Global Marine Composites Market By Composites(Ceramic Matrix Composites, Metal Matrix Composites, Polymer Matrix Composites, Polymer Matrix Composites by Fabric Type, Polymer Matrix Composites by Resin Type), Resin Type(Epoxy, Polyster, Other Resin Types), By Vessel Type(Power Boats, Racing Boats, Yachts, Catamarans, Others, Sailboats, Cruise Ships, Other Vessel Types), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2024

- Report ID: 18217

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

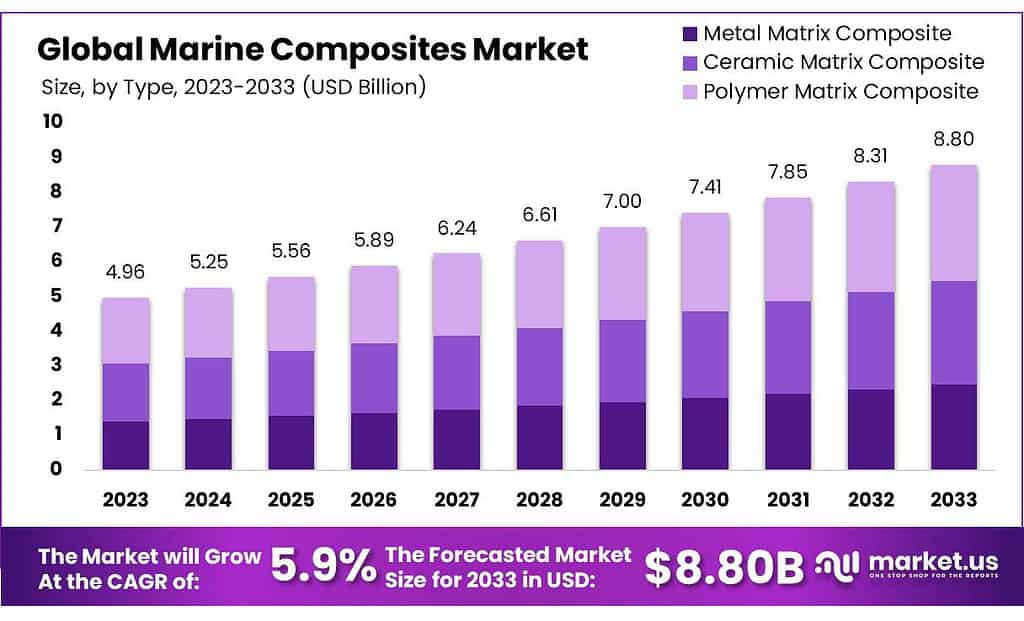

The Marine Composites Market size is expected to be worth around USD 8.80 billion by 2033, from USD 4.96 Bn in 2023, growing at a CAGR of 5.9% during the forecast period from 2023 to 2033.

The growth is expected to be driven by a growing demand for lightweight, corrosion-resistant, and high-strength parts in the shipbuilding sector. The market will continue to grow due to the increasing demand for high-speed, fuel-efficient boats.

Key Takeaways

- Market Growth Projection: Marine composites market size is expected to reach around USD 8.80 billion by 2033, indicating a significant growth from USD 4.96 billion in 2023, with a projected CAGR of 5.9%.

- Composite Dominance: Polymer Matrix Composites (PMC) holds the largest market share (38.1% in 2023) due to their blend of polymer resin and reinforcing fibers, offering strength, durability, and resistance to corrosive marine environments.

- Resin Preference: Epoxy resin dominates (36.5%) due to its exceptional strength, adhesion to fibers, and resilience against corrosive marine conditions, making it crucial in crafting boat hulls, decks, and key components.

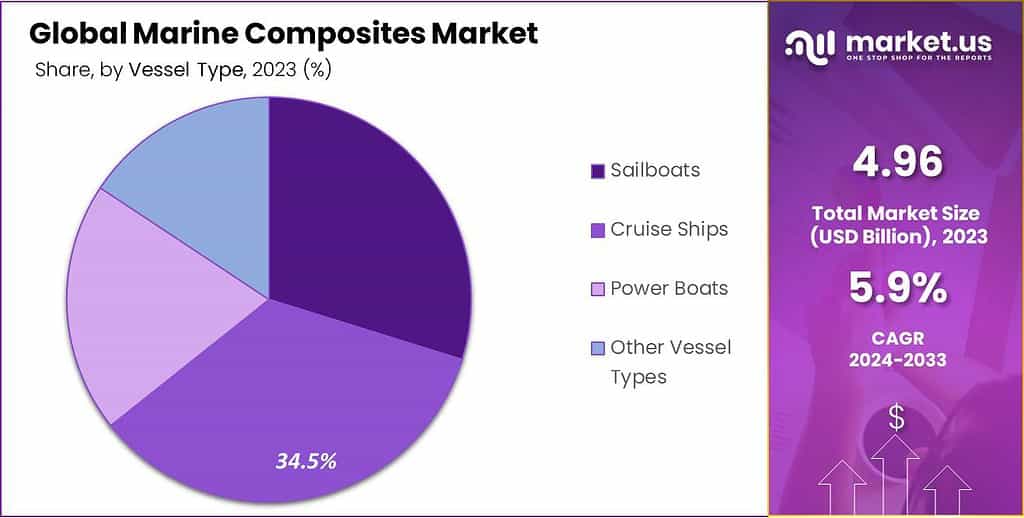

- Vessel Type Utilization: Cruise Ships hold a dominant share (34.5%) in utilizing marine composites due to their lightweight, durable, and corrosion-resistant properties, essential for cruise ship manufacturing.

- Market Drivers: The rising demand for high-speed, luxurious boats and yachts significantly propels the market. Composites offer reduced maintenance costs, improved reliability, and decreased component weight, fostering growth.

- Challenges and Opportunities: Challenges include high initial capital investment and uncertainties about reparability/recyclability. However, the opportunities lie in composites’ ability to withstand marine conditions and ongoing innovations in development, including the integration of renewable materials.

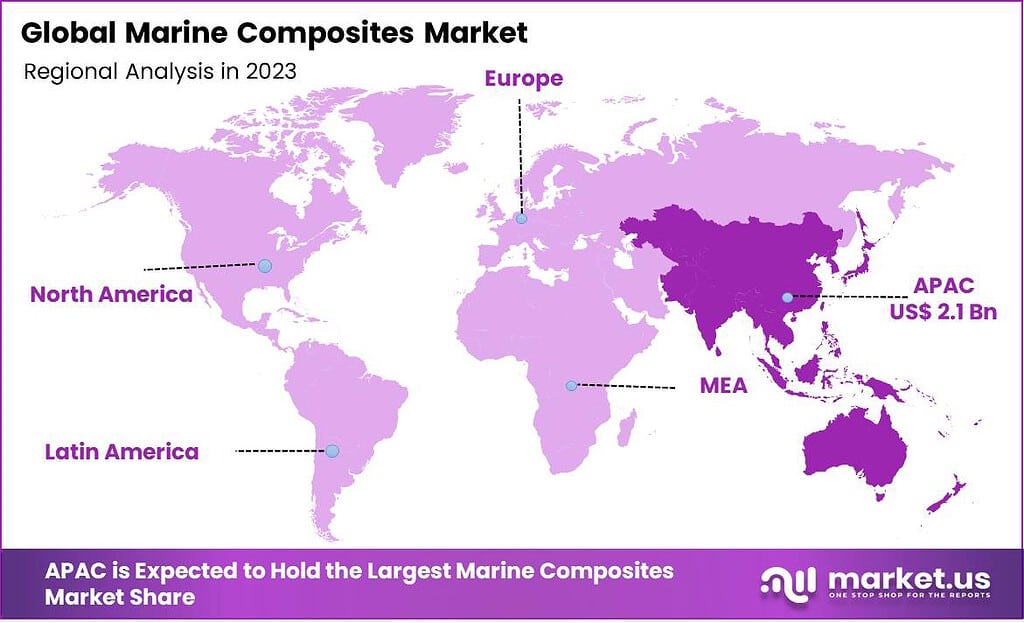

- Regional Analysis: Asia Pacific leads (42.6% revenue share in 2023) due to the growing demand for recreational boats, followed by Europe and North America, each with distinctive market dynamics and growth factors.

- Major Players: Key industry players such as Owens Corning, Toray Industries, and SGL Group, among others, engage in R&D, technology innovation, and strategic partnerships to produce cost-effective composite products.

Composites Analysis

In 2023, the Marine Composites market witnessed Polymer Matrix Composites dominating with a market share exceeding 38.1%. These composites, comprising a blend of polymer resin and reinforcing fibers, emerged as the primary choice in marine applications due to their remarkable properties.

Offering a unique combination of strength, durability, and resistance to corrosive marine environments, Polymer Matrix Composites have become integral in constructing various marine structures like boat hulls and decks. Their lightweight nature contributes to enhanced vessel performance, enabling increased fuel efficiency while maintaining structural integrity.

PMC is easy to manufacture and costs less than MMC or CMC. Glass fiber will be the most important PMC market based on its fiber type. The largest segment of resin type in the PMC market is expected to be polyester resin. Polyester resin has excellent electrical, mechanical, and thermal properties. The cost of polyester resin is significantly lower than epoxy and vinyl ester resins.

CMC is predicted to experience the fastest growth during the forecast period. CMC accounted for 30.4% global market share in 2021. CMC has properties like high stiffness and chemical inertness that increase its application in marine industries.

By Resin Type

In the landscape of the Marine Composites market in 2023, Epoxy resin stood out as the predominant choice, capturing a substantial market share exceeding 36.5%. This resin type held sway due to its exceptional characteristics highly sought after in marine applications.

Epoxy resin boasts outstanding strength, impeccable adhesion to reinforcing fibers, and remarkable resilience against the corrosive and challenging marine environment. Its robustness and resistance to moisture and various chemicals prevalent in marine settings make it an invaluable material.

The dominance of Epoxy resin in the market is rooted in its pivotal role within marine composite applications. Widely recognized for its capacity to deliver durability and reliability, Epoxy resin finds extensive use in crafting essential marine structures like boat hulls, decks, and various components requiring sturdy and enduring materials.

Its prevalence underscores its reliability and effectiveness in safeguarding marine structures against the rigors of harsh sea conditions, offering longevity and robustness crucial for maritime applications.

This significant market share held by Epoxy resin signifies its established position as a preferred choice within the marine composite industry. Its dominance reflects the industry’s confidence in its capacity to provide enduring and resilient solutions, catering to the demanding requirements of marine construction while ensuring durability and performance even in challenging marine environments.

Vessel Type Analysis

In the realm of Marine Composites market segmentation in 2023, Cruise Ships stood out, capturing a dominant share exceeding 34.5%. This substantial market position was primarily attributed to the extensive utilization of marine composites in the construction and design of cruise ships.

These composite materials offer a blend of essential characteristics such as lightweight nature, durability, and excellent corrosion resistance, essential for cruise ship manufacturing.

The powerboat segment is expected to be the largest vessel type and will grow at a CAGR (of 3.6%) between 2023-2032. The engine or motor that drives powerboats is either an engine or motor. Powerboats usually have a higher power-to-weight ratio, which allows for better handling and faster speeds. Marine composites are more suitable for high-speed boats because of their low weight and strength.

The forecast period will see an increase in demand for power boats that are high-speed and efficient. Race boats, yachts, and catamarans are just a few of the important types of powerboats that marine composites are used in. Swim ladders, hulls, and deck fittings for rudders are all made from marine composites. Composites of glass fibers are used mainly in the manufacture of masts and rudder stock parts.

Кеу Маrkеt Ѕеgmеntѕ

By Composites

- Ceramic Matrix Composites

- Metal Matrix Composites

- Polymer Matrix Composites

- Polymer Matrix Composites by Fabric Type

- Polymer Matrix Composites by Resin Type

Resin Type

- Epoxy

- Polyster

- Other Resin Types

By Vessel Type

- Power Boats

- Racing Boats

- Yachts

- Catamarans

- Others

- Sailboats

- Cruise Ships

- Other Vessel Types

Drivers

The rising demand for high-speed, powerful, and luxurious boats and yachts has significantly propelled the global marine composites industry. Marine composites, renowned for their exceptional resistance properties, have gained substantial traction across the marine sector worldwide. Particularly in the domain of racing powerboats, hybrid composites have revolutionized performance standards while augmenting driver safety.

The application spectrum is extensive, ranging from fiber-reinforced plastic composites utilized in producing various structural components like bow modules, hatch coverings, deckhouses, and king posts. Moreover, ongoing technological advancements aimed at minimizing manufacturing cycle times are forecasted to further boost demand within the marine sector.

These composite materials play a crucial role in fabricating an array of vessels including high-speed boats, fishing boats, ship components, naval vessels, high-capacity trawlers, and sailboats. Notably, their adoption offers multifaceted advantages such as reduced maintenance and fabrication costs, heightened aesthetic appeal, improved reliability, and decreased component weight. These compelling attributes emerge as primary drivers stimulating growth within the Marine Composites market.

Restraints

The marine composites market faces notable challenges predominantly rooted in the demand for substantial initial capital investment. This requirement stems from the considerable costs associated with raw materials and the extensive processing involved in crafting marine composites. Specifically, the high expense linked to carbon fiber and the emergence of alternative lightweight alloys pose significant hurdles impeding market expansion.

Additionally, financial concerns must be balanced against uncertainties regarding reparability and recyclability of marine composites, which cast shadows across the market landscape and present significant hurdles that must be cleared away in order for marine composites market growth to occur. To be effective, significant capital investments and issues related to repair/recyclability pose significant obstacles that impede its progress; both factors represent serious obstacles that impede marine composites market’s trajectory.

Opportunities

Marine composites, especially those reinforced with fibers, are experiencing increasing utilization owing to their ability to withstand the demanding conditions prevalent in marine environments. Their remarkable resilience against the pressures of seawater, winds, and waves makes them integral components in various marine applications. From critical structural elements like hull shells to components such as shafts, ducting, and grating, these composites offer diverse functionalities.

The competitive edge of marine composites lies in their exceptional traits: they improve fuel efficiency, reduce overall weight, offer prolonged durability, and present versatile design possibilities compared to traditional materials. Moreover, ongoing innovations in marine composite development, including the integration of renewable materials and the implementation of advanced infusion techniques like vacuum infusion, further bolster their appeal.

These innovations bring about notable enhancements, enhancing the composites’ rigidity, minimizing vibration, bolstering water repellence, and significantly fortifying resistance against wear, tear, and impact. These advancements continue to elevate marine composites’ desirability across various marine applications, driving their increased adoption in the industry.

Challenges

The marine composites market is experiencing robust competition due to the presence of numerous global and regional players. This heightened rivalry presents challenges, especially considering the significant production costs involved.

To mitigate these challenges, key industry players are actively pursuing strategies such as technological innovations, extensive research and development, strategic partnerships, and mergers and acquisitions. These initiatives aim to develop cost-effective and lightweight composite products, driving market growth and progress.

Amidst these challenges, opportunities emerge from advancements in product creation methodologies. The adoption of innovative technologies in manufacturing processes offers promising prospects for the market’s growth shortly. The proliferation of boat supply shops and dealerships on a global scale is fostering increased demand for composite materials in boat construction. This trend aligns with the industry’s shift towards advanced technology, further boosting the appeal and usage of composite boat-building materials.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 42.6% in 2023. Due to the growing demand for recreational boats, the region will experience significant growth in the future. China, India, and South Korea have taken measures to promote yachting as a leisure sport. This will drive the market.

Europe was the second-largest market. It is expected that it will grow at a CAGR of 4.1% during the forecast period. Due to a large number of regional competitors, the European shipbuilding industry has a high level of innovation and is highly competitive.

The European shipbuilding industry is well-positioned in complex vessel construction, submarine construction, and other vessels. This will have a positive impact on the marine composites sector in the region for the forecast period.

North America is one of the most mature markets. It is expected to reach US$ 674 million in 2025. Due to the region’s high spending power, North America has a strong demand for powerboats and recreational boating.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Due to the high number of regional and global players in the market, there is fierce competition among manufacturers. To produce lightweight, cost-effective products, the key players have taken various initiatives, including research and development, technology innovation, partnerships, and mergers and acquisitions. These initiatives will drive market growth during the forecast period. The following key players are involved in the R&D, manufacturing, and distribution of high-quality composite products:

Маrkеt Кеу Рlауеrѕ

- Owens Corning

- Toray Industries Inc

- Cytec Industries

- SGL Group

- Hexcel Corporation

- Teijin Limited

- E. I. Du Pont Nemours & Co

- Mitsubishi Rayon Co

- Gurit Holding

- 3A Composites

- Hyosung

- Others

Recent Developments

In January 2023, Gurit today reported preliminary and unaudited net sales of CHF 499.5 million for its full year 2022. Net revenues from ongoing operations totaled CHF 4888.6 million, an increase of 17.0% at constant exchange rates or 11.6% when reported in reported CHF over 2017. Sales decreased 8.0% when taking into account Fiberline’s purchase and Aerospace division sale as factors.

In March 2022, Hyosung Advanced Materials announced on March 2 that they will invest $38.5 million to expand carbon fiber production at their JeonJu, South Korea facility. When completed and operational in April 2023, this fourth polyacrylonitrile (PAN) carbon fiber plant will add an estimated 2,500-metric ton capacity increase and bring their total annual capacity up to 9,000 tons – joining previous announcements made in 2020 and 2021 by Hyosung Advanced Materials regarding similar expansion efforts.

Report Scope

Report Features Description Market Value (2023) US$ 4.96 Bn Forecast Revenue (2033) US$ 8.80 Bn CAGR (2023-2032) 5.9% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Composites(Ceramic Matrix Composites, Metal Matrix Composites, Polymer Matrix Composites, Polymer Matrix Composites by Fabric Type, Polymer Matrix Composites by Resin Type), Resin Type(Epoxy, Polyster, Other Resin Types), By Vessel Type(Power Boats, Racing Boats, Yachts, Catamarans, Others, Sailboats, Cruise Ships, Other Vessel Types) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Owens Corning, Toray Industries Inc, Cytec Industries, SGL Group, Hexcel Corporation, Teijin Limited, E. I. Du Pont Nemours & Co, Mitsubishi Rayon Co, Gurit Holding, 3A Composites, Hyosung, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are marine composites?Marine composites are materials made by combining two or more components to create a strong, lightweight, and durable material used in marine applications, such as boat construction.

Where are marine composites used?They are used extensively in boat and shipbuilding for hulls, decks, masts, and other structural components due to their high strength-to-weight ratio and resistance to corrosion in marine environments.

Where can marine composites be sourced?They are available through marine suppliers, specialized composite manufacturers, and boatbuilding companies that cater to the marine industry.

-

-

- Owens Corning

- Toray Industries Inc

- Cytec Industries

- SGL Group

- Hexcel Corporation

- Teijin Limited

- E. I. Du Pont Nemours & Co

- Mitsubishi Rayon Co

- Gurit Holding

- 3A Composites

- Hyosung

- Others