Global Plastic Lumber Market By Product (Virgin Plastic, Recycled Plastic, Composite), By Resin Type (Polyethylene, Polyvinyl Chloride, Polystyrene, Others), By Application (Molding Trim, Fencing, Landscaping Outdoor Products, Windows Doors, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132996

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

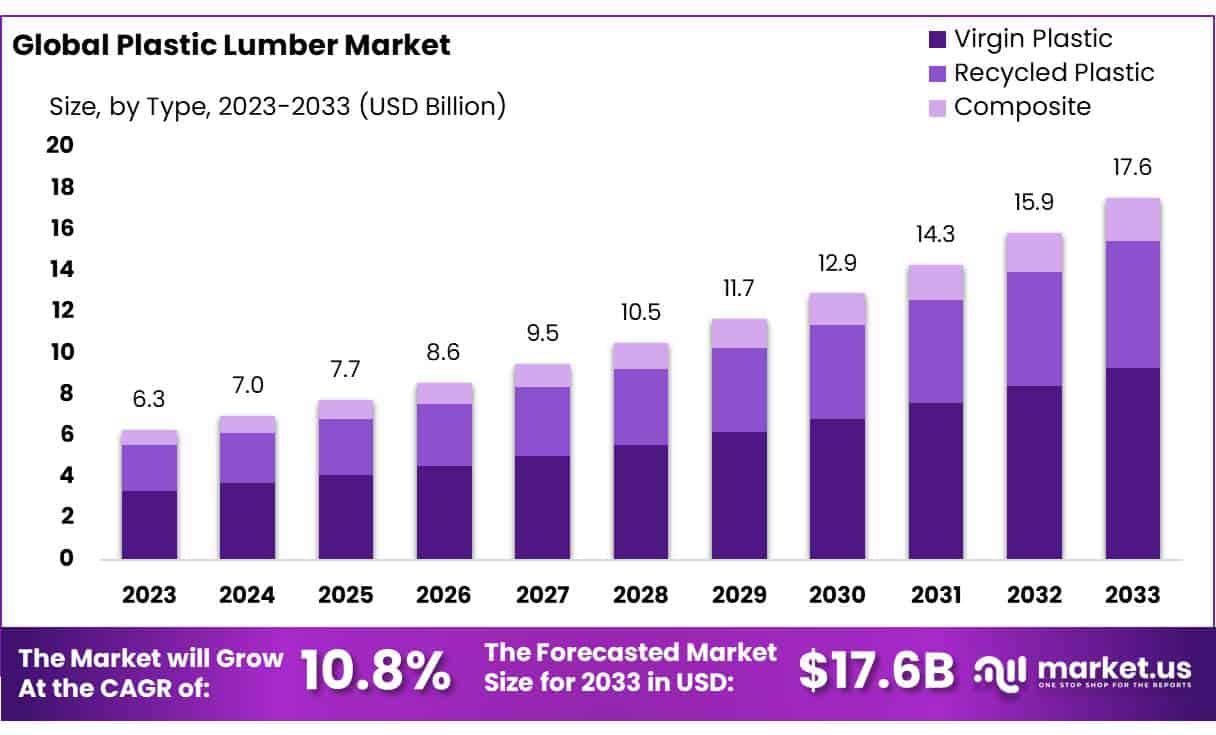

The Global Plastic Lumber Market size is expected to be worth around USD 17.6 Bn by 2033, from USD 6.3 Bn in 2023, growing at a CAGR of 10.8% during the forecast period from 2024 to 2033.

Plastic lumber, a sustainable alternative to traditional wood, is gaining traction globally due to its durability, recyclability, and low maintenance requirements. This material is increasingly being adopted across various end-use industries, including construction, landscaping, and outdoor furniture manufacturing.

In 2023, the global market for plastic lumber was estimated to be around USD 8 billion, reflecting its growing acceptance as a viable alternative to wood and other traditional materials.

Government initiatives and regulations play a crucial role in the adoption of plastic lumber. For instance, in the United States, the Environmental Protection Agency (EPA) promotes the use of recycled materials, including plastic lumber, in public construction projects.

The import and export dynamics of plastic lumber are influenced by regional demand and production capabilities. In 2023, North America exported approximately USD 200 million worth of plastic lumber to Europe and Asia, driven by the robust manufacturing infrastructure in the U.S. and Canada. These exports are supported by advancements in recycling technologies that enhance the quality and appeal of plastic lumber on the international market.

Investments in the plastic lumber sector are also significant, with private and public funding fueling innovation and expansion. For example, a major U.S.-based manufacturer of plastic lumber, Green Tree Plastics, invested USD 50 million in 2023 to expand its production capacity and develop new products tailored for the construction industry. This investment aims to meet the increasing demand for environmentally friendly building materials.

Key Takeaways

- Plastic Lumber Market size is expected to be worth around USD 17.6 Bn by 2033, from USD 6.3 Bn in 2023, growing at a CAGR of 10.8%.

- Virgin Plastic held a dominant market position in the plastic lumber sector, capturing more than a 53.3% share.

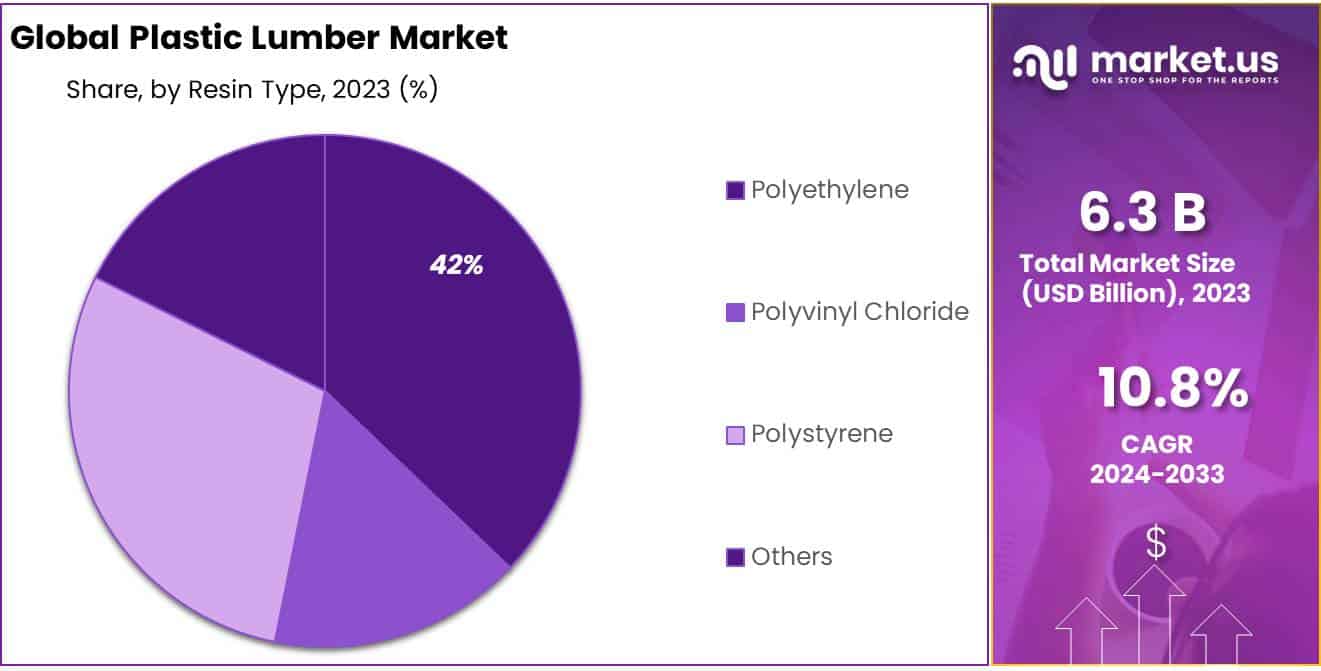

- Polyethylene held a dominant market position in the plastic lumber sector, capturing more than a 42.1% share.

- Molding and Trim held a dominant market position in the plastic lumber sector, capturing more than a 28.2% share.

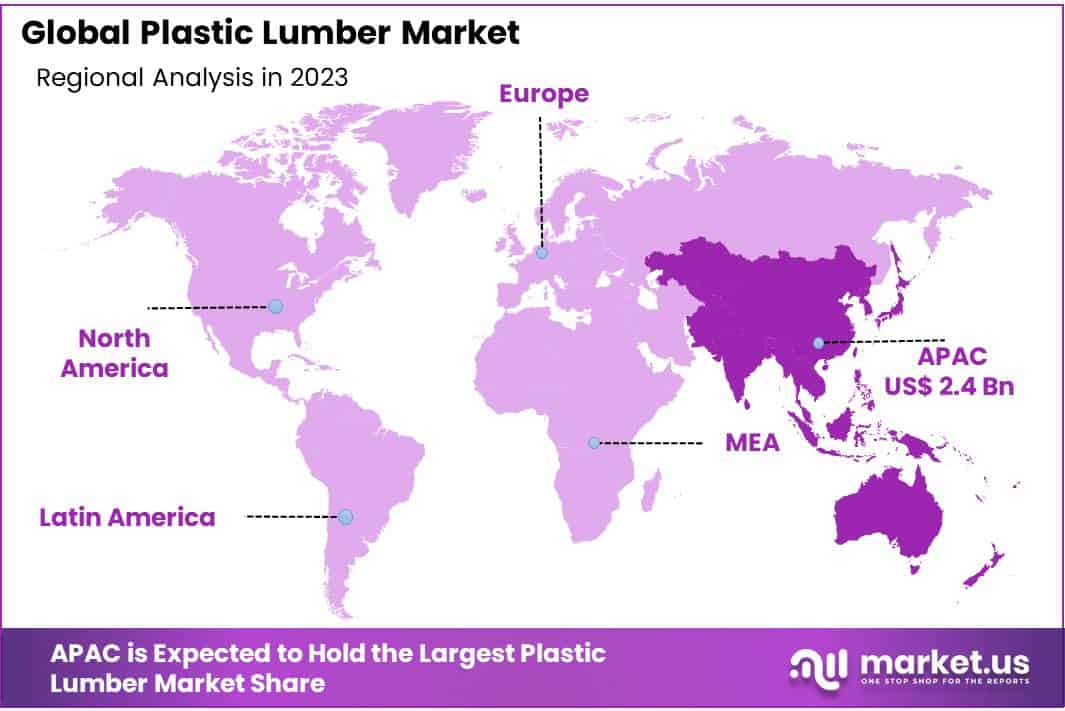

- Asia Pacific (APAC) leads with a substantial 38.4% market share, translating to around USD 2.4 billion in revenue.

By Product

In 2023, Virgin Plastic held a dominant market position in the plastic lumber sector, capturing more than a 53.3% share. This segment benefits significantly from the consistency and quality of new plastics, which provide superior strength and durability compared to other types. The high performance of virgin plastic lumber makes it particularly desirable in construction and outdoor structural applications where longevity and weather resistance are critical.

Recycled Plastic forms another crucial segment of the market. It appeals to environmentally conscious consumers and industries aiming to reduce their ecological footprint. While recycled plastic lumber generally offers slightly varied properties due to the nature of mixed recycled materials, advancements in processing technologies have enhanced its quality and broadened its applications, particularly in decking and fencing.

Composite plastic lumber, which combines plastic with other materials like wood fibers or additives, represents a growing niche. This product is engineered to offer specific qualities such as enhanced stiffness or improved aesthetic appeal, resembling natural wood while maintaining the benefits of plastic durability. Although it occupies a smaller portion of the market compared to virgin and recycled types, its demand is increasing due to its versatility and suitability for a wide range of applications.

By Resin Type

In 2023, Polyethylene held a dominant market position in the plastic lumber sector, capturing more than a 42.1% share. This resin type is favored for its durability, moisture resistance, and flexibility, making it highly suitable for outdoor applications such as decking, fencing, and landscaping products. Its resistance to environmental stressors like UV light and rot ensures long-lasting performance, which is highly valued in both residential and commercial construction projects.

Polyvinyl Chloride (PVC) also plays a significant role in the market. Known for its rigidity and excellent weather resistance, PVC is a preferred material for window frames and doors when used in plastic lumber. This resin offers unique properties, including flame resistance and easy customization through colors and textures, which have helped it carve a niche in both exterior and interior applications.

Polystyrene is another important resin used in the plastic lumber industry. It is typically lighter than other plastics and can be more cost-effective, making it suitable for applications where lower weight and affordability are priorities. Despite its susceptibility to UV degradation, advancements in additive technologies have improved its performance for outdoor use.

By Application

In 2023, Molding and Trim held a dominant market position in the plastic lumber sector, capturing more than a 28.2% share. This segment benefits from the aesthetic versatility and maintenance-free qualities of plastic lumber, which are ideal for both interior and exterior moldings and trims. The resistance to moisture and decay makes it a popular choice in construction, particularly in areas exposed to harsh weather conditions.

Fencing is another significant application of plastic lumber. Its durability and resistance to rotting, splintering, and insect damage make it an excellent choice for both residential and commercial properties seeking long-term, low-maintenance solutions. The ability to mimic the appearance of wood with improved functionality continues to drive its adoption in this segment.

Landscaping and Outdoor Products also make extensive use of plastic lumber due to its environmental resilience and minimal upkeep requirements. Items such as garden beds, benches, and playground equipment benefit from plastic lumber’s robustness and safety features, including its splinter-free surface.

Windows and Doors represent a smaller, yet important, application area where plastic lumber’s structural stability and insulation properties are leveraged. This material is particularly valued in climates with extreme weather conditions, where it contributes to energy efficiency and comfort.

Key Market Segments

By Product

- Virgin Plastic

- Recycled Plastic

- Composite

By Resin Type

- Polyethylene

- Polyvinyl Chloride

- Polystyrene

- Others

By Application

- Molding Trim

- Fencing

- Landscaping Outdoor Products

- Windows Doors

- Others

Driving Factors

Advancements in Material Science

Innovations in plastic lumber production, such as improvements in the versatility and customization of the product, are also contributing to market expansion. These advancements allow plastic lumber to meet specific consumer preferences and project requirements, broadening its applications across various industries, including construction.

Regulatory and Environmental Influence

The market is also positively impacted by stringent environmental regulations and sustainability goals, particularly in regions like Europe, where there is a high demand for eco-friendly building materials. Europe’s focus on reducing reliance on virgin resources and promoting recycling aligns well with the attributes of plastic lumber, enhancing its market adoption.

Growth in Sustainable Construction Materials

This growth is largely driven by the material’s durability, low maintenance requirements, and resistance to decay and insects, making it highly suitable for outdoor and structural applications.

Restraining Factors

High Initial Costs

Plastic lumber is often more expensive than traditional wood and other competitive materials, primarily due to the costs associated with recycling plastics and the manufacturing processes involved. The higher price point can deter both individual consumers and large-scale developers, especially in developing regions where budget constraints are tighter.

Competition from Traditional Wood and Alternatives

Despite its environmental benefits, plastic lumber faces stiff competition from traditional wood products, which are often cheaper and more familiar to consumers and contractors. Alternative materials like composites or treated woods that offer similar benefits at a lower cost also restrict the market expansion of plastic lumber.

Market Acceptance and Standardization Issues

The lack of standardization in the plastic lumber industry poses significant challenges. Without consistent standards and certifications, it can be difficult for users to trust the quality and performance claims of plastic lumber, which hampers broader market acceptance.

Economic and Regulatory Factors

Economic slowdowns and fluctuating raw material prices further compound the restraint posed by high initial costs. Regulatory factors also play a crucial role; while some regions have supportive recycling and green building policies, others lack the incentives that can drive adoption of alternative building materials like plastic lumber.

Growth Opportunity

Expansion into New Applications

Traditionally used for outdoor decking and fencing due to its durability and low maintenance, advancements in plastic lumber technology are now enabling its use in a broader range of applications. These include construction elements like beams and joists, landscaping, outdoor furniture, and even marine environments where resistance to rot and moisture is critical.

Sustainable Building Practices

With the escalating crisis of plastic waste, there’s a significant shift towards using recycled materials. Plastic lumber, often made from recycled plastics like discarded bottles and containers, not only helps reduce landfill waste but also conserves forest resources by offering an alternative to traditional wood. This aspect is particularly attractive in regions with stringent environmental regulations and sustainability goals, such as Europe and North America

Technological Innovations

Improvements in the manufacturing processes of plastic lumber, such as extrusion and injection molding, are enhancing its qualities and applications. These innovations help produce more complex shapes and profiles, allowing plastic lumber to meet a variety of specific construction needs. The development of co-extruded and laminated plastic lumber is also opening new market opportunities due to their enhanced durability and aesthetic appeal.

Latest Trends

Market Growth

The composite segment of the plastic lumber market is projected to experience the highest growth rate, reflecting a significant shift towards more sustainable and durable materials in construction and landscaping applications.

Technological Advancements

Advances in manufacturing technologies have enabled the production of composite plastic lumber with enhanced properties, such as increased strength and improved resistance to environmental factors. These technological improvements are crucial for meeting the stringent performance requirements of various applications, from decking to structural components.

Environmental Impact

The use of composite plastic lumber significantly contributes to environmental sustainability. It helps in diverting waste plastics from landfills and reducing reliance on virgin materials, aligning with global efforts to tackle plastic pollution and reduce carbon footprints.

Economic Viability

Despite higher initial costs, the long-term benefits of composite plastic lumber, such as lower maintenance, longer lifespan, and resistance to decay and pests, offer economic advantages over traditional materials. This cost-effectiveness is increasingly recognized in sectors such as commercial construction and residential landscaping

Regional Analysis

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The plastic lumber market features a diverse group of key players that significantly influence its dynamics. Trex Company, Inc. and Fiberon are prominent leaders known for their innovative and eco-friendly decking solutions. Both companies have heavily invested in recycling technologies to transform consumer and industrial waste into high-performance composite decking products, which have been pivotal in driving their growth and leadership in the market.

Tangent Technologies, LLC, Bedford Technology LLC, and Advanced Environmental Recycling Technology Inc are other notable contributors, specializing in the manufacture of recycled plastic lumber for a wide range of applications, from outdoor furniture to structural applications. These firms emphasize durability and sustainability, catering to both commercial and residential markets.

Smaller but vital players such as Genova Products, Inc., PlasTEAK, Inc., and PlasDECK, Inc. also add to the market variety with specialized offerings like marine-grade decking. Companies like KWK Plastic Lumber Co., Ltd. and American Recycled Plastic, Inc. focus on niche markets, including outdoor recreational and landscaping products, further enriching the market landscape.

Top Key Players in the Market

- Trex Company, Inc.

- Fiberon

- Tangent Technologies, LLC

- Genova Products, Inc.

- PlasTEAK, Inc.

- PlasDECK, Inc.

- American Recycled Plastic, Inc.

- KWK Plastic Lumber Co., Ltd.

- Ecoville

- CMI

- Repeat Plastics Australia Pty Ltd.

- Engineered Plastic System Llc

- Century-Board Usa, Llc

- Advanced Environmental Recycling Technology Inc

- Aeolian Enterprise Inc

- Bedford Technology Llc

Recent Developments

In 2023, Trex reported consistent sales, with full-year net sales totaling $1.1 billion, maintaining the previous year’s levels.

In 2023, Fiberon invested over $20 million in upgrading and expanding its manufacturing operations in New London, NC.

Report Scope

Report Features Description Market Value (2023) USD 6.3 Bn Forecast Revenue (2033) USD 17.6 Bn CAGR (2024-2033) 10.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Virgin Plastic, Recycled Plastic, Composite), By Resin Type (Polyethylene, Polyvinyl Chloride, Polystyrene, Others), By Application (Molding Trim, Fencing, Landscaping Outdoor Products, Windows Doors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trex Company, Inc., Fiberon, Tangent Technologies, LLC, Genova Products, Inc., PlasTEAK, Inc., PlasDECK, Inc., American Recycled Plastic, Inc., KWK Plastic Lumber Co., Ltd., Ecoville, CMI, Repeat Plastics Australia Pty Ltd., Engineered Plastic System Llc, Century-Board Usa, Llc, Advanced Environmental Recycling Technology Inc, Aeolian Enterprise Inc, Bedford Technology Llc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Trex Company, Inc.

- Fiberon

- Tangent Technologies, LLC

- Genova Products, Inc.

- PlasTEAK, Inc.

- PlasDECK, Inc.

- American Recycled Plastic, Inc.

- KWK Plastic Lumber Co., Ltd.

- Ecoville

- CMI

- Repeat Plastics Australia Pty Ltd.

- Engineered Plastic System Llc

- Century-Board Usa, Llc

- Advanced Environmental Recycling Technology Inc

- Aeolian Enterprise Inc

- Bedford Technology Llc