Global N-propanol Market By Type (Ethylene Hydrogenation Method, Allyl Alcohol Hydrogenation Method, Others), By Application (Coatings, Food Additive, Pharmaceutical, Cosmetics, Printing Inks, Chemical Intermediates, Others), By End Use (Pharmaceuticals, Household And Personal Care Products, Chemical Production, Coatings, Anti-freeze, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138866

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

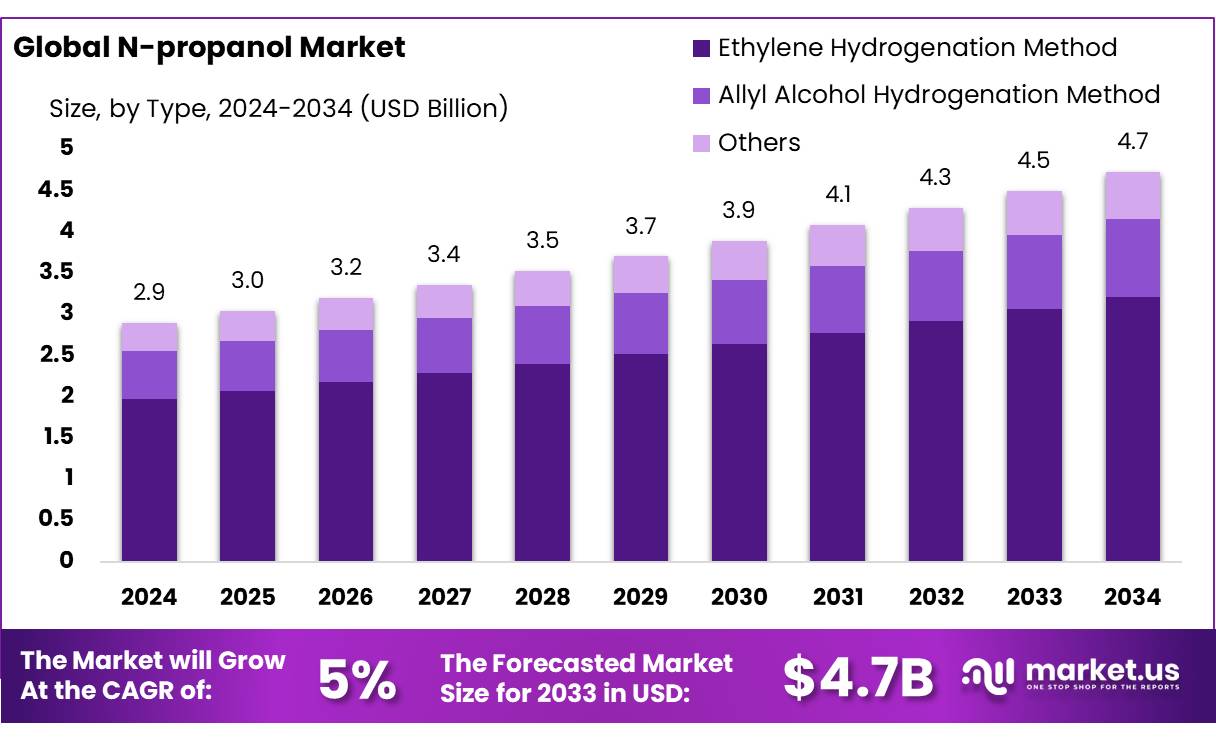

The Global N-propanol Market size is expected to be worth around USD 4.7 Bn by 2034, from USD 2.9 Bn in 2024, growing at a CAGR of 5% during the forecast period from 2025 to 2034.

The N-propanol market, a critical solvent and intermediate in the production of various chemicals, is poised for consistent growth as demand rises across multiple industries. N-propanol, commonly used in industries such as pharmaceuticals, paints and coatings, personal care, and cleaning, serves as an essential ingredient in a wide range of applications. It is produced through the hydration of propene, a by-product of petroleum refining, and has found widespread use due to its excellent solvency properties and versatility in industrial processes.

Investments in N-propanol production have surged as companies seek to capitalize on the increasing demand for cleaner and more efficient solvents. The expanding need for industrial-grade solvents, along with rising awareness about environmental sustainability, has been driving growth in the N-propanol market. According to recent industry trends, the market has been growing at a steady pace, underpinned by strong demand from industries like pharmaceuticals, agrochemicals, paints, and personal care. The market is expected to continue expanding as the shift towards sustainable chemical processes accelerates, especially in emerging markets where manufacturing and industrialization are on the rise.

The primary driving factors for the N-propanol market. It is widely used in the production of sanitizers, cosmetic formulations, and solvent extraction processes. In fact, the demand for N-propanol surged during the COVID-19 pandemic due to the heightened demand for alcohol-based hand sanitizers. Additionally, cosmetics and personal care sectors have increasingly adopted N-propanol for its ability to dissolve essential oils and act as a solvent in skincare formulations. This trend continues to fuel demand, particularly in North America and Europe, where consumer spending on premium personal care products is high.

Another key growth driver for the N-propanol market is the growth of the paints and coatings industry, particularly in the automotive and construction sectors. N-propanol is used as a solvent in paints and coatings formulations, enhancing the flow, leveling, and drying properties of these products. The Asia Pacific region, in particular, is seeing rapid growth in infrastructure development and automotive manufacturing, leading to increased demand for paints, coatings, and adhesives containing N-propanol. Countries like China, India, and Japan are anticipated to remain at the forefront of this trend.

The future growth of the N-propanol market is also closely tied to the shift towards renewable energy and sustainable chemicals. In the coming years, as industries seek alternatives to petroleum-based products, N-propanol’s role in bio-based formulations and its environmental benefits will likely become even more pronounced. For example, the growing focus on green chemistry is expected to foster innovations in the production of N-propanol from renewable feedstocks, further propelling its market expansion.

Key Takeaways

- N-propanol Market size is expected to be worth around USD 4.7 Bn by 2034, from USD 2.9 Bn in 2024, growing at a CAGR of 5%.

- Ethylene Hydrogenation Method held a dominant market position, capturing more than a 68.4% share.

- Coatings held a dominant market position, capturing more than a 37.5% share of the N-propanol market.

- Pharmaceuticals held a dominant market position, capturing more than a 29.3% share of the N-propanol market.

- Asia Pacific (APAC) dominates the market, accounting for 38.8% of the total market share, valued at USD 1.1 billion.

By Type

In 2024, the Ethylene Hydrogenation Method held a dominant market position, capturing more than a 68.4% share of the N-propanol market. This method is widely preferred due to its high efficiency and relatively low cost of production. The process involves hydrogenating ethylene oxide to produce propanol, making it a key player in industrial production.

Allyl Alcohol Hydrogenation Method, on the other hand, accounted for a smaller share in the market in 2024, though it is growing in popularity. While it represented a fraction of the total market, its appeal lies in the fact that it offers a different pathway for producin7g propanol.

By Application

In 2024, Coatings held a dominant market position, capturing more than a 37.5% share of the N-propanol market. This segment remains the largest due to the increasing demand for N-propanol as a solvent and stabilizer in various coating formulations. N-propanol is crucial in the production of paints, varnishes, and protective coatings, as it helps improve the consistency and drying times of these products.

The Food Additive segment, while smaller in comparison, is steadily gaining traction. In 2024, this application accounted for a significant portion of the market, driven by N-propanol’s role as a flavoring agent and carrier in food products.

In the Pharmaceutical sector, N-propanol is used in the formulation of drugs and as a solvent in various pharmaceutical preparations. Although this segment accounts for a smaller share compared to coatings, its importance is growing as the pharmaceutical industry continues to expand globally.

Cosmetics also represent a key application for N-propanol, with this segment seeing consistent growth. In 2024, N-propanol’s use in personal care products such as perfumes, lotions, and skin-care items contributed to a moderate share of the market. Printing Inks, which include applications in the production of inks for packaging, newspapers, and other printed materials, account for a smaller share but continue to be a crucial use of N-propanol.

The Chemical Intermediates segment is also an important contributor, as N-propanol is used in the production of various chemicals that are further processed into other industrial products. In 2024, the chemical intermediates application maintained a solid market share and is expected to remain stable through 2025, driven by ongoing demand for chemical products across diverse industries, such as automotive, textiles, and agriculture.

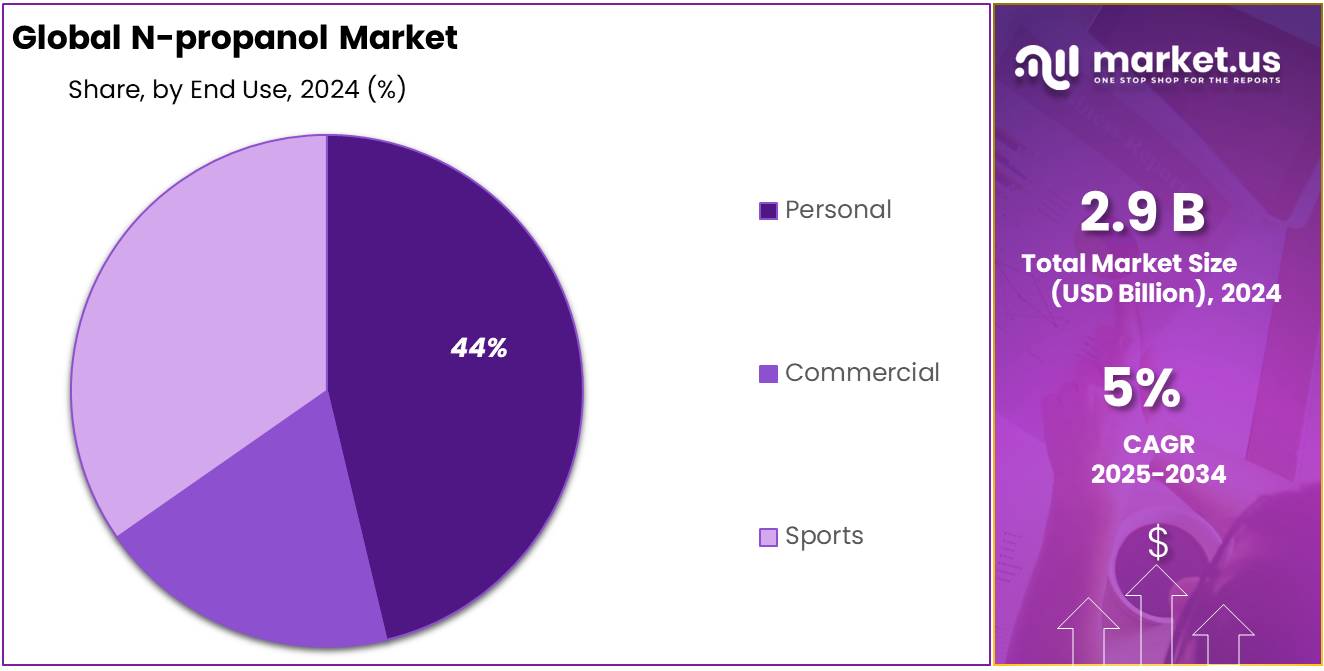

By End Use

In 2024, Pharmaceuticals held a dominant market position, capturing more than a 29.3% share of the N-propanol market. The pharmaceutical industry relies heavily on N-propanol as a solvent for various drugs and as an ingredient in the formulation of certain medicines. Its versatility and effectiveness in dissolving active ingredients make it essential in drug manufacturing.

The Household & Personal Care Products segment is another key contributor to the N-propanol market. In 2024, this application accounted for a significant share, driven by N-propanol’s role in the production of items such as shampoos, lotions, soaps, and deodorants. As consumers increasingly prioritize personal care and hygiene products, the demand for high-quality, effective formulations is growing.

In Chemical Production, N-propanol is widely used as a building block for the synthesis of other chemicals, making this segment an important part of the overall market. In 2024, this segment represented a solid portion of the market share. The demand for chemical intermediates in industries such as agriculture, textiles, and manufacturing drives the use of N-propanol in this application.

Coatings, one of the largest end-use sectors for N-propanol, held a substantial market share in 2024. N-propanol is extensively used in the formulation of paints, varnishes, and protective coatings due to its properties as a solvent and stabilizer. The ongoing demand for coatings, particularly in industries such as construction, automotive, and industrial manufacturing, is expected to keep this segment robust through 2025.

The Anti-freeze segment also represents a notable application for N-propanol. Used as a key ingredient in antifreeze formulations, N-propanol contributes to the lowering of the freezing point in automotive fluids, ensuring their performance in colder climates.

Key Market Segments

By Type

- Ethylene Hydrogenation Method

- Allyl Alcohol Hydrogenation Method

- Others

By Application

- Coatings

- Food Additive

- Pharmaceutical

- Cosmetics

- Printing Inks

- Chemical Intermediates

- Others

By End Use

- Pharmaceuticals

- Household & Personal Care Products

- Chemical Production

- Coatings

- Anti-freeze

- Others

Drivers

Growing Demand for N-propanol in the Food and Beverage Industry

The demand for processed and convenience foods has been steadily increasing, particularly in regions with growing urban populations. According to a report by the Food and Agriculture Organization (FAO), global food demand is expected to rise by 70% by 2050, driven by population growth and increased urbanization. As urban populations grow and consumer preferences shift towards ready-to-eat meals, the need for food additives like N-propanol will also rise to meet the demand for enhanced flavor profiles and product consistency. The FAO notes that emerging markets in Asia, Africa, and Latin America are seeing particularly sharp increases in demand for packaged foods and beverages, further driving the need for food additives such as N-propanol.

N-propanol is commonly used as a flavor carrier in food products, such as baked goods, sauces, beverages, and processed snacks. This is primarily because it helps dissolve and distribute flavor compounds evenly throughout a product, improving taste and ensuring uniformity in production. With the growing consumer preference for highly processed and pre-packaged food items that maintain long shelf lives, food manufacturers are increasingly turning to N-propanol to stabilize flavors and enhance product quality. Additionally, as food companies face rising demand for more complex and diverse flavor combinations, N-propanol’s role as a solvent and carrier is becoming even more vital.

The demand for natural and clean-label products has also influenced the usage of N-propanol in food manufacturing. With growing consumer awareness around food safety and health, many food companies are opting for safer, more natural ingredients in their production processes. N-propanol, when used in controlled amounts, can be considered safe for consumption. The U.S. Food and Drug Administration (FDA) classifies N-propanol as a generally recognized as safe (GRAS) substance for use in food products, which has bolstered its acceptance and use across the industry. As consumers continue to seek out products with fewer artificial additives, the use of safer, natural solvents like N-propanol is likely to rise.

The increasing trend of food and beverage innovation also plays a crucial role in driving N-propanol’s demand. As the industry develops new flavors, healthier alternatives, and innovative formulations, the need for reliable solvents and flavor carriers grows. For instance, the rising popularity of plant-based and vegan food products requires novel flavor profiles that can often be enhanced with the use of N-propanol. According to Mintel, the global market for plant-based foods is expected to grow by 11% annually, which could further boost demand for N-propanol as a flavor enhancer in these products.

Restraints

Environmental Concerns and Regulatory Challenges

The manufacturing of N-propanol, particularly through traditional methods like ethylene hydrogenation, is energy-intensive and releases greenhouse gases. The EPA reports that the chemical manufacturing sector contributes to about 15% of total industrial greenhouse gas emissions in the U.S., with petrochemical processes being a significant source. As pressure mounts on industries to reduce their carbon footprints, N-propanol producers are facing scrutiny. This has led to higher production costs, as companies must invest in cleaner technologies or offset emissions to comply with stricter environmental regulations.

Regulatory challenges are increasing for N-propanol manufacturers, especially in regions like Europe and North America. In Europe, the REACH regulation aims to limit harmful chemicals and encourage sustainable practices. N-propanol, used as a solvent in various industries, falls under these regulations, requiring manufacturers to conduct safety testing and provide detailed environmental data. This can result in higher compliance costs, potentially impacting the price and availability of N-propanol. In the U.S., the Clean Air Act and local regulations on volatile organic compounds (VOCs) are tightening, which could impose more stringent controls on N-propanol production.

The agricultural and food industries are also feeling the pressure to adopt more sustainable practices, especially regarding chemical use in food production. The Food and Agriculture Organization (FAO) emphasizes reducing chemical inputs to ensure long-term health for both consumers and the environment. As global demand for sustainable farming increases, food manufacturers are turning toward natural ingredients and chemicals with a lower environmental impact. This trend has led to a decrease in the use of chemicals like N-propanol, particularly in markets where sustainability and eco-conscious production methods are prioritized.

As the shift towards sustainability continues, there is growing pressure on food and beverage manufacturers to reduce reliance on chemicals like N-propanol. Consumers, particularly in eco-aware markets, are pushing for cleaner, greener products, prompting manufacturers to seek alternatives that align with these values. This has the potential to reduce N-propanol’s market share, especially in industries aiming to cater to environmentally-conscious consumers.

Opportunity

Growth Opportunities for N-propanol in the Renewable Chemicals Sector

One of the major growth opportunities for N-propanol lies in the expanding renewable chemicals sector. As global awareness of environmental issues increases, industries are shifting towards sustainable practices, particularly in chemicals and manufacturing. This is driving demand for bio-based chemicals, made from renewable resources like plant biomass instead of petrochemicals. N-propanol, traditionally derived from petrochemical processes, is now gaining interest for production from renewable sources, especially in sectors like food, pharmaceuticals, and cosmetics, where sustainability is increasingly important to consumers.

This shift is being driven by consumer demand for eco-friendly products and government incentives promoting sustainability. The U.S. Department of Energy (DOE) supports bio-based chemicals research, investing in efficient biomass conversion technologies. These efforts aim to make bio-based N-propanol more cost-competitive and reduce its carbon footprint. As a result, manufacturers are exploring renewable production methods, which could position N-propanol as a more sustainable and attractive option in the market.

The European Union’s Green Deal, with its focus on circular economies and reducing carbon emissions, is also pushing the chemicals industry toward sustainability. As part of the Circular Economy Action Plan, the EU encourages industries to reduce their reliance on non-renewable materials and adopt renewable resources. For the chemicals sector, this means increased investment in bio-based chemicals. N-propanol producers are exploring renewable production routes, creating opportunities in markets that prioritize environmental responsibility.

The food and beverage industry, a major consumer of N-propanol, is aligning with sustainability trends as consumers increasingly prefer products made from renewable resources. A 2021 survey by the Food Marketing Institute found that 73% of consumers consider sustainability when purchasing food. As food companies strive to meet these demands, bio-based N-propanol would appeal to this eco-conscious market, offering new growth opportunities for producers.

In the cosmetics industry, sustainability is also becoming a key driver. The Cosmetic Industry Association reports rising demand for natural, eco-friendly beauty products, with consumers seeking sustainably sourced ingredients. N-propanol is used in many cosmetic products, including perfumes and lotions, and sourcing it from renewable feedstocks could help cosmetics companies meet sustainability goals. This trend opens opportunities for bio-based N-propanol in the beauty and personal care sector as companies focus on greener supply chains.

Trends

Increasing Shift Toward Bio-based and Sustainable Production of N-propanol

A significant and growing trend in the N-propanol market is the shift toward bio-based and sustainable production methods. As global awareness of climate change and environmental sustainability increases, there has been an accelerating push in many industries to move away from petrochemical-based processes and toward renewable, bio-based alternatives. N-propanol, a chemical traditionally derived from fossil fuels, is now being produced through bio-based routes, thanks to advances in biotechnology and renewable energy. This trend is driven by both consumer demand for eco-friendly products and government policies that encourage the reduction of carbon footprints in chemical manufacturing.

The global chemical industry has been under increasing pressure to reduce its environmental impact, and many governments around the world are introducing regulations and incentives to promote greener practices. The European Union’s Green Deal, for example, is pushing for a transition to a carbon-neutral economy by 2050, and chemicals are a major part of this initiative. As part of this shift, the EU is focusing on increasing the use of bio-based chemicals in manufacturing processes, which has directly impacted the demand for renewable alternatives to N-propanol. The European Commission has set a target to increase the share of bio-based chemicals used in the industry, aligning with its broader goals of reducing dependence on fossil fuels and achieving climate neutrality.

In the U.S., the Department of Energy (DOE) is also supporting the transition to bio-based chemicals through initiatives like the Bioenergy Technologies Office, which funds research and development into sustainable chemical production processes. The DOE has been instrumental in advancing technologies that can efficiently convert renewable biomass into chemicals, including alcohols like N-propanol. With increasing investments in biofuels and biochemicals, the U.S. is rapidly becoming a key player in the development of bio-based N-propanol, further driving this trend.

This shift is also being driven by consumer demand. According to the Food and Agriculture Organization (FAO), there is a growing consumer preference for sustainably sourced products, including in the food and beverage industry, where N-propanol is commonly used as a flavoring agent and solvent. A 2019 Nielsen survey found that 73% of global consumers are willing to pay more for products that are sustainably sourced or produced. This trend is especially visible in the food sector, where consumers are increasingly opting for products with minimal environmental impact. As food manufacturers are increasingly pressured to adopt more sustainable practices, the demand for bio-based N-propanol in food and beverage applications is expected to rise.

Similarly, the cosmetics industry, which uses N-propanol as a solvent in products like perfumes, lotions, and personal care items, is also embracing sustainability. The Cosmetic Industry Association reports that 79% of consumers consider environmental impact when purchasing beauty products, and a large segment of them prefer items made with bio-based ingredients. As a result, many cosmetic companies are shifting to natural, bio-based solvents like N-propanol derived from renewable sources to appeal to this growing market of environmentally conscious consumers.

Bio-based N-propanol production uses feedstocks like agricultural waste, plant sugars, or other renewable resources, reducing the reliance on petroleum and lowering the carbon footprint associated with traditional manufacturing methods. Several companies are already exploring the potential of this alternative, including Dow Chemical and BASF, which have both launched projects to explore the viability of bio-based chemicals, including N-propanol. In addition, LanzaTech, a startup focused on using carbon capture and fermentation technology, has been developing ways to produce bio-based chemicals from industrial emissions. This innovative approach holds the potential to produce N-propanol from waste carbon, making the process not only sustainable but also circular.

Governments are also playing an important role in driving this trend through subsidies and funding for renewable chemical production. The U.S. Department of Agriculture (USDA), for example, has been providing grants and incentives for companies developing renewable chemicals from agricultural byproducts. These initiatives are helping to lower the cost of bio-based N-propanol production, making it more competitive with traditional petrochemical-derived N-propanol.

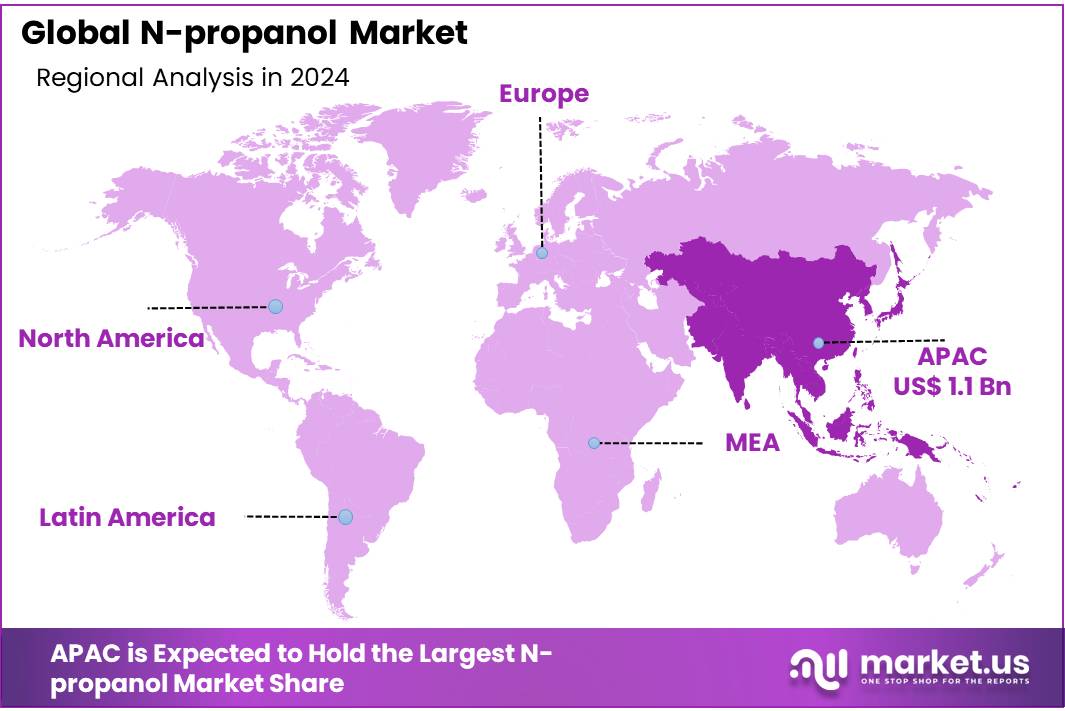

Regional Analysis

The global N-Propanol market is experiencing significant growth, with distinct regional trends and dynamics shaping its future. Asia Pacific (APAC) dominates the market, accounting for 38.8% of the total market share, valued at USD 1.1 billion. The region’s robust industrial base, especially in chemicals, automotive, and personal care sectors, has driven the high demand for N-Propanol.

In North America, the N-Propanol market is also growing steadily, fueled by strong demand from the pharmaceuticals, cosmetics, and food processing industries. The United States remains the largest contributor to the market, with a focus on increasing use in hand sanitizers, cleaning products, and as an intermediate in various chemical applications.

Europe is another key region, with demand driven by industries such as automotive and chemical manufacturing. The European market benefits from high demand in applications like paint and coatings and personal care. Countries such as Germany, France, and the UK are major consumers, owing to their well-established industrial infrastructure and stringent regulations that favor the use of safe solvents like N-Propanol.

The Middle East & Africa and Latin America are witnessing moderate growth, driven by developing industrial applications and an increase in consumer demand for cleaning products and personal care formulations. While growth in these regions is comparatively slower, their market share is expected to grow as infrastructure development and industrialization progress in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The N-propanol market is highly competitive, with several key players leading the production and distribution of this versatile chemical. BASF, Dow, Eastman, and Oxea are some of the global leaders in the N-propanol market. BASF, one of the largest chemical companies in the world, offers a wide range of N-propanol products, particularly in the pharmaceutical and coatings sectors.

Dow and Eastman leverage their extensive global distribution networks and strong manufacturing capabilities to cater to the growing demand for N-propanol in various industries. Oxea, a major player in the chemical sector, focuses on producing high-quality N-propanol through its large-scale manufacturing facilities in Europe and North America. These companies are investing heavily in sustainable production methods, responding to the increasing demand for bio-based N-propanol.

Other significant players include Sasol, Wu Jiang Chemical, and Nanjing Rongxin Chemical, which play a strong role in Asia, particularly in China and India. These companies benefit from the rapidly expanding industrial sectors in APAC, where N-propanol is used extensively in the chemical, pharmaceutical, and coatings industries.

Chang Chun Group and Ningbo Juhua Chemical are also capitalizing on the growth of the N-propanol market in Asia, while Zibo Nalcohol Chemical focuses on solvent applications in China. Additionally, companies such as OQ Chemicals, Spectrum Chemicals, and Solvay S.A. have a notable presence in Europe and North America, further strengthening the supply chain across various sectors.

Top Key Players

- BASF

- Dow

- Eastman

- Oxea

- Sasol

- Wu Jiang Chemical

- Nanjing Rongxin Chemical

- Chang Chun Group

- Ningbo Juhua Chemical

- Zibo Nalcohol Chemical

- OQ Chemicals

- Spectrum Chemicals

- Solvay S.A.

- Dairen Chemical Corporation

- Solventis Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

Recent Developments

In 2024, BASF’s chemical division, which includes solvents like N-propanol, generated approximately €25 billion in revenue, accounting for a significant share of the company’s overall sales.

In 2024, Dow continues to be one of the largest producers of N-propanol, contributing significantly to the demand for solvents and intermediates used in industrial processes.

In 2024, Eastman reported total annual revenues of approximately $10.5 billion, with its Specialty Chemicals division, including products like N-propanol, contributing to a significant portion of its earnings.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 4.7 Bn CAGR (2025-2034) 5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Typ (Ethylene Hydrogenation Method, Allyl Alcohol Hydrogenation Method, Others), By Application (Coatings, Food Additive, Pharmaceutical, Cosmetics, Printing Inks, Chemical Intermediates, Others), By End Use (Pharmaceuticals, Household And Personal Care Products, Chemical Production, Coatings, Anti-freeze, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF, Dow, Eastman, Oxea, Sasol, Wu Jiang Chemical, Nanjing Rongxin Chemical, Chang Chun Group, Ningbo Juhua Chemical, Zibo Nalcohol Chemical, OQ Chemicals, Spectrum Chemicals, Solvay S.A., Dairen Chemical Corporation, Solventis Ltd., Hefei TNJ Chemical Industry Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF

- Dow

- Eastman

- Oxea

- Sasol

- Wu Jiang Chemical

- Nanjing Rongxin Chemical

- Chang Chun Group

- Ningbo Juhua Chemical

- Zibo Nalcohol Chemical

- OQ Chemicals

- Spectrum Chemicals

- Solvay S.A.

- Dairen Chemical Corporation

- Solventis Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.