Global Generic Pharmaceuticals Market, By Type (Simple Generics, Specialty Generics, and Biosimilars), By Route of Administration (Oral, Injectable, Inhalable, and Other Routes of Administration), By Distribution Channel, By Application, By Region and Companies - Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Apr 2024

- Report ID: 103884

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

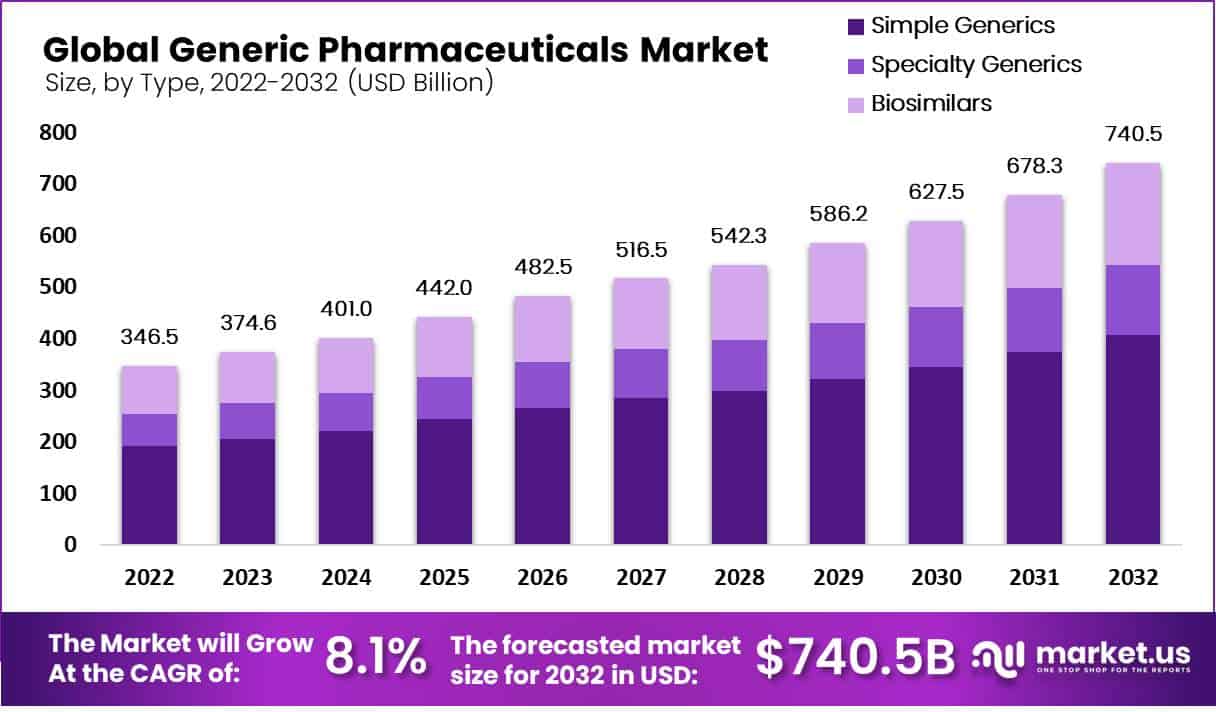

In 2022, the Global Generic Pharmaceuticals Market was worth USD 346.5 Billion. It is expected to reach USD 740.5 Billion growing at a CAGR of 8.1% between 2023-2032.

Generic pharmaceuticals, also known as generic drugs, are medications that are produced and marketed without a brand name after the patent protection of the original brand-name drug has expired.

These drugs are essentially bioequivalent to their brand-name counterparts, meaning they contain the same active ingredients and are administered in the same way, dosage form, strength, as well as route of administration. They are typically less expensive than brand-name drugs. This is because generic manufacturers do not have to invest in the extensive research, development, and marketing expenses that brand-name drug companies incur.

As a result, generic drugs offer a more affordable alternative, making healthcare more accessible to a larger population. While generic drugs have the same active ingredients as brand-name drugs, there may be minor differences in inactive ingredients, such as fillers, colorants, or preservatives. These differences do not affect the drug’s safety or efficacy since generic drugs are still required to meet specific standards for bioequivalence.

The increasing geriatric population, rising prevalence of chronic disorders, and a rise in healthcare spending around the globe are key factors stimulating the demand for generic pharmaceuticals. Also, a significant increase in abbreviated new drug applications (ANDAs), along with the launch of new generic drugs, is expected to contribute to the generic pharmaceuticals market growth during the projection period.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The global market for generic pharmaceuticals was valued at USD 346.5 billion in 2022, with a projected growth to USD 740.5 billion by 2032.

- Generics offer a cost-effective alternative, growing at a CAGR of 8.1% from 2023 to 2032, due to lower research and development investments.

- Stringent regulatory standards ensure that generics maintain bioequivalence and quality comparable to brand-name drugs, enhancing consumer trust and market stability.

- Patent expirations facilitate the entry of generic drugs, significantly boosting market expansion by providing cheaper alternatives to brand-name medications.

- The prevalence of chronic diseases globally drives demand for affordable generics, with significant market contributions from the aging demographic.

- The oral administration segment dominates the market, accounting for a 61% revenue share in 2022, favored for its convenience and safety.

- Retail pharmacies were the leading distribution channel in 2022, capturing a 39% revenue share, favored due to widespread prescription fulfillment.

- North America leads the generic pharmaceuticals market, holding a major revenue share, propelled by high disease prevalence and advanced regulatory practices.

- Technological advancements and regulatory changes are streamlining generic drug approvals, reducing costs, and improving market access.

- Significant investments in healthcare in developing countries are creating lucrative growth opportunities for the generic pharmaceuticals sector.

Driving Factors

Rising Prevalence of Chronic Diseases

Numerous people’s health and quality of life have been impacted by chronic diseases on a global scale. Chronic or non-communicable diseases are on the rise worldwide and are responsible for 73% of all fatalities, according to the Department of Biotechnology, Government of India. Non-communicable illnesses are responsible for 53% of all fatalities and 44% of lost years of life due to disability in India.

According to the International Diabetes Federation, India has the greatest prevalence of diabetes in the world, with an estimated 77 million people currently suffering from the disease and an additional 134 million expected by 2045. The Centers for Disease Control and Prevention (CDC) estimates that six out of ten Americans have at least one chronic illness, such as diabetes, cancer, heart disease, or stroke.

Thus, as a result of the rise in the prevalence of chronic diseases, more people around the globe are looking for cost-effective treatments and drugs, and therefore, it is a key factor that is expected to fuel the generic pharmaceuticals market growth over the forecast period.

Increasing Geriatric Population

Unquestionably, one of the most significant social trends of our century is population aging. The World Health Organization (WHO) reported that “the number of people 65 or older is projected to grow from an estimated 524 million in 2010 to nearly 1.5 billion in 2050, with the majority of the increase in developing countries.

Additionally, it is anticipated that by 2050, the proportion of adults 65 and older will be much higher than that of children under the age of 5. The geriatric population is more likely to suffer from different chronic diseases. When chronic noncommunicable illnesses replaced infections as the major cause of mortality, life expectancy improved, which is what the WHO credits to the senior population’s quick growth.

Hypertension, high cholesterol, arthritis, diabetes, heart disease, cancer, etc., are examples of these chronic diseases. Thus, the rising geriatric population is expected to boost the demand for generic pharmaceuticals during the projection period.

Rise in ANDA Approvals

Over the years, there has been a significant increase in the number of ANDA approvals, especially, in the case of generic drugs. The number of ANDAs approved in 2021 was 948 compared to 776 in 2020, which represents a significant increase, as per the Generic Drugs Annual report released by the United States Food & Drug Administration or FDA.

Additionally, in 2021, it was reported that 100 ANDAs had been approved. Indian corporations topped the ANDA approvals in 2022, accounting for 355 or 48% of all approvals, according to a review of 2022 ANDA approvals. This further raises their proportion from 42% (267 approvals) from the previous year, resulting in a 33% increase in ANDA approvals for Indian companies compared to 2021. In terms of the number of ANDA approvals, the US, China, Europe, and Israel, followed India in that order. Thus, a rise in ANDA approvals is expected to boost the growth of the generic pharmaceuticals market during the estimated time period.

Restraining Factors

Quality and Efficacy Issues

Although generic drugs are required to meet the same regulatory standards for safety, efficacy, and quality as their brand-name counterparts, some people have concerns about the consistency and reliability of generic medications. Variations in manufacturing processes, inactive ingredients, and formulations can lead to differences in the performance and effectiveness of generic drugs compared to their brand-name counterparts. Thus, quality and efficacy risks associated with the use of generic pharmaceuticals may limit the generic pharmaceuticals market growth during the projected time period.

Lack of Adequate Options

While there are generic alternatives available for many brand-name drugs, there are instances where generic versions may not exist or may be limited. This is particularly true for complex or specialized medications, such as biologics, which are more challenging to replicate due to their complex manufacturing processes. As a result, patients may not have the option to switch to a generic alternative, limiting their choices. As a result, a lack of adequate options is expected to have a negative impact on the growth of the generic pharmaceuticals market during the projection period.

Trust and Perception Issues

There is a perception among some individuals that generic drugs are of lower quality or less effective than brand-name drugs. This perception can be influenced by factors such as the appearance, packaging, and price difference between generic and brand-name drugs. Such trust issues may lead to some patients being skeptical about the effectiveness of generic medications, even when they are bioequivalent to their brand-name counterparts. Therefore, such trust issues may restrain the generic pharmaceuticals market growth during the estimated time period.

By Type Analysis

Simple Generics are Likely to Witness Highest Demand

The simple generics segment dominated the market in 2022 with the largest revenue share of 55%. The growth of the segment is driven by the presence of a simple and clear regulatory pathway for the approval of simple generic medications. Moreover, the implementation of several government initiatives for reducing healthcare expenditure on pharmaceuticals is likely to fuel the segment growth during the projection period.

Also, biosimilars are expected to witness high growth over the forecast period. The cost-effectiveness offered by biosimilars in the treatment of various chronic diseases is a key factor that is expected to fuel the growth of the segment during the projection period. Moreover, a rise in the approval of biosimilars and key strategic initiatives such as partnerships and collaborations are expected to contribute to the growth of the segment over the forecast period.

By Route of Administration Analysis

The Oral Route of Administration is Mostly Preferred

The oral segment leads the route of the administration segment by accounting for a revenue share of 61% in 2022. The easiest, most practical, and safest method of drug delivery is through the oral route. The growth of the segment is stimulated by the increasing product launches and partnerships. For instance, the USFDA announced the ANDA approval for a generic version of Cystadane1 (anhydrous betaine oral solution) Powder in a container of 180 gm and granted competitive generic treatment (CGT) 180 days of exclusivity, according to a February 2022 announcement from Oakrum Pharma, LLC and ANI Pharmaceuticals.

Also, the injectable segment is anticipated to witness high growth over the projection period. Injectable generic drugs are expected to witness high demand due to their fast onset of action, high bioavailability, and uniform absorption of the drug. Moreover, the high prevalence of chronic diseases is anticipated to fuel the demand for efficient generic injectables.

By Distribution Channel Analysis

Retail Pharmacies Lead the Generic Pharmaceuticals Market

The retail pharmacies segment is likely to hold the largest revenue share of 39% in 2022. A high number of filled prescriptions for retail drugs in retail pharmacies is a major factor driving the growth of the segment. Moreover, the availability of generic drugs, biosimilar insulin, and others in the retail pharmacy chains, like, Walmart and Walgreens. are likely to contribute to the growth of the segment during the projection period.

Furthermore, online pharmacies are projected to witness the fastest growth during the estimated time period. The growth of the segment can be attributed to growing internet penetration, flexibility, and convenience offered by online pharmacies, along with the availability of a wide range of options.

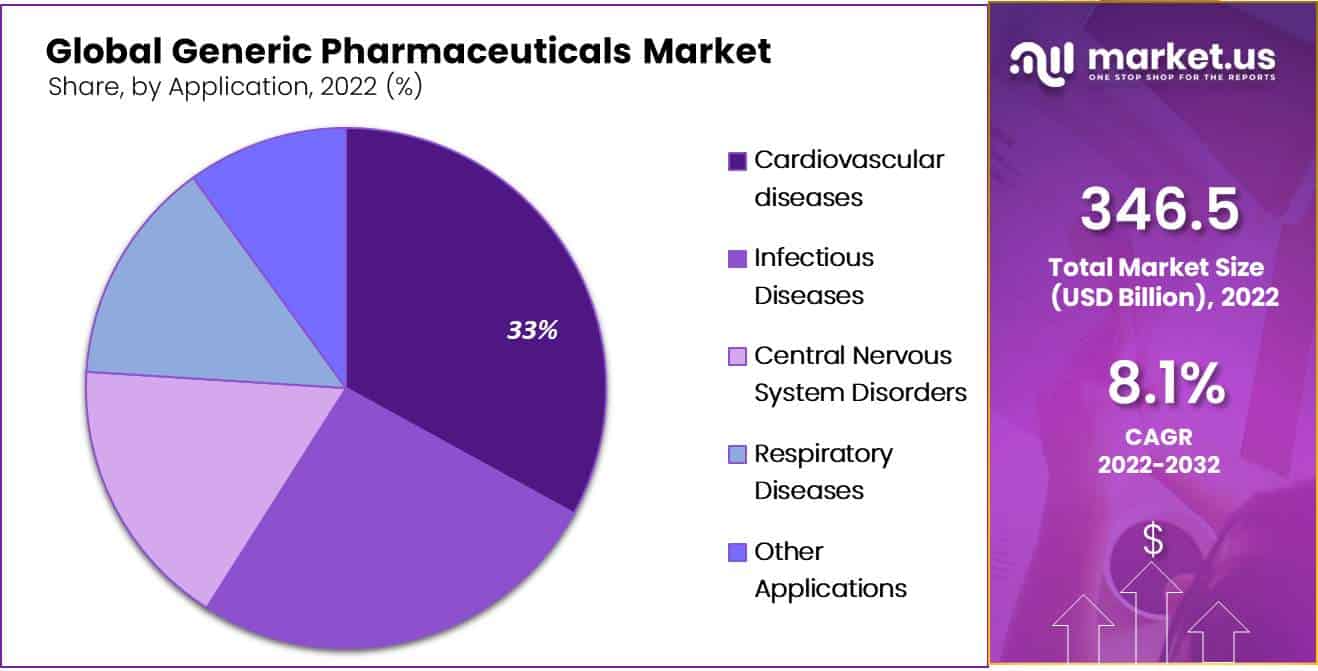

By Application Analysis

Cardiovascular Diseases Application is Expected to Grow at The Highest Rate

Cardiovascular diseases are expected to dominate the generic pharmaceuticals market, with a revenue share of 33% throughout the forecast period. The rising prevalence of cardiovascular diseases is a key factor driving the segment’s growth during the estimated time period. Also, an increase in the launch of generic drugs for the treatment of cardiovascular diseases is likely to contribute to the growth of the segment.

Moreover, infectious diseases are expected to witness growth at a high rate during the projection period. An increase in demand for anti-infective drugs due to growing incidences of infectious diseases is a key factor stimulating the growth of the segment. Also, the implementation of new R&D initiatives for the development of cost-effective anti-infective generic drugs is expected to fuel the growth of the segment.

Key Market Segments

By Type

- Simple Generics

- Specialty Generics

- Biosimilars

By Route of Administration

- Oral

- Injectable

- Inhalable

- Other Routes of Administration

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Other Distribution Channels

By Application

- Cardiovascular diseases

- Infectious Diseases

- Central Nervous System Disorders

- Respiratory Diseases

- Other Applications

Growth Opportunity

High Healthcare Investment in Developing Countries

Several developing nations all over the world are heavily investing in the healthcare sector. As per the 2023 Economic Survey, India’s public healthcare spending increased to 2.1% in 2021–2022 from 1.8% of GDP in 2020–2021. A comprehensive amount of USD 10.76 billion was received by the Ministry of Health and Family Welfare from the Union government in the Union Budget for the financial year 2023–2024.

To improve the nation’s healthcare infrastructure, the Indian government plans to implement a credit incentive program of USD 6.8 billion. The Brazilian Ministry of Health announced investments in healthcare IT totaling $83 million in March 2023 for the digitalization of the public basic healthcare system for the years 2020 to 2028. Thus, high healthcare investments in developing nations are likely to provide lucrative growth opportunities for the generic pharmaceuticals market in the upcoming years.

Latest Trends

Regulatory Changes and Technological Advancements

Regulatory authorities worldwide are focusing on streamlining the approval process for generic drugs, which can reduce the time and cost associated with bringing generic medications to market. These changes aim to promote competition and increase patient access to affordable drugs. This is likely to benefit a large section of patients around the globe.

Moreover, advancements in manufacturing technologies, such as continuous manufacturing and 3D printing, are being explored to improve efficiency, reduce costs, and enhance the quality of generic pharmaceuticals. Additionally, digital solutions and data analytics are being used to optimize manufacturing processes and supply chain management. Hence, advancements in technology, along with positive regulatory changes, are new trends that are likely to boost the growth of the generic pharmaceuticals market in the upcoming time period.

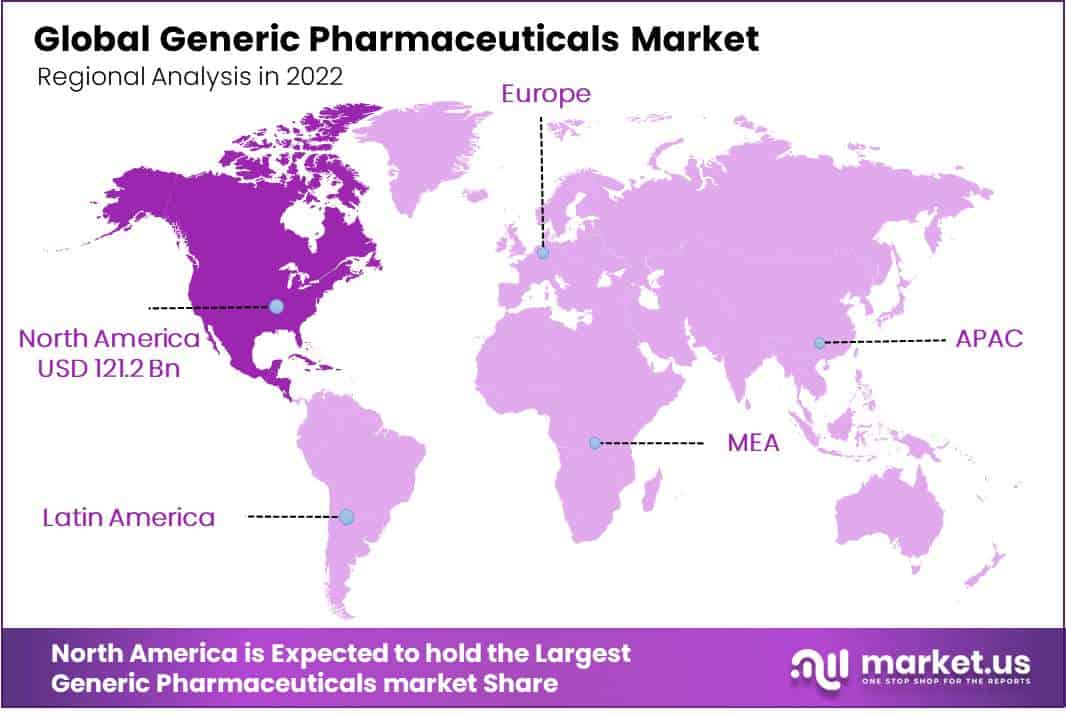

Regional Analysis

North America Leads the Market By Holding Major Revenue Share in Account

The North American region is expected to hold the largest share of 35% in the market during the projected time period. The growth of the generic pharmaceuticals market in the region is driven by key factors such as the increasing number of ANDA approvals, the rising prevalence of chronic diseases, and the increasing number of favorable government initiatives. Moreover, a rising number of product launches and technological advancements in the pharmaceutical sector are anticipated to boost market growth in the region throughout the forecast period.

Moreover, the Asia-Pacific region is likely to witness high growth during the estimated time period. The growth of the market in the region can be attributed to the rise in the geriatric population, along with the high prevalence of chronic diseases such as cancer, diabetes, cardiovascular diseases, etc. Also, high healthcare spending among Asian nations is expected to fuel the expansion of the generic pharmaceuticals market throughout the region during the projection period.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Generic Pharmaceuticals market is highly competitive and consists of several market players which dominate the market. The market is anticipated to grow at a high rate during the projection period due to increasing demand for generic pharmaceuticals in the treatment of several chronic diseases.

Additionally, increasing ANDA approvals, the launch of new generic drugs, strategic investments, and key partnerships and collaborations are likely to contribute to the growth of the market in the upcoming time period.

Top Players

- Pfizer Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Abbott Laboratories

- GlaxoSmithKline PLC

- Sun Pharmaceutical Industries Ltd

- Eli Lilly and Company

- Mylan N.V.

- Sun Pharmaceutical Industries Ltd

- Reddy’s Laboratories Ltd.

- Other Key Players

Recent Developments

- In January 2023, the generic version of Apalutamide, which is a drug specifically used in prostate cancer treatment, was launched in India by BDR Pharmaceuticals, a manufacturer of different cancer medications. In India, this brand new generic version of the drug is available in 60 mg dose strength under the trade name APATIDE for the treatment of metastatic castration-sensitive and non-metastatic castration-resistant prostate cancer.

- In July 2021, Lupin, an Indian multinational pharmaceutical company, announced that it had acquired Southern Cross Pharma Pty Ltd (SCP), a pharmaceutical company based in Australia. The SCP essentially focused on generic drug production for the treatment of different chronic illnesses like cardiovascular disease, cancer, diabetes, and others.

Report Scope

Report Features Description Market Value (2022) USD 346.5 Billion Forecast Revenue (2032) USD 740.5 Billion CAGR (2023-2032) 8.1% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Simple Generics, Specialty Generics, and Biosimilars, By Route of Administration- Oral, Injectable, Inhalable, and Other Routes of Administration, By Distribution Channel- Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Other Distribution Channels, By Application- Cardiovascular diseases, Infectious Diseases, Central Nervous System Disorders, Respiratory Diseases, and Other Applications Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Sanofi, Teva Pharmaceutical Industries Ltd., Novartis AG, Abbott Laboratories, GlaxoSmithKline PLC, Sun Pharmaceutical Industries Ltd, Eli Lilly and Company, Mylan N.V., Sun Pharmaceutical Industries Ltd, Dr. Reddy’s Laboratories Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Generic Pharmaceuticals Market?In 2022, the global Generic Pharmaceuticals Market was valued at USD 346.5 billion.

What will be the market size for Generic Pharmaceuticals Market in 2032?In 2032, the Generic Pharmaceuticals Market will reach USD 740.5 billion.

What CAGR is projected for the Generic Pharmaceuticals Market?The Generic Pharmaceuticals Market is expected to grow at 8.1% CAGR (2023-2032).

List the segments encompassed in this report on the Generic Pharmaceuticals Market?Market.US has segmented the Generic Pharmaceuticals Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Simple Generics, Specialty Generics and Biosimilars. By Route of Administration, the market has been further divided into Oral, Injectable, Inhalable and Other Routes of Administration.

Which segment dominate the Generic Pharmaceuticals industry?With respect to the Generic Pharmaceuticals industry, vendors can expect to leverage greater prospective business opportunities through the Simple Generics segment, as this dominate this industry.

Name the major industry players in the Generic Pharmaceuticals Market.Pfizer Inc, Sanofi, Teva Pharmaceutical Industries Ltd, Novartis AG, Abbott Laboratories, GlaxoSmithKline PLC and Other Key Players are the main vendors in this market.

Generic Pharmaceuticals MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample

Generic Pharmaceuticals MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Abbott Laboratories

- GlaxoSmithKline PLC

- Sun Pharmaceutical Industries Ltd

- Eli Lilly and Company

- Mylan N.V.

- Sun Pharmaceutical Industries Ltd

- Reddy’s Laboratories Ltd.

- Other Key Players