Global Bunker Fuel Market By Type (Low Sulfur Fuel Oil, High Sulfur Fuel Oil, Marine Gas Oil, Others), By Commercial Distributor (Oil Majors, Large Independent, Small Independent), By Application (Oil Tanker, Bulk Carrier, General Cargo, Chemical Tanker, Fishing Vessels, Gas Tankers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147416

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

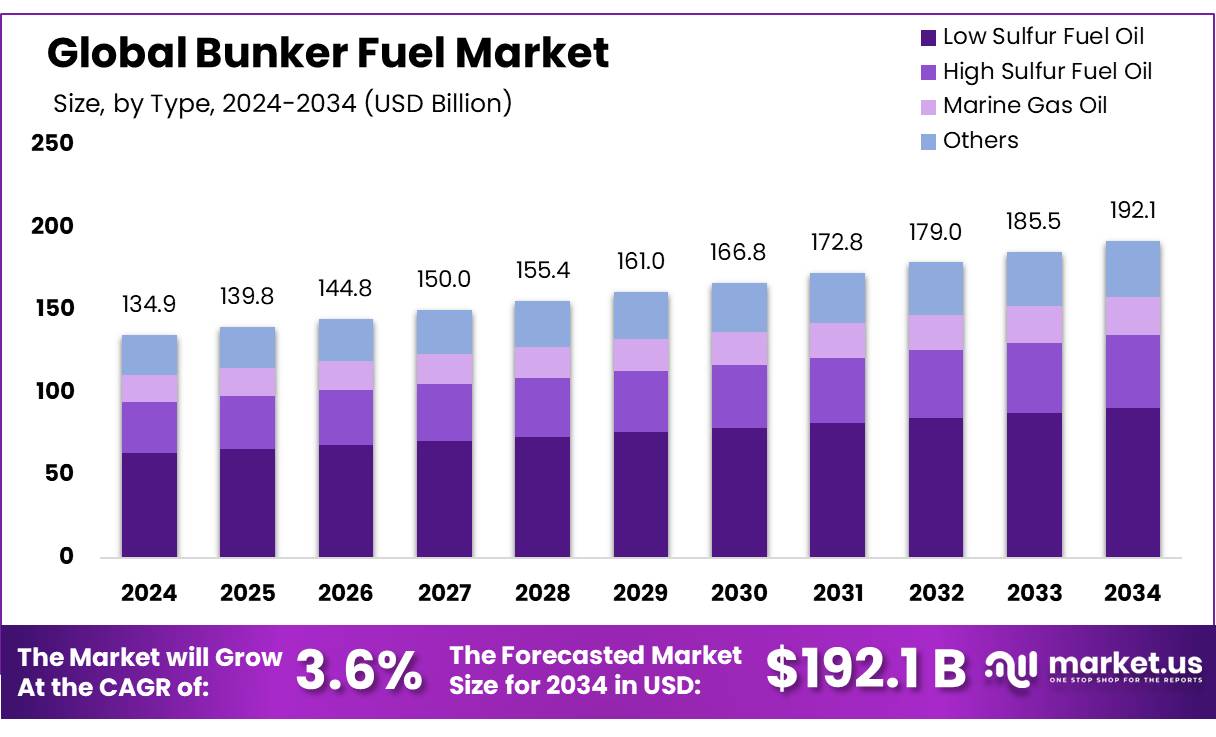

The Global Bunker Fuel Market size is expected to be worth around USD 192.1 Billion by 2034, from USD 134.9 Billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

The Global Bunker Fuel Market is currently undergoing significant transformations, driven by stringent environmental regulations and shifting industry dynamics towards sustainability. Bunker fuel, primarily used to power ships and large vessels, has been a critical component in global trade, facilitating the transportation of goods across international waters.

Bunker fuel encompasses various grades, including High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), and Liquefied Natural Gas (LNG). In 2022, low-sulfur fuel oil accounted for 66% of the global bunker fuel market revenue, reflecting the industry’s shift towards cleaner energy sources in compliance with international regulations. Government initiatives, such as Singapore’s plan to supply over 1 million metric tons of low-carbon methanol annually by 2030, underscore the industry’s commitment to sustainable practices.

The bunker fuel is characterized by ongoing efforts to address environmental concerns, especially regarding emissions from marine vessels. The International Maritime Organization (IMO) has introduced stringent regulations aimed at reducing sulfur emissions from ships. Since January 2020, ships have been required to use bunker fuel with a sulfur content of no more than 0.5%, a significant decrease from the previous limit of 3.5%. This shift has had a profound impact on the bunker fuel market, pushing the adoption of low-sulfur fuel oil (LSFO) and other alternatives such as LNG (liquefied natural gas) and biofuels.

Driving factors in the bunker fuel market include the growing demand for maritime trade, especially in emerging economies. The rise in global trade has led to increased shipping activity, particularly in regions such as Asia-Pacific, which accounts for the largest share of global maritime transport. According to the International Chamber of Shipping (ICS), more than 90% of the world’s trade is transported by sea, with global shipping expected to continue its growth trajectory in the coming years. In particular, containerized trade is expected to grow at an annual rate of 3.5%, increasing demand for bunker fuel.

Additionally, environmental regulations continue to push the industry toward more sustainable alternatives. The IMO’s Global Sulphur Cap of 0.5% has already led to a shift toward cleaner fuels, and further regulations are expected, including potential restrictions on greenhouse gas emissions. The European Union, for instance, has committed to decarbonizing its maritime transport sector by 2050. Governments and environmental agencies across the globe are investing in the development of alternative fuels, such as biofuels and hydrogen, to facilitate the transition to a low-carbon shipping sector.

Key Takeaways

- Bunker Fuel Market size is expected to be worth around USD 192.1 Billion by 2034, from USD 134.9 Billion in 2024, growing at a CAGR of 3.6%.

- Low Sulfur Fuel Oil (LSFO) held a dominant market position within the Bunker Fuel sector, capturing more than a 47.2% share.

- Oil Majors held a dominant market position in the distribution of bunker fuel, capturing more than a 51.7% share.

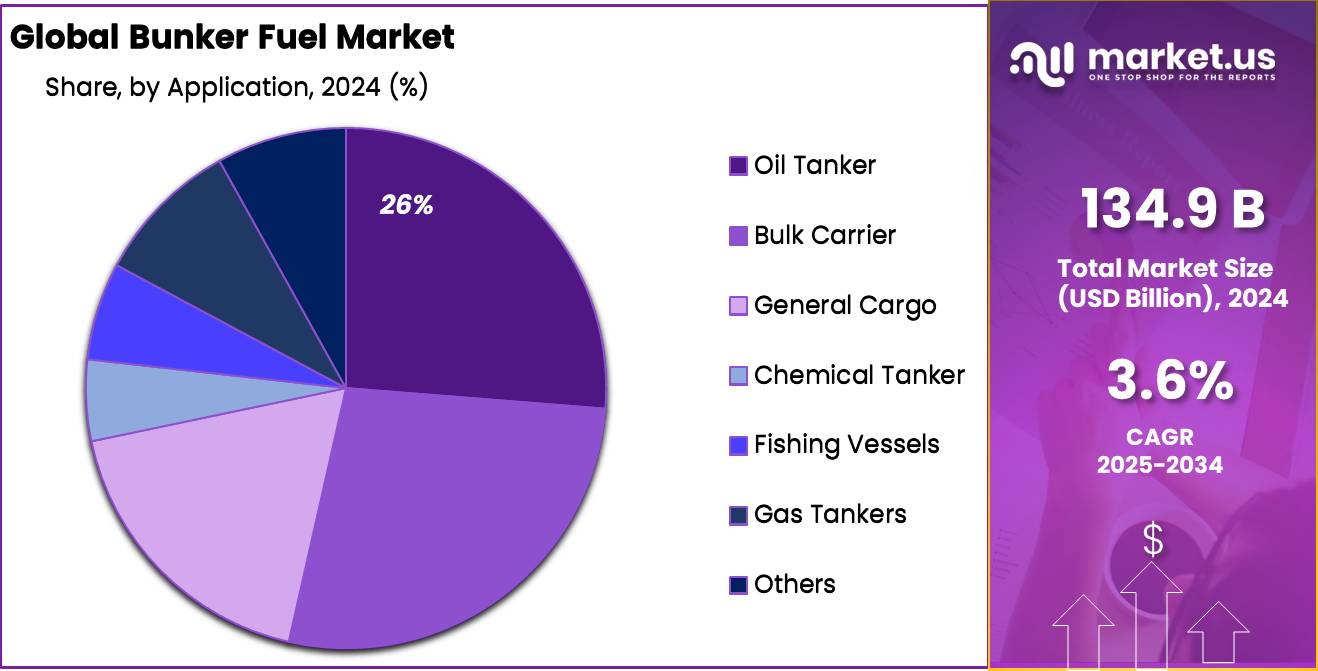

- Oil Tanker segment held a dominant market position in the bunker fuel market, capturing more than a 26.4% share.

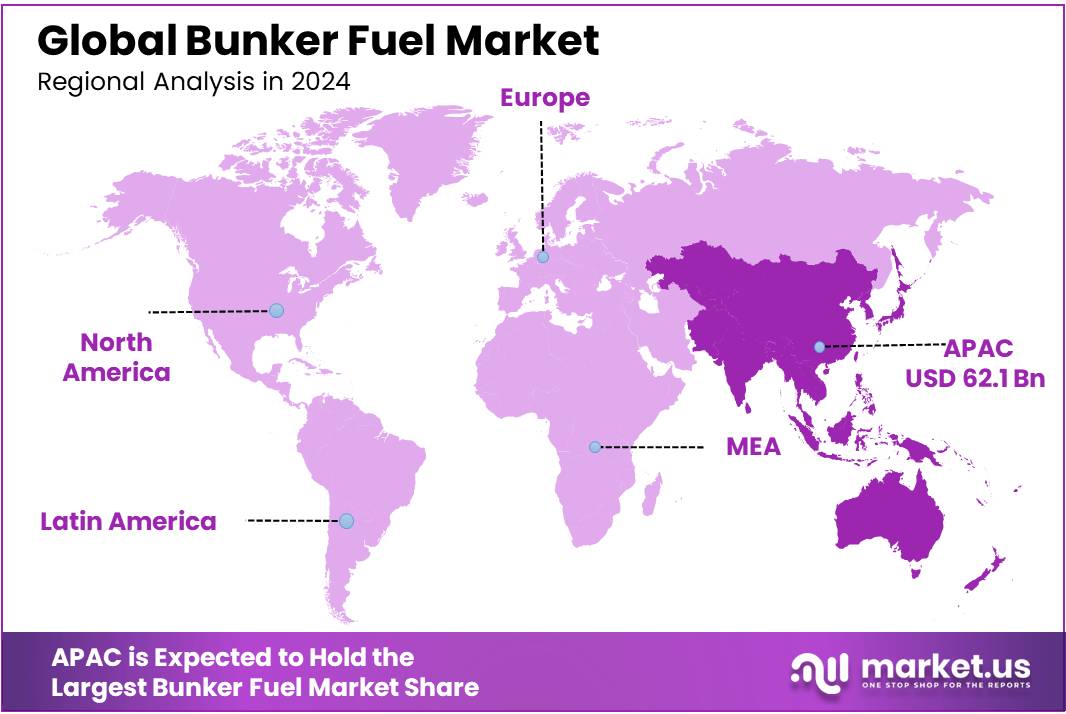

- Asia-Pacific (APAC) region holds a commanding position in the global bunker fuel market, accounting for 46.1% of the market share, which translates to a significant value of approximately USD 62.1 billion.

By Type

Low Sulfur Fuel Oil Leads with 47.2% Market Share Due to Stringent Emissions Standards

In 2024, Low Sulfur Fuel Oil (LSFO) held a dominant market position within the Bunker Fuel sector, capturing more than a 47.2% share. This considerable market presence can be largely attributed to the global push for reduced sulfur emissions in maritime operations. The International Maritime Organization’s regulations, which limit the sulfur content in marine fuels to 0.5%, have significantly influenced the shift towards LSFO. These regulations are part of a broader effort to decrease marine pollution and mitigate the environmental impact of global shipping activities.

Maritime operators worldwide have increasingly adopted LSFO to comply with these environmental standards, driving the fuel’s dominance in the market. Additionally, the adoption of LSFO has been facilitated by its growing availability and the maritime industry’s gradual shift towards more sustainable practices. As ports enhance their refueling infrastructure to accommodate cleaner fuels, LSFO’s market share is expected to maintain its strong position, reflecting the industry’s ongoing commitment to environmental compliance and sustainability.

By Commercial Distributor

Oil Majors Command a 51.7% Market Share, Reflecting Their Pivotal Role in Bunker Fuel Distribution

In 2024, Oil Majors held a dominant market position in the distribution of bunker fuel, capturing more than a 51.7% share. This significant control over the market underscores the critical role these large oil companies play in the global bunker fuel supply chain. With extensive logistics networks, substantial storage capacities, and strategic port relationships, Oil Majors are uniquely positioned to meet the complex demands of maritime fuel distribution.

The dominance of Oil Majors in the bunker fuel market is further bolstered by their ability to adapt to regulatory changes, such as the IMO’s sulfur cap requirements. By investing in refining processes that enhance the production of low-sulfur bunker fuels, these companies not only comply with environmental regulations but also cater to the growing demand for cleaner marine fuels. Their established presence and trust within the industry continue to drive their market share, ensuring that they remain at the forefront of the bunker fuel market.

By Application

Oil Tankers Lead Bunker Fuel Usage with a 26.4% Market Share, Driven by Global Oil Transport Demand

In 2024, the Oil Tanker segment held a dominant market position in the bunker fuel market, capturing more than a 26.4% share. This leadership underscores the critical role oil tankers play in the international oil trade, serving as the backbone for transporting crude oil and petroleum products across global routes. The reliance on oil tankers for maritime oil transport directly influences the demand for bunker fuel, reflecting the segment’s substantial impact on the fuel market.

Oil tankers require significant volumes of bunker fuel to operate, given their large capacities and long voyage distances. As global demand for oil continues to grow, especially in emerging economies, the need for oil tankers is expected to rise, thereby driving bunker fuel consumption. The oil tanker segment’s prominent position in the bunker fuel market is a direct result of its essential function in maintaining the flow of energy worldwide, highlighting its continued importance in the global energy supply chain.

Key Market Segments

By Type

- Low Sulfur Fuel Oil

- High Sulfur Fuel Oil

- Marine Gas Oil

- Others

By Commercial Distributor

- Oil Majors

- Large Independent

- Small Independent

By Application

- Oil Tanker

- Bulk Carrier

- General Cargo

- Chemical Tanker

- Fishing Vessels

- Gas Tankers

- Others

Drivers

Surge in International Maritime Trade Fuels Bunker Fuel Demand

One of the primary driving factors for the growth of the bunker fuel market is the significant increase in international maritime trade. As globalization expands, the movement of goods across oceans continues to escalate. According to the United Nations Conference on Trade and Development (UNCTAD), global maritime trade volumes are projected to grow annually, reflecting the escalating economic interdependence among countries and the increasing efficiency of shipping as a mode of transportation.

Government policies and initiatives play a substantial role in supporting this growth. For instance, initiatives under the International Maritime Organization (IMO), such as the International Convention for the Safety of Life at Sea (SOLAS) and the International Convention for the Prevention of Pollution from Ships (MARPOL), not only enhance maritime safety and environmental performance but also boost the shipping industry’s growth by ensuring stable and cleaner sea transport lanes.

Moreover, the development of trade corridors like China’s Belt and Road Initiative (BRI) further accentuates the demand for bunker fuel. These corridors are expected to increase shipping activities between Asia, Europe, and Africa, thereby directly boosting the demand for bunker fuel. Additionally, the expansion of canal routes such as the Panama Canal and the Suez Canal, which facilitate the passage of larger vessels, also contributes to the growing demand for bunker fuel. These infrastructural enhancements allow for more extensive and more frequent transits, increasing overall fuel consumption by the maritime sector.

Restraints

Stricter Environmental Regulations Impose Challenges on Bunker Fuel Market Growth

A major restraining factor for the bunker fuel market is the increasingly stringent environmental regulations. Governments and international bodies are imposing tougher standards to mitigate maritime pollution, significantly impacting fuel usage practices in the shipping industry. These regulations aim to reduce the harmful emissions associated with traditional bunker fuels, which include sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter.

The International Maritime Organization (IMO), under its MARPOL Annex VI regulations, has set a global limit for sulfur in fuel oil used on board ships of 0.50% m/m (mass by mass) outside designated emission control areas. This regulation, commonly referred to as IMO 2020, came into effect on January 1, 2020, and represents a significant decrease from the previous limit of 3.50% m/m established in 2012. The transition to compliant fuels, such as Very Low Sulfur Fuel Oil (VLSFO) and marine gasoil, has posed financial and operational challenges for shipping companies, affecting the overall demand for conventional high-sulfur bunker fuel.

Further compounding the issue, many regions are considering or have already implemented additional local emissions controls, such as Emission Control Areas (ECAs) in Europe and North America, where the sulfur content of fuel oils is capped at even more stringent levels (0.10% m/m). These regional regulations necessitate the use of even cleaner fuels or alternative solutions like scrubbers and LNG-powered vessels, which can be prohibitively expensive.

Opportunity

Expansion of LNG as a Cleaner Alternative Offers Growth Opportunities for Bunker Fuel Market

The bunker fuel market is experiencing significant transformational growth through the increasing adoption of Liquefied Natural Gas (LNG) as a cleaner alternative to traditional marine fuels. This shift is largely driven by the global maritime sector’s need to comply with stringent environmental regulations while maintaining operational efficiency.

LNG is touted for its environmental benefits, primarily its lower sulfur content and reduced emissions of nitrogen oxides (NOx) and carbon dioxide (CO2) compared to conventional bunker fuels. The International Maritime Organization (IMO) has been at the forefront of advocating for greener shipping practices. Its ambitious strategy aims to reduce total annual greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels. This regulatory push enhances the attractiveness of LNG as a bunker fuel.

The adoption of LNG is further supported by the development of global LNG bunkering infrastructure, which is expanding to meet the rising demand. Major ports around the world, including Rotterdam, Singapore, and Shanghai, are investing heavily in LNG bunkering facilities. These developments are essential for enabling the widespread use of LNG, ensuring that shipping companies can refuel conveniently at major shipping routes.

Moreover, the economic aspect of using LNG is becoming increasingly favorable as the price of LNG becomes more competitive relative to traditional fuels, especially with the fluctuating oil market. The long-term economic benefits, combined with regulatory compliance and reduced environmental impact, present a compelling case for shipping companies to transition to LNG.

Trends

Adoption of Digitalization and Technology Innovations in Bunker Fuel Operations

One of the most notable trends in the bunker fuel market is the rapid adoption of digitalization and technological advancements to enhance fuel management and operational efficiencies. This trend is reshaping the industry, as companies increasingly turn to technology to navigate the complexities of modern maritime fuel supply.

Digital solutions are being deployed across various stages of the bunker fuel supply chain to ensure compliance, optimize fuel consumption, and manage costs effectively. For example, digital fuel management systems allow for real-time monitoring of fuel usage and storage, helping vessel operators make informed decisions that optimize fuel efficiency and reduce emissions. These systems are crucial in helping shipping companies adhere to stringent environmental regulations while maintaining operational efficacy.

Additionally, the integration of blockchain technology is gaining traction in the bunker industry. Blockchain can provide a transparent and tamper-proof platform for recording transactions, enabling more secure and efficient operations. This technology helps in minimizing the risk of fraud and errors, ensuring that all parties in the supply chain have access to reliable and consistent data.

Artificial intelligence (AI) and machine learning (ML) are also emerging as significant tools in predicting fuel consumption patterns and optimizing routes. These technologies can analyze vast amounts of data to provide predictive insights that help reduce fuel consumption and costs, which is critical under the current economic pressures and environmental mandates.

Regional Analysis

Bunker Fuel Market Dominance in APAC: Leading with a 46.1% Market Share

The Asia-Pacific (APAC) region holds a commanding position in the global bunker fuel market, accounting for 46.1% of the market share, which translates to a significant value of approximately USD 62.1 billion. This dominance is driven by the extensive maritime activities in major APAC ports which are central to international trade routes.

APAC’s strategic importance in the bunker fuel market is underscored by the presence of some of the world’s busiest ports such as Shanghai, Singapore, and Hong Kong. These ports not only serve as crucial hubs for cargo movement but also as key locations for maritime fuel provisioning. Singapore, in particular, has cemented its status as a global bunkering hub, consistently ranking as the top port in terms of annual bunker sales. The region’s robust shipping activities are supported by its expansive shipbuilding industries and growing intercontinental trade, particularly with North America and Europe.

The market in APAC is further bolstered by its rapid economic growth, leading to increased investments in port infrastructure and maritime logistics. Governments across the region are also implementing favorable policies to support the maritime sector, including incentives for adopting cleaner bunker fuels. This is in response to global environmental regulations like the International Maritime Organization’s (IMO) sulfur cap, which has significantly influenced fuel strategies across the shipping industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aegean Marine Petroleum Network is a prominent international bunker fuel provider specializing in the supply of marine fuels and lubricants. With a vast network of service centers across major shipping routes, the company provides high-quality fuel products and services to vessels worldwide. Aegean’s strategic port locations facilitate efficient fueling operations, supporting global maritime commerce.

Bunker Holding is a global leader in the marine fuel sector, providing purchasing, sales, and supply services of bunker fuels. The company’s comprehensive portfolio includes risk management and price hedging solutions that cater to the specific needs of the maritime industry. With over 30 years of experience, Bunker Holding prides itself on its deep market knowledge and customer-focused approach.

BP is one of the world’s leading oil and gas companies, and its involvement in the bunker fuel market underscores its broad operational scope. The company supplies high-grade bunker fuels compliant with international regulations to a wide range of customers in the shipping industry. BP’s extensive experience in energy solutions further enhances its capability to meet the diverse needs of maritime operators globally.

Top Key Players in the Market

- Aegean Marine Petroleum Network

- BP p.l.c.

- Bunker Holding

- Chevron Corporation

- Cockett Marine Oil

- Exxon Mobil Corporation

- GAC Bunker Fuels

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd.

- KPI OceanConnect

- LUKOIL

- Mercuria Energy Group

- Minerva Bunkering

- Neste

- Peninsula Petroleum

Recent Developments

Aegean Marine has developed a robust infrastructure with a widespread network of fueling stations across key global ports, ensuring efficient service delivery that aligns with the stringent regulations of the shipping industry. Their operational strategy not only emphasizes compliance with international standards but also focuses on sustainable practices, aiming to reduce the environmental impact of marine operations.

In 2024, BP Marine expanded its offerings in Wellington Harbour by introducing the region’s first bio-VLSFO (Very Low Sulfur Fuel Oil), aligning with the International Maritime Organization’s (IMO) regulations to reduce sulfur emissions in marine fuels.

Report Scope

Report Features Description Market Value (2024) USD 134.9 Billion Forecast Revenue (2034) USD 192.1 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Low Sulfur Fuel Oil, High Sulfur Fuel Oil, Marine Gas Oil, Others), By Commercial Distributor (Oil Majors, Large Independent, Small Independent), By Application (Oil Tanker, Bulk Carrier, General Cargo, Chemical Tanker, Fishing Vessels, Gas Tankers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aegean Marine Petroleum Network, BP p.l.c., Bunker Holding, Chevron Corporation, Cockett Marine Oil, Exxon Mobil Corporation, GAC Bunker Fuels, Hindustan Petroleum Corporation Limited, Indian Oil Corporation Ltd., KPI OceanConnect, LUKOIL, Mercuria Energy Group, Minerva Bunkering, Neste, Peninsula Petroleum Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aegean Marine Petroleum Network

- BP p.l.c.

- Bunker Holding

- Chevron Corporation

- Cockett Marine Oil

- Exxon Mobil Corporation

- GAC Bunker Fuels

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd.

- KPI OceanConnect

- LUKOIL

- Mercuria Energy Group

- Minerva Bunkering

- Neste

- Peninsula Petroleum