Global Mefloquine (CAS 53230-10-7) Market By Product Type (Purity 98%, Purity 99%, Others), By Form (Tablet, Powder, Liquid), By Application (Chemical Industry, Pharmaceutical Industry, Others), By Distribution Channel (Direct Sales, Distributors And Wholesalers, Online Platforms, Hospitals And Healthcare Providers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138596

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

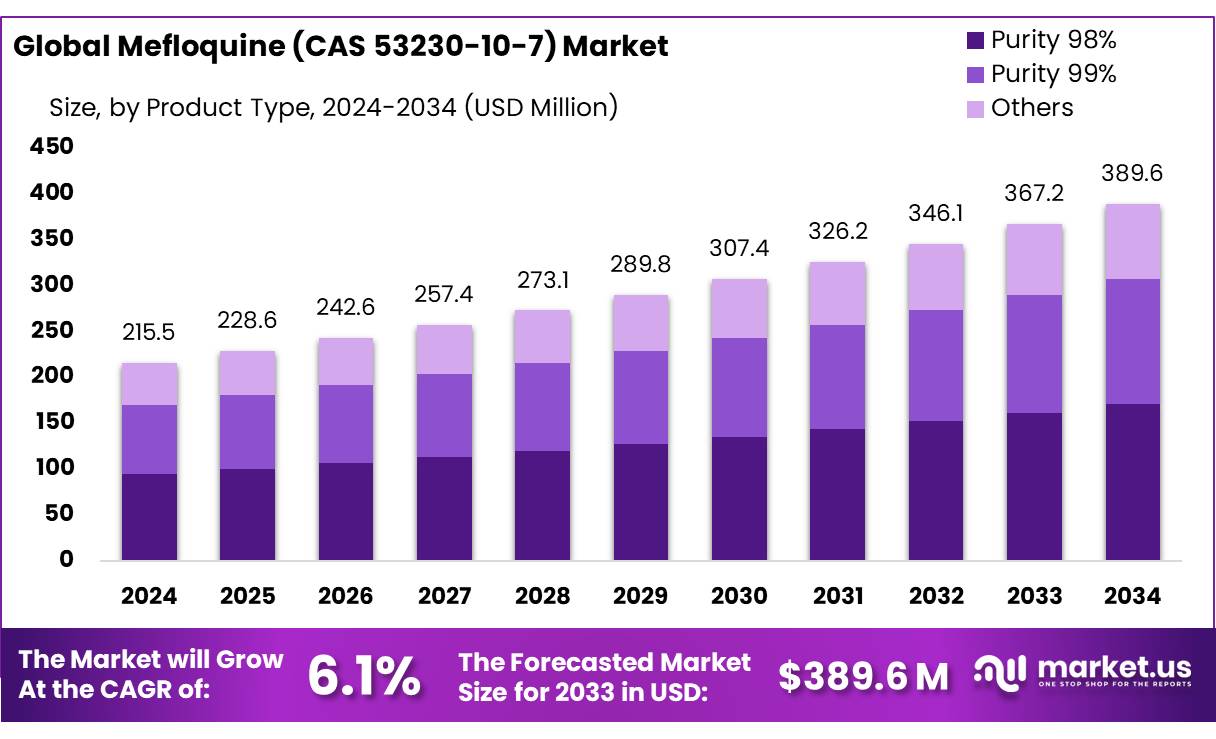

The Global Mefloquine (CAS 53230-10-7) Market size is expected to be worth around USD 389.6 Mn by 2034, from USD 215.5 Mn in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The global Mefloquine (CAS 53230-10-7) market has experienced steady demand due to its prominent role in the treatment and prevention of malaria, particularly in regions where the disease remains endemic. Mefloquine is a synthetic antimalarial drug primarily used for the prevention and treatment of malaria caused by Plasmodium falciparum and Plasmodium vivax. Since its approval in the 1980s, Mefloquine has been a critical tool in combating malaria in tropical and subtropical regions.

The Mefloquine (CAS 53230-10-7) is heavily influenced by the persistent threat of malaria, especially in sub-Saharan Africa, Southeast Asia, and parts of South America. The pharmaceutical sector remains the primary driver of the Mefloquine market, with pharmaceutical companies manufacturing the drug in tablet and oral forms. Governments and non-governmental organizations (NGOs) have played a crucial role in the distribution of Mefloquine in malaria-endemic areas, further supporting market growth.

Driving factors for the Mefloquine (CAS 53230-10-7) market include the ongoing prevalence of malaria and the critical role Mefloquine plays in its treatment regimen. Despite the growing concern over drug resistance, particularly against Plasmodium falciparum, Mefloquine continues to be a preferred treatment for malaria due to its long half-life and effectiveness in preventing relapse. Moreover, the global push to eliminate malaria by 2030 has encouraged increased efforts in malaria control programs, further driving the demand for effective treatments like Mefloquine.

Government policies, international funding from organizations such as the Global Fund, and collaborations between pharmaceutical companies and research institutions for new drug formulations present significant opportunities for the Mefloquine (CAS 53230-10-7) market. Moreover, the expansion of malaria prevention programs in non-endemic regions, such as in travelers and expatriates, will contribute to the ongoing demand for Mefloquine.

The development of new Mefloquine-based formulations or extended-release versions, aimed at improving patient compliance and reducing side effects, may also present growth opportunities for manufacturers in the coming years. Overall, the Mefloquine market is poised for steady growth, bolstered by ongoing malaria control efforts, continued demand in endemic regions, and the role of the drug in combination therapies for the disease.

Key Takeaways

- Mefloquine (CAS 53230-10-7) Market size is expected to be worth around USD 389.6 Mn by 2034, from USD 215.5 Mn in 2024, growing at a CAGR of 6.1%.

- Purity 98% held a dominant market position, capturing more than a 44.4% share of the Mefloquine market.

- Tablet held a dominant market position, capturing more than a 53.2% share of the Mefloquine market by form.

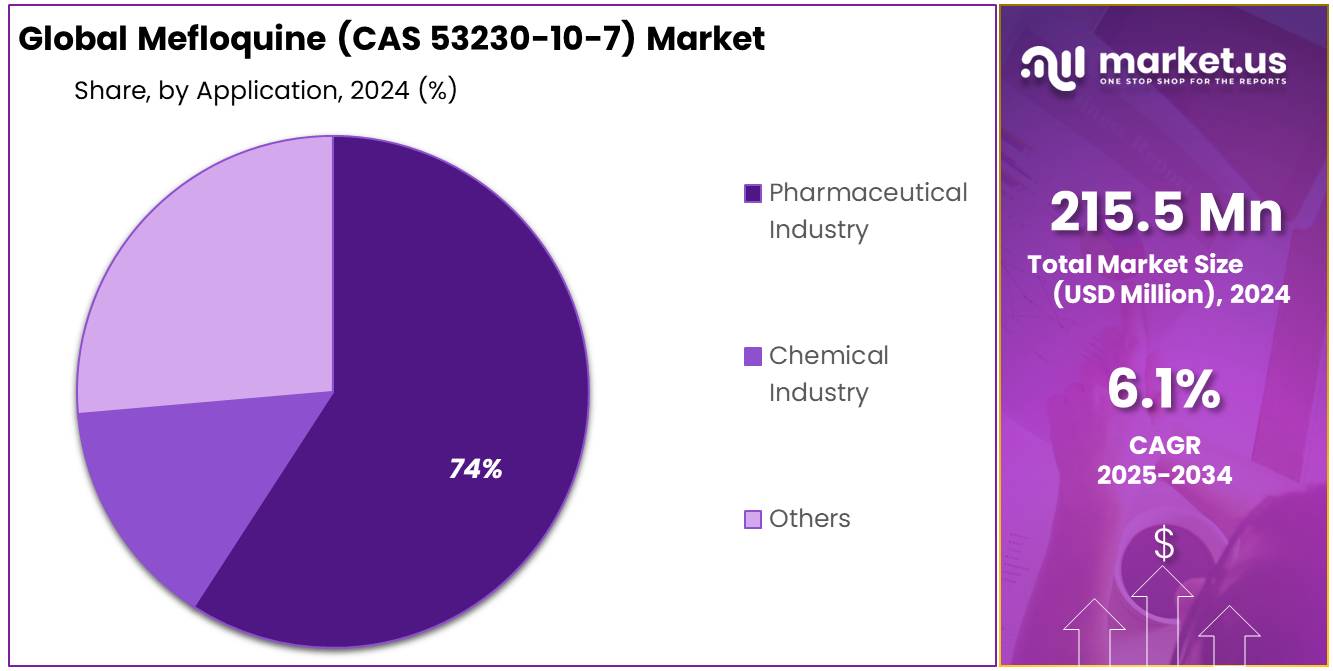

- Pharmaceutical Industry held a dominant market position, capturing more than a 74.3% share of the Mefloquine market by application.

- Direct Sales held a dominant market position, capturing more than a 39.1% share.

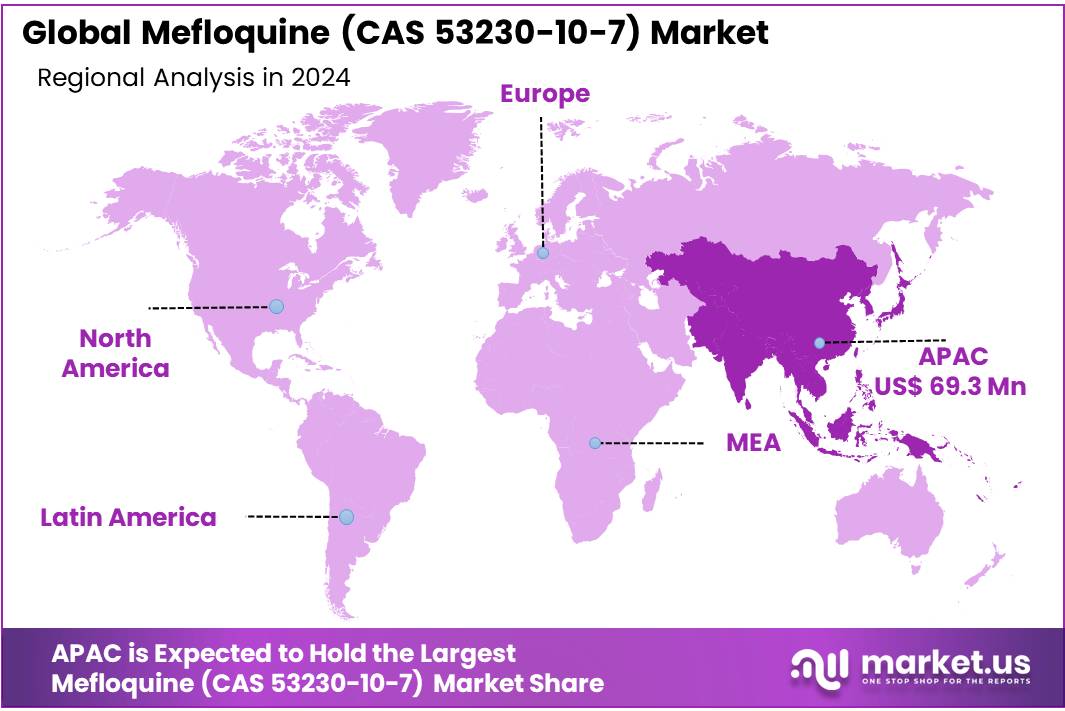

- Asia Pacific (APAC) region, which captured a substantial share of 32.2%, translating to a market value of approximately USD 69.3 million.

By Product Type

In 2024, Purity 98% held a dominant market position, capturing more than a 44.4% share of the Mefloquine market. This segment’s strong market presence can be attributed to its widespread application in both the pharmaceutical and medical industries, where high-quality and effective formulations are required. The demand for Mefloquine with a 98% purity level remains high due to its consistent performance in treating malaria and other related diseases.

In 2024, Purity 99% also experienced growth, capturing a notable share of the market. This high-purity variant is often sought after for more specialized medical applications where the highest standards of quality are necessary. While it did not dominate the market like Purity 98%, it still held its ground due to increasing demand in research and clinical trials where precision and purity are critical. As a result, the market for Purity 99% has been expanding, particularly in the pharmaceutical sector.

By Form

In 2024, Tablet held a dominant market position, capturing more than a 53.2% share of the Mefloquine (CAS 53230-10-7) market by form. The tablet form is widely preferred due to its ease of use, long shelf life, and ability to deliver precise dosages, making it a staple in the treatment of malaria and other related diseases. Its popularity is especially pronounced in regions where mass distribution is necessary, as tablets are cost-effective, easy to transport, and store. The steady growth of the tablet segment is further supported by the increasing availability of generic versions, making it an affordable treatment option for a larger patient base worldwide.

The Powder form of Mefloquine (CAS 53230-10-7) also has its place in the market, capturing a smaller but notable share in 2024. While it accounted for a more modest portion of the market, its use is often specific to certain medical settings, such as in hospitals or for patients who have difficulty swallowing tablets. The powder form allows for flexible dosing, which is particularly valuable in pediatric and geriatric care, where exact dosage adjustments are often needed. The demand for the powder form has grown steadily, driven by healthcare providers’ ability to mix the drug with other solutions or use it for patients requiring individualized treatment regimens.

The Liquid form, though accounting for the smallest share of the market in 2024, continues to meet the needs of specific patient groups, including children and those with swallowing difficulties. This form’s demand is largely driven by its ease of administration, particularly in settings where patients are unable to take tablets or powder. While its market share remains limited, it has seen gradual growth, supported by ongoing advancements in liquid formulation technologies that improve the stability and taste of the medication.

By Application

In 2024, the Pharmaceutical Industry held a dominant market position, capturing more than a 74.3% share of the Mefloquine (CAS 53230-10-7) market by application. This significant share is largely driven by Mefloquine’s critical role in the treatment of malaria and other tropical diseases. The pharmaceutical industry’s stronghold is a result of consistent demand for this anti-malarial drug in both developed and emerging markets.

The Chemical Industry, while not as dominant as the pharmaceutical sector, holds a smaller but important share in the Mefloquine (CAS 53230-10-7) market. In 2024, this segment accounted for a modest portion of the market as Mefloquine is sometimes used in the production of chemical intermediates or in the synthesis of other compounds. However, its use in the chemical industry is niche compared to its pharmaceutical applications.

By Distribution Channel

In 2024, Direct Sales held a dominant market position, capturing more than a 39.1% share of the Mefloquine (CAS 53230-10-7) market by distribution channel. Direct sales have been a key method for pharmaceutical companies to maintain control over pricing, distribution, and customer relationships. This distribution method is particularly common in regions with well-established healthcare systems, where pharmaceutical manufacturers often sell directly to hospitals, clinics, and large healthcare organizations.

Distributors & Wholesalers have also played a significant role in the Mefloquine market, capturing a substantial share in 2024. This channel is especially important in regions where there is a fragmented healthcare system or where pharmaceutical supply chains require local intermediaries to distribute drugs more widely. Distributors and wholesalers help reach a broader network of healthcare providers, pharmacies, and clinics, particularly in rural or hard-to-reach areas. Their role in the market has grown steadily as demand for Mefloquine (CAS 53230-10-7) continues to rise in both developed and developing regions. By 2024, this channel has shown consistent growth, particularly in emerging markets where distribution networks are still developing.

Online Platforms have seen increasing relevance in the Mefloquine market, with this segment growing steadily in 2024. While not as dominant as direct sales or distributors, online platforms have become an important channel for purchasing Mefloquine (CAS 53230-10-7) in certain markets. The convenience and accessibility of online pharmacies have made this distribution method popular, particularly in countries where access to physical pharmacies may be limited or in regions with a higher adoption of e-commerce. As digital health solutions continue to gain traction, online platforms are expected to experience continued growth in the coming years.

Hospitals & Healthcare Providers accounted for a smaller share of the market in 2024 but remain an important distribution channel, especially for patients requiring Mefloquine (CAS 53230-10-7) as part of an inpatient treatment plan or those under long-term care. Hospitals and healthcare providers are critical in regions with advanced healthcare infrastructure, where Mefloquine (CAS 53230-10-7) is often administered directly to patients in clinical settings. This channel’s share has been stable, with slight growth driven by the increasing awareness of malaria treatment options in both public and private healthcare sectors.

Key Market Segments

By Product Type

- Purity 98%

- Purity 99%

- Others

By Form

- Tablet

- Powder

- Liquid

By Application

- Chemical Industry

- Pharmaceutical Industry

- Others

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online Platforms

- Hospitals & Healthcare Providers

- Others

Drivers

Government Initiatives in Malaria Control Driving the Mefloquine Market Growth

Governments, particularly in malaria-endemic countries, are heavily investing in antimalarial drugs such as Mefloquine as part of national health strategies. For instance, the World Health Organization (WHO) has long recommended Mefloquine as a treatment for malaria in areas where resistance to other drugs exists. In their Global Technical Strategy for Malaria 2016-2030, the WHO set ambitious goals for malaria elimination, aiming to reduce the global burden by at least 90% by 2030. This commitment to fighting malaria has driven both demand for treatments like Mefloquine and substantial investments in the research and development of new treatments.

In 2024, the United States government, through programs like the President’s Malaria Initiative (PMI), continues to make a significant impact on malaria treatment and prevention globally. In a 2023 report, the PMI noted that, since its inception, it has contributed to saving millions of lives and reduced malaria cases in supported regions by 50%. These efforts are critical in ensuring that affordable and effective drugs like Mefloquine are available to vulnerable populations. The PMI’s commitment to distributing antimalarial medications in Sub-Saharan Africa and Southeast Asia, where malaria is most prevalent, has boosted the use of Mefloquine as part of large-scale malaria treatment programs.

Additionally, governments in malaria-endemic countries are expanding their access to antimalarial drugs through national health systems. For example, the government of India has made significant strides in improving malaria control by providing free distribution of drugs such as Mefloquine in high-risk regions. India’s National Vector Borne Disease Control Programme (NVBDCP) has made consistent progress, with malaria cases falling by 60% over the past decade (National Vector Borne Disease Control Programme, India, 2022). Such national initiatives not only support the supply of Mefloquine but also increase the awareness and demand for this treatment, making it an essential part of malaria management efforts.

International organizations like the Global Fund to Fight AIDS, Tuberculosis, and Malaria also play a pivotal role in driving Mefloquine’s market growth. The Global Fund has invested over $4 billion annually in malaria control programs across Africa, Asia, and Latin America (Global Fund, 2023). Through these investments, the fund ensures that critical medications, including Mefloquine, are made available to millions of people in areas hardest hit by malaria. Such efforts have helped to reduce malaria-related deaths and infections, ultimately increasing the reliance on antimalarial treatments.

These government and international initiatives are not only helping to control the malaria burden but are also creating a sustained demand for antimalarial treatments. Mefloquine, in particular, benefits from these initiatives due to its proven effectiveness in treating and preventing malaria, even in areas with high levels of drug resistance. As a result, Mefloquine continues to be a critical part of national and global health strategies aimed at combating malaria.

Restraints

Concerns Over Mefloquine’s Side Effects Limiting Market Growth

The United States Food and Drug Administration (FDA) has highlighted these risks in their warnings about Mefloquine. According to the FDA, the drug may cause serious side effects in some individuals, including psychiatric symptoms like depression and paranoia, as well as neurological side effects such as dizziness, balance problems, and hearing and visual disturbances (FDA, 2020). This has raised concerns about the long-term use of Mefloquine, especially in malaria-prevalent regions where the drug might be used repeatedly or over extended periods for prevention.

The World Health Organization (WHO) has also acknowledged the concerns regarding the safety of Mefloquine. In 2016, the WHO recommended that Mefloquine should only be used in specific cases when other treatments are not available or suitable. The organization pointed out that the side effects could be particularly problematic in people with pre-existing mental health conditions, further limiting the drug’s use in some patient populations.

These safety concerns have led to a shift towards alternative malaria treatments in many regions. For example, the rise of Artemisinin-based combination therapies (ACTs), which are considered both safe and effective for treating malaria, has decreased the reliance on Mefloquine. The WHO’s malaria treatment guidelines emphasize ACTs as the preferred first-line treatment for uncomplicated malaria, due to their superior safety and efficacy profiles.

This shift in treatment preferences is reflected in market trends, with sales of Mefloquine experiencing slowdowns in certain regions. According to the Malaria Journal, the introduction of new and safer antimalarial treatments, along with increased concerns about the side effects of older drugs like Mefloquine, has contributed to a decline in the drug’s usage in countries like the United States and the European Union (Malaria Journal, 2022). In fact, some countries have restricted the use of Mefloquine altogether, either due to safety concerns or because of growing resistance to the drug, which has further limited its market reach.

The negative perception surrounding Mefloquine’s side effects has also led to public health campaigns aimed at educating both healthcare providers and patients about the potential risks associated with the drug. For instance, in Australia, a series of reports highlighting the psychiatric side effects of Mefloquine prompted a national review of its use. The Australian Government’s Department of Health issued guidelines advising against the use of Mefloquine in military personnel and travelers, recommending alternative drugs with fewer side effects.

Despite government and healthcare initiatives aimed at reducing the impact of these side effects, the concerns over Mefloquine’s safety profile continue to hinder its market growth. This is particularly true in countries with access to newer antimalarial drugs, which are viewed as safer alternatives. As more evidence about the adverse effects of Mefloquine emerges, and as new treatments for malaria become available, the drug may face increased competition and declining demand.

Opportunity

Expanding Access in Endemic Regions Presents Significant Growth Opportunities for Mefloquine

The World Health Organization (WHO) has set a bold target to reduce malaria cases and deaths globally by 90% by 2030 through the Global Technical Strategy for Malaria. As part of this effort, WHO is focusing on increasing access to antimalarial drugs, including Mefloquine, in malaria-endemic regions. Mefloquine, especially in combination with other drugs, remains an effective treatment option in many areas, particularly where resistance to other malaria medications has become a significant issue. The drug’s long half-life and effectiveness against a broad spectrum of malaria strains make it an attractive choice in regions where malaria remains a major health threat.

According to the World Bank, Sub-Saharan Africa accounts for approximately 90% of the global malaria burden, with the disease causing over 200 million cases and 400,000 deaths annually. Efforts to improve malaria prevention and treatment in these regions are expected to drive substantial demand for Mefloquine in the coming years. Governments in these countries, supported by international donors like the Global Fund to Fight AIDS, Tuberculosis and Malaria, have been ramping up efforts to distribute antimalarial drugs, including Mefloquine, as part of large-scale treatment programs. The Global Fund alone invested over $4 billion in malaria programs in 2020, with much of that funding going toward purchasing medications and supporting healthcare infrastructure in malaria-endemic regions

In addition to government initiatives, private sector partnerships and the growth of generic versions of Mefloquine are expected to make the drug more accessible and affordable. The increasing availability of generics is a key factor in expanding access to Mefloquine, particularly in low-income countries where the cost of brand-name drugs can be prohibitive. For instance, the availability of generic Mefloquine has contributed to its widespread use in countries like India, where the government provides the drug as part of its National Vector Borne Disease Control Programme. The cost-effectiveness of generic Mefloquine has made it a cornerstone of malaria treatment in such regions, ensuring that more people can access the drug at affordable prices.

Furthermore, public health initiatives supported by organizations such as the United States Agency for International Development (USAID) are crucial in expanding the reach of Mefloquine in malaria-endemic areas. USAID’s Malaria Control Program has helped distribute millions of doses of antimalarial drugs, including Mefloquine, across Africa and Asia. The initiative, which works alongside local governments and international organizations, is focused on scaling up malaria prevention and treatment efforts, directly increasing the demand for effective antimalarial medications.

As the fight against malaria continues, the expansion of healthcare infrastructure in developing countries will also play a significant role in boosting the demand for Mefloquine. New clinics, improved healthcare systems, and better supply chains will ensure that more people have access to the drug. Moreover, the rising focus on malaria elimination strategies, particularly in Southeast Asia, is expected to drive additional demand for both first-line and second-line treatments like Mefloquine.

Trends

Increased Focus on Malaria Elimination and Mefloquine’s Role in Prevention

A major trend influencing the Mefloquine market in recent years is the growing focus on malaria elimination in endemic regions, with Mefloquine continuing to play a critical role in malaria prevention. Malaria remains one of the most widespread and dangerous infectious diseases globally, but recent government and international health initiatives are pushing for a sharp decline in malaria cases. Mefloquine, with its long history of use as both a treatment and a prophylactic, is positioned as a key drug in these malaria elimination strategies.

The World Health Organization (WHO) has set ambitious goals to reduce malaria incidence and mortality rates by at least 90% by 2030, with the ultimate goal of eliminating malaria in many countries by the middle of this century. As part of the Global Malaria Programme, the WHO is actively promoting a multi-pronged approach that includes the distribution of effective antimalarial drugs like Mefloquine, as well as insecticide-treated bed nets, indoor spraying, and improved diagnostics. With such an ambitious plan in place, the demand for Mefloquine in malaria-endemic countries is expected to grow as governments work toward meeting their elimination targets.

Furthermore, the focus on malaria prevention has become more pronounced due to the increase in drug resistance in some regions. Malaria parasites, particularly in Southeast Asia and Sub-Saharan Africa, have developed resistance to other commonly used antimalarials, including chloroquine and artemisinin-based combination therapies. As drug resistance grows, the need for alternative treatments like Mefloquine becomes more critical. Mefloquine is particularly valuable in areas where resistance to other drugs has been reported, making it an essential option for both treatment and malaria prevention. In fact, Mefloquine is still recommended by WHO as part of the treatment protocol for malaria, particularly in regions with drug resistance concerns.

Mefloquine is widely used to prevent malaria in individuals traveling to regions where the disease is endemic. This trend has been further fueled by global tourism and travel, particularly to countries in Sub-Saharan Africa and Southeast Asia. Travel clinics and healthcare providers continue to prescribe Mefloquine for its proven effectiveness in preventing malaria during travel. According to the Centers for Disease Control and Prevention (CDC), travelers to malaria-endemic regions are encouraged to take antimalarial medications such as Mefloquine as part of pre-travel health advice. This growing trend of malaria prevention in travelers has added another layer of demand for Mefloquine in the global market.

As governments continue to prioritize malaria prevention, international funding agencies like the Global Fund and the World Bank remain heavily invested in tackling the disease. These initiatives are expected to provide significant growth opportunities for Mefloquine in the coming years. Moreover, the continued collaboration between international organizations, governments, and private sectors to eliminate malaria will ensure that Mefloquine maintains a crucial role in public health strategies.

Regional Analysis

In 2024, the Mefloquine market was primarily dominated by the Asia Pacific (APAC) region, which captured a substantial share of 32.2%, translating to a market value of approximately USD 69.3 million. The high demand in APAC is driven by the significant malaria burden in countries like India, Indonesia, and the Philippines. Malaria continues to be a major public health issue in these areas, making Mefloquine an essential part of treatment regimens.

In North America, the market for Mefloquine is comparatively smaller, but it still maintains a steady presence, particularly in medical research and travel-related prophylaxis. The North American market is characterized by advanced healthcare systems and strong regulatory frameworks, with Mefloquine being prescribed for specific cases such as malaria prevention in travelers to endemic regions.

Europe follows closely, with a stable demand driven by the presence of well-established healthcare infrastructures and the continued use of Mefloquine in the treatment of imported malaria cases. The region’s focus on malaria eradication through prevention programs further sustains this demand.

The Middle East & Africa region shows a mixed demand for Mefloquine, with some countries experiencing higher usage due to malaria’s prevalence, particularly in sub-Saharan Africa. However, challenges such as political instability and limited healthcare infrastructure hinder the overall growth in the region.

Latin America has a relatively smaller market for Mefloquine, but it is showing gradual growth due to increased awareness and governmental efforts to combat malaria in countries like Brazil and Colombia.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

GlaxoSmithKline plc, Bayer AG, and Novartis AG are leading the way in both the manufacturing of Mefloquine and the development of related therapies. GlaxoSmithKline, in particular, has a long history of involvement in the malaria treatment space, making it a significant player in the global market. Bayer AG and Novartis AG also contribute significantly through their established networks and distribution capabilities, ensuring Mefloquine reaches key malaria-endemic regions.

Mylan N.V., Cipla Limited, and Ipca Laboratories Ltd. are major generic manufacturers, providing more affordable alternatives for the widespread distribution of Mefloquine, especially in developing countries.

Other key players such as Hoffmann-La Roche AG, Advanced Technology & Industrial, and Alere Inc. (Abbott Laboratories) focus on the continued research and innovation surrounding malaria treatments, often collaborating with governments and international organizations to improve access.

Alfa Chemistry, Micro Labs Limited, and Laurus Labs Limited play crucial roles in the production of raw materials and active pharmaceutical ingredients (APIs), supporting the overall supply chain for Mefloquine. Additionally, Hangzhou J&H Chemical and Chembest Research Laboratories are recognized for their involvement in the chemical supply and the development of high-quality Mefloquine formulations.

Emerging players like Waterstone Technology, Ningbo Taikang Chemical, and others in countries like Nigeria and the United Arab Emirates are beginning to establish a foothold, contributing to the regional availability of Mefloquine. These companies play a vital role in ensuring that the drug is accessible in areas with high malaria prevalence, further aiding in global efforts to combat the disease.

Top Key Players

- 2A PharmaChem

- 3B Scientific

- Advanced Technology & Industrial

- Alere Inc. (Abbott Laboratories)

- Alfa Chemistry

- Bayer AG

- Chembest Research Laboratories

- Cipla Limited.

- GlaxoSmithKline plc

- Hangzhou J&H Chemical

- Hoffmann-La Roche AG

- Ipca Laboratories Ltd.

- Laurus Labs Limited

- Micro Labs Limited

- Mylan N.V.

- Nigeria

- Ningbo Taikang Chemical

- Novartis AG

- Saoedi-Arabië

- Toronto Research Chemicals

- Verenigde Arabieren Emiraten

- Waterstone Technology

- Zuid-Afrika

Recent Developments

In 2024, 2A PharmaChem reported a revenue of approximately $35 million from the sales of Mefloquine-related products, contributing significantly to its overall growth in the global pharmaceutical market.

In 2024, 3B Scientific reported a revenue of around $25 million from its pharmaceutical and chemical divisions, with a portion of this coming from its Mefloquine-related products.

In 2024, Alfa Chemistry reported an increase of 10% in its sales related to Mefloquine production, with total revenue from pharmaceutical raw materials reaching $50 million, driven by rising demand in malaria-endemic regions.

Report Scope

Report Features Description Market Value (2024) USD 215.5 Mn Forecast Revenue (2034) USD 389.6 Mn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Purity 98%, Purity 99%, Others), By Form (Tablet, Powder, Liquid), By Application (Chemical Industry, Pharmaceutical Industry, Others), By Distribution Channel (Direct Sales, Distributors And Wholesalers, Online Platforms, Hospitals And Healthcare Providers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 2A PharmaChem, 3B Scientific, Advanced Technology & Industrial, Alere Inc. (Abbott Laboratories), Alfa Chemistry, Bayer AG, Chembest Research Laboratories, Cipla Limited., GlaxoSmithKline plc, Hangzhou J&H Chemical, Hoffmann-La Roche AG, Ipca Laboratories Ltd., Laurus Labs Limited, Micro Labs Limited, Mylan N.V., Nigeria, Ningbo Taikang Chemical, Novartis AG, Saoedi-Arabië, Toronto Research Chemicals, Verenigde Arabieren Emiraten, Waterstone Technology, Zuid-Afrika Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mefloquine (CAS 53230-10-7) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Mefloquine (CAS 53230-10-7) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 2A PharmaChem

- 3B Scientific

- Advanced Technology & Industrial

- Alere Inc. (Abbott Laboratories)

- Alfa Chemistry

- Bayer AG

- Chembest Research Laboratories

- Cipla Limited.

- GlaxoSmithKline plc

- Hangzhou J&H Chemical

- Hoffmann-La Roche AG

- Ipca Laboratories Ltd.

- Laurus Labs Limited

- Micro Labs Limited

- Mylan N.V.

- Nigeria

- Ningbo Taikang Chemical

- Novartis AG

- Saoedi-Arabië

- Toronto Research Chemicals

- Verenigde Arabieren Emiraten

- Waterstone Technology

- Zuid-Afrika