1-Propanol Market Size, Share, And Business Benefits By Type (Ethylene Hydrogenation Method, Allyl Alcohol Hydrogenation Method, Others), By Application (Coatings, Food Additive, Pharmaceutical, Cosmetics, Printing Inks, Chemical Intermediates, Others), By Sales Channel (Direct Sale, Indirect Sale), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135661

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

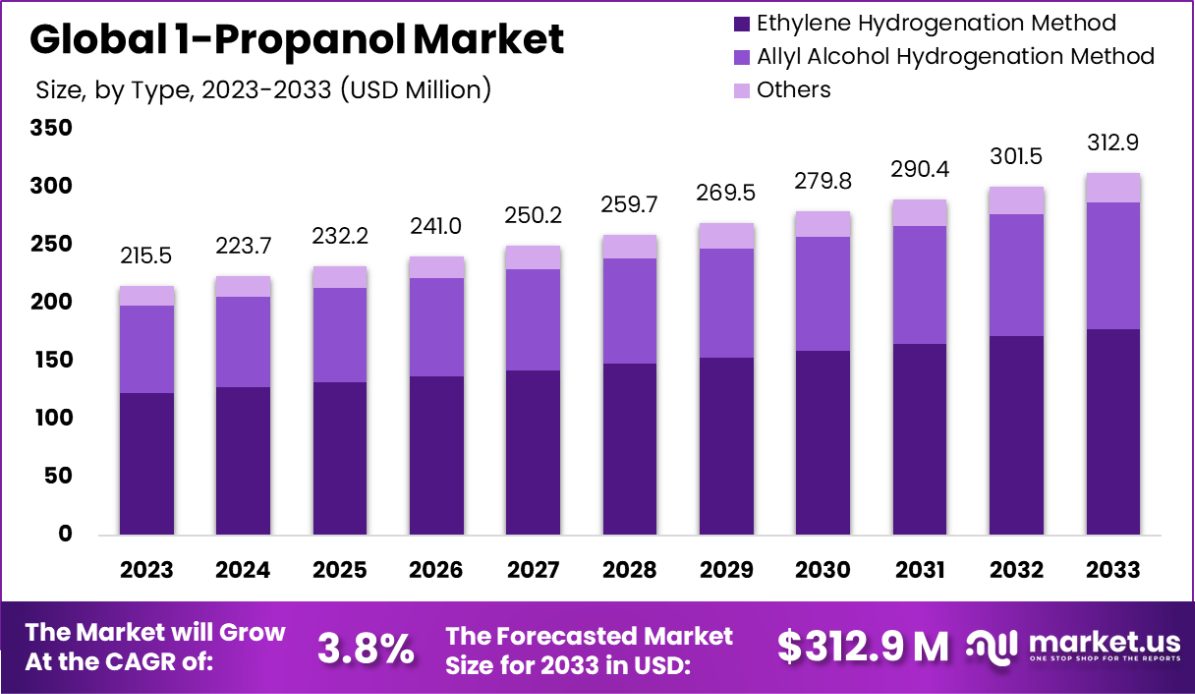

The Global 1-Propanol Market is expected to be worth around USD 312.9 Million by 2033, up from USD 215.5 Million in 2023, and grow at a CAGR of 3.8% from 2024 to 2033. Asia-Pacific holds 35.9% of the 1-Propanol market, totaling USD 78.4 million.

1-Propanol, also known as n-propanol or propyl alcohol, is a primary alcohol with the chemical formula C3H8O. It is a colorless liquid commonly used as a solvent in the pharmaceutical industry, in household cleaners, and in cosmetics. It also serves as a precursor to various chemicals like propyl acetate and as a fuel additive.

The 1-Propanol market is experiencing growth due to its increasing use in the pharmaceutical and cosmetic industries for the production of sanitizers and personal care products, particularly following heightened demand during the COVID-19 pandemic. Additionally, its application as a solvent in paints and coatings contributes to its market expansion.

Opportunities in the market are driven by advancements in green chemistry, leading to the development of bio-based 1-Propanol, which offers an environmentally friendly alternative to synthetic solvents. This shift is expected to meet the rising demand for sustainable chemical processes and products.

The 1-Propanol market is undergoing significant scrutiny due to its diverse industrial applications and the intrinsic properties of the substance. Predominantly used as a solvent in the pharmaceutical, cosmetic, and chemical industries, 1-Propanol’s market dynamics are influenced by its chemical versatility and safety profile.

This solvent’s density and volatility make it a critical component in various formulations, requiring meticulous handling and storage protocols to ensure workplace safety and environmental compliance.

Chemically, 1-Propanol can be transformed through reactions such as Fischer esterification—reacting with acetic acid in the presence of H2SO4 to produce propyl acetate—or oxidized to yield propionaldehyde and propionic acid, with varying efficiencies.

Furthermore, the metabolic breakdown of 1-Propanol into propionic acid and its associated health impacts, such as alcoholic intoxication and high anion gap metabolic acidosis, underline the critical need for stringent regulatory compliance and safety measures in its handling and use. These health concerns may temper market growth, especially in regions with stringent occupational health regulations.

However, these challenges also present opportunities for innovation in safer formulations and usage protocols. As the market continues to evolve, regulatory compliance, coupled with technological advancements in chemical processing, will play pivotal roles in shaping the trajectory of the 1-Propanol market.

Key Takeaways

- The Global 1-Propanol Market is expected to be worth around USD 312.9 Million by 2033, up from USD 215.5 Million in 2023, and grow at a CAGR of 3.8% from 2024 to 2033.

- The Ethylene Hydrogenation Method dominates 1-propanol production, accounting for 57.6% of the market.

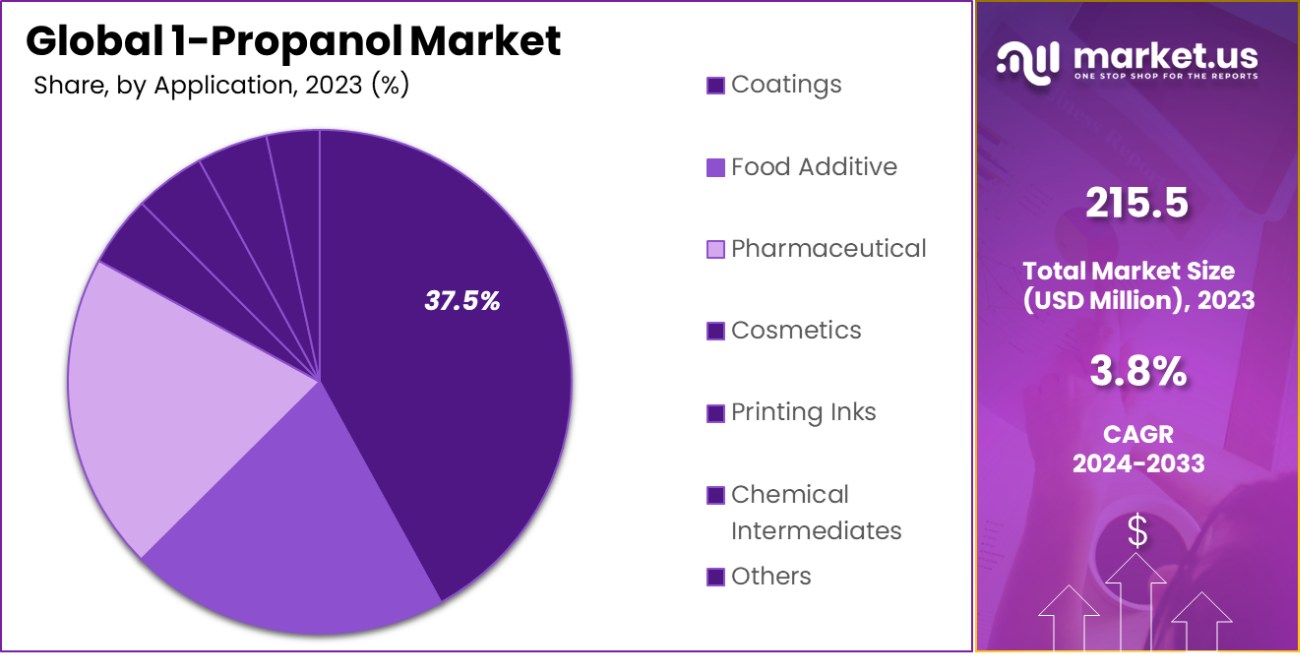

- In applications, 1-Propanol is most used in coatings, representing 37.5% of its market usage.

- The majority of 1-Propanol is sold through indirect channels, making up 65.4% of sales.

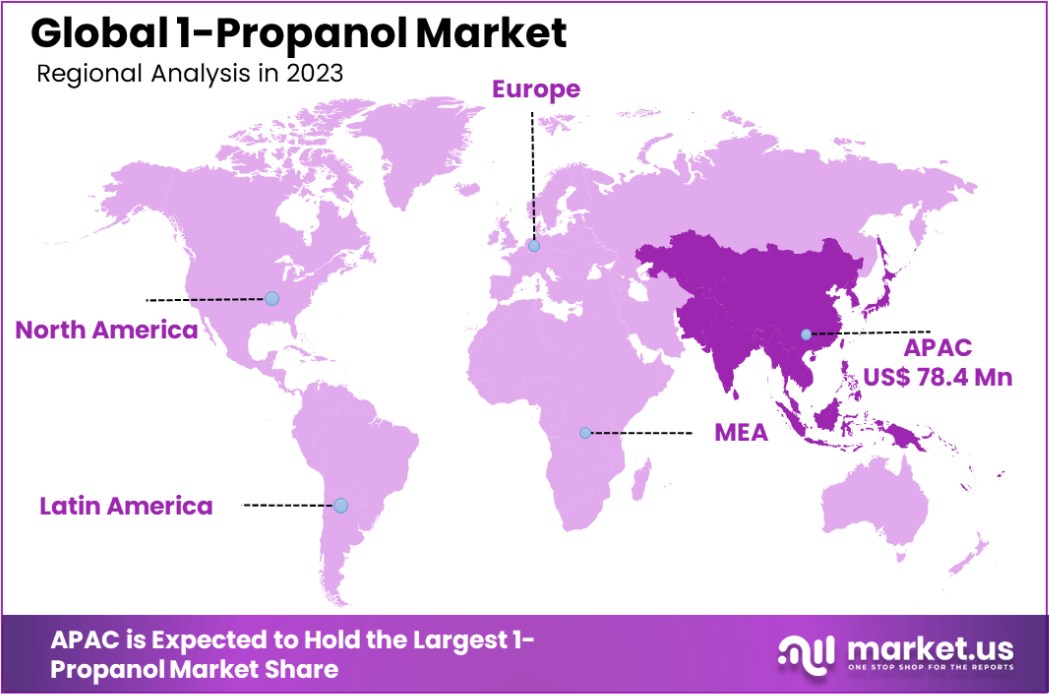

- In 2023, the Asia-Pacific 1-Propanol market held a 35.9% share, valued at USD 78.4 million.

1-Propanol Business Benefits

1-Propanol, also known as propyl alcohol or n-propanol, has several industrial benefits due to its chemical properties and wide applicability. It is a colorless liquid with a mild, alcohol-like odor, known for its role as a solvent in the pharmaceutical, cosmetic, and chemical manufacturing industries. The physical properties of 1-propanol, such as a boiling point of 97.2°C and a flash point of 22°C, make it suitable for use in various production processes.

Economically, 1-Propanol is valued for its effectiveness in reducing the viscosity of coating solutions, which enhances their ease of application and performance. This property is particularly beneficial in the paint and coatings industry, where it helps in formulating products that provide better coverage and smoother finishes. Additionally, 1-propanol is utilized in the creation of other chemicals, notably propyl acetate, which is used extensively in the flavor and fragrance industry.

From a safety perspective, 1-propanol has a moderate health hazard rating according to the National Fire Protection Association (NFPA), with established exposure limits to ensure safe handling in occupational settings.

The Occupational Safety and Health Administration (OSHA) has set a permissible exposure limit (PEL) of 200 parts per million (ppm) as an 8-hour time-weighted average, reflecting the balance between utility and worker safety.

Moreover, 1-propanol is featured in critical academic and industrial research for its thermodynamic properties, such as density and enthalpy, which are essential for designing chemical processes and equipment.

By Type Analysis

The Ethylene Hydrogenation Method dominates 1-Propanol production, accounting for 57.6% of its market share.

In 2023, the Ethylene Hydrogenation Method held a dominant market position in the “By Type” segment of the 1-Propanol Market, securing a 57.6% share. This method has proven to be a preferred choice due to its efficiency and cost-effectiveness in producing high-purity 1-Propanol.

The second prevalent method in the market is the Allyl Alcohol Hydrogenation Method. While it holds a smaller market share, it remains critical for specific applications where its unique properties are demanded.

The preference for the Ethylene Hydrogenation Method can be attributed to its robustness and the scalability it offers to large-volume manufacturers. Industries favor this method for its reliability and the consistent quality of 1-Propanol it produces, which is essential for high-stakes applications in pharmaceuticals and cosmetics.

This method’s dominance is further supported by ongoing advancements in catalytic technologies, which improve yield and reduce waste, thereby enhancing environmental sustainability and economic efficiency.

On the other hand, the Allyl Alcohol Hydrogenation Method caters to niche markets that require specialized solvent properties. Although smaller in scale, this method’s contribution to the market is significant, highlighting the diverse needs within the 1-Propanol industry.

As market dynamics shift and technologies evolve, both methods play vital roles in meeting the global demand for 1-Propanol, each addressing distinct segments with tailored solutions.

By Application Analysis

In applications, coatings lead with a 37.5% usage rate in the 1-Propanol market, indicating significant demand in this sector.

In 2023, Coatings held a dominant market position in the “By Application” segment of the 1-Propanol Market, commanding a 37.5% share. This prominence is largely due to the critical role that 1-Propanol plays as a solvent in the formulation of various coatings, enhancing their application and durability on surfaces.

Other key applications of 1-Propanol include its use as a food additive, in pharmaceuticals, cosmetics, printing inks, and as a chemical intermediate.

The coatings industry relies on 1-Propanol to achieve smooth finishes and optimal drying times, making it invaluable in both industrial and residential settings. As environmental regulations become stricter, the demand for eco-friendly and efficient solvents like 1-Propanol in coatings is expected to rise, reinforcing its market dominance.

Meanwhile, its roles in other sectors, though with smaller shares, are equally essential. In pharmaceuticals and cosmetics, for instance, 1-Propanol is prized for its safety and efficacy as a formulation component.

The food industry uses it to maintain product quality and shelf life, while in printing inks, it enhances fluidity and adherence. Each application benefits from the unique properties of 1-Propanol, demonstrating its versatility and enduring importance across various industries.

By Sales Channel Analysis

Indirect sales channels are the most preferred, representing 65.4% of 1-Propanol sales, highlighting the reliance on intermediaries.

In 2023, Indirect Sales held a dominant market position in the “By Sales Channel” segment of the 1-Propanol Market, with a 65.4% share. This method of distribution, which includes utilizing third parties such as distributors and resellers, has proven particularly effective in expanding market reach and enhancing customer service. In comparison, Direct Sales accounted for the remaining market share, showcasing a more straightforward but less widespread approach.

The preference for indirect sales channels can be attributed to their ability to bridge the gap between manufacturers and a diverse customer base spread across various regions. Distributors in the indirect sales network play a crucial role in handling logistics, reducing the burden on producers and allowing them to focus more on product development and production efficiency.

This method also facilitates better local market penetration and customer support, which are vital for maintaining a strong presence in the competitive 1-Propanol market.

Indirect sales channels are particularly advantageous for manufacturers who seek to expand their footprint in international markets without the need for extensive local infrastructure. This strategy not only helps in scaling operations efficiently but also enhances the adaptability of businesses to meet the varying demands and regulatory landscapes across different regions.

Key Market Segments

By Type

- Ethylene Hydrogenation Method

- Allyl Alcohol Hydrogenation Method

- Others

By Application

- Coatings

- Food Additive

- Pharmaceutical

- Cosmetics

- Printing Inks

- Chemical Intermediates

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Driving Factors

Expanding Industrial Applications Boost Market Growth

The 1-Propanol market is primarily driven by its expanding range of industrial applications. This chemical serves as a crucial solvent in pharmaceuticals, cosmetics, and particularly in coatings, where its properties facilitate smoother finishes and faster drying times.

As industries continually seek efficient and reliable solvents to enhance product quality and manufacturing processes, the demand for 1-Propanol is expected to remain strong, supporting steady market growth.

Stringent Environmental Regulations Increase Demand

Stringent environmental regulations across the globe are prompting industries to seek safer and more sustainable chemical solutions. 1-Propanol, known for its low toxicity and biodegradability, fits this requirement perfectly.

This shift towards environmentally friendly solvents is significantly driving the demand for 1-Propanol, as companies align with governmental policies aiming to reduce hazardous emissions and improve workplace safety.

Technological Advancements in Production Methods

Technological advancements in production methods for 1-Propanol are also a key market driver. Improved catalytic processes and innovations in chemical engineering have made the production of 1-Propanol more efficient and cost-effective.

These enhancements not only optimize the manufacturing process but also lead to higher yields and better-quality products, catering to the precise needs of diverse industries and thereby fueling market growth.

Restraining Factors

Health Hazards and Safety Concerns Limit Use

Health risks associated with exposure to 1-Propanol, such as irritation of the eyes, nose, and throat, and severe impacts like metabolic acidosis from ingestion, pose significant challenges. These health concerns necessitate strict handling and safety protocols, increasing operational costs and limiting its application in sensitive environments.

This restraint affects industries that prioritize worker safety and environmental health, potentially slowing down the adoption rate of 1-Propanol in various sectors.

High Competition from Alternative Solvents

The 1-Propanol market faces stiff competition from alternative solvents that offer similar or superior properties with potentially lower costs or enhanced safety profiles. As industries explore and adopt these alternatives, the demand for 1-Propanol could be adversely affected.

This competition forces continual innovation and marketing efforts from 1-Propanol producers to maintain their market share, adding pressure to sustain its relevance against newer, more efficient chemicals.

Volatility in Raw Material Prices Affects Production Costs

Fluctuations in the prices of raw materials required for producing 1-Propanol significantly impact the overall production costs. Such volatility can lead to inconsistent pricing strategies, affecting profitability and budgeting plans for producers.

This unpredictability can deter new entrants and discourage investment in the 1-Propanol market, making it challenging for companies to plan long-term operations and potentially restraining market growth.

Growth Opportunity

Emerging Markets Offer New Avenues for Expansion

Emerging markets present significant growth opportunities for the 1-Propanol market. As countries in regions like Asia-Pacific and Latin America industrialize and implement more sophisticated manufacturing practices, the demand for industrial solvents like 1-Propanol is expected to rise.

This trend provides a great opportunity for producers to establish a presence in these growing markets, potentially increasing their global market share and revenue streams through strategic expansions and partnerships with local entities.

Innovation in Green Solvents to Drive Demand

The push towards environmental sustainability opens up opportunities for innovation in the production of green solvents. 1-Propanol, known for its relatively low environmental impact, stands to benefit from advancements that improve its sustainability or reduce its carbon footprint.

By developing eco-friendly derivatives or more efficient production methods, companies can attract new customers, particularly in industries where environmental compliance is crucial, such as pharmaceuticals and food production. This not only boosts market growth but also aligns with global sustainability goals.

Expansion in Pharmaceutical and Cosmetic Industries

The pharmaceutical and cosmetic industries are rapidly growing sectors that consistently demand high-quality solvents. 1-Propanol is utilized extensively in these industries due to its effectiveness and safety as a solvent.

With global healthcare expansion and an increasing emphasis on personal care and wellness, the demand in these sectors is likely to provide substantial growth opportunities for the 1-Propanol market. Producers can capitalize on this by enhancing production capabilities and developing products tailored to the stringent requirements of these industries.

Latest Trends

Increased Use of Bio-based 1-Propanol in Industries

One of the latest trends in the 1-Propanol market is the shift towards bio-based alternatives. Companies are increasingly investing in the development of 1-Propanol derived from renewable resources as a response to the growing consumer and regulatory demand for sustainable and eco-friendly products.

This trend not only helps reduce the environmental footprint of solvent production but also aligns with global sustainability goals, making bio-based 1-Propanol a preferred choice in industries such as pharmaceuticals, cosmetics, and food processing.

Technological Innovations in Solvent Recycling Systems

Technological innovations in solvent recycling systems represent a significant trend in the 1-Propanol market. These advancements are improving the efficiency of solvent use, reducing waste, and lowering costs for industries that use 1-Propanol extensively.

By integrating advanced recycling technologies, companies can minimize environmental impact and adhere to strict regulations while maintaining production efficiency. This trend is particularly important in sectors like coatings and printing inks, where solvent loss during processes is a major cost factor.

Growing Demand for Specialized Solvent Formulations

The growing demand for specialized solvent formulations is a key trend in the 1-Propanol market. As industries seek to improve product performance and meet specific application needs, customized formulations that include 1-Propanol are becoming increasingly popular.

This trend is evident in sectors such as electronics, automotive, and aerospace, where precision and reliability are paramount. The ability to tailor solvents to specific industrial applications allows companies to offer unique solutions and strengthen their market position.

Regional Analysis

In 2023, the Asia-Pacific 1-Propanol market held a 35.9% share, valued at USD 78.4 million.

The 1-Propanol market exhibits varied dynamics across different global regions, reflecting diverse industrial needs and regulatory landscapes. Asia-Pacific dominates the market with a 35.9% share, valuing approximately USD 78.4 million. This region’s leadership is driven by rapid industrial growth in countries like China and India, combined with increasing investments in pharmaceuticals and coatings industries.

In North America, the market is propelled by advanced manufacturing practices and stringent environmental regulations that favor the use of safe and sustainable solvents like 1-Propanol. The demand in Europe follows closely, where emphasis on eco-friendly and high-performance solvents boosts the market, particularly in the pharmaceutical and cosmetic sectors.

Meanwhile, the Middle East & Africa, and Latin America are witnessing gradual growth. The expansion in these regions is slower due to emerging industrial sectors and developing economic conditions.

However, increasing industrialization and investment in manufacturing capabilities are expected to drive the demand for 1-Propanol in these areas over the coming years, with a particular emphasis on coatings and chemical intermediates.

Each region’s unique industrial and regulatory environment significantly influences the adoption and application of 1-Propanol, shaping the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global 1-Propanol market will be significantly shaped by the activities of key players who bring diverse strengths and strategies to the forefront. Companies like BASF SE and Dow Inc. stand out due to their extensive research and development capabilities, which allow them to innovate in both product quality and process efficiency.

These leaders leverage their advanced technological platforms to improve the yield and environmental profile of 1-Propanol, catering to the stringent requirements of various industries, including pharmaceuticals and cosmetics.

Eastman Chemical Company and ExxonMobil, known for their robust supply chains, excel in ensuring the availability and consistency of 1-Propanol across global markets. Their strong logistic frameworks effectively mitigate the risks associated with raw material price volatility and supply disruptions, providing stability in the market.

Asian companies like Mitsui Chemicals Inc. and Chang Chun Group are pivotal in addressing the rising demand in the Asia-Pacific region, driven by rapid industrialization and expansion in end-use sectors. Their localized production capabilities allow them to cater efficiently to regional needs, reinforcing their market position.

Smaller players such as KH Chemicals and Nanjing Rongxin Chemical are critical for introducing competitive dynamics in the market by focusing on niche applications and regional demands. Their agility and customer-centric approaches enable them to respond swiftly to changing market needs.

Moreover, companies like Oxea and Sasol Limited are actively expanding their production capacity to meet the growing global demand, indicating a bullish outlook on the market potential of 1-Propanol.

These firms, along with others like Solvay and Shell Chemicals, play a crucial role in shaping the competitive landscape through strategic growth initiatives, collaborations, and technological advancements, setting the stage for ongoing innovation and market expansion in the 1-Propanol sector.

Top Key Players in the Market

- BASF SE

- Chang Chun Group

- Dairen Chemical Corporation

- Dow Inc.

- Eastman Chemical Company

- ExxonMobil

- KH Chemicals

- Lyonellbasell

- Mitsui Chemicals Inc.

- Nanjing Rongxin Chemical

- Ningbo Juhua Chemical

- Oxea

- Sasol Limited

- Shell Chemicals

- Solvay

- Tokuyama Corporation

- Wu Jiang Chemical

- Zibo Nalcohol Chemical

Recent Developments

- In 2024, Dairen Chemical Corporation specializes in producing n-Propanol, used in coatings and medical products, while adhering to environmental and quality standards like ISO-14000 and ISO-9000. Also, they achieved ISCC PLUS certification, highlighting their commitment to sustainable and eco-friendly practices

- In 2023, Eastman Chemical Company faced revenue declines, dropping from $10.58 billion to $9.21 billion due to lower sales volumes and prices. However, they maintained strong operations, generating $1.4 billion in operating cash and cutting costs by $200 million.

Report Scope

Report Features Description Market Value (2023) USD 215.5 Billion Forecast Revenue (2033) USD 312.9 Billion CAGR (2024-2033) 3.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ethylene Hydrogenation Method, Allyl Alcohol Hydrogenation Method, Others), By Application (Coatings, Food Additive, Pharmaceutical, Cosmetics, Printing Inks, Chemical Intermediates, Others), By Sales Channel (Direct Sale, Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, Chang Chun Group, Dairen Chemical Corporation, Dow Inc., Eastman Chemical Company, ExxonMobil, KH Chemicals, Lyonellbasell, Mitsui Chemicals Inc., Nanjing Rongxin Chemical, Ningbo Juhua Chemical, Oxea, Sasol Limited, Shell Chemicals, Solvay, Tokuyama Corporation, Wu Jiang Chemical, Zibo Nalcohol Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Chang Chun Group

- Dairen Chemical Corporation

- Dow Inc.

- Eastman Chemical Company

- ExxonMobil

- KH Chemicals

- Lyonellbasell

- Mitsui Chemicals Inc.

- Nanjing Rongxin Chemical

- Ningbo Juhua Chemical

- Oxea

- Sasol Limited

- Shell Chemicals

- Solvay

- Tokuyama Corporation

- Wu Jiang Chemical

- Zibo Nalcohol Chemical