Global Needle Coke Market Size, Share, And Business Benefits By Type (Petroleum-based, Coal-based), By Grade (Regular, Premium, Super Premium), By Application (Graphite Electrodes, Lithium-ion Batteries, Specialty Carbon, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 32264

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

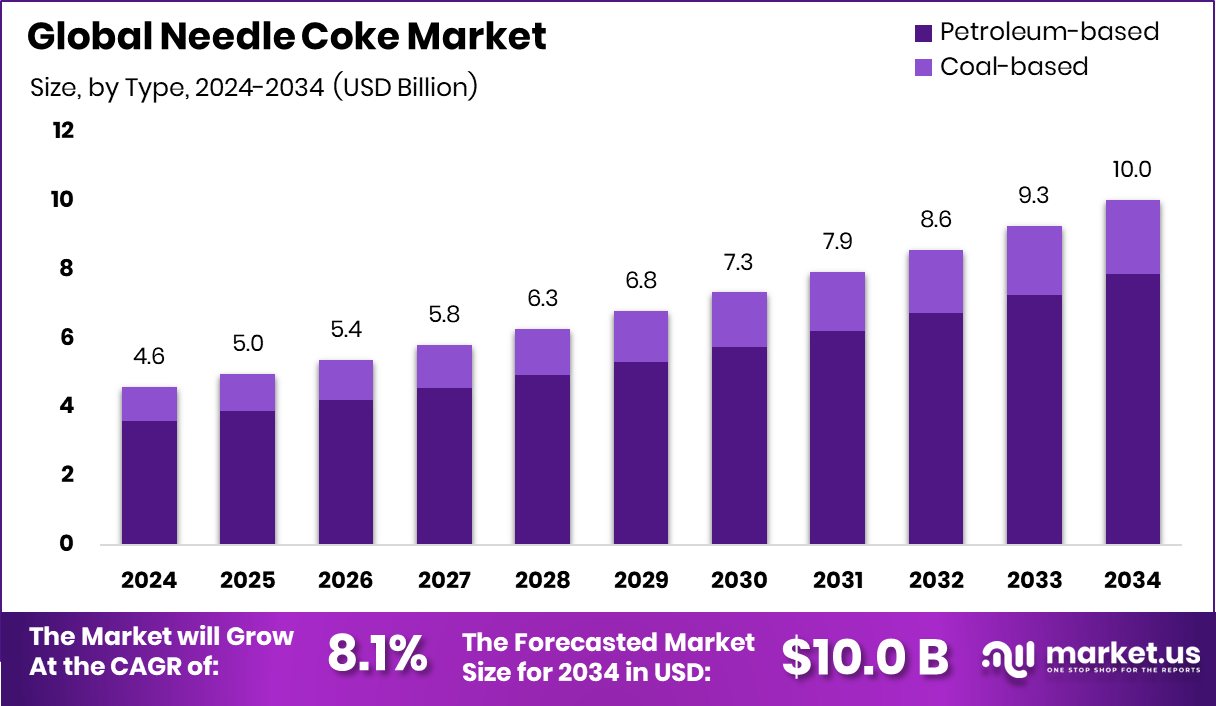

Global Needle Coke Market is expected to be worth around USD 10.0 billion by 2034, up from USD 4.6 billion in 2024, and grow at a CAGR of 8.1% from 2025 to 2034. Strong demand from the steel and battery sectors boosted Asia-Pacific’s 56.1% needle coke market position.

Needle coke is a premium grade, high-value petroleum-based material with a distinct needle-like structure when fractured. It is primarily used as a key raw material in the production of graphite electrodes, which are essential for electric arc furnace (EAF) steelmaking. Due to its low coefficient of thermal expansion, high electrical conductivity, and superior structural integrity, needle coke is preferred in high-temperature industrial applications, including steel recycling and energy storage systems such as lithium-ion batteries.

The needle coke market refers to the global trade and consumption of needle coke across various industries, primarily steel and energy. Demand for this specialized coke is closely linked to the growth of EAF-based steel production and advancements in battery technologies. The market is influenced by factors such as crude oil and coal tar availability, energy trends, and environmental regulations.

The growth of the needle coke market is mainly driven by the expansion of EAF-based steel manufacturing. This method of steel production is more environmentally friendly and is gaining traction globally due to energy efficiency and reduced emissions. As steelmakers transition from blast furnaces to EAFs, the need for high-quality graphite electrodes—and hence needle coke—has risen consistently.

Rising demand for electric vehicles (EVs) and grid storage solutions is significantly boosting the use of synthetic graphite anodes, which are produced using needle coke. With many countries focusing on clean transportation and investing in battery manufacturing plants, the demand for needle coke in the battery sector is witnessing sharp upward momentum.

Key Takeaways

- Global Needle Coke Market is expected to be worth around USD 10.0 billion by 2034, up from USD 4.6 billion in 2024, and grow at a CAGR of 8.1% from 2025 to 2034.

- Petroleum-based needle coke holds 78.5% share, driven by its high purity and superior thermal stability.

- Regular grade dominates the market with 57.5%, owing to its cost-effectiveness and broad industrial usage.

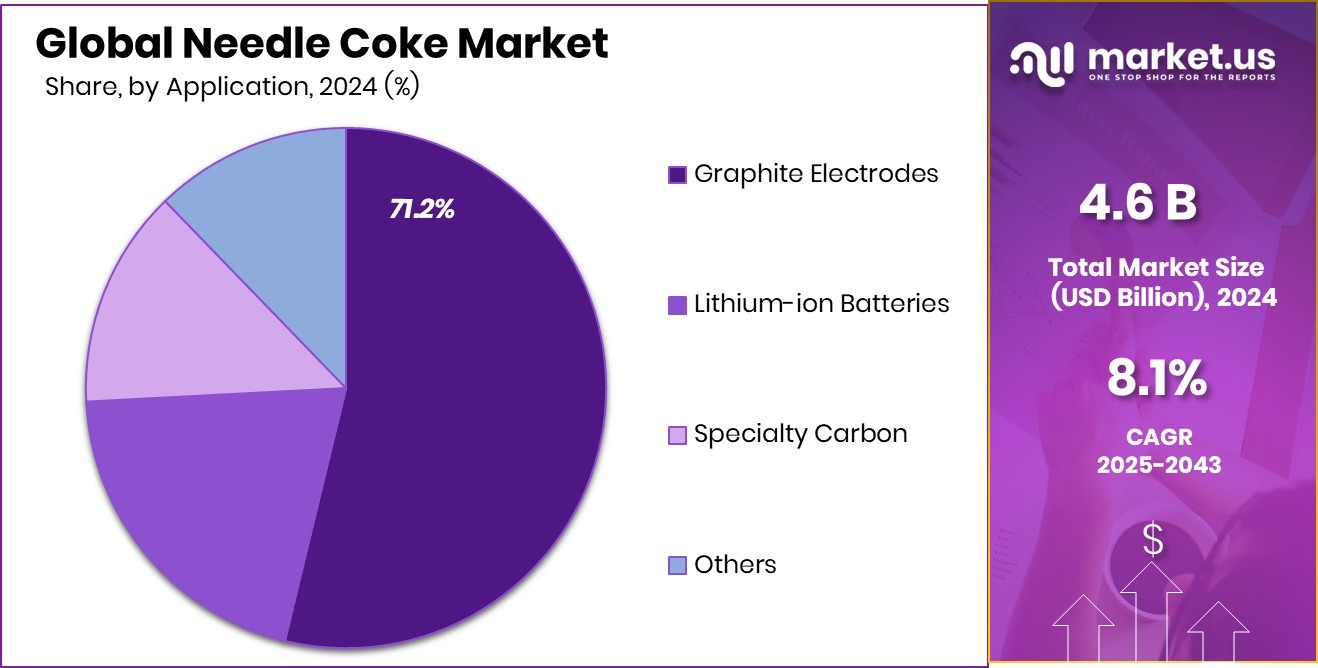

- Graphite electrodes remain the key application, capturing 71.2% of demand in the global needle coke market.

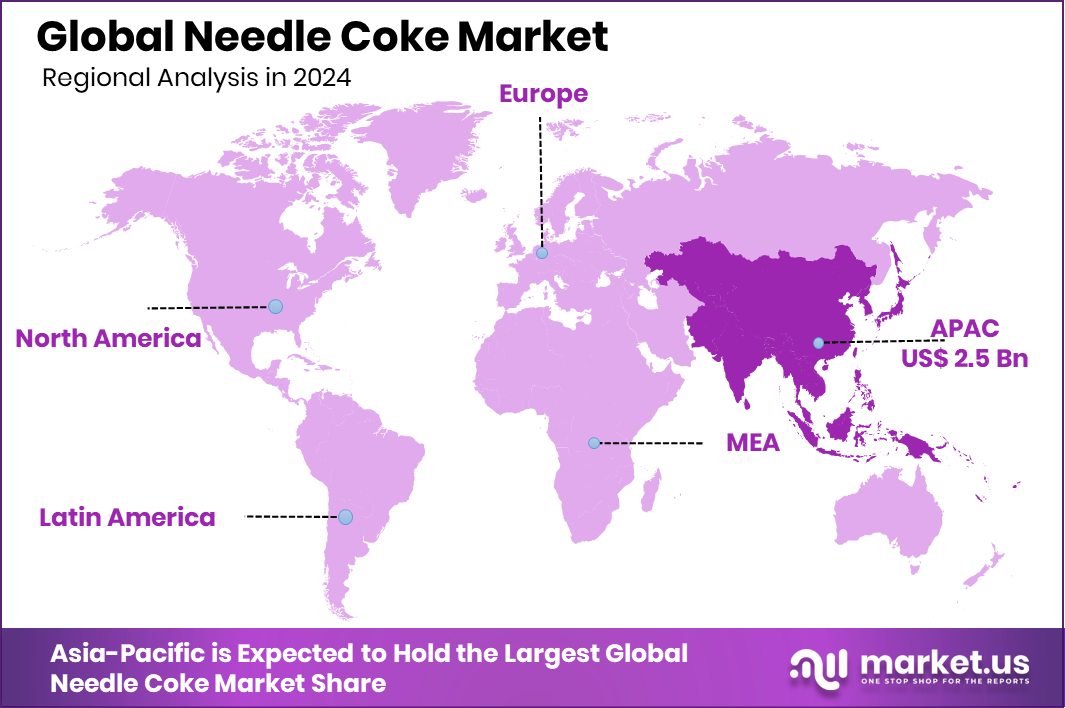

- The Asia-Pacific generated a market value of USD 2.5 billion this year.

By Type Analysis

Petroleum-based needle coke dominates the market with 78.5% total share.

In 2024, Petroleum-based held a dominant market position in the By Type segment of the Needle Coke Market, with a 78.5% share. This dominance is largely attributed to its superior structural consistency, higher carbon purity, and lower sulfur content compared to other forms. Petroleum-based needle coke is widely preferred for the production of ultra-high-power graphite electrodes used in electric arc furnace (EAF) steelmaking.

Its reliable performance under high temperatures and strong conductivity make it an ideal choice for steel manufacturers aiming to enhance process efficiency and reduce operational downtime. Additionally, its suitability for high-end lithium-ion battery applications, especially in anode materials, is further driving demand in the energy storage sector.

The sustained preference for petroleum-based variants also reflects broader industry shifts toward high-quality and performance-oriented inputs. Producers continue to invest in technologies that ensure stable production of petroleum needle coke from decant oil feedstocks, ensuring both consistency and supply reliability.

This type’s market lead is reinforced by its established supply chains and acceptance across major end-use industries. With rising global steel production through EAFs and growing energy storage requirements, petroleum-based needle coke remains the backbone of needle coke consumption in 2024, maintaining a strong foothold in the segment.

By Grade Analysis

Regular needle coke accounts for 57.5%, leading the overall consumption.

In 2024, Regular held a dominant market position in the By Grade segment of the Needle Coke Market, with a 57.5% share. This substantial lead is primarily driven by its widespread use in the manufacturing of graphite electrodes for electric arc furnace (EAF) steel production.

Regular-grade needle coke provides sufficient thermal resistance, structural strength, and conductivity needed for conventional applications, making it the preferred choice for standard-grade graphite electrode production across various industrial settings. Its availability and relatively lower production cost compared to higher-grade alternatives further support its broad adoption, especially in cost-sensitive steel manufacturing environments.

The dominance of regular-grade needle coke is also reinforced by stable demand from regions with mature steel recycling infrastructure, where consistent electrode performance is prioritized over ultra-high specifications. Regular grade continues to serve as a reliable material for users looking to balance quality with cost-efficiency, particularly in mid-range steel production facilities.

Its adaptability in various operating conditions and compatibility with existing EAF systems enhance its commercial viability. In 2024, with stable operational performance and steady supply chains, regular-grade needle coke maintained its position as the go-to material within the grade segment, underlining its critical role in supporting the global growth of EAF-based steel production.

By Application Analysis

Graphite electrodes use 71.2% of needle coke in global production.

In 2024, Graphite Electrodes held a dominant market position in the By Application segment of the Needle Coke Market, with a 71.2% share. This strong market presence is driven by the critical role graphite electrodes play in electric arc furnace (EAF) steelmaking, where needle coke serves as the primary raw material.

The high-temperature resistance, excellent electrical conductivity, and structural durability of needle coke make it essential for producing electrodes capable of withstanding the intense thermal cycles involved in EAF operations. As EAF-based steel production gains wider adoption due to its lower carbon footprint, the demand for needle coke for graphite electrode manufacturing continues to rise steadily.

The dominant share of this segment also reflects well-established industrial reliance on needle coke for ensuring consistent electrode quality and performance. Steel producers across the globe prioritize reliable electrode inputs, and needle coke’s unique properties make it irreplaceable in this regard.

The strong correlation between growing recycled steel output and electrode consumption has further reinforced this segment’s expansion. In 2024, with stable consumption trends and robust integration of EAF technologies in key steel-producing regions, the use of needle coke in graphite electrodes maintained its leading position, anchoring the material’s application-based demand profile across global markets.

Key Market Segments

By Type

- Petroleum-based

- Coal-based

By Grade

- Regular

- Premium

- Super Premium

By Application

- Graphite Electrodes

- Lithium-ion Batteries

- Specialty Carbon

- Others

Driving Factors

Rising Electric Arc Furnace (EAF) Steelmaking Demand

One of the main factors driving the growth of the needle coke market is the rising use of electric arc furnaces (EAF) in steel production. Unlike traditional blast furnaces, EAFs are more energy-efficient and environmentally friendly. They use scrap steel and require graphite electrodes—made from needle coke—to melt the metal. As more countries focus on reducing carbon emissions, the steel industry is shifting toward EAF technology.

This change is increasing the demand for high-quality graphite electrodes, which in turn is boosting the need for needle coke. With governments promoting cleaner industrial practices and steel producers investing in EAF capacity, the needle coke market is expected to grow steadily in line with this transition.

Restraining Factors

High Production Cost and Limited Raw Material Supply

One major factor holding back the growth of the needle coke market is the high cost of production and the limited availability of raw materials. Needle coke is made from specific feedstocks like decant oil or coal tar pitch, which are not easily available in large quantities. The refining and processing also require advanced technology, which adds to the cost.

As a result, manufacturers face challenges in scaling up production without raising prices. This makes needle coke expensive for end users, especially in price-sensitive markets. Any disruption in raw material supply, such as refinery shutdowns or trade restrictions, can further impact production and pricing, making this a serious barrier to long-term market growth.

Growth Opportunity

Growing Use in Lithium-ion Battery Anodes

A major growth opportunity for the needle coke market lies in its rising use in lithium-ion battery anodes. As electric vehicles (EVs), energy storage systems, and portable electronics grow in demand, so does the need for high-performance batteries. Needle coke is used to make synthetic graphite, a key material for battery anodes due to its excellent conductivity and structural stability.

With many countries investing in battery manufacturing and EV infrastructure, the need for reliable anode materials is increasing rapidly. This shift opens up a new and fast-growing application area beyond steelmaking. Companies producing needle coke now have the chance to expand their customer base by serving both the energy storage and mobility sectors.

Latest Trends

Shift Toward Low-Sulfur, Eco-Friendly Needle Coke

A key recent trend in the needle coke market is the growing preference for low-sulfur, eco-friendly variants. Industries are increasingly focused on reducing emissions and improving sustainability in production processes. Needle coke with lower sulfur content meets stricter environmental standards and contributes to cleaner manufacturing.

Producing this eco-friendly coke involves refining techniques that remove impurities more effectively, which benefits downstream users by improving the quality of graphite electrodes and battery anodes.

As global regulations tighten and companies aim to present greener supply chains, suppliers are investing in cleaner feedstocks and processing technology. This evolving demand is encouraging innovation within the needle coke sector and pushing manufacturers to focus on environmentally responsible production methods.

Regional Analysis

In 2024, Asia-Pacific led the Needle Coke Market with a 56.1% share.

In 2024, the Asia-Pacific region emerged as the leading market in the global needle coke landscape, capturing a dominant 56.1% share and reaching a market value of USD 2.5 billion. This leadership is primarily attributed to the region’s robust electric arc furnace (EAF) steel production, especially in countries like China, Japan, and South Korea, where demand for high-quality graphite electrodes remains strong. The presence of large-scale steel manufacturers and battery producers has further supported the consistent consumption of needle coke across industrial applications.

Meanwhile, North America and Europe continue to show steady performance due to technological advancements and a growing focus on cleaner steel production methods. However, their market shares remain moderate compared to Asia-Pacific. In the Middle East & Africa, and Latin America, the needle coke market remains in its developing stage, with demand largely concentrated in localized steel and energy sectors.

These regions present gradual growth potential but currently contribute marginally to the global revenue. Overall, Asia-Pacific continues to dominate the needle coke market, driven by strong industrial infrastructure, rising energy storage applications, and expanding manufacturing capacities, firmly establishing the region as the central hub for needle coke consumption in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, four key players in the global needle coke market—Mitsubishi Chemical Group Corporation, Phillips 66, Sumitomo Corporation, and GrafTech International—continue to shape industry dynamics through their strategic capabilities, production assets, and market positioning.

Mitsubishi Chemical Group Corporation maintains a robust presence by leveraging its integrated petrochemical operations and expertise in high-purity feedstock processing. With facilities capable of refining decant oil into ultra-low-sulfur needle coke, Mitsubishi Chemical Group ensures a consistent quality supply for high-end graphite electrode and battery anode applications. Its strong regional footprint in Asia-Pacific further bolsters its market influence, aligning with the region’s dominant 56.1% share in 2024.

Phillips 66, a major U.S.-based energy and petrochemical firm, capitalizes on its downstream refining infrastructure to produce needle coke derived from petroleum resid. The company’s established logistics network and technological investment allow it to meet stringent carbon purity standards, making it a reliable supplier to North American and European steel manufacturers.

Sumitomo Corporation acts primarily as a strategic trading and distribution player, facilitating the cross-border movement of needle coke from feedstock-rich regions to global customers. Its role in managing supply chains and securing long-term contracts enhances market stability and provides scale advantages, particularly in bridging Asian production with Western demand.

GrafTech International stands out as both a manufacturer of graphite electrodes and a producer of needle coke. Its vertical integration strategy—from feedstock procurement to end-product manufacturing—enables tight control over product quality and cost efficiency.

Top Key Players in the Market

- Mitsubishi Chemical Group Corporation

- Phillips 66

- Sumitomo Corporation

- GrafTech International

- Sinopec

- Asbury Carbons

- Sojitz JECT Corporation

- Shandong Yida New Materials Co., Ltd.

- POSCO MC MATERIALS

- RIZHAO HENGQIAO CARBON CO.,LTD

- Befar Group Co., Ltd.

- Nippon Steel Corporation

- Shandong Dongyang Technology Co., Ltd.

- Fangda Carbon New Material Technology Co., Ltd.

- Baotailong New Materials Co., Ltd

- Other Key Players

Recent Developments

- In September 2024, Phillips 66 announced that its Humber (UK) and Lake Charles (Louisiana) refineries began commercial production of specialty petroleum coke designed for lithium-ion battery anodes, offering a lower‑carbon precursor for EV batteries and electronics. This initiative positions the company as a key supplier for synthetic graphite anode feedstocks in both Europe and North America.

- In June 2024, Sumitomo Corporation restructured its leadership and operational framework under the appointment of President Shingo Ueno. This new setup was aimed at improving coordination across its multiple business domains, including petroleum needle coke manufacturing. The realignment is expected to enhance efficiency in feedstock sourcing and coke production processes.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 10.0 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Petroleum-based, Coal-based), By Grade (Regular, Premium, Super Premium), By Application (Graphite Electrodes, Lithium-ion Batteries, Specialty Carbon, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Chemical Group Corporation, Phillips 66, Sumitomo Corporation, GrafTech International, Sinopec, Asbury Carbons, Sojitz JECT Corporation, Shandong Yida New Materials Co., Ltd., POSCO MC MATERIALS, RIZHAO HENGQIAO CARBON CO.,LTD, Befar Group Co., Ltd., Nippon Steel Corporation, Shandong Dongyang Technology Co., Ltd., Fangda Carbon New Material Technology Co., Ltd., Baotailong New Materials Co., Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mitsubishi Chemical Group Corporation

- Phillips 66

- Sumitomo Corporation

- GrafTech International

- Sinopec

- Asbury Carbons

- Sojitz JECT Corporation

- Shandong Yida New Materials Co., Ltd.

- POSCO MC MATERIALS

- RIZHAO HENGQIAO CARBON CO.,LTD

- Befar Group Co., Ltd.

- Nippon Steel Corporation

- Shandong Dongyang Technology Co., Ltd.

- Fangda Carbon New Material Technology Co., Ltd.

- Baotailong New Materials Co., Ltd

- Other Key Players