Global Isocyanates Market By Type (MDI, TDI, Aliphatic and Others) By Application (Rigid Foam, Flexible Foam, Paints & Coatings, Adhesives & Sealants, Elastomers, Binders and Others) By End-user Industry (Building & Construction, Automotive, Healthcare, Furniture and Others) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019–2028

- Published date: Dec 2023

- Report ID: 22268

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

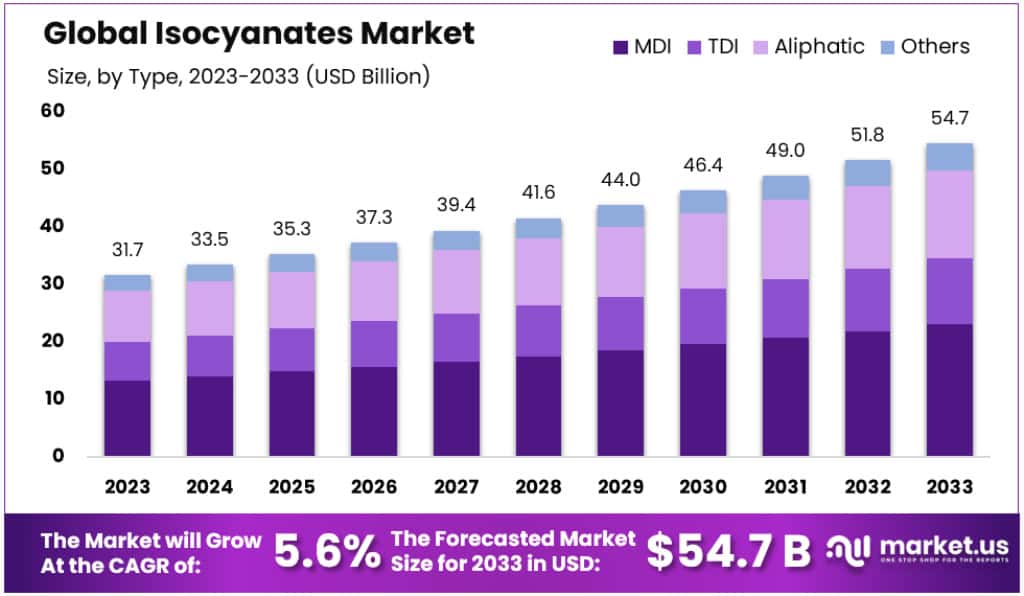

The Global Isocyanates Market size is expected to be worth around USD 54.7 Billion by 2033, from USD 31.7 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2023 to 2033.

Isocyanates are highly reactive chemicals with low molecular weight containing functional group isocyanate. On the basis of the number of isocyanate group, isocyanates are classed as diisocyanate and polyisocyanate. Diisocyanate as per name suggests are chemical compounds with two isocyanate group and are further classified as methylene diphenyl diisocyanate (MDI), toluene diisocyanate (TDI) and others. On the other hand, polyisocyanate contains multiple isocyanate groups and are derived from diisocyanates.

HDI isocyanurate and HDI biuret are among major types of polyisocyanate. Isocyanates are used as a raw material in the production of polyurethane (PU), which is widely used in several end-use industries.

Key Takeaways

- The Global Isocyanates Market is expected to reach a value of approximately USD 54.7 Billion by 2033, up from USD 31.7 Billion in 2023.

- The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period from 2023 to 2033.

- In 2023, MDI held the dominant market position, accounting for more than 42.3% of the isocyanates market.

- Rigid Foam was the leading application segment, capturing over 26.8% of the market share, in 2023.

- In 2023, the Building & Construction sector held the largest share in the end-user industry, at 35.6%.

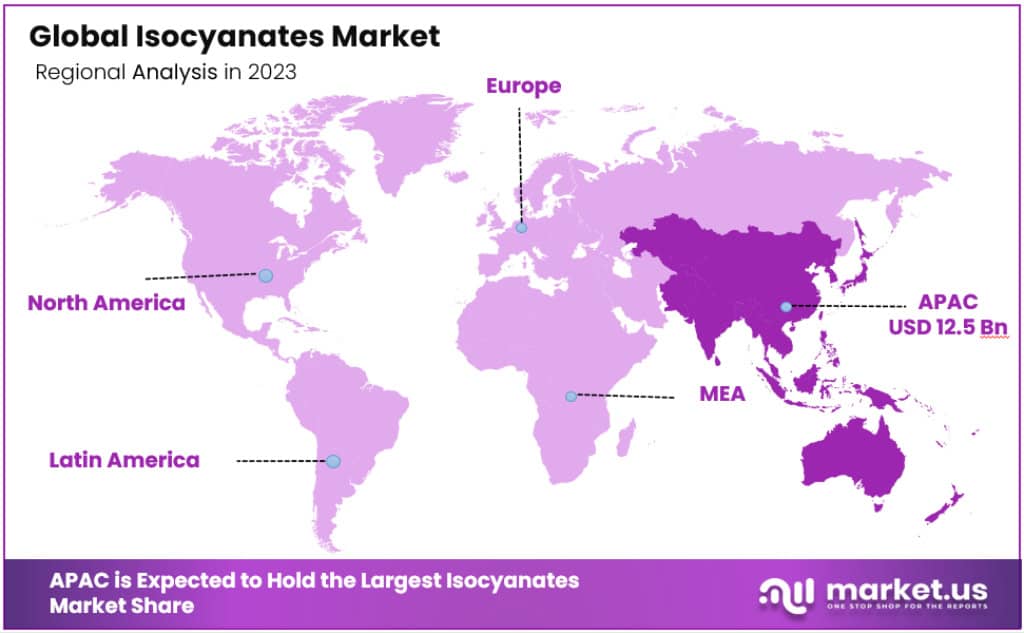

- APAC is dominating Isocyanates Market with 39.5% share, with USD 12.5 Billion in 2023

Type Analysis

In 2023, MDI held a dominant market position, capturing more than a significant 42.3% share of the isocyanates market. As the major isocyanates type, MDI’s prominence is underpinned by its critical role in producing rigid foams. These foams are extensively used in refrigerators, freezers, and in the manufacturing of automobile seats and interiors. The production process of MDI involves the chemical reaction of formaldehyde and aniline to produce diphenylmethanediamine (MDA), which, upon treatment with phosgene, yields MDI. The versatility and widespread application of MDI in various sectors, including construction for insulation purposes, underline its market supremacy.

TDI, another vital segment, also plays a crucial role in the isocyanates market. Toluene diphenyl diisocyanate is predominantly used in the production of flexible foams found in cushions, beddings, furniture, and various packaging materials. The demand for TDI is expected to remain robust, driven by its extensive application in consumer goods and the automotive industry. Its ability to enhance the comfort and durability of everyday products positions TDI as a key component in the isocyanates market.

Aliphatic isocyanates, though a smaller segment compared to aromatic diisocyanates, are gaining traction due to their superior resistance to UV radiation and their ability to maintain color clarity. This makes them ideal for applications in paints, coatings, and adhesives, especially in the automotive and aerospace industries where long-term aesthetic and functional performance is crucial.

Application Analysis

In 2023, Rigid Foam held a dominant market position in the isocyanates application segment, capturing more than a significant 26.8% share. This segment’s strength is primarily due to its indispensable use in the construction and automotive industries, where it provides superior insulation and structural integrity. Rigid foams are favored for their high performance in energy efficiency, making them a critical component in both residential and commercial building applications.

The Flexible Foam segment, continues to play a pivotal role in the isocyanates market. Its extensive use in cushions, bedding, furniture, and packaging stems from its versatility and comfort-enhancing properties. The demand for flexible foams is expected to remain strong, supported by the growing consumer goods sector and the ongoing innovations in foam products.

Paints & Coatings, another significant application, utilize isocyanates to provide enhanced protection against corrosion and UV radiation. Their application extends across various industries, including automotive, aerospace, and industrial machinery. The market for isocyanates in this segment is driven by the need for durable and long-lasting protective solutions.

Adhesives & Sealants are also critical applications for isocyanates, particularly in the construction and woodworking industries. The use of isocyanate-based adhesives and sealants is anticipated to grow, driven by their superior bonding properties and the expanding construction activities worldwide.

Elastomers, formed by reacting isocyanates with polyols, are used in various applications, including automotive components, tires, and footwear. The demand for isocyanate-based elastomers is expected to rise with the increasing need for more durable and flexible materials.

Binders, which play a crucial role in materials like wood paneling and fibers, are another important application for isocyanates. Their ability to enhance the structural integrity of materials makes them a preferred choice in construction and furniture manufacturing.

End-user Industry Analysis

In 2023, the Building & Construction sector held a dominant market position in the isocyanates end-user industry, capturing more than a 35.6% share. This sector’s strong performance is driven by the growing residential construction and rising consumer spending power. Isocyanates, known for their unique properties, are extensively used in various construction products, including flexible and rigid polyurethane foams for insulation, sealants, and binders. The increasing demand in the U.S. and globally for residential construction, which saw significant spending in recent years, underscores the sector’s robust growth and the critical role of isocyanates in this market.

The Automotive sector, which held the significant share of the isocyanates market, continues to exhibit strong growth with a projected CAGR of ~6.5% during 2023-2033. Isocyanates contribute to the automotive industry through their application in paints, coatings, and foams. The anti-corrosive and high thermal insulating properties of isocyanates make them indispensable in vehicle manufacturing. With increasing disposable income and a rise in automotive production, particularly noted in regions like South America, the demand for isocyanates in this sector is accelerating, marking its significance in the market.

In the Healthcare sector, isocyanates are gaining importance due to their application in medical devices and equipment. The sector’s growth is driven by an increasing demand for medical products that utilize flexible and rigid foams for cushioning and insulation purposes. The unique properties of isocyanates that lend durability and comfort to healthcare products underscore their growing utility in this industry.

The Furniture sector also represents a notable share in the isocyanates market. The extensive use of flexible polyurethane foam for cushioning in furniture and bedding is a testament to the material’s comfort and versatility. As consumer spending on home furnishings continues to rise, the demand for isocyanates in the furniture industry is expected to grow, contributing significantly to the market’s expansion.

Other sectors, including Electronics, Packaging, and Footwear, utilize isocyanates for various applications ranging from insulation and cushioning to adhesives and coatings. These industries benefit from the diverse properties of isocyanates, including their durability, flexibility, and resistance to environmental factors, driving their demand across a wide array of applications.

Key Market Segments

Type

- MDI

- TDI

- Aliphatic

- Others

Application

- Rigid Foam

- Flexible Foam

- Paints & Coatings

- Adhesives & Sealants

- Elastomers

- Binders

- Others

End-user Industry

- Building & Construction

- Automotive

- Healthcare

- Furniture

- Others

Driver

The Isocyanates market is experiencing substantial growth, largely driven by the booming Building & Construction sector, which held a dominant 35.6% share in 2023. This surge is propelled by massive infrastructural investments in emerging economies like China and India. For instance, China’s early 2022 investment in real estate development reached a staggering CNY 2,776.5 billion (USD 432 billion), with a notable year-on-year increase.

Similarly, India allocated an impressive INR 10 lakh crore (USD 130.57 billion) to bolster its infrastructure sector. These significant financial injections are expected to boost the demand for isocyanates, as they are extensively used in producing polyurethane foams for insulation and sealants in construction.

Restraint

However, the market faces challenges, particularly concerning the environmental and health impacts associated with isocyanate production and use. Strict regulatory frameworks and growing awareness about the toxic nature of certain isocyanate compounds could hinder market growth. Companies in the sector must navigate these regulations carefully and invest in safer, more sustainable production methods to mitigate these concerns.

Opportunity

The Automotive sector presents a lucrative opportunity, with a forecasted CAGR of ~6.5% from 2023 to 2033. Isocyanates are essential in manufacturing lightweight, energy-efficient automotive parts. As global automotive production increases and consumer demand for more fuel-efficient vehicles grows, the isocyanate market is set to expand significantly. The focus on reducing vehicle weight for better performance and fuel efficiency is particularly driving the demand for isocyanate-based foams and coatings.

Challenge

The production of key isocyanates, including MDI and TDI, heavily depends on crude oil as a primary raw material. With the rising industrial demand for oil in fuel and power generation, its prices have surged significantly. In 2022, the US Energy Information Administration reported an estimated increase in Brent crude oil prices to US$105 per barrel, marking a 48% hike from the previous year.

Similarly, WTI crude oil prices are projected to hit US$98 per barrel, reflecting a 44% increase. This escalating and unpredictable nature of crude oil prices presents a substantial challenge to the isocyanates market. As costs rise, manufacturers may face squeezed margins and increased production expenses, potentially hindering market growth and affecting the affordability of isocyanates-based products.

Trends

In the healthcare sector, the increasing demand for medical devices and equipment utilizing isocyanate-based products is trending upwards. This is due to their durability, flexibility, and cushioning properties, making them ideal for various medical applications. As healthcare continues to advance and expand, especially in developing countries, the demand for isocyanate products in this sector is expected to rise steadily.

Regional Analysis

Asia-Pacific is dominating the isocyanates market, commanding a significant share 39.5% with a valuation of USD 12.5 billion in 2023. This region’s leadership is largely attributed to the rapid industrial growth and expanding markets in China and India, coupled with consistent developments in Japan.

China stands as the world’s largest producer and consumer of polyurethane products, with MDI being extensively used for manufacturing both rigid and flexible foams. The burgeoning automotive, furniture, and footwear industries in the country are driving the demand for MDI, projecting a significant market expansion during the forecast period.

India is witnessing a surge in polyurethane applications, fueled by an expanding middle class, rising disposable incomes, and rapid urbanization. These factors, along with hefty investments in infrastructure, are setting the stage for a boom in the MDI market. Remarkably, India’s automobile industry reported its highest-ever annual domestic passenger vehicle sales in 2022, with a ~23% increase from the previous year. Additionally, India is poised to become a leader in shared mobility by 2030, further opening avenues for electric and autonomous vehicles, backed by the Government of India’s expectation of USD 8-10 billion in investments by 2023.

In Japan, despite a dip in new car sales in 2022 due to the global semiconductor shortage, the increasing production of polyurethane and rising demand from the construction, automotive, and furniture industries are expected to boost the isocyanates market. The country’s housing construction also saw a ~6% increase in March 2022 compared to the same month in the previous year, signaling a positive trend for the market.

The Asia-Pacific region’s overall growth is underpinned by impressive figures from key economies. In 2021, China’s automotive production rose by ~3.2%, and India saw a staggering 30% increase. Furthermore, the International Organization of Motor Vehicle Manufacturers and Japan’s Ministry of Land, Infrastructure, Transport, and Tourism provide data that underscores the rapid development in automotive and building & construction sectors, significantly influencing the demand for isocyanates.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Leading companies in the Isocyanates market are intensifying their efforts in research and development to diversify their product offerings. This strategy is pivotal for fostering growth in an increasingly competitive market. Key players are engaging in a myriad of strategic initiatives, including launching new products, entering into partnerships, and pursuing mergers and acquisitions. These efforts are designed not only to expand their market presence but also to offer cost-effective solutions to their customers.

One of the primary strategies adopted by manufacturers in the Isocyanates market to reduce operational costs and enhance customer service is local production. This approach has been especially beneficial in sectors like medicine, where isocyanates have played a significant role in recent advancements.

Major market players like BASF SE, Evonik Industries AG, LANXESS, DowDuPont Inc., Tosoh Corporation, Covestro AG, and Huntsman International LLC are aggressively investing in research and development. Their aim is to spur market demand by innovating and improving the types of isocyanates available. For instance, BASF SE is known for its broad range of products serving various industries, from construction to agriculture. The company is heavily investing in R&D and expanding its facilities, such as the methylene diphenyl diisocyanate (MDI) facility in Louisiana, with a substantial investment of USD 780 million expected to complete by 2025.

Similarly, Lanxess AG, another leader in specialty chemicals, recently introduced a new line of low free (LF) isocyanate-urethane prepolymers. These prepolymers are set to revolutionize the additive manufacturing industry with high-performance resins that are both user-friendly and safe for a wide range of environments.

Other significant players in the market, such as Dow Chemicals, Mitsui Chemicals, Inc., Bayer AG, and VENCOREX, are also making substantial contributions. They’re not only expanding their product lines but also enhancing their global footprint through strategic mergers, acquisitions, and collaborations.

Key Market Players

- Dow Chemicals

- BASF SE

- Evonik Industries

- Tosoh Corporation

- Mitsui Chemicals, Inc.

- Huntsman International LLC

- LANXESS

- Asahi Kasei Corporation

- Bayer AG

- Chemtura Corporation

- VENCOREX

- Others

Recent Developments

Acquisitions:

- Huntsman Corporation announces the acquisition of Dow Chemical’s Isocyanates and Polyols business for an estimated $4.5 billion. This combined entity is expected to become a global leader in the production and supply of polyurethane raw materials.

New Trends & Company News:

- BASF unveils a new line of bio-based isocyanates derived from castor oil as an alternative to traditional petroleum-based products. This development addresses sustainability concerns within the industry.

- Covestro launches a joint research program with MIT focused on developing next-generation non-isocyanate polyurethane (NIPU) technologies. This initiative aims to find environmentally friendly alternatives to conventional isocyanates.

Report Scope

Report Features Description Market Value (2023) USD 31.7 Billion Forecast Revenue (2033) USD 54.7 Billion CAGR (2023-2033) 5.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (MDI, TDI, Aliphatic and Others) By Application (Rigid Foam, Flexible Foam, Paints & Coatings, Adhesives & Sealants, Elastomers, Binders and Others) By End-user Industry (Building & Construction, Automotive, Healthcare, Furniture and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dow Chemicals, BASF SE, Evonik Industries, Tosoh Corporation, Mitsui Chemicals, Inc., Huntsman International LLC, LANXESS, Asahi Kasei Corporation, Bayer AG, Chemtura Corporation, VENCOREX, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dow Chemicals

- BASF SE

- Evonik Industries

- Tosoh Corporation

- Mitsui Chemicals, Inc.

- Huntsman International LLC

- LANXESS

- Asahi Kasei Corporation

- Bayer AG

- Chemtura Corporation

- VENCOREX

- Others