surging demand because of the increasing processed food industry. Additionally, the market is facing a trend toward the use of propylene glycol in the pharmaceutical industry, and it is used as an ingredient in various medicines & pharmaceuticals.

Furthermore, there is a trend towards the use of propylene glycol as a substitute for ethylene glycol in several applications because of its lower toxicity & better environmental profile.

Regional Analysis

Asia-Pacific Accounted for the Largest Revenue Share in the Propylene Glycol Market in 2022.

APAC will be the dominant region in the global propylene-glycol market. It is expected that APAC will have the highest revenue share, 44.6%. APAC should also register a CAGR between 5.4% and 5.4% over the forecast period. Construction is booming in India, Indonesia, and China. China is responsible for 26,3% of global construction growth.

Infrastructure activities will account for 13% of all foreign direct investment (FDI), that India receives, by 2021. The construction industry will grow as a result. In China, there were 12.32 million cars on the road. The transport industry will grow in the next year.

North America is Expected as Fastest Growing Region in Projected Period in Propylene Glycol Market.

North America is expected as the fastest-growing region in the forecast period in the propylene glycol market with a CAGR of 5.78%. ell-the established infrastructure of propylene glycol distribution and production, with some major players in the market, allows efficient supply chain management and easy access to raw materials.

Also, the demand for the propylene glycol market is high in various industries like food & beverage, personal care, cosmetics, and pharmaceuticals in North America. Additionally, there is a strong focus on innovation & sustainability in North America which will propel the growth of the market in the forecasted period.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global propylene glycol market is highly competitive, with many key players that are holding significant market shares.

According to a report Dow Chemicals, BASF, Huntsman Corporation, Shell, and LyondellBasell are among the top players in the market, which have a significant share of the global propylene glycol market.

Market Key Players

- The Dow Chemical Company

- BASF SE

- INEOS Oxide

- Shell Plc.

- Adeka Corporation

- Huntsman International LLC.

- LyondellBasell Industries Industries N.V.

- Archer Danials Midland Company

- Global Bio-Chem Technology Group Co., Ltd.

- DuPont Tate & Lyle Bio Products LLC

- Temix International S.R.L.

- Other Key Players

Recent Developments

- In January 2023, Braskem announced that it would invest $40 million to build a new bio-based propylene glycol plant in Brazil. The plant is expected to come online in 2024 and will produce 100,000 metric tons of bio-based propylene glycol per year.

- In March 2023, LyondellBasell announced that it would expand its propylene glycol production capacity at its plant in La Porte, Texas. The expansion is expected to be completed in 2025 and will add 100,000 metric tons of propylene glycol production capacity per year.

- In April 2023, Dow announced that it would launch a new line of propylene glycol products for the personal care industry. The new products are designed to meet the growing demand for sustainable and high-performance ingredients in personal care products.

Report Scope

Report Features Description Market Value (2022) USD 4.3 Bn Forecast Revenue (2032) USD 6.9 Bn CAGR (2023-2032) 5.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Petroleum Based and Bio-Based) By Grade (Industrial Grade, Pharmaceutical Grade, and Other Grades)

By End-User (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Construction, Transportation, Other End-Users)

Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape The Dow Chemical Company, BASF SE, INEOS Oxide, Shell Plc., Adeka Corporation, Huntsman International LLC., LyondellBasell Industries Industries N.V., Archer Danials Midland Company, Global Bio-Chem Technology Group Co., Ltd., DuPont Tate & Lyle Bio Products LLC, Temix International S.R.L., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Propylene Glycol (PG)?Propylene glycol is a clear, colorless liquid used across several industries such as food, pharmaceuticals, cosmetics, and industrial processes. As its source is petroleum-derived alcohol PG is a versatile yet affordable solution.

What are the primary uses for propylene glycol?It can be found as a solvent, emulsifier, humectant, and preservative in many industries such as food & beverages, pharmaceuticals, cosmetics antifreeze & deicing fluids as well as other industrial processes.

Which grades of propylene glycol exist?There are two major grades of propylene glycol available - industrial grade and USP grade.

What factors are driving the propylene glycol market?Key drivers for propylene glycol include its increased demand in food and beverage industries, pharmaceutical production facilities, and cosmetic industries as well as its increasing application in antifreeze/deicing fluid products.

What are the primary challenges associated with the propylene glycol market?Some major obstacles for propylene glycol markets include increasing competition from alternatives products like glycerin and ethylene glycol as well as stringent regulations regarding certain applications for its use.

-

-

- The Dow Chemical Company

- BASF SE

- INEOS Oxide

- Shell Plc.

- Adeka Corporation

- Huntsman International LLC.

- LyondellBasell Industries Industries N.V.

- Archer Danials Midland Company

- Global Bio-Chem Technology Group Co., Ltd.

- DuPont Tate & Lyle Bio Products LLC

- Temix International S.R.L.

- Other Key Players