Global 4-HBA Market By Type (Analysis Level, Industrial Grade), By Application(Paints and Coatings, Adhesives, Coatings, Sealants, Others), By Distribution Channel (Direct Sales, Distributors and Wholesalers, Online Platforms, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138635

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

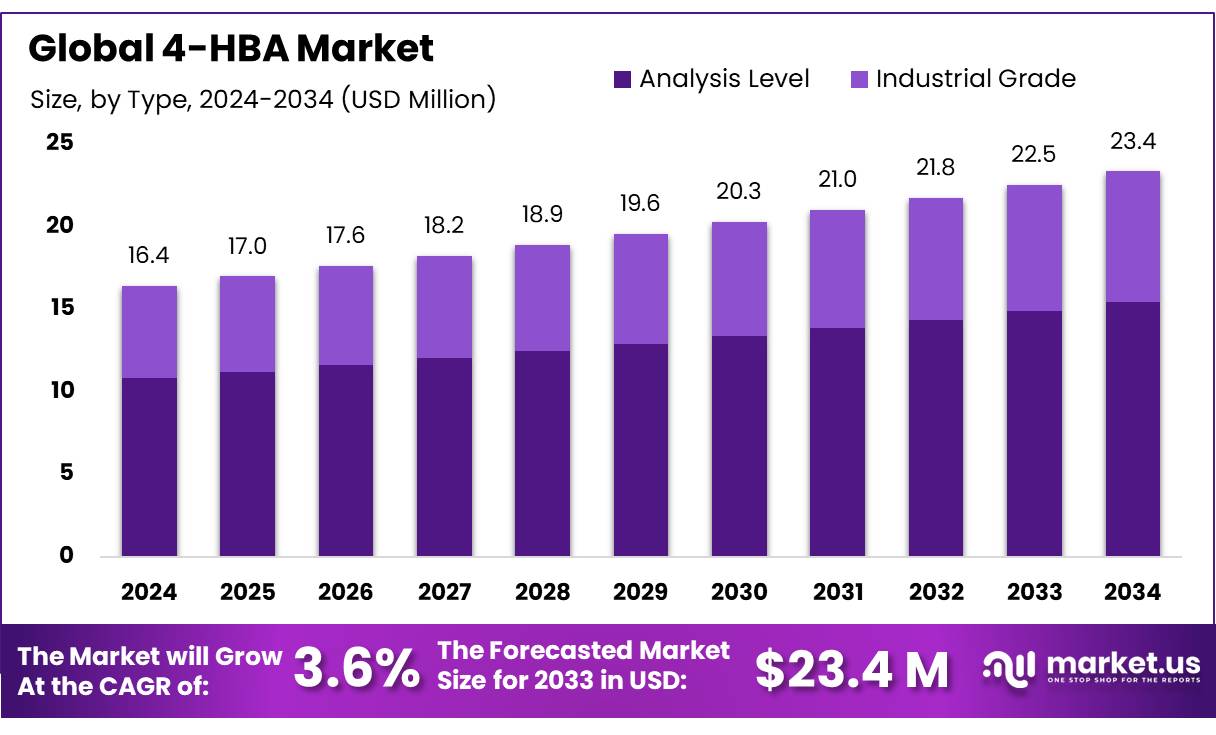

The Global 4-HBA Market size is expected to be worth around USD 23.4 Mn by 2034, from USD 16.4 Mn in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

The global 4-Hydroxybenzoic Acid (4-HBA) market is experiencing steady growth, driven by its extensive applications in pharmaceuticals, personal care, and polymer industries. 4-HBA, a white crystalline solid, is widely used as a precursor for parabens, which serve as preservatives in cosmetics, pharmaceuticals, and food products. Additionally, it is a crucial intermediate in the production of liquid crystal polymers (LCPs), a high-performance material used in electronics and automotive applications. The market’s growth is closely tied to the performance and expansion of these key end-use industries.

The pharmaceutical sector is a significant driver of 4-HBA consumption due to its role in the synthesis of parabens, which act as antimicrobial agents in drug formulations. The compound’s use in LCP production is also gaining momentum, spurred by the increasing demand for lightweight, high-performance materials in electronics and automotive sectors. The Asia-Pacific region, particularly China, Japan, and South Korea, holds a dominant position in the market, benefiting from strong industrial activity, especially in electronics and polymer manufacturing. China alone accounts for over 35% of global 4-HBA production, driven by cost-effective raw materials and advanced production capabilities.

Several factors are propelling the market’s expansion. The demand for high-performance polymers, particularly LCPs used in flexible printed circuit boards, automotive connectors, and 5G components, is a major growth driver. The shift toward miniaturization of electronic devices has fueled the need for LCPs, indirectly boosting 4-HBA consumption. Additionally, the personal care and cosmetics industry remains a key consumer of parabens, despite growing concerns over their safety. The pharmaceutical industry’s need for effective antimicrobial preservatives further supports market growth.

The 4-HBA market is poised for continued growth, particularly with the expansion of the high-performance polymer industry in automotive and electronics sectors. The increasing adoption of electric vehicles (EVs) and advancements in 5G infrastructure will drive demand for LCPs, thereby boosting 4-HBA consumption. Additionally, the growing trend toward sustainable and biodegradable antimicrobial agents could open new opportunities for 4-HBA in pharmaceuticals and food preservation, further diversifying its applications.

Key Takeaways

- 4-HBA Market size is expected to be worth around USD 23.4 Mn by 2034, from USD 16.4 Mn in 2024, growing at a CAGR of 3.6%.

- Analysis Level held a dominant market position, capturing more than a 66.4% share of the 4-HBA market.

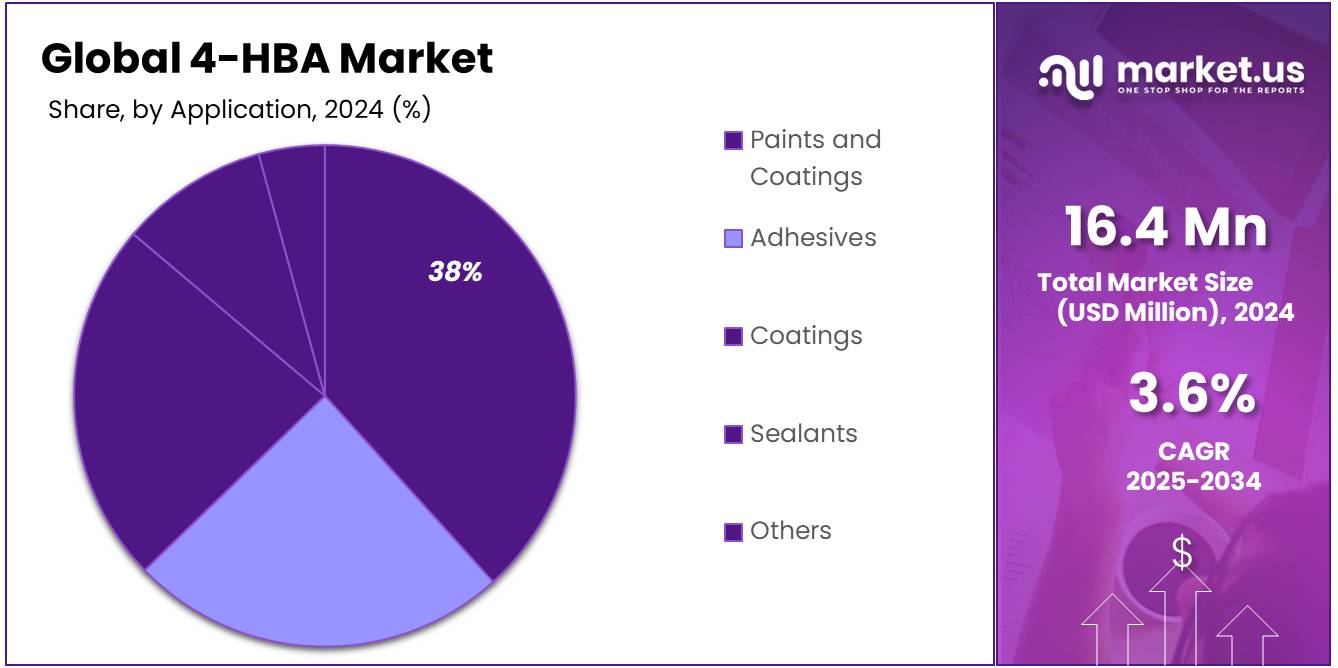

- Paints and Coatings held a dominant market position, capturing more than a 38.3% share of the 4-HBA market.

- Direct Sales held a dominant market position, capturing more than a 45.4% share of the 4-HBA market.

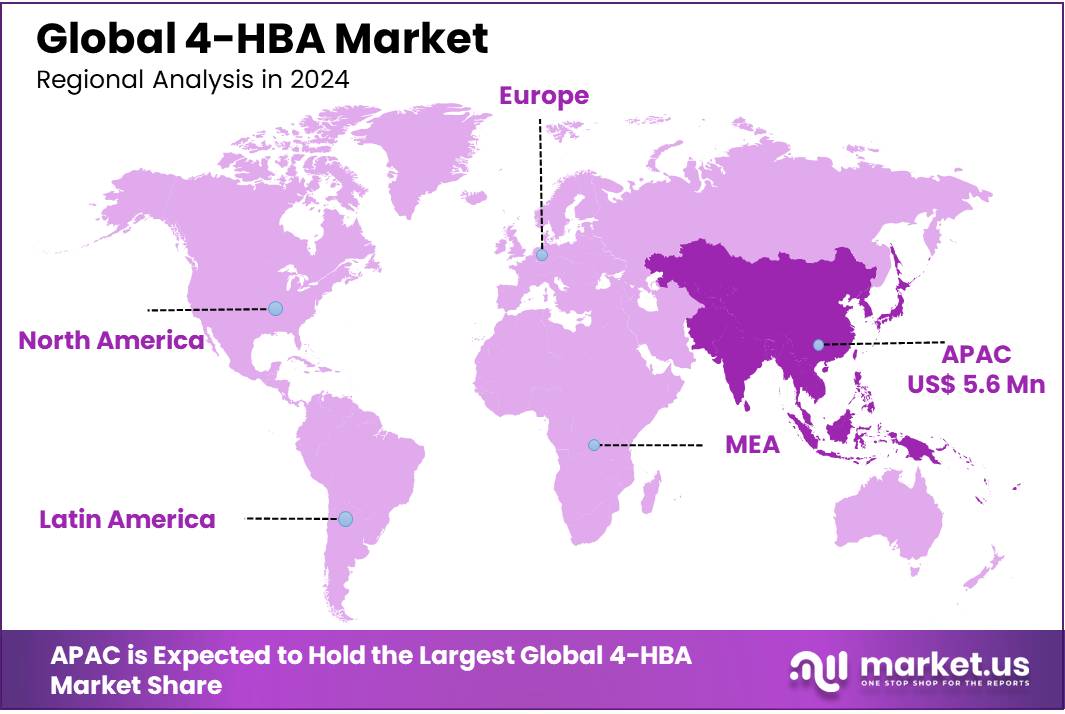

- Asia Pacific (APAC) region dominated the 4-HBA market, capturing more than 34.8% of the market share, valued at approximately USD 5.6 million.

By Type

In 2024, Analysis Level held a dominant market position, capturing more than a 66.4% share of the 4-HBA market. The analysis level segment is widely used across research and development activities, particularly in the pharmaceutical and chemical industries, where precise measurements and high-purity levels are crucial for accurate results.

The Industrial Grade segment accounts for the remaining share of the market. Industrial-grade 4-HBA is used primarily in manufacturing processes and large-scale applications, where cost efficiency is prioritized over purity. While the industrial-grade segment is smaller in comparison to the analysis level segment, it has shown stable growth, especially with the increasing demand from the polymer and coatings industries.

By Application

In 2024, Paints and Coatings held a dominant market position, capturing more than a 38.3% share of the 4-HBA market. This application segment has seen steady growth driven by the increasing demand for high-performance coatings in the automotive, construction, and industrial sectors. 4-HBA is used in the formulation of advanced resins and coatings that offer improved durability, chemical resistance, and environmental sustainability.

The Adhesives segment follows, holding a substantial share due to its importance in manufacturing and packaging industries. 4-HBA is used in the production of high-quality adhesives that provide strong bonding properties for various substrates, including plastics, metals, and wood. This segment is anticipated to experience steady growth at a rate of around 4-6% per year, supported by the continued rise in demand for durable and efficient bonding solutions in construction, automotive, and electronics industries.

The Sealants and Coatings segments, while important, account for a smaller market share compared to paints and adhesives. These segments continue to grow moderately, with demand for sealants driven by their applications in the automotive and construction industries.

By Distribution Channel

In 2024, Direct Sales held a dominant market position, capturing more than a 45.4% share of the 4-HBA market. This distribution channel is preferred by many manufacturers and industrial buyers because it allows for direct communication, bulk orders, and personalized service. Direct sales enable companies to maintain close relationships with their customers, ensuring timely delivery and better pricing, which is particularly important for industries such as automotive, construction, and chemicals.

Distributors & Wholesalers come in second, serving as intermediaries between manufacturers and end-users. This channel plays a critical role in expanding the market reach of 4-HBA, especially in regions where direct sales might not be feasible due to logistical constraints. In 2024, distributors and wholesalers are expected to account for around 30% of the market, with growth driven by their established networks and ability to cater to a broad customer base.

The Online Platforms segment is also gaining traction as digitalization continues to shape industries. Online platforms provide easier access to 4-HBA for small businesses and individuals looking for smaller quantities or specialty products. While this segment is still smaller compared to direct sales and distributors, it is expected to grow rapidly at an annual rate of around 8-10% as e-commerce continues to expand.

The Hospitals & Healthcare Providers segment holds a smaller but important share of the market, primarily used in pharmaceutical and research applications. While this sector remains niche, it is expected to grow at a modest rate of 3-5% per year.

Key Market Segments

By Type

- Analysis Level

- Industrial Grade

By Application

- Paints and Coatings

- Adhesives

- Coatings

- Sealants

- Others

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online Platforms

- Others

Drivers

Growing Demand for High-Performance Coatings in the Construction and Automotive Sectors

According to the International Energy Agency (IEA), global investment in the construction sector alone is expected to reach $10.5 trillion by 2030, with a large portion of this being driven by the need for sustainable building materials and energy-efficient infrastructure. This growth is expected to boost the demand for coatings, and consequently, for 4-HBA, which is essential in creating products that meet these higher standards.

The automotive industry, especially in the context of electric vehicles (EVs), is also a significant contributor to this trend. In 2024, the global electric vehicle market is expected to grow by over 35% year-on-year, according to the International Council on Clean Transportation (ICCT). As the automotive industry continues to adopt greener technologies, the need for advanced coatings that are both environmentally friendly and durable is increasing.

4-HBA plays an essential role in producing coatings that improve the longevity and performance of vehicles, from corrosion-resistant paints to those that enhance the vehicle’s energy efficiency. This trend has led to the continued growth of the 4-HBA market, with the compound being used not just in traditional coatings but in innovative formulations that meet the specific needs of electric vehicle manufacturers.

In addition to this, government initiatives around the world are focusing on reducing environmental impacts, driving further demand for 4-HBA in sustainable industries. For example, in 2024, the European Union’s Green Deal is pushing for carbon-neutral buildings by 2050, which directly benefits the coatings sector, as they are an essential part of building energy-efficient structures. The U.S. Department of Energy has also announced several initiatives aimed at improving the energy efficiency of industrial operations, many of which rely on high-performance coatings that use 4-HBA as a key ingredient.

In 2024, the demand for high-performance coatings that utilize 4-HBA is projected to grow by over 6-8% annually, driven by these factors. Furthermore, leading chemical companies, like BASF and Dow Chemical, are focusing on innovations in coatings technologies, incorporating more sustainable solutions and offering new, improved formulations that utilize 4-HBA as a critical compound.

Restraints

Regulatory and Environmental Concerns Around Chemical Usage

For instance, the European Union’s REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals), which aims to protect human health and the environment from risks posed by chemicals, has placed significant restrictions on the use of hazardous substances in various industries. As a result, manufacturers of products containing 4-HBA may face challenges in ensuring compliance with such regulations, which can result in higher costs related to product reformulation, testing, and certification.

The REACH regulation has impacted chemical manufacturers globally, with companies needing to adapt their processes to meet stringent guidelines. This regulatory burden can restrict the growth potential of the 4-HBA market, especially in regions like Europe, where the demand for high-purity chemicals is also coupled with environmental scrutiny.

Furthermore, concerns about the toxicity of some chemicals in the production and disposal of coatings, adhesives, and other products that use 4-HBA have led to calls for more sustainable alternatives. According to the United Nations Environment Programme (UNEP), the global shift towards reducing harmful chemical emissions in the manufacturing and construction industries is expected to continue. UNEP’s report highlights that industries are increasingly moving towards green chemistry solutions, which may result in a decline in the demand for certain chemicals like 4-HBA in the long term.

The US Environmental Protection Agency (EPA) is also tightening its stance on the use of chemicals deemed hazardous to health and the environment. This has led to a surge in compliance costs for companies using chemicals such as 4-HBA. The increase in testing requirements for toxicity, biodegradability, and eco-friendliness has further raised operational costs. Consequently, small- and medium-sized businesses in the 4-HBA supply chain may struggle to bear these additional expenses, hindering market growth.

For example, the US Department of Energy (DOE) has funded numerous projects aimed at improving chemical safety and sustainability in manufacturing, including developing low-impact chemical alternatives in sectors like coatings. These initiatives, although primarily focused on reducing the environmental footprint, can encourage innovation and open doors to new technologies that might lessen the restrictions currently limiting the 4-HBA market.

Opportunity

Increasing Demand for Sustainable and Eco-friendly Coatings

The construction industry, for example, has been actively adopting sustainable building practices, with an emphasis on using materials that are low in volatile organic compounds (VOCs) and other harmful chemicals. According to the U.S. Green Building Council (USGBC), the green building market in the U.S. alone is expected to reach $136 billion by 2025, with a major focus on sustainable paints and coatings. This trend is expected to drive significant demand for 4-HBA, which is used in the production of eco-friendly coatings due to its stability, low toxicity, and ability to help create high-performance, durable finishes.

Similarly, the automotive industry is embracing green technologies, particularly in electric vehicles (EVs), where coatings are required to be not only durable but also environmentally friendly. As electric vehicle sales are projected to grow by over 35% annually, according to the International Council on Clean Transportation (ICCT), the demand for sustainable coatings will increase. 4-HBA’s role in producing corrosion-resistant, energy-efficient, and eco-friendly coatings for automotive parts will place it in a strong position to benefit from this trend.

Additionally, many government initiatives are incentivizing the use of sustainable materials. For instance, the European Commission’s Green Deal aims to make the EU’s economy climate-neutral by 2050, which will increase demand for sustainable construction and automotive materials. This, in turn, will create a significant opportunity for 4-HBA to be used in the development of new coatings that help manufacturers meet these environmental goals.

Trends

Growing Adoption of Bio-based and Green Chemistry in Coatings

The construction industry, particularly, has been one of the leaders in this shift toward more sustainable materials. As per the U.S. Green Building Council (USGBC), more than 40% of all newly constructed buildings in the U.S. are being designed to meet green standards such as LEED (Leadership in Energy and Environmental Design). LEED certification requires the use of low-toxicity, environmentally friendly materials, including paints and coatings.

The automotive industry is also actively transitioning toward more sustainable solutions. As electric vehicles (EVs) and hybrid vehicles gain market share, manufacturers are focusing on reducing the carbon footprint of their production processes. This includes using coatings that are environmentally friendly, durable, and energy-efficient. According to the International Council on Clean Transportation (ICCT), global EV sales are projected to grow by more than 35% annually, indicating a rise in demand for sustainable automotive coatings.

Governments around the world have played a significant role in encouraging the adoption of sustainable practices in industrial processes. For instance, the European Union’s REACH regulation (Registration, Evaluation, Authorisation, and Restriction of Chemicals) has made it mandatory for manufacturers to phase out certain hazardous chemicals and replace them with safer alternatives, including bio-based substances like 4-HBA. Similarly, the U.S. Environmental Protection Agency (EPA) has been pushing for the reduction of VOCs in consumer products, which has further increased the demand for low-toxicity alternatives in coatings and adhesives.

Additionally, the global shift toward circular economy practices—which focus on reducing waste and reusing materials—is another key driver for the growth of bio-based chemicals like 4-HBA. As more industries move towards a circular model, there is a growing interest in products that can be easily recycled or are biodegradable. 4-HBA, being a naturally derived compound, fits well into this trend, offering manufacturers a more sustainable option in their formulations.

This growing preference for sustainable coatings has prompted numerous leading chemical manufacturers to invest heavily in green chemistry. Companies are actively researching new bio-based alternatives to replace traditional petrochemical-derived ingredients. As per the Green Chemistry Institute, the market for bio-based chemicals is expected to reach $30.7 billion by 2026, with growth driven by consumer demand for eco-friendly products and tightening environmental regulations.

Regional Analysis

In 2024, the Asia Pacific (APAC) region dominated the 4-HBA market, capturing more than 34.8% of the market share, valued at approximately 5.6 million USD. APAC is a key growth driver due to its rapidly expanding industrial base, particularly in countries like China, India, and Japan. The region’s booming construction, automotive, and consumer goods industries have spurred the demand for high-performance coatings, adhesives, and other chemical products that use 4-HBA.

In North America, the market is witnessing steady growth, with the U.S. being a major contributor. The demand for 4-HBA in eco-friendly coatings and construction materials, spurred by government regulations and initiatives promoting sustainability, is driving growth in this region. According to the U.S. Green Building Council (USGBC), green building projects are increasingly popular, supporting the rise in demand for sustainable chemical products. North America’s market share is expected to grow modestly, reflecting the strong demand for bio-based coatings, particularly in construction and automotive sectors.

Europe follows closely, driven by stringent environmental regulations such as REACH and the rise of the green building movement. The region’s emphasis on sustainability and low VOC emissions in industrial processes is promoting the use of bio-based chemicals like 4-HBA, especially in paints and coatings. Growth in Europe is expected to remain consistent, supported by regulatory frameworks and the increasing preference for eco-friendly solutions.

The Middle East & Africa (MEA) and Latin America are also experiencing gradual growth, though their shares remain relatively small compared to APAC, North America, and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 4-HBA market features several key players that are contributing significantly to its growth through innovation, production, and distribution. Osaka Organic Chemical, known for its expertise in organic chemical manufacturing, is a prominent player in the 4-HBA market. The company’s focus on high-quality raw materials and its strong R&D capabilities have positioned it as a key supplier in various industries such as pharmaceuticals, agriculture, and industrial coatings.

BASF, a global leader in chemicals, also plays a significant role in the market by leveraging its large-scale manufacturing capacity and extensive distribution network. BASF’s focus on sustainability and eco-friendly solutions is contributing to the growing demand for bio-based chemicals like 4-HBA.

Other notable players include Mitsubishi Chemical, Sigma-Aldrich, and Thermo Fisher Scientific, all of which are major contributors to the chemical supply chain, especially in the production of laboratory-grade chemicals and reagents. These companies provide high-purity 4-HBA that is used in analytical applications and specialized industrial sectors.

Nippon Kasei Chemical and Hangzhou Dayangchem Co. also play vital roles, particularly in the supply of 4-HBA for industrial-grade applications such as coatings, adhesives, and sealants. Meanwhile, Alfa Aesar, Santa Cruz Biotechnology, and Chemieliva Pharmaceutical Co. are key suppliers, catering to research laboratories and pharmaceutical companies, thus expanding the market’s reach.

Top Key Players

- Osaka Organic Chemical

- Mitsubishi Chemical

- Nippon Kasei Chemical

- BASF SE

- Sigma-Aldrich

- Alfa Aesar

- Thermo Fisher Scientific

- Santa Cruz Biotechnology Inc.

- Hangzhou Dayangchem Co.

- Nanjing Chemical Material Corp.

- Chemieliva Pharmaceutical Co.

- Tokyo Chemical Industry Co.

Recent Developments

In 2024, BASF’s chemical division has seen a 6% year-on-year increase in revenue, driven by the growing demand for sustainable and bio-based chemicals like 4-HBA.

In 2024, Mitsubishi’s 4-HBA division reported a 5% rise in global market share, reflecting its strategic focus on both supply chain efficiency and cutting-edge chemical innovations.

Report Scope

Report Features Description Market Value (2024) USD 16.4 Mn Forecast Revenue (2034) USD 23.4 Mn CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Analysis Level, Industrial Grade), By Application(Paints and Coatings, Adhesives, Coatings, Sealants, Others), By Distribution Channel (Direct Sales, Distributors and Wholesalers, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Osaka Organic Chemical, Mitsubishi Chemical, Nippon Kasei Chemical, BASF SE, Sigma-Aldrich, Alfa Aesar, Thermo Fisher Scientific, Santa Cruz Biotechnology Inc., Hangzhou Dayangchem Co., Nanjing Chemical Material Corp., Chemieliva Pharmaceutical Co., Tokyo Chemical Industry Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Osaka Organic Chemical

- Mitsubishi Chemical

- Nippon Kasei Chemical

- BASF SE

- Sigma-Aldrich

- Alfa Aesar

- Thermo Fisher Scientific

- Santa Cruz Biotechnology Inc.

- Hangzhou Dayangchem Co.

- Nanjing Chemical Material Corp.

- Chemieliva Pharmaceutical Co.

- Tokyo Chemical Industry Co.