Global Humectants Market by Product Type (Sugar Alcohol, Glycols, Alpha Hydroxy Acid), By Source (Natural, Synthetic) By Application (Food & Beverage, Oral & Personal Care, Pharmaceuticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Dec 2024

- Report ID: 102241

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

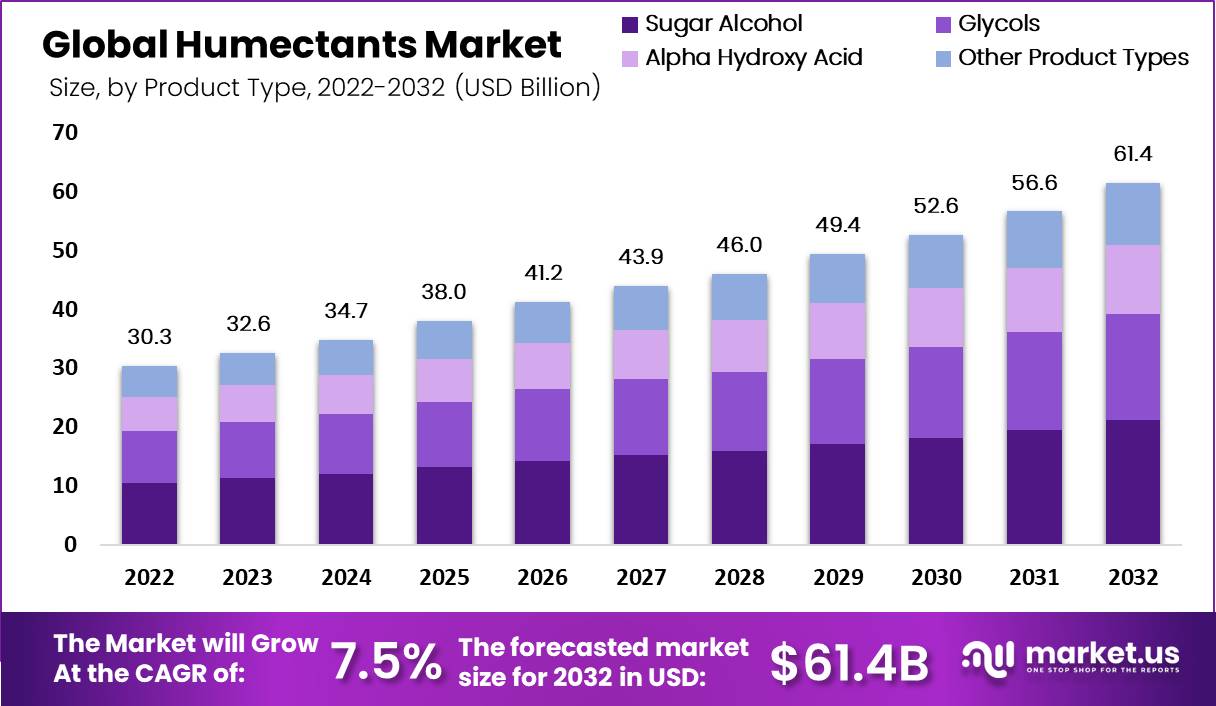

In 2022, the global humectants market was worth USD 30.3 billion and will reach USD 61.4 billion by 2032. It is estimated to grow a CAGR of 7.5% between 2023-2032.

Humectants are described as chemicals that attract water from the surrounding environment or within deep layers of the skin. A humectant is a common moisturizing component found in shampoos, lotions, and other hair and skincare products.

They are well-known for their capacity to retain moisture while keeping the overall characteristics of the product. Humectants come in a variety of forms. Some are found naturally, while others are created through the synthesis of organic molecules or petrochemicals.

When used in a cosmetics or personal care product, humectants are combined with other substances such as emollients, occlusives, preservatives, antioxidants, and others to offer moisture to our skin and aid in the absorption of other active ingredients.

Furthermore, humectants can form a desired barrier to outside elements, assisting in the retention of skin moisture. The market is being driven by prominent lifestyle changes which have led to an increase in ready-to-eat food consumption, as well as rising demand for increasing the shelf life of perishable products.

Another factor projected to drive market expansion is the rising usage of humectants as a food additive due to several benefits such as improved moisture content, higher nutritional value, cost-effectiveness, and convenience of use. In addition, increased demand for humectants from the cosmetic industry boosts market growth.

The market is continuing to grow as more people are focusing on health issues associated with sugar consumption. This has spurred the emergence of low-calorie foods made with polyols. In processed foods and beverages, consumers favor humectants as they manage water activity in foods.

Key Takeaways

- Market Growth: The global humectants market was valued at USD 30.3 billion in 2022 and is projected to reach USD 61.4 billion by 2032, representing a Compound Annual Growth Rate (CAGR) of 7.5% from 2023 to 2032.

- Definition of Humectants: Humectants are substances that attract water from the surrounding environment or deep layers of the skin. They are commonly used in cosmetics, skincare products, and food to retain moisture and improve product quality.

- Variety of Forms: Humectants come in various forms, including natural and synthetic types. Some occur naturally, while others are synthesized from organic molecules or petrochemicals.

- Application in Cosmetics: Humectants are used in cosmetics and personal care products in combination with other ingredients like emollients, occlusives, and antioxidants to provide moisture to the skin and aid in the absorption of active components.

- Factors Driving Market Growth: Rise in Ready-to-Eat Foods Changing lifestyles and increased demand for convenient, ready-to-eat foods have boosted the use of humectants in food products to maintain moisture and freshness. Food Contamination Concerns Rising awareness about food safety and foodborne illnesses has led to an increased demand for humectants as food additives.

- Anti-Aging Products: The global aging population has fueled demand for anti-aging skincare products, and humectants play a crucial role in these formulations.

- Challenges in Stability: Humectants may affect the stability and shelf life of cosmetic and skin care products, potentially leading to changes in texture and appearance over time.

- Leading Product Types: Sugar alcohol humectants, such as those used as sugar substitutes in low-calorie foods, have seen significant growth. Glycols, especially propylene glycol, are also widely used in skincare and cosmetic products.

- Natural vs. Synthetic: Natural humectants, sourced from ingredients like glycerin and aloe vera, are preferred due to their mildness and safety for the skin. Synthetic humectants, like glycerin and urea, are chosen for their cost-effectiveness and longer shelf life.

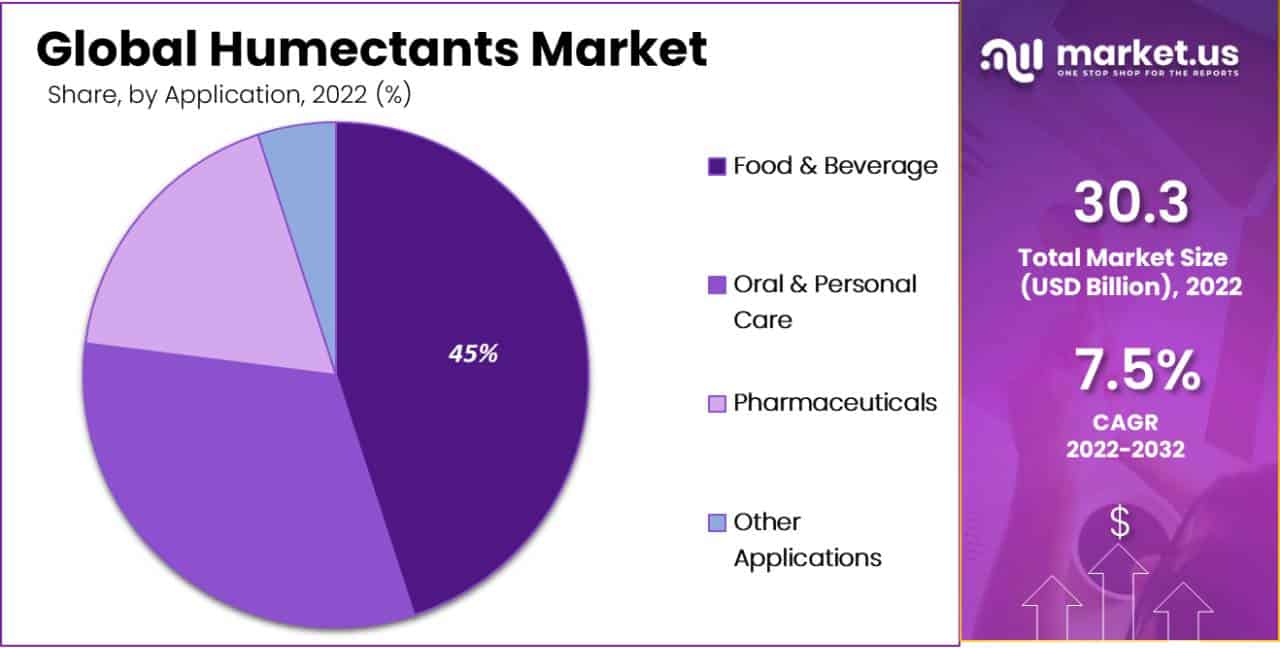

- Application Sectors: The food and beverage sector is the largest consumer of humectants, driven by their ability to extend product shelf life. Oral and personal care products also utilize humectants to retain moisture, improve gloss, and enhance skin health.

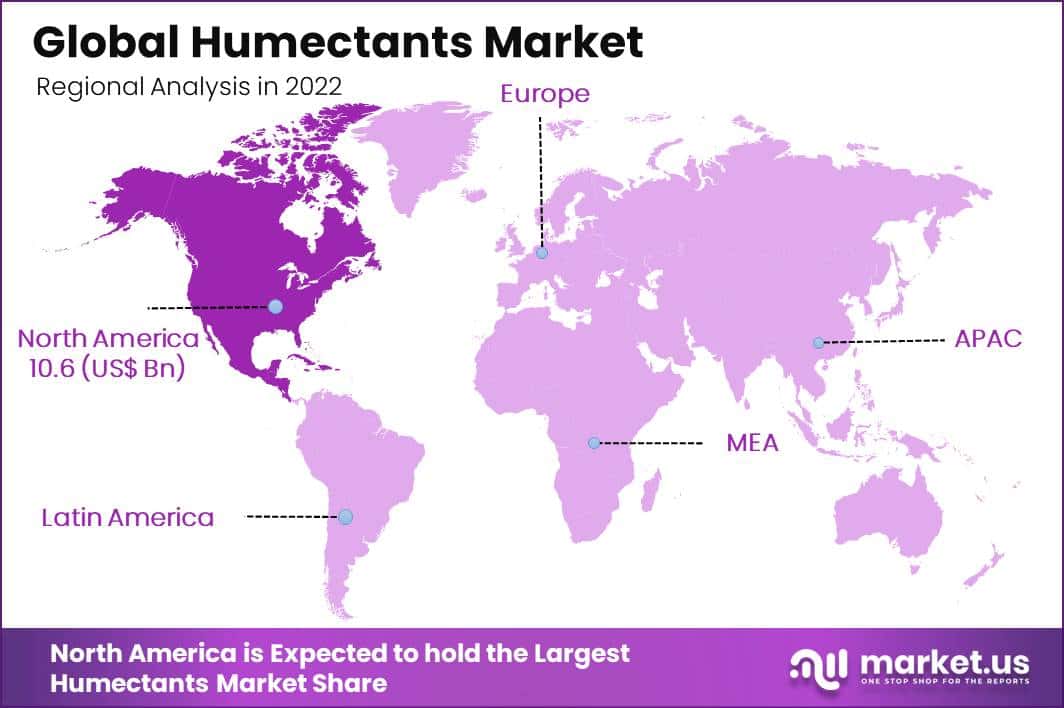

- Regional Analysis: North America The region holds a 35% share of the market due to high growth in the beauty and pharmaceutical industries and increasing demand for ready-to-eat food. Asia Pacific Changing consumer lifestyles, rising disposable income and a focus on health and nutrition in countries like India and China contribute to high growth.

- Market Players: Major players in the global humectants market include BASF SE, Archer Daniels Midland Company, Cargill Incorporated, Du Pont De Nemours and Company, Ashland Global Holdings Inc., The DOW Chemical Company, Barentz, Ingredion, Brenntag AG, and Roquette Freres, among others.

Driving Factors

Increasing demand for ready-to-eat food

Due to changing consumer lifestyles and hectic schedules, people desire items with a long shelf life. Ready-to-eat foods are ready for consumption without prior preparation or cooking, therefore, they are popular due to the convenience they provide. Ready-to-eat or processed food items are boosting the use of food humectants since they help to keep the product moist.

According to the 2020 Eating Better’s Ready Meals Snapshot Survey, 88% of adults in England consume ready-to-cook foods or ready breakfasts and dinners, and one in every five people consume packed meals on a weekly basis. In 2020, about 36% of Americans ate ready-to-eat meals. Every week, two in every five UK adults consume pre-packaged meals. Thus, increasing demand for ready-to-eat food is anticipated to fuel the demand for humectants.

Rising in diseases due to food contamination

The food industry’s demand for humectants is stimulated by rising awareness regarding the nutritional value of foods, as well as a rise in the prevalence of different diseases due to food contamination. Humectants are often used as food additives. According to a 2017 report, one out of every nine individuals in the world is either hungry or malnourished. This figure is likely to rise in the future years. Diseases caused by food poisoning have skyrocketed in recent years.

According to WHO or World Health Organization statistics, approximately 125,000 children die each year from malnutrition and food poisoning, and over 40% of children under the age of five suffer from foodborne infections. To avoid deaths from improper food intake, the government is launching measures to encourage people to consume safe and healthy food. Thus, an increase in diseases caused due to food contamination is expected to boost the demand for humectants during the forecast period.

Increasing demand for anti-aging skin-care products

Aging is a global phenomenon, and almost every country is seeing an increase in the number and proportion of older people in their population. Because population aging is increasing in most nations around the globe, anti-aging skin care products are in high demand among consumers.

More consumers are requesting premium natural-sourced cosmetics due to their strong spending power in both developed and developing countries. Humectants are in high demand since they are a vital component of cosmetic compositions.

Restraining Factors

Effects on stability

Humectants can occasionally have an impact on the stability and shelf life of cosmetic and skincare products. They can trigger the degradation of other active substances or changes in texture and appearance over time, especially in poorly formulated or properly kept products. Thus, stability issues associated with humectants may restrain the market growth during the projected time period.

Risk of microbial contamination

Humectants can improve the environment for the growth of microorganisms such as bacteria and fungi. Excess moisture on the skin can significantly raise the risk of infection or skin irritation, especially in people who have impaired skin barriers or have certain skin diseases. Therefore, concerns related to microbial contamination may limit the market growth during the forecast period.

Environmental issues

Humectant production and extraction frequently necessitate large amounts of energy. Certain humectants may contribute to greenhouse gas emissions and climate change depending on their source and manufacturing technique. Furthermore, energy-intensive extraction methods for getting humectants from seawater, such as desalination, can have environmental effects.

Some humectants, particularly those found in cosmetics and food packaging, can contribute to trash creation. Improper disposal of these products or their packing materials can result in pollution, especially if they wind up in landfills or are not properly recycled. Thus, environmental concerns associated with humectants may restrain the market growth during the estimated time period.

By Product Type Analysis

Sugar Alcohol is the leading segment

Sugar alcohol humectants have seen significant growth as a sugar substitute in certain meals, particularly those labeled “no added sugar” or “sugar-free.” As people worldwide become more aware of the benefits of eating low-calorie foods, sugar alcohol humectants are expected to witness high demand during the forecast period.

On the other hand, the glycol segment is expected to witness high growth during the estimated time period. Glycol humectants are highly popular due to their widespread use in skincare cosmetics, and hair care products like creams, serums, lotions, and shampoos. Propylene glycol is one of the most preferred glycols since it is regarded as a safe cosmetic product. Propylene glycol is also found in frozen dairy products, beer, packaged baked foods, coffee, soda, etc.

By Source Analysis

Natural source dominates the market

Natural humectants can be found in a variety of soaps, cosmetics, and moisturizers. Glycerin, honey, aloe vera, and lactic acid are among them. The rise in the number of customers who are concerned about hydration and skin care, as well as the increasing adoption of natural and organic components in personal care as well as skincare products, are important factors driving the growth of the segment during the forecast period.

Synthetic humectants are expected to witness growth at a high rate over the forecast period. Synthetic humectants are the ones that can promote skin moisture and are manufactured in a lab. Ectoin and Methyl Gluceth, for example, are tiny, compact molecules with several hydrogen-binding sites. Glycols promote hydration by passing between the hydrophilic heads of Ceramides or disturbing their arrangement entirely. They can also be used to substitute water in order to maintain skin cells’ flexibility because they have a lower vapour pressure and evaporate more slowly than water.

Due to their low cost of manufacturing and longer shelf life, synthetic humectants such as glycerin, urea, sodium lactate, butylene glycol, and sorbitol are frequently utilized in several personal care and cosmetic products. As a result, the increased use of synthetic humectants in the cosmetics industry will be a crucial element driving the segment’s growth.

By Application

Food and beverage sector accounts for the largest share

Key benefits offered by humectants, such as prolonging the shelf life of a product, and boosting product effectiveness, are driving its demand in the food and beverage industry. Moreover, increasing innovations in the area of applications in humectants in the food industry by key market players, as well as rising extensive research activities in the food and beverage industry, are expected to promote the demand for humectants over the estimated time period.

Furthermore, more manufacturers are using ingredients that are suitable for human consumption in order to provide safety and applicability to consumers in the food industry. This is expected to further fuel the demand for humectants in the food and beverage sector during the projection period.

Moreover, the oral and personal care segment is anticipated to experience high growth over the projected time period. Humectants’ ability to retain moisture is an important feature due to which it is widely used while formulating several oral and personal care products. It is a key factor driving the growth of the segment.

Humectants provide numerous skin advantages. In medicine, humectants are used to treat illnesses such as eczema and psoriasis. The cosmetics sector is driving growth in the humectant market. Humectants are substances used by cosmetics makers in a variety of products. Creams, lotions, and cosmetics are examples of skincare products. Furthermore, humectants are used in hair care products to improve gloss and moisture retention.

Humectants Key Market Segments

By Product Type

- Sugar Alcohol

- Glycols

- Alpha Hydroxy Acid

- Other Product Types

By Source

- Natural

- Synthetic

By Application

- Food & Beverage

- Oral & Personal Care

- Pharmaceuticals

- Other Applications

Opportunity

Investments in cosmetic industry

Over the years, there has been a tremendous increase in investments in the beauty and cosmetics industry. According to Crunchbase data, venture-backed firms in the beauty and cosmetics industry, including brands and marketplaces, raised around $1.9 billion in capital in more than 150 transactions in 2021. This is close to the approximately $2.1 billion raised by VC-backed beauty and cosmetics start-ups over 250 rounds during 2020.

In 2016, 278 rounds of funding were raised by VC-backed start-ups in the beauty and cosmetics industry, totaling less than $780 million. The largest fund raises in the space since 2018 include the Wipro Ventures and Amazon-led $71 million Series C round in MyGlamm in July 2021, ChrysCapital’s $50 million investment in Wow Skin Science, and the Sequoia Capital India-led $45 million fundraising in beauty marketplace Purplle, both in March 2021. Thus, such high investments in the beauty and cosmetics industry are expected to provide lucrative growth opportunities for the market in the upcoming time period.

Trends

Demand for natural ingredients

Because of the growing popularity of natural and organic components in consumer products, plant-based and bio-derived humectants are being developed at a high extent. A humectant derived from plants is a chemical that retains water molecules from its surroundings, and thus, they are an excellent ingredient for skincare products because they can assist in hydrating and moisturize the skin.

Plant-based humectants are frequently sourced from natural sources, such as fruits and vegetables, making them mild and safe to use on the skin. They’re also frequently obtained from natural sources like honey, aloe vera, and glycerin. Therefore, they are readily available, are cost-effective, and have fewer side-effects, and hence are being preferred by manufacturers as well as consumers.

Regional Analysis

The North America region is anticipated to hold the largest share of 35% in the market during the forecast period. It can be attributed to the health benefits offered by humectants along with high growth in North American beauty and pharmaceutical industries. Also, the growing demand for ready-to-eat food in countries like the United States and Canada is likely to drive the demand for humectants in the food and beverage industry in North America.

The Asia Pacific region is anticipated to witness high growth during the estimated time period. The high growth in the Asia Pacific region is due to changing lifestyles of consumers who are adopting a healthy lifestyle as a result of rising disposable income and increased demand for functional and nutritional food, which supports market growth, particularly in India and China.

Moreover, rising awareness about food additives among consumers is likely to boost market expansion in the region over the forecast period. Natural components are typically favored over synthetic ones in Europe. This is because it is widely assumed that natural components are less harmful to the skin than synthetic ones. Many European countries have tougher rules governing the use of chemicals in cosmetics than other parts of the world. As a result, cosmetics producers are less likely to use potentially dangerous substances in their products, such as synthetic humectants.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Humectants market is considerably competitive, and major players account for a large share of the overall revenue. The market is growing at a high pace due to rising demand for nutritional foods.

Also, strategic investments in the food, as well as cosmetic industry, is one of the main factors boosting competition among major industry players. Additionally, mergers and acquisitions and the launch of new products by key market players are likely to have a positive impact on market growth in the upcoming years.

Top Key Players in the Market

- BASF SE

- Archer Daniel Midland Company

- Cargill Incorporated

- Du Pont De Nemours and Company

- Ashland Global Holdings Inc.

- The DOW Chemical Company

- Barentz

- Ingredion

- Brenntag AG

- Roquette Freres

- Other Key Players

Recent developments in the Humectants Market

- September ’22: Beauté by Roquette PO 160 was launched by Roquette Frères. This COSMOS-humectant and moisturizer provides great bacteriological characteristics. Through this product launch, the company is expected to satisfy an increasing demand from consumers for natural and organic components or ingredients that precisely reduce scalp irritation as well as soothe the skin, at the same time conserving a variety of skin microorganisms.

- June ’19: In order to suit evolving consumer food preferences and interests, Cargill launched its first innovation center in Singapore.

Report Scope

Report Features Description Market Value (2022) US$ 30.3 Bn Forecast Revenue (2032) US$ 61.4 Bn CAGR (2023-2032) 7.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Sugar Alcohol, Glycols, Alpha Hydroxy Acid, and Other Product types; By Source- Natural, Synthetic; by Application – Food & Beverage, Oral & Personal Care, Pharmaceuticals, and Other Applications Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Archer Daniel Midland Company, Cargill Incorporated, Du Pont De Nemours and Company, Ashland Global Holdings Inc., The DOW Chemical Company, Barentz, Ingredion, Brenntag AG, Roquette Freres, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the global humectants market ?The global Humectants market was valued at US$ 30.3 billion in 2022 and will reach US$ 61.4 billion by 2032.

What is Humectants Market ?Humectants are chemicals that attract water from the surrounding environment or within deep layers of the skin. They are commonly used in hair and skincare products to retain moisture.

What are the driving factors for the Humectants market?The increasing demand for ready-to-eat food, rising diseases due to food contamination, and the increasing demand for anti-aging skincare products are driving the Humectants market.

Which segment dominates the Humectants market by product type?The sugar alcohol segment is the leading segment in the Humectants market, driven by the demand for low-calorie foods.

What opportunities are present in the Humectants market?The increasing investments in the cosmetic industry and the demand for natural ingredients in consumer products provide growth opportunities for the Humectants market.

What are the key product types in the global Humectants market?The key product types in the Humectants market include Sugar Alcohol, Glycols, and Alpha Hydroxy Acid.

Which application sectors drive the demand for humectants?The main application sectors driving the demand for humectants are Food & Beverage, Oral & Personal Care, and Pharmaceuticals.

Who are the key players in the Humectants market?The key players in the Humectants market include BASF SE, Archer Daniels Midland Company, Cargill Incorporated, Du Pont De Nemours and Company, Ashland Global Holdings Inc., The DOW Chemical Company, Barentz, Ingredion, Brenntag AG, Roquette Freres, and other key players.

What is the future of the Humectants market in the upcoming years?The market has a positive growth potential due to the increasing demand for nutritional foods, strategic investments, and the launch of new products by key market players.

What are the advantages of using natural humectants in personal care products?Natural humectants sourced from fruits, vegetables, honey, and aloe vera are mild, safe, readily available, cost-effective, and have fewer side effects compared to synthetic humectants.

-

-

- BASF SE

- Archer Daniel Midland Company

- Cargill Incorporated

- Du Pont De Nemours and Company

- Ashland Global Holdings Inc.

- The DOW Chemical Company

- Barentz

- Ingredion

- Brenntag AG

- Roquette Freres