Global Sulphur Coated Urea Market By Product Type (Wax Sulphur Coated Urea, Polymer Sulphur Coated Urea, Others), By Product (Conventional Sulfur Coated Urea, Controlled Release Sulfur Coated Urea), By Application (Agriculture, Golf Courses, Professional Lawn and Turf, Others), By Distribution Channel (Online Retail, Offline Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134509

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

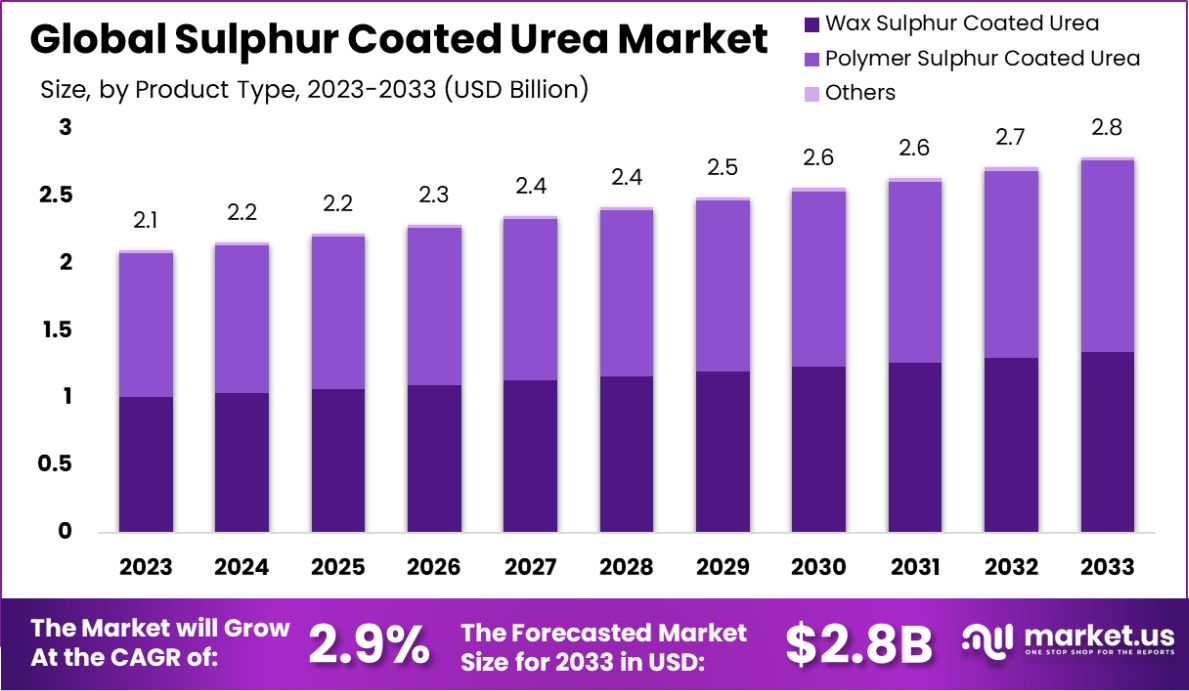

The Global Sulphur Coated Urea Market is expected to be worth around USD 2.8 Billion by 2033, up from USD 2.1 Billion in 2023, and grow at a CAGR of 2.9% from 2024 to 2033.

Sulphur Coated Urea (SCU) is a controlled-release fertilizer encapsulated with a layer of sulphur and wax, designed to decrease nutrient loss through volatilization and leaching, enhancing nitrogen utilization by plants. This technology allows for the gradual release of nutrients, which aligns with the nutrient uptake pattern of crops, promoting efficient and sustainable agricultural practices.

Sulphur Coated Urea Market refers to the industry segment dealing with the production, distribution, and use of SCU. This market is driven by increasing demand for high-efficiency fertilizers, growing awareness of sustainable farming practices, and stringent environmental regulations that favor controlled-release formulations.

The expansion of the SCU market can be attributed to rising global food demand and the subsequent need for enhanced crop yields. Advances in agricultural technologies and increasing adoption of precision farming techniques also contribute significantly to market growth.

The demand for SCU is primarily fueled by its efficacy in improving crop performance while reducing nitrogen loss to the environment. The shift towards sustainable agricultural practices across both developed and emerging economies amplifies this demand.

Significant opportunities exist in developing regions where agricultural intensification is progressing rapidly. Innovations in coating technologies that improve nutrient release profiles and minimize environmental impact further expand the market’s potential, offering considerable growth prospects for industry stakeholders.

The Sulphur Coated Urea (SCU) market is poised for substantial growth, driven by increasing global food security concerns and an emphasis on sustainable agricultural practices. SCU, an advanced controlled-release fertilizer, is engineered to enhance nitrogen uptake in crops, thereby improving nitrogen-use efficiency by an estimated 10-15 percentage points. This enhancement not only supports greater crop productivity but also significantly mitigates the environmental risks associated with nitrogen leakage, a common issue with conventional urea applications.

Research from the Indian Council of Agricultural Research (ICAR) underscores the efficiency of SCU, noting a reduction in urea consumption by up to 25% when SCU is employed. This reduction is crucial not only for lowering input costs for farmers but also for alleviating the environmental strain caused by excessive fertilizer use.

The adoption of SCU aligns with global trends towards precision agriculture, where the goal is to maximize agricultural output while minimizing environmental footprint and resource wastage.

The market’s trajectory is further influenced by regulatory frameworks that increasingly favor environmentally friendly agricultural inputs. Governments and international bodies are promoting the use of controlled-release fertilizers like SCU through subsidies and regulatory support, fostering a conducive environment for market expansion. ‘

As the agricultural sector continues to evolve, driven by technological advancements and regulatory changes, the SCU market is expected to offer significant investment opportunities, particularly in regions where the modernization of agricultural practices is accelerating.

Key Takeaways

- The Global Sulphur Coated Urea Market is expected to be worth around USD 2.8 Billion by 2033, up from USD 2.1 Billion in 2023, and grow at a CAGR of 2.9% from 2024 to 2033.

- Wax Sulphur Coated Urea dominates the market with a 48.1% share by product type.

- Conventional Sulfur Coated Urea holds a significant 67.4% share in the product category.

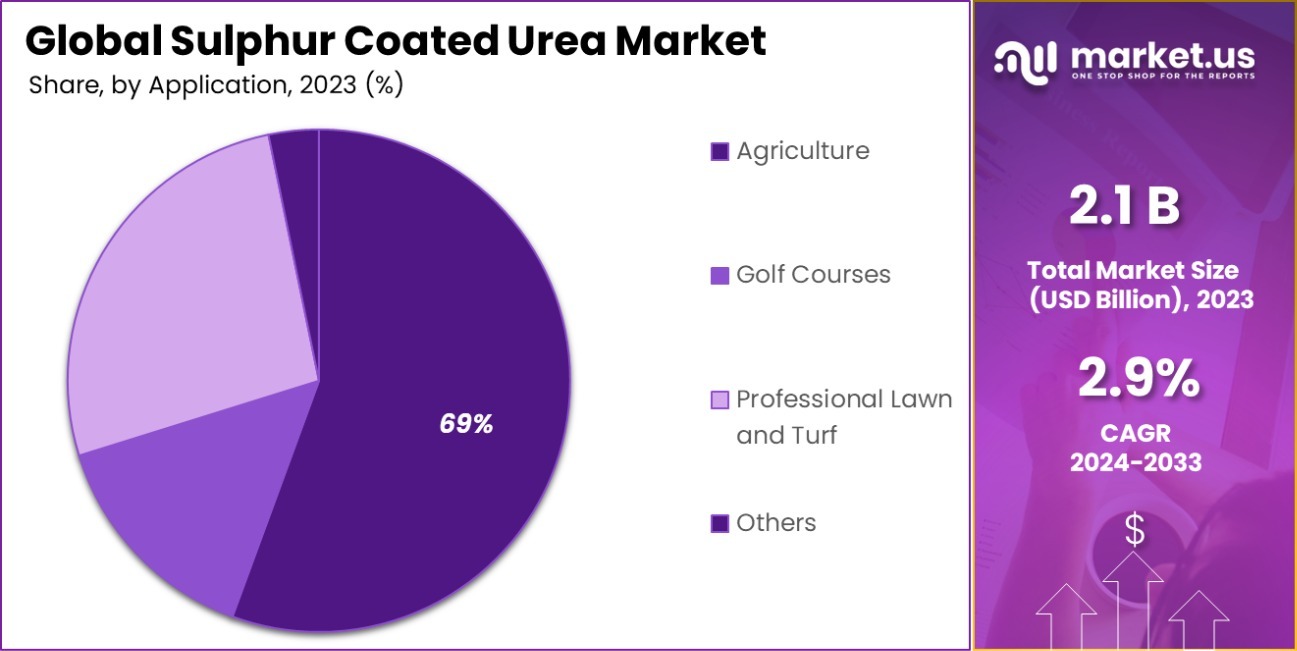

- Agriculture remains the largest application sector, accounting for 69.1% of SCU usage.

- Offline retail channels lead distribution with a substantial 78.1% market share.

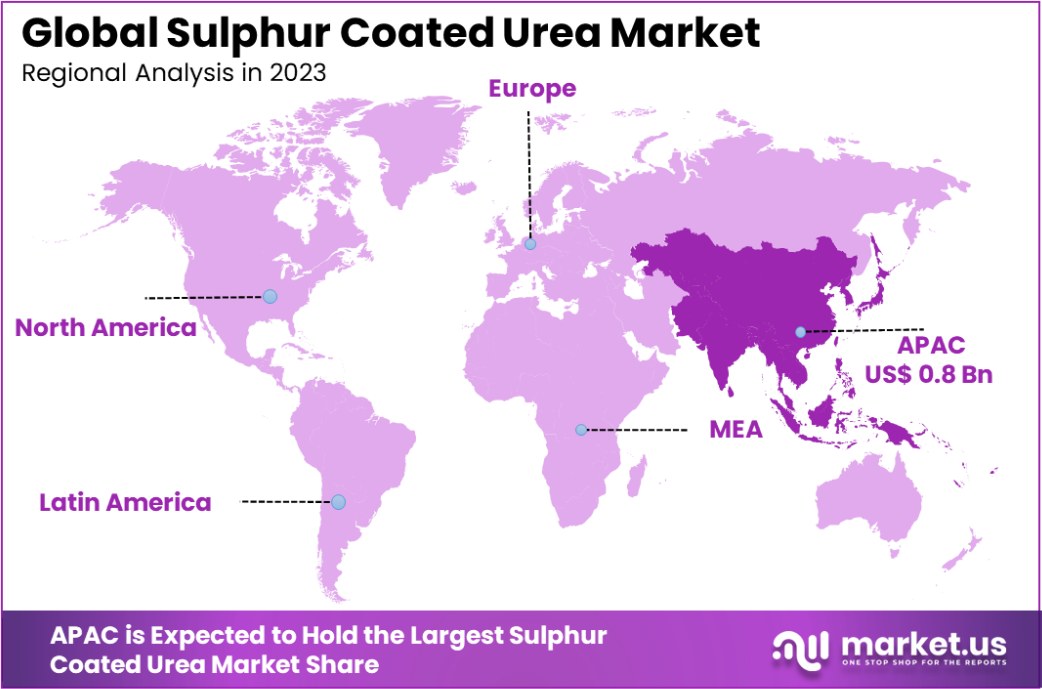

- The Asia-Pacific Sulphur Coated Urea market holds 38.2%, valued at USD 0.8 billion.

By Product Type Analysis

Wax Sulphur Coated Urea accounts for 48.1% of the market, emphasizing its popularity in controlled-release fertilizer applications.

In 2023, Wax Sulphur Coated Urea held a dominant market position in the By Product Type segment of the Sulphur Coated Urea Market, with a 48.1% share. This product type is favored for its cost-effectiveness and efficiency in releasing nutrients at a controlled pace, matching the nutrient uptake needs of crops.

Following closely are Polymer Sulphur Coated Urea and other varieties, which together round out the diversity of offerings in this market segment. Polymer variants, known for their enhanced durability and even more precise nutrient release patterns, cater to more specialized agricultural needs, thereby segmenting the market further based on crop type and regional climatic conditions.

The Conventional Sulfur Coated Urea segment also represents a significant portion of the market, commanding a 67.4% share. This prevalence underscores its established presence and continued preference among farmers seeking reliable and proven solutions for crop nutrition.

In terms of application, Agriculture remains the primary sector driving demand for Sulphur Coated Urea, accounting for 69.1% of the market. This high percentage reflects the critical role of advanced fertilizers in increasing agricultural productivity and efficiency.

Lastly, the distribution of Sulphur Coated Urea is predominantly through offline retail channels, which hold a 78.1% market share. This distribution dominance highlights the traditional buying behaviors of the agricultural sector, where direct purchasing and established distributor relationships remain key factors.

By Product Analysis

Conventional Sulfur Coated Urea dominates the market with a 67.4% share, preferred for its effectiveness and cost-efficiency.

In 2023, Conventional Sulfur Coated Urea held a dominant market position in the By Product segment of the Sulphur Coated Urea Market, with a 67.4% share. This segment’s strength highlights its longstanding reliability and cost-effectiveness, which continue to make it a popular choice among farmers globally. Conventional Sulfur Coated Urea is preferred for its straightforward application and proven results in a wide range of climatic and soil conditions.

Following it is Controlled Release Sulfur Coated Urea, which represents a growing niche driven by advancements in agricultural technology. This type is engineered for even more precise nutrient delivery, reducing environmental impact and improving crop yield consistency over varying agricultural conditions.

These products cater to a market increasingly driven by sustainability concerns and regulatory pressures to reduce nutrient runoff, which are prompting farmers and agricultural enterprises to adopt more efficient fertilization technologies.

The strong performance of Conventional Sulfur Coated Urea underscores its critical role in current agricultural practices, while the rise of Controlled Release variants points to a shift towards more environmentally conscious farming methods, promising significant growth and transformation in the fertilizer industry.

By Application Analysis

Agriculture remains the primary application of Sulphur Coated Urea, capturing 69.1% of the market due to high demand in farming.

In 2023, Agriculture held a dominant market position in the By Application segment of the Sulphur Coated Urea Market, with a 69.1% share. This significant portion underscores the essential role of Sulphur Coated Urea in enhancing crop productivity and efficiency in nutrient management across diverse agricultural settings.

The utilization of SCU in agriculture supports sustainable smart farming by minimizing nitrogen loss and improving soil health, aligning with global trends toward environmental stewardship and resource conservation.

Following agriculture, other segments such as Golf Courses, Professional Lawn and Turf, and miscellaneous applications each capture unique niches within the market. Golf Courses and Professional Lawn and Turf benefit from SCU’s slow-release properties, which are ideal for maintaining lush, green landscapes with reduced fertilizer applications, thereby lessening environmental impact and operational costs.

The ‘Others’ category, which includes various small-scale and specialty applications, also shows engagement with SCU products, highlighting the versatility and adaptability of this fertilizer technology.

Together, these segments reflect a robust and diverse market landscape, where SCU’s benefits are leveraged across multiple domains beyond traditional smart agriculture, supporting sustained growth and innovation in the industry.

By Distribution Channel Analysis

Offline retail channels lead Sulphur Coated Urea distribution, holding a 78.1% market share, reflecting strong consumer purchasing habits.

In 2023, Offline Retail held a dominant market position in the By Distribution Channel segment of the Sulphur Coated Urea Market, with a 78.1% share. This prominent position underscores the traditional preference for purchasing fertilizers through physical channels, where direct interaction and long-standing relationships between suppliers and farmers play a crucial role.

Offline retail’s stronghold is supported by its accessibility, especially in rural areas where digital infrastructure may still be developing, and the need for personal service and immediate product availability prevails.

Conversely, Online Retail is gradually carving out a space within the market. While it currently holds a smaller share, this segment is poised for growth, driven by the increasing digitization of agricultural supply chains and the convenience of online ordering systems. Farmers are beginning to recognize the benefits of online shopping, such as broader product selections and competitive pricing.

The contrast between these distribution channels highlights a dynamic market environment where traditional practices coexist with modern innovations. As digital platforms become more integrated into rural business ecosystems, the landscape of fertilizer distribution is expected to evolve, potentially shifting more market share towards online retail in the coming years.

Key Market Segments

By Product Type

- Wax Sulphur Coated Urea

- Polymer Sulphur Coated Urea

- Others

By Product

- Conventional Sulfur Coated Urea

- Controlled Release Sulfur Coated Urea

By Application

- Agriculture

- Golf Courses

- Professional Lawn and Turf

- Others

By Distribution Channel

- Online Retail

- Offline Retail

Driving Factors

Enhanced Crop Yields Through Controlled Nutrient Release

Sulphur Coated Urea (SCU) significantly enhances crop yields by providing a controlled nutrient release that aligns closely with the nutritional demands of plants. This targeted nutrition helps in maximizing the uptake of nitrogen, leading to healthier crops and improved productivity.

As global food demand continues to rise, the ability of SCU to increase output while using resources efficiently positions it as a critical component in modern agricultural practices.

Environmental Regulations Driving Sustainable Farming

Increasingly stringent environmental regulations are compelling farmers to adopt more sustainable agricultural practices. SCU fits well within these regulations by reducing nitrogen runoff and leaching, which are major contributors to environmental pollution.

As governments worldwide push for more environmentally friendly farming techniques, the demand for products like SCU that support these initiatives continues to grow, driving the market forward.

Adoption of Precision Agriculture Technologies

The adoption of precision agriculture technologies has provided a significant boost to the SCU market. These technologies enable the precise application of inputs like fertilizers, optimizing their effectiveness and reducing waste.

SCU’s properties complement these technologies by ensuring that nutrients are released in a controlled manner, matching the precise needs of crops at optimal times. This synergy between SCU and precision agriculture technologies enhances overall farm efficiency and productivity, bolstering market growth.

Restraining Factors

High Cost Compared to Conventional Fertilizers

Sulphur Coated Urea (SCU) is often more expensive than traditional urea and other conventional fertilizers. This price difference can be a significant barrier, especially for small-scale farmers and in regions where agricultural budgets are limited.

The higher cost not only affects initial adoption but can also influence ongoing purchasing decisions, potentially limiting the market growth of SCU despite its long-term benefits in terms of efficiency and reduced environmental impact.

Complexity in Manufacturing and Application

The production of SCU involves complex manufacturing processes that can increase production costs and logistical challenges. Additionally, the application of SCU requires specific knowledge and equipment to ensure optimal effectiveness.

These complexities can deter new users and restrict market expansion, as potential buyers may opt for simpler, more readily available fertilizer solutions that do not require specialized handling or application techniques.

Limited Awareness and Adoption in Emerging Markets

In many emerging markets, there is still limited awareness of the benefits of SCU, particularly its environmental advantages and cost-efficiency over the long term. Without adequate educational initiatives and demonstrations of SCU’s effectiveness, farmers may hesitate to switch from more familiar, traditional fertilizers to SCU.

This lack of awareness and slow adoption rate can significantly restrain the growth of the SCU market in regions that would otherwise stand to benefit greatly from its use.

Growth Opportunity

Expansion into Emerging Agricultural Markets

Emerging markets present significant growth opportunities for the Sulphur Coated Urea (SCU) market. As these regions continue to develop agriculturally, introducing SCU can enhance crop productivity and sustainability.

By targeting areas with increasing agricultural investments and those undergoing transitions to more modern farming practices, SCU providers can tap into new customer bases. The expansion strategy should include educational campaigns and partnerships with local governments to increase awareness and facilitate the adoption of SCU.

Integration with Smart Farming Technologies

Integrating SCU with smart farming technologies offers a lucrative growth opportunity. As precision agriculture gains traction, leveraging SCU’s slow-release properties can optimize nutrient usage, reduce environmental impact, and increase yields.

Manufacturers and marketers can collaborate with tech companies to develop systems that adjust SCU applications based on real-time soil and crop data, providing customized solutions that cater to the specific needs of modern farmers.

Development of Enhanced Coating Technologies

Innovating and improving SCU coating technologies can address existing limitations like uneven nutrient release and vulnerability to environmental conditions. Developing new formulations that offer more consistent and resilient nutrient delivery can broaden SCU’s appeal and usage, particularly in climates that pose challenging conditions for fertilizer stability.

Such advancements could also reduce manufacturing costs, making SCU more competitive against conventional fertilizers and appealing to a broader market segment.

Latest Trends

Adoption of Eco-Friendly Agricultural Practices

The growing global focus on sustainability is driving the adoption of eco-friendly agricultural practices, with Sulphur Coated Urea (SCU) at the forefront. As regulatory pressures increase to minimize environmental impacts, SCU is increasingly favored for its ability to reduce nitrogen runoff and enhance nutrient absorption efficiently.

This trend is not only prevalent in developed countries but is also gaining momentum in developing regions as awareness of environmental issues grows.

Rise of High-Efficiency Fertilizers in Developing Regions

Developing regions are witnessing a rapid rise in the adoption of high-efficiency fertilizers like SCU, spurred by the need to enhance agricultural productivity without expanding farmland. This trend is fueled by governmental policies supporting sustainable agriculture and initiatives aimed at increasing farmers’ access to advanced agricultural inputs.

The shift towards high-efficiency fertilizers is expected to continue as these regions seek to meet food production demands sustainably.

Technological Innovations in Fertilizer Application

Technological innovations in fertilizer application methods are shaping the SCU market. Precision farming tools and equipment that can accurately apply fertilizers like SCU to the soil are becoming increasingly popular. These technologies ensure that fertilizers are used efficiently, reducing waste and enhancing crop growth.

This trend is particularly strong in markets with high technology adoption rates, where farmers are keen to invest in technologies that promise higher returns on investment through optimized input usage and improved crop yields.

Regional Analysis

In Asia-Pacific, the Sulphur Coated Urea Market holds a 38.2% share, valued at USD 0.8 billion.

The Sulphur Coated Urea (SCU) market exhibits significant regional diversity, with Asia-Pacific leading as the dominating region. Holding 38.2% of the global market, Asia-Pacific’s SCU market is valued at USD 0.8 billion, driven by extensive agricultural activities and increasing adoption of advanced farming technologies in countries like China and India. The region benefits from high agricultural output demands and a strong push towards sustainable farming practices.

In contrast, North America and Europe show a robust interest in SCU due to stringent environmental regulations and the high adoption rate of precision agriculture technologies. North America, with its advanced agricultural infrastructure, is rapidly integrating SCU into its farming practices to enhance yield efficiency and reduce environmental impact.

Europe follows a similar pattern, focusing on sustainability and efficiency, particularly in countries with intensive agricultural practices.

The Middle East & Africa, and Latin America are emerging markets for SCU, with growth driven by increasing awareness of the benefits of controlled-release fertilizers. These regions present untapped potential due to expanding agricultural sectors and the need for improved agricultural productivity.

Efforts to modernize farming techniques and a gradual shift towards eco-friendly agricultural inputs are expected to boost SCU adoption in these markets significantly.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Sulphur Coated Urea (SCU) market is significantly influenced by a diverse array of key players, each contributing to the industry’s growth and innovation. Companies such as Agrium, now part of Nutrien Ltd., and Yara International ASA are at the forefront, leveraging extensive distribution networks and advanced R&D capabilities to enhance product efficacy and environmental compatibility. Nutrien Ltd., in particular, stands out due to its comprehensive portfolio that integrates SCU products into a broader strategy of sustainable agriculture solutions.

Another notable player, The Andersons, Inc., specializes in the North American market, where it combines manufacturing expertise with strong retail relationships to drive adoption among large-scale and specialty crop producers. Similarly, J.R. Simplot Chemicals leverages its strong foothold in the U.S. to innovate in product application techniques that complement the precision agriculture trend.

In Asia-Pacific, companies like Hanfeng Evergreen and Haifa Chemicals capitalize on the region’s rapid agricultural expansion and increasing environmental regulations. These companies focus on developing SCU formulations that meet the specific needs of high-output agriculture in countries like China and India, thus ensuring their competitive edge.

Koch Industries Inc. and Israel Chemicals highlight their global reach and investment in technology to create SCU products that offer superior performance and lower environmental impact, catering to the growing demand for sustainable agricultural inputs across various regions.

Overall, these companies are pivotal in driving the SCU market forward through technological advancements, strategic market expansions, and by responding to the tightening global regulations on environmental safety and agricultural efficiency. Their efforts are crucial for meeting the increasing global demand for high-efficiency, environmentally friendly fertilizers.

Top Key Players in the Market

- Agrium

- Andersons

- Everris

- Haifa Chemicals

- Hanfeng Evergreen

- Harrell’s Dencam Composite

- Israel Chemicals

- J.R. Simplot Chemicals

- Koch Industries Inc.

- Luyue Chemical

- Nutrien Ltd.

- PULCU TARIM

- QAFCO

- Sun Agro

- Syngenta

- The Andersons, Inc.

- Turf Care Supply, LLC

- Yara International ASA

Recent Developments

- In 2023, Haifa Chemicals continues its significant contributions to the Sulphur Coated Urea (SCU) sector. The company’s focus remains on developing specialized fertilizers, including SCU, which are designed to improve nutrient efficiency and reduce environmental impacts. Haifa Chemicals operates globally, ensuring a wide distribution and application of its innovative products in various agricultural and horticultural settings.

- In 2023, Syngenta remains a key player in the Sulphur Coated Urea market, focusing on developing and distributing controlled-release fertilizers. Their efforts, aligning with the shift towards sustainable agriculture, aim to enhance product efficiency, optimize fertilizer delivery, and contribute to higher agricultural yields while minimizing environmental impacts.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 2.8 Billion CAGR (2024-2033) 2.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wax Sulphur Coated Urea, Polymer Sulphur Coated Urea, Others), By Product (Conventional Sulfur Coated Urea, Controlled Release Sulfur Coated Urea), By Application (Agriculture, Golf Courses, Professional Lawn and Turf, Others), By Distribution Channel (Online Retail, Offline Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agrium, Andersons, Everris, Haifa Chemicals, Hanfeng Evergreen, Harrell’s Dencam Composite, Israel Chemicals, J.R. Simplot Chemicals, Koch Industries Inc., Luyue Chemical, Nutrien Ltd., PULCU TARIM, QAFCO, Sun Agro, Syngenta, The Andersons, Inc., Turf Care Supply, LLC, Yara International ASA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sulphur Coated Urea MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Sulphur Coated Urea MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Agrium

- Andersons

- Everris

- Haifa Chemicals

- Hanfeng Evergreen

- Harrell's Dencam Composite

- Israel Chemicals

- J.R. Simplot Chemicals

- Koch Industries Inc.

- Luyue Chemical

- Nutrien Ltd.

- PULCU TARIM

- QAFCO

- Sun Agro

- Syngenta

- The Andersons, Inc.

- Turf Care Supply, LLC

- Yara International ASA