Global Smart Coatings Market Size, Share, And Business Benefits By Layer (Single layer, Multi-layer), By Type (Self-Healing, Anti-corrosion, Anti-fouling, Anti-microbial, Self-cleaning), By Material (Polymer, Metal, Ceramic, Hybrid), By Technology (Nano-Coatings, Microencapsulation, Stimuli-Responsive Coatings, Self-Assembling Coatings, Layer-By-layer Deposition), By Function (Anti-corrosion, Anti-icing, Anti-fouling, Anti-microbial, Self-cleaning, Self-healing), By End-use (Automotive and Transportation, Marine, Aerospace and Defense, Building and Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142029

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

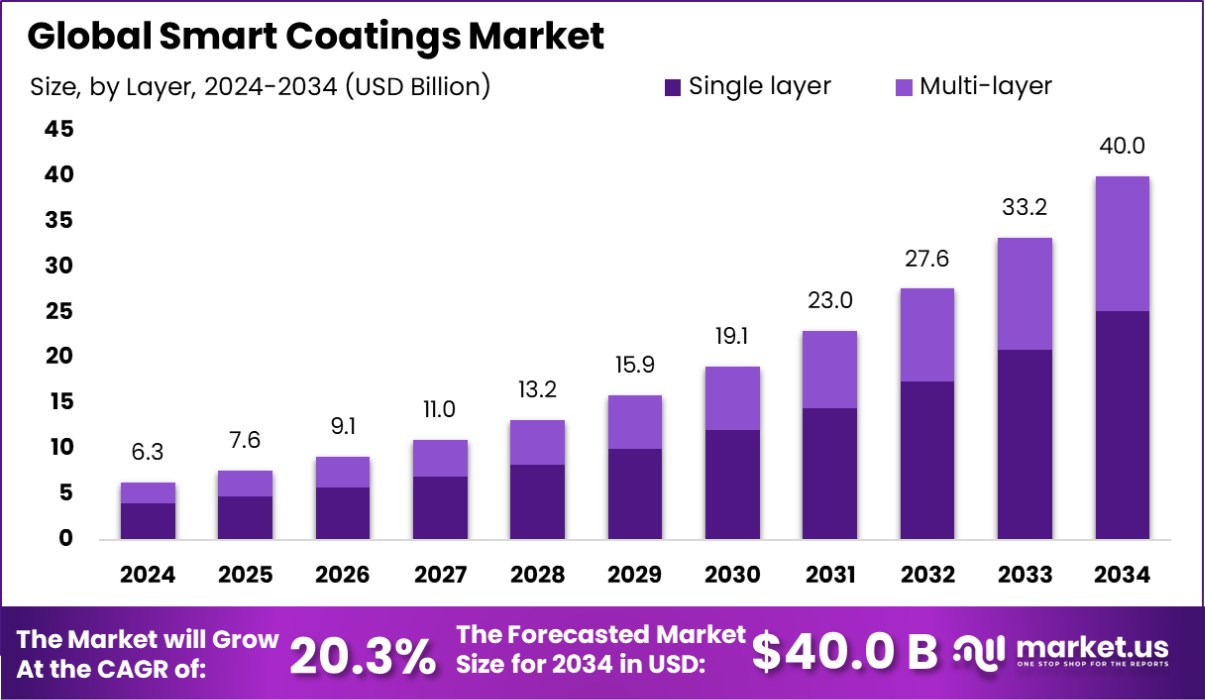

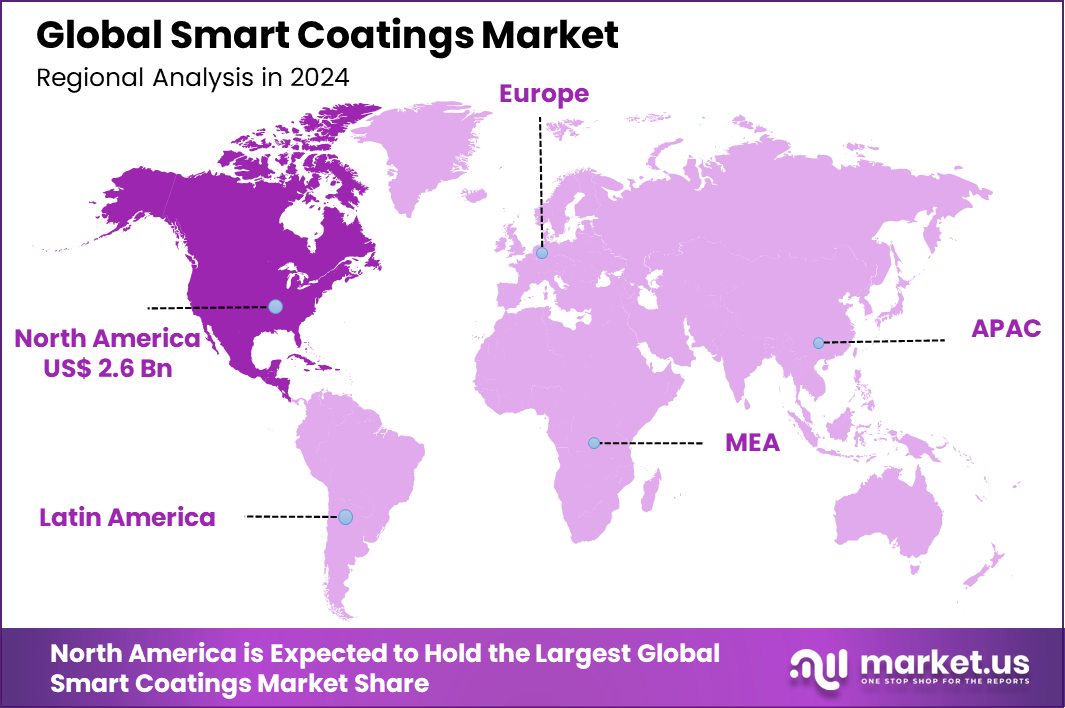

Global Smart Coatings Market is expected to be worth around USD 40.0 billion by 2034, up from USD 6.3 billion in 2024, and grow at a CAGR of 20.3% from 2025 to 2034. Accounting for 42.5% of the global market, North America’s Smart Coatings sector was valued at USD 2.6 billion in 2024.

Smart coatings are advanced materials designed to respond dynamically to external stimuli, such as temperature changes, light, pressure, and chemicals. These coatings have the ability to alter their properties automatically in response to their environment, which makes them incredibly useful in a variety of applications ranging from corrosion resistance in industrial settings to energy efficiency in residential and commercial buildings.

In the Smart Coatings Market, growth is primarily driven by the increasing demand for innovative materials that offer enhanced protection and longevity for assets and infrastructure. For example, NASA’s Kennedy Space Center, which maintains approximately $2 billion worth of ground support facilities, utilizes smart coatings to protect these valuable assets from corrosion, showcasing the critical role these coatings play in preserving infrastructure.

Demand for smart coatings is also bolstered by their potential to significantly reduce costs and improve energy efficiency. The average household in the U.S. could cut electricity costs by up to 10% with the installation of temperature-adaptive radiative coatings (TARC), highlighting the economic benefits alongside environmental impact reduction.

The market for smart coatings is ripe with opportunities, particularly in projects that merge innovation with substantial funding support. Canada’s Ocean Supercluster, for instance, is injecting $2.2 million into the Smart Protective Coatings Project, which has a total value of over $4.6 million. This investment underscores the potential for substantial advancements in coating technologies.

Moreover, initiatives like the Phase II project funded by NASA, which received a total award amount of $600,000 for developing low toxicity corrosion inhibitors, indicate a thriving arena for research and development in smart coatings. These projects not only advance the technological frontier but also open up new avenues for market expansion and the creation of value-added products in various sectors.

Key Takeaways

- Global Smart Coatings Market is expected to be worth around USD 40.0 billion by 2034, up from USD 6.3 billion in 2024, and grow at a CAGR of 20.3% from 2025 to 2034

- The Smart Coatings Market sees single-layer coatings dominating with a share of 63.5%.

- Self-Healing type coatings hold a significant market share of 31.2% in the Smart Coatings Market.

- Polymer materials are favored in the Smart Coatings Market, representing 37.3% of the material segment.

- Nano-coatings technology is integral, making up 34.2% of the technology segment in the Smart Coatings Market.

- The anti-corrosion function is crucial, accounting for 34.2% of the functional usage in the Smart Coatings Market.

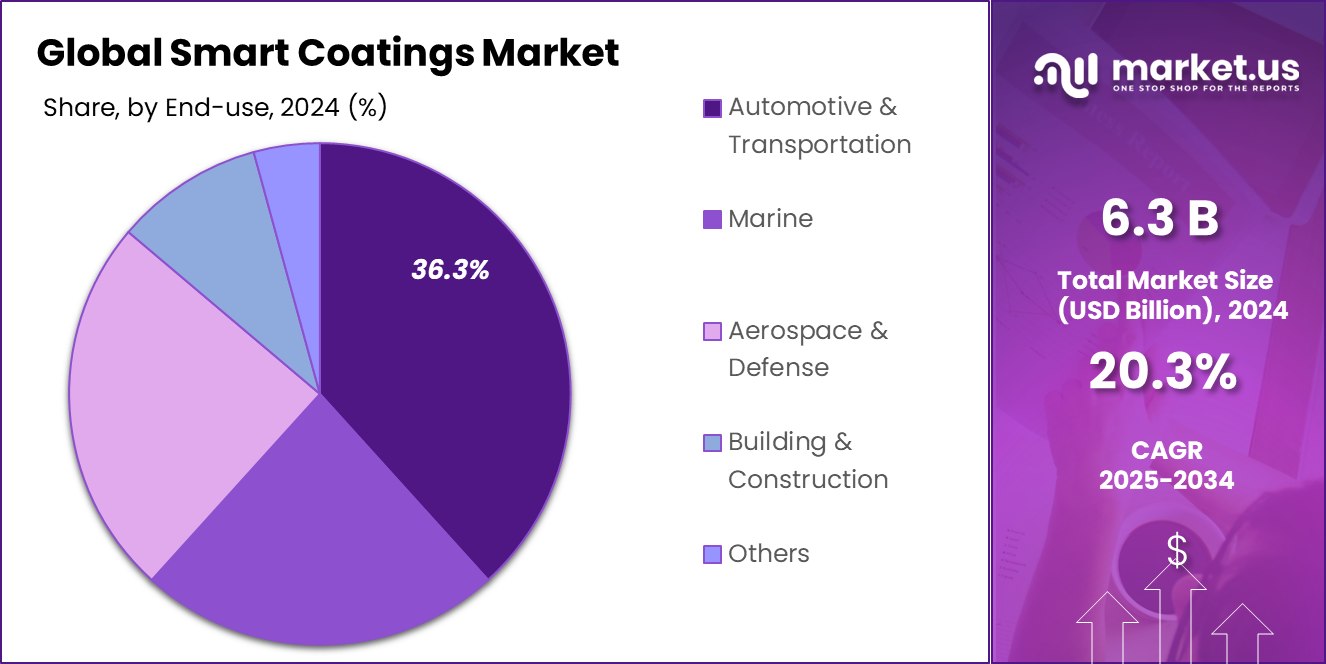

- Automotive and transportation end-use dominates the market, constituting 36.3% of the Smart Coatings Market share.

- The Smart Coatings Market in North America achieved a significant value of USD 2.6 billion, holding a 42.5% market share.

By Layer Analysis

Single-layer smart coatings dominate the market with a 63.5% share.

In 2024, Single Layer held a dominant market position in the By Layer segment of the Smart Coatings Market, capturing a significant 63.5% share. This substantial market presence is attributed to the segment’s cost-effectiveness and ease of application, which appeal to a wide range of industries seeking efficient and straightforward coating solutions.

Single Layer smart coatings are particularly favored for applications where simple yet effective performance enhancements are required, such as in protective coatings that offer anti-corrosion and self-cleaning properties.

The prominence of Single Layer coatings can also be linked to their widespread use in consumer goods and automotive industries, where durability and longevity are critical. These industries value the ability of single-layer coatings to extend the life of their products while maintaining aesthetic appeal and functionality.

The market’s inclination towards Single Layer options is further driven by the ongoing advancements in material science that continue to enhance the properties of these coatings, making them even more resilient and adaptive to environmental factors. As research progresses, the versatility and utility of Single Layer smart coatings are expected to sustain their dominant position in the market.

By Type Analysis

Self-healing smart coatings constitute 31.2% of the market by type.

In 2024, Self-Healing held a dominant market position in the by-type segment of the Smart Coatings Market, boasting a significant 31.2% share. This leadership stems from the increasing demand for coatings that offer enhanced durability and longevity across various applications. Self-healing coatings are particularly appealing in industries such as automotive and aerospace, where they contribute to reducing maintenance costs and extending the service life of critical components.

The ability of self-healing coatings to automatically repair damage caused by environmental or mechanical stresses adds substantial value to products. This capability is crucial in settings where constant upkeep is challenging or costly, ensuring continuous protection against wear and tear. Additionally, the growth of this segment is fueled by advancements in nanotechnology and materials science, which enable the development of more efficient and reliable self-healing coatings.

Industries focused on sustainability also drive the demand for these smart coatings, as they align with the goals of reducing resource waste and enhancing product lifecycle. As more companies adopt sustainable practices, the relevance and market penetration of self-healing smart coatings are expected to increase further, consolidating their dominant position in the smart coatings landscape.

By Material Analysis

Polymer-based smart coatings lead materials segment with a 37.3% market share.

In 2024, Polymer held a dominant market position in the By Material segment of the Smart Coatings Market, securing a 37.3% share. This leading position is primarily due to the versatility and adaptability of polymer-based coatings, which are essential in various applications across multiple industries. Polymers are favored for their excellent environmental resistance, mechanical flexibility, and ability to integrate with various functional additives, enhancing their smart properties.

The appeal of polymer coatings extends across sectors such as automotive, aerospace, and consumer electronics, where they are used to improve product durability and functionality. These coatings provide essential properties such as scratch resistance, self-healing abilities, and responsiveness to environmental changes, which are highly valued in dynamic operational conditions.

The continued dominance of polymer materials in the smart coatings market can also be attributed to ongoing advancements in polymer chemistry, which have expanded their applicability. Innovations in polymer coatings have led to improved performance in extreme conditions, boosting their adoption in more specialized and high-stakes environments.

As research and development in polymer technology persist, the market share of polymer smart coatings is expected to maintain its strength, supported by broadening applications and enhanced material properties.

By Technology Analysis

Nano-coatings technology holds a significant 34.2% slice of the market.

In 2024, Nano-Coatings held a dominant market position in the By Technology segment of the Smart Coatings Market, with a 34.2% share. This leading status is driven by the superior characteristics of nano-coatings, such as enhanced durability, improved corrosion resistance, and exceptional surface adaptability. These traits make nano-coatings highly sought after in critical applications across industries like aerospace, automotive, and healthcare, where high performance under extreme conditions is a necessity.

Nano-coatings stand out due to their ability to provide advanced functionalities at a microscopic scale, offering benefits such as anti-fouling, anti-corrosion, and UV protection without altering the appearance or functionality of the base material. This has led to their increased adoption in consumer electronics and energy sectors, where they contribute significantly to the efficiency and longevity of devices.

The market’s inclination towards nano-coatings is further supported by continuous advancements in nanotechnology, which enhance the efficiency and application range of these coatings. As the technology matures, the integration of nano-coatings in various products is expected to grow, maintaining their dominant position in the smart coatings market and continuing to drive innovation in coating technologies.

By Function Analysis

The anti-corrosion function is highly valued, representing 34.2% of the market.

In 2024, Anti-Corrosion held a dominant market position in the By Function segment of the Smart Coatings Market, with a 34.2% share. This prominence is primarily due to the critical need for protective solutions in industries prone to harsh environmental conditions, such as marine, automotive, and infrastructure. Anti-corrosion coatings are essential in these sectors, providing long-lasting protection against the detrimental effects of moisture, salts, and industrial chemicals.

The strong market share of anti-corrosion coatings is supported by their ability to significantly extend the life of metal structures and components, thereby reducing maintenance costs and downtime. This is especially valuable in industries like oil and gas, where the integrity of equipment is paramount.

Additionally, the ongoing innovations in material science have led to the development of more effective and environmentally friendly anti-corrosion coatings, enhancing their appeal across a broader range of applications.

As industries continue to prioritize durability and cost-efficiency, the demand for advanced anti-corrosion coatings is expected to remain robust. This will not only sustain their market dominance but also drive further technological advancements in the formulation of smart coatings that can provide even greater resistance to corrosion under increasingly challenging conditions.

By End-Use Analysis

Automotive and transportation end-use commands a 36.3% market share.

In 2024, Automotive and Transportation held a dominant market position in the By End-Use segment of the Smart Coatings Market, with a 36.3% share. This substantial market share is largely attributable to the ongoing demand for more durable and maintenance-reducing solutions in the automotive industry. Smart coatings are highly valued for their ability to offer self-healing, anti-corrosion, and UV protection properties that extend the lifespan and enhance the performance of vehicles.

The integration of smart coatings in automotive applications is not just about enhancing the aesthetic appeal of vehicles but also about functional improvements that contribute to vehicle longevity and efficiency. For instance, smart coatings applied to car exteriors can reduce wear from weather conditions and mechanical impacts, while interior coatings improve resistance to scratches and spills.

This segment’s dominance is further reinforced by the increasing adoption of smart coatings in the transportation sector, including aviation and marine, where coatings need to withstand extreme environmental conditions. The growth in this market segment is supported by technological advancements that continue to improve the performance parameters of smart coatings, ensuring sustained interest and investment from major automotive and transportation companies.

Key Market Segments

By Layer

- Single layer

- Multi-layer

By Type

- Self-Healing

- Anti-corrosion

- Anti-fouling

- Anti-microbial

- Self-cleaning

By Material

- Polymer

- Metal

- Ceramic

- Hybrid

By Technology

- Nano-Coatings

- Microencapsulation

- Stimuli-Responsive Coatings

- Self-Assembling Coatings

- Layer-By-layer Deposition

By Function

- Anti-corrosion

- Anti-icing

- Anti-fouling

- Anti-microbial

- Self-cleaning

- Self-healing

By End-use

- Automotive and Transportation

- Marine

- Aerospace and Defense

- Building and Construction

- Others

Driving Factors

Increasing Demand for Durable, Low-Maintenance Materials

One of the top driving factors of the Smart Coatings Market is the growing demand for durable and low-maintenance materials across various industries. Smart coatings are engineered to offer properties that significantly reduce the need for frequent maintenance and replacement, such as self-healing, corrosion resistance, and UV protection. These coatings are particularly appealing in sectors like automotive, aerospace, and construction, where longevity and durability are paramount.

The ability of smart coatings to adapt to environmental changes and self-repair minimizes downtime and maintenance costs, making them highly attractive to businesses looking to enhance the efficiency and lifespan of their products. This demand drives continuous innovation and adoption of smart coatings technologies, fueling market growth.

Restraining Factors

High Cost of Advanced Smart Coating Technologies

A significant restraining factor in the Smart Coatings Market is the high cost associated with developing and implementing advanced smart coating technologies. These coatings often require sophisticated materials and complex manufacturing processes, which can drive up production costs substantially. This makes smart coatings more expensive compared to traditional coatings, posing a challenge for widespread adoption, especially in cost-sensitive markets.

Industries such as construction and consumer goods, where price competitiveness is crucial, may hesitate to adopt these innovative solutions due to budget constraints. Additionally, the need for specialized application techniques and the limited availability of raw materials can further exacerbate the cost issue, slowing down the market penetration of smart coatings.

Growth Opportunity

Expansion into Emerging Markets and Applications

A major growth opportunity for the Smart Coatings Market lies in its expansion into emerging markets and new applications. As economies in Asia, Africa, and South America continue to grow and industrialize, the demand for innovative materials such as smart coatings is expected to rise. These regions present untapped opportunities where smart coatings can be applied in industries such as energy, construction, and transportation to improve efficiency and durability.

Additionally, the integration of smart coatings into emerging technologies like renewable energy systems and smart electronics offers further avenues for growth. By adapting smart coatings to meet the specific needs of these diverse applications, companies can capitalize on new market segments and drive substantial growth in the global smart coatings market.

Latest Trends

Integration of IoT with Smart Coating Technologies

One of the latest trends in the Smart Coatings Market is the integration of the Internet of Things (IoT) technology with smart coatings. This innovative combination allows for the development of coatings that can communicate data about their environment and condition in real time. For example, smart coatings on a building or vehicle can detect corrosion or damage and relay this information to a central system for immediate action.

This trend is transforming industries by enabling predictive maintenance, enhancing safety, and reducing costs associated with manual inspections and repairs. The use of IoT with smart coatings not only extends the functionality of the coatings but also opens up new possibilities for monitoring and managing infrastructure and assets more efficiently.

Regional Analysis

In 2024, North America dominated the Smart Coatings Market with a substantial 42.5% share, reaching USD 2.6 billion.

The Smart Coatings Market showcases varied regional dynamics, with North America emerging as the dominant region. In 2024, North America held a commanding 42.5% share of the global market, amounting to USD 2.6 billion. This prominence is largely driven by advanced manufacturing capabilities and heightened demand from sectors such as automotive, aerospace, and consumer electronics, which prioritize innovative, functional materials for enhanced product performance.

Europe and Asia Pacific also represent significant contributors to the smart coatings landscape. Europe benefits from stringent regulations supporting environmentally sustainable innovations, thereby accelerating the adoption of advanced, eco-friendly smart coatings.

Meanwhile, the Asia Pacific region is witnessing rapid industrial growth and infrastructure development, particularly in China and India, making it a critical market for smart coatings. This region is expected to exhibit substantial growth due to increasing investments in technology and a booming manufacturing sector.

The Middle East & Africa and Latin America, though smaller in comparison, are expected to experience gradual growth. Increased industrial activities and rising awareness about the benefits of smart coatings in these regions will likely foster market expansion. Collectively, these regional markets underscore a global shift toward efficiency and sustainability in material technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global Smart Coatings Market of 2024, key players like Akzo Nobel, PPG Industries, The Sherwin-Williams Company, and RPM International are at the forefront, driving innovation and expansion in this highly competitive sector.

Akzo Nobel, renowned for its commitment to sustainability and innovation, continues to lead with its advanced portfolio of eco-efficient coatings. The company focuses on developing coatings that offer energy efficiency and lower environmental impact, which strongly aligns with global regulatory trends and customer demand for sustainable products.

PPG Industries stands out with its broad range of technologically advanced coatings tailored for a variety of industries, including automotive and aerospace. PPG’s investment in research and development has resulted in high-performance coatings that are durable, protective, and aesthetically pleasing. Their strategic focus on expanding in emerging markets, particularly in the Asia Pacific region, positions them well for increased global reach and influence.

The Sherwin-Williams Company, with its extensive distribution network and strong brand recognition, capitalizes on its market presence to push the boundaries of paint and coating technology. Their products are integral to construction and remodeling sectors, where demand for smart coatings that offer long-term protection and low maintenance continues to rise.

RPM International, though smaller than the other giants, carves a niche with specialized coatings that cater to both industrial and consumer markets. RPM’s focus on performance coatings and sealants, paired with strategic acquisitions, helps them maintain a strong position in the market, particularly in North America and Europe.

Top Key Players in the Market

- Akzo Nobel

- PPG Industries

- The Sherwin

- Williams Company

- RPM International

- Axalta Coating Systems

- 3M

- Jotun

- Hempel

- NEI Corporation

- DOW Corning Corporation

- Bayer AG

- BASF SE

- Eastman Chemical Company

- Tesla Nanocoatings

- Helicity Technologies.

Recent Developments

- In February 2025, Akzo Nobel India Ltd. agreed to sell its powder coatings business and R&D Centre to Akzo Nobel N.V. for ₹2,073 crore and ₹70 crore, respectively. Additionally, Akzo Nobel India will acquire intellectual property rights for its decorative paints business across India, Bangladesh, Bhutan, and Nepal.

- In February 2025, Jotun reported a robust performance for the year 2024, achieving record sales totaling $3.074 billion, marking a 7% increase from the previous year. The company experienced solid sales growth across all its business segments and geographical regions, reflecting its strong market presence and operational efficiency.

- In August 2024, Hempel introduced a groundbreaking hull coating system, Hempaguard Ultima. This innovative product promises up to 21% fuel savings, providing vessel owners with a significant tool to achieve their decarbonization goals. The introduction of Hempaguard Ultima marks a substantial advancement in marine coating technology, aligning with global efforts toward more sustainable maritime operations.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Billion Forecast Revenue (2034) USD 40.0 Billion CAGR (2025-2034) 20.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Layer (Single layer, Multi-layer), By Type (Self-Healing, Anti-corrosion, Anti-fouling, Anti-microbial, Self-cleaning), By Material (Polymer, Metal, Ceramic, Hybrid), By Technology (Nano-Coatings, Microencapsulation, Stimuli-Responsive Coatings, Self-Assembling Coatings, Layer-By-layer Deposition), By Function (Anti-corrosion, Anti-icing, Anti-fouling, Anti-microbial, Self-cleaning, Self-healing), By End-use (Automotive and Transportation, Marine, Aerospace and Defense, Building and Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel, PPG Industries, The Sherwin, Williams Company, RPM International, Axalta Coating Systems, 3M, Jotun, Hempel, NEI Corporation, DOW Corning Corporation, Bayer AG, BASF SE, Eastman Chemical Company, Tesla Nanocoatings, Helicity Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Akzo Nobel

- PPG Industries

- The Sherwin

- Williams Company

- RPM International

- Axalta Coating Systems

- 3M

- Jotun

- Hempel

- NEI Corporation

- DOW Corning Corporation

- Bayer AG

- BASF SE

- Eastman Chemical Company

- Tesla Nanocoatings

- Helicity Technologies.