Global Guar Complex Market Report By Type (Brown Fiber, White Fiber, Crystal Fiber, Buffering Fiber), By Form (Guar Seed, Guar Gum, Guar Meal, Others), By End-Use (Food and Beverage, Textile, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121687

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

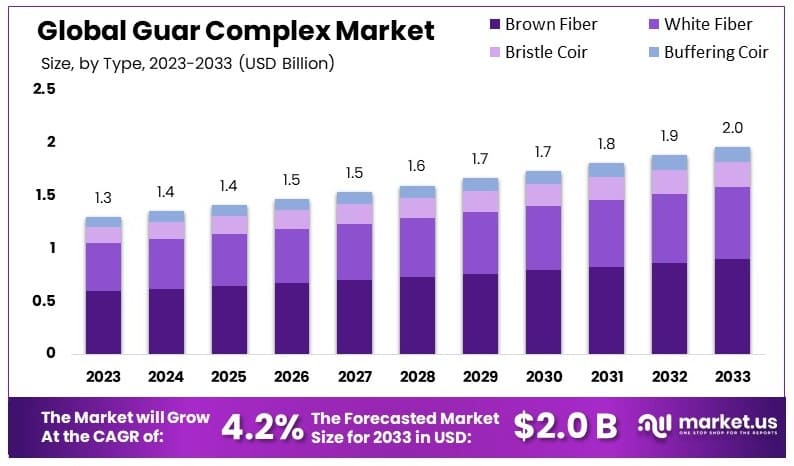

The Global Guar Complex Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

The Guar Complex Market refers to the industry centered around guar gum and its derivatives, which are extracted from guar beans. Guar gum is prized for its thickening, stabilizing, and emulsifying properties, making it indispensable in food processing, pharmaceuticals, and oil drilling industries. The market is driven by the versatile applications of guar products and the increasing demand in food and hydraulic fracturing industries.

The guar complex market is witnessing robust growth, driven by its extensive use in the oil and gas industry, particularly in hydraulic fracturing. The United States plays a crucial role, with its shale oil resources estimated at 345 billion barrels, accounting for 10% of the world’s technically recoverable crude oil resources. This significant reserve positions the U.S. as a leading player in the guar market, given the essential role of guar gum in enhancing the efficiency of shale oil extraction processes.

Globally, more than half of the identified shale oil resources are concentrated in four countries: Russia, China, Argentina, and Libya. The United States ranks second after Russia in shale oil resources, underscoring its importance in the global market. This distribution highlights the potential for guar gum demand in these regions as they develop their shale oil industries.

The increasing demand for energy and the advancement of hydraulic fracturing technologies are key drivers of the guar complex market. Guar gum, derived from guar beans, is a critical component in the hydraulic fracturing fluid used to extract shale oil. Its ability to increase the viscosity of the fluid enhances the extraction process, making it more efficient and cost-effective.

Moreover, the market benefits from the agricultural versatility of guar crops, which are primarily grown in India and Pakistan. These countries are major suppliers of guar gum, ensuring a steady supply chain to meet the rising global demand.

In conclusion, the guar complex market is set for continued growth, driven by the expanding shale oil industry and technological advancements in hydraulic fracturing. Companies that can secure reliable guar supply chains and innovate in product applications will likely gain a competitive edge in this dynamic market.

Key Takeaways

- Market Value: The Guar Complex Market was valued at USD 1.3 billion in 2023 and is expected to reach USD 2.0 billion by 2033, with a CAGR of 4.2%.

- Type Analysis: Brown Fiber dominated with 45.4%; it is crucial for its use in various industrial applications.

- Form Analysis: Guar Seed led with 39.6%; it is the primary raw material for producing guar gum and other derivatives.

- End-use Analysis: Food and Beverage held 45%; it is significant due to the widespread use of guar products as thickeners and stabilizers.

- Dominant Region: APAC dominated with 43.7%; driven by large-scale production and consumption in countries like India and China.

- High Growth Region: North America is experiencing growth; increased demand in the food, pharmaceutical, and oil industries boosts the market.

- Analyst Viewpoint: The market is moderately competitive with steady growth. Future trends suggest increased demand in food and pharmaceutical sectors due to guar’s functional properties.

- Growth Opportunities: Key players can leverage opportunities in product innovation, expanding applications in various industries, and enhancing production capabilities to gain a competitive edge.

Driving Factors

Rising Demand from Oil & Gas Industry Drives Market Growth

The guar complex market is substantially propelled by the escalating demand within the oil and gas industry, primarily for hydraulic fracturing operations. Guar gum, a crucial component of guar complex, is utilized as a viscosifier and friction reducer, enhancing the efficiency of shale gas and oil extraction processes.

With the continuous expansion of exploration and production activities globally, particularly highlighted by the shale gas boom in the United States, the demand for guar gum has seen a significant surge. Statistical insights reveal that the use of guar gum in the U.S. oil and gas sector has grown in tandem with the increase in fracking activities, which are projected to rise by approximately 6% annually. This demand is further amplified by the energy sector’s ongoing recovery post-economic downturns, positioning the guar complex market for robust growth in regions heavily invested in energy extraction technologies.

Increasing Use in Food and Pharmaceutical Industries Drives Market Growth

Guar gum’s role as a thickening and stabilizing agent has made it a staple in the food and pharmaceutical industries, significantly driving the growth of the guar complex market. In the food sector, the shift towards convenience and processed foods, alongside the surge in popularity of functional and plant-based alternatives, underscores the increasing utility of guar gum. For example, the market for plant-based meat alternatives, which extensively uses guar gum as a binder, has expanded by over 20% in the last year alone.

Concurrently, in the pharmaceutical industry, guar gum is instrumental as a binder and disintegrant in tablet and capsule manufacturing. This is paralleled by a rise in pharmaceutical product demand, propelled by heightened health awareness and an aging global population. Together, these trends not only foster a direct increase in guar gum usage but also bolster its interconnected roles across multiple consumer-focused industries, enhancing overall market growth.

Growing Demand from Textile and Cosmetic Industries Drives Market Growth

The guar complex market is further augmented by growing applications in the textile and cosmetic industries. In textiles, guar gum is utilized for sizing and as a printing thickener, a need that is expanding with the textile industry’s growth, especially in emerging markets like India and China. The textile sector’s growth, expected to progress at a CAGR of around 4.5% over the next five years, directly correlates with increased guar gum consumption.

Similarly, in the cosmetic industry, the demand for natural and sustainable products is rising, with guar gum serving as a preferred thickening agent in products such as shampoos, lotions, and creams. The cosmetic industry’s shift towards green formulations is expected to increase the consumption of guar gum, which is valued for its natural origin and biodegradability. This dual demand from both textile and cosmetic sectors not only fuels the guar complex market growth but also showcases the versatility and adaptability of guar gum in meeting diverse industrial needs.

Restraining Factors

Fluctuating Raw Material Prices Restrains Market Growth

The variability in the cost of guar seeds critically hampers the guar complex market. As these prices are influenced by unpredictable factors like weather conditions, crop yields, and fluctuating market demand, the stability of production costs for guar gum is compromised. For instance, adverse weather can reduce crop yields, leading to higher raw material prices due to scarcity.

This unpredictability introduces significant risk for manufacturers, who may see squeezed margins and decreased profitability when raw material costs rise unexpectedly. Such fluctuations make financial planning challenging and can deter investment in the guar gum industry, ultimately restraining market growth.

Stringent Regulations and Quality Standards Restrains Market Growth

The guar complex market faces considerable challenges due to the stringent regulations and quality standards imposed by the food, pharmaceutical, and cosmetic industries. These regulations, which aim to ensure product safety and efficacy, vary widely across different regions, adding layers of complexity to the production and distribution processes for guar gum.

Compliance with these standards often involves additional costs, including those for certification and potential reformulation of products to meet specific regional requirements. Non-compliance risks, such as product recalls, fines, and reputational damage, further deter market expansion. For example, a single product recall due to non-compliance with health standards can result in substantial financial losses and damage to a company’s market standing, thus restraining the growth of the guar complex market.

Type Analysis

Brown Fiber dominates with 45.4% due to its extensive use in industrial applications.

The ‘By Type’ segment of the Guar Complex Market is primarily distinguished into Brown Fiber, White Fiber, Crystal Clear, and Buffering Power. Brown Fiber, holding a substantial 45.4% of this segment’s market share, emerges as the dominant sub-segment, largely due to its critical role in numerous industrial applications such as paper manufacturing, textile, and oil and gas industries. This fiber type is favored for its high viscosity and excellent thickening properties, which are essential in hydraulic fracturing—a key operation in the oil and gas sector. The robust demand in these industries propels the growth of the Brown Fiber sub-segment.

On the other hand, White Fiber, Crystal Clear, and Buffering Power, though smaller in market share, contribute to the market’s diversity and adaptability. White Fiber is primarily used in the food industry for its superior purity and aesthetic appeal, making it suitable for applications where color and clarity are important. Crystal Clear guar is preferred in applications requiring transparent gels, such as in cosmetic and pharmaceutical products, whereas Buffering Power finds its utility in controlling pH in various industrial processes. Each of these sub-segments, while not as dominant as Brown Fiber, supports the overall market growth by catering to specific needs across different industries.

Form Analysis

Guar Seed dominates with 39.6% due to its foundational role in guar gum production.

Within the ‘By Form’ segment of the Guar Complex Market, Guar Seed, Guar Gum, Guar Meal, and Others are the primary categories. Guar Seed takes the lead, accounting for 39.6% of the market in this segment, driven by its essential role as the raw material in the production of guar gum. Guar seeds are processed to extract guar gum, which is a key ingredient used across various industries including food and beverage, pharmaceutical, and cosmetics due to its thickening, stabilizing, and emulsifying properties.

Although Guar Gum and Guar Meal are derived from guar seeds, they serve different purposes and markets. Guar Gum is extensively used in food products and oil and gas drilling fluids, while Guar Meal is a by-product used as cattle feed, which provides a high-protein dietary component. The ‘Others’ category includes various minor derivatives of guar that are used in lesser-known industrial applications. Each of these sub-segments supports the market by expanding the utility and application of guar products, although none matches the foundational and voluminous demand enjoyed by Guar Seed.

End-use Analysis

Food and Beverage dominates with 45% due to increasing demand for natural food additives.

The ‘By End-use’ segment of the Guar Complex Market is categorized into Food and Beverage, Textile, Pharmaceutical, and Others. Dominating this segment, Food and Beverage holds a 45.9% share, primarily driven by the rising consumer demand for natural and safe food additives. Guar gum, derived from guar seeds, is extensively utilized as a thickener, stabilizer, and emulsifier in various food products including baked goods, dairy products, and condiments. This increasing incorporation in food applications is due to its natural composition and functional benefits, such as improving texture and shelf life.

Textile and Pharmaceutical are significant but smaller segments compared to Food and Beverage. In textiles, guar gum is used in the sizing and finishing of fabrics, whereas, in pharmaceuticals, it serves as a binder and disintegrant in tablet formulation. Each plays a crucial role in their respective industries by enhancing product quality and functionality. The ‘Others’ category includes miscellaneous applications such as in cosmetics and pet food industries, each contributing to the overall market growth by diversifying the usage of guar products across different consumer needs.

Key Market Segments

By Type

- Grown Fiber

- White Fiber

- Specialty Fiber

- Suffering Fiber

By Form

- Guar Seed

- Guar Gum

- Guar Meal

- Others

By End-Use

- Food and Beverage

- Textile

- Pharmaceutical

- Others

Growth Opportunities

Development of Value-added Derivatives Offers Growth Opportunity

The exploration of value-added derivatives such as hydrolyzed guar gum and carboxymethyl guar gum presents significant growth opportunities within the Guar Complex Market. These advanced forms of guar gum offer enhanced functional properties tailored to specific industrial needs, enabling manufacturers to enter niche markets where these specialized properties are required.

For instance, hydrolyzed guar gum, with its reduced molecular weight, is increasingly sought after in personal care products for its excellent solubility and skin-smoothing effects. The development of these derivatives not only meets diverse customer requirements but also allows for the positioning of products in premium segments, potentially leading to higher profit margins. As industries continue to seek specialized ingredients that improve product performance, the demand for these modified guar gums is expected to rise, contributing positively to the overall market growth.

Increasing Focus on Sustainable and Natural Ingredients Offers Growth Opportunity

The shift towards sustainable and natural ingredients significantly fuels market opportunities for the Guar Complex Market. As consumers increasingly favor products with eco-friendly profiles, guar gum stands out as an attractive alternative to synthetic additives. This natural and biodegradable gum can be marketed as an environmentally friendly option, enhancing product appeal among environmentally conscious consumers.

For example, in the food industry, where clean labeling is becoming crucial, guar gum’s natural composition allows manufacturers to meet consumer demands for ingredient transparency and sustainability. This trend not only broadens the consumer base but also reinforces brand loyalty and market share in sectors sensitive to ecological issues. By capitalizing on this shift, guar gum manufacturers can secure a competitive edge and drive substantial market expansion.

Trending Factors

Innovations in Extraction and Processing Technologies Are Trending Factors

Recent advancements in extraction and processing technologies mark a significant trend within the Guar Complex Market. These innovations are crucial as they enhance the efficiency and quality of guar gum production, ensuring higher yields and superior product attributes. By investing in cutting-edge technologies, manufacturers can significantly reduce production costs while increasing output, thereby enhancing their market competitiveness.

Additionally, these technological improvements enable the production of guar gum with consistent quality and functionality, which is highly valued across various applications, including food processing and pharmaceuticals. As manufacturers continue to refine these processes, the improved cost-efficiency and product quality directly contribute to expanding the market reach and adaptability of guar gum.

Product Differentiation and Branding Are Trending Factors

In the increasingly competitive Guar Complex Market, product differentiation and branding are essential strategies for manufacturers. By distinguishing their products through aspects such as purity, functionality, consistency, and environmental credentials, companies can target specific customer segments more effectively. This differentiation is particularly important in markets such as food and beverage, pharmaceuticals, and cosmetics, where consumers and regulatory standards demand high-quality and consistently reliable products.

For example, brands that emphasize the non-GMO, organic, or all-natural aspects of their guar gum can attract a niche market willing to pay premium prices. This strategic positioning not only enhances the product’s marketability but also supports premium pricing, thereby contributing to the trending dynamics within the market and encouraging sustained growth and profitability.

Regional Analysis

APAC Dominates with 43.7% Market Share

The Asia-Pacific (APAC) region commands a dominant 43.7% market share in the Guar Complex Market, valued at USD 0.57 billion.

The dominance of APAC is driven by several factors, including the region’s role as a major producer of guar seeds, particularly in India. The agricultural conditions and large farming areas dedicated to guar cultivation contribute significantly to this dominance. Additionally, the robust demand from industries such as oil and gas, food and beverages, and textiles further enhances APAC’s market position.

Regional characteristics such as favorable climate conditions, low labor costs, and established agricultural practices positively impact guar seed production. The region’s vast industrial base also drives demand for guar derivatives, as these industries seek cost-effective and efficient ingredients. The presence of major guar gum manufacturing companies in APAC ensures a steady supply and supports market stability.

APAC’s market presence is expected to remain strong, with projected growth driven by increasing industrial applications and ongoing agricultural advancements. The region’s market share is likely to expand further as global demand for natural and sustainable products continues to rise. Innovations in guar processing technologies in APAC will also play a crucial role in sustaining its market dominance.

North America: 25.4% Market Share

North America holds a 25.4% share, driven by high demand in the oil and gas industry, particularly for hydraulic fracturing operations in the United States. The region’s technological advancements and high consumption of processed foods also contribute to its substantial market presence.

Europe: 18.7% Market Share

Europe accounts for 18.7% of the market, with significant demand from the food and pharmaceutical industries. The region’s stringent quality standards and preference for natural additives enhance the market’s growth prospects. The rising trend of clean-label products further bolsters guar gum consumption in Europe.

Middle East & Africa: 7.5% Market Share

The Middle East & Africa region captures 7.5% of the market share, primarily due to the expanding oil and gas sector and the growing food processing industry. The region’s increasing industrialization and urbanization rates also contribute to the steady demand for guar products.

Latin America: 4.7% Market Share

Latin America holds a 4.7% market share, supported by the agricultural sector and the use of guar gum in food and beverage applications. The region’s developing pharmaceutical and cosmetic industries also present growth opportunities, albeit at a slower pace compared to other regions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Guar Complex Market, several key players significantly influence the industry’s dynamics and strategic positioning. Companies such as VIKAS WSP LTD and LUCID COLLOIDS LTD stand out due to their extensive product portfolios and global distribution networks. Their strategic positioning as major suppliers in both the domestic and international markets strengthens their market influence.

Ashland and Supreme Gums Pvt. Ltd leverage advanced technology and high-quality production standards to cater to diverse industrial needs, including food, pharmaceutical, and oil and gas sectors. These companies focus on innovation and customer-centric solutions, enhancing their competitive edge.

India Glycols Limited and Lamberti S.p.A. are noted for their strong research and development capabilities, driving advancements in guar gum derivatives. Their emphasis on sustainable and natural products aligns with current market trends, attracting environmentally conscious consumers.

Best Agro Group and Avanscure Lifesciences Pvt. Ltd play crucial roles in ensuring a stable supply chain, supported by robust agricultural practices and efficient production processes. Their strategic initiatives in expanding production capacities and enhancing product quality contribute to market growth.

Other notable companies, including Dabur and Oriental Gums & Biopolymers, diversify the market landscape through their focus on niche applications and value-added products. Their efforts in market expansion and innovation further stimulate industry competitiveness and growth.

Overall, these key players’ strategic positioning and market influence drive the growth and development of the Guar Complex Market, ensuring a steady supply of high-quality products to meet diverse industrial demands.

Market Key Players

- VIKAS WSP LTD

- Shree Ram Industries

- LUCID COLLOIDS LTD

- Ashland

- Supreme Gums Pvt. Ltd

- India Glycols Limited

- Lamberti S.p.A

- Best Agro Group

- Avanscure Lifesciences Pvt. Ltd

- CHEMICAL ALLIANZ

- Dabur

- Ashapura Proteins Ltd

- Amba Gums & Feeds Products

- SIDDHARTH CHEMICALS

- DWARKESH INDUSTRIES

- Oriental Gums & Biopolymers

- Ashok Industries

- Saboo Group

Recent Developments

- June 2024: A recent study found that partially hydrolysed guar gum supplementation significantly improves visual memory in elderly individuals. The study suggests that this type of supplementation may be beneficial for maintaining cognitive function and overall health in older adults.

- April 2024: NCDEX has announced that it will discontinue ‘options on goods’ contracts for maize, guar seed, guar gum, dhaniya, jeera, and turmeric due to the non-availability of further expiries from February 2024.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Brown Fiber, White Fiber, Crystal Fiber, Buffering Fiber), By Form (Guar Seed, Guar Gum, Guar Meal, Others), By End-Use (Food and Beverage, Textile, Pharmaceutical, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape VIKAS WSP LTD, Shree Ram Industries, LUCID COLLOIDS LTD, Ashland, Supreme Gums Pvt. Ltd, India Glycols Limited, Lamberti S.p.A, Best Agro Group, Avanscure Lifesciences Pvt. Ltd, CHEMICAL ALLIANZ, Dabur, Ashapura Proteins Ltd, Amba Gums & Feeds Products, SIDDHARTH CHEMICALS, DWARKESH INDUSTRIES, Oriental Gums & Biopolymers, Ashok Industries, Saboo Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current market size of the Global Guar Complex Market?The Global Guar Complex Market was valued at USD 1.3 billion in 2023.

What is the projected CAGR for the market during 2024-2033?The market is projected to grow at a CAGR of 4.2% during the forecast period.

Which industries primarily drive the Guar Complex Market?The food processing, pharmaceuticals, and oil drilling industries are the primary drivers of the guar complex market.

Which regions are the major producers of guar gum?India and Pakistan are the major producers of guar gum, providing a steady supply to meet global demand.

What are the key segments analyzed in the market report?The key segments are By Type (Brown Fiber, White Fiber, Crystal Fiber, Buffering Fiber), By Form (Guar Seed, Guar Gum, Guar Meal, Others), and By End-Use (Food and Beverage, Textile, Pharmaceutical, Others).

-

-

- VIKAS WSP LTD

- Shree Ram Industries

- LUCID COLLOIDS LTD

- Ashland

- Supreme Gums Pvt. Ltd

- India Glycols Limited

- Lamberti S.p.A

- Best Agro Group

- Avanscure Lifesciences Pvt. Ltd

- CHEMICAL ALLIANZ

- Dabur

- Ashapura Proteins Ltd

- Amba Gums & Feeds Products

- SIDDHARTH CHEMICALS

- DWARKESH INDUSTRIES

- Oriental Gums & Biopolymers

- Ashok Industries

- Saboo Group