Global 1-hexene Market Size, Share, Upcoming Investments Report Size, Share, Upcoming Investments Report By Purity (Technical, Pure), By Application (Polyethylene Production, Heptanol Production, Flavors, Perfumes, Dyes, Resin, Others), By End-use (Paper Industry, Consumer Goods, Chemical Industry, Automotive Industry, Packaging Industry, Cosmetics and Pharmaceuticals Industry, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135635

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

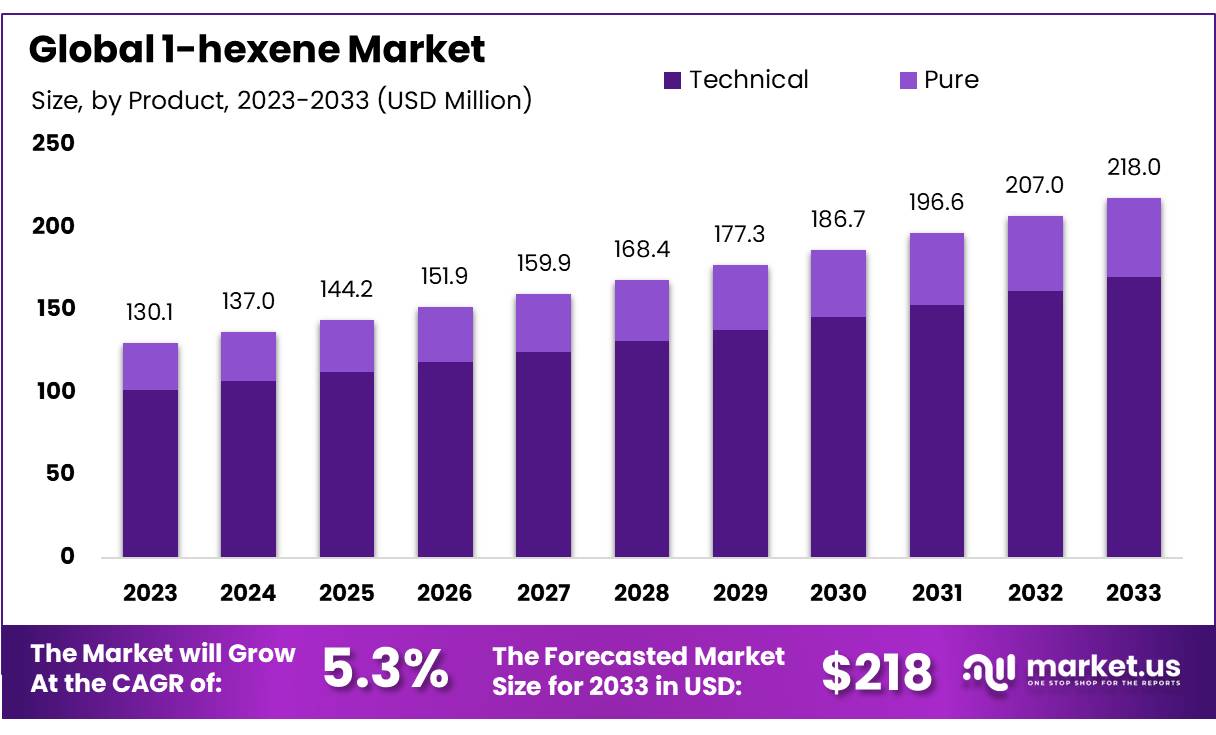

The Global 1-hexene Market size is expected to be worth around USD 218.0 Mn by 2033, from USD 130.1 Mn in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

1-Hexene is an organic compound belonging to the class of alpha-olefins, primarily used in the production of polyethylene, particularly in the manufacture of linear low-density polyethylene (LLDPE). It serves as a comonomer in the polymerization process, improving the material’s properties, such as flexibility, tensile strength, and resistance to chemical stress.

Additionally, 1-hexene finds applications in the production of surfactants, lubricants, and plasticizers. The 1-hexene market has witnessed steady growth, driven by the expanding demand for high-performance plastics across industries like packaging, automotive, and construction.

Government regulations play a crucial role in shaping the market, particularly in terms of sustainability and emissions control. For example, the European Union has set stringent targets for reducing plastic waste, indirectly boosting demand for high-performance plastics like those produced with 1-hexene.

The EU’s regulations, such as the European Green Deal, encourage the use of recyclable and eco-friendly materials, which is expected to boost the demand for LLDPE—a primary product made from 1-hexene. Additionally, in India, the Ministry of Chemicals and Fertilizers has been actively promoting the Make in India initiative, leading to increased domestic production of key chemicals, including 1-hexene.

Import-Export Trends Asia-Pacific region is the largest consumer of 1-hexene, accounting for over 40% of global consumption. The region has seen a rise in import-export activities, with China, India, and Japan being the largest importers and exporters of 1-hexene.

Market Innovations, Acquisitions, and Partnerships has also seen significant innovations and acquisitions in recent years. For instance, in 2023, LyondellBasell, a leading petrochemical company, announced a USD 1.8 billion investment in a new polyethylene facility in the Middle East, aimed at boosting the production of LLDPE, which uses 1-hexene as a key comonomer.

Key Takeaways

- 1-hexene Market size is expected to be worth around USD 218.0 Mn by 2033, from USD 130.1 Mn in 2023, growing at a CAGR of 5.3%.

- Technical-grade 1-hexene held a dominant market position, capturing more than 78.3% of the market share.

- Polyethylene Production held a dominant market position, capturing more than 63.3% of the 1-hexene market share.

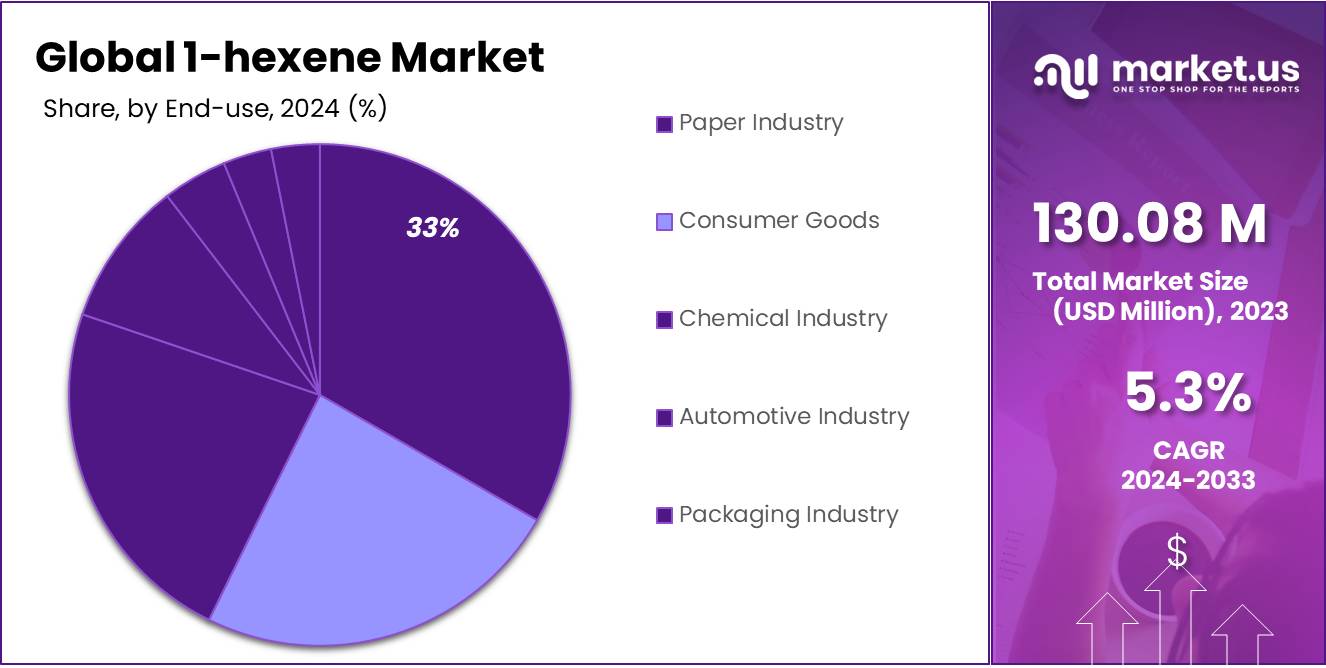

- Paper Industry held a dominant market position, capturing more than 32.3% of the 1-hexene market share.

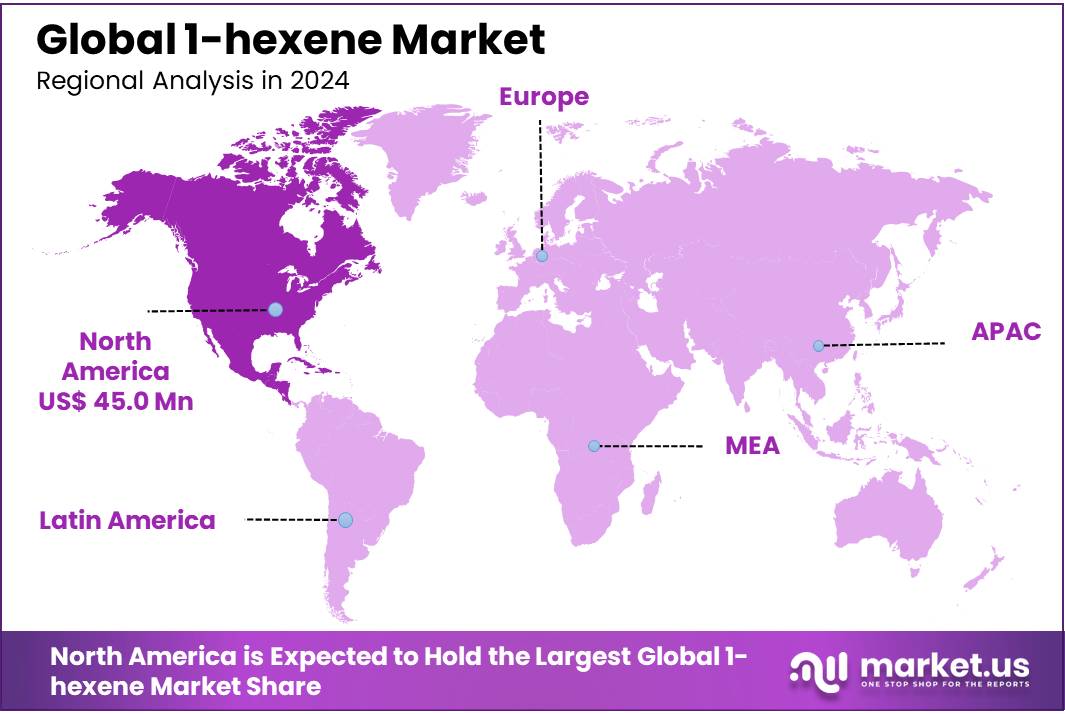

- North America dominated the 1-hexene market, accounting for 37.8% of the global share, valued at USD 45.0 million.

By Purity

In 2023, Technical-grade 1-hexene held a dominant market position, capturing more than 78.3% of the market share. This segment is primarily driven by its widespread use in industrial applications, including the production of polymers, surfactants, and lubricants. Technical-grade 1-hexene is widely available at a lower cost, making it the preferred choice for large-scale manufacturing processes. Its high volume demand in the production of polyethylene and other chemicals continues to support its dominance in the market.

The Pure-grade 1-hexene segment accounted for a smaller share, but it is gaining traction due to its higher purity levels, which are required in certain high-performance applications. Pure-grade 1-hexene is essential in the production of specialty chemicals, where precision and high quality are crucial. The segment is expected to grow steadily, driven by increasing demand from industries like pharmaceuticals, fine chemicals, and electronics, which require higher purity for specific processes.

By Application

In 2023, Polyethylene Production held a dominant market position, capturing more than 63.3% of the 1-hexene market share. This is primarily due to the widespread use of 1-hexene as a comonomer in the production of linear low-density polyethylene (LLDPE) and other forms of polyethylene.

Polyethylene is in high demand for packaging, films, and containers, driving continuous growth in this segment. The expanding packaging industry, particularly in developing regions, further supports the strong market share of polyethylene production.

The Heptanol Production segment accounted for a smaller but significant portion of the market. Heptanol, derived from 1-hexene, is used in the manufacture of surfactants and solvents. As demand grows for these chemicals in the automotive and industrial sectors, the heptanol production segment is expected to see steady growth.

In the Flavors and Perfumes industry, 1-hexene is utilized for its aromatic properties. While this segment holds a modest share of the market, it continues to grow due to increasing demand for natural and synthetic flavoring agents in food and cosmetic products.

The Dyes and Resin sectors also contribute to the 1-hexene market, albeit at a lower rate. 1-hexene is used in producing certain resins and as a raw material for specific dye compounds. Although this segment is smaller, it benefits from innovations in resin-based products and growing interest in eco-friendly alternatives.

By End-use

In 2023, the Paper Industry held a dominant market position, capturing more than 32.3% of the 1-hexene market share. 1-hexene is used in the production of certain chemicals and coatings essential for paper manufacturing, such as surfactants and adhesives. The growing demand for coated and specialty papers, especially in packaging and labeling, continues to drive the need for 1-hexene in this sector.

The Consumer Goods industry, particularly in the production of plastics and packaging materials, accounted for a significant portion of the market. The rise in consumer demand for durable and lightweight products, including household goods and personal care items, has made this segment a key driver for 1-hexene. The packaging industry’s growing demand for high-quality films and containers further supports this segment.

In the Chemical Industry, 1-hexene plays a key role in the production of various chemicals, including plasticizers, surfactants, and lubricants. This segment is expected to experience steady growth, fueled by increasing industrial demand for chemicals in diverse applications, from manufacturing to agriculture.

The Automotive Industry also contributes to the demand for 1-hexene, albeit at a smaller scale. 1-hexene is used in the production of lightweight and durable components like automotive plastics and interior materials. As automotive manufacturers continue to focus on fuel efficiency and lightweight materials, this segment is projected to grow at a moderate pace.

The Packaging Industry remains the largest consumer of 1-hexene, driven by its essential role in producing polyethylene and other plastic materials. With increasing global demand for sustainable and flexible packaging solutions, the packaging sector is expected to continue to lead the market.

In the Cosmetics & Pharmaceuticals Industry, 1-hexene is used in the formulation of certain skincare products, creams, and ointments. While this segment holds a smaller share, it is projected to expand as the demand for high-quality personal care and pharmaceutical products increases.

Key Market Segments

By Purity

- Technical

- Pure

By Application

- Polyethylene Production

- Heptanol Production

- Flavors

- Perfumes

- Dyes

- Resin

- Others

By End-use

- Paper Industry

- Consumer Goods

- Chemical Industry

- Automotive Industry

- Packaging Industry

- Cosmetics & Pharmaceuticals Industry

- Others

Drivers

Packaging Industry Growth and Demand for 1-Hexene

The increasing need for consumer goods, e-commerce packaging, and sustainable packaging solutions is a key driver of this growth. Plastics, especially polyethylene, are in high demand for packaging due to their durability, flexibility, and cost-effectiveness. The rise in e-commerce and online shopping has led to a surge in demand for packaging materials. The global packaging materials market is expected to reach USD 1.4 trillion by 2026, further solidifying the importance of LLDPE and, consequently, 1-hexene.

The packaging industry’s push toward sustainable packaging also plays a role in increasing 1-hexene demand. Many companies are focusing on producing recyclable and biodegradable packaging materials. As a result, LLDPE is favored for its versatility in producing recyclable films and bags. In 2023, approximately 15% of the global polyethylene market was dedicated to sustainable packaging, and this share is expected to rise, boosting the demand for 1-hexene.

Government Initiatives Supporting Sustainable Packaging

Governments around the world are actively promoting the use of sustainable materials, which is positively influencing the demand for 1-hexene in the packaging sector. For example, the European Union’s Plastic Strategy aims to reduce plastic waste by promoting recycling and the use of alternative materials. As part of these initiatives, companies are increasingly investing in sustainable packaging solutions, and the demand for high-quality polyethylene, produced with the help of 1-hexene, is rising.

Similarly, in the United States, the Environmental Protection Agency (EPA) has launched several initiatives to reduce plastic waste. These initiatives encourage the adoption of recyclable materials, which has led to increased investments in the production of LLDPE. The US packaging market alone is expected to reach USD 200 billion by 2025, with a large portion of this growth driven by sustainable packaging materials.

Rising E-commerce and Online Retail Impact

The rapid growth of e-commerce is another significant driver for the 1-hexene market. As more consumers shift toward online shopping, the demand for packaging materials has skyrocketed. E-commerce companies require a large volume of packaging materials to ship products safely and efficiently.

The global shift toward online retail, especially in regions like Asia-Pacific and North America, has led to a substantial increase in demand for packaging materials. For instance, China has seen a 30% year-over-year increase in e-commerce packaging demand, while the US has seen a similar rise of around 25%. This surge in e-commerce sales directly correlates to the growing demand for packaging materials, in turn fueling the consumption of 1-hexene.

Increased Focus on Lightweight and Cost-Effective Materials

Another factor driving the demand for 1-hexene in packaging is the increased focus on producing lightweight and cost-effective materials. 1-hexene plays an important role in the production of LLDPE, which offers a higher strength-to-weight ratio than many other materials. The use of lightweight packaging helps companies reduce transportation costs and minimize their carbon footprint, which aligns with the global push for sustainability.

As companies strive to reduce packaging weight while maintaining the strength and protection of the contents, 1-hexene-based polyethylene continues to be a preferred material. The rise in demand for eco-friendly packaging solutions further boosts the consumption of 1-hexene in this sector. According to PlasticsEurope, approximately 45% of global polyethylene production is used in packaging, and the share is expected to increase as sustainable packaging becomes more prominent.

Restraints

Stricter Environmental Regulations and Policies

In recent years, governments around the world have implemented stricter regulations to curb pollution and promote the use of sustainable materials. The European Union (EU), for example, has introduced the Green Deal, which aims to make Europe the first climate-neutral continent by 2050.

According to the European Commission, the chemical industry is responsible for approximately 30% of total energy consumption in Europe, with a significant portion attributed to the production of petrochemical products like 1-hexene.

In the U.S., the Environmental Protection Agency (EPA) has also set tighter regulations on emissions from chemical plants, forcing companies to adopt more sustainable practices. These regulations, coupled with growing consumer demand for eco-friendly products, are pushing manufacturers to explore alternative, more sustainable chemicals and production methods.

For instance, more companies are investing in bio-based polymers, which use renewable resources like plant sugars rather than petrochemical derivatives, thus posing a direct challenge to the demand for 1-hexene.

High Costs of Compliance and Impact on Profitability

Compliance with these regulations often requires significant investment in new technologies and production methods, which increases operational costs for 1-hexene manufacturers. The shift towards greener production technologies, such as carbon capture and storage (CCS) and bio-based chemical processes, involves substantial upfront capital expenditure.

According to the International Energy Agency (IEA), the cost of implementing CCS in industrial sectors can range from USD 50 to USD 150 per ton of CO2 captured. This can add significant costs to the production of 1-hexene, reducing profit margins for companies already facing fluctuating raw material prices.

Furthermore, the growing costs of environmental compliance are compounded by the increasing demand for more sustainable raw materials. The plastic waste crisis, which has been a focal point of global discussions, has prompted governments and corporations to shift towards biodegradable plastics and reduce their reliance on conventional petrochemical-based plastics.

As of 2022, global plastic production reached over 400 million metric tons, with over 60 million metric tons of plastic waste generated annually, according to the United Nations Environment Programme (UNEP). This shift is pushing manufacturers to reconsider their use of conventional chemicals like 1-hexene, which are perceived as less sustainable in the long term.

Shift Towards Bio-Based Alternatives

In response to regulatory pressures and growing consumer concerns about sustainability, many companies are exploring bio-based alternatives to traditional petrochemicals. For instance, bio-ethylene produced from renewable resources like sugarcane is gaining popularity as a more environmentally friendly option for polyethylene production.

According to the Renewable Energy Group (REG), bio-based ethylene production could reduce carbon emissions by as much as 80% compared to conventional petrochemical processes. This shift is particularly evident in the packaging industry, where companies like Coca-Cola and PepsiCo are already investing in plant-based plastics to replace petrochemical-derived packaging.

Impact on Global Trade and Supply Chain

Finally, the tightening of environmental regulations and the demand for sustainable alternatives are impacting global trade and supply chains. Countries with stringent environmental laws, like those in the EU and North America, are increasingly limiting imports of non-sustainable goods.

This creates a complex challenge for 1-hexene producers, particularly in regions where regulatory frameworks are not as strict. As a result, companies may face barriers to entering new markets or have to adjust their business models to comply with evolving regulations.

For example, in China, the world’s largest producer and consumer of polyethylene, the government has begun implementing more rigorous environmental standards for chemical production. The Ministry of Ecology and Environment has stated that companies must reduce their environmental impact by 15% by 2025, leading to potential slowdowns in petrochemical production, including 1-hexene.

Opportunity

Growing Focus on Sustainability and Circular Economy Initiatives

This rapid growth is largely driven by the increasing adoption of environmentally friendly packaging solutions. Many major corporations, particularly in the food and beverage, consumer goods, and cosmetics sectors, are committing to reducing plastic waste and promoting a circular economy. A 2019 report from the Ellen MacArthur Foundation highlighted that plastic packaging accounts for over 40% of total plastic waste globally, prompting a push toward recyclable and biodegradable packaging materials.

Governments across the globe are also introducing policies to address plastic waste. For instance, the European Union’s Circular Economy Action Plan, part of the European Green Deal, has outlined initiatives to increase the recyclability of plastics and reduce the consumption of single-use plastics. Under this plan, packaging waste is expected to be reduced by 50% by 2030, with a focus on promoting the use of recyclable materials. This policy shift directly impacts the demand for polyethylene and other materials derived from 1-hexene.

Innovation in Biodegradable and Recyclable Plastics

Innovation in biodegradable and recyclable plastics presents another avenue for growth. With increasing environmental pressures, the demand for polyethylene with improved recyclability is rising. Companies are investing in the development of advanced polymers that are both high-performing and more sustainable.

For example, a growing focus on bio-based polyethylene (made from renewable sources such as sugarcane) is expanding the scope for 1-hexene to be integrated into these green polymer solutions. According to Plastics Europe, the production of bio-based polyethylene has increased by 15-20% annually in the past few years.

In response to these developments, companies in the 1-hexene supply chain are exploring innovative methods of polymer production that use renewable feedstocks and reduce carbon footprints.

For instance, Braskem, one of the world’s largest polyethylene producers, has invested in the production of green polyethylene derived from sugarcane. These innovations are expected to continue as sustainability becomes a top priority, creating new growth avenues for 1-hexene.

Expanding E-commerce and Food Packaging Markets

The e-commerce industry is another significant growth driver for the 1-hexene market. As online shopping continues to rise, so does the demand for packaging materials, particularly flexible packaging used in shipping. This growth will continue to fuel demand for polyethylene packaging materials derived from 1-hexene.

In addition, the food packaging market, which accounts for a substantial share of the overall packaging industry, is experiencing growth due to changing consumer lifestyles, increased demand for ready-to-eat foods, and the need for longer shelf-life products.

1-hexene-based materials, such as LLDPE, are widely used in food packaging due to their superior properties, including flexibility, durability, and moisture resistance. As consumer preference for convenient and sustainable packaging grows, the demand for 1-hexene is expected to rise significantly.

Trends

Government Initiatives Promoting Sustainable Chemical Production

Governments around the world are actively supporting the development and adoption of sustainable chemical solutions. The European Union’s Green Deal, for instance, has set ambitious targets to achieve carbon neutrality by 2050, promoting the use of bio-based chemicals and renewable resources.

In line with these objectives, the EU is investing heavily in sustainable chemical production, with initiatives like Horizon Europe funding research into renewable chemical pathways. The EU has also mandated that by 2025, 25% of all plastic products on the market must come from recycled or bio-based materials. These efforts are expected to significantly boost demand for bio-based alternatives, including bio-based 1-hexene, creating a new growth opportunity in the market.

In the U.S., the Renewable Fuel Standard (RFS), overseen by the Environmental Protection Agency (EPA), incentivizes the use of renewable feedstocks in chemical production. This program, which mandates the blending of renewable fuels into the national fuel supply, has created a growing demand for bio-based chemicals across industries. As a result, chemical manufacturers are exploring bio-based processes to produce 1-hexene, positioning the sector for growth as companies strive to meet sustainability goals.

Rising Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly and sustainable products is one of the driving forces behind this shift. A 2022 report by NielsenIQ showed that 73% of global consumers are willing to pay more for sustainable products, with the packaging industry leading the charge.

As a major consumer of polyethylene, the packaging sector is increasingly turning to bio-based materials to meet consumer expectations for reduced environmental impact. This trend is evident in the rising demand for bio-based polyethylene (PE) made from renewable feedstocks, which requires 1-hexene derived from bio-based sources.

In line with this, major packaging companies, including Amcor and Unilever, are setting targets to achieve 100% recyclable, reusable, or compostable packaging by 2025.

To meet these goals, the use of bio-based 1-hexene in polyethylene production will become increasingly important, further driving market growth. By integrating renewable feedstocks into the supply chain, these companies can reduce their carbon footprint and align with consumer preferences for more sustainable solutions.

Technological Advancements in Bio-Based 1-Hexene Production

Technological innovation in bio-based 1-hexene production is another key trend shaping the market. Companies are investing in advanced biotechnology and catalytic processes to improve the efficiency and cost-effectiveness of producing 1-hexene from renewable resources.

According to the U.S. Department of Energy (DOE), bio-based chemicals, including 1-hexene, are becoming more competitive with their petroleum-derived counterparts due to advancements in production technologies. The development of new catalysts and fermentation processes allows for the cost-effective conversion of plant sugars and oils into high-purity 1-hexene, which is suitable for industrial applications.

For instance, LanzaTech, a leading biotechnology company, has developed a process to convert carbon-rich waste gases into bio-based chemicals, including 1-hexene. This innovation not only reduces reliance on fossil fuels but also helps mitigate industrial carbon emissions, which aligns with global sustainability efforts. The increasing availability and competitiveness of bio-based 1-hexene will likely accelerate its adoption across various industries, presenting a significant opportunity for growth in the market.

Regional Analysis

In 2023, North America dominated the 1-hexene market, accounting for 37.8% of the global share, valued at USD 45.0 million. The strong presence of major chemical companies in the U.S. and Canada, alongside robust demand from the packaging, automotive, and chemical industries, has driven this dominance.

Additionally, government regulations supporting the transition to more sustainable materials and initiatives like the Green New Deal in the U.S. further boosted the market in this region. North America’s mature infrastructure, along with the increasing need for high-quality polyethylene and specialty chemicals, is expected to sustain its leading position over the forecast period.

In Europe, the market for 1-hexene holds a significant share, driven by the region’s commitment to sustainability and its large chemical industry. Europe is a leader in promoting bio-based and sustainable alternatives to petrochemical products, with initiatives like the European Green Deal pushing the demand for eco-friendly chemical production.

The Asia Pacific region is witnessing the fastest growth in the 1-hexene market, primarily due to high demand in emerging economies like China, India, and Japan. Asia Pacific’s chemical industry is the largest globally, and the increasing need for packaging, consumer goods, and automotive materials is driving demand for 1-hexene-based polymers.

Latin America, Middle East & Africa are expected to witness moderate growth, driven by rising industrialization and improving chemical production capabilities. However, they continue to trail behind North America and Asia Pacific in market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 1-hexene market is dominated by several major global players, each contributing significantly to production capacity and market development. Chevron Phillips Chemical Company, a joint venture between Chevron and Phillips 66, is one of the leading producers of 1-hexene, utilizing advanced technology for efficient production.

Similarly, Idemitsu Kosan Co. Ltd is a key player with a strong foothold in Asia, particularly Japan, contributing to the global supply of 1-hexene through its refinery operations. INEOS Group Limited, a major petrochemical manufacturer, also holds a substantial market share, focusing on producing 1-hexene for a variety of industrial applications, including polyethylene and synthetic lubricants.

Other notable players in the 1-hexene market include Mitsui, Nizhnekamskneftekhim, and Qatar Chemical Company Ltd, which are key suppliers in the Middle East and Asia Pacific regions. Royal Dutch Shell plc and SABIC also play a vital role in the production of 1-hexene, with significant capacities located in Europe and the Middle East, respectively.

Sasol, Shell, and Sinopec are also leading contributors, leveraging their large-scale operations and strong distribution networks to meet the rising demand in markets such as packaging, automotive, and chemicals.

Finally, The Dow Chemical Company and The Linde Group are major players in the global 1-hexene supply chain, with Dow being a prominent supplier of polyethylene-based products and Linde specializing in the technology and gases required for petrochemical production. Together, these companies help shape the competitive landscape of the 1-hexene market, driving innovation, efficiency, and sustainability in chemical production.

Top Key Players

- Chemicals and Idemitsu Kosan.

- Chevron Phillips Chemical Company

- Idemitsu Kosan Co.Ltd

- INEOS Group Limited

- Mitsui

- Nizhnekamskneftekhim

- Qatar Chemical Company Ltd

- Royal Dutch Shell plc

- Sabic

- Sasol

- Shell

- Sinopec

- The Dow Chemical Company

- The Linde Group

Recent Developments

In 2024 Chemicals and Idemitsu Kosan., the company is expected to increase its production capacity by 5%, aiming to meet the growing demand for high-quality polymers.

In 2024 Chevron Phillips Chemical Company, the company is projected to increase its production by 6% to meet the rising demand for high-quality polyethylene and other chemicals derived from 1-hexene.

Report Scope

Report Features Description Market Value (2023) USD 130.1 Mn Forecast Revenue (2033) USD 218.0 Mn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Technical, Pure), By Application (Polyethylene Production, Heptanol Production, Flavors, Perfumes, Dyes, Resin, Others), By End-use (Paper Industry, Consumer Goods, Chemical Industry, Automotive Industry, Packaging Industry, Cosmetics and Pharmaceuticals Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Chemicals and Idemitsu Kosan, Chevron Phillips Chemical Company, Idemitsu Kosan Co.Ltd, INEOS Group Limited, Mitsui, Nizhnekamskneftekhim, Qatar Chemical Company Ltd, Royal Dutch Shell plc, Sabic, Sasol, Shell, Sinopec, The Dow Chemical Company, The Linde Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chemicals and Idemitsu Kosan.

- Chevron Phillips Chemical Company

- Idemitsu Kosan Co.Ltd

- INEOS Group Limited

- Mitsui

- Nizhnekamskneftekhim

- Qatar Chemical Company Ltd

- Royal Dutch Shell plc

- Sabic

- Sasol

- Shell

- Sinopec

- The Dow Chemical Company

- The Linde Group