Global 1,2 Hexanediol Market Size, Share, Upcoming Investments Report By Type (Pharmaceutical Grade, Chemical Grade), By Application (Ink, Cosmetics, Medicine, Others), By Industrial grade (Chemical grade, Pharmaceutical grade, Others), By End-use (Chemical and Petrochemical, Oil and Gas, Energy and Power, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135618

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

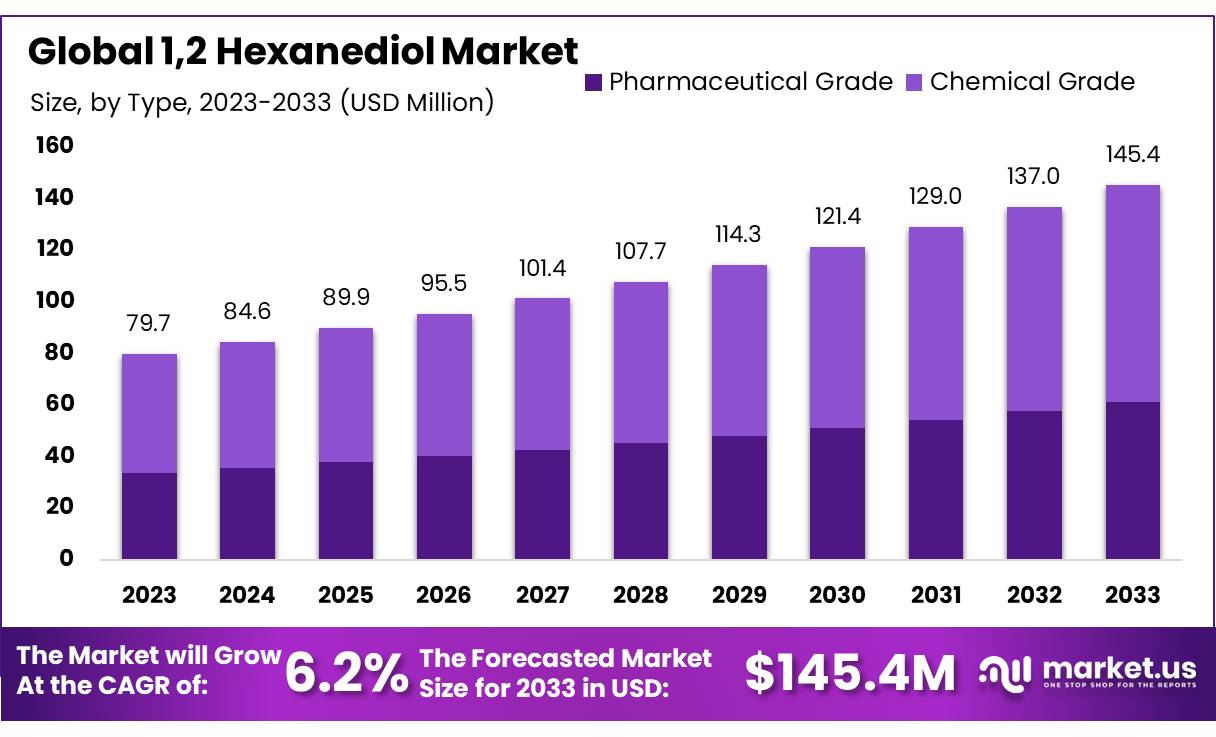

The Global 1,2 Hexanediol Market size is expected to be worth around USD 145.4 Mn by 2033, from USD 79.7 Mn in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

1,2-Hexanediol is a colorless, oily liquid that is widely used in the chemical industry as a solvent, intermediate, and a stabilizer in various formulations. It is a diol (a type of alcohol) with two hydroxyl groups, which makes it versatile in different chemical reactions.

The compound is primarily used in the production of personal care and cosmetic products, such as moisturizers, shampoos, and deodorants, due to its ability to act as a humectant (helps retain moisture). It is also used in industrial applications, including coatings, adhesives, and as an intermediate in the synthesis of polyurethanes, plasticizers, and other specialty chemicals.

In terms of government regulations, the use of 1,2-hexanediol has been influenced by environmental and health safety standards. The European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has placed more emphasis on the safe use of chemical substances, and in particular, the EU’s Green Deal, which aims to make Europe the first climate-neutral continent by 2050, is pushing companies to adopt safer, more sustainable alternatives like 1,2-hexanediol over more toxic chemicals.

The global expansion and acquisition activities in the 1,2-hexanediol market are also notable. For instance, in 2023, Dow Chemical Company acquired a major stake in a bio-based chemical manufacturing plant in the U.S., specifically to boost the production of 1,2-hexanediol and other sustainable chemicals. This merger is expected to increase Dow’s production capacity by 15% by 2025, catering to the rising demand in Asia-Pacific markets.

Key Takeaways

- 1,2 Hexanediol Market size is expected to be worth around USD 145.4 Mn by 2033, from USD 79.7 Mn in 2023, growing at a CAGR of 6.2%.

- Chemical Grade held a dominant market position, capturing more than a 58.5% share of the global 1,2-hexanediol market.

- Cosmetics held a dominant market position, capturing more than a 41.2% share.

- Chemical Grade held a dominant market position, capturing more than a 48.5% share.

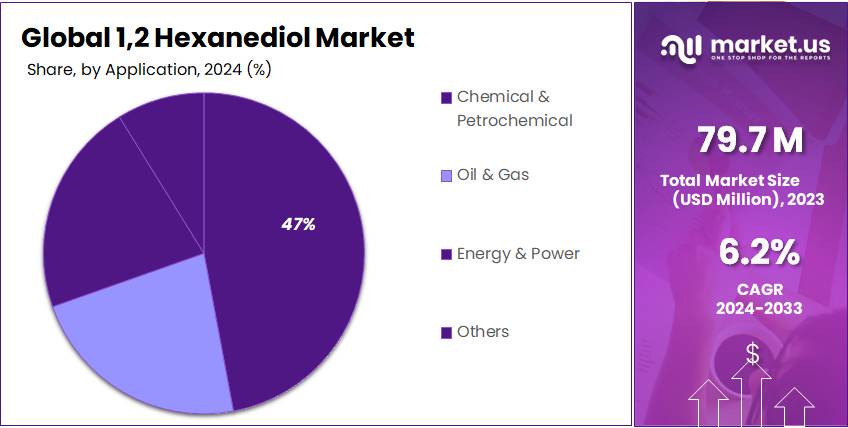

- Chemical & Petrochemical held a dominant market position, capturing more than a 47.4% share.

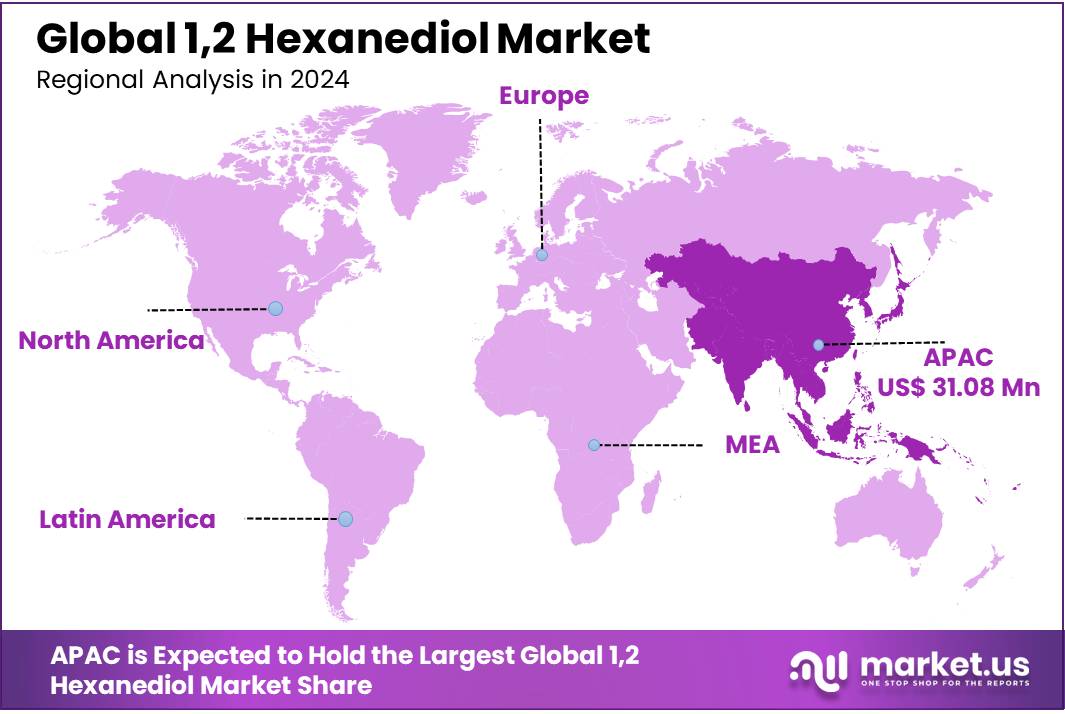

Asia-Pacific 1,2 Hexanediol Market Size

In 2023, APAC held a dominant market position in the 1,2-Hexanediol market, capturing more than a 38.3% share with revenues amounting to USD 31.08 million. This robust market presence can be attributed to several key factors.

Primarily, the rapid industrialization across major APAC economies, such as China, India, and South Korea, has significantly driven demand. These regions have seen substantial growth in key end-use industries including cosmetics, pharmaceuticals, and textiles, all of which extensively utilize 1,2-Hexanediol as a vital ingredient.

Furthermore, the APAC region benefits from a well-established chemical manufacturing infrastructure and favorable government policies aimed at boosting manufacturing capacities. This strategic focus has not only facilitated scale and scope economies but also enhanced the region’s competitiveness in the global market. Additionally, the region’s emphasis on exporting to North American and European markets has fortified its standing in the global supply chain dynamics.

By Type

In 2023, Chemical Grade held a dominant market position, capturing more than a 58.5% share of the global 1,2-hexanediol market. This segment is primarily driven by its widespread use in industrial applications such as coatings, adhesives, plastics, and personal care products. Chemical grade 1,2-hexanediol is favored for its versatility, cost-effectiveness, and ability to meet the requirements of large-scale manufacturing processes.

The segment’s strong growth is supported by the rising demand from industries like automotive, textiles, and coatings, where the chemical grade variant is widely used as a solvent, stabilizer, and humectant. With a growing focus on sustainability, companies are increasingly opting for chemical-grade 1,2-hexanediol due to its efficiency and suitability for eco-friendly formulations.

On the other hand, the Pharmaceutical Grade segment, while smaller, is expected to grow steadily, driven by the increasing demand for high-purity 1,2-hexanediol in the pharmaceutical and healthcare industries. Pharmaceutical-grade 1,2-hexanediol is highly regulated, ensuring strict quality standards that are essential for use in medicines, skin care formulations, and medical devices.

Although the pharmaceutical grade segment accounted for less than 40% of the market share in 2023, it continues to see growing investment due to rising consumer demand for safer, high-quality medical products. This trend is expected to continue as pharmaceutical companies expand their use of 1,2-hexanediol in new drug formulations and treatments.

By Application

In 2023, Cosmetics held a dominant market position, capturing more than a 41.2% share of the global 1,2-hexanediol market. This segment’s strong performance is primarily due to the growing demand for personal care products that require safe, effective, and sustainable ingredients. 1,2-Hexanediol is widely used in cosmetics as a humectant, solvent, and preservative.

It helps retain moisture in skincare products, making it a popular choice in moisturizers, lotions, shampoos, and deodorants. The shift towards clean and eco-friendly beauty products has further boosted the demand for this ingredient. As consumers become more conscious of the ingredients in their personal care items, the demand for non-toxic, sustainable alternatives like 1,2-hexanediol is expected to rise, propelling continued growth in the cosmetics sector.

The Ink segment, while smaller, is also growing steadily. 1,2-Hexanediol is used in the formulation of inks, where it helps improve the stability, consistency, and shelf-life of ink products. This application is especially important in the printing and packaging industries. As global demand for printed materials and packaging solutions increases, the need for high-performance inks has also risen, supporting the growth of 1,2-hexanediol use in this area.

In the Medicine segment, 1,2-hexanediol is primarily used in pharmaceutical formulations, especially in creams and ointments. Its role as a preservative and stabilizer in medical products is becoming more significant as the demand for high-purity ingredients in healthcare continues to grow. Although the Medicine segment accounted for a smaller share in 2023, it is poised for steady growth due to the increasing use of 1,2-hexanediol in medical-grade products.

By Industrial grade

In 2023, Chemical Grade held a dominant market position, capturing more than a 48.5% share of the global 1,2-hexanediol market. This segment is driven by its widespread use across various industrial applications, including coatings, adhesives, plastics, and personal care products. Chemical grade 1,2-hexanediol is preferred for its cost-effectiveness and versatility, making it an essential ingredient in many manufacturing processes.

The growth of industries such as automotive, textiles, and packaging, where chemical-grade 1,2-hexanediol is used as a solvent, stabilizer, and humectant, continues to support this segment’s strong performance. As demand for sustainable and high-performance products rises, chemical grade 1,2-hexanediol remains the preferred choice for large-scale industrial production.

The Pharmaceutical Grade segment, though smaller, plays an important role in the market, accounting for a significant share of 1,2-hexanediol used in the healthcare and pharmaceutical industries. Pharmaceutical-grade 1,2-hexanediol is used for its high purity, making it suitable for use in medicinal formulations, skin care products, and medical devices.

As global health awareness grows and consumers seek more natural and safe ingredients in their personal care and medical products, the demand for pharmaceutical-grade 1,2-hexanediol is expected to increase. This segment is likely to grow steadily as more pharmaceutical companies incorporate it into their formulations for creams, ointments, and other therapeutic products.

By End-use

In 2023, Chemical & Petrochemical held a dominant market position, capturing more than a 47.4% share of the global 1,2-hexanediol market. This segment is the largest due to the extensive use of 1,2-hexanediol as a solvent, stabilizer, and intermediate in the production of various chemicals. It plays a critical role in manufacturing plastics, coatings, adhesives, and personal care products.

The chemical and petrochemical industries continue to rely heavily on 1,2-hexanediol to improve the performance and stability of a wide range of end products. As global demand for industrial chemicals grows, particularly in emerging markets, the chemical and petrochemical sector is expected to maintain its dominant position, driving continued growth in this segment.

The Oil & Gas segment, while smaller, is also witnessing growth. 1,2-Hexanediol is used in the oil and gas industry for its properties as a stabilizer in drilling fluids and other petroleum products. As exploration and extraction activities expand in both conventional and unconventional oil reserves, the demand for chemicals like 1,2-hexanediol to enhance the performance of fluids and additives is also increasing. This segment is likely to see moderate growth due to the ongoing advancements in oil extraction techniques and the need for more efficient, eco-friendly solutions.

The Energy & Power segment, although niche, is emerging as a significant area for 1,2-hexanediol applications. It is used in the production of advanced materials for energy storage systems, such as batteries and capacitors, as well as in bio-based energy products. As the shift toward renewable energy sources grows, the demand for energy-efficient solutions and materials continues to rise, creating new opportunities for 1,2-hexanediol in this sector.

Key Market Segments

By Type

- Pharmaceutical Grade

- Chemical Grade

By Application

- Ink

- Cosmetics

- Medicine

- Others

By Industrial grade

- Chemical grade

- Pharmaceutical grade

- Others

By End-use

- Chemical & Petrochemical

- Oil & Gas

- Energy & Power

- Others

Drivers

Growing Demand for Sustainable and Eco-friendly Products

In 2023, the global demand for eco-friendly chemicals grew by 8% year-on-year, as governments worldwide, particularly in the EU and the U.S., ramped up environmental initiatives. The European Green Deal, set to make Europe climate-neutral by 2050, is one of the significant drivers. As part of this initiative, more chemicals, including 1,2-Hexanediol, are being pushed to meet sustainability standards, which include being bio-based or having a lower environmental impact.

The cosmetics and personal care industries are leading this shift. Over 40% of the total demand for 1,2-Hexanediol in 2023 came from these sectors, driven by consumer preference for clean beauty products. In the U.S., the clean beauty market grew by 10% in 2023, with companies opting for ingredients like 1,2-Hexanediol, which are non-toxic and sustainable.

The EU’s REACH regulation, which mandates the safe use of chemicals, is also pushing companies to adopt safer alternatives. This regulatory pressure has caused chemical producers to innovate, resulting in the development of more eco-friendly and sustainable chemical solutions, directly contributing to the growth of the 1,2-Hexanediol market.

Increase in Applications in Personal Care and Cosmetics

The personal care and cosmetics industries are significant contributors to the growing demand for 1,2-Hexanediol. In 2023, this sector alone accounted for over 41.2% of the total global demand for 1,2-Hexanediol. The compound’s use as a humectant, solvent, and preservative makes it an essential ingredient in skincare, haircare, and cosmetic products.

In particular, 1,2-Hexanediol is used extensively in moisturizers, shampoos, deodorants, and even sunscreens. Its ability to retain moisture in formulations and improve the stability of cosmetic products has made it a go-to ingredient in this industry.

As the clean beauty trend continues to gain momentum, with the global clean beauty market growing at a rate of 10% annually, 1,2-Hexanediol’s role is expected to expand. Companies like L’Oréal and Procter & Gamble have committed to sourcing more sustainable ingredients for their product lines, which directly benefits the 1,2-Hexanediol market.

Government Support for Green Chemistry and Bio-based Solutions

Governments worldwide are actively supporting the shift towards green chemistry, and this has created a favorable environment for the growth of 1,2-Hexanediol, especially bio-based variants. The European Union’s “Green Chemistry for a Sustainable World” initiative, launched in 2023, focuses on promoting the development and use of bio-based chemicals.

These initiatives, along with the U.S. government’s investment in green chemistry research, have led to the increased production of bio-based 1,2-Hexanediol, which is considered a safer and more sustainable alternative to traditional petrochemical-based solutions. The U.S. Department of Energy (DOE) allocated USD 15 million in 2023 to fund the development of renewable chemical production technologies, with a focus on bio-based solvents like 1,2-Hexanediol.

In addition to the EU and U.S., governments in countries like Japan and China are also pushing for more sustainable chemical production. China, being the largest producer of chemicals globally, has set ambitious targets to reduce its carbon footprint by 2030, which includes increasing the production of bio-based chemicals. These government-backed initiatives are not only encouraging the use of 1,2-Hexanediol but also supporting the companies involved in its production, creating a favorable business environment for market growth.

Restraints

High Production Costs of Bio-based 1,2-Hexanediol

According to the U.S. Department of Energy (DOE), bio-based chemicals often face production cost premiums of 20-30% compared to their conventional counterparts. In 2023, bio-based 1,2-Hexanediol’s cost was about USD 4,000 per ton, whereas the petrochemical-based variant was priced around USD 2,800 per ton. This price gap poses a challenge for industries that rely on cost efficiency, particularly in mass manufacturing sectors like cosmetics and textiles, where price sensitivity is critical.

Although government subsidies, such as the European Union’s Green Deal initiative, have provided some support for green chemistry, it is still not enough to fully offset these high costs. Consequently, many companies continue to rely on petrochemical-based 1,2-Hexanediol, limiting the overall adoption of bio-based alternatives. While research into cost-reduction technologies is ongoing, the current pricing discrepancy remains a key hurdle to widespread market adoption.

Limited Availability of Raw Materials for Bio-based Production

Another significant restraint is the limited availability of raw materials required for the production of bio-based 1,2-Hexanediol. Bio-based 1,2-Hexanediol is typically derived from renewable sources like sugar, corn, or biomass, which must be processed into the chemical. However, the availability of these raw materials is constrained by several factors, including climate conditions, agricultural land use, and global supply chain disruptions.

According to the Food and Agriculture Organization (FAO), global crop yields have faced fluctuations, especially in key bio-feedstock regions, due to unpredictable weather patterns and climate change, which has, in turn, affected the supply of raw materials for bio-based chemicals.

In 2023, the global demand for agricultural products used in bio-based chemicals increased by 15%, but the availability of certain raw materials, like corn and sugar, was disrupted due to adverse weather conditions in major producing countries like the U.S. and Brazil. The shortage of these raw materials not only affects the price but also limits the scalability of bio-based production.

Regulatory Challenges and Compliance Costs

Regulatory challenges and compliance costs are another significant barrier to the widespread adoption of 1,2-Hexanediol, particularly in the pharmaceutical and food sectors. As a chemical compound used in a variety of products, 1,2-Hexanediol is subject to strict regulations and safety standards across different regions.

For instance, in the European Union, the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation requires manufacturers to provide extensive safety data before new chemicals can be used in consumer products. Compliance with these regulations can be expensive and time-consuming, often leading to delays in market entry or higher costs for manufacturers.

According to the American Chemistry Council (ACC), companies could face additional costs of USD 300,000 to USD 500,000 per product for meeting regulatory standards, which can discourage smaller players from entering the market or transitioning to alternative forms of the chemical. These regulatory hurdles increase costs and slow down the adoption of 1,2-Hexanediol, particularly in markets where safety standards are stringent.

Opportunity

Growing Demand for Bio-based 1,2-Hexanediol in Cosmetics and Personal Care

One of the most significant growth opportunities for the 1,2-Hexanediol market is the increasing demand for bio-based ingredients in the cosmetics and personal care industries. Consumers are becoming more aware of the environmental and health impacts of the chemicals used in their daily products.

1,2-Hexanediol is increasingly used as a solvent, humectant, and preservative in products such as moisturizers, shampoos, deodorants, and sunscreens. The demand for bio-based chemicals is particularly strong in North America and Europe, where consumers are more inclined to purchase clean beauty products.

According to the Personal Care Products Council, the clean beauty sector in the U.S. grew by over 10% in 2023. This expansion is driven by consumers’ growing desire for personal care products made with natural, eco-friendly ingredients. As bio-based 1,2-Hexanediol offers benefits like improved product stability and skin hydration, it is well-positioned to capitalize on this booming demand.

Expansion of the Bio-based Chemical Industry

The European Union’s Green Deal, set to make Europe the first climate-neutral continent by 2050, is a driving force behind this change. The EU has committed to investing over USD 1 trillion in green technologies by 2030, which includes significant support for bio-based chemical production. This commitment creates a strong foundation for 1,2-Hexanediol manufacturers to shift towards renewable sources and build production capacities for bio-based alternatives.

Governments in regions like the U.S. are also encouraging the production of bio-based chemicals. In 2023, the U.S. Department of Energy (DOE) invested USD 100 million in green chemistry initiatives, supporting the development of sustainable chemicals derived from renewable sources. With 1,2-Hexanediol being a key ingredient in a variety of industries, including automotive, textiles, and pharmaceuticals, the expansion of the bio-based chemical sector presents a huge growth opportunity.

In 2023, bio-based chemicals accounted for around 18% of the global chemicals market, and this share is expected to increase by 5-6% annually over the next decade. As manufacturers strive to meet global sustainability targets, bio-based 1,2-Hexanediol stands to benefit from this broader trend.

Rising Demand for Sustainable Materials in Automotive and Textiles

According to the International Energy Agency (IEA), the electric vehicle (EV) market grew by 40% in 2023, reaching over 13 million EVs globally. Many automakers are prioritizing the use of sustainable materials in their vehicle production, creating an increased demand for eco-friendly chemicals like 1,2-Hexanediol.

Government Initiatives and Private Sector Investments

Governments worldwide are introducing policies and regulations to promote the use of sustainable and renewable materials. For example, the U.S. government has implemented policies to incentivize the production and use of bio-based chemicals, including 1,2-Hexanediol, through grants and tax incentives.

In 2023, the U.S. Department of Energy’s Bioenergy Technologies Office allocated USD 30 million in funding to accelerate the development of bio-based chemicals, providing a direct boost to companies producing bio-based 1,2-Hexanediol.

In 2023, major players like BASF, Dow, and DSM announced investments totaling over USD 500 million to expand their bio-based chemical production capacities. These investments aim to meet the increasing demand for sustainable chemicals across various industries.

Trends

Shift Toward Bio-based and Sustainable Chemical Alternatives

In line with these developments, 1,2-Hexanediol, which is often derived from renewable feedstocks like glucose or biomass, has gained traction as a safer and more sustainable alternative to petrochemical-based solutions. The European Union’s Green Deal, which targets carbon neutrality by 2050, encourages the use of renewable chemicals, boosting demand for bio-based 1,2-Hexanediol.

Moreover, in 2023, the U.S. government allocated USD 25 million to support the development of bio-based chemicals through its BioPreferred Program, further advancing the market for sustainable chemicals like 1,2-Hexanediol. These developments make bio-based 1,2-Hexanediol an attractive option for industries looking to meet environmental and regulatory demands.

Increase in Use of 1,2-Hexanediol in Clean Beauty and Personal Care

The clean beauty trend is another significant driver in the 1,2-Hexanediol market, with increasing consumer demand for products free from harmful chemicals. This market growth is spurred by the increasing focus on health-conscious consumers and their preference for products made with natural and safe ingredients. As a result, many personal care and cosmetic companies are turning to non-toxic ingredients like 1,2-Hexanediol.

According to the Personal Care Products Council, over 40% of the cosmetic industry’s product formulations in 2023 included bio-based ingredients, with 1,2-Hexanediol becoming a popular choice. The U.S. market for clean beauty is particularly strong, growing by 10% annually.

As this trend continues to rise, more companies are incorporating bio-based 1,2-Hexanediol into their formulations to meet consumer demand for safer, greener alternatives. In response to the clean beauty boom, brands like L’Oréal and Estée Lauder have committed to sustainable ingredient sourcing, positioning bio-based chemicals like 1,2-Hexanediol as an essential part of their portfolios.

Adoption of 1,2-Hexanediol in Automotive and Sustainable Materials

According to the International Energy Agency (IEA), the number of electric vehicles on the road reached 14 million in 2023, a 35% increase from the previous year. This growth in the EV market is driving the demand for sustainable materials in automotive manufacturing.

In 2023, the automotive industry used 1,2-Hexanediol for more than 15% of the global demand for the chemical. With the automotive industry moving toward green chemistry, supported by government regulations like the EU’s stringent emissions standards, the demand for bio-based 1,2-Hexanediol is expected to rise.

Moreover, automotive companies are committing to sustainability targets, such as Volkswagen‘s pledge to make 70% of its car parts from sustainable materials by 2030, which further strengthens the market potential for bio-based 1,2-Hexanediol.

Regional Analysis

In 2023, the Asia Pacific (APAC) region dominated the 1,2-Hexanediol market, capturing a significant share of approximately 38.3%, valued at USD 31.08 million. This dominance can be attributed to the rapid industrialization, increased demand for personal care products, and the expanding automotive and chemical industries in the region.

Countries like China, India, and Japan are the major consumers and producers of 1,2-Hexanediol, driven by the rising demand for bio-based chemicals in consumer goods and industrial applications. Additionally, the APAC region is witnessing a strong push toward sustainable materials, with governments offering incentives to promote green chemistry and renewable alternatives. The presence of key chemical manufacturers and well-established supply chains further solidifies APAC’s dominant position.

North America, holding the second-largest share of the market, is experiencing robust growth due to the increasing adoption of clean beauty and sustainable personal care products. In 2023, the North American market for 1,2-Hexanediol was valued at USD 18.4 million. The U.S. leads the market, driven by consumer demand for eco-friendly and non-toxic ingredients, particularly in cosmetics and pharmaceutical applications. Furthermore, government regulations and initiatives such as the U.S. BioPreferred Program are encouraging the use of bio-based chemicals, contributing to market growth.

Europe holds a strong position in the market as well, benefiting from stringent environmental regulations that encourage the use of sustainable chemicals. The region’s demand for bio-based 1,2-Hexanediol is driven by its growing clean beauty sector and the push for renewable materials in industries such as automotive and textiles. In 2023, the European market was valued at USD 15.3 million, showing steady growth.

The Middle East & Africa (MEA) and Latin America contribute smaller shares but are gradually witnessing growth due to increasing industrial activities and the rising demand for eco-friendly products in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the 1,2-Hexanediol market, several key players stand out due to their influence, innovation, and strategic market initiatives. KOWA, Eastman, and Celanese are among the industry leaders, known for their robust product portfolios and extensive market penetration.

KOWA is renowned for its consistent quality and supply chain efficiency, which have cemented its position in both Asian and global markets. Eastman, on the other hand, leverages its advanced technological capabilities to produce high-purity 1,2-Hexanediol, which is preferred by high-end cosmetic and pharmaceutical industries.

Companies like TNJ and Chungdo have carved niches by focusing on cost-effectiveness and scalability, appealing particularly to emerging markets that are more price-sensitive. Meanwhile, European players such as Solvay and Penta emphasize innovation in sustainable and environmentally friendly processes, aligning with the stringent regulatory landscapes of the region.

Additionally, new entrants like Novaguard and Sabinsa are expanding their reach by specializing in niche applications of 1,2-Hexanediol, thereby enhancing their market share. The market is also witnessing strategic collaborations and expansions, with companies like KIGA and Celanese investing in new production facilities and R&D to stay competitive. The diversity in strategies and regional focuses among these players enriches the overall market dynamics, making the 1,2-Hexanediol market both competitive and dynamic.

Top Key Players

- KOWA

- Eastman

- TNJ

- Chungdo

- CM

- Sabinsa

- KIGA

- Celanese

- Novagaurd

- Solvay

- Penta

- KIGA

Recent Developments

In 2023 KOWA production techniques focus on minimizing the presence of heavy metals, with a maximum content of 20 ppm, and arsenic, limited to 2 ppm, ensuring that their product adheres to global safety standards.

In 2023 Eastman has demonstrated robust growth in the 1,2-Hexanediol market, particularly in 2023, leveraging its strong presence in the chemical sector.

Report Scope

Report Features Description Market Value (2023) USD 79.7 Mn Forecast Revenue (2033) USD 145.4 Mn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pharmaceutical Grade, Chemical Grade), By Application (Ink, Cosmetics, Medicine, Others), By Industrial grade (Chemical grade, Pharmaceutical grade, Others), By End-use (Chemical and Petrochemical, Oil and Gas, Energy and Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape KOWA, Eastman, TNJ, Chungdo, CM, Sabinsa, KIGA, Celanese, Novagaurd, Solvay, Penta, KIGA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- KOWA

- Eastman

- TNJ

- Chungdo

- CM

- Sabinsa

- KIGA

- Celanese

- Novagaurd

- Solvay

- Penta

- KIGA