Global Pigments Market By Product Type (Organic Pigments, Inorganic Pigments, Specialty Pigments), By Color (Reds, Orange, Yellows, Blue, Green, Brown, Others), By Application (Paints and Coatings, Plastics, Printing Inks, Construction Materials, Others), By End Use (Home use, Commercial use), By Distribution Channel (Supermarkets, Hypermarkets, E-commerce Websites, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133169

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

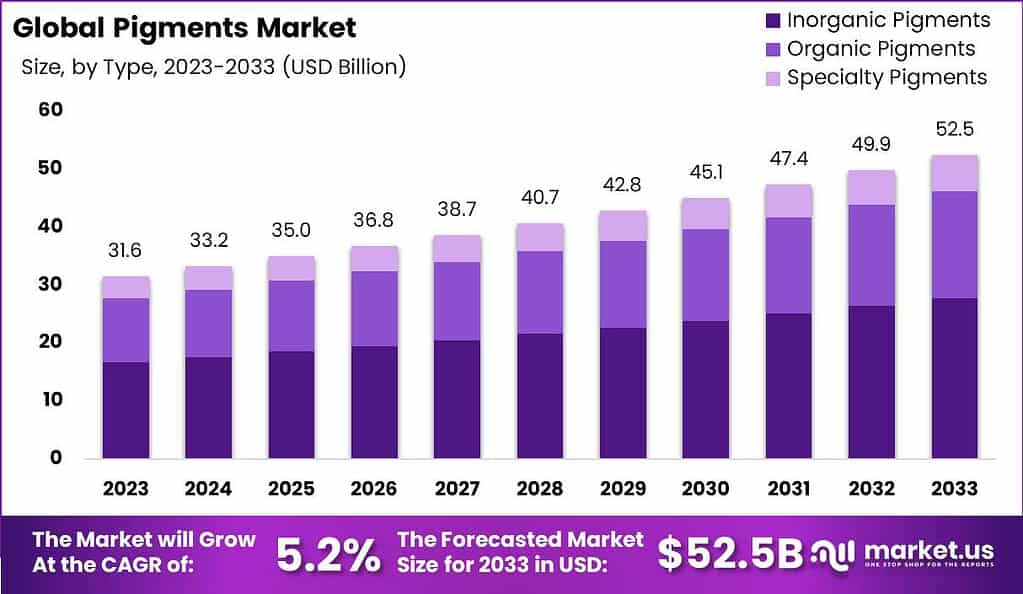

The Global Pigments Market is expected to be worth around USD 52.5 billion by 2033, up from USD 31.6 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

The pigment market is a significant global industry primarily involved in producing and distributing substances used to color various materials. These pigments find extensive applications in diverse sectors such as paints, inks, plastics, and cosmetics.

The market is strongly influenced by technological advancements, consumer preferences for eco-friendly and safer products, and stringent regulatory standards, which guide the development and usage of pigments.

Asia-Pacific is a major hub in the pigment market due to its robust industrial growth and expanding automotive and construction industries, with China playing a pivotal role in production and consumption.

The demand for pigments is particularly high in the automotive sector, which utilized about 35% of all pigments produced globally in 2022. Additionally, the construction industry consumed approximately 25% of the total pigments, fueled by the need for architectural paints and coatings that align with ongoing urban development trends.

In terms of trade, China emerged as a dominant exporter with pigments exports valued at over USD 3.2 billion in 2022. The United States is a significant importer, reflecting its reliance on external sources, with imports totaling about USD 1.1 billion. Recognizing the strategic importance of self-reliance in pigment production, the Indian government introduced a funding initiative in 2021, allocating INR 500 crores to bolster domestic manufacturing and reduce dependency on imports.

The market is also witnessing substantial investments aimed at enhancing sustainable production capacities. For example, a major chemical manufacturer invested USD 200 million in 2023 to establish a new facility in Southeast Asia dedicated to producing eco-friendly pigments. This move is indicative of the industry’s shift towards sustainability and environmentally responsible practices.

Strategic acquisitions and partnerships are further steering the market towards innovation and sustainability. A notable transaction in early 2023 involved a U.S. firm acquiring a European pigment manufacturer for USD 800 million, aiming to expand its portfolio of environmentally friendly pigments. Additionally, collaborations focused on developing bio-based pigments have resulted in a significant increase in production capacity, with a 10% rise reported in 2022 alone.

As companies continue to expand their global presence, new production facilities are being set up in strategic locations. A prominent example is the establishment of a new production line in Brazil by a leading chemical company, designed to boost their annual pigment output by 20,000 tons to meet the growing demand in South America. These expansions and investments highlight the dynamic nature of the pigment market and its alignment with global economic and environmental trends.

Key Takeaways

- The Global Pigments Market is expected to be worth around USD 52.5 billion by 2033, up from USD 31.6 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

- Inorganic Pigments dominated the market with a 53.4% share across diverse industries.

- Yellows dominated the Pigments Market with a 13.4% share across color segments.

- Paints and Coatings dominated the Pigments Market with a 42.3% share.

- APAC dominates the global pigments market with a 31.4% share, valued at $10.1 billion.

By Product Type Analysis

Inorganic Pigments dominated the market with a 53.4% share across diverse industries.

In 2023, Inorganic Pigments held a dominant market position in the By Product Type segment of the Pigments Market, capturing more than a 53.4% share. This significant market presence can be attributed to the widespread application of inorganic pigments across various industries, including automotive, construction, and coatings, where they are favored for their excellent durability and vibrant color stability. These pigments, which include oxides, sulfides, and chromates, are essential in applications demanding high heat resistance and lightfastness.

Organic Pigments, which represented the second largest category, are known for their bright, vivid colors and are primarily used in applications requiring high tinting strength and aesthetic appeal, such as in printing inks and plastics. Although they command a smaller share of the market compared to inorganic pigments, their use is growing due to advancements in formulation that improve their lightfastness and opacity.

Specialty Pigments, which include metallic, pearlescent, and luminescent pigments, cater to niche markets that require unique aesthetic effects. These pigments are increasingly popular in high-end cosmetics, automotive finishes, and electronics, driving their demand. Despite their higher cost, the demand for specialty pigments is expected to rise, propelled by consumer preferences for products that offer differentiation through unique visual effects and functional benefits.

By Color Analysis

Yellows dominated the Pigments Market with a 13.4% share across color segments.

In 2023, The Pigments Market saw varied trends across its color segments. Leading the market, Yellows held a dominant position in the By Color segment, capturing more than a 13.4% share. The popularity of yellows can be attributed to their broad application in paints, coatings, and plastics, driving their demand, particularly in consumer goods and automotive sectors.

The Reds were the second most significant segment. Known for their vibrant hues and strong tinting properties, red pigments are extensively used in industries like cosmetics and food coloring, contributing to their substantial market share. As environmental regulations tighten, the shift towards organic red pigments is accelerating, further influencing this segment’s growth dynamics.

Orange pigments, ranking third, have carved a niche in both industrial and artistic applications. Their ability to offer warm, rich tones makes them ideal for automotive paints and industrial coatings, where durability and aesthetics are paramount. The demand in this segment is spurred by the booming construction and automotive industries, especially in emerging economies.

Blues, known for their calming shades, are integral to both decorative and functional applications. Their ultramarine and cobalt variations are particularly favored in the art material sector and in architectural coatings, underlining the segment’s stable market presence.

Greens, often associated with nature and tranquility, have seen a rise in usage due to the growing trend towards eco-friendly and sustainable products. The demand for green pigments is increasing in sectors like packaging, where they are used to convey freshness and safety.

Brown pigments hold a smaller, yet steady share of the market. These earth tones are essential in applications requiring a natural or subdued look, such as in camouflage materials, construction, and landscape painting.

By Application Analysis

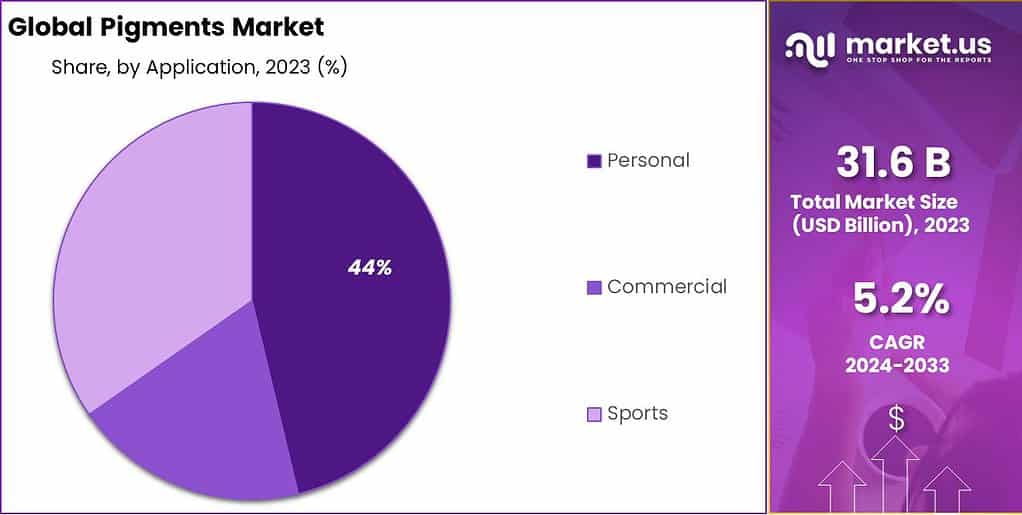

Paints and Coatings dominated the Pigments Market with a 42.3% share.

In 2023, Paints and Coatings held a dominant market position in the By Application segment of the Pigments Market, capturing more than a 42.3% share. This segment benefits greatly from the consistent demand in both residential and commercial construction, as well as from the automotive industry, which relies on high-quality finishes and protective coatings. The vibrant and durable characteristics of modern pigments have significantly enhanced the aesthetic appeal and lifespan of painted surfaces, propelling growth in this market segment.

Plastics followed as the second-largest segment, where pigments are integral in colorizing and adding functionality to consumer goods, packaging, and electronic devices. The need for aesthetically pleasing yet durable products drives the demand for advanced pigment solutions in the plastics industry, supporting its robust market share.

The Printing Inks segment also showed significant activity, with pigments being crucial for achieving the vividness and clarity required in digital and offset printing. The growth in packaging and labeling driven by e-commerce has particularly spurred the demand for printing inks, highlighting the segment’s vitality within the market.

Construction Materials, another key segment, utilize pigments primarily for aesthetic enhancements in materials such as concrete, tiles, and decorative overlays. As urbanization progresses, the demand for construction materials that can deliver both performance and visual appeal is expected to rise.

Key Market Segments

By Product Type

- Organic Pigments

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Chromium Compounds

- Others

- Inorganic Pigments

- Azo

- Phthalocyanine

- Quinacridone

- Others

- Specialty Pigments

- Classic Organic

- Metallic

- High-performance Organic

- Light Interference

- Complex Inorganic

- Fluorescent

- Luminescent/Phosphorescent

- Thermochromic

- Others

By Color

- Reds

- Orange

- Yellows

- Blue

- Green

- Brown

- Others

By Application

- Paints and Coatings

- Plastics

- Printing Inks

- Construction Materials

- Others

Driving factors

Increasing Demand from the Automotive Industry

The pigments market is experiencing significant growth, primarily driven by the expanding automotive industry. Pigments are essential for providing color and aesthetic appeal to automotive coatings, which play a crucial role in vehicle manufacturing. As the global automotive sector recovers and expands, particularly in emerging markets, the demand for high-quality and durable pigments escalates.

The surge in automotive production is closely correlated with an increase in the consumption of pigments used in paints and coatings. This demand is further amplified by the evolving consumer preferences for vibrant and varied vehicle colors, which necessitate a broader spectrum of pigment solutions.

Rising Popularity of Sustainable and Bio-based Pigments

A transformative shift in the pigments market is the rising popularity of sustainable and bio-based pigments. This trend is driven by increasing environmental awareness and stringent regulations focusing on reducing the ecological footprint of manufacturing processes. Bio-based pigments, derived from renewable sources, offer a reduced environmental impact and are gaining favor among manufacturers and consumers alike.

The demand for these pigments is further bolstered by their growing application in industries such as plastics, textiles, and inks, where they are prized for their non-toxic and eco-friendly properties. This shift not only aligns with global sustainability goals but also opens new avenues for market growth through innovative product offerings that cater to a more environmentally conscious consumer base.

Growth in Construction Activities

The construction sector plays a pivotal role in the expansion of the pigments market. Pigments are extensively used in the production of architectural coatings, which are essential for both interior and exterior applications. As urbanization accelerates, especially in Asia-Pacific and the Middle East, there is a marked increase in construction activities. This urban growth drives the demand for more infrastructure, which in turn boosts the consumption of pigments.

The coloration of construction materials such as concrete, plasters, and mortars integrates aesthetic value with functional benefits, such as heat reflection in lighter-colored surfaces. Consequently, the robust growth in construction not only stimulates direct pigment demand but also complements the advancements in manufacturing technologies that enhance pigment quality and application efficiency.

Restraining Factors

Stringent Environmental Regulations

The growth of the pigment market is notably influenced by stringent environmental regulations. These regulations, aimed at minimizing the environmental damage caused by chemical releases during pigment production, pose significant challenges for manufacturers. Compliance with such regulations often necessitates substantial investments in cleaner technologies and practices, which can elevate production costs and reduce profit margins.

Additionally, the push toward eliminating certain types of synthetic pigments due to their toxicological profiles has constrained market expansion. However, these regulations also drive innovation, compelling companies to develop eco-friendly pigments that comply with environmental standards, thereby fostering a subset of the market dedicated to sustainable solutions.

Volatility in Raw Material Prices

Another critical restraining factor is the volatility of raw material prices, which affects the stability of pigment production costs. Pigments are derived from a variety of raw materials, the prices of which can fluctuate widely due to changes in the global economic landscape, trade policies, and natural resource availability.

Such volatility makes it challenging for pigment manufacturers to maintain consistent pricing and profitability, potentially deterring investment in new production capacities. This volatility can also lead to a shift in manufacturing strategies, such as the sourcing of cheaper or alternative raw materials, which may affect product quality and market perception.

Replacement by Digital Printing Technologies

The emergence and adoption of digital printing technologies pose a significant threat to traditional segments of the pigments market, particularly within the printing inks sector. Digital printing does not require the extensive use of conventional pigments used in analog processes, as it relies on fewer inks to produce a wide spectrum of colors through digital blending techniques.

This shift not only reduces the demand for traditional print pigments but also influences the development and sales strategies of pigment producers. The impact is particularly pronounced in markets that are rapidly adopting digital techniques, such as advertising and packaging.

Growth Opportunity

Innovations in Eco-friendly Pigments

The global shift towards sustainability is a major driver of innovation in the pigment industry. With increasing environmental regulations and a growing consumer preference for eco-friendly products, manufacturers are investing in the development of organic and non-toxic pigments. These innovations not only meet regulatory compliance but also appeal to a broader demographic concerned with environmental impact and health implications.

The adoption of such eco-friendly pigments is expected to surge, offering significant growth opportunities in sectors ranging from automotive coatings to personal care products.

Increased Use in Food and Beverages

The food and beverage sector presents a burgeoning market for high-quality pigments that can comply with stringent food safety standards. As manufacturers strive to make their products more appealing and distinctive, the demand for natural and vibrant colorants is increasing.

This trend is particularly noticeable in health-conscious consumables, where visually appealing presentation enhances marketability. Pigments that can provide enhanced color stability and safety in food and beverages are poised to see considerable growth.

Advancements in Color Matching Technologies

Technological advancements in color matching are revolutionizing the pigments market. Enhanced precision in color reproduction enables industries such as printing, textiles, and paints to offer more consistent and customized products. This capability is crucial in a market where differentiation and product customization are key competitive strategies.

As technologies such as AI and machine learning continue to evolve, the ability to match and predict pigment behavior more accurately will drive growth and innovation across multiple pigment application sectors.

Latest Trends

Shift Towards Organic Pigments

The pigments market is witnessing a significant shift towards organic pigments, driven by growing environmental concerns and stringent regulations regarding synthetic colorants. These organic pigments, derived from natural sources, not only reduce environmental impact but also cater to the increasing consumer demand for sustainable and eco-friendly products.

This trend is reshaping the strategies of major players in the industry as they invest in research and development to expand their portfolio of organic pigments, aiming to replace traditional synthetic options without compromising on vibrancy and durability.

Increased Transparency in Supply Chains

Another key trend is the increased transparency in supply chains. Consumers and regulatory bodies are pushing for greater visibility into the sourcing and manufacturing processes. This shift is propelled by an enhanced awareness of the environmental and ethical implications of pigment production.

Companies are adopting blockchain technology and other digital tools to provide real-time tracking and ensure the authenticity of raw materials. This transparency not only bolsters consumer trust but also streamlines operations and mitigates risks associated with supply chain disruptions.

Adoption of International Quality Standards

The adoption of international quality standards is becoming crucial in the pigments market. As companies expand globally, uniform standards ensure consistency and quality across all markets, enhancing product credibility.

Compliance with standards like ISO and ASTM not only facilitates easier access to international markets but also ensures that products meet safety, environmental, and performance criteria. This trend is prompting companies to upgrade their production technologies and processes to align with global best practices, thereby improving overall market competitiveness.

Regional Analysis

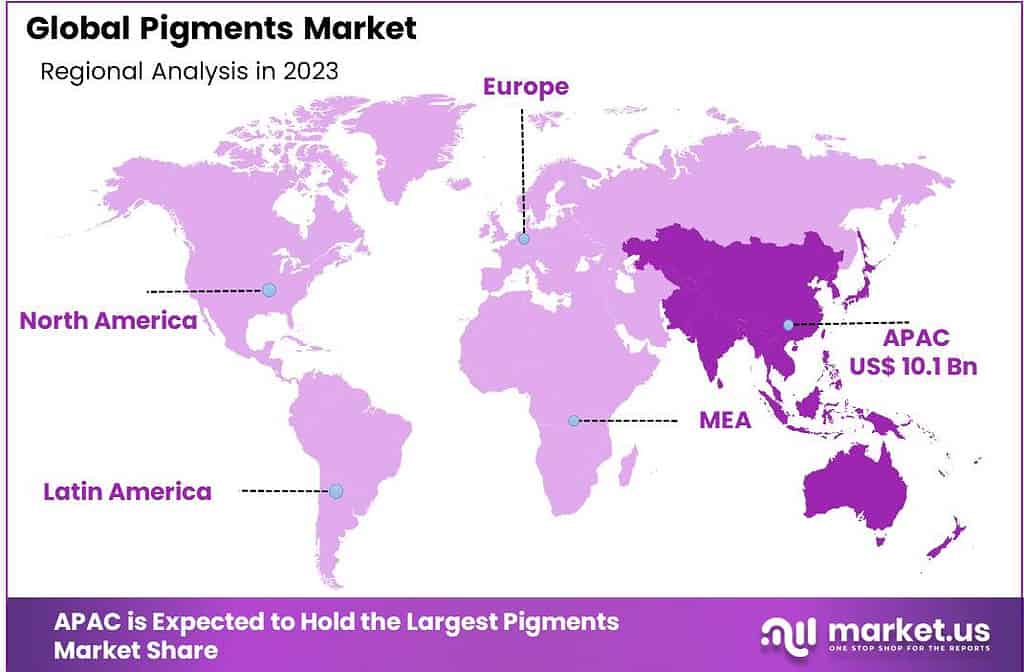

APAC dominates the global pigments market with a 31.4% share, valued at $10.1 billion.

In the pigments market, regional dynamics significantly influence trends and opportunities. Asia Pacific (APAC) stands as the dominating region, holding a substantial 31.4% market share valued at approximately $10.1 billion. This dominance is primarily driven by rapid industrialization, an expanding automotive sector, and significant investments in construction activities across emerging economies such as China and India. These factors contribute to heightened demand for both organic and inorganic pigments.

North America remains a key player in the pigment market, with a focus on innovative and sustainable pigment solutions. The region’s stringent environmental regulations and the growing trend towards green construction materials foster a steady demand for organic and non-toxic pigments. Additionally, North American manufacturers are heavily invested in technological advancements to improve pigment quality and functionality, aligning with the evolving requirements of industries such as automotive and consumer goods.

Europe mirrors similar trends with a strong emphasis on sustainability and high-quality standards. The European market is significantly influenced by regulatory frameworks like REACH, which push for safer and environmentally friendly pigments. European manufacturers are leading in the adoption of international quality standards and the development of advanced pigment technologies that offer superior performance characteristics.

The Middle East & Africa (MEA) region, though smaller in comparison, is experiencing growth due to increased infrastructure development and an expanding automotive sector. The demand for high-performance pigments that can withstand extreme environmental conditions is rising, propelling local and international suppliers to capitalize on these emerging opportunities.

Latin America, with its diverse industrial base, exhibits growth in the demand for pigments, particularly in the paint and coatings industry, driven by urbanization and the renovation of residential and commercial structures. The region shows potential for increased market penetration by global pigment manufacturers, aiming to establish local production units to reduce costs and enhance supply chain efficiencies.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the evolving landscape of the global pigments market in 2024, key players like ALTANA AG, BASF SE, CLARIANT, and DIC Corporation are strategically positioned to leverage their core competencies and drive innovation and growth.

ALTANA AG has consistently focused on high-value specialty chemicals, including pigments for various applications. In 2024, ALTANA is expanding its capabilities in sustainable and high-performance pigments, tapping into the demand for environmentally friendly products. The company’s robust R&D infrastructure allows it to develop unique pigment solutions that meet stringent regulatory standards and consumer preferences for green products.

BASF SE, as a global chemical leader, maintains a significant position in the pigments market through its vast portfolio and extensive distribution network. BASF’s strategy involves continuous innovation in pigment technology, particularly in high-performance and effect pigments that offer superior color and functionality. The company’s commitment to sustainability is evident in its production processes and products, aiming to reduce environmental impact across its global operations.

CLARIANT specializes in creating pigments that are tailored to the specific needs of diverse industries, such as automotive, plastics, and coatings. The company’s focus in 2024 remains on expanding its range of non-toxic and eco-friendly pigments. Clariant’s investment in customer-centric and sustainable innovations allows it to strengthen its market presence and cater to the evolving regulatory landscapes and market demands.

DIC Corporation plays a crucial role in the Asia-Pacific region, benefiting from its proximity to fast-growing markets. DIC’s strategic focus on expanding its portfolio to include a wider range of organic pigments and dispersions positions it well within the competitive landscape. The company’s commitment to quality and innovation, coupled with its strong regional footprint, supports its growth in a market increasingly driven by demand for high-quality, durable, and safe pigments.

Market Key Players

- ALTANA AG

- BASF SE

- CLARIANT

- CPS Color AG

- Cristal

- Dainichiseika Color & Chemicals Mfg., Co., Ltd.

- DIC Corporation

- Ferro Corporation

- Gharda Chemicals Limited

- Heubach Gmbh

- Kronos Worldwide Inc.

- LANXESS

- LB Group

- Lonsen

- Pidilite Industries Ltd.

- RIKA Technology Co., Ltd.

- Sudarshan Chemical Industries Limited

- The Chemours Company

- Toyo Ink Mfg. Co. Ltd.

- Tronox Holdings Plc

- Venator Materials PLC.

Recent Development

- In May 2023, U.S. Silica introduced EverWhite, a new pigment product designed for coatings, building products, and various applications. This pigment can be used to partially substitute or complement other inorganic white pigments such as aluminum trihydrate (ATH) and titanium dioxide (TiO2), aligning with the company’s strategy to deliver innovative solutions across different industries

- In March 2023, BTC Europe entered into a distribution agreement with Sudarshan Chemical Industries Limited to supply high-performance pigments across Europe. This partnership is aimed at expanding BTC Europe’s third-party product portfolio and strengthening its competitive edge in the pigments market.

Report Scope

Report Features Description Market Value (2023) USD 31.6 Billion Forecast Revenue (2033) USD 52.5 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic Pigments, Inorganic Pigments, Specialty Pigments), By Color (Reds, Orange, Yellows, Blue, Green, Brown, Others), By Application (Paints and Coatings, Plastics, Printing Inks, Construction Materials, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ALTANA AG, BASF SE, CLARIANT, CPS Color AG, Cristal, Dainichiseika Color & Chemicals Mfg., Co., Ltd., DIC Corporation, Ferro Corporation, Gharda Chemicals Limited, Heubach Gmbh, Kronos Worldwide Inc., LANXESS, LB Group, Lonsen, Pidilite Industries Ltd., RIKA Technology Co., Ltd., Sudarshan Chemical Industries Limited, The Chemours Company, Toyo Ink Mfg. Co. Ltd., Tronox Holdings Plc, Venator Materials PLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ALTANA AG

- BASF SE

- CLARIANT

- CPS Color AG

- Cristal

- Dainichiseika Color & Chemicals Mfg., Co., Ltd.

- DIC Corporation

- Ferro Corporation

- Gharda Chemicals Limited

- Heubach Gmbh

- Kronos Worldwide Inc.

- LANXESS

- LB Group

- Lonsen

- Pidilite Industries Ltd.

- RIKA Technology Co., Ltd.

- Sudarshan Chemical Industries Limited

- The Chemours Company

- Toyo Ink Mfg. Co. Ltd.